Renasant Corporation (NASDAQ:RNST) (the "Company") today announced

results for the third quarter of 2005. Basic earnings per share

were $.61, up 17% for the third quarter of 2005, and diluted

earnings per share were $.60, up 15% for the third quarter of 2005,

compared to basic and diluted earnings per share of $.52 for the

third quarter of 2004. Net income for the third quarter of 2005 was

$6,325,000, up 35%, or $1,634,000, from the third quarter of 2004.

"We are pleased with our third quarter performance as we begin to

realize the benefits of our acquisition of Heritage Financial

Holding Corporation (Heritage) and continue to build on the success

of our acquisition of Renasant Bancshares. Consistent with our

strategic goals, we continue to experience a low level of

charge-offs and non-performing loans. Net interest margin has

remained relatively steady while non-interest income has shown

solid growth. We are particularly pleased that non-interest expense

has declined over the last two-quarters as we realize the synergies

of our acquisition," commented Renasant Chairman and Chief

Executive Officer, E. Robinson McGraw. "I think it is important to

note that our footprint was spared from the wrath of Hurricane

Katrina and it should have no foreseeable negative impact on our

performance," continued McGraw. Total assets as of September 30,

2005 were $2.380 billion, an increase of 39% from December 31,

2004, reflecting primarily the acquisition of Heritage. Total loans

grew 41% to $1.609 billion at the end of the third quarter of 2005

from $1.141 billion at December 31, 2004, while total deposits grew

38% to $1.818 billion during the same period. The increase in total

loans and total deposits was also primarily due to the Heritage

acquisition. Excluding Heritage balances at the date of

acquisition, total loans and deposits at September 30, 2005 grew

$77,477,000, or 9% annualized and $118,643,000, or 12% annualized,

respectively, from December 31, 2004. "It is now over a year since

our entry into Tennessee with the acquisition of Renasant

Bancshares, and we have realized strong growth in loans and

deposits for our Tennessee division of over $63 million and $35

million year-to-date, respectively. It has been less than a year

since we entered into Alabama through our acquisition of Heritage,

but we are beginning to realize solid loan growth. Alabama deposit

growth has been robust with net year-to-date growth of $11 million,

including the intentional runoff of nearly $20 million in brokered

deposits which Heritage held at the time of the acquisition. In

Mississippi, deposit growth has been strong at $46 million

year-to-date while loan growth has been flat," stated McGraw. "We

continue to expand our presence in new growth markets with the

recent opening of a full-service banking office in a high profile

East Memphis, Tennessee location and expect to open a full service

banking office in Collierville, Tennessee in the first quarter of

2006," commented McGraw. "We also opened a full service banking

office in Oxford, Mississippi, which compliments our downtown

presence and ATM on the campus of the University of Mississippi. We

anticipate opening additional offices in Nashville, Tennessee and

in Huntsville and Birmingham, Alabama and other growth markets in

2006 and 2007 in accordance with our strategic plan," continued

McGraw. Net interest income grew 32% to $19,739,000 for the third

quarter of 2005 compared to $15,003,000 for the same period in 2004

due to loan growth and the Company's acquisition of Heritage. Net

interest margin decreased to 3.94% for the third quarter of 2005

from 4.16% for the third quarter of 2004. Factors negatively

impacting net interest margin include the acquisition of Heritage,

which had a lower net interest margin than the Company prior to the

acquisition, the issuance of subordinated debentures to fund that

acquisition and the rising cost of deposits. Noninterest income

increased 22% to $10,244,000 for the third quarter of 2005 from

$8,378,000 for the third quarter of 2004. The increase in

noninterest income was due to the combination of the Heritage

acquisition and improvements in service charges, fees and

