false

0001425287

0001425287

2024-05-14

2024-05-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

May 14, 2024

WORKHORSE GROUP INC.

(Exact name of registrant as specified in its charter)

| Nevada |

|

001-37673 |

|

26-1394771 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification Number) |

3600 Park 42 Drive, Suite 160E, Sharonville, Ohio

45241

(Address of principal executive offices) (zip code)

(888) 646-5205

(Registrant's telephone number, including area

code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.001 par value per share |

|

WKHS |

|

The Nasdaq Capital Market |

Item 5.07.

Submission of Matters to a Vote of Security Holders.

On May 14, 2024, the Company held its Annual Meeting.

As of March 15, 2024, the record date for holders of shares of common stock (the “Shares”) entitled to vote at the Annual

Meeting, there were 314,606,266 Shares outstanding and entitled to vote at the Annual Meeting. Of the Shares entitled to vote, 159,032,534,

or approximately 50.55% of the Shares, were present or represented by proxy at the Annual Meeting, constituting a quorum under the Company’s

Articles of Incorporation. There were six matters presented and voted on at the Annual Meeting. Set forth below is a brief description

of each matter voted on at the Annual Meeting and the final voting results with respect to each such matter.

Proposal 1 - Election of seven nominees to

serve on the Board of Directors until the next annual meeting or until their respective successors are duly elected and qualified.

| Nominee |

|

Votes For |

|

Votes Against |

|

Abstentions |

|

Broker

Non-Votes |

| |

|

|

|

|

|

|

|

|

| Raymond J. Chess |

|

44,155,363 |

|

22,919,916 |

|

2,548,981 |

|

89,408,274 |

| Richard F. Dauch |

|

51,032,945 |

|

16,465,023 |

|

2,126,292 |

|

89,408,274 |

| Jacqueline A. Dedo |

|

44,205,829 |

|

22,952,143 |

|

2,466,288 |

|

89,408,274 |

| Pamela S. Mader |

|

45,662,736 |

|

21,507,970 |

|

2,453,554 |

|

89,408,274 |

| William G. Quigley III |

|

45,426,256 |

|

21,715,718 |

|

2,482,286 |

|

89,408,274 |

| Austin S. Miller |

|

46,119,638 |

|

21,056,003 |

|

2,448,619 |

|

89,408,274 |

| Dr. Jean Botti |

|

46,125,228 |

|

21,021,534 |

|

2,477,498 |

|

89,408,274 |

The shareholders elected all seven of the nominees

as directors.

Proposal 2 – Approval, on an advisory

basis, of the compensation of named executive officers

| |

|

Votes

For |

|

Votes

Against |

|

Abstentions |

|

Broker

Non-Votes |

| Votes Cast |

|

41,006,830 |

|

25,258,757 |

|

3,358,673 |

|

89,408,274 |

The shareholders approved, on an advisory basis,

the compensation of the Company’s named executive officers.

Proposal 3 – Approval, on an advisory

basis, of the frequency of voting on named executive officer compensation

| |

|

One Year |

|

Two Years |

|

Three Years |

|

Abstentions |

|

Broker

Non-Votes |

| Votes Cast |

|

55,408,269 |

|

1,293,948 |

|

9,719,840 |

|

3,202,203 |

|

89,408,274 |

The shareholders approved, on an advisory basis, a

yearly frequency of voting on named executive officer compensation. In accordance with the original recommendation of the Company’s

board of directors and consistent with the stockholder vote results, the Company’s board of directors has determined that the Company

will conduct future non-binding advisory votes on the compensation of the Company's named executive officers every year until the next

required advisory vote on the frequency of such vote.

Proposal 4 – Approval, pursuant to Nevada

Revised Statutes 78.2055, of a reverse stock split of the Company’s outstanding shares of common stock by a ratio of any whole number

between 1-for-10 and 1-for-20, at any time prior to August 30, 2024, to be determined at the discretion of the Board of Directors, for

the purpose of complying with the Nasdaq Listing Rules, subject to the Board’s discretion to abandon such reverse stock split.

| |

|

Votes For |

|

Votes Against |

|

Abstentions |

|

Broker

Non-Votes |

| Votes Cast |

|

90,195,037 |

|

65,160,755 |

|

3,676,742 |

|

0 |

The stockholders approved the proposed reverse

stock split.

Proposal 5 – Approval, for the purposes

of Nasdaq Listing Rule 5635(D), the proposed issuance of the maximum number of shares of the Company’s common stock underlying the

Company’s (A) senior secured convertible notes and (B) warrants to purchase common stock.

| |

|

Votes For |

|

Votes Against |

|

Abstentions |

|

Broker

Non-Votes |

| Votes Cast |

|

35,204,064 |

|

31,832,919 |

|

2,587,277 |

|

89,408,274 |

The shareholders approved the proposed issuance

of the Company’s common stock.

