Singing Machine Announces Financial Results for Full Fiscal Year Ended 2023

15 July 2023 - 6:05AM

The Singing Machine Company, Inc.

(the “Singing Machine” or

the “Company”) (NASDAQ:

MICS) -- the

worldwide leader in consumer karaoke products -- today released its

results of operations for the fiscal year ended March 31, 2023.

Financial highlights were as follows:

- Revenues for the 12 months ended

March 31, 2023 were $39.3 million, as compared to $47.5 million for

the same period in the prior year. The 17.3% decrease was largely

due to a comparatively slower holiday retail season in North

America as inflation, higher interest rates and overall economic

conditions led to slower retail sales;

- Gross margins improved to 23.4% for

fiscal 2023, as compared to 22.8% for the prior fiscal year. The

improvement was largely the result of cost rationalizations and

lower logistics costs post COVID. These improvements were partially

offset by higher labor costs and fuel costs;

- Operating expenses were $12.9

million for the 12 months ended March 31, 2023, as compared to

$10.7 million for the same period in the prior year, an increase of

20.6%. Half of the $2.2 million increase represented expenses due

to non-recurring transactions during the fiscal year, resulting in

higher overall general and administrative expenses. The Company

completed two capital raises and a successful uplisting to Nasdaq

during fiscal 2023, resulting in approximately $1.1 million in

one-time expenses. Excluding these items, operating expenses were

$11.8 million, a 10.3% increase, as the Company added additional

staffing resources to support new marketing and growth initiatives;

and

- The overall balance sheet improved

significantly during the fiscal year 2023. Cash on hand improved to

$2.8 million at March 31, 2023. The Company reduced its overall

working capital investments by approximately $5.2 million during

the year as the management team focused heavily on inventory

management and building a more liquid short-term capital

position.

- The Company also heavily reduced

its short-term liabilities. Current liabilities at March 31, 2023

decreased 49%, from $12.0 million at March 31, 2022 to $6.1 million

at fiscal 2023 year-end. As a result, the Company had no short-term

debt and 67% less trade payables at fiscal year-end.

“Fiscal 2023 includes a number of major

milestones for our team and the Company,” commented Gary Atkinson,

CEO of the Singing Machine. “Our public offering and uplisting onto

the Nasdaq in May 2022 was a major accomplishment, and it has

enabled us to significantly upgrade our access to growth capital

since. This flexibility has already proved very useful as we

executed a cost-effective at-the-market offering that was concluded

in May of 2023. This has enabled our team to begin investing in

several promising growth initiatives for fiscal 2024 and beyond,

which we look forward to sharing with stockholders over the coming

months.”

“While we executed very well on virtually all

fronts that were within our control, we were confronted by a

backlog of inventory at the retail level during calendar 2022

caused by the supply chain bottleneck,” stated Atkinson. “This

over-supply of inventory, together with lower overall economic

demand during the holiday season, caused many of our retail

customers to take a more conservative approach to stocking

inventory last year. As these developments unfolded, we

aggressively sought to control costs, invest carefully, and

leverage our growth initiatives during the second half of the

fiscal year as we began to turn our attention to the 2024 fiscal

period.”

“As the premier in-home karaoke device

manufacturer in North America, we are fortunate to hold a majority

market share. However, there are additional areas of growth

internationally, as well as new segments of the domestic karaoke

industry that we are eager to penetrate. Please join us on our

earnings call to hear more on what we feel are some exciting new

opportunities for our Company,” concluded Mr. Atkinson.

About The Singing Machine

Singing Machine is the worldwide leader in

consumer karaoke products. Based in Fort Lauderdale, Florida, and

founded over forty years ago, the Company designs and distributes

the industry's widest assortment of at-home and in-car karaoke

entertainment products. Their portfolio is marketed under both

proprietary brands and popular licenses, including Carpool Karaoke

and Sesame Street. Singing Machine products incorporate the latest

technology and provide access to over 100,000 songs for streaming

through its mobile app and select WiFi-capable products. Singing

Machine is also developing the world’s first fully integrated

in-car karaoke system. The Company also has a new philanthropic

initiative, CARE-eoke by Singing Machine, to focus on the social

impact of karaoke for children and adults of all ages who would

benefit from singing. Their products are sold in over 25,000

locations worldwide, including Amazon, Costco, Sam’s Club, Target,

and Walmart. To learn more, go to www.singingmachine.com.

