As filed with the Securities and Exchange Commission

on January 19, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Edgewise Therapeutics, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

82-1725586 |

|

(State or other jurisdiction of

incorporation or organization) |

(I.R.S. Employer

Identification Number) |

1715 38th St.

Boulder, CO 80301

(720) 262-7002

(Address, including zip code, and telephone

number, including area code, of registrant’s principal executive offices)

Kevin Koch, Ph.D.

President and Chief Executive Officer

Edgewise Therapeutics, Inc.

1715 38th St.

Boulder, CO 80301

(720) 262-7002

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

|

Kenneth A. Clark

Tony Jeffries

Jennifer Knapp

Wilson Sonsini Goodrich & Rosati,

Professional Corporation

1881 9th Street, Suite 110

Boulder, CO 80302

(303) 256-5900 |

R. Michael Carruthers

Chief Financial Officer

Edgewise Therapeutics, Inc.

1715 38th St.

Boulder, CO 80301

(720) 262-7002 |

From time to time after the effective date

of the registration statement.

(Approximate date of commencement of proposed

sale to the public)

If the only securities being registered

on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ☐

If any of the securities being registered

on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other

than securities offered only in connection with dividend or interest reinvestment plans, check the following box. x

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act,

please check the following box and list the Securities Act registration statement number of the earlier effective registration statement

for the same offering. x (File no. 333-264083)

If this Form is a post-effective

amendment filed pursuant to Rule 462(c) under the Securities Act, please check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement

pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission

pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective

amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional

classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions

of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging

growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Accelerated filer |

¨ |

| |

|

|

|

| Non-accelerated filer |

x |

Smaller reporting company |

x |

| |

|

|

|

| |

|

Emerging growth company |

x |

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

This Registration Statement shall become effective upon filing with

the Securities and Exchange Commission in accordance with Rule 462(b) of the Securities Act.

EXPLANATORY NOTE AND INCORPORATION BY REFERENCE

Pursuant to Rule 462(b) under the

Securities Act of 1933, as amended, and General Instruction IV(A) of Form S-3, the registrant is filing this Registration

Statement on Form S-3 to register the offer and sale of an additional $37,919,578.05, or the equivalent thereof, of its

(a) shares of the Company’s common stock, $0.0001 par value per share (the “Common Stock”);

(b) shares of the Company’s preferred stock, $0.0001 par value per share (the “Preferred Stock”);

(c) the Company’s debt securities (the “Debt Securities”); (d) depositary shares of the Company

representing a fractional interest in a share of Preferred Stock (the “Depositary Shares”); (e) warrants to

purchase Common Stock, Preferred Stock, Debt Securities or Depositary Shares (the “Warrants”); (f) subscription

rights to purchase Common Stock, Preferred Stock, Debt Securities, Depositary Shares, Warrants or units consisting of some or all of

these securities (the “Subscription Rights”); (g) purchase contracts of the Company with respect to the securities

of the Company (the “Purchase Contracts”); and (h) units consisting of two or more securities described above in

any combination (the “Units”) (the Common Stock, the Preferred Stock, the Debt Securities, the Depositary Shares, the

Warrants, the Subscription Rights, the Purchase Contracts and the Units are collectively referred to herein as the

“Securities”). This Registration Statement relates to the registrant’s Registration Statement on Form S-3

(File No. 333-264083) (the “Prior Registration Statement”), initially filed on April 1, 2022 and declared

effective by the Securities and Exchange Commission on May 5, 2022. The required opinion and consents are filed herewith. The

additional amount of Securities that is being registered for offer and sale represents no more than 20% of the maximum aggregate

offering price of the remaining securities available to be sold under the Prior Registration Statement. Pursuant to

Rule 462(b), the contents of the Prior Registration Statement, including the exhibits thereto, are incorporated by reference

into this Registration Statement.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3

and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City

of Boulder, State of Colorado, on January 19, 2024.

