Xcel Brands, Inc. (NASDAQ: XELB) (“Xcel” or the “Company”), a media

and consumer products company with significant expertise in

livestream shopping, today announced its financial results for the

second quarter ended June 30, 2022.

Robert W. D’Loren, Chairman and Chief Executive

Officer of Xcel commented, “Our second quarter results reflect the

challenges facing the global apparel industry, which includes

continued supply chain issues, inflation, geopolitical events, and

cancelled orders by retailers as they prudently manage inventory

levels. While we expect these headwinds will continue throughout

the remainder of 2022, we believe we will emerge from this period

stronger and well positioned to re-accelerate growth and

profitability in 2023 and beyond.”

Mr. D’Loren continued “We have developed a

powerful platform and growth strategy supported by our compelling

lifestyle brands, differentiated livestreaming and interactive TV

capabilities, and strong balance sheet. As a result, we have the

strongest pipeline of new projects and opportunities in our

history, which is driving our optimism as we look forward to

2023.”

“Selling a majority interest in the Isaac

Mizrahi brand was a transformative moment in Xcel’s history and

represents the first time we have monetized one of our brands. We

believe this transaction supports the value of our remaining

brands, while significantly improving our balance sheet. With the

financial flexibility to support our growth strategies, momentum in

our business is expanding and we expect to announce exciting new

projects and opportunities soon,” concluded Mr. D’Loren.

Second Quarter 2022 Financial

Results

Total revenue was $8.5 million, a decrease of

$2.3 million or 21% compared to the prior year quarter, primarily

driven by declines in wholesale apparel sales, as well as lower

licensing revenue as a result of the sale of the Isaac Mizrahi

brand.

Net income attributable to Xcel Brands was

approximately $9.5 million, or $0.48 per diluted share, compared

with a net loss of $1.6 million, or ($0.08) per diluted share, for

the prior year quarter. After adjusting for certain cash and

non-cash items, results on a non-GAAP basis were a net loss of

approximately $3.6 million, or ($0.18) per share for the quarter

ended June 30, 2022, and a net loss of approximately $0.1 million,

or $(0.01) per share, for the quarter ended June 30, 2021. Adjusted

EBITDA was negative $2.8 million for the current quarter and

positive $0.9 million for the prior year quarter.

Six Month 2022 Financial

Results

Total revenue was $17.2 million, a decrease of

$1.4 million compared with the prior year six months, driven by

lower net sales of $2.0 million, partially offset by higher

licensing revenues of $0.6 million. The decrease in net product

sales for the six months ended June 30, 2022, was primarily

attributable to lower apparel wholesales, driven by the temporary

closing of overseas factories, causing delays in product deliveries

that resulted in cancelled orders. The year-over-year increase in

licensing revenue was primarily attributable to the April 1, 2021

acquisition of the LOGO Lori Goldstein brand, partially offset by

declines in due to the sale of the Isaac Mizrahi brand.

Net income attributable to Xcel Brands

shareholders for the current six-month period was approximately

$6.0 million, or $0.30 per diluted share, compared with a net loss

of $4.1 million, or ($0.21) per diluted share, for the prior year

six months. After adjusting for certain cash and non-cash items,

results on a non-GAAP basis were a net loss of approximately $5.5

million, or $(0.28) per diluted share for the six months ended June

30, 2022, and a net loss of approximately $1.6 million, or $(0.09)

per diluted share, for the six months ended June 30, 2021. Adjusted

EBITDA was negative $3.7 million and approximately $0.0 million for

the current year six months and prior year comparable period,

respectively.

Balance Sheet

The Company's balance sheet at June 30, 2022,

reflected stockholders' equity of approximately $81 million, cash

and cash equivalents of approximately $10.9 million, and working

capital, exclusive of the current portion of lease obligations, of

approximately $16.7 million.

Conference Call and Webcast

The Company will host a conference call with

members of the executive management team to discuss these results

with additional comments and details at 11:00 a.m. Eastern Time on

August 15, 2022. A webcast of the conference call will be available

live on the Investor Relations section of Xcel's website at

www.xcelbrands.com. Interested parties unable to access the

conference call via the webcast may dial 1-877-407-3982. A replay

of the conference call will be available until August 29, 2022 and

can be accessed at 1-844-512-2921 using the replay pin number

13732023.

