UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form 6-K

Report

of Foreign Private Issuer

Pursuant

to Rules 13a-16 or

15d-16 under

the

Securities Exchange Act of 1934

For

the month of July 2023

Commission

File Number: 001-10086

VODAFONE

GROUP

PUBLIC

LIMITED COMPANY

(Translation

of registrant’s name into English)

VODAFONE

HOUSE, THE CONNECTION, NEWBURY, BERKSHIRE, RG14 2FN, ENGLAND

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F þ Form

40-F ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

This Report on Form 6-K

contains the following:

| 1. | A

Stock Exchange Announcement dated 3 July 2023 entitled ‘TOTAL VOTING RIGHTS AND

CAPITAL’. |

| 2. | A

Stock Exchange Announcement dated 7 July 2023 entitled ‘NOTIFICATION OF TRANSACTIONS

OF DIRECTORS, PERSONS DISCHARGING MANAGERIAL RESPONSIBILITIES OR PERSONS CLOSELY ASSOCIATED’. |

| 3. | A

Stock Exchange Announcement dated 14 July 2023 entitled ‘MAJOR SHAREHOLDING NOTIFICATION’. |

| 4. | A

Stock Exchange Announcement dated 27 July 2023 entitled ‘MAJOR SHAREHOLDING NOTIFICATION’. |

| 5. | A

Stock Exchange Announcement dated 28 July 2023 entitled ‘NOTIFICATION OF TRANSACTIONS

OF DIRECTORS, PERSONS DISCHARGING MANAGERIAL RESPONSIBILITIES OR PERSONS CLOSELY ASSOCIATED’. |

RNS Number:

5818E

Vodafone Group

Plc

3 July 2023

VODAFONE

GROUP PLC

TOTAL

VOTING RIGHTS AND CAPITAL

In

conformity with Disclosure Guidance and Transparency Rule (“DTR”)

5.6.1R, Vodafone Group Plc (“Vodafone”) hereby notifies the market that, as at 30 June 2023:

Vodafone’s

issued share capital consists of 28,818,587,308 ordinary shares of US$0.20 20/21 of

which 1,765,605,241 ordinary shares are held in Treasury.

Therefore,

the total number of voting rights in Vodafone is 27,052,982,067. This figure

may be used by shareholders as the denominator for the calculations by which they will determine if they are required to notify their

interest in, or a change to their interest in, Vodafone under the FCA’s DTRs.

This

announcement does not constitute, or form part of, an offer or any solicitation of an offer for securities in any jurisdiction.

END

RNS

Number: 3491F

Vodafone Group

Plc

7 July 2023

VODAFONE

GROUP PLC

(the

"Company")

NOTIFICATION

OF TRANSACTIONS OF DIRECTORS, PERSONS DISCHARGING MANAGERIAL RESPONSIBILITIES OR PERSONS CLOSELY ASSOCIATED

| 1 |

Details

of the person discharging managerial responsibilities/person closely associated |

| a) |

Name |

Maaike

de Bie |

| 2 |

Reason

for the notification |

| a) |

Position/status |

Vodafone

Group General Counsel and Company Secretary |

| b) |

Initial

notification/ Amendment |

Initial

notification |

| 3 |

Details

of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor |

| a) |

Name |

Vodafone

Group Plc |

| b) |

LEI |

213800TB53ELEUKM7Q61 |

| 4 |

Details

of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each

date; and (iv) each place where transactions have been conducted |

| a) |

Description

of the financial instrument, type of instrument and identification code |

Ordinary

shares of US$0.20 20/21 each in Vodafone Group Plc (ISIN: GB00BH4HKS39) |

| b) |

Nature

of the transaction |

Option

to purchase shares granted on 7 July 2023 under the Vodafone Sharesave scheme at an

option price of £0.5844 per share, exercisable 3 years from the savings contract start

date provided that the required monthly savings are made.

|

| c) |

Price(s)

and volume(s) |

|

| |

|

|

Price(s) |

Volume(s) |

|

| |

|

|

GBP

0.5844 |

23,100 |

|

| |

|

|

|

|

|

| d) |

Aggregated

information: volume, Price |

Aggregated

volume: 23,100 Ordinary shares

Aggregated

price: GBP 13,500 |

| e) |

Date

of the transaction |

2023-07-07 |

| f) |

Place

of the transaction |

Outside

a trading venue |

| 1 |

Details

of the person discharging managerial responsibilities/person closely associated |

| a) |

Name |

Leanne

Wood |

| 2 |

Reason

for the notification |

| a) |

Position/status |

Vodafone

Group Chief Human Resources Officer |

| b) |

Initial

notification/ Amendment |

Initial

notification |

| 3 |

Details

of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor |

| a) |

Name |

Vodafone

Group Plc |

| b) |

LEI |

213800TB53ELEUKM7Q61 |

| 4 |

Details

of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each

date; and (iv) each place where transactions have been conducted |

| a) |

Description

of the financial instrument, type of instrument and identification code |

Ordinary

shares of US$0.20 20/21 each in Vodafone Group Plc (ISIN: GB00BH4HKS39) |

| b) |

Nature

of the transaction |

Option

to purchase shares granted on 7 July 2023 under the Vodafone Sharesave scheme at an

option price of £0.5844 per share, exercisable 3 years from the savings contract start

date provided that the required monthly savings are made.

|

| c) |

Price(s)

and volume(s) |

|

| |

|

|

Price(s) |

Volume(s) |

|

| |

|

|

GBP

0.5844 |

23,100 |

|

| |

|

|

|

|

|

| d) |

Aggregated

information: volume, Price |

Aggregated

volume: 23,100 Ordinary shares

Aggregated

price: GBP 13,500 |

| e) |

Date

of the transaction |

2023-07-07 |

| f) |

Place

of the transaction |

Outside

a trading venue |

| 1 |

Details

of the person discharging managerial responsibilities/person closely associated |

| a) |

Name |

Leanne

Wood |

| 2 |

Reason

for the notification |

| a) |

Position/status |

Vodafone

Group Chief Human Resources Officer |

| b) |

Initial

notification/ Amendment |

Initial

notification |

| 3 |

Details

of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor |

| a) |

Name |

Vodafone

Group Plc |

| b) |

LEI |

213800TB53ELEUKM7Q61 |

| 4 |

Details

of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each

date; and (iv) each place where transactions have been conducted |

| a) |

Description

of the financial instrument, type of instrument and identification code |

Ordinary

shares of US$0.20 20/21 each in Vodafone Group Plc (ISIN: GB00BH4HKS39) |

| b) |

Nature

of the transaction |

Withdrawal

of cash contributions made in accordance with the savings contract under the Spring 2023

Vodafone Sharesave scheme.

|

| c) |

Price(s)

and volume(s) |

|

| |

|

|

Price(s) |

Volume(s) |

|

| |

|

|

GBP

0.7760 |

17,396 |

|

| |

|

|

|

|

|

| d) |

Aggregated

information: volume, Price |

Aggregated

volume: 17,396 Ordinary shares

Aggregated

price: GBP 13,500 |

| e) |

Date

of the transaction |

2023-07-07 |

| f) |

Place

of the transaction |

Outside

a trading venue |

END

RNS Number:

1168G

Vodafone Group

Plc

14 July 2023

14 July 2023

VODAFONE

GROUP PLC ('the Company')

Major

Shareholding Notification

1.

Issuer Details

ISIN

Issuer

Name

| |

VODAFONE

GROUP PUBLIC LIMITED COMPANY |

UK

or Non-UK Issuer

2.

