Report of Foreign Issuer (6-k)

28 March 2018 - 9:03PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 6-K

Report

Of Foreign Private Issuer

Pursuant

To Rule 13a-16 Or 15d-16 Of

The

Securities Exchange Act Of 1934

For the month

of March 2018

Commission

File Number: 000-54290

Grupo Aval Acciones y Valores S.A.

(Exact

name of registrant as specified in its charter)

Carrera

13 No. 26A - 47

Bogotá

D.C., Colombia

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

GRUPO

AVAL ACCIONES Y VALORES S.A.

TABLE

OF CONTENTS

|

ITEM

|

|

|

1.

|

Report of Relevant Information dated March 27, 2018

|

|

2.

|

Resolutions adopted by the General Shareholders Meeting held on March 23, 2018

|

Item 1

RELEVANT

INFORMATION

Grupo

Aval Acciones y Valores S.A. (“Grupo Aval”) informs that on March 21, 2018, the Board of Directors approved an amendment

to the accounting policies of the company, with respect to the rules applicable to the preparation of Grupo Aval’s consolidated

financial statements in Colombia.

As

a result of the mentioned approval, as of January 1, 2018, Grupo Aval will prepare its consolidated financial statements according

to International Financial Reporting Standards (“IFRS”) issued by International Accounting Standards Board (“IASB”).

Grupo Aval currently applies these rules in the preparation of the consolidated financial statements reported to investors abroad.

This

decision, allows the standardization of information reported to local and international investors under the same accounting rules.

The amendment of policies also considers that with the implementation of IFRS 9 in Colombia, as of January 1, 2018, the principal

differences between accounting policies applied for local purposes and rules issued by IASB, will disappear. Consequently, such

modification will not have relevant effects in Grupo Aval’s financial statements.

Item 2

Grupo

Aval Acciones y Valores S.A. (“Grupo Aval”) informs that the ordinary session of the General Shareholders Meeting,

held on March 23, 2018, has:

|

|

1.

|

Approved

the company’s financial statements, management report and other attachments, for

the year ended on December 31, 2017. It further approved the following proposed distribution

of profits:

|

GRUPO

AVAL ACCIONES Y VALORES S.A.

APPROVED

DISTRIBUTION OF PROFITS

FOR

THE PERIOD BEGINNING ON JANUARY 1st AND ENDING ON DECEMBER 31st, 2017

GENERAL

MEETING OF SHAREHOLDERS

|

Net Income

|

|

|

|

|

|

|

|

|

|

2,001,177,878,368.99*

|

|

|

|

|

|

|

|

|

|

|

|

With tax benefit

|

|

|

|

|

|

|

2,001,177,878,368.99

|

|

|

Without tax benefit

|

|

|

|

|

|

|

0.00

|

|

|

|

|

|

|

|

|

|

|

|

|

Plus:

|

|

|

|

|

|

|

|

|

|

Occasional reserve release at the disposal of the General Meeting of shareholders

|

|

|

|

|

|

|

|

|

|

5,333,761,499,614.71

|

|

With tax benefit

|

|

|

|

|

|

|

3,276,142,684,872.74

|

|

|

Without tax benefit

|

|

|

|

|

|

|

2,057,618,814,741.97

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Income available for disposal of the General meeting of Shareholders

|

|

|

|

|

|

|

|

|

|

7,334,939,377,983.70

|

|

|

|

|

|

|

|

|

|

|

|

To distribute a cash dividend of $ 4.00 per share per month

from April, 2018 to March, 2019, including

those

two months, over 22,281,017,159 outstanding shares as of the date of this meeting.

|

|

|

|

|

|

|

|

|

|

1,069,488,823,632.00

|

|

|

|

|

|

|

|

|

|

|

|

With benefit

|

|

|

|

|

|

|

1,069,488,823,632.00

|

|

|

These dividends were taken from profits of year 2016 and previous years, consequently they may be distributed with benefit to shareholders.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: Dividends shall be paid within the first ten (10) days of each month according to applicable regulations. In accordance with article 2.23.1.1.4 of Decree 2555 of 2010 (modified by Decree 4766 of 2011) and the regulations of the Colombian Stock Exchange, dividends for the month of April 2018, will be paid from the fourth trading day following the date in which the General Meeting of Shareholders approves the distribution of profits, which is from April 2. In this month, dividends will be paid until April 11.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Occasional reserve at the disposal of General Meeting of Shareholders

|

|

|

|

|

|

|

|

|

|

6,265,450,554,351.70

|

|

|

|

|

|

|

|

|

|

|

|

Total with tax benefit

|

|

|

|

|

|

|

|

|

|

Year 2017 -with tax benefit:

|

|

|

2,001,177,878,368.99

|

|

|

|

|

|

|

Acumulated - with tax benefit

|

|

|

2,206,653,861,240.74

|

|

|

|

4,207,831,739,609.73

|

|

|

|

|

|

|

|

|

|

|

|

|

Total without tax benefit

|

|

|

|

|

|

|

|

|

|

Year 2017 - without tax benefit

|

|

|

0

|

|

|

|

|

|

|

Acumulated - without tax benefit

|

|

|

2,057,618,814,741.97

|

|

|

|

2,057,618,814,741.97

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL

|

|

|

|

|

|

|

|

|

|

7,334,939,377,983.70

|

*

Since year 2017, distributed dividends regarding profits of year 2017 and subsecuent years, will be taxable and subject to witholding

tax, according to articles 242, 245, 246, 342 and 343 of the Colombian Tax Code (Law 1819 of 2016). With respect to distributed

dividends from profits prior to year 2017, they will be taxable and subject to witholding tax if they are distributed from the

reserves without benefit to shareholders.

Item 2

2.

Elected, as members of the Board of Directors, for the period beginning in April 1, 2018 and ending on March 31, 2019, the following

individuals:

BOARD

OF DIRECTORS - GRUPO AVAL ACCIONES Y VALORES S.A.

2018

- 2019:

|

PRINCIPAL

|

ALTERNATE

|

|

|

|

|

Luis

Carlos Sarmiento Angulo

|

Mauricio

Cárdenas Müller

|

|

Alejandro

Figueroa Jaramillo

|

Juan

María Robledo Uribe

|

|

Efraín

Otero Álvarez

|

Juan

Camilo Ángel Mejía

|

|

Álvaro

Velásquez Cock

|

Ana

María Cuellar de Jaramillo

|

|

Fabio

Castellanos Ordoñez

|

Luis

Fernando López Roca

|

|

German

Michelsen Cuellar

|

Gabriel

Mesa Zuleta

|

|

Esther

América Paz Montoya

|

Germán

Villamil Pardo

|

3.

Re-elected KPMG Ltda. as External Auditor of the company. KPMG Ltda. will appoint the individuals that will act as principal and

alternate External Auditor of the Company, on behalf of such firm.

In

addition to the aforementioned decisions, the Company informs that the following will be the ex-dividend dates applicable to the

period beginning on April 2018 and ending on March 2019

|

Ex-dividend

Dates - April 2018 to March 2019(*)

|

|

Month

|

Initial

ex-dividend date

|

Final

ex-dividend date

|

|

April,

2018

|

03.26.2018

|

04.02.2018

|

|

May,

2018

|

04.25.2018

|

05.02.2018

|

|

June,

2018

|

05.28.2018

|

06.01.2018

|

|

July,

2018

|

06.26.2018

|

07.03.2018

|

|

August,

2018

|

07.26.2018

|

08.01.2018

|

|

September,

2018

|

08.28.2018

|

09.03.2018

|

|

October,

2018

|

09.25.2018

|

10.01.2018

|

|

November,

2018

|

10.26.2018

|

11.01.2018

|

|

December,

208

|

11.27.2018

|

12.03.2018

|

|

January,

2019

|

12.26.2018

|

01.02.2019

|

|

February,

2019

|

01.28.2019

|

02.01.2019

|

|

March,

2019

|

02.25.2019

|

03.01.2019

|

(*) Ex-Dividend dates may vary

subject to any determination of the Colombian Stock Exchange with respect to the business days for trading purposes.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

Date: March

27, 2018

|

|

|

GRUPO AVAL ACCIONES Y VALORES S.A.

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Jorge Adrián

Rincón Plata

|

|

|

|

|

|

Name:

|

Jorge Adrián Rincón Plata

|

|

|

|

|

|

Title:

|

Chief Legal Counsel

|

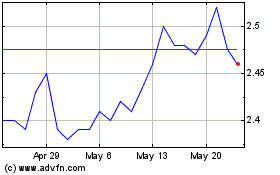

Grupo Aval Acciones y Va... (NYSE:AVAL)

Historical Stock Chart

From Jun 2024 to Jul 2024

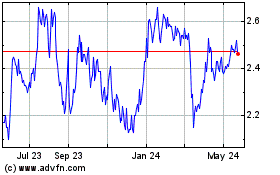

Grupo Aval Acciones y Va... (NYSE:AVAL)

Historical Stock Chart

From Jul 2023 to Jul 2024