commissions generated on the Company's loan and deposit products,

trust revenue and gains on the sale of mortgage loans. Noninterest

income represented 34% of total revenue for the third quarter of

2005. Noninterest expense was $20,564,000 for the third quarter of

2005 compared to $16,210,000 for the third quarter of 2004 due

primarily to the acquisition of Heritage. When compared to the

second and first quarters of 2005, noninterest expenses for the

third quarter of 2005 decreased $293,000 and $399,000,

respectively. The decrease reflects the planned elimination of

duplicate data processing operations and staff as a result of the

Heritage acquisition, reduced data processing costs through

contract renegotiations with the Company's primary vendor and

planned Mississippi staff reductions. "We elected to expense stock

options at the beginning of 2001 and we anticipate the impact on

2005 earnings to be $.04 per share. Our third quarter 2005

noninterest expenses include $171,000 related to the expensing of

those stock options," stated McGraw. The Company maintained its

quality credit during the third quarter of 2005. Annualized net

charge-offs as a percentage of average loans were .11% for the

third quarter of 2005, down from .12% for the third quarter of

2004. Annualized net charge-offs as a percentage of average loans

for the nine months ending September 30, 2005 were .20% compared to

.19% for the same period in 2004. Non-performing loans as a

percentage of total loans were .45% at September 30, 2005, as

compared to .40% at June 30, 2005 and .43% at March 31, 2005. The

allowance for loan losses as a percentage of loans was 1.15% at

September 30, 2005, basically unchanged from 1.14% for June 30,

2005 and March 31, 2005. The non-performing loan coverage ratio was

256.19% at September 30, 2005 compared to 280.35% at June 30, 2005

and 264.53% at March 31, 2005. At September 30, 2005, the carrying

balance of the loans acquired by the Company in connection with its

acquisition of Heritage accounted for in accordance with SOP 03-3

was $9,617,000 as compared to the June 30, 2005 balance of

$10,604,000. The balance of these acquired loans decreased

primarily due to principal reductions. The acquisition of Heritage

was completed on January 1, 2005 using the purchase accounting

method under generally accepted accounting principles. Under this

method of accounting, the financial statements of the Company do

not reflect the results of operations of Heritage prior to January

1, 2005. The balance sheet of the Company as of September 30, 2005,

however, reflects the Company's acquisition of Heritage, including

total assets of $540.3 million, total loans of $389.8 million,

total deposits of $381.0 million, goodwill of $47.3 million and

core deposits intangible of $4.6 million. The Company issued

1,369,589 shares of Renasant Corporation common stock and paid

$23.1 million cash in connection with the acquisition. CONFERENCE

CALL INFORMATION A live audio webcast of a conference call with

analysts will be available beginning at 10:00 a.m. Eastern time on

Wednesday, October 19, 2005, through the Company's website:

www.renasant.com, and through Thompson/CCBN's individual investor

center at www.fulldisclosure.com, or any of Thompson/CCBN's

Investor Distribution Network websites. The event will be archived

on the Company's website for 90 days. If Internet access is

unavailable, the conference may also be heard live (listen-only)

via telephone by dialing 1-800-510-9661 in the United States and

entering the participant passcode 81268594. ABOUT RENASANT

CORPORATION Renasant Corporation is the parent of Renasant Bank and

Renasant Insurance. Renasant has assets of approximately $2.4

billion and operates 61 banking and insurance offices in 36 cities

in Mississippi, Tennessee and Alabama. NOTE TO INVESTORS This news

release may contain, or incorporate by reference, statements which

may constitute "forward-looking statements" within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. Such

forward looking statements usually include words such as "expects,"

"projects," "anticipates," "believes," "intends," "estimates,"

