Filed by Jupiter Acquisition Corporation

pursuant to Rule 425 under the Securities Act

of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Companies:

Jupiter Acquisition Corporation

(Commission File No. 001-39505)

1427702 B.C. Ltd.

The following is a transcript of a video interview

with Benjamin Lightburn, Chief Executive Officer of Filament Health Corp., on The Power Play by The Market Herald on July 25, 2023:

Coreena Robertson: Hello and welcome to

the Power Play. I’m Coreena Robertson. Filament Health is listing on the NASDAQ. Here with the details is CEO Ben Lightburn, Ben

pleasure to have you.

Ben Lightburn: Thanks so much for having

me on.

Coreena Robertson: And to get started let’s

just talk about what is Filament Health?

Ben Lightburn: Filament Health is a botanical,

psychedelic drug development company. What that means is we’ve developed proprietary technology for manufacturing botanical drugs

from natural psychedelic sources. What sets them apart from synthetic drugs is A) the manufacturing technology, which we have 17 issued

patents covering, as well as the fact that they contain all of the active secondary metabolites from the raw material. If you can imagine

magic mushrooms have much more than just psilocybin, they have psilocin, baeocystin, many other secondary compounds. That’s the

exact same for our drug products. They’re the first and only ones to contain, not just the primary metabolites, but also the secondary

metabolites, which, of course, mirrors how humans have been consuming these substances for thousands of years.

Coreena Robertson: All right, and you’ve

also had an exciting week announcing you’re uplisting to the NASDAQ through Jupiter Acquisition, tell us about that transaction

and what it means for your company.

Ben Lightburn: This transaction is extremely

positive news for Filament Health. We believe that the NASDAQ market has many more sophisticated and wealthy, obviously, investors that

will be much more able to appreciate our biotech drug development story. Relative to the NEO exchange in Canada. We came to an agreement

with Jupiter Acquisition which is already a NASDAQ listed, Special Purpose Acquisition Company or SPAC and we negotiated a very attractive

value for Filament shareholders which they will be given in shares of Jupiter upon the listing to NASDAQ. The definitive agreement has

been signed. That’s what was the big announcement last week. There’s still a few steps between now and closing. So stay tuned

for lots of very positive news in that regard, and our targeted close and listing is in Q4 of this year.

Coreena Robertson: All right, and you also

announced a non-brokered private placement, which you have closed for up to two million dollars. What are you going to do with the funds?

Ben Lightburn: So again very exciting news,

for Filament, we’re proud to be one of the few psychedelics companies that’s actually out there, raising money. There’s

been a lot of interest and excitement into what we’re doing. This round which we announced last week and then actually closed yesterday

and in fact it was upsized from 2 million to 2.5 million based on very strong demand, this round is going to be used for general working

capital but also to begin our two key clinical trials, one in methamphetamine use disorder, one in opioid use disorder. Methamphetamine

use disorder is a very large indication with approximately 1.5 million sufferers in the United States alone. There are no approved treatments

and the fatal overdose rate is growing by about 30 percent per year. Opioid use disorder is similar although there are already treatments

that are available as we all know they are often ineffective, poorly tolerated, and in many cases lead to relapse, and we are very excited

to be launching our PEX010 product in development programs for both methamphetamine use disorder and opioid use disorder. Ideally we’re

timing the start of these trials with the Nasdaq uplisting so lots of very very exciting things on the go.

Coreena Robertson: Yes and congratulations

Ben we look forward to continued updates. For the Power Play, I’m Coreena Robertson.

[END OF TRANSCRIPT]

Important Information About the Proposed

Business Combination and Where to Find It

This communication relates

to the proposed business combination (the “Proposed Business Combination”) between Jupiter Acquisition Corporation, a Delaware

corporation (“Jupiter”), and Filament Health Corp., a corporation organized under the laws of British Columbia, Canada (“Filament”),

and may be deemed to be solicitation material in respect of the Proposed Business Combination. The Proposed Business Combination will

be submitted to Jupiter’s stockholders for their consideration and approval. 1427702 B.C. Ltd., a British Columbia corporation (“TopCo”),

intends to file a registration statement on Form F-4 (the “Registration Statement”) with the U.S. Securities and Exchange

Commission (the “SEC”), which will include a proxy statement to be distributed to Jupiter’s stockholders in connection

with Jupiter’s solicitation of proxies for the vote by Jupiter’s stockholders to approve the Proposed Business Combination

and other matters as described in the Registration Statement, as well as a prospectus relating to the offer of the securities to be issued

by TopCo in connection with the completion of the Proposed Business Combination. Jupiter and TopCo also intend to file other relevant

documents with the SEC and, in the case of Filament and TopCo, with the applicable Canadian securities regulatory authorities, regarding

the Proposed Business Combination. After the Registration Statement has been filed and declared effective, Jupiter will mail a definitive

proxy statement and other relevant documents to its stockholders as of the record date established for voting on the Proposed Business

Combination. The Proposed Business Combination will also be submitted to the securityholders of Filament for their consideration and approval.

