Form 8-K - Current report

07 November 2023 - 8:12AM

Edgar (US Regulatory)

false0000846901250 OAK RIDGE RDOAKRIDGENASDAQ00008469012023-11-062023-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 6, 2023

LAKELAND BANCORP INC

(Exact Name of Registrant as Specified in its Charter)

| |

|

|

|

|

|

New Jersey

|

|

000-17820

|

|

22-2953275

|

|

(State or Other Jurisdiction of Incorporation)

|

|

(Commission File No.)

|

|

(I.R.S. Employer Identification No.)

|

| |

|

|

|

|

|

250 Oak Ridge Road, Oak Ridge, New Jersey

|

|

07438

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

| |

|

|

|

|

|

Registrant's telephone number, including area code: (973) 697-2000

|

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

Title of each class

|

Trading symbol(s)

|

Name of each exchange on which registered

|

|

Common stock, no par value

|

LBAI

|

The NASDAQ Stock Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

On November 6, 2023, Lakeland Bancorp, Inc. (the “Company”), the parent company of Lakeland Bank, announced

that the Company’s 2023 Annual Meeting of Shareholders (“Annual Meeting”) will be held virtually on Thursday, December 28, 2023, at 8:00 a.m. The agenda of the Annual Meeting includes proposals to: elect four directors, approve, on an advisory

basis, the executive compensation of the Company’s Named Executive Officers, and to ratify the Company’s appointment of KPMG LLP as the Company’s independent registered public accounting firm for the year ended December 31, 2023.

Additional information regarding the Company’s Annual Meeting will be disclosed in the Company’s Proxy

Statement to be sent to shareholders entitled to notice of and to vote at the Annual Meeting.

The record date for the determination of shareholders of the Company entitled to receive notice of and to vote

at the Annual Meeting has been set as the close of business on November 17, 2023.

Because the date of the Annual Meeting will be held more than 30 days after the anniversary date of the Company’s 2022 annual

meeting of shareholders, pursuant to Rule 14a-8 (“Rule 14a-8”) under the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), the Company is setting a deadline for receipt of Rule 14a-8 shareholder proposals that is a reasonable time

before the Company expects to begin to print and send its proxy materials. Accordingly, the Company has fixed the new deadline for the submission of proposals to be included in the proxy statement for the Annual Meeting as November 20, 2023.

Shareholder proposals must comply with the Company’s Bylaws and the U.S. Securities and Exchange Commission’s (the “SEC”) rules regarding the inclusion of stockholder proposals in proxy materials.

Pursuant to the Company’s Bylaws, any shareholder who wishes to make a nomination or introduce an item of business at the Annual

Meeting, other than pursuant to Rule 14a-8 under the Exchange Act, must comply with the procedures set forth in our Bylaws, including delivering proper notice to us in writing to our Corporate Secretary at our principal executive offices not later

than the close of business on November 16, 2023, which notice must contain the information specified in our Bylaws.

In addition, to comply with the SEC’s universal proxy rules, shareholders who intend to solicit proxies in support of director

nominees other than the Company’s nominees must provide notice in writing to our Corporate Secretary at our principal executive offices that sets forth the information required by Rule 14a-19 under the Exchange Act, no later than November 16, 2023.

Notices of intention to present proposals or nominate directors at the 2023 Annual Meeting, and all supporting information required

by SEC rules and our Bylaws, as applicable, must be submitted to: Corporate Secretary of Lakeland Bancorp, Inc., 250 Oak Ridge Road Oak Ridge, New Jersey 07438.

If the previously announced merger between the Company and Provident Financial Services, Inc. is completed before December 28, 2023, the Annual

Meeting will not occur.

A copy of the Company’s press release, dated November 6, 2023, announcing the date of the Annual Meeting, is attached hereto as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

|

(a)

|

Financial statements of businesses acquired. None.

|

| |

|

|

(b)

|

Pro forma financial information. None.

|

| |

|

|

(c)

|

Shell company transactions: None.

|

| |

|

|

(d)

|

Exhibits.

|

| |

|

Press Release dated November 6, 2023

|

| |

104 |

Cover Page Interactive Data File (formatted as inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on

its behalf by the undersigned, hereunto duly authorized.

| |

|

LAKELAND BANCORP, INC.

|

|

DATE: November 6, 2023

|

By:

|

/s/ Timothy J. Matteson |

| |

|

Timothy J. Matteson

|

| |

|

Executive Vice President, Chief Administrative Officer, General Counsel and Corporate Secretary

|

Exhibit 99.1

Company Release – November 6, 2023

LAKELAND BANCORP, INC. ANNOUNCES DATE FOR 2023 ANNUAL MEETING OF SHAREHOLDERS

OAK RIDGE, NJ, November 6, 2023 – Lakeland Bancorp, Inc. (NASDAQ: LBAI) (the “Company”), the parent company of Lakeland

Bank, today announced that the Company’s 2023 Annual Meeting of Shareholders (“Annual Meeting”) will be held virtually on Thursday, December 28, 2023, at 8:00 a.m. The agenda of the Annual Meeting includes proposals to: elect four directors,

approve, on an advisory basis, the executive compensation of the Company’s Named Executive Officers, and to ratify the Company’s appointment of KPMG LLP as the Company’s independent registered public accounting firm for the year ended December 31,

2023.