"strategy," "plan," "potential," "possible" and other similar

expressions. Prospective investors are cautioned that any such

forward-looking statements are not guarantees for future

performance and involve risks and uncertainties, and that actual

results may differ materially from those contemplated by such

forward-looking statements. Important factors currently known to

management that could cause actual results to differ materially

from those in forward-looking statements include significant

fluctuations in interest rates, inflation, economic recession,

significant changes in the federal and state legal and regulatory

environment, significant underperformance in our portfolio of

outstanding loans, and competition in our markets. We undertake no

obligation to update or revise forward-looking statements to

reflect changed assumptions, the occurrence of unanticipated events

or changes to future operating results over time. -0- *T RENASANT

CORPORATION -------------------- (Unaudited) (Dollars in thousands,

except per share data) 2005

--------------------------------------------- Third Second First

Statement of earnings Quarter Quarter Quarter ---------------------

------------- --------------- --------------- Interest income -

taxable equivalent basis $ 33,249 $ 32,718 $ 30,146 Interest income

$ 32,417 $ 31,900 $ 29,295 Interest expense 12,678 11,445 9,977

------------ -------------- -------------- Net interest income

19,739 20,455 19,318 Provision for loan losses 833 847 597

------------ -------------- -------------- Net interest income

after provision 18,906 19,608 18,721 Service charges on deposit

accounts 4,358 4,167 3,874 Fees and commissions on loans and

deposits 2,853 2,965 2,505 Insurance commissions and fees 955 906

831 Trust revenue 613 611 625 Gain (loss) on sale of securities -

(32) 102 Gain on sale of mortgage loans 766 673 693 Gain on sale of

merchant business - - - Merchant discounts 2 2 2 Other 697 659

1,271 ------------ -------------- -------------- Total non-interest

income 10,244 9,951 9,903 Salaries and employee benefits 11,696

11,520 11,459 Occupancy and equipment 2,220 2,222 2,605 Data

processing 966 962 1,044 Amortization of intangibles 557 571 586

Other 5,125 5,582 5,269 ------------ -------------- --------------

Total non-interest expense 20,564 20,857 20,963 Income before

income taxes 8,586 8,702 7,661 Income taxes 2,261 2,495 2,202

------------ -------------- -------------- Net income (loss) $

6,325 $ 6,207 $ 5,459 ============ ============== ==============

Basic earnings per share $ 0.61 $ 0.60 $ 0.52 Diluted earnings per

share 0.60 0.59 0.52 Average basic shares outstanding 10,396,579

10,400,330 10,406,243 Average diluted shares outstanding 10,511,212

10,518,760 10,560,330 Common shares outstanding 10,380,372

10,397,897 10,412,775 Cash dividend per common share $ 0.22 $ 0.22

$ 0.21 Performance ratios ------------------ Return on average

shareholders' equity 10.57% 10.64% 9.40% Return on average tangible

shareholders' equity 19.44% 19.85% 17.78% Return on average assets

1.07% 1.06% 0.93% Return on average tangible assets 1.17% 1.17%

1.05% Net interest margin (FTE) 3.94% 4.14% 3.98% Yield on earning

assets (FTE) 6.36% 6.36% 5.95% Average earning assets to average

assets 88.06% 88.10% 87.54% Average loans to average deposits

90.68% 90.75% 90.75% Noninterest income (less securities gains/

losses) to average assets 1.73% 1.71% 1.68% Noninterest expense to

average assets 3.47% 3.57% 3.58% Net overhead ratio 1.74% 1.86%

1.91% Efficiency ratio (FTE) 66.73% 66.80% 69.71% (a)Percent

variance not meaningful 2004

----------------------------------------------- Fourth Third Second

First Statement of earnings Quarter Quarter Quarter Quarter

--------------------- ----------- ----------- -----------

----------- Interest income - taxable equivalent basis $ 21,803 $

21,538 $ 18,418 $ 18,441 Interest income $ 21,076 $ 20,805 $ 17,559

$ 17,584 Interest expense 5,848 5,802 5,012 5,134 ----------

---------- ---------- ---------- Net interest income 15,228 15,003

