As filed with the Securities and Exchange Commission on July 14, 2023

|

Registration Statement No. 333 –

|

| |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

EURODRY LTD.

(Exact name of registrant as specified in its charter)

|

Republic of the Marshall Islands

(State or other jurisdiction of

incorporation or organization)

|

|

N/A

(I.R.S. Employer

Identification No.)

|

|

EuroDry Ltd.

4 Messogiou & Evropis Street

151 24 Maroussi, Greece

001 30 211 1804005

(Address and telephone number of Registrant's principal executive offices)

|

|

Seward & Kissel LLP

Attention: Anthony Tu-Sekine, Esq.

901 K Street NW

Washington, D.C. 20001

(202) 661-7150

(Name, address and telephone number of agent for service)

|

Copies to:

| |

Anthony Tu-Sekine, Esq.

Seward & Kissel LLP

901 K Street NW

Washington, D.C. 20001

(202) 661-7150

|

|

| |

|

|

Approximate date of commencement of proposed sale to the public: From time to time

after this registration statement becomes effective as determined by market conditions and other factors.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans,

please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule

415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act,

please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that

shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to

register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of

1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☒

|

The registrant hereby amends this registration statement

on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section

8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

|

The information in this prospectus is not complete and may be changed. The selling shareholders may not sell these securities

until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or

sale is not permitted.

PRELIMINARY PROSPECTUS (subject to completion dated July 14, 2023)

1,336,679 of our Common Shares Offered by the Selling Shareholders

The Selling Shareholders named in this Prospectus or their respective donees, pledgees, transferees or

other successors in interest may sell in one or more offerings pursuant to this registration statement up to 1,336,679 of our common shares that were previously acquired in private transactions or in the open market. We refer to such common shares as

the "Selling Shareholder Shares." The Selling Shareholders or their respective donees, pledgees, transferees or other successors in interest may, from time to time, sell, transfer or otherwise dispose of any or all of these common shares, including on

any stock exchange, market or trading facility on which the shares are traded or in privately negotiated transactions at fixed prices that may be changed, at market prices prevailing at the time of sale or at negotiated prices. See "Plan of

Distribution" beginning on page 11. Information on the Selling Shareholders and the times and manners in which they may offer and sell our common shares are described under the sections entitled "Selling Shareholders" and "Plan of Distribution" in

this prospectus. While we will bear all costs, expenses and fees in connection with the registration of the Selling Shareholder Shares, we will not receive any of the proceeds from the sale of our common shares by the Selling Shareholders.

The prices and other terms of the securities that we will offer will be determined at the time of their

offering and will be described in a supplement to this prospectus.

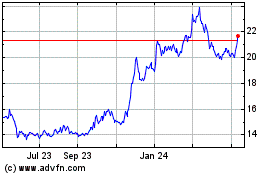

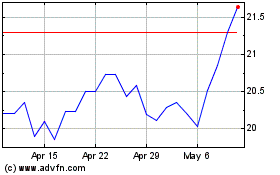

Our common shares are currently listed on the Nasdaq Capital Market under the symbol "EDRY". On July 13,

2023, the last reported sale price of our common shares was $14.305 per share.

The securities to be sold under this prospectus may be offered directly or through underwriters, agents

or dealers. The names of any underwriters, agents or dealers will be included in a supplement to this prospectus.

An investment in these securities involves risks. See the section entitled "Risk Factors" on page 6,

and other risk factors contained in the applicable prospectus supplement and in the documents incorporated by reference herein and therein.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR

DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is July 14, 2023.

TABLE OF CONTENTS

|

PROSPECTUS SUMMARY

|

1

|

|

RISK FACTORS

|

6

|

|

USE OF PROCEEDS

|

7

|

|

SELLING SHAREHOLDERS

|

8 |

|

OUR CAPITALIZATION

|

9

|

|

DIVIDEND POLICY

|

10

|

|

PLAN OF DISTRIBUTION

|

11

|

|

DESCRIPTION OF CAPITAL STOCK

|

13

|

|

TAX CONSIDERATIONS

|

18

|

|

EXPENSES

|

25 |

|

EXPERTS

|

25

|

|

LEGAL MATTERS

|

25

|

|

WHERE YOU CAN FIND ADDITIONAL INFORMATION

|

25

|

|

GLOSSARY OF SHIPPING TERMS

|

27

|

ABOUT THIS PROSPECTUS

As permitted under the rules of the U.S. Securities and Exchange Commission, or the Commission, this

prospectus incorporates important business information about us that is contained in documents that we have previously filed with the Commission but that are not included in or delivered with this prospectus. You may obtain copies of these documents,

without charge, from the website maintained by the Commission at www.sec.gov, as well as other sources. You may also obtain copies of the incorporated documents, without charge, upon written or oral request to EuroDry Ltd., 4 Messogiou & Evropis

Street, 151 24 Maroussi, Greece, +30-211-1804005. See "Where You Can Find Additional Information."

You should rely only on the information contained or incorporated by reference in this prospectus.

Neither we nor the Selling Shareholders have authorized any person to provide information other than that provided in this prospectus and the documents incorporated by reference. Neither we nor the Selling Shareholders are making an offer to sell

common shares in any state or other jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front of this prospectus regardless

of its time of delivery, and you should not consider any information in this prospectus or in the documents incorporated by reference herein to be investment, legal or tax advice. We encourage you to consult your own counsel, accountant and other

advisors for legal, tax, business, financial and related advice regarding an investment in our securities.

Unless otherwise indicated or unless the context requires otherwise, all references in this prospectus

to "EuroDry," the "Company," "we," "us," "our," or similar references, mean EuroDry Ltd. and, where applicable, its consolidated subsidiaries, and the “Selling Shareholders” refers to those of our shareholders described in “Selling Shareholders” on

page 8 of this prospectus.

ENFORCEABILITY OF CIVIL LIABILITIES

EuroDry Ltd. is a Marshall Islands corporation and our principal executive offices are located outside

the United States in Maroussi, Greece. A majority of our directors, officers and the experts named in the prospectus reside outside the United States. In addition, a substantial portion of our assets and the assets of our directors, officers and

experts are located outside the United States. As a result, you may have difficulty serving legal process within the United States upon us or any of these persons. You may also have difficulty enforcing, both in and outside the United States, judgments

you may obtain in United States courts against us or these persons in any action, including actions based upon the civil liability provisions of United States federal or state securities laws. Furthermore, there is substantial doubt that the courts of

the Marshall Islands or Greece would enter judgments in original actions brought in those courts predicated on United States federal or state securities laws.

