false

0000868278

0000868278

2025-02-17

2025-02-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

The

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 17, 2025

PROPHASE

LABS, INC.

(Exact

name of Company as specified in its charter)

| Delaware |

|

000-21617 |

|

23-2577138

|

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

711

Stewart Avenue, Suite 200

Garden

City, New

York |

|

11530 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (215) 345-0919

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Company under any

of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

Registered Pursuant to Section 12(b) of the Exchange Act:

| Title

of Each Class |

|

Trading

Symbol |

|

Name

of Each Exchange on Which Registered |

| Common

Stock, par value $0.0005 |

|

PRPH |

|

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

On

February 18, 2025, ProPhase Labs, Inc. (the “Company”) announced that Stuart Hollenshead has been appointed to serve as Chief

Operating Officer of the Company, effective on February 17, 2025, to replace Jed Latkin, who as previously reported, stepped down as

Chief Operating Officer effective February 14, 2025 to pursue other business opportunities.

Stuart

Hollenshead, age 41, is a seasoned C-level executive with over 15 years of experience at the intersection of media, entertainment, e-commerce,

marketing, product and technology. Mr. Hollenshead’s expertise spans strategic business planning, P&L management, direct, paid

and lifecycle marketing, data analytics, product innovation, and audience development for subscription, e-commerce, and digital platforms.

Mr.

Hollenshead worked at Barstool Sports from June 2018 to March 2024, where he rose from EVP of Growth to Chief Operating Officer and Chief

Business Officer. During his tenure, Barstool experienced unprecedented expansion across audience, revenue streams, and business lines,

culminating in its $600-million acquisition by PENN Entertainment. He led teams across engineering, product development, marketing, data,

and business development, spearheading initiatives that redefined media monetization and audience engagement. Currently, Mr. Hollenshead

serves as CEO (previously CRO) of 10PM Curfew, one of the largest and fastest-growing female-centric media platforms, with an audience

of over 70 million. Under his leadership, 10PM Curfew has become a leader in creating high-impact brand partnerships and delivering exceptional

value through innovative content and audience engagement strategies. Mr. Hollenshead’s career is defined by his ability to build,

scale, monetize and operate businesses, leveraging a blend of creative vision and analytical precision to drive exceptional results.

Mr. Hollenshead received his bachelor’s degree from Bucknell University.

With

the repositioning of the Company as a consumer products company, the Company believes that Mr. Hollenshead is well suited as Chief Operating

Officer given his extensive experience at world class marketing companies.

On

February 14, 2025, Mr. Hollenshead accepted the Company’s Offer and Terms of Employment (the “Hollenshead Offer Letter”),

which provides that Mr. Hollenshead’s annual base compensation in connection with his service as Chief Operating Officer of the

Company will be $190,000. In addition, as an inducement to his employment as Chief Operating Officer of the Company, the Company granted

Mr. Hollenshead stock options (the “Options”) to purchase up to 500,000 shares of the Company’s common stock, with

an exercise price of $0.60 per share and will be exercisable for a period of seven years, pursuant to an inducement option award agreement

(the “Inducement Agreement”) to be entered into between the Company and Mr. Hollenshead. This award was made in accordance

with the employment inducement award exemption provided by Nasdaq Rule 5635(c)(4) and was therefore not awarded under the Company’s

stockholder approved equity plan. The Options will vest over a three-year period, with 25% of the Options vested at the time of grant

and the remainder of the Options vesting ratably on each of the first three anniversaries of the commencement date of his employment

and subject to continued service on each vesting date. Mr. Hollenshead will be eligible for an annual discretionary bonus based on both

the performance of the Company and of Mr. Hollenshead, individually. Mr. Hollenshead will also be eligible to participate in any and

all benefit plans of the Company that are made generally available to similarly-situated employees of the Company.

In

connection with Mr. Hollenshead’s appointment as Chief Operating Officer the Company, Mr. Hollenshead will enter into the Company’s

standard form of indemnification agreement, a copy of which was filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K

filed with the Securities and Exchange Commission on August 19, 2009 and is incorporated herein by reference. Pursuant to the terms of

this agreement, the Company may be required, among other things, to indemnify Mr. Hollenshead for certain expenses, including attorneys’

fees, judgments, fines and settlement amounts incurred by him in any action or proceeding arising out of his service as principal accounting

officer.

There

are no family relationships between Mr. Hollenshead and any of the officers or directors of the Company, and there are no related party

transactions with Mr. Hollenshead that are reportable under Item 404(a) of Regulation S-K.

The

foregoing summary of the Hollenshead Offer Letter and Inducement Agreement does not purport to be a complete description and is qualified

in its entirety by reference to the full text of the Hollenshead Offer Letter and Inducement Agreement, which are included as Exhibit

10.1 and Exhibit 10.2 hereto and incorporated herein by reference.

Item

7.01 Regulation FD Disclosure.

A

copy of the Company’s press release dated February 18, 2025, relating to the announcement described in Item 5.02, is furnished

as Exhibit 99.1 to this Form 8-K.