Additional information regarding the Company’s Annual Meeting will be disclosed in the Company’s Proxy Statement to be

sent to shareholders entitled to notice of and to vote at the Annual Meeting.

The record date for the determination of shareholders of the Company entitled to receive notice of and to vote at the

Annual Meeting has been set as the close of business on November 17, 2023.

Because the date of the Annual Meeting will be held more than 30 days after the anniversary date of the Company’s 2022 annual meeting of

shareholders, pursuant to Rule 14a-8 (“Rule 14a-8”) under the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), the Company is setting a deadline for receipt of Rule 14a-8 shareholder proposals that is a reasonable time before the

Company expects to begin to print and send its proxy materials. Accordingly, the Company has fixed the new deadline for the submission of proposals to be included in the proxy statement for the Annual Meeting as November 20, 2023. Shareholder

proposals must comply with the Company’s Bylaws and the U.S. Securities and Exchange Commission’s (the “SEC”) rules regarding the inclusion of stockholder proposals in proxy materials.

Pursuant to the Company’s Bylaws, any shareholder who wishes to make a nomination or introduce an item of business at the Annual Meeting,

other than pursuant to Rule 14a-8 under the Exchange Act, must comply with the procedures set forth in our Bylaws, including delivering proper notice to us in writing to our Corporate Secretary at our principal executive offices not later than the

close of business on November 16, 2023, which notice must contain the information specified in our Bylaws.

In addition, to comply with the SEC’s universal proxy rules, shareholders who intend to solicit proxies in support of director nominees

other than the Company’s nominees must provide notice in writing to our Corporate Secretary at our principal executive offices that sets forth the information required by Rule 14a-19 under the Exchange Act, no later than November 16, 2023.

Notices of intention to present proposals or nominate directors at the 2023 Annual Meeting, and all supporting information required by SEC

rules and our Bylaws, as applicable, must be submitted to: Corporate Secretary of Lakeland Bancorp, Inc., 250 Oak Ridge Road Oak Ridge, New Jersey 07438.

If the previously announced merger between the Company and Provident Financial Services, Inc. is completed before December 28, 2023, the Annual Meeting will

not occur.

Forward-Looking Statements

The information disclosed in this document includes various forward-looking statements that are made in reliance upon the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. The words “anticipates,” “projects,” “intends,” “estimates,” “expects,” “believes,” “plans,” “may,” “will,” “should,” “could,” and other similar expressions are intended to identify such

forward-looking statements. The Company cautions that these forward-looking statements are necessarily speculative and speak only as of the date made, and are subject to numerous assumptions, risks and uncertainties, all of which may change over

time. Actual results could differ materially from such forward-looking statements. Accordingly, you should not place undue reliance on forward-looking statements. In addition to the specific risk factors disclosed in the Company’s Annual Report on

Form 10-K for the year ended December 31, 2022, as updated by our subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, the following factors, among others, could cause actual results to differ materially and adversely from such

forward-looking statements: delays related to the proposed merger with Provident Financial Services, Inc, the inability to obtain regulatory approvals or satisfy other closing conditions required to complete the proposed merger, and failure to

realize anticipated efficiencies and synergies from the proposed merger. Any statements made by the Company that are not historical facts should be considered to be forward-looking statements. The Company is not obligated to update and does not

undertake to update any of its forward-looking statements made herein.

About Lakeland Bancorp

Lakeland Bancorp, Inc. (NASDAQ:LBAI), the parent company of its wholly owned subsidiary, Lakeland Bank, had $11.18 billion in total assets at September 30, 2023. With an extensive branch

network and commercial lending centers throughout New Jersey and Highland Mills, New York, Lakeland Bank offers business and retail banking products and services. Business services include commercial loans and lines of credit, commercial real estate

loans, loans for healthcare services, asset-based lending, equipment financing, small business loans and lines and cash management services. Consumer services include online and mobile banking, home equity loans and lines, mortgage options and wealth

management solutions. Lakeland Bank is proud to be recognized as New Jersey's Best-In-State Bank by Forbes and Statista for the fifth consecutive

year, Best Banks to Work For by American Banker, rated a 5-Star Bank by Bauer Financial and named one of New Jersey's 50 Fastest Growing

Companies by NJBIZ. Visit LakelandBank.com or call 973-697-6140 for more information.

Thomas J. Shara Thomas F. Splaine

President & CEO EVP & CFO

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

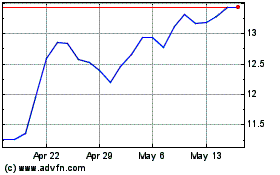

Lakeland Bancorp (NASDAQ:LBAI)

Historical Stock Chart

From Jun 2024 to Jul 2024

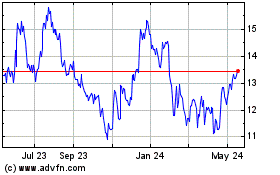

Lakeland Bancorp (NASDAQ:LBAI)

Historical Stock Chart

From Jul 2023 to Jul 2024