About Xcel Brands

Xcel Brands, Inc. (NASDAQ:XELB) is a media and

consumer products company engaged in the design, production,

marketing, livestreaming, wholesale distribution, and

direct-to-consumer sales of branded apparel, footwear, accessories,

fine jewelry, home goods and other consumer products, and the

acquisition of dynamic consumer lifestyle brands. Xcel was founded

in 2011 with a vision to reimagine shopping, entertainment, and

social media as one thing. Xcel’s brand portfolio – including

wholly owned brands and business ventures with others – consists of

the LOGO by Lori Goldstein, Halston, Judith Ripka, C. Wonder and

owns and manages the Longaberger brand through its controlling

interest in Longaberger Licensing LLC and a minority interest in

the Isaac Mizrahi brand, pioneering a true omni-channel sales

strategy which includes the promotion and sale of products under

its brands through interactive television, digital live-stream

shopping, brick-and-mortar retail, and e-commerce channels. The

company’s brands have generated in excess of $3 billion in retail

sales via live streaming in interactive television and digital

channels alone. Headquartered in New York City, Xcel Brands is led

by an executive team with significant livestreaming, production,

merchandising, design, marketing, retailing, and licensing

experience, and a proven track record of success in elevating

branded consumer products companies. With an experienced team of

professionals focused on design, production, and digital marketing,

Xcel maintains control of product quality and promotion across all

of its product categories and distribution channels. Xcel

differentiates by design. www.xcelbrands.com

Forward Looking Statements

This press release contains forward-looking

statements. All statements other than statements of historical fact

contained in this press release, including statements regarding

future events, our future financial performance, business strategy

and plans and objectives of management for future operations, are

forward-looking statements. We have attempted to identify

forward-looking statements by terminology including "anticipates,"

"believes," "can," "continue," "ongoing," "could," "estimates,"

"expects," "intends," "may," "appears," "suggests," "future,"

"likely," "goal," "plans," "potential," "projects," "predicts,"

"seeks," "should," "would," "guidance," "confident" or "will" or

the negative of these terms or other comparable terminology. These

forward-looking statements include, but are not limited to,

statements regarding our anticipated revenue, expenses,

profitability, strategic plans and capital needs. These statements

are based on information available to us on the date hereof and our

current expectations, estimates and projections and are not

guarantees of future performance. Forward-looking statements

involve known and unknown risks, uncertainties, assumptions and

other factors, including, without limitation, the risks discussed

in the "Risk Factors" section and elsewhere in the Company's Annual

Report on form 10-K for the year ended December 31, 2021 and its

other filings with the SEC, which may cause our or our industry's

actual results, levels of activity, performance or achievements to

differ materially from those expressed or implied by these

forward-looking statements. Moreover, we operate in a very

competitive and rapidly changing environment. New risks emerge from

time to time and it is not possible for us to predict all risk

factors, nor can we address the impact of all factors on our

business or the extent to which any factor, or combination of

factors, may cause our actual results to differ materially from

those contained in any forward-looking statements. You should not

place undue reliance on any forward-looking statements. Except as

expressly required by the federal securities laws, we undertake no

obligation to update any forward-looking statements, whether as a

result of new information, future events, changed circumstances or

any other reason.

For further information please contact:

Andrew BergerSM Berger & Company, Inc.

216-464-6400andrew@smberger.com

|

Xcel Brands, Inc. and Subsidiaries |

|

Unaudited Condensed Consolidated Statements of

Operations |

|

(in thousands, except share and per share

data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended |

|

For the Six Months Ended |

|

|

June 30, |

|

June 30, |

|

|

2022 |

|

2021 |

|

2022 |

|

2021 |

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

Net licensing revenue |

$ |

5,175 |

|

|

$ |

6,224 |

|

|

$ |

11,136 |

|

|

$ |

10,531 |

|

|

Net sales |

|

3,292 |

|

|

|

4,540 |

|

|

|

6,078 |

|

|

|

8,042 |

|

|

Net revenue |

|

8,467 |

|

|

|

10,764 |

|

|

|

17,214 |

|

|

|

18,573 |

|

|

Cost of goods sold |

|

2,570 |

|

|

|

3,063 |

|

|

|

4,250 |

|

|

|

4,898 |

|

|

Gross profit |

|

5,897 |

|

|

|

7,701 |

|

|

|

12,964 |

|

|

|

13,675 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating costs and expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Salaries, benefits and employment taxes |