The

information contained in this Item 7.01 and Exhibit 99.1 hereto shall not be deemed “filed” for purposes of Section 18 of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section,

nor shall it be deemed incorporated by reference into any other filing under the Securities Act of 1933, as amended, or the Exchange

Act, except as expressly set forth by specific reference in such a filing.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

*

Certain portions of this Exhibit have been omitted pursuant to Regulation S-K Item 601(a)(6) promulgated under the Exchange Act. The

Company agrees to furnish supplementally a copy of any omitted schedule to the Securities and Exchange Commission upon request.

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

ProPhase

Labs, Inc. |

| |

|

|

| |

By: |

/s/

Ted Karkus |

| |

|

Ted

Karkus |

| |

|

Chairman

of the Board and Chief Executive Officer |

Date:

February 21, 2025

Exhibit

10.1

CERTAIN

PERSONALLY IDENTIFIABLE INFORMATION HAS BEEN OMITTED FROM THIS EXHIBIT PURSUANT TO ITEM 601(A)(6) OF REGULATION S-K. [***] INDICATES

THAT INFORMATION HAS BEEN REDACTED.

February

14, 2025

Stuart

Hollenshead

[***]

Offer

and Terms of Employment

Dear

Stu:

It

is with great pleasure that I offer you a position with ProPhase Labs, Inc. (“PRPH”) as Chief Operating Officer (“COO’’).

You will be reporting directly to Ted Karkus. We at ProPhase work closely together in a hands-on, team oriented, collaborative environment.

We are developing a high energy environment for the quick thinking, skilled professional that is looking to expand our consumer products

business, our genomics business, our biopharmaceuticals business, and our company as a whole.

Your

position will be, as with all Associates, on an “at will” basis. Assuming acceptance of the terms outlined below, I look

forward to your starting upon signing of this agreement. The following outlines the terms discussed:

| ● | Your

position will be considered a full-time position. |

| ● | Your

compensation will be a base salary of $190,000 per annum. |

| ● | You

will receive an incentive stock option grant to purchase 500,000 shares of ProPhase Labs

common stock at $0.60 per share subject to executing our standard written stock option agreement

containing the specific terms and conditions of the stock option grant (25% vested at grant

date, 25% per year vesting thereafter over 3 years). |

| ● | You

will be eligible for an annual bonus based on both company and individual performance to

be paid at the discretion of the Compensation Committee of the Board of Directors. |

| ● | You

will be eligible for additional stock options at the discretion of the Compensation Committee

of the Board of Directors. |

| ● | You

will be paid the base compensation every other Friday, 26 paychecks annually, subject to

all Federal, State and Local tax, withholdings. |

711

Stewart Ave, Suite 200 ● Garden City, NY 11530 ● U.S.A

Telephone:

516-464-6121 ● Fax: 516-464-6132 ● For information:

www.ProPhaseLabs.com

| ● | You

will be eligible for participation in our various employee benefit plans based upon

the terms of each of the individual plan provisions. |

| |

● |

You will receive 3 paid weeks’ vacation for each 12 months

employment in addition to all other scheduled holidays in accordance with Prophase’s policy. |

| |

● |

All out of pocket expenses such as but not limited to client

lunches, travel etc (approved in advance) shall be reimbursed to you in a timely fashion. |

On

behalf of the company, I am pleased to extend this offer to you. This offer will expire on February 21, 2025. I look forward to a long

relationship and believe you can become an important component and member of our team to achieve success. If you have any questions,

please feel free to contact me at your earliest convenience.

I

look forward to your favored reply.

Sincerely,

| /s/

Ted Karkus |

|

| Ted

Karkus |

|

| Chief

Executive Officer |

|

| Offer

Accepted: |

/s/

Stuart Hollenshead |

|

| |

|

|

| Date: |

2/14/2025 |

|

Exhibit

10.2

PROPHASE

LABS, INC.

INDUCEMENT

OPTION AWARD AGREEMENT

THIS

AGREEMENT (the “Agreement”), is made effective as of the 17th day of February 2025 (hereinafter called the “Date

of Grant”), between ProPhase Labs, Inc., a Delaware corporation (hereinafter called the “Company”), and

Stuart Hollenshead (hereinafter called the “Optionee”):

RECITALS:

WHEREAS,

the Optionee satisfies the standards for inducement grants under Nasdaq Marketplace Rule 5635(c)(4) and the related guidance under Nasdaq

IM 5635-1;

WHEREAS,

the grant of this “Option” (as defined below) to the Optionee was approved by the Compensation Committee of the Board of

Directors of the Company (the “Committee”) and complies with the exemption from the stockholder approval requirement

for “inducement grants” provided under Rule 5635(c)(4) of the Nasdaq Listing Rules;

WHEREAS,

the Option evidenced by this Agreement was granted to the Optionee pursuant to the inducement grant exception under Nasdaq Stock Market

Rule 5635(c)(4), and not pursuant to the Company’s 2022 Equity Compensation Plan or any other equity incentive plan of the Company,

as an inducement that is material to the Optionee entering into employment with the Company; and

WHEREAS,

the Committee has determined that it would be in the best interests of the Company and its stockholders to grant the Option provided

for herein to the Optionee pursuant to the terms set forth herein.

NOW

THEREFORE, in consideration of the mutual covenants hereinafter set forth, the parties agree as follows:

1.