Proposal 6 – Ratification of Grant Thornton

LLP as the Company’s independent registered public accounting firm for fiscal year 2024.

| |

|

Votes For |

|

Votes Against |

|

Abstentions |

|

Broker

Non-Votes |

| Votes Cast |

|

130,154,367 |

|

21,611,313 |

|

7,266,854 |

|

0 |

The shareholders ratified the appointment of Grant

Thornton LLP as the Company’s independent registered public accounting firm for fiscal year 2024.

Item

8.01. Other Events.

On May 14, 2024, the Company issued a press release about the meeting

results. The press release is furnished as Exhibit 99.1 and incorporated by reference herein.

Forward-Looking Statements

Certain statements in this Current Report on Form

8-K are forward-looking statements that involve a number of risks and uncertainties. For such statements, the Company claims the protection

of the Private Securities Litigation Reform Act of 1995. Actual events or results may differ materially from the Company’s expectations.

Additional factors that could cause actual results to differ materially from those stated or implied by the Company’s forward-looking

statements are disclosed in the Company’s reports filed with the Securities and Exchange Commission.

Item 9.01. Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

WORKHORSE GROUP INC. |

| |

|

| Date: May 14, 2024 |

By: |

/s/ James D. Harrington |

| |

Name: |

James D. Harrington |

| |

Title: |

General Counsel, Chief Compliance Officer and Secretary |

4

Exhibit

99.1

Workhorse

Group Stockholders Approve Key Proposals at Annual Meeting

CINCINNATI

– May 14, 2024 – Workhorse Group Inc. (Nasdaq: WKHS) (“Workhorse” or “the Company”), an American technology

company focused on pioneering the transition to zero emission commercial vehicles, today announced that at its 2024 Annual Meeting of

Stockholders (the “Annual Meeting”), Workhorse stockholders voted to approve key proposals that enable the Company to continue

executing its strategic commercial vehicle product roadmap.

At the Annual Meeting, stockholders approved, among other proposals:

| 1) | Re-election

of the following persons to the Company’s Board of Directors for the ensuing year:

Raymond Chess, Richard Dauch, Jacqueline Dedo, Pamela Mader, Scott Miller and Bill Quigley

and Jean Botti. The Directors have been elected to serve a term expiring at the 2025 annual

meeting of stockholders; |

| 2) | Pursuant

to Nevada Revised Statutes 78.2055, a reverse stock split of Workhorse’s outstanding

shares of common stock by a ratio of any whole number between 1-for-10 and 1-for-20, at any

time prior to August 30, 2024, to be determined at the discretion of the Board of Directors,

for the purpose of complying with the Nasdaq Listing Rules, subject to the Board’s

discretion to abandon such reverse stock split; and |

| 3) | For

the purposes of Nasdaq Listing Rule 5635(D), the proposed issuance of the maximum number

of shares of Workhorse common stock underlying the Company’s (A) senior secured convertible

notes and (B) warrants to purchase common stock. |

Workhorse

will file the final vote results, as certified by the independent Inspector of Election, on a Form 8-K with the U.S. Securities and Exchange

Commission.

About

Workhorse Group Inc.

Workhorse

is a technology company focused on providing ground and air-based electric vehicles to the last-mile delivery sector. As an American

original equipment manufacturer, we design and build high performance, battery-electric trucks and drones. Workhorse also develops cloud-based,

real-time telematics performance monitoring systems that are fully integrated with our vehicles and enable fleet operators to optimize

energy and route efficiency. All Workhorse vehicles are designed to make the movement of people and goods more efficient and less harmful

to the environment. For additional information visit workhorse.com.

Forward-Looking

Statements

Certain

statements contained in this press release, other than purely historical information, including, but not limited to, estimates, projections,

statements relating to our business plans, objectives and expected operating results, and the assumptions upon which those statements

are based, contain forward-looking statements reflecting our current expectations that involve risks and uncertainties. These statements

are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. When used

in this prospectus supplement, the words “anticipate,” “expect,” “plan,” “believe,” “seek,”