12,547 12,450 Provision for loan losses (82) 636 488 505 ----------

---------- ---------- ---------- Net interest income after

provision 15,310 14,367 12,059 11,945 Service charges on deposit

accounts 3,856 4,067 3,732 3,700 Fees and commissions on loans and

deposits 1,812 1,975 1,958 1,671 Insurance commissions and fees 887

993 890 820 Trust revenue 419 658 606 464 Gain (loss) on sale of

securities (1,130) 51 (31) 89 Gain on sale of mortgage loans 166

138 151 128 Gain on sale of merchant business - - 1,000 - Merchant

discounts 39 7 270 356 Other 570 489 543 943 ---------- ----------

---------- ---------- Total non-interest income 6,619 8,378 9,119

8,171 Salaries and employee benefits 8,755 9,106 7,952 7,593

Occupancy and equipment 2,406 2,095 1,727 1,566 Data processing

1,159 1,020 1,141 1,163 Amortization of intangibles 389 403 100 123

Other 3,922 3,586 3,262 3,241 ---------- ---------- ----------

---------- Total non-interest expense 16,631 16,210 14,182 13,686

Income before income taxes 5,298 6,535 6,996 6,430 Income taxes

1,250 1,844 1,939 1,783 ---------- ---------- ---------- ----------

Net income (loss) $ 4,048 $ 4,691 $ 5,057 $ 4,647 ==========

========== ========== ========== Basic earnings per share $ 0.45 $

0.52 $ 0.61 $ 0.57 Diluted earnings per share 0.45 0.52 0.61 0.57

Average basic shares outstanding 9,024,384 8,977,549 8,186,826

8,191,530 Average diluted shares outstanding 9,081,944 9,042,695

8,207,941 8,212,533 Common shares outstanding 9,046,997 9,018,145

8,186,826 8,186,826 Cash dividend per common share $ 0.21 $ 0.21 $

0.20 $ 0.20 Performance ratios ------------------ Return on average

shareholders' equity 9.07% 10.49% 14.02% 13.27% Return on average

tangible shareholders' equity 13.14% 15.51% 14.77% 14.07% Return on

average assets 0.95% 1.12% 1.40% 1.29% Return on average tangible

assets 1.04% 1.21% 1.43% 1.32% Net interest margin (FTE) 4.20%

4.16% 4.10% 4.09% Yield on earning assets (FTE) 5.74% 5.69% 5.64%

5.67% Average earning assets to average assets 89.10% 89.52% 91.10%

90.79% Average loans to average deposits 84.13% 82.46% 77.17%

76.09% Noninterest income (less securities gains/losses) to average

assets 1.82% 1.98% 2.26% 2.25% Noninterest expense to average

assets 3.92% 3.86% 3.94% 3.80% Net overhead ratio 2.09% 1.88% 1.68%

1.56% Efficiency ratio (FTE) 73.67% 67.22% 62.96% 63.72% (a)Percent

variance not meaningful 3rd Qtr 2005 - 3rd Qtr For the Nine Months

2004 Ended September 30, -------------------------------- Percent

Percent Statement of earnings Variance 2005 2004 Variance

--------------------- -------- ----------- ---------- --------

Interest income - taxable equivalent basis 54.37 $ 96,113 $ 58,397

64.59 Interest income 55.81 $ 93,612 $ 55,948 67.32 Interest

expense 118.51 34,100 15,948 113.82 -------- ----------- ----------

-------- Net interest income 31.57 59,512 40,000 48.78 Provision

for loan losses 30.97 2,277 1,629 39.78 -------- -----------

---------- -------- Net interest income after provision 31.59

57,235 38,371 49.16 Service charges on deposit accounts 7.16 12,399

11,499 7.83 Fees and commissions on loans and deposits 44.46 8,323

5,604 48.52 Insurance commissions and fees (3.83) 2,692 2,703

(0.41) Trust revenue (6.84) 1,849 1,728 7.00 Gain (loss) on sale of

securities (100.00) 70 109 (35.78) Gain on sale of mortgage loans

455.07 2,132 417 411.27 Gain on sale of merchant business - - 1,000

(100.00) Merchant discounts (71.43) 6 633 (99.05) Other 42.54 2,627

1,975 33.01 -------- ----------- ---------- -------- Total

non-interest income 22.27 30,098 25,668 17.26 Salaries and employee

benefits 28.44 34,675 24,651 40.66 Occupancy and equipment 5.97

7,047 5,388 30.79 Data processing (5.29) 2,972 3,324 (10.59)

Amortization of intangibles 38.21 1,714 626 173.80 Other 42.92

15,976 10,089 58.35 -------- ----------- ---------- -------- Total

non-interest expense 26.86 62,384 44,078 41.53 Income before income

taxes 31.38 24,949 19,961 24.99 Income taxes 22.61 6,958 5,566

25.01 -------- ----------- ---------- -------- Net income (loss)