JUPITER’S STOCKHOLDERS AND OTHER INTERESTED PERSONS ARE ADVISED TO READ, ONCE AVAILABLE, THE REGISTRATION STATEMENT AND THE PRELIMINARY

PROXY STATEMENT/PROSPECTUS AND ANY AMENDMENTS THERETO AND, ONCE AVAILABLE, THE DEFINITIVE PROXY STATEMENT/PROSPECTUS IN CONNECTION WITH

JUPITER’S SOLICITATION OF PROXIES FOR ITS SPECIAL MEETING OF STOCKHOLDERS TO BE HELD TO APPROVE, AMONG OTHER THINGS, THE PROPOSED

BUSINESS COMBINATION, BECAUSE THESE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION ABOUT JUPITER, FILAMENT, TOPCO AND THE PROPOSED BUSINESS

COMBINATION.

Jupiter’s stockholders

and other interested parties may also obtain a copy of the Registration Statement, any amendments or supplements thereto and the preliminary

or definitive proxy statement included therein, once available, as well as other documents filed with the SEC regarding the Proposed Business

Combination and other documents filed with the SEC by Jupiter, without charge, at the SEC’s website located at www.sec.gov, or by

directing a request to: Jupiter Acquisition Corporation, 11450 SE Dixie Hwy, Suite 105, Hobe Sound, FL 33455.

INVESTMENT IN ANY

SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY, NOR HAS ANY AUTHORITY PASSED

UPON OR ENDORSED THE MERITS OF THE PROPOSED BUSINESS COMBINATION PURSUANT TO WHICH ANY SECURITIES ARE TO BE OFFERED OR THE ACCURACY OR

ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Forward-Looking Statements

This communication includes

“forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities

Litigation Reform Act of 1995 and forward-looking information within the meaning of applicable Canadian securities laws. Forward-looking

statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,”

“intend,” “will,” “expect,” “anticipate,” “believe,” “could,”

“continue,” “may,” “might,” “outlook,” “possible,” “potential,”

“predict,” “scheduled,” “should,” “would.” “seek,” “target” or

other similar expressions that predict or indicate future events or trends or that are not statements of historical matters, but the absence

of these words does not mean that a statement is not forward-looking. Generally, statements that are not historical facts, including statements

concerning possible or assumed future actions, business strategies, events or results of operations, and any statements that refer to

projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking

statements. These statements are based on various assumptions, whether or not identified in this communication, and on the current beliefs

and expectations of Filament’s, TopCo’s and Jupiter’s management and are not predictions of actual performance. These

forward-looking statements are provided for illustrative purposes only and are not intended to serve as and must not be relied on by any

investor as a guarantee, an assurance, a prediction, or a definitive statement of fact or probability. Although Filament, TopCo and Jupiter

believe that their respective plans, intentions, and expectations reflected in or suggested by these forward-looking statements are reasonable,

none of Filament, TopCo or Jupiter can assure you that any of them will achieve or realize these plans, intentions, or expectations. Actual

events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances

are beyond the control of Filament, TopCo and Jupiter. These forward-looking statements are subject to a number of risks and uncertainties,

including (i) the occurrence of any event, change or other circumstances that could give rise to the termination of the Proposed Business

Combination; (ii) the failure of either Jupiter or Filament prior to the Proposed Business Combination, or TopCo after the Proposed Business

Combination, to execute their business strategy; (iii) the outcome of any legal proceedings that may be instituted against Filament, TopCo

or Jupiter or others following the announcement of the Proposed Business Combination; (iv) the inability to complete the Proposed Business

Combination due to the failure to obtain any necessary interim order or other required court orders in respect of Filament’s statutory

plan of arrangement under the Business Corporations Act (British Columbia) with respect to the Proposed Business Combination or the failure

to obtain the approval of Filament’s shareholders or Jupiter’s stockholders or to satisfy other conditions to closing; (v)

changes to the proposed structure of the Proposed Business Combination that may be required or appropriate as a result of applicable laws

or regulations or as a condition to obtaining regulatory approval of the Proposed Business Combination; (vi) the ability to meet stock

exchange listing standards prior to and following the consummation of the Proposed Business Combination; (vii) the risk that the Proposed

Business Combination disrupts current plans and operations of Filament as a result of the announcement and consummation of the Proposed