Investor Relations

Contact:investors@singingmachine.comwww.singingmachine.comwww.singingmachine.com/investors

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995, Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Words such as "may", "could", "expects", "projects,"

"intends", "plans", "believes", "predicts", "anticipates", "hopes",

"estimates" and variations of such words and similar expressions

are intended to identify forward-looking statements. These

statements involve known and unknown risks and are based upon

several assumptions and estimates, which are inherently subject to

significant uncertainties and contingencies, many of which are

beyond the Company's control. Actual results may differ materially

from those expressed or implied by such forward-looking statements.

Factors that could cause actual results to differ materially

include, but are not limited to, the risk factors described in the

Company's filings with the Securities and Exchange Commission. The

forward-looking statements are applicable only as of the date on

which they are made, and the Company does not assume any obligation

to update any forward-looking statements.

The Singing Machine Company,

Inc. and

SubsidiariesCONSOLIDATED BALANCE

SHEETS

|

|

|

March 31, 2023 |

|

|

March 31, 2022 |

|

|

|

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

| Current

Assets |

|

|

|

|

|

|

|

|

|

Cash |

|

$ |

2,894,574 |

|

|

$ |

2,290,483 |

|

|

Accounts receivable, net of allowances of $165,986 and $122,550,

respectively |

|

|

2,075,086 |

|

|

|

2,785,038 |

|

|

Due from Crestmark Bank |

|

|

- |

|

|

|

100,822 |

|

|

Accounts receivable related party - Stingray Group, Inc. |

|

|

218,328 |

|

|

|

152,212 |

|

|

Accounts receivable related party - Ault Alliance, Inc. |

|

|

20,750 |

|

|

|

- |

|

|

Inventories, net |

|

|

9,639,992 |

|

|

|

14,161,636 |

|

|

Prepaid expenses and other current assets |

|

|

266,068 |

|

|

|

344,409 |

|

|

Deferred financing costs |

|

|

84,667 |

|

|

|

7,813 |

|

|

Total Current Assets |

|

|

15,199,465 |

|

|

|

19,842,413 |

|

|

|

|

|

|

|

|

|

|

|

| Property and

equipment, net |

|

|

633,207 |

|

|

|

565,094 |

|

| Deferred financing

costs, net of current portion |

|

|

130,528 |

|

|

|

- |

|

| Deferred tax

assets |

|

|

- |

|

|

|

892,559 |

|

| Operating Leases -

right of use assets |

|

|

561,185 |

|

|

|

1,279,347 |

|

| Other non-current

assets |

|

|

124,212 |

|

|

|

86,441 |

|

|

Total Assets |

|

$ |

16,648,597 |

|

|

$ |

22,665,854 |

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Shareholders’ Equity |

|

|

|

|

|

|

|

|

| Current

Liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

1,769,348 |

|

|

$ |

5,328,215 |

|

|

Accrued expenses |

|

|

2,265,424 |

|

|

|

1,732,355 |

|

|

Due to related party - Starlight Consumer Electronics Co.,

Ltd. |

|

|

- |

|

|

|

14,400 |

|

|

Due to related party - Starlight R&D, Ltd. |

|

|

- |

|

|

|

48,650 |

|

|

Revolving lines of credit |

|

|

- |

|

|

|

2,500,000 |

|

|

Refunds due to customers |

|

|

583,323 |

|

|

|

97,968 |

|

|

Reserve for sales returns |

|

|

900,000 |

|

|

|

990,000 |

|

|

Current portion of finance leases |

|

|

18,162 |

|

|

|

7,605 |

|

|

Current portion of installment notes |

|

|

80,795 |

|

|

|

74,300 |

|

|

Current portion of operating lease liabilities |

|

|

508,515 |

|

|

|

876,259 |

|

|

Subordinated note payable - Starlight Marketing Development,

Ltd. |

|

|

- |

|

|

|

352,659 |

|

|

Total Current Liabilities |

|

|

6,125,567 |

|

|

|

12,022,411 |

|

| |

|

|

|

|

|

|

|

|

| Finance leases, net of

current portion |

|

|

46,142 |

|

|

|

10,620 |

|

| Installment notes, net

of current portion |

|

|

57,855 |

|

|

|

138,649 |

|

| Operating lease

liabilities, net of current portion |

|

|

87,988 |

|

|

|

457,750 |

|

|

Total Liabilities |

|

|

6,317,552 |

|

|

|

12,629,430 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and

Contingencies |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Shareholders’