34.83 $ 17,991 $ 14,395 24.98 ======== =========== ==========

======== Basic earnings per share 17.31 $ 1.73 $ 1.70 1.76 Diluted

earnings per share 15.38 1.71 1.70 0.59 Average basic shares

outstanding 15.81 10,399,915 8,453,886 23.02 Average diluted shares

outstanding 16.24 10,512,291 8,481,369 23.95 Common shares

outstanding 15.11 10,380,372 9,018,145 15.11 Cash dividend per

common share 4.76 $ 0.65 $ 0.61 6.56 Performance ratios

------------------ Return on average shareholders' equity 10.25%

12.55% Return on average tangible shareholders' equity 19.12%

14.94% Return on average assets 1.03% 1.26% Return on average

tangible assets 1.14% 1.32% Net interest margin (FTE) 4.02% 4.12%

Yield on earning assets (FTE) 6.24% 5.67% Average earning assets to

average assets 87.90% 90.41% Average loans to average deposits

91.52% 78.35% Noninterest income (less securities gains/ losses) to

average assets 1.71% 2.24% Noninterest expense to average assets

3.56% 3.87% Net overhead ratio 1.85% 1.63% Efficiency ratio (FTE)

67.73% 64.71% (a)Percent variance not meaningful RENASANT

CORPORATION -------------------- (Unaudited) (Dollars in thousands,

except per share data) ----------------------------------- Third

Second First Average balances Quarter Quarter Quarter

---------------- ----------- ----------- ----------- Total assets

$2,353,914 $2,340,597 $2,339,201 Earning assets 2,072,762 2,062,124

2,047,770 Securities 408,161 420,463 452,818 Loans, net of unearned

1,640,121 1,611,143 1,576,877 Intangibles 101,323 101,385 101,453

Non-interest bearing deposits 235,611 234,946 229,638 Interest

bearing deposits 1,573,085 1,515,318 1,483,677 Total deposits

1,808,696 1,750,264 1,713,315 Other borrowings 289,849 333,710

371,855 Shareholders' equity 237,386 233,908 232,348 Asset quality

data ------------------ Nonaccrual loans $ 3,803 $ 4,157 $ 3,807

Loans 90 past due or more 3,398 2,292 3,002 ---------- ----------

---------- Non-performing loans 7,201 6,449 6,809 Other real estate

owned and repossessions 6,646 7,114 7,232 ---------- ----------

---------- Non-performing assets 13,847 13,563 14,041 ==========

========== ========== Net loan charge-offs $ 465 $ 781 $ 1,186

Allowance for loan losses 18,448 18,080 18,012 Non-performing loans

/ total loans 0.45% 0.40% 0.43% Non-performing assets / total

assets 0.58% 0.58% 0.60% Allowance for loan losses / total loans

1.15% 1.14% 1.14% Allowance for loan losses / non- performing loans

256.19% 280.35% 264.53% Net loan charge-offs (annualized) / average

loans 0.11% 0.19% 0.31% Balances at period end

---------------------- Total assets $2,379,793 $2,353,385

$2,320,164 Earning assets 2,073,678 2,075,244 2,041,307 Securities

400,786 415,193 425,196 Mortgage loans held for sale 42,865 32,792

32,623 Loans, net of unearned 1,608,697 1,592,391 1,572,103

Intangibles 100,766 101,528 101,406 Non-interest bearing deposits $

244,086 $ 233,095 $ 238,651 Interest bearing deposits 1,574,232

1,531,082 1,502,350 Total deposits 1,818,318 1,764,177 1,741,001

Other borrowings 299,076 334,952 324,330 Shareholders' equity

237,211 235,454 230,892 Market value per common share 31.65 30.76

31.10 Book value per common share 22.85 22.64 22.17 Tangible book

value per common share 13.14 12.88 12.44 Shareholders' equity to

assets (actual) 9.97 10.00 9.95 Tangible capital ratio 5.99 5.95