Reason for Notification

| |

An

acquisition or disposal of voting rights |

3.

Details of person subject to the notification obligation

Name

City

of registered office (if applicable)

Country

of registered office (if applicable)

4.

Details of the shareholder

Full

name of shareholder(s) if different from the person(s) subject to the notification obligation, above

City

of registered office (if applicable)

Country

of registered office (if applicable)

5.

Date on which the threshold was crossed or reached

6.

Date on which Issuer notified

7.

Total positions of person(s) subject to the notification obligation

| |

%

of voting

rights attached

to shares (total

of 8.A) |

%

of voting

rights through

financial

instruments

(total of 8.B 1 +

8.B 2) |

Total

of both

in % (8.A +

8.B) |

Total

number of

voting rights held

in issuer |

| Resulting

situation on the date on |

4.160000 |

2.120000 |

6.280000 |

1706927946

|

| which threshold was crossed or reached |

|

|

|

|

| Position

of previous notification (if applicable) |

5.100000 |

1.960000 |

7.060000 |

|

8.

Notified details of the resulting situation on the date on which the threshold was crossed or reached

8A.

Voting rights attached to shares

Class/Type

of

shares ISIN code(if

possible) |

Number

of

direct voting

rights (DTR5.1) |

Number

of indirect

voting rights

(DTR5.2.1) |

%

of direct

voting rights

(DTR5.1) |

%

of indirect

voting rights

(DTR5.2.1) |

| GB00BH4HKS39

|

|

1127753370 |

|

4.160000 |

| Sub

Total 8.A |

1127753370 |

4.160000% |

8B1.

Financial Instruments according to (DTR5.3.1R.(1) (a))

Type

of financial

instrument |

Expiration

date |

Exercise/conversion

period |

Number

of voting rights

that may be acquired if

the instrument is

exercised/converted |

%

of voting

rights |

| American

Depository Receipt |

|

|

18021249 |

0.060000 |

| Securities

Lending |

|

|

503443573 |

1.860000 |

| Sub

Total 8.B1 |

|

521464822 |

1.920000% |

8B2.

Financial Instruments with similar economic effect according to (DTR5.3.1R.(1) (b))

Type

of

financial

instrument |

Expiration

date |

Exercise/conversion

period |

Physical

or

cash

settlement |

Number

of

voting rights |

%

of voting

rights |

| CFD |

|

|

Cash |

41639254 |

0.150000 |

| ELN |

27-Jul-2023 |

|

Cash |

16070500 |

0.050000 |

| Sub

Total 8.B2 |

|

57709754 |

0.200000% |

9.

Information in relation to the person subject to the notification obligation

| |

2.

Full chain of controlled undertakings through which the voting rights and/or the financial instruments are effectively held starting

with the ultimate controlling natural person or legal entities (please add additional rows as necessary) |

Ultimate

controlling person |

Name

of

controlled

undertaking |

%

of voting

rights if it equals

or is higher than

the notifiable

threshold |

%

of voting rights

through financial

instruments if it equals

or is higher than the

notifiable threshold |

Total

of both if

it equals or is

higher than the

notifiable

threshold |

| BlackRock, Inc.

(Chain 1) |

BlackRock

Holdco 2, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 1) |

BlackRock

Financial Management, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 1) |

BlackRock

International Holdings, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 1) |

BR

Jersey International Holdings L.P. |

|

|

|

| BlackRock, Inc.

(Chain 1) |

BlackRock

(Singapore) Holdco Pte. Ltd. |

|

|

|

| BlackRock, Inc.

(Chain 1) |

BlackRock

HK Holdco Limited |

|

|

|

| BlackRock, Inc.

(Chain 1) |

BlackRock

Lux Finco S.a.r.l. |

|

|

|

| BlackRock, Inc.

(Chain 1) |

BlackRock

Japan Holdings GK |

|

|

|

| BlackRock, Inc.

(Chain 1) |

BlackRock

Japan Co., Ltd. |

|

|

|

| BlackRock, Inc.

(Chain 2) |

Trident

Merger, LLC |

|

|

|

| BlackRock, Inc.

(Chain 2) |

BlackRock

Investment Management, LLC |

|

|

|

| BlackRock, Inc.

(Chain 3) |

BlackRock

Holdco 2, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 3) |

BlackRock

Financial Management, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 3) |

BlackRock

International Holdings, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 3) |

BR

Jersey International Holdings L.P. |

|

|

|

| BlackRock, Inc.

(Chain 3) |

BlackRock

Holdco 3, LLC |

|

|

|

| BlackRock, Inc.

(Chain 3) |

BlackRock

Cayman 1 LP |

|

|

|

| BlackRock, Inc.

(Chain 3) |

BlackRock

Cayman West Bay Finco Limited |

|

|

|

| BlackRock, Inc.

(Chain 3) |

BlackRock

Cayman West Bay IV Limited |

|

|

|

| BlackRock, Inc.

(Chain 3) |

BlackRock

Group Limited |

|

|

|

| BlackRock, Inc.

(Chain 3) |

BlackRock

Finance Europe Limited |

|

|

|

| BlackRock, Inc.

(Chain 3) |

BlackRock

Investment Management (UK) Limited |

|

|

|

| BlackRock, Inc.

(Chain 4) |

BlackRock

Holdco 2, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 4) |

BlackRock

Financial Management, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 4) |

BlackRock

International Holdings, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 4) |

BR

Jersey International Holdings L.P. |

|

|

|

| BlackRock, Inc.

(Chain 4) |

BlackRock

Australia Holdco Pty. Ltd. |

|

|

|

| BlackRock, Inc.

(Chain 4) |

BlackRock

Investment Management (Australia) Limited |

|

|

|

| BlackRock, Inc.

(Chain 5) |

BlackRock

Holdco 2, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 5) |

BlackRock

Financial Management, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 5) |

BlackRock

Holdco 4, LLC |

|

|

|

| BlackRock, Inc.

(Chain 5) |

BlackRock

Holdco 6, LLC |

|

|

|

| BlackRock, Inc.

(Chain 5) |

BlackRock

Delaware Holdings Inc. |

|

|

|

| BlackRock, Inc.

(Chain 5) |

BlackRock

Institutional Trust Company, National Association |

|

|

|

| BlackRock, Inc.

(Chain 6) |

BlackRock

Holdco 2, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 6) |

BlackRock

Financial Management, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 6) |

BlackRock

Holdco 4, LLC |

|

|

|

| BlackRock, Inc.

(Chain 6) |

BlackRock

Holdco 6, LLC |

|

|

|

| BlackRock, Inc.

(Chain 6) |

BlackRock

Delaware Holdings Inc. |

|

|

|

| BlackRock, Inc.

(Chain 6) |

BlackRock

Fund Advisors |

|

|

|

| BlackRock, Inc.

(Chain 7) |

BlackRock

Holdco 2, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 7) |

BlackRock

Financial Management, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 8) |

BlackRock

Holdco 2, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 8) |

BlackRock

Financial Management, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 8) |

BlackRock

Capital Holdings, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 8) |

BlackRock

Advisors, LLC |

|

|

|

| BlackRock, Inc.

(Chain 8) |

BlackRock

Capital Management, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 9) |

BlackRock

Holdco 2, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 9) |

BlackRock

Financial Management, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 9) |

BlackRock

International Holdings, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 9) |

BR

Jersey International Holdings L.P. |

|

|

|

| BlackRock, Inc.

(Chain 9) |

BlackRock

(Singapore) Holdco Pte. Ltd. |

|

|

|

| BlackRock, Inc.

