Outbrain Inc. (NASDAQ: OB) today announced the closing of its

acquisition of Teads, following receipt of all necessary regulatory

approvals. The two companies will merge their respective branding

and performance offerings to create the omnichannel outcomes

platform for the open internet, and will operate under the name

Teads.

The new Teads will create one of the largest optimized supply

paths on the premium open internet, with a focus on connecting

curated, exclusive media environments with elevated, data-driven

creative experiences. The combined company offering will be

strengthened by Outbrain’s proprietary predictive technology and AI

optimization. It will provide a solution for marketers to leverage

a single partner to deliver concrete outcomes at every step of the

marketing funnel— offering unique ways to combine advertising

solutions from awareness to sales. The company’s combined data set

will power expanded contextual, audience and purchase-based

targeting capabilities, connecting CTV experiences to digital

moments to drive measurable outcomes.

“I am extremely excited about this new chapter in our journey.

This transformative merger creates a company that directly

addresses a large gap in the advertising industry: a scaled

end-to-end platform that can drive outcomes, from branding to

consideration to purchase, across screens,” said CEO, David

Kostman.

“Together, we are creating an extraordinary new company,

combining the best of both organizations' deep expertise in

omnichannel video branding solutions and performance advertising.

The new Teads’ mission is to drive lasting value with an offering

that invites marketers to expect better outcomes, media owners to

expect sustainable value, and consumers to expect elevated

experiences. I want to thank the teams of both Outbrain and Teads,

who have pioneered major advertising categories, and have built

leading global companies over more than a decade. It is their

innovation and commitment that have brought us to this moment and

will propel us to new heights,” added Kostman.

Co-President & Chief Business Officer, Jeremy Arditi, added:

“We’re committed to creating a solution that will harness the

untapped opportunity of the open internet, and allow all of its

constituents to thrive. We believe that by prioritizing beautiful

creative experiences, trust and transparency in media, and delivery

of meaningful outcomes, we can create a stronger ecosystem that

provides value for all.”

"The merger between Teads and Outbrain makes a lot of sense

strategically. We look forward to exploring the new possibilities

this provides us with to reach our audiences in a new and

interesting way, to deliver full funnel solutions and better

business outcomes," said Sital Banerjee, Global Head of Integrated

Media, Performance Marketing, and BMI Management at Lipton Teas and

Infusions.

Key Combined Strengths

With the completion of the combination, the new Teads will offer

clients and partners:

- Exceptional reach at great scale, across exclusive environments

- 96 percent open internet audience reach*

- Number one most direct supply path, as rated by Jounce**

- Direct access to 10,000 media environment

- Connected to the top 4 OEMs and several of the top Streaming

Apps unlocking access to 50bn CTV Monthly Ad Opportunities,

including unique CTV homescreen inventory

- Proprietary code-on-page relationships with premium editorial

properties globally, providing access to incremental inventory and

yielding extensive audience interest and engagement insights

- Creatives built for outcomes

- Data-driven, beautiful creative solutions designed to connect

brand moments across the marketing funnel — from CTV to editorial

and beyond

- Proven impact from unique experiences, with 74 percent higher

attention for unique CTV native creative

- Strategic Joint Business Partnerships with more than 50 of the

world’s most premium brands

- AI-powered predictive technology

- Proprietary prediction engine, cultivated over 18+ years to

drive performance outcomes, making 1 billion predictions each

minute

- 4 billion signals processed each minute via AI and machine

learning

- 50 live AI models

- Expansive omnichannel graph, expanded on the Teads Omnichannel

Graph foundation

- The Teads Omnichannel Graph (OG), a proprietary tool extending

contextual and audience-targeting capabilities into the CTV

environment, will be further expanded by Outbrain engagement,

interest, and conversion data

- Extensive data signals feeding an understanding of audiences

across screens, including:

- 130,000 articles scanned per minute

- 500,000 CTV programs enriched with data per month

- 1 billion engagement and contextual signals processed each

minute

*According to Comscore, Media Metrix, Key Metrix, US, December

2024 for Teads. **According to 2024 Jounce SPO analyses, specific

to Teads platform.