5.84 Leverage ratio 8.79 8.67 8.59 Detail of Loans by Category

--------------------------- Commercial, financial, agricultural $

224,673 $ 228,371 $ 228,305 Lease financing 8,143 9,576 10,763 Real

estate - construction 162,694 159,798 159,155 Real estate - 1-4

family mortgages 558,616 547,307 531,347 Real estate - commercial

mortgages 570,849 556,694 537,800 Installment loans to individuals

83,722 90,645 104,733 ---------- ---------- ---------- Loans, net

of unearned 1,608,697 1,592,391 1,572,103 ========== ==========

========== (a)Percent variance not meaningful 2004

----------------------------------------------- Fourth Third Second

First Average balances Quarter Quarter Quarter Quarter

---------------- ----------- ----------- ----------- -----------

Total assets $1,699,207 $1,681,430 $1,440,130 $1,439,689 Earning

assets 1,514,042 1,505,190 1,311,945 1,307,160 Securities 377,482

388,286 403,959 405,543 Loans, net of unearned 1,128,631 1,103,362

897,219 871,897 Intangibles 48,128 51,483 5,697 5,797 Non-interest

bearing deposits 195,732 182,542 160,744 140,084 Interest bearing

deposits 1,143,957 1,153,291 999,160 1,003,744 Total deposits

1,339,689 1,335,833 1,159,904 1,143,828 Other borrowings 161,263

149,590 123,197 113,586 Shareholders' equity 178,591 178,855

144,306 140,084 Asset quality data ------------------ Nonaccrual

loans $ 6,443 $ 5,626 $ 5,566 $ 5,413 Loans 90 past due or more

2,228 2,054 1,848 3,891 ---------- ---------- ---------- ----------

Non-performing loans 8,671 7,680 7,414 9,304 Other real estate

owned and repossessions 2,324 2,516 1,901 1,661 ----------

---------- ---------- ---------- Non-performing assets 10,995

10,196 9,315 10,965 ========== ========== ========== ========== Net

loan charge-offs $ 1,824 $ 324 $ 610 $ 463 Allowance for loan

losses 14,403 16,309 13,152 13,274 Non-performing loans / total

loans 0.76% 0.68% 0.82% 1.05% Non-performing assets / total assets

0.64% 0.60% 0.65% 0.75% Allowance for loan losses / total loans

1.26% 1.45% 1.45% 1.50% Allowance for loan losses / non- performing

loans 166.30% 212.36% 177.39% 142.67% Net loan charge-offs

(annualized) / average loans 0.64% 0.12% 0.28% 0.21% Balances at

period end ---------------------- Total assets $1,707,545

$1,706,462 $1,422,381 $1,469,269 Earning assets 1,519,704 1,527,387

1,295,876 1,347,168 Securities 371,581 384,550 360,120 425,609

Mortgage loans held for sale 2,714 1,502 1,708 1,255 Loans, net of

unearned 1,141,480 1,128,047 906,186 882,484 Intangibles 50,424

50,712 5,646 5,746 Non-interest bearing deposits $ 200,922 $

201,419 $ 160,771 $ 195,837 Interest bearing deposits 1,117,755

1,135,882 990,310 1,002,188 Total deposits 1,318,677 1,337,301

1,151,081 1,198,025 Other borrowings 191,547 172,723 115,679

112,340 Shareholders' equity 179,042 176,712 138,276 141,286 Market

value per common share 33.10 32.55 34.56 33.70 Book value per

common share 19.79 19.60 16.89 17.26 Tangible book value per common

share 14.22 13.97 16.20 16.56 Shareholders' equity to assets

(actual) 10.49 10.36 9.72 9.62 Tangible capital ratio 7.76 7.61

9.36 9.26 Leverage ratio 8.97 8.95 10.77 10.54 Detail of Loans by

Category ------------------ Commercial, financial, agricultural $

175,571 $ 177,018 $ 142,999 $ 139,960 Lease financing 10,809 11,450

11,365 11,785 Real estate - construction 96,404 94,779 58,344

59,361 Real estate - 1-4 family mortgages 375,698 356,798 320,198

