XTL Biopharmaceuticals Announces Financial Results for the Year Ended December 31, 2007

21 March 2008 - 8:15AM

PR Newswire (US)

VALLEY COTTAGE, N.Y., March 20 /PRNewswire-FirstCall/ -- XTL

Biopharmaceuticals Ltd. (NASDAQ:XTLB)(TASE:XTL), a

biopharmaceutical company engaged in the acquisition and

development of therapeutics for the treatment of unmet medical

needs, particularly diabetic neuropathic pain and hepatitis C,

today announced its financial results for the year ended December

31, 2007. At December 31, 2007, the Company had cash, cash

equivalents and short- term bank deposits of $13.0 million,

compared to $25.2 million at December 31, 2006. The decrease of

$12.2 million during the year ended December 31, 2007 was

attributable primarily to the Company's $7.5 million initial

upfront license payment made in connection with the in-licensing of

Bicifadine, a serotonin and norepinephrine reuptake inhibitor for

the treatment of diabetic neuropathic pain, in January 2007,

operating expenditures associated with the Phase 2b clinical trial

of Bicifadine, the development of the DOS hepatitis C pre-clinical

program, and operating expenditures associated with the Company's

legacy hepatitis C clinical programs that were terminated in 2007,

offset by $8.8 million in net proceeds from the private placement

that was completed in November 2007. The loss for the year ended

December 31, 2007 was $24.9 million, or $0.11 per ordinary share,

compared to a loss of $15.1 million, or $0.08 per ordinary share,

for the year ended December 31, 2006, representing an increase in

net loss of $9.8 million. The increased loss was primarily

attributable to the $7.5 million upfront license fee in connection

with the in-licensing of Bicifadine and additional costs associated

with the Bicifadine clinical program, offset by lower costs

associated with the Company's legacy hepatitis C clinical programs.

The increase in loss was also due to a $1.6 million charge that was

recorded in 2007 relating to the fair-value of stock appreciation

rights granted as a transaction advisory fee to certain third party

intermediaries in connection with the Bicifadine transaction. Also,

for the years ended December 31, 2007 and 2006, the Company's loss

of $24.9 million and $15.1 million, respectively, included $1.9

million and $2.2 million, respectively, of non-cash stock option

compensation expense. Ron Bentsur, Chief Executive Officer of XTL,

commented, "2007 was a pivotal year for XTL. The year began with

the in-licensing of Bicifadine, a member of the SNRI class. In

September, we initiated a multi-center, double- blind,

placebo-controlled Phase 2b clinical trial with Bicifadine in

diabetic neuropathic pain, an indication where the SNRI class has

demonstrated consistent efficacy. We expect to complete and

announce results from this study in the fourth quarter of 2008."

Mr. Bentsur added, "In November 2007, we strengthened our cash

position with the completion of a $9.8 million fund- raising to

institutional investors. We believe that this fund-raising, coupled

with the pending $4.0 million upfront payment from the recently

announced out-licensing transaction of our hepatitis C pre-clinical

program, provides us with sufficient capital well into the first

quarter of 2009." ABOUT XTL BIOPHARMACEUTICALS LTD. XTL

Biopharmaceuticals Ltd. ("XTL") is engaged in the development of

therapeutics for the treatment of diabetic neuropathic pain and

HCV. XTL is developing Bicifadine, a serotonin and norepinephrine

reuptake inhibitor, for the treatment of diabetic neuropathic pain,

which is currently in a Phase 2b study. XTL has out-licensed its

novel pre-clinical HCV small molecule inhibitor program. XTL also

has an active in-licensing and acquisition program designed to

identify and acquire additional drug candidates. XTL is publicly

traded on the NASDAQ and Tel-Aviv Stock Exchanges

(NASDAQ:XTLB)(TASE:XTL). Cautionary Statement Some of the

statements included in this press release, particularly those

anticipating future financial performance, clinical and business

prospects for our clinical compound for neuropathic pain,

Bicifadine, and for our pre- clinical compounds for hepatitis C

from our XTL-DOS program, growth and operating strategies and

similar matters, may be forward-looking statements that involve a

number of risks and uncertainties. For those statements, we claim

the protection of the safe harbor for forward-looking statements

contained in the Private Securities Litigation Reform Act of 1995.