CAUTIONARY STATEMENT REGARDING FORWARD LOOKING STATEMENTS

EuroDry Ltd. desires to take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of

1995 and is including this cautionary statement in connection with this safe harbor legislation. This prospectus contains forward-looking statements. These forward-looking statements include information about possible or assumed future results of our

operations or our performance. Words such as “expects,” “intends,” “plans,” “believes,” “anticipates,” “estimates,” and variations of such words and similar expressions are intended to identify the forward-looking statements. Although we believe that

the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove to have been correct. These statements involve known and unknown risks and are based upon a number of assumptions

and estimates which are inherently subject to significant uncertainties and contingencies, many of which are beyond our control. Actual results may differ materially from those expressed or implied by such forward-looking statements. Forward-looking

statements include, but are not limited to, statements regarding:

|

• |

our future operating or financial results;

|

|

• |

future, pending or recent acquisitions, joint ventures, business strategy, areas of possible expansion, and expected capital spending or operating expenses;

|

|

• |

drybulk industry trends, including charter rates and factors affecting vessel supply and demand;

|

|

• |

fluctuations in our stock price as a result of volatility in securities markets;

|

|

• |

the impact of increasing scrutiny and changing expectations from investors, lenders, charterers and other market participants with respect to our Environmental, Social and Governance (“ESG”)

policies;

|

|

• |

our financial condition and liquidity, including our ability to obtain additional financing in the future to fund capital expenditures, acquisitions and other general corporate activities;

|

|

• |

availability of crew, number of off-hire days, drydocking requirements and insurance costs;

|

|

• |

our expectations about the availability of vessels to purchase or the useful lives of our vessels;

|

|

• |

our expectations relating to dividend payments and our ability to make such payments;

|

|

• |

our ability to leverage to our advantage our manager’s relationships and reputations in the drybulk shipping industry;

|

|

• |

changes in seaborne and other transportation patterns;

|

|

• |

changes in governmental rules and regulations or actions taken by regulatory authorities;

|

|

• |

potential liability from future litigation;

|

|

• |

global and regional political conditions;

|

|

• |

acts of terrorism and other hostilities, including piracy;

|

|

• |

the severity and duration of natural disasters or public health emergencies, including the spread of coronavirus (“COVID-19”), including possible delays due to the quarantine of vessels and

crew, as well as government-imposed shutdowns; and

|

|

• |

other factors discussed in the section titled “Risk Factors.”

|

WE CAUTION READERS OF THIS PROSPECTUS AND ANY PROSPECTUS SUPPLEMENT NOT TO PLACE

UNDUE RELIANCE ON THESE FORWARD LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THEIR DATES. WE UNDERTAKE NO OBLIGATION TO PUBLICLY UPDATE OR REVISE ANY FORWARD-LOOKING STATEMENTS CONTAINED IN THIS PROSPECTUS OR ANY PROSPECTUS SUPPLEMENTS, OR THE DOCUMENTS

TO WHICH WE REFER YOU IN THIS PROSPECTUS OR ANY PROSPECTUS SUPPLEMENT, TO REFLECT ANY CHANGE IN OUR EXPECTATIONS WITH RESPECT TO SUCH STATEMENTS OR ANY CHANGE IN EVENTS, CONDITIONS OR CIRCUMSTANCES ON WHICH ANY STATEMENT IS BASED. THESE FORWARD

LOOKING STATEMENTS ARE NOT GUARANTEES OF OUR FUTURE PERFORMANCE, AND ACTUAL RESULTS AND FUTURE DEVELOPMENTS MAY VARY MATERIALLY FROM THOSE PROJECTED IN THE FORWARD LOOKING STATEMENTS.

Unless otherwise indicated, all references to "dollars" and "$" in this prospectus are to United States

dollars and financial information presented in this prospectus that is derived from financial statements incorporated by reference is prepared in accordance with accounting principles generally accepted in the United States.

This prospectus is part of a registration statement that we filed with the Commission using a shelf

registration process. The Selling Shareholders may sell in one or more offerings pursuant to this registration statement up to 1,336,679 of our common shares that were previously acquired in private transactions or in the open market. This prospectus

provides you with a general description of the securities the Selling Shareholders may offer. Each time the Selling Shareholders offer securities, we may provide you with a supplement to this prospectus that will describe the specific information

about the securities being offered and the specific terms of that offering. The prospectus supplement may also add, update or change the information contained in this prospectus. If there is any inconsistency between the information in this

prospectus and any prospectus supplement, you should rely on the prospectus supplement. Before purchasing any securities, you should read carefully both this prospectus and any prospectus supplement, together with the additional information described

below.

This prospectus does not contain all the information provided in the registration statement that we

filed with the Commission. For further information about us or the securities offered hereby, you should refer to the registration statement, which you can obtain from the Commission as described below under "Where You Can Find Additional

Information."

PROSPECTUS SUMMARY

This section summarizes some of the information and consolidated financial

statements that appear later in this prospectus or in documents incorporated by reference herein. As an investor or prospective investor, you should review carefully the risk factors and the more detailed information and financial statements that

appear later in this prospectus or in documents incorporated by reference herein. In this prospectus, references to "EuroDry," "Company," "we," "our," "ours" and "us" refer to EuroDry Ltd., and its subsidiaries, unless otherwise stated or the context

requires.

We use the term "deadweight tons," or dwt, in describing the capacity of our

vessels. Dwt, expressed in metric tons, each of which is equivalent to 1,000 kilograms, refers to the maximum weight of cargo and supplies that a vessel can carry. For the definition of certain shipping terms used in this prospectus, see the "Glossary

of Shipping Terms" on page 27 of this prospectus.

Our Company

EuroDry Ltd. is a Marshall Islands company incorporated under the Marshall Islands Business Corporations

Act, or BCA, on January 8, 2018. We are a provider of worldwide ocean-going transportation services. We own and operate drybulk carriers that transport major bulks such as iron ore, coal and grains, and minor bulks such as bauxite, phosphate and

fertilizers. As of July 7, 2023, our fleet consisted of ten drybulk carriers (comprising five Panamax drybulk carriers, two Kamsarmax, two Ultramax drybulk carriers and one Supramax drybulk carrier). The total cargo carrying capacity of our ten drybulk

carriers is 728,975 dwt.

We actively manage the deployment of our fleet between spot market voyage charters and short term time

charters, which generally last from several days to several weeks, and medium or longer term time charters, which can last up to several years. Some of our vessels may participate in shipping pools, or, in some cases in contracts of affreightment. We

may also use freight forward agreement, or FFA, contracts to provide partial coverage for our drybulk vessels – as a substitute for time charters – in order to increase the predictability of our revenues.

Vessels operating on medium and longer term time charters provide more predictable cash flows but can

yield lower profit margins than vessels operating in the spot market during periods characterized by favorable market conditions. Vessels operating in the spot market generate revenues that are less predictable but may enable us to achieve increased

profit margins during periods of high vessel rates although we are exposed to the risk of declining vessel rates, which may have a materially adverse impact on our financial performance. Vessels operating in pools benefit from better scheduling, and

thus increased utilization, and better access to contracts of affreightment due to the larger commercial operation of the pool. We are constantly evaluating opportunities to increase the number of our vessels deployed on medium and longer term time

charters upon expiration of our existing charters or to participate in shipping pools (if available for our vessels), however we only expect to enter into longer term time charters or shipping pools if we can obtain contract terms that satisfy our

criteria. We carefully evaluate the length and the rate of the time charter contract at the time of fixing or renewing a contract considering market conditions, trends and expectations.

We constantly evaluate vessel purchase opportunities to expand our fleet accretive to our earnings and

cash flow. Additionally, we will consider selling certain of our vessels when favorable sales opportunities present themselves. If, at the time of sale, the carrying value is less than the sales price, we will realize a gain on sale, which will

increase our earnings, but if, at the time of sale, the carrying value of a vessel is more than the sales price, we will realize a loss on sale, which will negatively impact our earnings.