Grant of the Option. The Company hereby grants to the Optionee the right and option (the “Option”) to purchase,

on the terms and conditions hereinafter set forth, all or any part of an aggregate of 500,000 shares of common stock of the Company,

par value $0.0005 per share (the “Shares”), subject to adjustment as set forth in Section 4 below. The purchase price

of the Shares subject to the Option shall be $0.60 per Share (the “Option Price”). The Option is intended to be a

non-qualified stock option, and is not intended to be treated as an option that complies with Section 422 of the Internal Revenue Code

of 1986, as amended (the “Code”).

2.

Vesting.

(a)

All Options granted pursuant to this Agreement shall vest and become exercisable in accordance with the following schedule, in each case,

subject to the Optionee’s continued “Employment” (as defined below) through the applicable vesting date, except as

otherwise provided in Section 2(b) below:

| Date of Grant | |

| 25 | % |

| First Anniversary of the Date of Grant | |

| 25 | % |

| Second Anniversary of the Date of Grant | |

| 25 | % |

| Third Anniversary of the Date of Grant | |

| 25 | % |

(b)

Any portion of the Option that does not become vested and exercisable in accordance with the provisions of Section 2 hereof shall be

automatically forfeited and cancelled for no value without any consideration being paid therefor and otherwise without any further action

of the Company whatsoever on the earliest to occur of the events listed in Section 3. For the avoidance of doubt, there shall be no proportionate

or partial vesting in the periods prior to each vesting date set forth in Section 2(a) and all vesting shall occur only on the applicable

vesting date, subject to the Optionee’s continued Employment with the Company on each applicable vesting date.

3.

Exercise of Option.

(a)

Period of Exercise. Subject to the provisions of this Agreement, the Optionee may exercise all or any part of the vested portion

of the Option at any time prior to the earliest to occur of:

(i)

the seventh anniversary of the Date of Grant;

(ii)

one year following the date of the Optionee’s termination of “Employment” (as defined below) due to death or “Disability”

(as defined below);

(iii)

thirty (30) days following the date of the Optionee’s termination of Employment by the Company without “Cause” (as

defined below); and

(iv)

the date of the Optionee’s termination of Employment by the Company for Cause or by the Optionee for any reason.

For

purposes of this Agreement, “Employment” shall mean (i) the Optionee’s employment if the Optionee is an employee

of the Company or any of its Affiliates, (ii) the Optionee’s services as a consultant, advisor or other service provider, if the

Optionee is a consultant, advisor or other service provider to the Company or its Affiliates and (iii) the Optionee’s services

as a non-employee director, if the Optionee is a non-employee member of the Board of Directors of the Company (the “Board”).

For

purposes of this Agreement, “Disability” shall mean the inability of the Optionee to perform in all material respects

his or her duties and responsibilities to the Company or any Affiliate, by reason of a physical or mental disability or infirmity which

inability is reasonably expected to be permanent and has continued (i) for a period of six consecutive months or (ii) such shorter period

as the Committee may reasonably determine in good faith. The Disability determination shall be in the sole discretion of the Committee

and the Optionee (or his or her representative) shall furnish the Committee with medical evidence documenting the Optionee’s disability

or infirmity which is satisfactory to the Committee.

For

purposes of this Agreement, “Cause” shall mean “Cause” as defined in any employment agreement then in

effect between the Optionee and the Company or any entity directly or indirectly controlling, controlled by or under common control with

the Company or any other entity designated by the Board in which the Company or an affiliate has an interest (each such entity, an “Affiliate”)

or if not defined therein or, if there shall be no such agreement, (i) the willful failure or refusal by such Optionee to perform his

or her duties to the Company or its Affiliates (other than any such failure resulting from such Optionee’s incapacity due to physical

or mental illness), which has not ceased within ten days after a written demand for substantial performance is delivered to such Optionee

by the Company, which demand identifies the manner in which the Company believes that such Optionee has not performed such duties; (ii)

the willful engaging by such Optionee in misconduct which is materially injurious to the Company or its Affiliates, monetarily or otherwise

(including breach of any confidentiality or non-competition covenants to which such Optionee is bound); (iii) the conviction of such

Optionee of, or the entering of a plea of nolo contendere by such Optionee with respect to, a felony or to any crime which is materially

injurious to the Company or its Affiliates; or (iv) substantial or repeated acts of dishonesty by such Optionee in the performance of

his/her duties to the Company or its Affiliates. The determination of the existence of Cause shall be made by the Committee in good faith.

(b)

Method of Exercise.