|

5,236 |

|

|

|

4,049 |

|

|

|

10,089 |

|

|

|

8,101 |

|

|

Other selling, general and administrative expenses |

|

3,803 |

|

|

|

3,090 |

|

|

|

7,195 |

|

|

|

6,128 |

|

|

Stock-based compensation |

|

485 |

|

|

|

431 |

|

|

|

517 |

|

|

|

591 |

|

|

Depreciation and amortization |

|

1,812 |

|

|

|

1,848 |

|

|

|

3,632 |

|

|

|

3,058 |

|

|

Total operating costs and expenses |

|

11,336 |

|

|

|

9,418 |

|

|

|

21,433 |

|

|

|

17,878 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Income |

|

|

|

|

|

|

|

|

|

|

|

|

Gain on sale of assets |

|

20,608 |

|

|

|

- |

|

|

|

20,608 |

|

|

|

- |

|

|

Total other income |

|

20,608 |

|

|

|

|

|

|

20,608 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss) |

|

15,169 |

|

|

|

(1,717 |

) |

|

|

12,139 |

|

|

|

(4,203 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest and finance expense |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense - term loan debt |

|

479 |

|

|

|

522 |

|

|

|

1,187 |

|

|

|

798 |

|

|

Other interest and finance charges (income), net |

|

(1 |

) |

|

|

100 |

|

|

|

- |

|

|

|

104 |

|

|

Loss on extinguishment of debt |

|

2,324 |

|

|

|

821 |

|

|

|

2,324 |

|

|

|

821 |

|

|

Total interest and finance expense |

|

2,802 |

|

|

|

1,443 |

|

|

|

3,511 |

|

|

|

1,723 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (Loss) before income taxes |

|

12,367 |

|

|

|

(3,160 |

) |

|

|

8,628 |

|

|

|

(5,926 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax provision (benefit) |

|

3,178 |

|

|

|

(1,346 |

) |

|

|

3,178 |

|

|

|

(1,484 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

9,189 |

|

|

|

(1,814 |

) |

|

|

5,450 |

|

|

|

(4,442 |

) |

|

Net loss attributable to noncontrolling interest |

|

(301 |

) |

|

|

(256 |

) |

|

|

(553 |

) |

|

|

(337 |

) |

|

Net income (loss) attributable to Xcel Brands, Inc.

stockholders |

$ |

9,490 |

|

|

$ |

(1,558 |

) |

|

$ |

6,003 |

|

|

$ |

(4,105 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss per share attributed to Xcel Brands, Inc. common

stockholders: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted net loss per share |

$ |

0.48 |

|

|

$ |

(0.08 |

) |

|

$ |

0.31 |

|

|

$ |

(0.21 |

) |

|

Weighted average number of common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted weighted average common shares outstanding |