Transaction Details

Outbrain, Altice and Teads have amended the previously announced

share purchase agreement, dated August 1, 2024. Under the terms of

the revised agreement, Outbrain will be paying a total

consideration of approximately $900 million, consisting of $625

million upfront cash and 43.75 million shares of common stock of

Outbrain (valued at approximately $263 million based on the closing

price of Outbrain’s common stock as of January 31, 2025, of

$6.01).

Under the revised terms, there is no deferred cash payment or

convertible preferred equity component. The revised terms have

meaningfully reduced the level of required debt financing and

simplified the transaction structure.

Outbrain intends to finance the transaction with existing cash

resources and $625 million in committed debt financing from Goldman

Sachs Bank USA, Jefferies Finance LLC and Mizuho Bank, Ltd.,

subject to customary funding conditions. Outbrain will also issue

to Altice 43.75 million shares of common stock. Altice will

nominate two directors to the board of Outbrain and will be bound

by a stockholder agreement with Outbrain containing arrangements

and restrictions concerning voting and disposition of the shares

issued to Altice.

Financial Highlights

Preliminary Estimated Unaudited Financial Information

for the Quarter and Year Ended December 31, 2024

Today Outbrain is furnishing on Form 8-K selected preliminary

estimated unaudited financial information for each of Outbrain and

Teads on a standalone basis and on a combined company basis for the

quarter and year ended December 31, 2024. Excerpts of such

financial information can be found below. You are encouraged to

refer to the Form 8-K and other documents filed or furnished by

Outbrain with the SEC through the website maintained by the SEC at

www.sec.gov.

The Company previously announced its expectation

to achieve $50 – 60 million of annual revenue and cost synergies in

the second full year following completion of the acquisition, with

further opportunities for expanded synergies in the following

years. The Company now expects to realize approximately $65 – 75

million of annual synergies in FY 2026 with further opportunities

for expanded synergies in the following years. Of this amount,

approximately $60 million relates to cost synergies, including

approximately $45 million of compensation related expenses. The

Company plans to action approximately 70% of the compensation

related expense savings during the first month post-closing. The

upsize in expected synergies follows a robust integration planning

process, enabling a larger and more rapid synergy capture.

Outbrain is providing selected preliminary results for the

fourth quarter and full year 2024, as follows:

- Ex-TAC gross profit of $68.3 million

for Q4 2024, and $236.1 million for FY 2024

- Adjusted EBITDA of $17.0 million

for Q4 2024, and $37.3 million for FY 2024

For Teads, we are providing the following selected preliminary

results for the fourth quarter and full year 2024, as follows:

- Ex-TAC gross profit of $119.9 million

for Q4 2024, and $386.6 million for FY 2024

- Adjusted EBITDA of $52.2 million

for Q4 2024, and $122.7 million for FY 2024

The two companies are preliminarily reporting a combined Ex-TAC

Gross Profit of approximately $623 million and Adjusted EBITDA of

approximately $230 million in 2024, including $65-75 million of

estimated synergies2.

Conference Call and Webcast:Outbrain will host

an investor conference call this morning, Monday, February 3rd at

9:00 am ET. Interested parties are invited to listen to the

conference call which can be accessed live by phone by dialing

1-877-497-9071 or for international callers, 1-201-689-8727. A

replay will be available two hours after the call and can be

accessed by dialing 1-877-660-6853, or for international callers,

1-201-612-7415. The passcode for the live call and the replay is

13751603. The replay will be available until February 17, 2025.

Interested investors and other parties may also listen to a

simultaneous webcast of the conference call by logging onto the

Investors Relations section of the Company’s website at

https://investors.outbrain.com. The online replay will be available

for a limited time shortly following the call.

Cautionary Note About Forward-Looking

StatementsThis press release contains forward-looking

statements within the meaning of the U.S. federal securities laws

and the Private Securities Litigation Reform Act of 1995, which

statements involve substantial risks and uncertainties. These

statements are based on current expectations, estimates, forecasts

and projections about the industries in which Outbrain and Teads

operate, and beliefs and assumptions of Outbrain’s management.