(i)

Subject to Section 3(a), the vested portion of the Option may be exercised by delivering to the Company at its principal office written

notice of intent to so exercise; provided that, the Option may be exercised with respect to whole Shares only. Such notice shall

specify the number of Shares for which the Option is being exercised and shall be accompanied by payment in full of the purchase price

per Share of the Option (the “Option Price”). The payment of the Option Price may be made at the election of the Optionee

(i) in cash or its equivalent (e.g., by check), (ii) to the extent permitted by the Committee, in Shares having a “Fair Market

Value” (as defined below) equal to the aggregate Option Price for the Shares being purchased and satisfying such other requirements

as may be imposed by the Committee; provided, that such Shares have been held by the Optionee for no less than six months (or such other

period as established from time to time by the Committee in order to avoid adverse accounting treatment applying generally accepted accounting

principles), (iii) partly in cash and, to the extent permitted by the Committee, partly in such Shares, (iv) if there is a public market

for the Shares at such time, through the delivery of irrevocable instructions to a broker to sell Shares obtained upon the exercise of

the Option and to deliver promptly to the Company an amount out of the proceeds of such sale equal to the aggregate Option Price for

the Shares being purchased, or (v) through a “net settlement.” In the case of a “net settlement” of the Option,

the Company will not require a cash payment of the Option Price of the Option, but will reduce the number of Shares issued upon the exercise

by the largest number of whole Shares that have a Fair Market Value that does not exceed the aggregate Option Price. With respect to

any remaining balance of the aggregate Option Price, the Company shall accept a cash payment. The Optionee shall have no rights to dividends

or other rights of a stockholder with respect to Shares subject to the Option until the Optionee has given written notice of exercise

of the Option, paid in full for such Shares as applicable and, if applicable, has satisfied any other conditions set forth in this Agreement.

(ii)

Notwithstanding any other provision of this Agreement to the contrary, the Option may not be exercised prior to the completion of any

registration or qualification of the Option or the Shares under applicable state and federal securities or other laws, or under any ruling

or regulation of any governmental body or national securities exchange that the Committee shall in its sole discretion determine to be

necessary or advisable.

(iii)

In the event of the Optionee’s death, the vested portion of the Option shall remain exercisable by the Optionee’s executor

or administrator, or the person or persons to whom the Optionee’s rights under this Agreement shall pass by will or by the laws

of descent and distribution as the case may be, to the extent set forth in Section 3(a). Any heir or legatee of the Optionee shall take

rights herein granted subject to the terms and conditions hereof.

For

purposes of this Agreement, “Fair Market Value” shall mean on a given date, (i) if there should be a public market

for the Shares on such date, the closing price of the Shares as reported on such date on the composite tape of the principal national

securities exchange on which such Shares are listed or admitted to trading or, if no composite tape exists for such national securities

exchange on such date, then the closing price on the principal national securities exchange on which such Shares are listed or admitted

to trading, (ii) if the Shares are not listed or admitted on a national securities exchange, the arithmetic mean of the per Share closing

bid price and per Share closing asked price on such date as quoted on the National Association of Securities Dealers Automated Quotation

System (or such other market in which such prices for the Shares are regularly quoted) or (iii) if there is no market on which the Shares

are regularly quoted, the Fair Market Value shall be the value established by the Committee in good faith; provided, however that in

determining the Fair Market value, the Committee shall not apply a discount for any minority interest. With respect to (i) and (ii) above,

if no sale of Shares shall have been reported on such composite tape or such national securities exchange on such date or quoted on the

National Association of Securities Dealer Automated Quotation System or other applicable market on such date, then the immediately preceding

date on which sales of the Shares have been so reported or quoted shall be used.

4.

Adjustments Upon Certain Events. Notwithstanding any other provisions of this Agreement to the contrary, the following provisions

shall apply to the Option granted under this Agreement:

(a)

Generally. In the event of any change in the outstanding Shares after the Date of Grant by reason of any Share dividend or split,

reorganization, recapitalization, merger, consolidation, spin-off, combination or exchange of Shares or other corporate exchange or change

in capital structure, any distribution or special dividend to stockholders of Shares, cash or other property (other than regular cash

dividends), or any similar event, the Committee without liability to any person shall make such substitution or adjustment, if any, as

it deems to be equitable (subject to Section 12 below), as to the number or kind of Shares or other securities subject to this Option

and the per share exercise price thereof; provided that the Committee shall determine in its sole discretion the manner in which such

substitution or adjustment shall be made.

(b)

Change of Control. In the event of a “Change of Control” (or similar corporate transaction) after the Date of Grant,

the Committee may accelerate, vest or cause the restrictions to lapse with respect to all or any portion of this Option. With respect

to any portion of this Option that becomes vested pursuant to the preceding sentence, the Committee may (A) cancel such portion for fair

value (as determined in the sole discretion of the Committee) which may equal the excess, if any, of value of the consideration to be

paid in the Change of Control transaction to holders of the same number of Shares subject to awards (or, if no consideration is paid

in any such transaction, the Fair Market Value of the Shares) over the aggregate exercise price of the Option, (B) provide for the issuance

of substitute awards that will substantially preserve the otherwise applicable terms of this Option previously granted hereunder as determined

by the Committee in its sole discretion or (C) provide that for a period of at least 10 days prior to the Change of Control, the vested

portion of this Option, as may be accelerated pursuant to the first sentence of this subsection (b), shall be exercisable as to all Shares

subject hereto and that upon the occurrence of the Change of Control, this Option shall terminate and be of no further force or effect.

For the avoidance of doubt, pursuant to (A) above, the Committee may cancel this Option for no consideration if the aggregate Fair Market

Value of the Shares subject to this Option is less than or equal to the aggregate Option Price.