(Chain 9) |

BlackRock

HK Holdco Limited |

|

|

|

| BlackRock, Inc.

(Chain 9) |

BlackRock

Asset Management North Asia Limited |

|

|

|

| BlackRock, Inc.

(Chain 10) |

BlackRock

Holdco 2, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 10) |

BlackRock

Financial Management, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 10) |

BlackRock

International Holdings, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 10) |

BR

Jersey International Holdings L.P. |

|

|

|

| BlackRock, Inc.

(Chain 10) |

BlackRock

Holdco 3, LLC |

|

|

|

| BlackRock, Inc.

(Chain 10) |

BlackRock

Cayman 1 LP |

|

|

|

| BlackRock, Inc.

(Chain 10) |

BlackRock

Cayman West Bay Finco Limited |

|

|

|

| BlackRock, Inc.

(Chain 10) |

BlackRock

Cayman West Bay IV Limited |

|

|

|

| BlackRock, Inc.

(Chain 10) |

BlackRock

Group Limited |

|

|

|

| BlackRock, Inc.

(Chain 10) |

BlackRock

Finance Europe Limited |

|

|

|

| BlackRock, Inc.

(Chain 10) |

BlackRock

(Netherlands) B.V. |

|

|

|

| BlackRock, Inc.

(Chain 10) |

BlackRock

Asset Management Deutschland AG |

|

|

|

| BlackRock, Inc.

(Chain 11) |

BlackRock

Holdco 2, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 11) |

BlackRock

Financial Management, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 11) |

BlackRock

International Holdings, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 11) |

BR

Jersey International Holdings L.P. |

|

|

|

| BlackRock, Inc.

(Chain 11) |

BlackRock

Holdco 3, LLC |

|

|

|

| BlackRock, Inc.

(Chain 11) |

BlackRock

Canada Holdings LP |

|

|

|

| BlackRock, Inc.

(Chain 11) |

BlackRock

Canada Holdings ULC |

|

|

|

| BlackRock, Inc.

(Chain 11) |

BlackRock

Asset Management Canada Limited |

|

|

|

| BlackRock, Inc.

(Chain 12) |

BlackRock

Holdco 2, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 12) |

BlackRock

Financial Management, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 12) |

BlackRock

Capital Holdings, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 12) |

BlackRock

Advisors, LLC |

|

|

|

| BlackRock, Inc.

(Chain 13) |

BlackRock

Holdco 2, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 13) |

BlackRock

Financial Management, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 13) |

BlackRock

International Holdings, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 13) |

BR

Jersey International Holdings L.P. |

|

|

|

| BlackRock, Inc.

(Chain 13) |

BlackRock

Holdco 3, LLC |

|

|

|

| BlackRock, Inc.

(Chain 13) |

BlackRock

Cayman 1 LP |

|

|

|

| BlackRock, Inc.

(Chain 13) |

BlackRock

Cayman West Bay Finco Limited |

|

|

|

| BlackRock, Inc.

(Chain 13) |

BlackRock

Cayman West Bay IV Limited |

|

|

|

| BlackRock, Inc.

(Chain 13) |

BlackRock

Group Limited |

|

|

|

| BlackRock, Inc.

(Chain 13) |

BlackRock

Finance Europe Limited |

|

|

|

| BlackRock, Inc.

(Chain 13) |

BlackRock

Advisors (UK) Limited |

|

|

|

| BlackRock, Inc.

(Chain 14) |

BlackRock

Holdco 2, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 14) |

BlackRock

Financial Management, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 14) |

BlackRock

International Holdings, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 14) |

BR

Jersey International Holdings L.P. |

|

|

|

| BlackRock, Inc.

(Chain 14) |

BlackRock

(Singapore) Holdco Pte. Ltd. |

|

|

|

| BlackRock, Inc.

(Chain 14) |

BlackRock

(Singapore) Limited |

|

|

|

| BlackRock, Inc.

(Chain 15) |

Trident

Merger, LLC |

|

|

|

| BlackRock, Inc.

(Chain 15) |

BlackRock

Investment Management, LLC |

|

|

|

| BlackRock, Inc.

(Chain 15) |

Amethyst

Intermediate, LLC |

|

|

|

| BlackRock, Inc.

(Chain 15) |

Aperio

Holdings, LLC |

|

|

|

| BlackRock, Inc.

(Chain 15) |

Aperio

Group, LLC |

|

|

|

10.

In case of proxy voting

Name

of the proxy holder

The

number and % of voting rights held

The

date until which the voting rights will be held

11.

Additional Information

| |

BlackRock

Regulatory Threshold Reporting Team

Jana Blumenstein

020 7743

3650 |

12.

Date of Completion

13.

Place Of Completion

| |

12 Throgmorton

Avenue, London, EC2N 2DL, U.K.

|

-ends-

For

more information, please contact:

| Investor Relations |

Media Relations |

| |

| Investors.vodafone.com |

Vodafone.com/media/contact |

| ir@vodafone.co.uk |

GroupMedia@vodafone.com |

Registered

Office: Vodafone House, The Connection, Newbury, Berkshire RG14 2FN, England. Registered in England No. 1833679

RNS

Number: 4641H

Vodafone Group

Plc

27 July 2023

27 July 2023

VODAFONE

GROUP PLC ('the Company')

Major

Shareholding Notification

1.

Issuer Details

ISIN

Issuer

Name

| |

VODAFONE

GROUP PUBLIC LIMITED COMPANY |

UK

or Non-UK Issuer

2.

Reason for Notification

| |

An

acquisition or disposal of voting rights |

3.

Details of person subject to the notification obligation

Name

City

of registered office (if applicable)

Country

of registered office (if applicable)

4.

Details of the shareholder

Full

name of shareholder(s) if different from the person(s) subject to the notification obligation, above

City

of registered office (if applicable)

Country

of registered office (if applicable)

5.

Date on which the threshold was crossed or reached

6.

Date on which Issuer notified

7.

Total positions of person(s) subject to the notification obligation

| |

%

of voting

rights attached

to shares (total

of 8.A) |

%

of voting

rights through

financial

instruments

(total of 8.B 1 +

8.B 2) |

Total

of both

in % (8.A +

8.B) |

Total

number of

voting rights held

in issuer |

| Resulting

situation on the date on which threshold was crossed or reached |

5.620000 |

0.610000 |

6.230000 |

1690543089

|

| Position

of previous notification (if applicable) |

4.160000 |

2.120000 |

6.280000 |

|

8.

Notified details of the resulting situation on the date on which the threshold was crossed or reached

8A.

Voting rights attached to shares

Class/Type

of

shares ISIN code(if

possible) |

Number

of

direct voting

rights

(DTR5.1) |

Number

of indirect

voting rights

(DTR5.2.1) |

%

of direct

voting rights

(DTR5.1) |

%

of indirect

voting rights

(DTR5.2.1) |

| GB00BH4HKS39

|

|

1520449059 |

|

5.620000 |

| Sub

Total 8.A |

1520449059 |

5.620000% |

8B1.

Financial Instruments according to (DTR5.3.1R.(1) (a))

Type

of financial

instrument |

Expiration

date |

Exercise/conversion

period |

Number

of voting rights

that may be acquired if

the instrument is

exercised/converted |

%

of voting

rights |

| American

Depository Receipt |

|

|

16153959 |

0.050000 |

| Securities

Lending |

|

|

89573105 |

0.330000 |

| Sub

Total 8.B1 |

|

105727064 |

0.380000% |

8B2.