Among the factors that could cause our actual results to differ

materially is our ability to complete in a timely and cost

effective manner clinical trials on Bicifadine, which could

directly impact our ability to continue to fund our operations; our

ability to meet anticipated development timelines for all of our

drug candidates due to recruitment, clinical trial results,

manufacturing capabilities or other factors; the success of our

drug development and marketing arrangements with third parties; and

other risk factors identified from time to time in our reports

filed with the Securities and Exchange Commission, including our

annual report on Form 20-F filed with the Securities and Exchange

Commission on March 23, 2007. Any forward-looking statements set

forth in this press release speak only as of the date of this press

release. We do not intend to update any of these forward-looking

statements to reflect events or circumstances that occur after the

date hereof. This press release and prior releases are available at

http://www.xtlbio.com/ . The information in our website is not

incorporated by reference into this press release and is included

as an inactive textual reference only. XTL Biopharmaceuticals Ltd.

Selected Consolidated Financial Data (Thousands of US Dollars,

Except Share and Per Share Data) Statements of Operations

Information: Year ended December 31, 2007 2006 ------------

------------ (unaudited) Revenues: Reimbursed out-of-pocket

expenses -- -- License 907 454 ------------ ------------ 907 454

Cost of revenues: Reimbursed out-of-pocket expenses -- -- License

(with respect to royalties) 110 54 ------------ ------------ 110 54

Gross margin 797 400 ------------ ------------ Research and

development costs (includes $7,500 initial upfront license fee in

2007 and also includes non-cash stock option compensation of $141

and $173, in 2007 and 2006, respectively) 18,998 10,229 Less -

participations 56 -- ------------ ----------- 18,942 10,229 General

and administrative expenses (includes non-cash stock option

compensation of $1,784 and $1,992, in 2007 and 2006, respectively)

5,582 5,576 Business development costs (includes stock appreciation

rights compensation of $1,560 in 2007 and also includes non-cash

stock option compensation of $22 and $15, in 2007 and 2006,

respectively) 2,008 641 ------------ ------------ Operating loss

25,735 16,046 Financial and other income, net 590 1,141

------------ ------------ Loss before income taxes 25,145 14,905

Income taxes (206) 227 ------------ ------------ Loss for the

period 24,939 15,132 ============ ============ Basic and diluted

loss per ordinary share $0.11 $0.08 ============ ============

Weighted average number of shares used in computing basic and

diluted loss per ordinary share 228,492,818 201,737,295

============ ============ Balance Sheet Information: December 31,

2007 2006* ------------ ------------ (unaudited) Cash, cash

equivalents, and bank deposits 12,977 25,245 Total assets 14,127

26,900 Accumulated deficit (139,862) (114,923) Total shareholders'

equity 8,564 22,760 * Condensed from audited financial statements.

DATASOURCE: XTL Biopharmaceuticals Ltd. CONTACT: Ron Bentsur, Chief

Executive Officer, of XTL Biopharmaceuticals Ltd., +1-845-267-0707,

ext. 225 Web site: http://www.xtlbio.com/

Copyright

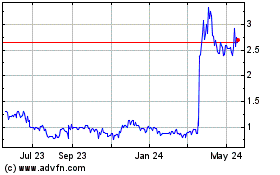

XTL Biopharmaceuticals (NASDAQ:XTLB)

Historical Stock Chart

From Jun 2024 to Jul 2024

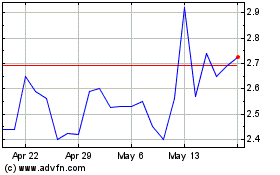

XTL Biopharmaceuticals (NASDAQ:XTLB)

Historical Stock Chart

From Jul 2023 to Jul 2024