Equity |

|

|

|

|

|

|

|

|

|

Preferred stock, $1.00 par value; 1,000,000 shares authorized; no

shares issued and outstanding |

|

|

- |

|

|

|

- |

|

|

Common stock $0.01 par value; 100,000,000 shares authorized;

3,184,439 shares issued, 3,167,489 shares outstanding and 1,221,209

shares issued and outstanding, respectively |

|

|

31,675 |

|

|

|

12,212 |

|

|

Additional paid-in capital |

|

|

29,822,205 |

|

|

|

24,902,694 |

|

|

Subscriptions receivable |

|

|

(5,891 |

) |

|

|

- |

|

|

Accumulated deficit |

|

|

(19,516,944 |

) |

|

|

(14,878,482 |

) |

|

Total Shareholders’ Equity |

|

|

10,331,045 |

|

|

|

10,036,424 |

|

|

Total Liabilities and Shareholders’ Equity |

|

$ |

16,648,597 |

|

|

$ |

22,665,854 |

|

See notes to the consolidated

financial statements

The Singing Machine Company,

Inc. and

SubsidiariesCONSOLIDATED STATEMENTS OF

OPERATIONS

| |

|

For the Twelve Months Ended |

|

| |

|

March 31, 2023 |

|

|

March 31, 2022 |

|

| |

|

|

|

|

|

|

| Net

Sales |

|

$ |

39,299,280 |

|

|

$ |

47,512,161 |

|

| |

|

|

|

|

|

|

|

|

| Cost of Goods

Sold |

|

|

30,090,686 |

|

|

|

36,697,383 |

|

| |

|

|

|

|

|

|

|

|

| Gross

Profit |

|

|

9,208,594 |

|

|

|

10,814,778 |

|

| |

|

|

|

|

|

|

|

|

| Operating

Expenses |

|

|

|

|

|

|

|

|

|

Selling expenses |

|

|

3,441,975 |

|

|

|

3,588,276 |

|

|

General and administrative expenses |

|

|

9,236,899 |

|

|

|

6,911,377 |

|

|

Depreciation |

|

|

228,004 |

|

|

|

245,890 |

|

| Total Operating

Expenses |

|

|

12,906,878 |

|

|

|

10,745,543 |

|

| |

|

|

|

|

|

|

|

|

| (Loss) Income from

Operations |

|

|

(3,698,284 |

) |

|

|

69,235 |

|

| |

|

|

|

|

|

|

|

|

| Other Income

(Expense), net |

|

|

|

|

|

|

|

|

|

Gain from Paycheck Protection Plan loan forgiveness |

|

|

- |

|

|

|

448,242 |

|

|

Gain - related party |

|

|

- |

|

|

|

11,236 |

|

|

Gain from Employee Retension Credit Program refund |

|

|

704,297 |

|

|

|

- |

|

|

Gain from settlement of accounts payable |

|

|

48,650 |

|

|

|

339,311 |

|

|

Loss from extinguishment of debt |

|

|

(183,333 |

) |

|

|

- |

|

|

Interest expense |

|

|

(432,700 |

) |

|

|

(535,202 |

) |

|

Finance costs |

|

|

(46,618 |

) |

|

|

(45,047 |

) |

| Total Other Income

(Expense), net |

|

|

90,296 |

|

|

|

218,540 |

|

| |

|

|

|

|

|

|

|

|

| (Loss) Income Before

Income Tax (Provision) |

|

|

(3,607,988 |

) |

|

|

287,775 |

|

| |

|

|

|

|

|

|

|

|

| Income Tax

(Provision) |

|

|

(1,030,474 |

) |

|

|

(57,304 |

) |

| |

|

|

|

|

|

|

|

|

| Net (Loss)