For

purposes of this Agreement, “Change of Control” shall mean the occurrence of any one of the following events:

(i)

A change in the ownership of the Company that occurs on the date that any one person, or more than one person acting as a group (for

purposes of SEC Rule 13d) (“Person”), acquires ownership of the Shares that, together with the Shares held by such

Person, constitutes more than 50% of the total voting power of the Shares of the Company. No Change of Control shall have occurred in

the event Ted Karkus (the “Executive”) or a group which includes Executive acquires more than 50% of the voting control

of the Company. The acquisition of additional Shares by any one Person, who is considered to own more than 50% of the total voting power

of the Shares of the Company will not be considered an additional Change of Control; or

(ii)

A change in the effective control of the Company that occurs on the date that a majority of members of the Board is replaced during any

12-month period by directors whose appointment or election is not endorsed by one of either the Executive or a majority of the members

of the Board prior to the date of the appointment or election; or

(iii)

A change in the ownership of a “substantial portion of the Company’s assets”, as defined herein. For this purpose,

a “substantial portion of the Company’s assets” shall mean assets of the Company having a total gross fair market value

equal to or more than 50% of the total gross fair market value of all of the assets of the Company immediately prior to such change in

ownership. For purposes of this subsection (iii), a change in ownership of a substantial portion of the Company’s assets occurs

on the date that any Person acquires (or has acquired during the 12-month period ending on the date of the most recent acquisition by

such Person or Persons) assets from the Company that constitute a “substantial portion of the Company’s assets.” For

purposes of this subsection (iii), the following will not constitute a change in the ownership of a substantial portion of the Company’s

assets: (a) a transfer to an entity that is controlled by the Company’s stockholders immediately after the transfer, or (b) a transfer

of assets by the Company to: (1) a stockholder of the Company (immediately before the asset transfer) in exchange for or with respect

to the Company’s stock, (2) an entity, 50% or more of the total value or voting power of which is owned, directly or indirectly,

by the Company, (3) a Person, that owns, directly or indirectly, 50% or more of the total value or voting power of all the outstanding

stock of the Company, or (4) an entity, at least 50% of the total value or voting power of which is owned, directly or indirectly, by

a Person described in this subsection (iii). For purposes of this subsection (iii), gross fair market value means the value of the assets

of the Company, or the value of the assets being disposed of, determined without regard to any liabilities associated with such assets.

For

purposes of this definition, persons will be considered to be acting as a group if they are owners of a corporation that enters into

a merger, consolidation, purchase or acquisition of stock, or similar business transaction with the Company. Notwithstanding the foregoing,

a transaction will not be deemed a Change of Control unless the transaction qualifies as a change of control event within the meaning

of Section 409A. Further and for the avoidance of doubt, a transaction will not constitute a Change of Control if its primary purpose

is to: (1) change the state of the Company’s incorporation, or (2) create a holding company that will be owned in substantially

the same proportions by the persons who held the Company’s securities immediately before such transaction.

5.

Option Recovery. If the Committee determines that the Optionee (a) engaged in conduct that constituted Cause as defined in Section

3(a) of this Agreement at any prior to the Optionee’s termination of services, (b) engaged in conduct during the 6 month period

after the Optionee’s termination of services that would have constituted Cause if the Optionee had not ceased to provide services,

or (c) violates the terms of any non-compete agreement, non-solicitation agreement, confidentiality agreement, or any other restriction

on the Optionee’s post-termination activities established under any agreement with the Company or other Company policy or arrangement

during the 6 months after the Optionee’s ceases to provide services to the Company, then (i) any Option held by the Optionee shall

immediately terminate, and the Optionee shall automatically forfeit all Shares underlying any exercised portion of an Option for which

the Company has not yet delivered the Share certificates, upon refund by the Company of the Option Price paid by the Optionee for such

Shares and (ii) the Optionee shall return any Shares received upon exercise of this Option or repay to the Company any proceeds received

from the sale of other disposition of the Shares transferred pursuant to this Option less the Option Price. Upon any exercise of an Option,

the Company may withhold delivery of share certificates pending resolution of an inquiry that could lead to a finding resulting in a

forfeiture under this Section.

6.

No Right to Continued Employment. The granting of the Option evidenced hereby and this Agreement shall impose no obligation on

the Company or any Affiliate to continue the Employment of the Optionee and shall not lessen or affect the Company’s or its Affiliate’s

right to terminate the Employment of such Optionee.

7.

Transferability. The Option may not be assigned, alienated, pledged, attached, sold or otherwise transferred or encumbered by

the Optionee otherwise than by will or by the laws of descent and distribution, and any such purported assignment, alienation, pledge,

attachment, sale, transfer or encumbrance shall be void and unenforceable against the Company or any Affiliate; provided that the designation

of a beneficiary shall not constitute an assignment, alienation, pledge, attachment, sale, transfer or encumbrance. No such permitted

transfer of the Option to heirs or legatees of the Optionee shall be effective to bind the Company unless the Committee shall have been

furnished with written notice thereof and a copy of such evidence as the Committee may deem necessary to establish the validity of the

transfer and the acceptance by the transferee or transferees of the terms and conditions hereof. During the Optionee’s lifetime,

the Option is exercisable only by the Optionee.