Our Fleet

As of July 7, 2023, the profile and deployment of our fleet is the following:

|

Name

|

Type

|

Dwt

|

Year Built

|

Employment (*)

|

TCE Rate ($/day)

|

|

Dry Bulk Vessels

|

|

|

|

|

|

|

EKATERINI

|

Kamsarmax

|

82,000

|

2018

|

TC until Mar-25

|

Hire 105.5% of the Average Baltic Kamsarmax P5TC(**) index

|

|

XENIA

|

Kamsarmax

|

82,000

|

2016

|

TC until Mar-24

|

Hire 105.5% of the Average Baltic Kamsarmax P5TC(**) index

|

|

ALEXANDROS P

|

Ultramax

|

63,500

|

2017

|

TC until Jul-23

|

$16,250

|

|

GOOD HEART

|

Ultramax

|

62,996

|

2014

|

TC until Aug-23

|

$15,075

|

|

MOLYVOS LUCK

|

Supramax

|

57,924

|

2014

|

TC until Aug-23

|

$7,750

|

|

EIRINI P

|

Panamax

|

76,466

|

2004

|

TC until Oct-23

|

$15,750

|

|

SANTA CRUZ

|

Panamax

|

76,440

|

2005

|

TC until Jul-23

|

$8,000

|

|

STARLIGHT

|

Panamax

|

75,845

|

2004

|

TC until Aug-23

|

$9,000

|

|

TASOS

|

Panamax

|

75,100

|

2000

|

TC until Jul-23

|

$12,700

|

|

BLESSED LUCK

|

Panamax

|

76,704

|

2004

|

TC until Jan-24

|

$15,800

|

|

Total Vessels

|

10

|

728,975

|

|

|

|

| (*) |

TC denotes time charter. Charter duration indicates the earliest redelivery date.

|

| (**) |

The average Baltic Kamsarmax P5TC Index is an index based on five Panamax time charter routes.

|

We plan to expand our fleet by investing in vessels in the drybulk market under favorable market conditions. We also intend to take advantage

of the cyclical nature of the market by buying and selling ships when we believe favorable opportunities exist. We employ our vessels in the spot and time charter market and through pool arrangements. As of July 7, 2023, all our vessels are employed

under time charter contracts.

Management of Our Fleet

The operations of our vessels are managed by Eurobulk Ltd., or Eurobulk, and Eurobulk (Far East) Ltd. Inc., or Eurobulk

FE, collectively the “Managers”, both affiliated companies. Eurobulk was founded in 1994 by members of the Pittas family and is a reputable ship management company with strong industry relationships and experience in managing vessels. Eurobulk FE was

founded in 2015 and is based in the Philippines. Eurobulk manages our fleet under a Master Management Agreement ("MMA") with us and separate management agreements with each ship-owning company. Eurobulk FE manages

four of our vessels under similar management agreements with the respective ship-owning companies. Under our MMA, Eurobulk is responsible for providing us with: (i) executive services associated with us being a

public company; (ii) other services to our subsidiaries including accounting and commercial management services, which include obtaining employment for our vessels and managing our relationships with charterers; and (iii) technical management services,

which include managing day-to-day vessel operations, performing general vessel maintenance, ensuring regulatory and classification society compliance, supervising the maintenance and general efficiency of vessels, arranging our hire of qualified

officers and crew, arranging and supervising drydocking and repairs, arranging insurance for vessels, purchasing stores, supplies, spares and new equipment for vessels, appointing supervisors and technical consultants and providing technical support

and shoreside personnel who carry out the management functions described above and certain accounting services.

Our MMA is substantially similar to the MMA between Euroseas and Eurobulk relating to our vessels that

were previously owned by Euroseas, which were contributed by Euroseas to EuroDry in connection with the spin-off of Euroseas’ drybulk vessels held for use as of December 31, 2017 (the “Spin-off”). The MMA is terminable by Eurobulk only for cause or

under other limited circumstances, such as the sale of the Company or Eurobulk or the bankruptcy of either party. The management agreements between Eurobulk FE and the ship-owning companies follow substantially the same terms of the similar agreements

with Eurobulk. The EuroDry MMA with the Managers provides for an annual adjustment of the daily vessel management fee due to inflation in the Eurozone to take effect on January 1 of each year. The vessel management fee for laid-up vessels is half of

the daily fee. This MMA, as periodically amended and restated, will automatically be extended after the initial five-year period for an additional five-year period unless terminated on or before the 90th day preceding the initial termination date.

Pursuant to the MMA, each ship-owning company has signed – and each future ship owning company when a vessel is acquired will sign – with the Managers, a management agreement with the rate and term of these agreements set in the MMA effective at such

time.

Our MMAs with the Managers which took effect after the completion of the Spin-off were for an initial five-year term

until January 1, 2023. These MMAs were extended for an additional five-year term starting on January 1, 2023 and expiring on January 1, 2028. Our MMA with Eurobulk compensates Eurobulk with an annual executive

compensation and a daily management fee per vessel managed. For the Company post Spin-off the annual compensation for such services was set at $1,250,000. Effective from January 1, 2023, this fee was increased to

$1,350,000 to account for inflation in the Eurozone. The daily fixed vessel management fee was 685 Euros for the years ended December 31, 2020 and 2021. From January 1, 2022 the daily vessel management fee was adjusted for inflation to 720 Euros

per day per vessel in operation and 360 Euros per day per vessel in lay-up. From January 1, 2023 the daily vessel management fee was further adjusted for inflation at 775 Euros per day per vessel in operation. In case of a vessel in lay-up, the

Company pays 50% of the daily management fee during the respective period. In the case of newbuilding vessel contracts, the same management fee of 775 Euros becomes effective when construction of the vessel actually begins.

The management of the M/V “Xenia”, M/V “Alexandros P.”, M/V “Tasos” and M/V “Ekaterini” is performed

by Eurobulk FE. The remaining fleet (M/V “Santa Cruz”, M/V “Eirini P.”, M/V “Good Heart”, M/V “Blessed Luck”, M/V “Molyvos Luck” and M/V “Starlight”) is managed by Eurobulk.

Our Competitive Strengths

We believe that we possess the following competitive strengths:

|

• |

Experienced Management Team. Our management team has significant experience in all aspects of commercial, technical, operational and financial areas of

our business. Aristides J. Pittas, our Chairman and Chief Executive Officer, holds a dual graduate degree in Naval Architecture and Marine Engineering and Ocean Systems Management from the Massachusetts Institute of Technology. He has worked in

various technical, shipyard and ship management capacities and since 1991 has focused on the ownership and operation of vessels carrying dry cargoes. Dr. Anastasios Aslidis, our Chief Financial Officer, holds a Ph.D. in Ocean Systems Management

also from the Massachusetts Institute of Technology and has over 30 years of experience in the financial management of public shipping companies as well as investment and risk management in the maritime industry.

|

|

• |

Cost Efficient Vessel Operations. We believe that because of the efficiencies afforded to us through Eurobulk, the strength of our management team and

the quality of our fleet, we are, and will continue to be, a reliable, low cost vessel operator, without compromising our high standards of performance, reliability and safety. Our total vessel operating expenses, including management fees and

general and administrative expenses but excluding drydocking expenses were $6,698 per day for the year ended December 31, 2022.