|

19,677,243 |

|

|

|

19,449,116 |

|

|

|

19,624,474 |

|

|

|

19,355,795 |

|

|

Xcel Brands, Inc. and Subsidiaries |

|

Unaudited Condensed Consolidated Balance

Sheets |

|

(in thousands, except share and per share

data) |

| |

|

|

|

|

|

|

| |

June 30, 2022 |

|

|

December 31, 2021 |

|

|

(Unaudited) |

|

|

|

|

Assets |

|

|

|

|

|

|

|

Current Assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

10,873 |

|

|

|

$ |

4,483 |

|

|

Accounts receivable, net |

|

9,291 |

|

|

|

|

7,640 |

|

|

Inventory |

|

3,475 |

|

|

|

|

3,375 |

|

|

Prepaid expenses and other current assets |

|

1,975 |

|

|

|

|

1,681 |

|

|

Total current assets |

|

25,614 |

|

|

|

|

17,179 |

|

|

|

|

|

|

|

|

|

|

Non-Current Assets: |

|

|

|

|

|

|

|

Property and equipment, net |

|

2,070 |

|

|

|

|

2,549 |

|

|

Operating lease right-of-use assets |

|

5,876 |

|

|

|

|

6,314 |

|

|

Trademarks and other intangibles, net |

|

50,735 |

|

|

|

|

98,304 |

|

|

Equity method investment |

|

19,797 |

|

|

|

|

- |

|

|

Restricted cash |

|

- |

|

|

|

|

739 |

|

|

Deferred tax assets, net |

|

- |

|

|

|

|

141 |

|

|

Other assets |

|

147 |

|

|

|

|

555 |

|

|

Total non-current assets |

|

78,625 |

|

|

|

|

108,602 |

|

|

Total Assets |

$ |

104,239 |

|

|

|

$ |

125,781 |

|

|

|

|

|

|

|

|

|

|

Liabilities and Equity |

|

|

|

|

|

|

|

Current Liabilities: |

|

|

|

|

|

|

|

Accounts payable, accrued expenses and other current

liabilities |

$ |

4,759 |

|

|

|

$ |

6,169 |

|

|

Accrued income taxes payable |

|

1,823 |

|

|

|

|

64 |

|

|

Accrued payroll |

|

276 |

|

|

|

|

577 |

|

|

Current portion of contingent obligations |

|

2,800 |

|

|

|

|

- |

|

|

Current portion of operating lease obligations |

|

1,094 |

|

|

|

|

1,207 |

|

|

Current portion of long-term debt |

|

- |

|

|

|

|

2,500 |

|

|

Total current liabilities |

|

10,752 |

|

|

|

|

10,517 |

|

|

Long-Term Liabilities: |

|

|

|

|

|

|

|

Long-term portion of operating lease obligations |

|

6,661 |

|

|

|

|

7,252 |

|

|

Long-term debt, less current portion |

|

- |

|

|

|

|

25,531 |

|

|

Contingent obligations, net of short term portion |

|

4,739 |

|

|

|

|

7,539 |

|

|

Deferred tax liabilities, net |

|

1,244 |

|

|

|

|

- |

|

|

Total long-term liabilities |

|

12,644 |

|

|

|

|

40,322 |

|

|

Total Liabilities |

|

23,396 |

|

|

|

|

50,839 |

|

| |

|

|

|

|

|

|

|

Commitments and Contingencies |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Equity: |