Income |

|

$ |

(4,638,462 |

) |

|

$ |

230,471 |

|

| |

|

|

|

|

|

|

|

|

| Net (Loss) Income per

Common Share |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(1.65 |

) |

|

$ |

0.14 |

|

|

Diluted |

|

$ |

(1.65 |

) |

|

$ |

0.14 |

|

| |

|

|

|

|

|

|

|

|

| Weighted Average

Common and Common Equivalent Shares: |

|

|

|

|

|

|

|

|

|

Basic |

|

|

2,811,872 |

|

|

|

1,614,506 |

|

|

Diluted |

|

|

2,811,872 |

|

|

|

1,623,397 |

|

See notes to the consolidated

financial statements

The Singing Machine Company,

Inc. and

SubsidiariesCONSOLIDATED STATEMENTS OF CASH

FLOWS

| |

|

For the Twelve Months Ended |

|

| |

|

March 31, 2023 |

|

|

March 31, 2022 |

|

| |

|

|

|

|

|

|

| Cash flows from

operating activities |

|

|

|

|

|

|

|

|

|

Net (Loss) Income |

|

$ |

(4,638,462 |

) |

|

$ |

230,471 |

|

|

Adjustments to reconcile net (loss) income to net cash used in

operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation |

|

|

228,004 |

|

|

|

245,890 |

|

|

Amortization of deferred financing costs |

|

|

46,618 |

|

|

|

45,047 |

|

|

Change in inventory reserve |

|

|

535,553 |

|

|

|

(271,892 |

) |

|

Change in allowance for bad debts |

|

|

43,436 |

|

|

|

(16,030 |

) |

|

Loss from disposal of property and equipment |

|

|

2,565 |

|

|

|

4,394 |

|

|

Stock based compensation |

|

|

381,826 |

|

|

|

44,287 |

|

|

Change in net deferred tax assets |

|

|

892,559 |

|

|

|

(5,395 |

) |

|

Loss on debt extinguishment |

|

|

183,333 |

|

|

|

- |

|

|

Paycheck Protection Plan loan forgiveness |

|

|

- |

|

|

|

(448,242 |

) |

|

Gain - related party |

|

|

- |

|

|

|

(11,236 |

) |

|

Gain from extinguishment of accounts payable |

|

|

(48,650 |

) |

|

|

(339,311 |

) |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

666,516 |

|

|

|

(558,127 |

) |

|

Due from banks |

|

|

100,822 |

|

|

|

4,456,298 |

|

|

Accounts receivable - related parties |

|

|

(86,866 |

) |

|

|

(64,171 |

) |

|

Inventories |

|

|

3,986,091 |

|

|

|

(8,399,489 |

) |

|

Prepaid expenses and other current assets |

|

|

78,341 |

|

|

|

(123,338 |

) |

|

Other non-current assets |

|

|

(37,771 |

) |

|

|

60,732 |

|

|

Accounts payable |

|

|

(3,510,217 |

) |

|

|

3,217,659 |

|

|

Accrued expenses |

|

|

533,069 |

|

|

|

77,198 |

|

|