| EDGEWISE THERAPEUTICS, INC. |

|

| |

|

|

| By: |

/s/ Kevin Koch |

|

| |

Kevin Koch, Ph.D. |

|

| |

President and Chief Executive Officer |

|

Pursuant to the requirements of the Securities

Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated:

| Signature |

|

Title |

|

Date |

| |

|

|

|

/s/ Kevin Koch |

|

President and Chief Executive Officer and Director

(Principal Executive Officer) |

|

January 19, 2024 |

| Kevin Koch, Ph.D. |

| |

|

|

|

/s/ R. Michael

Carruthers |

|

Chief Financial Officer

(Principal Financial and Accounting Officer) |

|

January 19, 2024 |

| R. Michael Carruthers |

|

|

| |

|

|

|

* |

|

Chairman and Director |

|

January 19, 2024 |

| Peter Thompson, M.D. |

|

|

| |

|

|

|

* |

|

Director |

|

January 19, 2024 |

| Laura Brege |

|

|

| |

|

|

|

* |

|

Director |

|

January 19, 2024 |

| Badreddin Edris, Ph.D. |

|

|

| |

|

|

|

|

|

Director |

|

January 19, 2024 |

| Jonathan C. Fox, M.D., Ph.D., FACC |

|

|

| |

|

|

|

* |

|

Director |

|

January 19, 2024 |

| Jonathan Root, M.D. |

|

|

| |

|

|

|

* |

|

Director |

|

January 19, 2024 |

| Alan Russell, Ph.D. |

|

|

| *By: |

/s/ Kevin Koch |

|

| |

Kevin Koch, Ph.D. |

|

| |

President and Chief Executive Officer

Attorney-in-Fact |

|

Exhibit 5.1

|

|

Wilson Sonsini Goodrich & Rosati

Professional Corporation

1881 9th Street, Suite 110

Boulder, Colorado 80302

o: 303.256.5900

f: 866.974.7329

|

January 19, 2023

Edgewise Therapeutics, Inc.

1715 38th Street

Boulder, Colorado 80301

| Re: |

Registration Statement on Form S-3 |

Ladies and Gentlemen:

This opinion is furnished to you in connection

with the Registration Statement on Form S-3 (the “Registration Statement”), filed by Edgewise Therapeutics,

Inc. (the “Company”) with the U.S. Securities and Exchange Commission (the “Commission”)

pursuant to Rule 462(b) of the Securities Act of 1933, as amended (the “Securities Act”), in connection with

the registration under the Securities Act of additional (a) shares of the Company’s common stock, $0.0001 par value per share

(the “Common Stock”); (b) shares of the Company’s preferred stock, $0.0001 par value per share (the

“Preferred Stock”); (c) the Company’s debt securities (the “Debt Securities”);

(d) depositary shares of the Company representing a fractional interest in a share of Preferred Stock (the “Depositary

Shares”); (e) warrants to purchase Common Stock, Preferred Stock, Debt Securities or Depositary Shares (the “Warrants”);

(f) subscription rights to purchase Common Stock, Preferred Stock, Debt Securities, Depositary Shares, Warrants or units consisting

of some or all of these securities (the “Subscription Rights”); (g) purchase contracts of the Company with

respect to the securities of the Company (the “Purchase Contracts”); and (h) units consisting of two or

more securities described above in any combination (the “Units”) (the Common Stock, the Preferred Stock, the

Debt Securities, the Depositary Shares, the Warrants, the Subscription Rights, the Purchase Contracts and the Units are collectively referred

to herein as the “Securities”), with an aggregate offering price of $37,919,578.05. The Registration Statement

incorporates by reference the Registration Statement on Form S-3 (Registration No. 333-264083) (the “Prior Registration Statement”),

which was declared effective on May 5, 2022, including the prospectus which forms part of the Registration Statement (the “Prospectus”)

and the supplements to the prospectus referred to therein (each a “Prospectus Supplement”).

The Securities are to be sold from time to time

as set forth in the Registration Statement, the Prospectus contained therein and the Prospectus Supplements. The Debt Securities are to

be issued pursuant to a debt securities indenture (the “Indenture”), a form of which has been filed as an exhibit

to the Prior Registration Statement and is to be entered into between the Company and a trustee to be named in a Prospectus Supplement

to the Registration Statement (the “Trustee”). The Securities are to be sold pursuant to a purchase, underwriting

or similar agreement in substantially the form to be filed under a Current Report on Form 8-K. The Debt Securities are to be issued

in the form set forth in the Indenture. The Indenture may be supplemented in connection with the issuance of each such series of Debt

Securities, by a supplemental indenture or other appropriate action of the Company creating such series of Debt Securities.