Forward-looking statements may include, without limitation,

statements regarding possible or assumed future results of our

business, financial condition, results of operations, liquidity,

plans and objectives, expected synergies and statements of a

general economic or industry-specific nature. You can generally

identify forward-looking statements because they contain words such

as “may,” “will,” “should,” “expects,” “plans,” “anticipates,”

“could,” “intends,” “target,” “projects,” “contemplates,”

“believes,” “estimates,” “predicts,” “foresee,” “potential” or

“continue” or the negative of these terms or other similar

expressions that concern our expectations, strategy, plans or

intentions, or are not statements of historical fact. The outcome

of the events described in these forward-looking statements is

subject to risks, uncertainties and other factors including, but

not limited to: risks that the acquisition disrupts current plans

and operations or diverts management’s attention from its ongoing

business; the initiation or outcome of any legal proceedings that

may be instituted against Outbrain or Teads, or their respective

directors or officers, related to the acquisition; unexpected

costs, charges or expenses resulting from the acquisition; the

ability of Outbrain to successfully integrate Teads’ operations,

technologies and employees; the ability to realize anticipated

benefits and synergies of the acquisition, including the

expectation of enhancements to Outbrain’s services, greater revenue

or growth opportunities, operating efficiencies and cost savings;

overall advertising demand and traffic generated by Outbrain and

the combined company’s media partners; factors that affect

advertising demand and spending, such as the continuation or

worsening of unfavorable economic or business conditions or

downturns, instability or volatility in financial markets, and

other events or factors outside of Outbrain and the combined

company’s control, such as U.S. and global recession concerns;

geopolitical concerns, including the ongoing war between

Ukraine-Russia and conditions in Israel and the Middle East; supply

chain issues; inflationary pressures; labor market volatility; bank

closures or disruptions; the impact of challenging economic

conditions; political and policy uncertainties; and other factors

that have and may further impact advertisers’ ability to pay;