|

|

|

|

|

|

|

Preferred stock, $.001 par value, 1,000,000 shares authorized, none

issued and outstanding |

|

- |

|

|

|

|

- |

|

|

Common stock, $.001 par value, 50,000,000 shares authorized, and

19,571,119 shares issued and outstanding at March 31, 2022 and

December 31, 2021 |

|

20 |

|

|

|

|

20 |

|

|

Paid-in capital |

|

103,490 |

|

|

|

|

103,039 |

|

|

Accumulated deficit |

|

(22,776 |

) |

|

|

|

(28,779 |

) |

|

Total Xcel Brands, Inc. stockholders' equity |

|

80,734 |

|

|

|

|

74,280 |

|

|

Noncontrolling interest |

|

109 |

|

|

|

|

662 |

|

|

Total Equity |

|

80,843 |

|

|

|

|

74,942 |

|

| |

|

|

|

|

|

|

|

Total Liabilities and Equity |

$ |

104,239 |

|

|

|

$ |

125,781 |

|

|

Xcel Brands, Inc. and Subsidiaries |

|

Unaudited Condensed Consolidated Statements of Cash

Flows |

|

(in thousands) |

|

|

|

|

|

|

|

|

|

|

For the Six Months Ended |

|

|

June 30, |

|

|

2022 |

|

|

2021 |

|

|

|

|

|

|

|

Cash flows from operating activities |

|

|

|

|

|

|

|

Net income (loss) |

$ |

5,450 |

|

|

|

$ |

(4,442 |

) |

|

Adjustments to reconcile net income (loss) to net cash provided by

operating activities: |

|

|

|

|

|

|

|

Depreciation and amortization expense |

|

3,632 |

|

|

|

|

3,058 |

|

|

Amortization of deferred finance costs included in interest

expense |

|

156 |

|

|

|

|

109 |

|

|

Stock-based compensation |

|

517 |

|

|

|

|

591 |

|

|

Allowance for doubtful accounts |

|

90 |

|

|

|

|

132 |

|

|

Loss on extinguishment of debt |

|

2,324 |

|

|

|

|

821 |

|

|

Income tax provision (benefit) |

|

1,384 |

|

|

|

|

(1,484 |

) |

|

Net gain on sale of assets |

|

(20,608 |

) |

|

|

|

- |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

Accounts receivable |

|

(1,741 |

) |

|

|

|

(2,392 |

) |

|

Inventory |

|

(100 |

) |

|

|

|

(1,930 |

) |

|

Prepaid expenses and other assets |

|

8 |

|

|

|

|

(174 |

) |

|

Accounts payable, accrued expenses and other current

liabilities |

|

328 |

|

|

|

|

192 |

|

|

Cash paid in excess of rent expense |

|

(159 |

) |

|

|

|

(225 |

) |

|

Net cash used in by operating activities |

|

(8,719 |

) |

|

|

|

(5,744 |

) |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities |

|

|

|

|

|

|

|

Net proceeds from sale of majority interest in Isaac Mizrahi

brand |

|

45,408 |

|

|

|

|

|

|

Cash consideration for acquisition of Lori Goldstein assets |

|

- |

|

|

|

|

(1,616 |

) |

|

Purchase of other intangible assets |

|

- |

|

|

|

|

(37 |

) |

|

Purchase of property and equipment |

|

(85 |

) |

|

|

|

(747 |

) |

|

Net cash used in investing activities |

|

45,323 |

|

|

|

|

(2,400 |

) |

|

|

|

|

|

|

|

|

|

Cash flows from financing activities |

|

|

|

|

|

|

|

Proceeds from long-term debt |

|

- |

|

|

|

|

5 |

|

|

Shares repurchased including vested restricted stock in exchange

for withholding taxes |

|

(442 |

) |

|

|

|

- |

|

|

Proceeds from revolving loan debt |

|

- |

|

|

|

|

1,500 |

|

|

Proceeds from long-term debt |

|

- |

|

|

|

|

25,000 |

|

|

Payment of deferred finance costs |

|

- |

|

|

|

|

(1,131 |

) |

|

Payment of long-term debt |

|

(29,000 |

) |

|

|

|

(17,375 |

) |

|

Payment of breakage fees associated with extinguishment of

long-term debt |

|

(1,511 |

) |

|

|

|

(367 |

) |

|

Net cash used in financing activities |

|

(30,953 |

) |

|

|

|

7,632 |

|

|

|

|

|

|

|

|

|

|

Net (decrease) increase in cash, cash equivalents, and

restricted cash |

|

5,651 |

|

|

|

|

(512 |

) |

|

|

|

|

|

|

|

|

|

Cash, cash equivalents, and restricted cash at beginning of

period |

|

5,222 |

|

|

|

|

6,066 |

|

|

|

|

|

|

|

|

|

|

Cash, cash equivalents, and restricted cash at end of period |

$ |

10,873 |

|

|

|

$ |

5,554 |

|

|

|

|

|

|

|

|

|

|

Reconciliation to amounts on consolidated balance

sheets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

10,873 |

|

|

|

$ |

4,815 |

|

|

Restricted cash |

|

- |

|

|

|

|

739 |

|

|

Total cash, cash equivalents, and restricted cash |

$ |

10,873 |

|

|

|

$ |

5,554 |

|

|

|

|

|

|

|

|

|

|

Supplemental disclosure of non-cash

activities: |

|

|

|

|

|

|

|

Consideration payable to seller of Lori Goldstein assets |