8.

Withholding. The Optionee may be required to pay to the Company or any Affiliate and the Company shall have the right and is hereby

authorized to withhold, any applicable withholding taxes in respect of the Option, its exercise or any payment or transfer under or with

respect to the Option and to take such other action as may be necessary in the opinion of the Committee to satisfy all obligations for

the payment of such withholding taxes.

9.

Securities Laws. Upon the acquisition of any Shares pursuant to the exercise of the Option, the Optionee will make or enter into

such written representations, warranties and agreements as the Committee may reasonably request in order to comply with applicable securities

laws or with this Agreement.

10.

Notices. Any notice necessary under this Agreement shall be addressed to the Company in care of its Secretary at the principal

executive office of the Company and to the Optionee at the address appearing in the personnel records of the Company for the Optionee

or to either party at such other address as either party hereto may hereafter designate in writing to the other. Any such notice shall

be deemed effective upon receipt thereof by the addressee.

11.

Choice of Law. This Agreement shall be governed by and construed in accordance with the laws of the state of Delaware without

regard to conflicts of laws.

12.

Section 409A. The Company intends that income realized by the Optionee pursuant to this Agreement will not be subject to taxation

under Section 409A of the Code. The provisions of this Agreement shall be interpreted and construed in favor of satisfying any applicable

requirements of Section 409A of the Code. In the event that it is reasonably determined by the Committee that, as a result of Section

409A of the Code, any payment or delivery of Shares in respect of the Option may not be made at the time contemplated by the terms of

this Agreement, as the case may be, without causing Optionee to be subject to taxation under Section 409A of the Code, the Company shall

use reasonably commercial efforts to make such payment or delivery of Shares on the first day that would not result in the Optionee incurring

any tax liability under Section 409A of the Code. If Optionee is a “specified employee” (within the meaning of Section 409A(a)(2)(B)(i)

of the Code), any payment and/or delivery of Shares in respect of the Option that are linked to the date of the Optionee’s separation

from service shall not be made prior to the date which is six (6) months after the date of such Optionee’s separation from service

from the Company, determined in accordance with Section 409A of the Code and the regulations promulgated thereunder. The Company, in

its reasonable discretion, may amend (including retroactively) this Agreement in order to conform to the applicable requirements of Section

409A of the Code, including amendments to facilitate the Optionee’s ability to avoid taxation under Section 409A of the Code. However,

the preceding provisions shall not be construed as a guarantee by the Company of any particular tax result for income realized by the

Optionee pursuant to this Agreement.

13.

Administration. This Agreement shall be administered by the Committee. The Committee is authorized to interpret this Agreement,

to establish, amend and rescind any rules and regulations relating to this Agreement, and to make any other determinations that it deems

necessary or advisable for the administration of this Agreement. The Committee may correct any defect or supply any omission or reconcile

any inconsistency in this Agreement in the manner and to the extent the Committee deems necessary or advisable. Any decision of the Committee

in the interpretation and administration of this Agreement, as described herein, shall lie within its sole and absolute discretion and

shall be final, conclusive and binding on all parties concerned (including, but not limited to, the Optionee and his or her beneficiaries

or successors). The Committee shall have the full power and authority to establish the terms and conditions of this Option consistent

with the provisions of this Agreement and to waive any such terms and conditions at any time (including, without limitation, accelerating

or waiving any vesting conditions). Awards may, in the discretion of the Committee, be granted in assumption of, or in substitution for,

any outstanding portion of this Option. The Committee shall require payment of any minimum amount it may determine to be necessary to

withhold for federal, state, local or other, taxes as a result of the exercise, vesting or grant of this Option. Unless the Committee

specifies otherwise, the Optionee may elect to pay a portion or all of such minimum withholding taxes by (a) delivery in Shares or (b)

having Shares withheld by the Company from any Shares that would have otherwise been received by the Optionee. The number of Shares so

delivered or withheld shall have an aggregate Fair Market Value sufficient to satisfy the applicable minimum withholding taxes.

14.

Successors and Assigns. This Agreement shall be binding on all successors and assigns of the Company and the Optionee, including,

without limitation, the estate of the Optionee and the executor, administrator or trustee of such estate, and any receiver or trustee

in bankruptcy or any other representative of the Optionee’s creditors.

15.

Signature in Counterparts. This Agreement may be signed in counterparts, each of which shall be an original, with the same effect

as if the signatures thereto and hereto were upon the same instrument.

[Signatures

on next page.]

IN

WITNESS WHEREOF, the parties have caused this Agreement to be effective as of the day and year first above written.

| |

PROPHASE

LABS, INC. |

| |

|

| |

By: |

/s/

Ted Karkus |

| |

Name: |

Ted

Karkus |

| |

Title: |

Chief

Executive Officer and

Chairman

of the Board |

| |

|

|

| |

OPTIONEE |

| |

|

| |

/s/

Stuart Hollenshead |

| |

Stuart

Hollenshead |

[Signature

Page to Inducement Option Award Agreement]

Exhibit 99.1

ProPhase

Labs hires Stuart Hollenshead as COO, the former COO and CBO of Barstool Sports

GARDEN

CITY, NY, February 18, 2025 (GLOBE NEWSWIRE) – ProPhase Labs, Inc. (NASDAQ: PRPH) (“ProPhase” or the “Company”),

a next-generation biotech, genomics, and consumer products company, today announced the appointment of Stu Hollenshead as Chief Operating

Officer, marking a pivotal step in the company’s expansion into consumer-centered health and wellness products. As COO, Hollenshead

will focus on accelerating ProPhase Labs’ consumer-facing strategy, leveraging his deep expertise in direct-to-consumer growth,

subscription models, digital marketing, and audience monetization to position the company as a leader in science-backed health solutions.