We have examined instruments, documents, certificates

and records that we have deemed relevant and necessary for the basis of our opinions hereinafter expressed. In such examination, we have

assumed: (a) the authenticity of original documents and the genuineness of all signatures; (b) the conformity to the originals

of all documents submitted to us as copies; (c) the truth, accuracy and completeness of the information, representations and warranties

contained in the instruments, documents, certificates and records we have reviewed; (d) that the Registration Statement, and any

amendments thereto (including post-effective amendments), will have become effective under the Act; (e) that a Prospectus Supplement

will have been filed with the Commission describing the Securities offered thereby; (f) that the Securities will be issued and sold

in compliance with applicable U.S. federal and state securities laws and in the manner stated in the Registration Statement and the applicable

Prospectus Supplement; (g) that a definitive purchase, underwriting or similar agreement with respect to any Securities offered

will have been duly authorized and validly executed and delivered by the Company and the other parties thereto; (h) that any Securities

issuable upon conversion, exchange, redemption or exercise of any Securities being offered will be duly authorized, created and, if appropriate,

reserved for issuance upon such conversion, exchange, redemption or exercise; (i) with respect to shares of Common Stock or Preferred

Stock, that there will be sufficient shares of Common Stock or Preferred Stock authorized under the Company’s organizational documents

that are not otherwise reserved for issuance; and (j) the legal capacity of all natural persons. As to any facts material to the

opinions expressed herein that were not independently established or verified, we have relied upon oral or written statements and representations

of officers and other representatives of the Company. The term “Board” means the Board of Directors of the Company or a duly

constituted and acting committee thereof.

austin beijing boston BOULDER brussels hong kong london los angeles new york palo alto

salt lake city san diego san francisco seattle shanghai washington, dc wilmington, de

Edgewise Therapeutics, Inc.

January 19, 2024

Page 2

Based on such examination, we are of the opinion

that:

| 1. | With respect to the shares of Common Stock, when: (a) the Board has taken all necessary corporate action to approve the issuance

and the terms of the offering of the shares of Common Stock and related matters; and (b) the shares of Common Stock have been duly

delivered either (i) in accordance with the applicable definitive purchase, underwriting or similar agreement approved by the Board,

or upon the exercise of Warrants to purchase Common Stock, upon payment of the consideration therefor (not less than the par value of

the Common Stock) provided for therein or (ii) upon conversion or exercise of any other Security, in accordance with the terms of

such Security or the instrument governing such Security providing for such conversion or exercise as approved by the Board, for the consideration

approved by the Board, then the shares of Common Stock will be validly issued, fully paid and nonassessable. |

| 2. | With respect to any particular series of shares of Preferred Stock, when: (a) the Board has taken all necessary corporate action

to approve the issuance and terms of the shares of Preferred Stock, the terms of the offering thereof, and related matters, including

the adoption of a certificate of designation (a “Certificate”) relating to such Preferred Stock conforming to the General

Corporation Law of the State of Delaware (the “DGCL”) and the filing of the Certificate with the Secretary of

State of the State of Delaware; and (b) the shares of Preferred Stock have been duly delivered either (i) in accordance with

the applicable definitive purchase, underwriting or similar agreement approved by the Board, or upon the exercise of Warrants to purchase

Preferred Stock, upon payment of the consideration therefor (not less than the par value of the Preferred Stock) provided for therein

or (ii) upon conversion or exercise of any other Security, in accordance with the terms of such Security or the instrument governing

such Security providing for such conversion or exercise as approved by the Board, for the consideration approved by the Board, then the

shares of Preferred Stock will be validly issued, fully paid and nonassessable. |

| 3. | With respect to Debt Securities to be issued under the Indenture, when: (a) the

Trustee is qualified to act as Trustee under the Indenture and the Company has filed a Form T-1 for the Trustee with the Commission;

(b) the Trustee has duly executed and delivered the Indenture; (c) the

Indenture has been duly authorized and validly executed and delivered by the Company to the Trustee; (d) the

Indenture has been duly qualified under the Trust Indenture Act of 1939, as amended; (e) the

Board has taken all necessary corporate action to approve the issuance and terms of such Debt Securities, the terms of the offering thereof

and related matters; and (f) such Debt Securities have been duly executed, authenticated,

issued and delivered in accordance with the provisions of the Indenture and the applicable definitive purchase, underwriting or similar

agreement approved by the Board, or upon the exercise of Warrants to purchase Debt Securities, upon payment of the consideration therefor

provided for therein, such Debt Securities will constitute valid and binding obligations of the Company, enforceable against the Company

in accordance with their terms, and entitled to the benefits of the Indenture. |

Edgewise Therapeutics, Inc.