Due to related parties |

|

|

(63,050 |

) |

|

|

- |

|

|

Customer deposits |

|

|

- |

|

|

|

(139,064 |

) |

|

Refunds due to customers |

|

|

485,355 |

|

|

|

(47,440 |

) |

|

Reserve for sales returns |

|

|

(90,000 |

) |

|

|

30,000 |

|

|

Operating lease liabilities, net of operating leases - right of use

assets |

|

|

(19,344 |

) |

|

|

(171 |

) |

|

Net cash used in operating activities |

|

|

(330,272 |

) |

|

|

(2,011,930 |

) |

| Cash flows from

investing activities |

|

|

|

|

|

|

|

|

|

Purchase of property and equipment |

|

|

(243,729 |

) |

|

|

(117,573 |

) |

|

Net cash used in investing activities |

|

|

(243,729 |

) |

|

|

(117,573 |

) |

| Cash flows from

financing activities |

|

|

|

|

|

|

|

|

|

Proceeds from Issuance of stock - net of transaction expenses |

|

|

3,362,750 |

|

|

|

9,000,579 |

|

|

Proceeds from Issuance of stock - at the market offering |

|

|

30,522 |

|

|

|

- |

|

|

Payment of redemption and retirement of treasury stock |

|

|

- |

|

|

|

(7,162,451 |

) |

|

Net (payment) proceeds from revolving lines of credit |

|

|

(2,500,000 |

) |

|

|

2,435,085 |

|

|

Payment of deferred financing charges |

|

|

(254,000 |

) |

|

|

(37,501 |

) |

|

Payment of early termination fees on revolving lines of credit |

|

|

(183,333 |

) |

|

|

- |

|

|

Payments on installment notes |

|

|

(74,299 |

) |

|

|

(68,332 |

) |

|

Proceeds from exercise of stock options |

|

|

- |

|

|

|

14,000 |

|

|

Proceeds from exercise of pre-funded warrants |

|

|

168,334 |

|

|

|

- |

|

|

Proceeds from exercise of common warrants |

|

|

989,651 |

|

|

|

- |

|

|

Payment on subordinated note payable |

|

|

(352,659 |

) |

|

|

(150,000 |

) |

|

Payments on finance leases |

|

|

(8,874 |

) |

|

|

(7,973 |

) |

|

Net cash provided by financing activities |

|

|

1,178,092 |

|

|

|

4,023,407 |

|

| Net change in

cash |

|

|

604,091 |

|

|

|

1,893,904 |

|

| |

|

|

|

|

|

|

|

|

| Cash at beginning of

year |

|

|

2,290,483 |

|

|

|

396,579 |

|

| Cash at end of

period |

|

$ |

2,894,574 |

|

|

$ |

2,290,483 |

|

| |

|

|

|

|

|

|

|

|

| Supplemental

disclosures of cash flow information: |

|

|

|

|

|

|

|

|

|

Cash paid for interest |

|

$ |

481,425 |

|

|

$ |

546,545 |

|

|

Cash paid for income taxes - SMC (Comercial Offshore de Macau)