The

Company plans to provide additional updates very shortly regarding progress in its accounts receivables that the Company believes will

be significant, the exploration of new strategic alternatives for Nebula Genomics and DNA Complete, and additional cost-cutting measures.

CEO

Commentary

“Stu

is a world-class operator who understands how to build and scale consumer-first businesses,” said Ted Karkus, CEO of ProPhase Labs.

“The Company’s particular focus going forward will be direct-to-consumer revenue streams. Furthermore, we are optimistic

about the potential for a significant inflow of capital into the Company between Q2 and Q3 2025 related to our enhanced accounts receivable

collection initiatives and look forward to updating shareholders further in the near future. These are just some of the reasons that

someone of Stu’s caliber was willing to transition from being a consultant at ProPhase to its COO. Stu’s relentless work

ethic, competitive will to win as well as his expertise in audience building & engagement, marketing, e-commerce, and media-driven

brand growth aligns perfectly with our vision as we launch Legendz XL and Legendz Triple Edge online and prepare for the introduction

of Equivir in the near future. Stu will also be able to leverage his role at 10PM Curfew to create abundant win-win scenarios while scaling

our new product introductions to the marketplace.”

Mr.

Karkus continued, “10PM Curfew represents a true competitive advantage for ProPhase. It is a one-stop shop for anyone that wants

to build their brand with the support of a highly-engaged audience of 70-million women. 10PM can guarantee tens to hundreds of millions

of impressions in the blink of an eye at the most competitive CPMs in the market while bringing a best-of-breed content shop & social

platform, creator & influencer management infrastructure and TikTok Shop services division to the table for immediate use. ProPhase

stood on the sidelines for years watching brands use Barstool to scale their growth. Now, ProPhase will be directly aligned with the

Barstool equivalent in the female space with 10PM. ProPhase is getting in on the ground floor while Stu continues to scale the 10PM business

exactly like he did at Barstool.”

Following

the successful sale of Pharmaloz Manufacturing, COO Jed Latkin has resigned and transitioned to a consulting role to focus on advancing

ProPhase’s BE-Smart esophageal cancer test. He will collaborate with Igor Ban, Director of Research, for commercialization efforts.

Several discussions with potential partners are ongoing. In parallel, the next batch of BE-Smart samples is being prepared in collaboration

with The Mayo Clinic to continue to further validate the statistical evidence of the advantages and effectiveness of this breakthrough

diagnostic cancer test. The Company has determined that the target market for this potential lifesaving cancer diagnostic test is $7

- $14 billion, in the U.S. alone, and has minimal competition at present.

About

Stu Hollenshead

Hollenshead

has played a pivotal role in two of the most high-profile media acquisitions in recent years. At Business Insider, he helped lead audience

and subscription growth, contributing to its $442-million acquisition by Axel Springer in 2015. Later, at Barstool Sports, Hollenshead

served as Chief Operating Officer & Chief Business Officer, leading the company through record-breaking expansion in revenue, audience,

and product monetization—culminating in its $551-million acquisition by Penn Entertainment in 2023.

At

Barstool Sports, Hollenshead played a significant role in the company’s evolution from a disruptive digital brand into a powerhouse

in media, commerce, and sports betting. He helped to oversee a multi-pronged business strategy, spanning subscription models, e-commerce,

direct-to-consumer monetization, licensing and branded partnerships, all while managing teams across engineering, product, marketing,

and business development. During his tenure the company experienced double-digit audience and revenue growth year over year, significantly

expanding Barstool’s digital footprint, revenue, and brand equity—making it one of the most sought-after acquisitions in

digital media in the past decade.

Prior

to Barstool, Hollenshead built a reputation as a growth architect, scaling TheStreet’s direct-to-consumer subscription business

to $30 million, pioneering AI-driven content automation, and later helping Business Insider surpass 100 million monthly users with a

profitable mix of B2B and direct-to-consumer subscription revenue streams. He also drove product monetization and platform migrations

at WWE, helping WWE Network reach nearly 2 million paying subscribers.

In

addition to his new role at ProPhase Labs, Hollenshead will continue serving as CEO of 10PM Curfew, one of the largest and fastest-growing

female-centric digital platforms, reaching over 70 million women. Under his leadership, 10PM Curfew has built a one-of-a-kind innovative

audience and content strategy, successfully partnering with brands to drive highly engaged, scalable digital communities that create

significant brand awareness, consideration and conversion.