Financial Instruments with similar economic effect according to (DTR5.3.1R.(1) (b))

Type

of

financial

instrument |

Expiration

date |

Exercise/conversion

period |

Physical

or

cash

settlement |

Number

of

voting rights |

%

of voting

rights |

| CFD |

|

|

Cash |

30878766 |

0.110000 |

| ELN |

03-Oct-2023 |

|

Cash |

17417700 |

0.060000 |

| ELN |

27-Jul-2023 |

|

Cash

|

16070500 |

0.060000 |

| Sub

Total 8.B2 |

|

64366966 |

0.230000% |

9.

Information in relation to the person subject to the notification obligation

| |

2.

Full chain of controlled undertakings through which the voting rights and/or the financial instruments are effectively held starting

with the ultimate controlling natural person or legal entities (please add additional rows as necessary) |

Ultimate

controlling person |

Name

of

controlled

undertaking |

%

of voting

rights if it equals

or is higher than

the notifiable

threshold |

%

of voting rights

through financial

instruments if it equals

or is higher than the

notifiable threshold |

Total

of both if

it equals or is

higher than the

notifiable

threshold |

| BlackRock, Inc.

(Chain 1) |

BlackRock

Holdco 2, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 1) |

BlackRock

Financial Management, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 1) |

BlackRock

International Holdings, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 1) |

BR

Jersey International Holdings L.P. |

|

|

|

| BlackRock, Inc.

(Chain 1) |

BlackRock

(Singapore) Holdco Pte. Ltd. |

|

|

|

| BlackRock, Inc.

(Chain 1) |

BlackRock

HK Holdco Limited |

|

|

|

| BlackRock, Inc.

(Chain 1) |

BlackRock

Lux Finco S.a.r.l. |

|

|

|

| BlackRock, Inc.

(Chain 1) |

BlackRock

Japan Holdings GK |

|

|

|

| BlackRock, Inc.

(Chain 1) |

BlackRock

Japan Co., Ltd. |

|

|

|

| BlackRock, Inc.

(Chain 2) |

Trident

Merger, LLC |

|

|

|

| BlackRock, Inc.

(Chain 2) |

BlackRock

Investment Management, LLC |

|

|

|

| BlackRock, Inc.

(Chain 3) |

BlackRock

Holdco 2, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 3) |

BlackRock

Financial Management, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 3) |

BlackRock

International Holdings, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 3) |

BR

Jersey International Holdings L.P. |

|

|

|

| BlackRock, Inc.

(Chain 3) |

BlackRock

Holdco 3, LLC |

|

|

|

| BlackRock, Inc.

(Chain 3) |

BlackRock

Cayman 1 LP |

|

|

|

| BlackRock, Inc.

(Chain 3) |

BlackRock

Cayman West Bay Finco Limited |

|

|

|

| BlackRock, Inc.

(Chain 3) |

BlackRock

Cayman West Bay IV Limited |

|

|

|

| BlackRock, Inc.

(Chain 3) |

BlackRock

Group Limited |

|

|

|

| BlackRock, Inc.

(Chain 3) |

BlackRock

Finance Europe Limited |

|

|

|

| BlackRock, Inc.

(Chain 3) |

BlackRock

Investment Management (UK) Limited |

|

|

|

| BlackRock, Inc.

(Chain 4) |

BlackRock

Holdco 2, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 4) |

BlackRock

Financial Management, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 4) |

BlackRock

International Holdings, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 4) |

BR

Jersey International Holdings L.P. |

|

|

|

| BlackRock, Inc.

(Chain 4) |

BlackRock

Australia Holdco Pty. Ltd. |

|

|

|

| BlackRock, Inc.

(Chain 4) |

BlackRock

Investment Management (Australia) Limited |

|

|

|

| BlackRock, Inc.

(Chain 5) |

BlackRock

Holdco 2, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 5) |

BlackRock

Financial Management, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 5) |

BlackRock

Holdco 4, LLC |

|

|

|

| BlackRock, Inc.

(Chain 5) |

BlackRock

Holdco 6, LLC |

|

|

|

| BlackRock, Inc.

(Chain 5) |

BlackRock

Delaware Holdings Inc. |

|

|

|

| BlackRock, Inc.

(Chain 5) |

BlackRock

Institutional Trust Company, National Association |

|

|

|

| BlackRock, Inc.

(Chain 6) |

BlackRock

Holdco 2, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 6) |

BlackRock

Financial Management, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 6) |

BlackRock

Holdco 4, LLC |

|

|

|

| BlackRock, Inc.

(Chain 6) |

BlackRock

Holdco 6, LLC |

|

|

|

| BlackRock, Inc.

(Chain 6) |

BlackRock

Delaware Holdings Inc. |

|

|

|

| BlackRock, Inc.

(Chain 6) |

BlackRock

Fund Advisors |

|

|

|

| BlackRock, Inc.

(Chain 7) |

BlackRock

Holdco 2, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 7) |

BlackRock

Financial Management, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 8) |

BlackRock

Holdco 2, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 8) |

BlackRock

Financial Management, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 8) |

BlackRock

International Holdings, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 8) |

BR

Jersey International Holdings L.P. |

|

|

|

| BlackRock, Inc.

(Chain 8) |

BlackRock

(Singapore) Holdco Pte. Ltd. |

|

|

|

| BlackRock, Inc.

(Chain 8) |

BlackRock

HK Holdco Limited |

|

|

|

| BlackRock, Inc.

(Chain 8) |

BlackRock

Asset Management North Asia Limited |

|

|

|

| BlackRock, Inc.

(Chain 9) |

BlackRock

Holdco 2, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 9) |

BlackRock

Financial Management, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 9) |

BlackRock

International Holdings, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 9) |

BR

Jersey International Holdings L.P. |

|

|

|

| BlackRock, Inc.

(Chain 9) |

BlackRock

Holdco 3, LLC |

|

|

|

| BlackRock, Inc.

(Chain 9) |

BlackRock

Cayman 1 LP |

|

|

|

| BlackRock, Inc.

(Chain 9) |

BlackRock

Cayman West Bay Finco Limited |

|

|

|

| BlackRock, Inc.

(Chain 9) |

BlackRock

Cayman West Bay IV Limited |

|

|

|

| BlackRock, Inc.

(Chain 9) |

BlackRock

Group Limited |

|

|

|

| BlackRock, Inc.

(Chain 9) |

BlackRock

Finance Europe Limited |

|

|

|

| BlackRock, Inc.

(Chain 9) |

BlackRock

(Netherlands) B.V. |

|

|

|

| BlackRock, Inc.

(Chain 9) |

BlackRock

Asset Management Deutschland AG |

|

|

|

| BlackRock, Inc.

(Chain 10) |

BlackRock

Holdco 2, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 10) |

BlackRock

Financial Management, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 10) |

BlackRock

International Holdings, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 10) |

BR

Jersey International Holdings L.P. |

|

|

|

| BlackRock, Inc.

(Chain 10) |

BlackRock

Holdco 3, LLC |

|

|

|

| BlackRock, Inc.

(Chain 10) |

BlackRock

Canada Holdings LP |

|

|

|

| BlackRock, Inc.

(Chain 10) |

BlackRock

Canada Holdings ULC |

|

|

|

| BlackRock, Inc.

(Chain 10) |

BlackRock

Asset Management Canada Limited |

|

|

|

| BlackRock, Inc.