Limitada |

|

$ |

34,390 |

|

|

$ |

- |

|

|

Equipment purchased under capital lease |

|

$ |

54,953 |

|

|

$ |

23,651 |

|

|

Issuance of common stock and warrants for stock issuance

expenses |

|

$ |

243,901 |

|

|

$ |

547,838 |

|

|

Operating leases - right of use assets and lease liabilities at

inception of lease |

|

$ |

191,951 |

|

|

$ |

16,364 |

|

See notes to the consolidated

financial statements

The Singing Machine Company,

Inc. and

SubsidiariesCONSOLIDATED STATEMENTS OF

SHAREHOLDERS’ EQUITY For the twelve months ended March 31,

2023 and 2022

|

|

|

Common Stock |

|

|

Additional Paid in |

|

|

Subscriptions |

|

|

Accumulated |

|

|

|

|

|

|

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Receivable |

|

|

Deficit |

|

|

Total |

|

| Balance

at March 31, 2021 |

|

|

1,301,358 |

|

|

$ |

13,014 |

|

|

$ |

20,150,715 |

|

|

$ |

- |

|

|

$ |

(12,254,191 |

) |

|

$ |

7,909,538 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

230,471 |

|

|

|

230,471 |

|

| Issuance of stock |

|

|

550,000 |

|

|

|

5,500 |

|

|

|

4,944,500 |

|

|

|

- |

|

|

|

- |

|

|

|

4,950,000 |

|

| Issuance of pre-funded

warrants |

|

|

- |

|

|

|

- |

|

|

|

4,881,667 |

|

|

|

- |

|

|

|

- |

|

|

|

4,881,667 |

|

| Payment of stock issuance

expenses |

|

|

- |

|

|

|

- |

|

|

|

(831,088 |

) |

|

|

- |

|

|

|

- |

|

|

|

(831,088 |

) |

| Issuance of stock for stock

issuance expenses |

|

|

19,047 |

|

|

|

190 |

|

|

|

(190 |

) |

|

|

- |

|

|

|

|

|

|

|

- |

|

| Redemption and retirement of

treasury shares |

|

|

(654,105 |

) |

|

|

(6,542 |

) |

|

|

(4,301,147 |

) |

|

|

- |

|

|

|

(2,854,762 |

) |

|

|

(7,162,451 |

) |

| Issuance of common stock -

directors |

|

|

575 |

|

|

|

6 |

|

|

|

4,994 |

|

|

|

- |

|

|

|

- |

|

|

|

5,000 |

|

| Issuance of common stock -

non-employee |

|

|

1,667 |

|

|

|

17 |

|

|

|

16,983 |

|

|

|

- |

|

|

|

- |

|

|

|

17,000 |

|

| Employee compensation-stock

option |

|

|

- |

|

|

|

- |

|

|

|

22,287 |

|

|

|

- |

|

|

|

- |

|

|

|

22,287 |

|

| Exercise of stock options |

|

|

2,667 |

|

|

|

27 |

|

|

|

13,973 |

|

|

|

- |

|

|

|

- |

|

|

|

14,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance

at March 31, 2022 |

|

|

1,221,209 |

|

|

|

12,212 |

|

|

|

24,902,694 |

|

|

|

- |

|

|

|

(14,878,482 |

) |

|

|

10,036,424 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(4,638,462 |

) |

|

|

(4,638,462 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Issuance of common stock |

|

|

1,000,000 |

|

|

|

10,000 |

|

|

|

3,990,000 |

|

|

|

- |

|

|

|

- |

|

|

|

4,000,000 |

|

| Payment of stock issuance

expenses |

|

|

- |

|

|

|

- |

|

|

|

(637,250 |

) |

|

|

- |

|

|

|

- |

|

|

|

(637,250 |

) |

| Issuance of common stock - at

the market offering |

|

|

14,230 |

|

|

|

143 |

|

|

|

36,270 |

|

|

|

(5,891 |

) |

|

|

- |

|

|

|

30,522 |

|

| Exercise of pre-funded

warrants |

|

|

561,113 |

|

|

|

5,611 |

|

|

|

162,723 |

|

|

|

- |

|

|

|

- |

|

|

|

168,334 |

|

| Exercise of common stock

warrants |

|

|

353,445 |

|

|

|

3,534 |

|

|

|

986,117 |

|

|

|

- |

|

|

|

- |

|

|

|

989,651 |

|

| Issuance of common stock -

directors |

|

|

2,468 |

|

|

|

25 |

|

|

|

19,991 |

|

|

|

- |

|

|

|

- |

|

|

|

20,016 |

|

| Issuance of common stock -

officers |

|

|

3,335 |

|

|

|

33 |

|

|

|

31,216 |

|

|

|

- |

|

|

|

- |

|

|

|

31,249 |

|

| Issuance of common stock -

non-employee |

|

|

10,000 |

|

|

|

100 |

|

|

|

93,600 |

|

|

|

- |

|

|

|

- |

|

|

|

93,700 |

|

| Employee compensation-stock

option |

|

|

- |

|

|

|

- |

|

|

|

236,861 |

|

|

|

- |

|

|

|

- |

|

|

|

236,861 |

|

| Rounding of common stock

issued due to reverse split |

|

|

1,688 |

|

|

|

17 |

|

|

|

(17 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance

at March 31, 2023 |

|

|

3,167,488 |

|

|

$ |

31,675 |

|

|

$ |

29,822,205 |

|

|

$ |

(5,891 |

) |

|

$ |

(19,516,944 |

) |

|

$ |

10,331,045 |

|

See notes to

the consolidated financial statements.

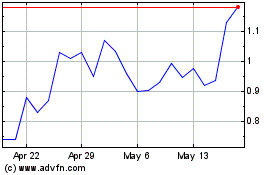

Singing Machine (NASDAQ:MICS)

Historical Stock Chart

From Dec 2024 to Jan 2025

Singing Machine (NASDAQ:MICS)

Historical Stock Chart

From Jan 2024 to Jan 2025