Business Combination; (viii) the ability to recognize the anticipated benefits of the Proposed Business Combination, which may be affected

by, among other things, competition and the ability of TopCo to grow and manage growth profitably, maintain relationships with customers

and retain its management and key employees; (ix) costs related to the Proposed Business Combination; (x) failure to comply with and stay

abreast of changes in laws or regulations applicable to Filament’s business, including health and safety regulations and policies;

(xi) Filament’s estimates of expenses and profitability and underlying assumptions with respect to redemptions by Jupiter’s

stockholders and purchase price and other adjustments; (xii) any downturn or volatility in economic or business conditions; (xiii) the

effects of COVID-19 or other epidemics or pandemics; (xiv) changes in the competitive environment affecting Filament or its customers,

including Filament’s inability to introduce, or obtain regulatory approval for, new products; (xv) the failure to obtain additional

capital on acceptable terms; (xvi) the impact of pricing pressure and erosion; (xvii) failures or delay’s in Filament’s supply

chain; (xviii) Filament’s ability to protect its intellectual property and avoid infringement by others, or claims of infringement

against Filament; (xix) the possibility that Filament, TopCo or Jupiter may be adversely affected by other economic, business and/or competitive

factors; (xx) the failure of Filament or TopCo to respond to fluctuations in foreign currency exchange rates; and (xxi) Filament’s

estimates of its financial performance; and those factors discussed in documents of Jupiter or TopCo filed, or to be filed, with the SEC.

If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied

by these forward-looking statements. There may be additional risks that none of Filament, TopCo or Jupiter presently knows or that Filament,

TopCo and Jupiter currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking

statements. In addition, forward-looking statements reflect Filament’s, TopCo’s and Jupiter’s expectations, plans, or

forecasts of future events and views as of the date of this communication. Filament, TopCo and Jupiter anticipate that subsequent events

and developments will cause Filament’s, TopCo’s and Jupiter’s assessments to change. However, while Filament, TopCo

and Jupiter may elect to update these forward-looking statements at some point in the future, Filament, TopCo and Jupiter specifically

disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing Filament’s, TopCo’s

or Jupiter’s assessments as of any date after the date of this communication. Accordingly, undue reliance should not be placed upon

the forward-looking statements.

No Offer or Solicitation

This communication does

not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall

there be any sale of securities in any jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration

or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus

meeting the requirements of Section 10 of the Securities Act or pursuant to an exemption from the Securities Act. In Canada, no offering

of securities shall be made except by means of a prospectus in accordance with the requirements of applicable Canadian securities laws

or an exemption therefrom. This communication is not, and under no circumstances is it to be construed as, a prospectus, offering memorandum,

an advertisement or a public offering in any province or territory of Canada. In Canada, no prospectus has been filed with any securities

commission or similar regulatory authority in respect of any of the securities referred to herein.

Participants in Solicitation

Jupiter, Filament, TopCo

and certain of their respective directors, executive officers, and other members of management and employees may, under SEC rules, be

deemed to be participants in the solicitations of proxies from Jupiter’s stockholders in connection with the Proposed Business Combination.

Information regarding Jupiter’s directors and executive officers is available in its Annual Report on Form 10-K for the fiscal year

ended December 31, 2022, which was filed with the SEC on March 10, 2023. Information regarding the persons who may, under SEC rules, be

deemed participants in the solicitation of proxies from Jupiter’s stockholders in connection with the Proposed Business Combination

will be set forth in the Registration Statement, and the proxy statement/prospectus included therein, when it is filed with the SEC. Additional

information regarding the participants in the proxy solicitation and a description of their direct and indirect interests will be included

in the Registration Statement, and the proxy statement/prospectus included therein, when it becomes available. Jupiter’s stockholders,

potential investors, and other interested persons should carefully read the Registration Statement, and the proxy statement/prospectus

included therein, when it becomes available and related documents filed with the SEC before making any voting or investment decisions.

These documents, once available, can be obtained free of charge from the sources indicated above.

No Assurances

There can be no assurance

that the Proposed Business Combination will be completed, nor can there be any assurance, if the Proposed Business Combination is completed,

that the potential benefits of the Proposed Business Combination will be realized.

4

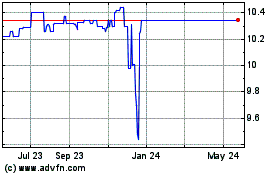

Jupiter Acquisition (NASDAQ:JAQCU)

Historical Stock Chart

From Apr 2024 to May 2024

Jupiter Acquisition (NASDAQ:JAQCU)

Historical Stock Chart

From May 2023 to May 2024