“estimate” and similar expressions are intended to identify forward-looking statements. These are statements that relate

to future periods and include, but are not limited to, statements about the features, benefits and performance of our products, our ability

to introduce new product offerings and increase revenue from existing products, expected expenses including those related to selling

and marketing, product development and general and administrative, our beliefs regarding the health and growth of the market for our

products, anticipated increase in our customer base, expansion of our products functionalities, expected revenue levels and sources of

revenue, expected impact, if any, of legal proceedings, the adequacy of our liquidity and capital resources, the likelihood of us obtaining

additional financing in the immediate future and the expected terms of such financing, and expected growth in business. Forward-looking

statements are statements that are not historical facts. Such forward-looking statements are subject to risks and uncertainties, which

could cause actual results to differ materially from the forward-looking statements contained in this press release. Factors that could

cause actual results to differ materially include, but are not limited to: our ability to develop and manufacture our new product portfolio,

including the W4 CC, W750, W56 and WNext programs; our ability to attract and retain customers for our existing and new products; risks

associated with obtaining orders and executing upon such orders; the unavailability, reduction, elimination or adverse application of

government subsidies, incentives and regulations; supply chain disruptions, including constraints on steel, semiconductors and other

material inputs and resulting cost increases impacting our Company, our customers, our suppliers or the industry; our ability to capitalize

on opportunities to deliver products to meet customer requirements; our limited operations and need to expand and enhance elements of

our production process to fulfill product orders; our general inability to raise additional capital to fund our operations and business

plan; our ability to obtain financing to meet our immediate liquidity needs and the potential costs, dilution and restrictions imposed

by any such financing; our ability to regain compliance with the listing requirements of the Nasdaq Capital Market and otherwise maintain

the listing of our securities thereon and the impact of any steps we take to regain such compliance, such as a reverse split of our common

stock, on our operations, stock price and future access to liquidity; our ability to protect our intellectual property; market acceptance

for our products; our ability to obtain sufficient liquidity from operations and financing activities to continue as a going concern

and, our ability to control our expenses; the effectiveness of our cost control measures and impact such measures could have on our operations,

including the effects of the furloughing employees; potential competition, including without limitation shifts in technology; volatility

in and deterioration of national and international capital markets and economic conditions; global and local business conditions; acts

of war (including without limitation the conflicts in Ukraine and Israel) and/or terrorism; the prices being charged by our competitors;

our inability to retain key members of our management team; our inability to satisfy our customer warranty claims; the outcome of any

regulatory or legal proceedings, including with Coulomb Solutions Inc.; our ability to consummate the divestiture of our aero business,

our ability to consummate and realize the benefits of a potential sale and leaseback transaction of our Union City Facility; and other

risks and uncertainties and other factors discussed from time to time in our filings with the Securities and Exchange Commission. Forward-looking

statements speak only as of the date hereof. We expressly disclaim any obligation or undertaking to release publicly any updates or revisions

to any forward-looking statements contained herein to reflect any change in our expectations with regard thereto or any change in events,

conditions or circumstances on which any such statement is based, except as required by law.

Discussions containing these forward-looking statements may be found,

among other places, in “Business” and “Management’s Discussion and Analysis of Financial Condition and Results

of Operations” in our most recent Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q, as well as any amendments

thereto reflected in subsequent filings with the SEC or in any Current Report on Form 8-K. These forward-looking statements involve known

and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements

to be materially different from the information expressed or implied by these forward-looking statements. While we believe that we have

a reasonable basis for each forward-looking statement contained in this press release, we caution you that these statements are based

on a combination of facts and factors currently known by us and our projections of the future, about which we cannot be certain. As a

result of these factors, we cannot assure you that the forward-looking statements in this press release and the documents referenced

herein will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material.

In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation

or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all. You should

not place undue reliance on these forward-looking statements, which apply only as of the date of this press release. You should read

this press release completely and with the understanding that our actual future results may be materially different from what we expect.

We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or

otherwise. You are advised, however, to consult any further disclosures we make on related subjects in our Annual Reports on Form 10-K,

Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, as well as any amendments thereto.

Media

Contact:

Aaron

Palash / Greg Klassen

Joele

Frank, Wilkinson Brimmer Katcher

212-355-4449

Investor

Relations Contact:

Matt

Glover and Tom Colton

Gateway

Group

949-574-3860

WKHS@gateway-grp.com

3

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

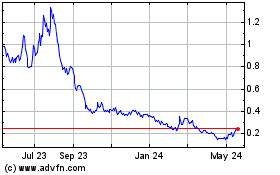

Workhorse (NASDAQ:WKHS)

Historical Stock Chart

From Apr 2024 to May 2024

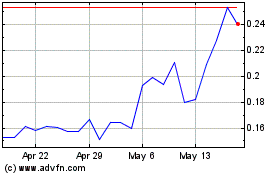

Workhorse (NASDAQ:WKHS)

Historical Stock Chart

From May 2023 to May 2024