|

Our technical and operating expertise allows us to efficiently manage and transport a wide range of cargoes with a

flexible trade route profile, which helps reduce ballast time between voyages and minimize off-hire days. Our professional, well-trained masters, officers and on board crews further help us to control costs and ensure consistent vessel operating

performance. We actively manage our fleet and strive to maximize utilization and minimize maintenance expenditures for operational and commercial utilization. For the year ended December 31, 2022, our operational fleet utilization was 99.3%, from 99.6%

in 2021, while our commercial utilization rate was at 99.8% and 99.9% for each year, respectively. Our total fleet utilization rate in 2022 was 99.1%, from 99.5% in 2021.

|

• |

Strong Relationships with Customers and Financial Institutions. We believe ourselves, Eurobulk, Eurobulk FE and the Pittas family have developed strong

industry relationships and have gained acceptance with charterers, lenders and insurers because of long-standing reputation for safe and reliable service and financial responsibility through various shipping cycles. Through Eurobulk and

Eurobulk FE, we offer reliable service and cargo carrying flexibility that enables us to attract customers and obtain repeat business. We also believe that the established customer base and reputation of ourselves, Eurobulk, Eurobulk FE and the

Pittas family help us to secure favorable employment for our vessels with well-known charterers.

|

Our Business Strategy

Our business strategy is focused on providing consistent shareholder returns by carefully timing and structuring

acquisitions of drybulk carriers and by reliably, safely and competitively operating our vessels through our Managers. We continuously evaluate purchase and sale opportunities, as well as long term employment opportunities for our vessels. Key elements

of the above strategy are:

|

• |

Renew and Expand our Fleet. We expect to grow our fleet in a disciplined manner through timely and selective acquisitions of quality vessels. We perform

in-depth technical review and financial analysis of each potential acquisition and only purchase vessels as market opportunities present themselves. We focus on purchasing well-maintained secondhand vessels, newbuildings or newbuilding resales

based on the evaluation of each investment option at the time it is made. In May 2021, we acquired a Panamax drybulk vessel, followed by an Ultramax drybulk vessel in September 2021. In February 2022, we purchased a Supramax drybulk carrier,

followed by another Panamax drybulk vessel in April 2022.

|

|

• |

Maintain Balanced Employment. We intend to employ our fleet on either longer term time charters, i.e. charters with duration of more than a year, or

shorter term time/spot charters. We seek longer term time charter employment to obtain adequate cash flow to cover as much as possible of our fleet’s recurring costs, consisting of vessel operating expenses, management fees, general and

administrative expenses, interest expense and drydocking costs for the upcoming 12-month period. We also may use FFAs – as a substitute for time charter employment – to partly provide coverage for our drybulk vessels in order to increase the

predictability of our revenues. We look to deploy the remainder of our fleet on spot charters, shipping pools or contracts of affreightment (“COA”) depending on our view of the direction of the markets and other tactical or strategic

considerations. When we expect charter rates to improve we try to increase the percentage of our fleet employed in shorter term contracts (allowing us to take advantage of higher rates in the future), while when we expect the market to weaken

we try to increase the percentage of our fleet employed in longer term contracts (allowing us to take advantage of higher current rates). We believe this balanced employment strategy will provide us with more predictable operating cash flows

and sufficient downside protection, while allowing us to participate in the potential upside of the spot market during periods of rising charter rates. As of June 30, 2023, on the basis of our existing time charters, approximately 46% of our

vessel capacity for the remainder of 2023 are under time charter contracts, which will ensure employment of a portion of our fleet, partly protect us from market fluctuations and increase our ability to make principal and interest payments on

our debt and pay dividends to our shareholders.

|

|

• |

Optimize Use of Financial Leverage. We intend to use bank debt to partly fund our vessel acquisitions and increase financial returns for our

shareholders. We actively assess the level of debt we incur in light of our ability to repay that debt based on the level of cash flow generated from our balanced chartering strategy and efficient operating cost structure. Our debt repayment

schedule as of December 31, 2022 calls for a reduction of approximately 28.15% of our debt by the end of 2023 and an additional reduction of about 17.21% by the end of 2024 for a total of 45.36% reduction over the next two years, excluding any

new debt that we assumed or may assume. As our debt is being repaid, we expect that our ability to raise or borrow additional funds more cheaply in order to grow our fleet and generate better returns for our shareholders will increase.

|

|

• |

ESG Practices: We actively manage a broad range of ESG initiatives, taking into consideration their expected impact on the sustainability of our business

over time, and the potential impact of our business on society and the environment. Regarding environmental initiatives, in 2021 and 2022 we implemented technical and operational measures that we expect will result in energy savings and a

reduced carbon footprint for our vessels. Moreover, we pay considerable attention to our human resources both on our vessels and ashore, proven by a variety of practices, including worldwide training on safety and management systems, and

medical insurance for all employees. Our current ESG report can be found on our website.

|

Corporate Information

EuroDry Ltd. is a Marshall Islands company incorporated under the Marshall Islands Business Corporations

Act, or BCA. We maintain our principal executive offices at 4 Messogiou & Evropis Street, 151 24 Maroussi, Greece. Our telephone number at that address is +30-211-1804005. Our website address is http://www.eurodry.gr. The information on our

website is not a part of this prospectus.

Recent Developments

On June 20, 2023, we signed a loan agreement with Hamburg Commercial Bank pursuant to a term sheet

signed on March 30, 2023, and drew a loan of $14.0 million mortgaging as collateral M/V Ekaterini, which had been previously released from its mortgage following the full repayment of its loan with HSBC Bank Plc. on March 3, 2023.

As of July 7, 2023, we had repurchased and cancelled 207,265 common shares, under our share repurchase

program for an aggregate consideration of approximately $3.1 million, since the initiation of our share repurchase plan of up to $10 million announced in August 2022.

The Securities the Selling Shareholders May Offer

The Selling Shareholders may sell in one or more offerings pursuant to this registration statement up to

1,336,679 of our common shares that were previously acquired in private transactions or in the open market. We will not receive any of the proceeds from the sale of our common shares by the Selling Shareholders.

A prospectus supplement may describe the amounts, prices, and type of transaction in which the Selling

Shareholders may offer securities and may describe certain risks in addition to those set forth below associated with an investment in the securities. Terms used in the prospectus supplement will have the meanings set forth in this prospectus, unless

otherwise specified.

RISK FACTORS

An investment in our securities involves a high degree of risk. You should

carefully consider the risks discussed under the heading "Item 3. Key Information—D. Risk Factors" in our Annual Report on Form 20-F for the year ended December 31, 2022 and the other documents we have incorporated by reference in this prospectus that

summarize the risks that may materially affect our business before making an investment in our securities. Please see "Where You Can Find Additional Information – Information Incorporated by Reference." In addition, you should also consider carefully

the risks set forth under the heading "Risk Factors" in any prospectus supplement before investing in any securities offered by this prospectus. The occurrence of one or more of those risk factors could adversely impact our business, financial

condition, results of operations or the price of our common stock.

USE OF PROCEEDS

All of the common shares offered by the Selling Shareholders pursuant to this prospectus will be sold by

the Selling Shareholders for their own account. We will not receive any of the proceeds from these sales.