Outbrain and the combined company’s ability to continue to

innovate, and adoption by Outbrain and the combined company’s

advertisers and media partners of expanding solutions; the success

of Outbrain and the combined company’s sales and marketing

investments, which may require significant investments and may

involve long sales cycles; Outbrain and the combined company’s

ability to grow their business and manage growth effectively; the

ability to compete effectively against current and future

competitors; the loss or decline of one or more large media

partners, and Outbrain and the combined company’s ability to expand

advertiser and media partner relationships; conditions in Israel,

including the ongoing war between Israel and Hamas and other

terrorist organizations, may limit Outbrain and the combined

company’s ability to market, support and innovate their products

due to the impact on employees as well as advertisers and

advertising markets; Outbrain and the combined company’s ability to

maintain revenues or profitability despite quarterly fluctuations

in results, whether due to seasonality, large cyclical events or

other causes; the risk that research and development efforts may

not meet the demands of a rapidly evolving technology market; any

failure of Outbrain or the combined company’s recommendation engine

to accurately predict attention or engagement, any deterioration in

the quality of Outbrain or the combined company’s recommendations

or failure to present interesting content to users or other factors

which may cause us to experience a decline in user engagement or

loss of media partners; limits on Outbrain and the combined

company’s ability to collect, use and disclose data to deliver

advertisements; Outbrain and the combined company’s ability to

extend their reach into evolving digital media platforms; Outbrain

and the combined company’s ability to maintain and scale their

technology platform; the ability to meet demands on our

infrastructure and resources due to future growth or otherwise; the

failure or the failure of third parties to protect Outbrain and the

combined company’s sites, networks and systems against security

breaches, or otherwise to protect the confidential information of

Outbrain and the combined company; outages or disruptions that

impact Outbrain or the combined company or their service providers,

resulting from cyber incidents, or failures or loss of our

infrastructure; significant fluctuations in currency exchange

rates; political and regulatory risks in the various markets in

which Outbrain and the combined company operate; the challenges of

compliance with differing and changing regulatory requirements; the

timing and execution of any cost-saving measures and the impact on

Outbrain and the combined company’s business or strategy; and the

other risk factors and additional information described in the

section entitled “Risk Factors”, and under the heading “Risk

Factors” in Item 1A of Outbrain’s Annual Report on Form 10-K filed

with the SEC on March 8, 2024 for the year ended December 31, 2023,

Outbrain’s Form 10-Q filed with the SEC on August 8, 2024 for the

period ended June 30, 2024, Outbrain’s Form 10-Q filed with the SEC

on November 7, 2024 for the period ended September 30, 2024 and in

subsequent reports filed with the SEC.

Accordingly, you should not rely upon forward-looking statements

as an indication of future performance. Outbrain cannot assure you

that the results, events and circumstances reflected in the

forward-looking statements will be achieved or will occur, and

actual results, events or circumstances could differ materially

from those projected in the forward-looking statements. The

forward-looking statements made in this press release relate only

to events as of the date on which the statements are made. Outbrain

and the combined company may not actually achieve the plans,

intentions or expectations disclosed in the forward-looking

statements and you should not place undue reliance on the

forward-looking statements. Outbrain undertakes no obligation, and

does not assume any obligation, to update any forward-looking

statements, whether as a result of new information, future events

or circumstances after the date on which the statements are made or

to reflect the occurrence of unanticipated events or otherwise,

except as required by law.

About The Combined Company Outbrain Inc.

(Nasdaq: OB) and Teads combined on February 3, 2025 and are

operating under the new Teads brand. The new Teads is the

omnichannel outcomes platform for the open internet, driving

full-funnel results for marketers across premium media. With a

focus on meaningful business outcomes, the combined company ensures

value is driven with every media dollar by leveraging predictive AI

technology to connect quality media, beautiful brand creative, and

context-driven addressability and measurement. One of the most

scaled advertising platforms on the open internet, the new Teads is

directly partnered with more than 10,000 publishers and 20,000

advertisers globally. The company is headquartered in New York,

with a global team of nearly 1,800 people in 36 countries.

For more information, visit

https://thenewteads.com/.

Media Contact

press@outbrain.com

Investor Relations Contact

IR@outbrain.com(332) 205-8999

Non-GAAP Reconciliations

The following table presents the reconciliation of Gross profit

to Ex-TAC gross profit, for the periods presented:

|

|

|

Three Months Ended December 31, 2024 |

|

Year Ended December 31, 2024 |

|

|

|

Outbrain |

|

Teads |

|

Combined |

|

Outbrain |

|

Teads |

|

Combined |

|

Revenue |

|

$ |

234,586 |

|

|

$ |

188,953 |

|

|

$ |

423,539 |

|

|

$ |

889,875 |

|

|

$ |

617,435 |

|

|

$ |

1,507,310 |

|

|

Traffic acquisition costs |

|

|

(166,247 |

) |

|

|

(69,091 |

) |

|

|

(235,338 |

) |

|

|

(653,731 |

) |

|

|

(230,831 |

) |

|

|

(884,562 |

) |

|

Other cost of revenue (a) |

|

|

(12,277 |

) |

|

|

(26,441 |

) |

|

|

(38,718 |

) |

|

|

(44,042 |

) |

|

|

(106,414 |

) |

|

|

(150,456 |

) |

|

Gross profit |

|

|

56,062 |

|

|

|

93,421 |

|

|

|

149,483 |

|

|

|

192,102 |

|

|

|

280,190 |

|

|

|

472,292 |

|

|

Other cost of revenue (a) |

|

|

12,277 |

|

|

|

26,441 |

|

|

|

38,718 |

|

|

|

44,042 |

|

|

|

106,414 |

|

|

|

150,456 |

|

|

Ex-TAC Gross Profit |

|

$ |

68,339 |

|

|

$ |

119,862 |

|

|

$ |

188,201 |

|

|

$ |

236,144 |

|

|

$ |

386,604 |

|

|

$ |

622,748 |

|

___________(a) Other cost of revenue for Teads is subject to

accounting policy harmonization.