$ |

- |

|

|

|

$ |

2,045 |

|

|

Contingent obligation related to acquisition of Lori Goldstein

assets at fair value |

|

- |

|

|

|

$ |

6,639 |

|

|

Liability for equity-based bonuses |

|

(283 |

) |

|

|

$ |

62 |

|

| |

|

|

|

|

|

|

|

Supplemental disclosure of cash flow

information: |

|

|

|

|

|

|

|

Cash paid during the period for interest |

$ |

1,032 |

|

|

|

$ |

852 |

|

|

Cash paid during the period for income taxes |

$ |

- |

|

|

|

$ |

15 |

|

Non-GAAP net income and non-GAAP diluted EPS are

non-GAAP unaudited terms. We define non-GAAP net income as net

income (loss) attributable to Xcel Brands, Inc. stockholders,

exclusive of amortization of trademarks, stock-based compensation,

certain adjustments to the provision for doubtful accounts related

to the bankruptcy of and economic impact on certain retail

customers due to the COVID-19 pandemic, gain on the sale of assets

and income taxes. Non-GAAP net income and non-GAAP diluted EPS

measures do not include the tax effect of the aforementioned

adjusting items, due to the nature of these items and the Company’s

tax strategy.

Adjusted EBITDA is a non-GAAP unaudited measure,

which we define as net income (loss) attributable to Xcel Brands,

Inc. stockholders, before depreciation and amortization, interest

and finance expenses (including loss on extinguishment of debt, if

any), income taxes, other state and local franchise taxes, gain on

the sale of assets and stock-based compensation.

Management uses non-GAAP net income, non-GAAP

diluted EPS, and Adjusted EBITDA as measures of operating

performance to assist in comparing performance from period to

period on a consistent basis and to identify business trends

relating to our results of operations. Management believes non-GAAP

net income, non-GAAP diluted EPS, and Adjusted EBITDA are also

useful because these measures adjust for certain costs and other

events that management believes are not representative of our core

business operating results, and thus these non-GAAP measures

provide supplemental information to assist investors in evaluating

our financial results. Adjusted EBITDA is the measure used to

calculate compliance with the EBITDA covenant under our term loan

agreement.

Non-GAAP net income, non-GAAP diluted EPS, and

Adjusted EBITDA should not be considered in isolation or as

alternatives to net income, earnings per share, or any other

measure of financial performance calculated and presented in

accordance with GAAP. Given that non-GAAP net income, non-GAAP

diluted EPS, and Adjusted EBITDA are financial measures not deemed

to be in accordance with GAAP and are susceptible to varying

calculations, our non-GAAP net income, non-GAAP diluted EPS, and

Adjusted EBITDA may not be comparable to similarly titled measures

of other companies, including companies in our industry, because

other companies may calculate these measures in a different manner

than we do. In evaluating non-GAAP net income, non-GAAP diluted

EPS, and Adjusted EBITDA, you should be aware that in the future we

may or may not incur expenses similar to some of the adjustments in

this document. Our presentation of non-GAAP net income, non-GAAP

diluted EPS, and Adjusted EBITDA does not imply that our future

results will be unaffected by these expenses or any unusual or

non-recurring items. When evaluating our performance, you should

consider non-GAAP net income, non-GAAP diluted EPS, and Adjusted

EBITDA alongside other financial performance measures, including

our net income and other GAAP results, and not rely on any single

financial measure.

| |

Three Months

Ended |

|

Six Months

Ended |

| ($

in thousands) |

June

30, |

|

June

30, |

|

June

30, |

|

June

30, |

|

|

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

Net income (loss) attributable to Xcel Brands, Inc.

stockholders |

$ |

9,490 |

|

|

$ |

(1,558 |

) |

|

$ |

6,003 |

|

|

$ |

(4,105 |

) |

| Amortization

of trademarks |

|

1,525 |

|

|

|

1,520 |

|

|

|

3,039 |

|

|

|

2,396 |

|

|

Stock-based compensation |

|

485 |

|

|

|

431 |

|

|

|

517 |

|

|

|

591 |

|

| Loss on

extinguishment of debt |

|

2,324 |

|

|

|

821 |

|

|

|

2,324 |

|

|

|

821 |

|

| Certain

adjustments to provision for doubtful accounts |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