SELLING SHAREHOLDERS

This prospectus relates to the proposed sale from time to time of up to 1,336,679 of our common shares

beneficially owned by the Selling Shareholders named in the table below. We have filed the registration statement of which this prospectus forms a part in order to permit the Selling Shareholders to offer these shares for resale or transfer from time

to time as set forth below in “Plan of Distribution”.

Set forth below is information regarding the Selling Shareholders and their beneficial ownership of our

common shares. The table is based upon information provided by the Selling Shareholders. The table assumes that all the shares being offered by the Selling Shareholders pursuant to this prospectus are ultimately sold in the offering.

Selling Shareholders

|

Name of Selling Shareholder

|

|

Common Shares Owned Before Offering (1)

|

|

|

Percentage of Class Prior to the Offering (2)

|

|

|

Total Common Shares Offered Hereby

|

|

|

Common Shares Owned Following the Offering

|

|

|

Percentage of Class Following the Offering

|

|

|

Friends Dry Investment Company Inc. (3)

|

|

|

868,928

|

|

|

|

30.6

|

%

|

|

|

868,928

|

|

|

|

0

|

|

|

|

0.0

|

%

|

|

Family United Navigation Company (4)

|

|

|

287,443

|

|

|

|

10.1

|

%

|

|

|

287,443

|

|

|

|

0

|

|

|

|

0.0

|

%

|

|

Ergina Shipping Ltd. (5)

|

|

|

180,308

|

|

|

|

6.4

|

%

|

|

|

180,308

|

|

|

|

0

|

|

|

|

0.0

|

%

|

|

Total

|

|

|

1,336,679

|

|

|

|

47.1

|

%

|

|

|

1,336,679

|

|

|

|

0

|

|

|

|

0.0

|

%

|

| (1) |

Beneficial ownership is determined in accordance with the Rule 13d-3(a) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and generally includes voting or

investment power with respect to securities. Except as subject to community property laws or otherwise as described in the notes below, where applicable, the person named above has sole voting and investment power with respect to all common

shares shown as beneficially owned by it.

|

| (2) |

Based on 2,835,656 shares outstanding as of July 7, 2023.

|

| (3) |

Represents 868,928 shares of common stock beneficially owned by Friends Dry Investment Company Inc. (“Friends Dry”). A majority of the shareholders of Friends Dry are members of

the Pittas family. Investment power and voting control by Friends Dry resides in its Board of Directors which consists of five directors, a majority of whom are members of the Pittas family: Aristides J. Pittas, CEO, President and Director of

the Company; Aristides P. Pittas, Vice Chairman and Director of the Company; Nikolaos J. Pittas, Financial Manager of Eurobulk, an affiliate of the Company; Emmanuel J. Pittas, Vice President of Eurobulk; and Markos Vasilikos, Managing Director

of Eurobulk. Actions by Friends Dry may be taken by a majority of the members on its Board of Directors. The business address for Friends Dry is 4 Messogiou & Evropis Street, 151 24 Maroussi, Greece.

|

| (4) |

Represents shares of common stock held of record by Family United Navigation Co. (“FUN”). A majority of the shareholders of FUN are members of the Pittas family. Investment power

and voting control by FUN resides in its Board of Directors which consists of four directors, affiliated with the Pittas family: Aristides P. Pittas, Vice Chairman and Director of the Company; Pantelis A. Pittas; Despoina Pitta; and Eleni A.

Pitta. Actions by FUN may be taken by a majority of the members on its Board of Directors. The business address of FUN is 4 Messogiou & Evropis Street, 151 24 Maroussi, Greece.

|

| (5) |

Represents shares of common stock held of record by Ergina Shipping Ltd (“Ergina”). A majority of the shareholders of Ergina are members of the Pittas family. Investment power

and voting control by Ergina resides in its Board of Directors which consists of three directors, affiliated with the Pittas family: Aristides J. Pittas, President and Director of the Company; Markos Vasilikos, Managing Director of Eurobulk;

and Nikolaos J. Pittas; Financial Manager of Eurobulk. Actions by Ergina may be taken by a majority of the members on its Board of Directors. The business address of Ergina is 4 Messogiou & Evropis Street, 151 24 Maroussi, Greece.

|

OUR CAPITALIZATION

The following table sets forth our capitalization as of March 31, 2023:

|

• |

on an actual basis; and

|

|

• |

on an as adjusted basis, to give effect to events that have occurred between April 1, 2023, and July 7, 2023: (a) $2,885,000 of installments paid under our secured long-term debt since March 31,

2023, (b) a bank loan of $14,000,000 to refinance M/V Ekaterini, and (c) 8,534 of shares bought under our share repurchase program as of July 7, 2023 for $119,622.

|

There have been no significant adjustments to our capitalization since July 7, 2023,

other than the adjustments described above. You should also read this table in conjunction with our report on Form 6-K filed with the Commission on May 15, 2023, which is incorporated by reference herein.

As of March 31, 2023

|

(All figures in U.S. dollars, except for share amounts)

|

|

Actual*

|

|

|

As Adjusted**

|

|

|

Debt***:

|

|

|

|

|

|

|

|

Long-term bank loans, current portion

|

|

$

|

10,317,900

|

|

|

$

|

7,432,900

|

|

|

Long-term bank loans, net of current portion

|

|

|

56,018,193

|

|

|

|

70,018,193

|

|

|

Total debt

|

|

$

|

66,336,093

|

|

|

|

77,451,093

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholder’s equity:

|

|

|

|

|

|

|

|

|

|

Common shares, $0.01 par value; 200,000,000 authorized shares; 2,844,190 shares issued and outstanding as at March 31, 2023; 2,835,656 shares issued and

outstanding as adjusted

|

|

$

|

28,442

|

|

|

|

28,357

|

|

|

Additional paid-in capital

|

|

|

68,696,297

|

|

|

|

68,576,760

|

|

|

Retained earnings

|

|

|

42,932,813

|

|

|

|

42,932,813

|

|

|

Total Shareholders' equity

|

|

|

111,657,552

|

|

|

|

111,537,930

|

|

|

Total capitalization

|

|

$

|

177,993,645

|

|

|

|

188,989,023

|

|

| * |

The “Actual” column is based on our report on Form 6-K filed with SEC on May 15, 2023.

|

| ** |

The “As Adjusted” Additional paid-in capital and Accumulated deficit do not include the incentive plan charge from April 1, 2023 to July 7, 2023.

|

| *** |

Debt is secured by mortgages on all our vessels.

|

DIVIDEND POLICY

A description of our dividend policy can be found in Item 8.A "Financial Information – Consolidated Statements and Other

Financial Information – Dividend Policy" of our Annual Report on Form 20-F for the year ended December 31, 2022, incorporated by reference in this prospectus.

PLAN OF DISTRIBUTION

The Selling Shareholders, which as used herein include donees, pledgees, transferees or other successors

in interest, including any successor funds thereto, and their respective affiliates that are direct or indirect equity investors in us, including other successors in interest selling our common shares received after the date of this prospectus from the

Selling Shareholders as a gift, pledge, partnership distribution or other transfer, may, from time to time, sell, transfer or otherwise dispose of any or all of our common shares, including on any stock exchange, quotation service, market or other

trading facility on which our common shares are listed or traded, in the over-the-counter market, through underwriters, through agents, to dealers, or in private transactions, at fixed prices, at market prices prevailing at the time of sale, at prices

related to the prevailing market prices, at varying prices (which may be above or below market prices prevailing at the time of sale), at negotiated prices or otherwise.