January 19, 2024

Page 3

| 4. | With respect to Depositary Shares, when: (a) the Board has taken all necessary corporate action to approve the issuance and terms

of the Depositary Shares, the terms of the offering thereof, and related matters, including the adoption of a Certificate relating to

the Preferred Stock underlying such Depositary Shares and the filing of the Certificate with the Secretary of State of the State of Delaware;

(b) the Deposit Agreement (the “Deposit Agreement”) or agreements relating to the Depositary Shares and the related Depositary

Receipts (the “Depositary Receipts”) have been duly authorized and validly executed and delivered by the Company and the depositary

appointed by the Company; (c) the shares of Preferred Stock underlying such Depositary Shares have been deposited with a bank or

trust company (which meets the requirements for the depositary set forth in the Registration Statement) under the applicable Deposit Agreement;

and (d) the Depositary Receipts representing the Depositary Shares have been duly executed, countersigned, registered and delivered

in accordance with the appropriate Deposit Agreement and the applicable definitive purchase, underwriting or similar agreement approved

by the Board upon payment of the consideration therefor provided for therein, the Depositary Shares will be validly issued, fully paid

and nonassessable. |

| 5. | With respect to the Warrants, when: (a) the Board has taken all necessary corporate action to approve the issuance and terms

of the Warrants and related matters; and (b) the Warrants have been duly executed and delivered against payment therefor, pursuant

to the applicable definitive purchase, underwriting, warrant or similar agreement, as applicable, duly authorized, executed and delivered

by the Company and a warrant agent and the certificates for the Warrants have been duly executed and delivered by the Company and such

warrant agent, then the Warrants will constitute valid and binding obligations of the Company, enforceable against the Company in accordance

with their terms. |

| 6. | With respect to the Subscription Rights, when: (a) the Board has taken all necessary corporate action to authorize the issuance

and terms of the Subscription Rights, the terms of the offering thereof, and related matters and (b) the rights agreement under which

the Subscription Rights are to be issued has been duly authorized and validly executed and delivered by the Company, and upon payment

of the consideration for the Subscription Rights provided for in such rights agreement, if any, then the Subscription Rights will be valid

and binding obligations of the Company, enforceable against the Company in accordance with their terms. |

| 7. | With respect to the Purchase Contracts, when: (a) the Board has taken all necessary corporate action to approve the issuance

and terms of the Purchase Contracts and related matters and (b) the agreement under which the Purchase Contracts are to be issued

has been duly authorized and validly executed and delivered by the Company, then the Purchase Contracts will be valid and binding obligations

of the Company, enforceable against the Company in accordance with their terms. |

| 8. | With respect to the Units, when: (a) the Board has taken all necessary

corporate action to approve the issuance and terms of the Units (including any Securities underlying the Units) and related matters;

and (b) the Units (including any Securities underlying the Units) have been duly executed and delivered against payment

therefor, pursuant to the applicable definitive purchase, underwriting, or similar agreement duly authorized, executed and delivered

by the Company and any applicable unit or other agents, and the certificates for the Units (including any Securities underlying the

Units) have been duly executed and delivered by the Company and any applicable unit or other agents, then the Units will constitute valid

and binding obligations of the Company, enforceable against the Company in accordance with their terms. |

Edgewise Therapeutics, Inc.

January 19, 2024

Page 4

Our opinion that any document is legal, valid and

binding is qualified as to:

| a) | limitations imposed by bankruptcy, insolvency, reorganization, arrangement, fraudulent transfer, moratorium or other similar laws

relating to or affecting the rights of creditors generally; |

| b) | rights to indemnification and contribution, which may be limited by applicable law or equitable principles; and |

| c) | the effect of general principles of equity, including without limitation concepts of materiality, reasonableness, good faith and fair

dealing, and the possible unavailability of specific performance or injunctive relief, whether considered in a proceeding in equity or

at law. |

We express no opinion herein as to the laws of

any state or jurisdiction other than the DGCL, the federal laws of the United States of America and the laws of the State of New York

as to the enforceability of the Debt Securities.

We consent to the use of this opinion as an exhibit

to the Registration Statement, and we consent to the reference of our name wherever it appears in the Registration Statement, Prior Registration

Statement, Prospectus, any Prospectus Supplement, and in any amendment or supplement thereto. In giving this consent, we do not admit

that we are in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of

the Commission thereunder.

| Very truly yours, |

|

| |

|

| /s/ Wilson Sonsini Goodrich & Rosati, P.C. |

|

| |

|

| WILSON SONSINI GOODRICH & ROSATI |

|

| Professional Corporation |

|

Exhibit 23.1

|

|

| |

|

KPMG LLP

Suite 800

1225 17th Street

Denver, CO 80202-5598 |

|

Consent of Independent

Registered Public Accounting Firm

We consent to the incorporation by reference in the registration statement

(No. 333-264083) on Form S-3 of our report dated February 23, 2023, with respect to the financial statements of Edgewise

Therapeutics, Inc.