(Chain 11) |

BlackRock

Holdco 2, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 11) |

BlackRock

Financial Management, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 11) |

BlackRock

Capital Holdings, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 11) |

BlackRock

Advisors, LLC |

|

|

|

| BlackRock, Inc.

(Chain 12) |

BlackRock

Holdco 2, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 12) |

BlackRock

Financial Management, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 12) |

BlackRock

International Holdings, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 12) |

BR

Jersey International Holdings L.P. |

|

|

|

| BlackRock, Inc.

(Chain 12) |

BlackRock

Holdco 3, LLC |

|

|

|

| BlackRock, Inc.

(Chain 12) |

BlackRock

Cayman 1 LP |

|

|

|

| BlackRock, Inc.

(Chain 12) |

BlackRock

Cayman West Bay Finco Limited |

|

|

|

| BlackRock, Inc.

(Chain 12) |

BlackRock

Cayman West Bay IV Limited |

|

|

|

| BlackRock, Inc.

(Chain 12) |

BlackRock

Group Limited |

|

|

|

| BlackRock, Inc.

(Chain 12) |

BlackRock

Finance Europe Limited |

|

|

|

| BlackRock, Inc.

(Chain 12) |

BlackRock

Advisors (UK) Limited |

|

|

|

| BlackRock, Inc.

(Chain 13) |

BlackRock

Holdco 2, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 13) |

BlackRock

Financial Management, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 13) |

BlackRock

International Holdings, Inc. |

|

|

|

| BlackRock, Inc.

(Chain 13) |

BR

Jersey International Holdings L.P. |

|

|

|

| BlackRock, Inc.

(Chain 13) |

BlackRock

(Singapore) Holdco Pte. Ltd. |

|

|

|

| BlackRock, Inc.

(Chain 13) |

BlackRock

(Singapore) Limited |

|

|

|

| BlackRock, Inc.

(Chain 14) |

Trident

Merger, LLC |

|

|

|

| BlackRock, Inc.

(Chain 14) |

BlackRock

Investment Management, LLC |

|

|

|

| BlackRock, Inc.

(Chain 14) |

Amethyst

Intermediate, LLC |

|

|

|

| BlackRock, Inc.

(Chain 14) |

Aperio

Holdings, LLC |

|

|

|

| BlackRock, Inc.

(Chain 14) |

Aperio

Group, LLC |

|

|

|

10.

In case of proxy voting

Name

of the proxy holder

The

number and % of voting rights held

The

date until which the voting rights will be held

11.

Additional Information

| |

BlackRock

Regulatory Threshold Reporting Team

Jana Blumenstein

020 7743

3650 |

12.

Date of Completion

13.

Place Of Completion

| |

12

Throgmorton Avenue, London, EC2N 2DL, U.K. |

-ends-

For

more information, please contact:

| Investor Relations |

Media Relations |

| |

| Investors.vodafone.com |

Vodafone.com/media/contact |

| ir@vodafone.co.uk |

GroupMedia@vodafone.com |

Registered

Office: Vodafone House, The Connection, Newbury, Berkshire RG14 2FN, England. Registered in England No. 1833679

RNS Number:

6166H

Vodafone Group

Plc

28 July 2023

VODAFONE

GROUP PLC

(the

"Company")

NOTIFICATION

OF TRANSACTIONS OF DIRECTORS, PERSONS DISCHARGING MANAGERIAL RESPONSIBILITIES OR PERSONS CLOSELY ASSOCIATED

Conditional

Award of Shares

Conditional

awards of shares were granted to the below participants on 27 July 2023 by the Company. The awards have been granted in accordance

with the Vodafone Global Incentive Plan. The vesting of these awards is conditional on continued employment with the Vodafone Group

and on the satisfaction of performance conditions approved by the Remuneration Committee and will vest on 27 July 2026 unless otherwise

stated. The adjusted free cash flow target range for the awards vesting is €9.0bn (threshold) to €11.0bn (maximum) whilst details

of the relative total shareholder return and ESG targets can be found in the Company’s 2023 Annual Report available at vodafone.com/ar2023.

The below tables set out the maximum number of shares granted and these will be reduced accordingly if the Company achieves less than

maximum performance.

| 1 |

Details

of the person discharging managerial responsibilities/person closely associated |

| a) |

Name |

Margherita

Della Valle |

| 2 |

Reason

for the notification |

| a) |

Position/status |

Vodafone

Group Chief Executive and Chief Financial Officer |

| b) |

Initial

notification/ Amendment |

Initial

notification |

| 3 |

Details

of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor |

| a) |

Name |

Vodafone

Group Plc |

| b) |

LEI |

213800TB53ELEUKM7Q61 |

| 4 |

Details

of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each

date; and (iv) each place where transactions have been conducted |

| a) |

Description

of the financial instrument, type of instrument and identification code |

Ordinary

shares of US$0.20 20/21 each in Vodafone Group Plc (ISIN: GB00BH4HKS39) |

| b) |

Nature

of the transaction |

Grant

of nil cost conditional award of shares under the Global Incentive Plan, based on Group performance. |

| c) |

Price(s) and

volume(s) |

|

| |

|

|

Price(s) |

Volume(s) |

|

| |

|

|

GBP

0.7753 |

8,061,395 |

|

| |

|

|

|

|

|

| d) |

Aggregated

information: volume, Price |

Aggregated

volume: 8,061,395 Ordinary shares

Aggregated

price: GBP 6,249,999.54 |

| e) |

Date

of the transaction |

2023-07-27 |

| f) |

Place

of the transaction |

Outside

a trading venue |

| 1 |

Details

of the person discharging managerial responsibilities/person closely associated |

| a) |

Name |

Aldo

Bisio |

| 2 |

Reason

for the notification |

| a) |

Position/status |

Vodafone

Italy Chief Executive Officer |

| b) |

Initial

notification/ Amendment |

Initial

notification |

| 3 |

Details

of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor |

| a) |

Name |

Vodafone

Group Plc |

| b) |

LEI |

213800TB53ELEUKM7Q61 |

| 4 |

Details

of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each

date; and (iv) each place where transactions have been conducted |

| a) |

Description

of the financial instrument, type of instrument and identification code |

Ordinary

shares of US$0.20 20/21 each in Vodafone Group Plc (ISIN: GB00BH4HKS39) |

| b) |

Nature

of the transaction |

Grant

of nil cost conditional award of shares under the Global Incentive Plan, based on Group performance. |

| c) |

Price(s) and

volume(s) |

|

| |

|

|

Price(s) |

Volume(s) |

|

| |

|

|

GBP

0.7753 |

3,533,703 |

|

| |

|

|

|

|

|

| d) |

Aggregated

information: volume, Price |

Aggregated

volume: 3,533,703 Ordinary shares

Aggregated

price: GBP 2,739,679.94 |

| e) |

Date

of the transaction |

2023-07-27 |

| f) |

Place

of the transaction |

Outside

a trading venue |

| 1 |

Details

of the person discharging managerial responsibilities/person closely associated |

| a) |

Name |

Maaike

de Bie |

| 2 |

Reason

for the notification |

| a) |

Position/status |

Vodafone

Group General Counsel and Company Secretary |

| b) |

Initial

notification/ Amendment |

Initial

notification |

| 3 |

Details

of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor |

| a) |

Name |

Vodafone

Group Plc |

| b) |

LEI |

213800TB53ELEUKM7Q61 |

| 4 |

Details

of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each

date; and (iv) each place where transactions have been conducted |

| a) |

Description

of the financial instrument, type of instrument and identification code |

Ordinary

shares of US$0.20 20/21 each in Vodafone Group Plc (ISIN: GB00BH4HKS39) |

| b) |

Nature

of the transaction |

Grant

of nil cost conditional award of shares under the Global Incentive Plan, based on Group performance. |