309,029 Real estate - commercial mortgages 395,048 394,386 291,012

277,517 Installment loans to individuals 87,950 93,616 82,268

84,832 ---------- ---------- ---------- ---------- Loans, net of

unearned 1,141,480 1,128,047 906,186 882,484 ========== ==========

========== ========== (a)Percent variance not meaningful 3rd Qtr

2005 - 3rd Qtr For the Nine Months 2004 Ended September 30,

-------------------------------- Percent Percent Average balances

Variance 2005 2004 Variance ---------------- -------- ----------

---------- -------- Total assets 39.99 $2,344,625 $1,521,336 54.12

Earning assets 37.71 2,060,977 1,375,497 49.84 Securities 5.12

426,984 399,479 6.89 Loans, net of unearned 48.65 1,609,675 958,025

68.02 Intangibles 96.81 101,387 21,010 (a) Non-interest bearing

deposits 29.07 233,420 170,365 37.01 Interest bearing deposits

36.40 1,525,390 1,052,434 44.94 Total deposits 35.40 1,758,810

1,222,799 43.83 Other borrowings 93.76 331,504 128,867 157.25

Shareholders' equity 32.73 234,566 153,184 53.13 Asset quality data

------------------ Nonaccrual loans (32.40) $ 3,803 $ 5,626 (32.40)

Loans 90 past due or more 65.43 3,398 2,054 65.43 ----------

---------- Non-performing loans (6.24) 7,201 7,680 (6.24) Other

real estate owned and repossessions 164.15 6,646 2,516 164.15

---------- ---------- Non-performing assets 35.81 13,847 10,196

35.81 ========== ========== Net loan charge-offs 43.52 $ 2,432 $

1,397 74.09 Allowance for loan losses 13.12 18,448 16,309 13.12

Non-performing loans / total loans 0.45% 0.68% Non-performing

assets / total assets 0.58% 0.60% Allowance for loan losses / total

loans 1.15% 1.45% Allowance for loan losses / non-performing loans

256.19% 212.36% Net loan charge-offs (annualized) / average loans

0.20% 0.19% Balances at period end ---------------------- Total

assets 39.46 $2,379,793 $1,706,462 39.46 Earning assets 35.77

2,073,678 1,527,387 35.77 Securities 4.22 400,786 384,550 4.22

Mortgage loans held for sale (a) 42,865 1,502 (a) Loans, net of

unearned 42.61 1,608,697 1,128,047 42.61 Intangibles 98.70 100,766

50,712 98.70 Non-interest bearing deposits 21.18 $ 244,086 $

201,419 21.18 Interest bearing deposits 38.59 1,574,232 1,135,882

38.59 Total deposits 35.97 1,818,318 1,337,301 35.97 Other

borrowings 73.15 299,076 172,723 73.15 Shareholders' equity 34.24

237,211 176,712 34.24 Market value per common share 31.65 32.55

Book value per common share 22.85 19.60 Tangible book value per

common share 13.14 13.97 Shareholders' equity to assets (actual)

9.97 10.36 Tangible capital ratio 5.99 7.61 Leverage ratio 8.79

8.95 Detail of Loans by Category ---------------------------

Commercial, financial, agricultural 26.92 $ 224,673 $ 177,018 26.92

Lease financing (28.88) 8,143 11,450 (28.88) Real estate -

construction 71.66 162,694 94,779 71.66 Real estate - 1-4 family

mortgages 56.56 558,616 356,798 56.56 Real estate - commercial

mortgages 44.74 570,849 394,386 44.74 Installment loans to

individuals (10.57) 83,722 93,616 (10.57) ---------- ----------

Loans, net of unearned 42.61 1,608,697 1,128,047 42.61 ==========

========== (a)Percent variance not meaningful *T

Renasant (NASDAQ:RNST)

Historical Stock Chart

From Jun 2024 to Jul 2024

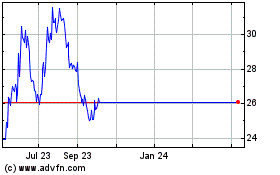

Renasant (NASDAQ:RNST)

Historical Stock Chart

From Jul 2023 to Jul 2024