The Selling Shareholders may sell, transfer or otherwise dispose of our common shares offered in this

prospectus through:

|

o |

one or more block trades in which a broker-dealer will attempt to sell the shares as agent, but may reposition and resell a portion of the block, as principal, in order to

facilitate the transaction;

|

|

o |

purchases by a broker-dealer, as principal, and resale by the broker-dealer for its account;

|

|

o |

ordinary brokerage transactions and transactions in which a broker-dealer solicits purchasers;

|

|

o |

underwriters, brokers or dealers (who may act as agents or principals) or directly to one or more purchasers;

|

|

o |

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

o |

broker-dealers, who may agree with the Selling Shareholders to sell a specified number of such shares at a stipulated price per share;

|

|

o |

public or privately negotiated transactions;

|

|

o |

short sales effected after the date the registration statement of which this prospectus is a part is declared effective by the Commission;

|

|

o |

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

|

|

o |

trading plans entered into by the Selling Shareholders pursuant to Rule 10b5-1 under the Securities Exchange Act of 1934, as amended, or the Exchange Act, that are in place at

the time of an offering pursuant to this prospectus and any applicable prospectus supplement hereto that provide for periodic sales of their securities on the basis of parameters described in such trading plans;

|

|

o |

any combination of the foregoing; or

|

|

o |

any other method permitted pursuant to applicable law.

|

The Selling Shareholders may from time to time, pledge or grant a security interest in some or all of

our common shares owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the common shares from time to time, under this prospectus, or under an amendment to this

prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act amending the list of Selling Shareholders to include the donee, pledgee, transferee or other successors in interest as Selling Shareholders under this prospectus. The

Selling Shareholders also may transfer our common shares in other circumstances, in which case the donees, transferees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

In connection with the sale of our common shares, the Selling Shareholders may enter into hedging

transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of our common shares in the course of hedging the positions they assume. The Selling Shareholders may also sell our common shares short and

deliver these common shares to close out their short positions, or loan or pledge the common shares to broker-dealers that in turn may sell these securities. The Selling Shareholders may also enter into option or other transactions with broker-dealers

or other financial institutions or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of our common shares offered by this prospectus, which shares such broker-dealer or

other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The Selling Shareholders also may sell all or a portion of our common shares in open market transactions

in reliance upon Rule 144 under the Securities Act, regardless of whether the shares are offered in this prospectus, provided that they meet the criteria and conform to the requirements of that rule.

There can be no assurance that the Selling Shareholders will sell any or all of our common shares

offered by this prospectus.

The aggregate proceeds to the Selling Shareholders from the sale of our common shares offered by them

will be the purchase price of the common shares less discounts or commissions, if any. Each Selling Shareholder reserves the right to accept and, together with its agents from time to time, to reject, in whole or in part, any proposed purchase of

common shares to be made directly or through agents. We will not receive any of the proceeds from the sale of our common shares by the Selling Shareholders.

The Selling Shareholders and any underwriters, broker-dealers or agents that participate in the sale of

our common shares may be deemed by the Commission to be "underwriters" within the meaning of Section 2(a)(11) of the Securities Act. Any discounts, commissions, concessions or profit they earn on any resale of the shares may therefore be underwriting

discounts and commissions under the Securities Act. Selling Shareholders who are deemed by the Commission to be "underwriters" within the meaning of Section 2(a)(11) of the Securities Act will be subject to the prospectus delivery requirements of the

Securities Act.

We have informed the Selling Shareholders that the anti-manipulation rules of Regulation M, promulgated

under the Exchange Act, may apply to sales of our common shares by the Selling Shareholders in the market and to the activities of the Selling Shareholders and their affiliates. In addition, to the extent applicable we will make copies of this

prospectus (as it may be supplemented or amended from time to time) available to the Selling Shareholders for the purpose of satisfying the prospectus delivery requirements of the Securities Act. The Selling Shareholders may indemnify any broker,

dealer or agent that participates in transactions involving the sale of our common shares against certain liabilities, including liabilities arising under the Securities Act.

As of the date of this prospectus, we are not a party to any agreement, arrangement or understanding

between any broker or dealer and us with respect to the offer or sale of any of our common shares pursuant to this prospectus.

At the time that any particular offering of common shares is made, to the extent required by the

Securities Act, a prospectus or prospectus supplement or, if appropriate, a post-effective amendment, will be distributed, setting forth the terms of the offering, including the aggregate number of common shares being offered, the purchase price of the

common shares, the public offering price of the common shares, the names of any underwriters, dealers or agents and any applicable discounts or commission.

In order to comply with the securities laws of some states, if applicable, our common shares may be sold

in these jurisdictions only through registered or licensed brokers or dealers. In addition, in some states our common shares may not be sold unless they have been registered or qualified for sale or an exemption from registration or qualification

requirements is available and is complied with.

Underwriters or agents could make sales in privately negotiated transactions and/or any other method

permitted by law, including sales deemed to be an at-the-market offering as defined in Rule 415 promulgated under the Securities Act, which includes sales made directly on or through the Nasdaq Capital Market, the existing trading market for our common

shares, or sales made to or through a market maker other than on an exchange.

We will bear the costs relating to the registration and sale of the common shares offered by the Selling

Shareholders under this Registration Statement, other than any underwriting discounts and commissions and transfer taxes, if any. We have agreed to indemnify the Selling Shareholders against certain liabilities, including liabilities of any violation

by the Company of the Securities Act, the Exchange Act and state securities laws applicable to the Company and relating to the registration of the shares offered by this prospectus that have not resulted from written information provided by the Selling

Shareholders to us expressly for use in connection with such registration. We have agreed with the Selling Shareholders to use best efforts to keep the registration statement of which this prospectus constitutes a part effective until the earlier of

(a) such time as all of our common shares covered by this prospectus have been disposed of pursuant to and in accordance with the registration statement and (b) when all of the common shares owned by the Selling Shareholders may be resold pursuant to

Rule 144 under the Securities Act without restriction as to volume or manner of sale.

DESCRIPTION OF CAPITAL STOCK

The following description of our capital stock, together with the additional information we include in

any applicable prospectus supplements, summarizes the material terms and provisions of the capital stock offered under this prospectus. For the complete terms of our capital stock, please refer to our amended and restated articles of incorporation

that are filed as an exhibit to our Report on Form 6-K filed on May 29, 2018, which are incorporated by reference herein; our bylaws, as amended, that are filed as exhibits to our Registration Statement on Form F-1 filed on May 8, 2018, which are

incorporated by reference herein; the Statement of Designation of Series A Participating Preferred Stock, filed as an exhibit to our Report on Form 6-K filed on May 31, 2018 and incorporated by reference herein; and the Amended and Restated Statement

of Designation of Series B Convertible Perpetual Preferred Shares, filed as an exhibit to our Report on Form 6-K filed on February 1, 2021 and incorporated by reference herein. The BCA may also affect the terms of these securities.

Authorized Capitalization

Under our amended and restated articles of incorporation, our authorized capital stock consists of

200,000,000 shares of common stock, par value $0.01 per share and 20,000,000 shares of preferred stock par value $0.01 per share. All of our shares of stock are in registered form.