| c) |

Price(s) and

volume(s) |

|

| |

|

|

Price(s) |

Volume(s) |

|

| |

|

|

GBP

0.7753 |

2,579,646 |

|

| |

|

|

|

|

|

| d) |

Aggregated

information: volume, Price |

Aggregated

volume: 2,579,646 Ordinary shares

Aggregated

price: GBP 1,999,999.54 |

| e) |

Date

of the transaction |

2023-07-27 |

| f) |

Place

of the transaction |

Outside

a trading venue |

| 1 |

Details

of the person discharging managerial responsibilities/person closely associated |

| a) |

Name |

Ahmed

Essam |

| 2 |

Reason

for the notification |

| a) |

Position/status |

Vodafone

UK Chief Executive Officer |

| b) |

Initial

notification/ Amendment |

Initial

notification |

| 3 |

Details

of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor |

| a) |

Name |

Vodafone

Group Plc |

| b) |

LEI |

213800TB53ELEUKM7Q61 |

| 4 |

Details

of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each

date; and (iv) each place where transactions have been conducted |

| a) |

Description

of the financial instrument, type of instrument and identification code |

Ordinary

shares of US$0.20 20/21 each in Vodafone Group Plc (ISIN: GB00BH4HKS39) |

| b) |

Nature

of the transaction |

Grant

of nil cost conditional award of shares under the Global Incentive Plan, based on Group performance. |

| c) |

Price(s) and

volume(s) |

|

| |

|

|

Price(s) |

Volume(s) |

|

| |

|

|

GBP

0.7753 |

3,188,443 |

|

| |

|

|

|

|

|

| d) |

Aggregated

information: volume, Price |

Aggregated

volume: 3,188,443 Ordinary shares

Aggregated

price: GBP 2,471,999.86 |

| e) |

Date

of the transaction |

2023-07-27 |

| f) |

Place

of the transaction |

Outside

a trading venue |

| 1 |

Details

of the person discharging managerial responsibilities/person closely associated |

| a) |

Name |

Shameel

Joosub |

| 2 |

Reason

for the notification |

| a) |

Position/status |

Vodacom

Group Chief Executive Officer |

| b) |

Initial

notification/ Amendment |

Initial

notification |

| 3 |

Details

of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor |

| a) |

Name |

Vodafone

Group Plc |

| b) |

LEI |

213800TB53ELEUKM7Q61 |

| 4 |

Details

of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each

date; and (iv) each place where transactions have been conducted |

| a) |

Description

of the financial instrument, type of instrument and identification code |

Ordinary

shares of US$0.20 20/21 each in Vodafone Group Plc (ISIN: GB00BH4HKS39) |

| b) |

Nature

of the transaction |

Grant

of nil cost conditional award of shares under the Global Incentive Plan, based on Group performance. |

| c) |

Price(s) and

volume(s) |

|

| |

|

|

Price(s) |

Volume(s) |

|

| |

|

|

GBP

0.7753 |

783,046 |

|

| |

|

|

|

|

|

| d) |

Aggregated

information: volume, Price |

Aggregated

volume: 783,046 Ordinary shares

Aggregated

price: GBP 607,095.56 |

| e) |

Date

of the transaction |

2023-07-27 |

| f) |

Place

of the transaction |

Outside

a trading venue |

| 1 |

Details

of the person discharging managerial responsibilities/person closely associated |

| a) |

Name |

Scott

Petty |

| 2 |

Reason

for the notification |

| a) |

Position/status |

Vodafone

Group Chief Technology Officer |

| b) |

Initial

notification/ Amendment |

Initial

notification |

| 3 |

Details

of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor |

| a) |

Name |

Vodafone

Group Plc |

| b) |

LEI |

213800TB53ELEUKM7Q61 |

| 4 |

Details

of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each

date; and (iv) each place where transactions have been conducted |

| a) |

Description

of the financial instrument, type of instrument and identification code |

Ordinary

shares of US$0.20 20/21 each in Vodafone Group Plc (ISIN: GB00BH4HKS39) |

| b) |

Nature

of the transaction |

Grant

of nil cost conditional award of shares under the Global Incentive Plan, based on Group performance. |

| c) |

Price(s) and

volume(s) |

|

| |

|

|

Price(s) |

Volume(s) |

|

| |

|

|

GBP

0.7753 |

2,579,646 |

|

| |

|

|

|

|

|

| d) |

Aggregated

information: volume, Price |

Aggregated

volume: 2,579,646 Ordinary shares

Aggregated

price: GBP 1,999,999.54 |

| e) |

Date

of the transaction |

2023-07-27 |

| f) |

Place

of the transaction |

Outside

a trading venue |

| 1 |

Details

of the person discharging managerial responsibilities/person closely associated |

| a) |

Name |

Joakim

Reiter |

| 2 |

Reason

for the notification |

| a) |

Position/status |

Vodafone

Group External and Corporate Affairs Officer |

| b) |

Initial

notification/ Amendment |

Initial

notification |

| 3 |

Details

of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor |

| a) |

Name |

Vodafone

Group Plc |

| b) |

LEI |

213800TB53ELEUKM7Q61 |

| 4 |

Details

of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each

date; and (iv) each place where transactions have been conducted |

| a) |

Description

of the financial instrument, type of instrument and identification code |

Ordinary

shares of US$0.20 20/21 each in Vodafone Group Plc (ISIN: GB00BH4HKS39) |

| b) |

Nature

of the transaction |

Grant

of nil cost conditional award of shares under the Global Incentive Plan, based on Group performance. |

| c) |

Price(s) and

volume(s) |

|

| |

|

|

Price(s) |

Volume(s) |

|

| |

|

|

GBP

0.7753 |

2,579,646 |

|

| |

|

|

|

|

|

| d) |

Aggregated

information: volume, Price |

Aggregated

volume: 2,579,646 Ordinary shares

Aggregated

price: GBP 1,999,999,54 |

| e) |

Date

of the transaction |

2023-07-27 |

| f) |

Place

of the transaction |

Outside

a trading venue |

| 1 |

Details

of the person discharging managerial responsibilities/person closely associated |

| a) |

Name |

Alberto

Ripepi |

| 2 |

Reason

for the notification |

| a) |

Position/status |

Vodafone

Group Chief Network Officer |

| b) |

Initial

notification/ Amendment |

Initial

notification |

| 3 |

Details

of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor |

| a) |

Name |

Vodafone

Group Plc |

| b) |

LEI |

213800TB53ELEUKM7Q61 |

| 4 |

Details

of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each

date; and (iv) each place where transactions have been conducted |

| a) |

Description

of the financial instrument, type of instrument and identification code |

Ordinary

shares of US$0.20 20/21 each in Vodafone Group Plc (ISIN: GB00BH4HKS39) |

| b) |

Nature

of the transaction |

Grant

of nil cost conditional award of shares under the Global Incentive Plan, based on Group performance. |

| c) |

Price(s) and

volume(s) |

|

| |

|

|

Price(s) |

Volume(s) |

|

| |

|

|

GBP

0.7753 |

2,429,420 |

|

| |

|

|

|

|

|

| d) |

Aggregated

information: volume, Price |

Aggregated

volume: 2,429,420 Ordinary shares

Aggregated

price: GBP 1,883,529.33 |

| e) |

Date

of the transaction |

2023-07-27 |

| f) |

Place

of the transaction |

Outside

a trading venue |

| 1 |

Details

of the person discharging managerial responsibilities/person closely associated |

