J. Allen Fine, Chairman of Investors Title Company (NASDAQ: ITIC),

announced that for the quarter ended March 31, 2007, the Company

reported net income of $2,322,214, a decrease of 19% compared with

$2,874,941 for the prior year period. Net income per diluted share

equaled $0.92, a decrease of 17% compared with $1.11 per diluted

share in the same period last year. Net premiums written increased

1% to $16,792,542 and revenues increased 1% to $20,333,769 compared

with the prior year period. Revenues slightly exceeded the prior

year period primarily due to an increase in investment income and

to a lesser extent, an increase in net premiums written. Income in

the exchange segment also increased principally due to an increase

in interest earned on exchange funds. Profit margins and net income

declined due to a decrease in the net realized gain on sales of

investments and a 6% increase in operating expenses. The increase

in operating expenses was primarily the result of an increase in

commissions to agents due to an increase in agent premiums. Also

contributing to the increase in operating expenses was a small

overall increase in salaries and employee benefits. Chairman Fine

added, �Overall, we are pleased with our results for the quarter,

which is typically a seasonally slow period of the year. We remain

focused on identifying opportunities to extend our distribution

base, operate more efficiently and expand our business lines.�

Investors Title Company is engaged through its subsidiaries in the

business of issuing and underwriting title insurance policies. The

Company also provides services in connection with tax-deferred

exchanges of like-kind property and investment management services

to individuals, companies, banks and trusts. Certain statements

contained herein may constitute forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. Such statements include any predictions regarding activity in

the U.S. real estate market. These statements involve a number of

risks and uncertainties that could cause actual results to differ

materially from anticipated and historical results. For more

details on risk, uncertainties and other factors that could affect

expectations, refer to the Company�s Annual Report on Form 10-K for

the year ended December 31, 2006, as filed with the Securities and

Exchange Commission. Investors Title Company and Subsidiaries

Consolidated Statements of Income March 31, 2007 and 2006

(Unaudited) � For The Three Months Ended March 31 2007� 2006�

Revenues: Underwriting income: Premiums Written $ 16,874,977� $

16,746,269� Less-premiums for reinsurance ceded 82,435� 114,643�

Net premiums written 16,792,542� 16,631,626� Investment

income-interest and dividends 1,209,607� 994,054� Net realized gain

on sales of investments 166,180� 561,647� Exchange services revenue

1,245,479� 1,027,732� Other 919,961� 963,789� Total Revenues

20,333,769� 20,178,848� � Operating Expenses: Commissions to agents

6,845,288� 6,283,396� Provision for claims 1,809,433� 1,855,279�

Salaries, employee benefits and payroll taxes 5,274,375� 5,005,847�

Office occupancy and operations 1,436,123� 1,465,313� Business

development 523,182� 505,658� Filing fees and taxes, other than

payroll and income 165,213� 150,858� Premium and retaliatory taxes

441,920� 342,068� Professional and contract labor fees 645,010�

587,622� Other 222,011� 218,866� ` Total Operating Expenses

17,362,555� 16,414,907� � Income Before Income Taxes 2,971,214�

3,763,941� � Provision For Income Taxes 649,000� 889,000� � Net

Income $ 2,322,214� $ 2,874,941� � Basic Earnings Per Common Share

$ 0.93� $ 1.13� � Weighted Average Shares Outstanding - Basic

2,499,035� 2,549,070� � Diluted Earnings Per Common Share $ 0.92� $

1.11� � Weighted Average Shares Outstanding - Diluted 2,535,858�

2,586,465� Investors Title Company and Subsidiaries Consolidated

Balance Sheets As of March 31, 2007 and December 31, 2006

(Unaudited) � March 31, 2007 Dec. 31, 2006 Assets Investments in

securities: Fixed maturities: Held-to-maturity, at amortized cost $

1,193,959� $ 1,195,617� Available-for-sale, at fair value

104,236,975� 101,954,292� Equity securities, available-for-sale at

fair value 12,677,136� 12,495,923� Short-term investments

2,122,879� 4,460,911� Other investments 1,623,036� 1,473,303� Total

investments 121,853,985� 121,580,046� � Cash and cash equivalents

3,414,489� 3,458,432� � Premiums and fees receivable, net

6,792,739� 6,693,706� Accrued interest and dividends 1,204,662�

1,336,790� Prepaid expenses and other assets 1,692,953� 1,479,366�

Property acquired in settlement of claims 303,538� 303,538�

Property, net 5,910,789� 6,134,304� Deferred income taxes, net

2,308,436� 2,530,196� � Total Assets $ 143,481,591� $ 143,516,378�

� Liabilities and Stockholders' Equity Liabilities: Reserves for

claims $ 37,133,000� $ 36,906,000� Accounts payable and accrued

liabilities 9,522,465� 10,537,992� Commissions and reinsurance

payables 242,617� 470,468� Current income taxes payable 333,704�

326,255� Total liabilities 47,231,786� 48,240,715� � Stockholders'

Equity: Common stock - no par value (shares authorized 10,000,000;

2,486,352 and 2,507,325 shares issued and outstanding 2007 and

2006, respectively, excluding 291,676 shares for 2007 and 2006 of

common stock held by the Company's subsidiary) � � 1� 1� Retained

earnings 93,213,418� 92,134,608� Accumulated other comprehensive

income 3,036,386� 3,141,054� Total stockholders' equity 96,249,805�

95,275,663� � Total Liabilities and Stockholders' Equity $

143,481,591� $ 143,516,378� Investors Title Company and

Subsidiaries Net Premiums Written By State For the Three Months

Ended March 31, 2007 and 2006 (Unaudited) � � � 2007� � 2006�

Alabama $ 139,360� $ 243,636� Florida 828,547� 278,335� Illinois

388,957� 247,895� Kentucky 549,690� 573,498� Maryland 286,871�

373,769� Michigan 779,325� 877,309� Minnesota 118,682� 337,169�

Mississippi 263,842� 134,452� Nebraska 173,324� 134,310� New York

506,759� 503,596� North Carolina 7,913,473� 8,441,482� Pennsylvania

326,654� 315,912� South Carolina 1,716,400� 1,402,073� Tennessee

649,390� 666,323� Virginia 1,560,504� 1,674,103� West Virginia

467,925� 455,418� Other States 198,344� 80,563� Direct Premiums

16,868,047� 16,739,843� Reinsurance Assumed 6,930� 6,426�

Reinsurance Ceded (82,435) (114,643) Net Premiums Written $

16,792,542� $ 16,631,626� Investors Title Company and Subsidiaries

Net Premiums Written By Branch and Agency March 31, 2007 and 2006

(Unaudited) � � � For The Three Months Ended March 31 � 2007� % �

2006� % Branch $ 7,133,311� 42� $ 7,727,025� 46� � Agency �

9,659,231� 58� � 8,904,601� 54� � Total $ 16,792,542� 100� $

16,631,626� 100�

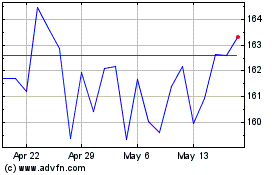

Investors Title (NASDAQ:ITIC)

Historical Stock Chart

From Jun 2024 to Jul 2024

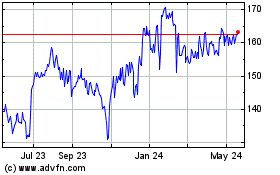

Investors Title (NASDAQ:ITIC)

Historical Stock Chart

From Jul 2023 to Jul 2024