Common Shares

As of the date of this prospectus, we are authorized to issue up to 200,000,000 shares of common stock,

par value $0.01 per share, of which there are 2,835,656 shares issued and outstanding. Each outstanding share of common stock is entitled to one vote, either in person or by proxy, on all matters that may be voted upon by their holders at meetings of

the shareholders. Holders of our common stock (i) have equal ratable rights to dividends from funds legally available therefore, if declared by the Board of Directors; (ii) are entitled to share ratably in all of our assets available for distribution

upon liquidation, dissolution or winding up; and (iii) do not have preemptive, subscription or conversion rights or redemption or sinking fund provisions. All issued shares of our common stock when issued will be fully paid for and non-assessable.

Preferred Shares

As of the date of this prospectus, we are authorized to issue up to 20,000,000 shares of preferred

stock, par value $0.01 per share, of which there are currently no shares issued and outstanding. The preferred stock may be issued in one or more series and our Board of Directors, without further approval from our shareholders, is authorized to fix

the dividend rights and terms, conversion rights, voting rights, redemption rights, liquidation preferences and other rights and restrictions relating to any series. Issuances of preferred stock, while providing flexibility in connection with

possible financings, acquisitions and other corporate purposes, could, among other things, adversely affect the voting power of the holders of our common stock.

For a full description of the terms of our Series B Preferred Shares, please see the Amended and

Restated Statement of Designation for the Series B Convertible Perpetual Preferred Shares, filed as an exhibit to our Report on Form 6-K filed on February 1, 2021.

Share History

On November 5, 2020, the Board of Directors awarded 44,900 shares of restricted stock to

our directors, officers and key employees of Eurobulk, 50% of which vested on November 16, 2021, and the remainder vested on November 16, 2022. There were 1,314 shares that were forfeited due to employee termination.

On January 29, 2021, the Board of Directors agreed to redeem $3.0 million of its Series B

Preferred Shares with a simultaneous reduction of the dividend rate for the remaining outstanding shares. After the redemption, there were 13,606 Series B Preferred Shares with $13.6 million face value

outstanding.

On June 4, 2021, Ergina elected to convert into shares of common stock part of the outstanding amount

of the bridge loan it provided to the Company on May 10, 2021; the conversion price was the average closing price over the fifteen business days prior to the conversion notice as per the terms of the loan. As result of the conversion, EuroDry issued

180,308 shares to Ergina for the converted loan amount of $3.3 million.

From June 15, 2021, through November 3, 2021, we sold 341,017 shares of common stock under our

at-the-market offering for $9,975,312 in gross proceeds net of commissions.

On November 19, 2021, the Board of Directors awarded 49,650 shares of restricted stock to our directors,

officers and key employees of Eurobulk, 50% of which vested on July 1, 2022, and the remainder will vest on July 1, 2023. Vesting of the awards is conditioned on continuous employment throughout the period to the vesting date.

On December 16, 2021, we redeemed all of our Series B Preferred Shares for a net amount of $13.6

million.

In April 2022, we sold 65,130 shares of common stock under our at-the-market offering for $2,685,602 in

gross proceeds net of commissions.

On November 3, 2022, the Board of Directors awarded 58,600 shares of restricted stock to our directors,

officers and key employees of Eurobulk, 50% of which will vest on November 16, 2023, and the remainder will vest on November 15, 2024. Vesting of the awards is conditioned on continuous employment throughout the period to the vesting date.

During the year ended December 31, 2022, we repurchased and cancelled 140,301 common shares, under our

share repurchase program for an aggregate consideration of approximately $2.0 million.

During 2023, up until July 7, 2023, we had repurchased and cancelled 66,964 common shares, under our

share repurchase program for an aggregate consideration of approximately $1.1 million.

Share Repurchase Program

On August 8, 2022, we announced that our Board of Directors approved a share repurchase program (the

“Program”) to purchase up to an aggregate of $10.0 million of our common shares. The Board will review the Program after a period of twelve months. Share repurchases will be made from time to time for cash in open market transactions pursuant to Rule

10b-18 of the Exchange Act at prevailing market prices and/or in privately negotiated transactions. The timing and amount of purchase under the Program will be determined by management based upon market conditions and other factors. The Program does

not require the Company to purchase any specific number or amount of shares and may be suspended or reinstated at any time at the Company’s discretion and without notice. We will cancel common shares repurchased as part of the Program. As of July 7,

2023, we have repurchased the following common shares:

|

Period

|

|

Total Number of Shares Purchased

|

|

|

Average Price Paid per Share (1)

|

|

|

Total Number of Shares Purchased as part of Publicly Announced Plans or Programs

|

|

|

Maximum Number (or Approximate Dollar Value) of Shares that May Yet Be Purchased Under the Plans or Programs

|

|

|

September 1-30, 2022

|

|

|

106,821

|

|

|

$

|

13.725

|

|

|

|

106,821

|

|

|

$

|

8,533,908

|

|

|

October 1-31, 2022

|

|

|

2,142

|

|

|

$

|

13.796

|

|

|

|

2,142

|

|

|

$

|

8,504,356

|

|

|

November 1-30, 2022

|

|

|

9,325

|

|

|

$

|

15.922

|

|

|

|

9,325

|

|

|

$

|

8,355,885

|

|

|

December 1-31, 2022

|

|

|

22,013

|

|

|

$

|

15.926

|

|

|

|

22,013

|

|

|

$

|

8,005,313

|

|

|

January 1-31, 2023

|

|

|

7,061

|

|

|

$

|

16.765

|

|

|

|

7,061

|

|

|

$

|

7,886,935

|

|

|

February 1-28, 2023

|

|

|

11,851

|

|

|

$

|

16.760

|

|

|

|

11,851

|

|

|

$

|

7,688,314

|

|

|

March 1-31, 2023

|

|

|

39,518

|

|

|

$

|

17.233

|

|

|

|

39,518

|

|

|

$

|

7,007,319

|

|

|

April 1-30, 2023

|

|

|

0

|

|

|

|

N/A

|

|

|

|

0

|

|

|

$

|

7,007,319

|

|

|

May 1-31, 2023

|

|

|

0

|

|

|

|

N/A

|

|

|

|

0

|

|

|

$

|

7,007,319

|

|

|

June 1-30, 2023

|

|

|

3,518

|

|

|

|

13.871

|

|

|

|

3,518

|

|

|

$

|

6,958,522

|

|

|

July 1-7, 2023

|

|

|

5,016

|

|

|

|

14.051

|

|

|

|

5,016

|

|

|

$

|

6,888,043

|

|

|

Total

|

|

|

207,265

|

|

|

|

N/A

|

|

|

|

207,265

|

|

|

|

N/A

|

|

|

(1) |

The average price paid per share does not include commissions paid for each transaction.

|

The repurchased shares were cancelled and removed from the Company’s share capital as of July 7, 2023.

Directors

Our directors are elected by a plurality of the votes cast at a meeting of the shareholders by the

holders of shares entitled to vote in the election. Cumulative voting may not be used to elect directors.

Our Board of Directors must consist of at least three directors, such number to be determined by the

Board of Directors by a majority vote of the entire Board of Directors from time to time. Shareholders may change the number of our directors only by an affirmative vote of the holders of the majority of the outstanding shares of capital stock entitled

to vote generally in the election of directors.