| a) |

Name |

Philippe

Rogge |

| 2 |

Reason

for the notification |

| a) |

Position/status |

Vodafone

Germany Chief Executive Officer |

| b) |

Initial

notification/ Amendment |

Initial

notification |

| 3 |

Details

of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor |

| a) |

Name |

Vodafone

Group Plc |

| b) |

LEI |

213800TB53ELEUKM7Q61 |

| 4 |

Details

of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each

date; and (iv) each place where transactions have been conducted |

| a) |

Description

of the financial instrument, type of instrument and identification code |

Ordinary

shares of US$0.20 20/21 each in Vodafone Group Plc (ISIN: GB00BH4HKS39) |

| b) |

Nature

of the transaction |

Grant

of nil cost conditional award of shares under the Global Incentive Plan, based on Group performance. |

| c) |

Price(s) and volume(s) |

|

| |

|

|

Price(s) |

Volume(s) |

|

| |

|

|

GBP 0.7753 |

3,754,559 |

|

| |

|

|

|

|

|

| d) |

Aggregated

information: volume, Price |

Aggregated

volume: 3,754,559 Ordinary shares

Aggregated

price: GBP 2,910,909.59 |

| e) |

Date

of the transaction |

2023-07-27 |

| f) |

Place

of the transaction |

Outside

a trading venue |

| 1 |

Details

of the person discharging managerial responsibilities/person closely associated |

| a) |

Name |

Serpil

Timuray |

| 2 |

Reason

for the notification |

| a) |

Position/status |

Vodafone

Chief Executive Officer Europe Cluster |

| b) |

Initial

notification/ Amendment |

Initial

notification |

| 3 |

Details

of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor |

| a) |

Name |

Vodafone

Group Plc |

| b) |

LEI |

213800TB53ELEUKM7Q61 |

| 4 |

Details

of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each

date; and (iv) each place where transactions have been conducted |

| a) |

Description

of the financial instrument, type of instrument and identification code |

Ordinary

shares of US$0.20 20/21 each in Vodafone Group Plc (ISIN: GB00BH4HKS39) |

| b) |

Nature

of the transaction |

Grant

of nil cost conditional award of shares under the Global Incentive Plan, based on Group performance. |

| c) |

Price(s) and volume(s) |

|

| |

|

|

Price(s) |

Volume(s) |

|

| |

|

|

GBP 0.7753 |

3,353,540 |

|

| |

|

|

|

|

|

| d) |

Aggregated

information: volume, Price |

Aggregated

volume: 3,353,540 Ordinary shares

Aggregated

price: GBP 2,599,999.56 |

| e) |

Date

of the transaction |

2023-07-27 |

| f) |

Place

of the transaction |

Outside

a trading venue |

| 1 |

Details

of the person discharging managerial responsibilities/person closely associated |

| a) |

Name |

Leanne

Wood |

| 2 |

Reason

for the notification |

| a) |

Position/status |

Vodafone

Group Chief Human Resources Officer |

| b) |

Initial

notification/ Amendment |

Initial

notification |

| 3 |

Details

of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor |

| a) |

Name |

Vodafone

Group Plc |

| b) |

LEI |

213800TB53ELEUKM7Q61 |

| 4 |

Details

of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each

date; and (iv) each place where transactions have been conducted |

| a) |

Description

of the financial instrument, type of instrument and identification code |

Ordinary

shares of US$0.20 20/21 each in Vodafone Group Plc (ISIN: GB00BH4HKS39) |

| b) |

Nature

of the transaction |

Grant

of nil cost conditional award of shares under the Global Incentive Plan, based on Group performance. |

| c) |

Price(s) and volume(s) |

|

| |

|

|

Price(s) |

Volume(s) |

|

| |

|

|

GBP 0.7753 |

2,922,739 |

|

| |

|

|

|

|

|

| d) |

Aggregated

information: volume, Price |

Aggregated

volume: 2,922,739 Ordinary shares

Aggregated

price: GBP 2,265,999.55 |

| e) |

Date

of the transaction |

2023-07-27 |

| f) |

Place

of the transaction |

Outside

a trading venue |

A

conditional award of shares was granted to the below participant on 27 July 2023 by the Company. The award has been granted in accordance

with the Vodafone Global Incentive Plan and is subject to the same conditions as the July 2022 award made to other members of the

Executive Committee. The below table sets out the maximum number of shares granted and these will be reduced accordingly if the Company

achieves less than maximum performance.

| 1 |

Details

of the person discharging managerial responsibilities/person closely associated |

| a) |

Name |

Maaike

de Bie |

| 2 |

Reason

for the notification |

| a) |

Position/status |

Vodafone

Group General Counsel and Company Secretary |

| b) |

Initial

notification/ Amendment |

Initial

notification |

| 3 |

Details

of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor |

| a) |

Name |

Vodafone

Group Plc |

| b) |

LEI |

213800TB53ELEUKM7Q61 |

| 4 |

Details

of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each

date; and (iv) each place where transactions have been conducted |

| a) |

Description

of the financial instrument, type of instrument and identification code |

Ordinary

shares of US$0.20 20/21 each in Vodafone Group Plc (ISIN: GB00BH4HKS39) |

| b) |

Nature

of the transaction |

Grant

of nil cost conditional award of shares under the Global Incentive Plan, based on Group performance. |

| c) |

Price(s) and volume(s) |

|

| |

|

|

Price(s) |

Volume(s) |

|

| |

|

|

GBP 0.7753 |

2,179,130 |

|

| |

|

|

|

|

|

| d) |

Aggregated

information: volume, Price |

Aggregated

volume: 2,179,130 Ordinary shares

Aggregated

price: GBP 1,689,479.49 |

| e) |

Date

of the transaction |

2023-07-27 |

| f) |

Place

of the transaction |

Outside

a trading venue |

A

conditional award of shares was granted to the below participant on 27 July 2023 by the Company. The award has been granted in accordance

with the Vodafone Global Incentive Plan. The vesting of this award

is conditional on continued employment with the Vodafone Group and will vest on 27 July 2025. The award also attracts dividend equivalent

awards.

| 1 |

Details

of the person discharging managerial responsibilities/person closely associated |

| a) |

Name |

Maaike

de Bie |

| 2 |

Reason

for the notification |

| a) |

Position/status |

Vodafone

Group General Counsel and Company Secretary |

| b) |

Initial

notification/ Amendment |

Initial

notification |

| 3 |

Details

of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor |

| a) |

Name |

Vodafone

Group Plc |

| b) |

LEI |

213800TB53ELEUKM7Q61 |

| 4 |

Details

of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each

date; and (iv) each place where transactions have been conducted |

| a) |

Description

of the financial instrument, type of instrument and identification code |

Ordinary

shares of US$0.20 20/21 each in Vodafone Group Plc (ISIN: GB00BH4HKS39) |

| b) |

Nature

of the transaction |

Grant

of nil cost conditional award of shares under the Global Incentive Plan, subject to continued employment. |

| c) |

Price(s) and volume(s) |

|

| |

|

|

Price(s) |

Volume(s) |

|

| |

|

|

GBP 0.7753 |

386,946 |

|

| |

|

|

|

|

|

| d) |

Aggregated

information: volume, Price |

Aggregated

volume: 386,946 Ordinary shares

Aggregated

price: GBP 299,999.23 |

| e) |

Date

of the transaction |

2023-07-27 |

| f) |

Place

of the transaction |

Outside

a trading venue |

A

conditional award of shares was granted to the below participant on 27 July 2023 by the Company. The award has been granted in accordance

with the Vodafone Global Incentive Plan. The vesting of the award is conditional on continued employment with Vodafone Germany and on

the satisfaction of local performance conditions approved by the Remuneration Committee and will vest on 27 July 2025. The below

table sets out the maximum number of shares granted and these will be reduced accordingly if less than maximum performance is achieved.