The following table presents the reconciliation of net income

(loss) to Adjusted EBITDA, for the periods presented:

|

|

|

Three Months Ended December 31, 2024 |

|

Year Ended December 31, 2024 |

|

|

|

Outbrain |

|

Teads |

|

Combined |

|

Outbrain |

|

Teads |

|

Combined |

|

Net (loss) income |

|

$ |

(167 |

) |

|

$ |

69,613 |

|

|

$ |

69,446 |

|

|

$ |

(711 |

) |

|

$ |

89,318 |

|

|

$ |

88,607 |

|

|

Interest expense/financial costs |

|

|

699 |

|

|

$ |

116 |

|

|

|

815 |

|

|

|

3,649 |

|

|

|

1,176 |

|

|

|

4,825 |

|

|

Interest income and other income, net |

|

|

(1,522 |

) |

|

$ |

- |

|

|

|

(1,522 |

) |

|

|

(9,209 |

) |

|

|

- |

|

|

|

(9,209 |

) |

|

Gain related to convertible debt |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(8,782 |

) |

|

|

- |

|

|

|

(8,782 |

) |

|

Other financial income and (expenses) |

|

|

- |

|

|

|

(13,973 |

) |

|

|

(13,973 |

) |

|

|

- |

|

|

|

(26,404 |

) |

|

|

(26,404 |

) |

|

Provision for income taxes |

|

|

3,525 |

|

|

|

16,143 |

|

|

|

19,668 |

|

|

|

2,415 |

|

|

|

38,256 |

|

|

|

40,671 |

|

|

Depreciation and amortization |

|

|

4,985 |

|

|

|

3,027 |

|

|

|

8,012 |

|

|

|

19,479 |

|

|

|

12,834 |

|

|

|

32,313 |

|

|

Share-based compensation |

|

|

3,974 |

|

|

|

(28,089 |

) |

|

|

(24,115 |

) |

|

|

15,461 |

|

|

|

- |

|

|

|

15,461 |

|

|

Severance costs |

|

|

- |

|

|

|

393 |

|

|

|

393 |

|

|

|

742 |

|

|

|

1,593 |

|

|

|

2,335 |

|

|

Merger and acquisition costs |

|

|

5,469 |

|

|

|

4,930 |

|

|

|

10,399 |

|

|

|

14,256 |

|

|

|

5,890 |

|

|

|

20,146 |

|

|

Adjusted EBITDA, excluding synergies |

|

$ |

16,963 |

|

|

$ |

52,160 |

|

|

$ |

69,123 |

|

|

$ |

37,300 |

|

|

$ |

122,663 |

|

|

$ |

159,963 |

|

|

The Company expects to realize approximately $65 – 75 million of

annual synergies in the second full year following completion of

the Acquisition. (midpoint) |

|

|

|

|

|

|

|

|

|

|

|

|

70,000 |

|

|

Combined company Adjusted EBITDA (incl. synergies) |

|

|

|

|

|

|

|

|

|

|

|

$ |

229,963 |

|

1Represents estimated full year 2026 Adjusted EBITDA synergies,

with further opportunities for expanded synergies in the following

years. Ex-TAC Gross Profit and Adjusted EBITDA are non-GAAP

financial measures. See “Non-GAAP Reconciliations”

below.2Represents estimated full year 2026 Adjusted EBITDA

synergies, with further opportunities for expanded synergies in the

following years

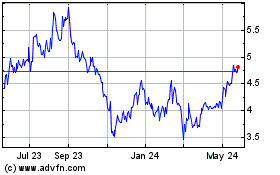

Outbrain (NASDAQ:OB)

Historical Stock Chart

From Jan 2025 to Feb 2025

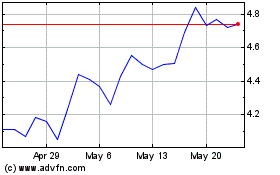

Outbrain (NASDAQ:OB)

Historical Stock Chart

From Feb 2024 to Feb 2025