Our Board of Directors is divided into three classes as set out below in “Classified Board of

Directors.” Each director is elected to serve until the third succeeding annual meeting after his election and until his successor shall have been elected and qualified, except in the event of his death, resignation or removal.

Shareholder Meetings

Under our bylaws, as amended, annual shareholder meetings will be held at a time and place selected by

our Board of Directors. The meetings may be held in or outside of the Marshall Islands. Special meetings may be called at any time by the Board of Directors, the Chairman of the Board or by the President. Notice of every annual and special meeting of

shareholders must be given to each shareholder of record entitled to vote at least 15 but no more than 60 days before such meeting.

Dissenters' Rights of Appraisal and Payment

Under the BCA, our shareholders have the right to dissent from various corporate actions, including any

merger or consolidation or sale of all or substantially all of our assets not made in the usual course of our business, and receive payment of the fair value of their shares. In the event of any further amendment of our amended and restated articles of

incorporation, a shareholder also has the right to dissent and receive payment for his or her shares if the amendment alters certain rights in respect of those shares. The dissenting shareholder must follow the procedures set forth in the BCA to

receive payment. In the event that we and any dissenting shareholder fail to agree on a price for the shares, the BCA procedures involve, among other things, the institution of proceedings in the high court of the Republic of the Marshall Islands or in

any appropriate court in any jurisdiction in which the Company’s shares are primarily traded on a local or national securities exchange.

Shareholders Derivative Actions

Under the BCA, any of our shareholders may bring an action in our name to procure a judgment in our

favor, also known as a derivative action, provided that the shareholder bringing the action is a holder of common stock both at the time the derivative action is commenced and at the time of the transaction to which the action relates.

Limitations on Liability and Indemnification of Officers and Directors

The BCA authorizes corporations to limit or eliminate the personal liability of directors and officers

to corporations and their shareholders for monetary damages for breaches of directors’ fiduciary duties. Our bylaws, as amended, include a provision that eliminates the personal liability of directors for monetary damages for actions taken as a

director to the fullest extent permitted by law.

Our bylaws, as amended, provide that we must indemnify our directors and officers to the fullest extent

authorized by law. We are also expressly authorized to carry directors’ and officers’ insurance providing indemnification for our directors, officers and certain employees for some liabilities. We believe that these indemnification provisions and

insurance are useful to attract and retain qualified directors and executive officers.

The limitation of liability and indemnification provisions in our bylaws, as amended, may discourage

shareholders from bringing a lawsuit against directors for breach of their fiduciary duty. These provisions may also have the effect of reducing the likelihood of derivative litigation against directors and officers, even though such an action, if

successful, might otherwise benefit us and our shareholders. In addition, your investment may be adversely affected to the extent we pay the costs of settlement and damage awards against directors and officers pursuant to these indemnification

provisions.

There is currently no pending material litigation or proceeding involving any of our directors, officers

or employees for which indemnification is sought.

Purpose

Our purpose, as stated in our amended and restated articles of incorporation, is to engage in any lawful

act or activity for which corporations may now or hereafter be organized under the BCA.

Anti-takeover Effect of Certain Provisions of our Amended and Restated Articles of Incorporation and

Bylaws, as Amended

Several provisions of our amended and restated articles of incorporation and bylaws, as amended, which

are summarized below, may have anti-takeover effects. These provisions are intended to avoid costly takeover battles, lessen our vulnerability to a hostile change in control and enhance the ability of our Board of Directors to maximize shareholder

value in connection with any unsolicited offer to acquire us. However, these anti-takeover provisions, which are summarized below, could also discourage, delay or prevent (1) the merger or acquisition of our company by means of a tender offer, a proxy

contest or otherwise that a shareholder may consider in its best interest and (2) the removal of incumbent officers and directors.

Blank Check Preferred Stock

Under the terms of our amended and restated articles of incorporation, our Board of Directors has

authority, without any further vote or action by our shareholders, to issue up to 20,000,000 shares of blank check preferred stock. Our Board of Directors may issue shares of preferred stock on terms calculated to discourage, delay or prevent a change

in control of our company or the removal of our management.

Classified Board of Directors

Our amended and restated articles of incorporation provide for the division of our Board of Directors

into three classes of directors, with each class as nearly equal in number as possible, serving staggered, three-year terms. Approximately one-third of our Board of Directors will be elected each year. This classified board provision could discourage a

third party from making a tender offer for our shares or attempting to obtain control of us. It could also delay shareholders who do not agree with the policies of our Board of Directors from removing a majority of our Board of Directors for two years.

Election and Removal of Directors

Our amended and restated articles of incorporation prohibit cumulative voting in the election of

directors. Our bylaws, as amended, require parties other than the Board of Directors to give advance written notice of nominations for the election of directors. Our bylaws, as amended, also provide that our directors may be removed only for cause and

by either action of the Board of Directors or the affirmative vote of the holders of 51% of the issued and outstanding voting shares of the Company. These provisions may discourage, delay or prevent the removal of incumbent officers and directors.

Limited Actions by Shareholders

Our amended and restated articles of incorporation and our bylaws, as amended, provide that any action

required or permitted to be taken by our shareholders must be effected at an annual or special meeting of shareholders or by the unanimous written consent of our shareholders. Our amended and restated articles of incorporation and our bylaws, as

amended, provide that, subject to certain exceptions, a special meeting of shareholders may be called only by our Board of Directors, our Chairman of the Board or by the President and the business transacted at the special meeting is limited to the

purposes stated in the notice. Accordingly, a shareholder may not call a special meeting and shareholder consideration of a proposal may be delayed until the next annual meeting.

Advance Notice Requirements for Shareholder Proposals and

Director Nominations

Our bylaws, as amended, provide that shareholders seeking to nominate candidates for election as

directors or to bring business before an annual meeting of shareholders must provide timely notice of their proposal in writing to the corporate secretary. Generally, to be timely, a shareholder’s notice must be received at our principal executive

offices not less than 150 days nor more than 180 days prior to the one-year anniversary of the immediately preceding annual meeting of shareholders. Our bylaws, as amended, also specify requirements as to the form and content of a shareholder’s notice.

These provisions may impede shareholders’ ability to bring matters before an annual meeting of shareholders or make nominations for directors at an annual meeting of shareholders.

Certain Business Combinations

Our amended and restated articles of incorporation also prohibit us, subject to several exclusions, from

engaging in any “business combination” with any interested shareholder for a period of three years following the date the shareholder became an interested shareholder.

Shareholders' Rights Plan

We adopted a shareholders’ rights plan on May 5, 2018 (the “Rights Plan”). Each right entitles the

registered holder, upon the occurrence of certain events, to purchase from us one-thousandth of a share of Series A Participating Preferred Stock at an exercise price of $26, subject to adjustment.

The rights will expire on the earliest of (i) May 30, 2028 or (ii) redemption or exchange of the rights. The Rights Plan

was designed to enable us to protect shareholder interests in the event that an unsolicited attempt is made for a business combination with or takeover of the Company. We believe that the Rights Plan should enhance the board of directors' negotiating

power on behalf of shareholders in the event of a coercive offer or proposal. We are not currently aware of any such offers or proposals and we adopted the plan as a matter of prudent corporate governance. A copy of the Rights Plan is filed as an

Exhibit hereto.

Transfer Agent