The award also attracts dividend equivalent awards.

| 1 |

Details

of the person discharging managerial responsibilities/person closely associated |

| a) |

Name |

Philippe

Rogge |

| 2 |

Reason

for the notification |

| a) |

Position/status |

Vodafone

Germany Chief Executive Officer |

| b) |

Initial

notification/ Amendment |

Initial

notification |

| 3 |

Details

of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor |

| a) |

Name |

Vodafone

Group Plc |

| b) |

LEI |

213800TB53ELEUKM7Q61 |

| 4 |

Details

of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each

date; and (iv) each place where transactions have been conducted |

| a) |

Description

of the financial instrument, type of instrument and identification code |

Ordinary

shares of US$0.20 20/21 each in Vodafone Group Plc (ISIN: GB00BH4HKS39) |

| b) |

Nature

of the transaction |

Grant

of nil cost conditional award of shares under the Global Incentive Plan, based on local market performance. |

| c) |

Price(s) and volume(s) |

|

| |

|

|

Price(s) |

Volume(s) |

|

| |

|

|

GBP 0.7753 |

1,877,279 |

|

| |

|

|

|

|

|

| d) |

Aggregated

information: volume, Price |

Aggregated

volume: 1,877,279 Ordinary shares

Aggregated

price: GBP 1,455,454.41 |

| e) |

Date

of the transaction |

2023-07-27 |

| f) |

Place

of the transaction |

Outside

a trading venue |

Acquisition

of shares

The

below individuals acquired shares under the Vodafone Global Incentive Plan. The vesting of the share awards was conditional on continued

employment with the Vodafone Group.

| 1 |

Details

of the person discharging managerial responsibilities/person closely associated |

| a) |

Name |

Scott

Petty |

| 2 |

Reason

for the notification |

| a) |

Position/status |

Vodafone

Group Chief Technology Officer |

| b) |

Initial

notification/ Amendment |

Initial

notification |

| 3 |

Details

of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor |

| a) |

Name |

Vodafone

Group Plc |

| b) |

LEI |

213800TB53ELEUKM7Q61 |

| 4 |

Details

of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each

date; and (iv) each place where transactions have been conducted |

| a) |

Description

of the financial instrument, type of instrument and identification code |

Ordinary

shares of US$0.20 20/21 each in Vodafone Group Plc (ISIN: GB00BH4HKS39) |

| b) |

Nature

of the transaction |

Vesting

of retention shares as part of the Global Long Term Retention (GLTR) plan for Senior Leadership Team members.

Sale

of shares to satisfy tax withholding obligations. |

| c) |

Price(s) and volume(s) |

|

| |

|

|

Price(s) |

Volume(s) |

|

| |

|

|

GBP nil |

115,800 |

|

| |

|

|

GBP 0.765544 |

54,564 |

|

| |

|

|

|

|

|

| d) |

Aggregated

information: volume, Price |

Aggregated

volume of shares acquired: 115,800 Ordinary shares

Aggregated

price of shares acquired: GBP nil

Aggregated

volume of shares sold: 54,564 Ordinary shares

Aggregated

price of shares sold: GBP 41,771.14 |

| e) |

Date

of the transaction |

2023-07-27 |

| f) |

Place

of the transaction |

London

Stock Exchange (XLON) |

| 1 |

Details

of the person discharging managerial responsibilities/person closely associated |

| a) |

Name |

Alberto

Ripepi |

| 2 |

Reason

for the notification |

| a) |

Position/status |

Vodafone

Group Chief Network Officer |

| b) |

Initial

notification/ Amendment |

Initial

notification |

| 3 |

Details

of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor |

| a) |

Name |

Vodafone

Group Plc |

| b) |

LEI |

213800TB53ELEUKM7Q61 |

| 4 |

Details

of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each

date; and (iv) each place where transactions have been conducted |

| a) |

Description

of the financial instrument, type of instrument and identification code |

Ordinary

shares of US$0.20 20/21 each in Vodafone Group Plc (ISIN: GB00BH4HKS39) |

| b) |

Nature

of the transaction |

Ordinary

shares of US$0.20 20/21 each in Vodafone Group Plc (ISIN: GB00BH4HKS39) |

| c) |

Price(s) and

volume(s) |

Vesting

of retention shares as part of the Global Long Term Retention (GLTR) plan for Senior Leadership Team members.

Sale

of shares to satisfy tax withholding obligations. |

| |

|

|

| d) |

Aggregated information: volume, Price |

|

Price(s) |

Volume(s) |

|

| |

|

|

GBP nil |

132,512 |

|

| |

|

|

GBP 0.765544 |

54,583 |

|

| |

|

|

|

|

|

| e) |

Date

of the transaction |

Aggregated

volume of shares acquired: 132,512 Ordinary shares

Aggregated

price of shares acquired: GBP nil

Aggregated

volume of shares sold: 54,583 Ordinary shares

Aggregated

price of shares sold: GBP 41,785.69 |

| f) |

Place

of the transaction |

2023-07-27 |

Purchase

of Shares

| 1 |

Details

of the person discharging managerial responsibilities/person closely associated |

| a) |

Name |

Philippe

Rogge |

| 2 |

Reason

for the notification |

| a) |

Position/status |

Vodafone

Germany Chief Executive Officer |

| b) |

Initial

notification/ Amendment |

Initial

notification |

| 3 |

Details

of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor |

| a) |

Name |

Vodafone

Group Plc |

| b) |

LEI |

213800TB53ELEUKM7Q61 |

| 4 |

Details

of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each

date; and (iv) each place where transactions have been conducted |

| a) |

Description

of the financial instrument, type of instrument and identification code |

Ordinary

shares of US$0.20 20/21 each in Vodafone Group Plc (ISIN: GB00BH4HKS39) |

| b) |

Nature

of the transaction |

Purchase

of shares. |

| c) |

Price(s) and volume(s) |

|

| |

|

|

Price(s) |

Volume(s) |

|

| |

|

|

GBP 0.7674 |

65,823 |

|

| |

|

|

|

|

|

| d) |

Aggregated

information: volume, Price |

Aggregated

volume: 65,823 Ordinary shares

Aggregated

price: GBP 50,512.57 |

| e) |

Date

of the transaction |

2023-07-27 |

| f) |

Place

of the transaction |

London

Stock Exchange (XLON) |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorised.

| |

VODAFONE GROUP |

| |

PUBLIC LIMITED COMPANY |

| |

(Registrant) |

| |

| Dated: 2 August 2023 |

By: |

/s/ M D B |

| |

Name: |

Maaike de Bie |

| |

Title: |

Group General Counsel and Company Secretary |

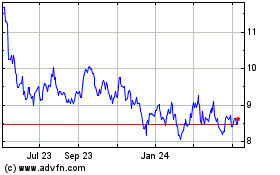

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Mar 2024 to Apr 2024

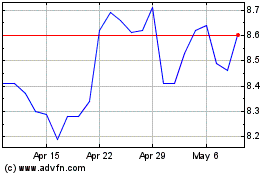

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Apr 2023 to Apr 2024