Air Liquide successfully completes the first step in refinancing the Airgas acquisition

07 June 2016 - 3:32AM

Business Wire

Regulatory News:

Air Liquide (Paris:AI) announces the placement today of a

3-billion euro bond issue that constitutes the first step in

refinancing its acquisition of Airgas. This transaction involves

the issuances of several bond tranches ranging from 2 to 12 years,

with a weighted average maturity of 7.3 years.

The 3-billion euros raised enable the Group to refinance a

portion of the bridge loan of 12 billion US dollars that was

contracted in December 2015 from its main banks in connection with

the acquisition of the US-based company Airgas, and to continue to

sustainably finance the Group’s long-term growth.

The characteristics of the bonds issued under the Group’s

12-billion euro Euro Medium Term Note (EMTN) program

are the following:

- Amount: 3 billion euros, in 5

tranches (from 500 million to 1 billion euros on the 12

years)

- Issuer: Air Liquide Finance,

garanteed by L’Air Liquide S.A.

- Maturities: 2, 4, 6, 8 and 12

years

- Format: Floating rate for the 2-year

tranche and fixed rate for the other tranches

- Coupons: 3-month Euribor + 0.20% on

the 2-year tranche, 0.125% on the 4-year, 0.50% on the 6-year,

0.75% on the 8-year, and 1.25% on the 12-year, for a weighted

average rate of 0.65%.

This issue is rated A- by Standard & Poor’s and

A-3 by Moody’s.

With the completion of this transaction, the total amount of

bond issues outstanding to date is approximately 10.6 billion euros

for the Group, with an average maturity of 5.7 years.

In addition, the base prospectus of the EMTN program, updated on

June 3rd, 2016, is available on the Air Liquide website at the

following address:

https://www.airliquide.com/investors/financing-tools. It provides

up-to-date information pertaining to the Group’s risk factors,

specifically those related to the acquisition of Airgas.

UPCOMING DATES

Capital Markets Day:July 6, 2016

First half 2016 revenue and results:August 1, 2016

The world leader in gases, technologies and services for

Industry and Health, Air Liquide is present in 80 countries with

approximately 68,000 employees and serves more than 3 million

customers and patients.* Oxygen, nitrogen and hydrogen have been at

the core of the company’s activities since its creation in 1902.

Air Liquide’s ambition is to be the leader in its industry,

delivering long-term performance and acting responsibly.

Air Liquide ideas create value over the long term. At the core

of the company’s development are the commitment and constant

inventiveness of its people.

Air Liquide anticipates the challenges of its markets, invests

locally and globally, and delivers high-quality solutions to its

customers and patients, and the scientific community.

The company relies on competitiveness in its operations,

targeted investments in growing markets and innovation to deliver

profitable growth over the long-term.

Air Liquide’s revenues amounted to €16.4 billion in 2015, and

its solutions that protect life and the environment represented

more than 40% of sales. On 23 May 2016, Air Liquide completed its

acquisition of Airgas, which had revenues amounting to $5.3 billion

(around €4.8 billion) for the fiscal year ending 31 March 2016.

Air Liquide is listed on the Paris Euronext stock exchange

(compartment A) and is a member of the CAC 40 and Dow Jones Euro

Stoxx 50 indexes.

*Following the acquisition of Airgas on 23 May 2016

www.airliquide.comFollow us on Twitter

@AirLiquideGroup

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160606006279/en/

Air LiquideCorporate CommunicationsCaroline Philips, +33

(0)1 40 62 50 84Annie Fournier, +33 (0)1 40 62 51 31orInvestor

RelationsAude Rodriguez, +33 (0)1 40 62 57 08Erin Sarret, +33

(0)1 40 62 57 37Louis Laffont, +33 (0)1 40 62 57 18orGroup

Financing & TreasuryJacques Molgo, +33 (0)1 40 62 57 75Aude

Revel, +33 (0)1 40 62 56 64

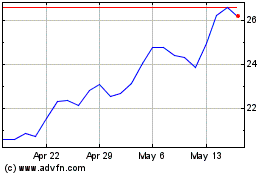

C3 AI (NYSE:AI)

Historical Stock Chart

From Jun 2024 to Jul 2024

C3 AI (NYSE:AI)

Historical Stock Chart

From Jul 2023 to Jul 2024