0001819113FALSE00018191132024-02-072024-02-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 7, 2024

SCIENCE 37 HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39727 | | 84-4278203 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | |

800 Park Offices Drive, Suite 3606 Research Triangle Park, NC | | 27709 |

| (Address of principal executive offices) | | (Zip Code) |

(984) 377-3737

Registrant’s telephone number, including area code

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Shares of Common stock, par value $0.0001 per share | | SNCE | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.05 Costs Associated with Exit or Disposal Activities.

On February 8, 2024, Science 37 Holdings, Inc. (the “Company”) commenced a cost reduction program intended to reduce its operating expenses and strategically realign its resources. The cost reduction program included a reduction in force affecting approximately 73 employees (representing approximately 23.2% of total employees prior to these actions). The Company’s Board of Directors approved the program on February 7, 2024, and the majority of the affected employees were informed of the reduction in force on February 8, 2024. The Company expects the majority of the reduction in force to be completed by the end of the first quarter of 2024. The Company expects that the cost reduction program will generate annual gross cash savings between $12.0 million to $13.0 million.

Total cash expenditures for the cost reduction program are estimated to be between $1.0 million and $1.3 million, substantially all of which are expected to be related to employee severance costs. The Company expects to recognize most of these pre-tax reduction in force charges in the first quarter of 2024. The Company’s estimates are subject to a number of assumptions, and actual results may differ. The Company may also incur additional costs not currently contemplated due to events that may occur as a result of, or that are associated with, the cost reduction program.

Additional Information and Where to Find It

The Company previously announced that, on January 28, 2024, it entered into an Agreement and Plan of Merger (the “Merger Agreement”) with eMed, LLC, a Delaware limited liability company (“Parent”), and Marlin Merger Sub Corporation, a Delaware corporation and a wholly owned subsidiary of Parent (“Merger Sub”), pursuant to which Merger Sub will commence a tender offer to acquire all of the issued and outstanding shares of the common stock of the Company in exchange for $5.75 per share, in cash, without interest thereon (but subject to applicable withholding).

The tender offer has not yet commenced. This report is for informational purposes only, is not a recommendation and is neither an offer to purchase nor a solicitation of an offer to sell any securities of the Company, nor is it a substitute for the tender offer materials that the Company, Parent or Merger Sub will file with the Securities and Exchange Commission (the “SEC”) upon commencement of the tender offer. The solicitation and offer to buy the Company’s common stock will only be made pursuant to an Offer to Purchase and related tender offer materials that Parent and Merger Sub intend to file with the SEC. At the time the tender offer is commenced, Parent and Merger Sub will file a Tender Offer Statement on Schedule TO and thereafter the Company will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC with respect to the tender offer. The Company’s stockholders and other investors are urged to read carefully the tender offer materials (including an Offer to Purchase, a related letter of transmittal and certain other tender offer documents) and the Solicitation/Recommendation Statement on Schedule 14D-9, and any amendments or supplements thereto, when they become available because they will contain important information that holders of the Company’s securities and other investors should consider before making any decision with respect to the tender offer. The Offer to Purchase, the related letter of transmittal, and certain other tender offer documents, as well as the Solicitation/Recommendation Statement on Schedule 14D-9, will be made available to all stockholders of the Company at no expense to them and will also be made available for free at the SEC’s website at www.sec.gov. Copies of the documents filed with the SEC by the Company will be available free of charge on the Company’s website at investors.science37.com or by contacting the Company’s Investor Relations by email at Investors@science37.com.

Cautionary Note Regarding Forward-Looking Statements

This report contains certain forward-looking statements within the meaning of the federal securities laws, including statements regarding the potential benefits of the proposed transaction; the prospective performance, future plans, events, expectations, performance, objectives and opportunities and the outlook for the Company’s business; filings and approvals relating to the transaction; the expected timing of the completion of the transaction; the ability to complete the transaction, including the parties’ ability to satisfy the various closing conditions; any potential strategic benefits, synergies or opportunities expected as a result of the proposed transaction; and any assumptions underlying any of the foregoing. These forward-looking statements generally are identified by the words “believe,” “can,” “could,” “seek,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “might,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties, many of which are outside of the Company’s control. Many factors could cause actual future events to differ materially from the forward-looking statements in this report, including, but not limited to: uncertainties as to the timing of the tender offer and merger; the risk that the proposed transaction may not be completed in a timely manner or at all; uncertainties as to how many of the Company’s stockholders will tender their stock in the tender offer; the possibility that various closing conditions for the transaction may not be satisfied or waived, including that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of the transaction (or only grant

approval subject to adverse conditions or limitations); the difficulty of predicting the timing or outcome of regulatory approvals or actions, if any; the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement; the possibility that competing offers will be made; the effect of the announcement or pendency of the proposed transaction on the Company’s ability to retain and hire key personnel, its ability to maintain relationships with its customers, suppliers and others with whom it does business, its business generally or its stock price; risks related to diverting management’s attention from the Company’s ongoing business operations; the risk of litigation and/or regulatory actions related to the proposed acquisition, including the risk that such litigation or actions may result in significant costs of defense, indemnification and liability; the potential that the strategic benefits, synergies or opportunities expected from the proposed acquisition may not be realized or may take longer to realize than expected; risks related to any cost reduction or restructuring measures; the successful integration of the Company into Parent subsequent to the closing of the transaction and the timing of such integration; other business effects, including the effects of industry, economic or political conditions outside of the Company’s control; transaction costs; and other risks and uncertainties detailed from time to time in documents filed with the SEC by the Company, including the Company’s current Annual Report on Form 10-K on file with the SEC, as well as the Schedule 14D-9 to be filed by the Company and the tender offer documents to be filed by Parent and Merger Sub. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022 filed with the SEC on March 6, 2023 and in the other documents filed by the Company from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Investors are cautioned not to put undue reliance on forward-looking statements, and the Company assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law. The Company does not give any assurance that the Company will achieve its expectations.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | Science 37 Holdings, Inc. |

| | | |

| Date: | February 9, 2024 | By: | /s/ Christine Pellizzari |

| | | Name: | Christine Pellizzari |

| | | Title: | Chief Legal and Human Resources Officer |

Cover

|

Feb. 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 07, 2024

|

| Entity Registrant Name |

SCIENCE 37 HOLDINGS, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39727

|

| Entity Tax Identification Number |

84-4278203

|

| Entity Address, Address Line One |

800 Park Offices Drive

|

| Entity Address, Address Line Two |

Suite 3606

|

| Entity Address, City or Town |

Research Triangle Park

|

| Entity Address, State or Province |

NC

|

| Entity Address, Postal Zip Code |

27709

|

| City Area Code |

984

|

| Local Phone Number |

377-3737

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Shares of Common stock, par value $0.0001 per share

|

| Trading Symbol |

SNCE

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001819113

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

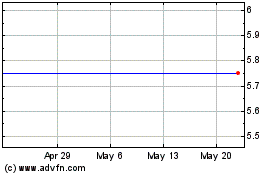

Science 37 (NASDAQ:SNCE)

Historical Stock Chart

From Apr 2024 to May 2024

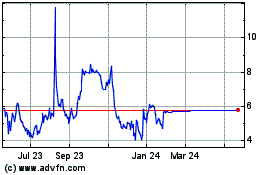

Science 37 (NASDAQ:SNCE)

Historical Stock Chart

From May 2023 to May 2024