132 |

|

| Gain on

the sale of assets |

|

(20,608 |

) |

|

|

- |

|

|

|

(20,608 |

) |

|

|

- |

|

| Income tax

provision (benefit) |

|

3,178 |

|

|

|

(1,346 |

) |

|

|

3,178 |

|

|

|

(1,484 |

) |

| Non-GAAP

net loss |

$ |

(3,606 |

) |

|

$ |

(132 |

) |

|

$ |

(5,547 |

) |

|

$ |

(1,649 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months

Ended |

|

Six Months

Ended |

|

|

June

30, |

|

June

30, |

|

June

30, |

|

June

30, |

|

|

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

| Diluted

earnings (loss) per share |

$ |

0.48 |

|

|

$ |

(0.08 |

) |

|

$ |

0.31 |

|

|

$ |

(0.22 |

) |

| Amortization

of trademarks |

|

0.08 |

|

|

|

0.08 |

|

|

|

0.16 |

|

|

|

0.12 |

|

|

Stock-based compensation |

|

0.02 |

|

|

|

0.02 |

|

|

|

0.03 |

|

|

|

0.03 |

|

| Loss on

extinguishment of debt |

|

0.12 |

|

|

|

0.04 |

|

|

|

0.12 |

|

|

|

0.04 |

|

| Certain

adjustments to provision for doubtful accounts |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

0.01 |

|

| Gain on

the sale of assets |

|

(1.05 |

) |

|

|

- |

|

|

|

(1.05 |

) |

|

|

- |

|

| Income tax

provision (benefit) |

|

0.16 |

|

|

|

(0.07 |

) |

|

|

0.16 |

|

|

|

(0.08 |

) |

| Non-GAAP

diluted EPS |

$ |

(0.18 |

) |

|

$ |

(0.01 |

) |

|

$ |

(0.28 |

) |

|

$ |

(0.09 |

) |

| Non-GAAP

weighted average diluted shares |

|

19,571,119 |

|

|

|

19,261,436 |

|

|

|

19,418,469 |

|

|

|

19,092,828 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months

Ended |

|

Six Months

Ended |

| ($

in thousands) |

June

30, |

|

June

30, |

|

June

30, |

|

June

30, |

|

|

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

| Net

income (loss) attributable to Xcel Brands, Inc. stockholders |

$ |

9,490 |

|

|

$ |

(1,558 |

) |

|

$ |

6,003 |

|

|

$ |

(4,105 |

) |

| Depreciation

and amortization |

|

1,812 |

|

|

|

1,848 |

|

|

|

3,632 |

|

|

|

3,058 |

|

| Interest

and finance expense |

|

478 |

|

|

|

622 |

|

|

|

1,187 |

|

|

|

902 |

|

| Income tax

provision (benefit) |

|

3,178 |

|

|

|

(1,346 |

) |

|

|

3,178 |

|

|

|

(1,484 |

) |

| State and

local franchise taxes |

|

- |

|

|

|

33 |

|

|

|

36 |

|

|

|

72 |

|

| Stock-based

compensation |

|

485 |

|

|

|

431 |

|

|

|

517 |

|

|

|

591 |

|

| Loss on

extinguishment of debt |

|

2,324 |

|

|

|

821 |

|

|

|

2,324 |

|

|

|

821 |

|

| Certain

adjustments to provision for doubtful accounts |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

132 |

|

| Gain on

the sale of assets |

|

(20,608 |

) |

|

|

- |

|

|

|

(20,608 |

) |

|

|

- |

|

| Adjusted

EBITDA |

$ |

(2,841 |

) |

|

$ |

851 |

|

|

$ |

(3,731 |

) |

|

$ |

(13 |

) |

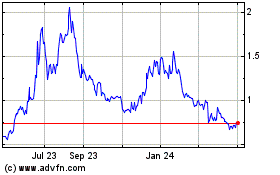

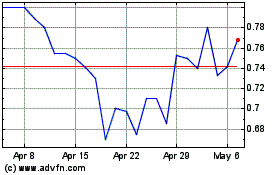

Xcel Brands (NASDAQ:XELB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Xcel Brands (NASDAQ:XELB)

Historical Stock Chart

From Apr 2023 to Apr 2024