/s/ KPMG LLP

Denver, Colorado

January 19, 2024

| |

KPMG LLP, a Delaware limited liability partnership and a member firm of

the KPMG global organization of independent member firms affiliated with

KPMG International Limited, a private English company limited by guarantee. |

Exhibit 107.1

CALCULATION OF FILING FEE TABLES

FORM S-3

(Form Type)

EDGEWISE THERAPEUTICS, INC.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

| |

|

|

|

|

|

|

|

|

| |

Security

Type |

|

Title of each

Class of

Securities to

be Registered |

|

Fee

Calculation

Rule |

|

Amount to

be

Registered |

|

Proposed

Maximum

Offering

Price Per

Share |

|

Proposed

Maximum

Aggregate

Offering

Price |

|

Fee

Rate |

|

Amount of

Registration

Fee |

| |

|

|

|

|

|

|

|

|

|

Fees to be

Paid |

Equity |

|

Common stock, par value

$0.0001 per share |

|

457(o) |

|

(1) |

|

(1) |

|

(1) |

|

− |

|

− |

|

Fees to be

Paid |

Equity |

|

Preferred Stock, par value $0.0001 per share |

|

457(o) |

|

(1) |

|

(1) |

|

(1) |

|

− |

|

− |

|

Fees to be

Paid |

Debt |

|

Debt Securities |

|

457(o) |

|

(1) |

|

(1) |

|

(1) |

|

− |

|

− |

|

Fees to be

Paid |

Equity |

|

Depositary Shares |

|

457(o) |

|

(1) |

|

(1) |

|

(1) |

|

− |

|

− |

|

Fees to be

Paid |

Other |

|

Warrants |

|

457(o) |

|

(1) |

|

(1) |

|

(1) |

|

− |

|

− |

|

Fees to be

Paid |

Other |

|

Subscription Rights |

|

457(o) |

|

(1) |

|

(1) |

|

(1) |

|

− |

|

− |

|

Fees to be

Paid |

Other |

|

Purchase Contracts |

|

457(o) |

|

(1) |

|

(1) |

|

(1) |

|

− |

|

− |

|

Fees to be

Paid |

Other |

|

Units |

|

457(o) |

|

(1) |

|

(1) |

|

(1) |

|

− |

|

− |

|

Fees to be

Paid |

Unallocated (Universal Shelf) |

|

Unallocated (Universal Shelf) |

|

457(o) |

|

(1) |

|

(1) |

|

$37,919,578.05 (1) |

|

0.0001476 |

|

$5,596.93 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| |

Total Offering Amounts |

|

|

|

$37,919,578.05 (1) |

|

|

|

$5,596.93 |

| |

|

|

|

|

|

| |

Total Fees Previously Paid |

|

|

|

|

|

|

|

— |

| |

|

|

|

|

|

| |

Total Fee Offsets |

|

|

|

|

|

|

|

— |

| |

|

|

|

|

|

| |

Net Fee Due |

|

|

|

|

|

|

|

$5,596.93 |

| (1) |

The registrant previously registered the offer and sale of certain securities having a proposed maximum aggregate offering price of $400,000,000 pursuant to a Registration Statement on Form S-3 (File No. 333-264083) (the “Prior Registration Statement”), which was initially filed on April 1, 2022 and declared effective by the Securities and Exchange Commission on May 5, 2022. As of the date hereof, a balance of $202,080,423.95 of such securities remains unsold under the Prior Registration Statement. In accordance with Rule 462(b) under the Securities Act of 1933, as amended, and General Instruction IV(A) of Form S-3, the registrant is hereby registering the offer and sale of an additional $37,919,578.05 of its Securities. The additional amount of Securities that is being registered for offer and sale represents no more than 20% of the maximum aggregate offering price of the remaining securities available to be sold under the Prior Registration Statement. |

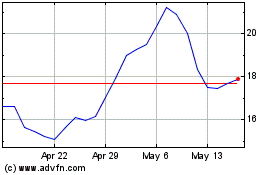

Edgewise Therapeutics (NASDAQ:EWTX)

Historical Stock Chart

From Apr 2024 to May 2024

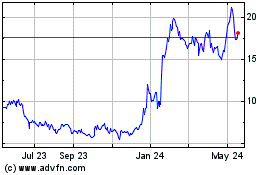

Edgewise Therapeutics (NASDAQ:EWTX)

Historical Stock Chart

From May 2023 to May 2024