Stu

Hollenshead Commentary

“I

couldn’t be more excited to join ProPhase Labs at this stage of its evolution,” said Hollenshead. “Ted Karkus built

up and sold the Cold-EEZE consumer brand for $50 million, and Jason Karkus built a multi-hundred-million-dollar Covid testing business

from scratch. With significant cash flow anticipated into ProPhase later this year, this is the perfect time and perfect fit for me to

join them in building a world-class consumer products company. The Company is currently selling its Legendz testosterone and energy boosting

products in stores, but the larger opportunity will be to sell online. I am also looking forward to leveraging our marketing platform

with the launch of Equivir, a product with enormous potential, in stores and online in the near future.

In

parallel, I am looking forward to numerous potential joint venture opportunities, now and in the future, to develop other company’s

brands that have significant potential but need our marketing platform and expertise, network of influencers, etc. The opportunity is

enormous. I am excited to leverage my experience in scaling high-growth businesses to accelerate the success of Legendz, Equivir, and

leveraging my network to expand the portfolio of innovative health solutions over time.”

With

Hollenshead’s leadership, ProPhase Labs is poised for rapid growth, developing innovative consumer-first health solutions and establishing

itself as a dominant player in the evolving wellness landscape.

The

Company plans to provide additional updates very shortly regarding the exploration of new strategic alternatives for Nebula, progress

in its accounts receivables that should be significant, and additional cost cutting measures.

Inducement

Award

Mr.

Hollenshead was awarded a stock option to purchase up to 500,000 shares of ProPhase common stock as an inducement to his employment

as Chief Operating Officer of ProPhase Labs. This award was made in accordance with the employment inducement award exemption provided

by Nasdaq Rule 5635(c)(4) and was therefore not awarded under the Company’s stockholder approved equity plan. The option award

will vest as follows, contingent upon continued service: 25% will vest on the date of grant and 25% will vest on each of the next three

anniversaries of the grant date. The options will have a strike price of $0.60 per share and will be exercisable for a period of seven

years.

About

ProPhase Labs

ProPhase

Labs Inc. (Nasdaq: PRPH) (“ProPhase”) is a next-generation biotech, genomics and consumer products company. Our goal is to

create a healthier world with bold action and the power of insight. We’re revolutionizing healthcare with industry-leading Whole

Genome Sequencing solutions, while developing potential game changer diagnostics and therapeutics in the fight against cancer. This includes

a potentially life-saving cancer test focused on early detection of esophageal cancer and potential breakthrough cancer therapeutics

with novel mechanisms of action. We develop, manufacture, and commercialize health and wellness solutions to enable people to live their

best lives. We are committed to executional excellence, smart diversification, and a synergistic, omni-channel approach. ProPhase Labs’

valuable subsidiaries, their synergies, and significant growth underscore our potential for long-term value.

Forward

Looking Statements

Except

for the historical information contained herein, this document contains forward looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995, including statements regarding our strategy, plans, objectives and initiatives, including our

expectations regarding the future revenue growth potential of each of our subsidiaries, our expectations regarding future liquidity events,

the success of our efforts to collect accounts receivables and anticipated timeline for any payments relating thereto, and our ability

to successfully transition into a consumer products company. Management believes that these forward-looking statements are reasonable

as and when made. However, such forward-looking statements involve known and unknown risks, uncertainties, and other factors that may

cause actual results to differ materially from those projected in the forward-looking statements. These risks and uncertainties include

but are not limited to our ability to obtain and maintain necessary regulatory approvals, general economic conditions, consumer demand

for our products and services, challenges relating to entering into and growing new business lines, the competitive environment, and

the risk factors listed from time to time in our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and any other SEC filings.

The Company undertakes no obligation to update forward-looking statements except as required by applicable securities laws. Readers are

cautioned that forward-looking statements are not guarantees of future performance and are cautioned not to place undue reliance on any

forward-looking statements.

Media

Relations and Institutional Investor Contact:

ProPhase

Labs, Inc.

267-880-1111

investorrelations@prophaselabs.com

Retail

Investor Relations Contact:

Renmark

Financial Communications

John

Boidman

212-812-7680

Jboidman@renmarkfinancial.com

v3.25.0.1

Cover

|

Feb. 17, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 17, 2025

|

| Entity File Number |

000-21617

|

| Entity Registrant Name |

PROPHASE

LABS, INC.

|

| Entity Central Index Key |

0000868278

|

| Entity Tax Identification Number |

23-2577138

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

711

Stewart Avenue

|

| Entity Address, Address Line Two |

Suite 200

|

| Entity Address, City or Town |

Garden

City

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

11530

|

| City Area Code |

(215)

|

| Local Phone Number |

345-0919

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.0005

|

| Trading Symbol |

PRPH

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

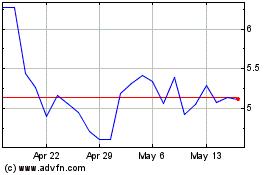

ProPhase Labs (NASDAQ:PRPH)

Historical Stock Chart

From Feb 2025 to Mar 2025

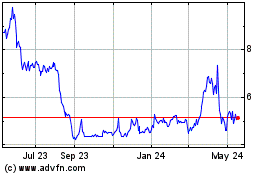

ProPhase Labs (NASDAQ:PRPH)

Historical Stock Chart

From Mar 2024 to Mar 2025