false000000743100000074312024-10-292024-10-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 29, 2024

ARMSTRONG WORLD INDUSTRIES, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Pennsylvania |

|

1-2116 |

|

23-0366390 |

(State or other jurisdiction of incorporation or organization) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

|

|

2500 Columbia Avenue P.O. Box 3001 Lancaster, Pennsylvania |

|

17603 |

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (717) 397-0611

NA

(Former name or former address if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, $0.01 par value per share |

|

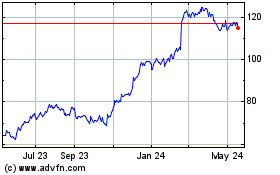

AWI |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ◻

Section 2 - Financial Information

Item 2.02 Results of Operations and Financial Condition.

On October 29, 2024, Armstrong World Industries, Inc. (the "Company") issued a press release announcing its third quarter 2024 consolidated financial results. The full text of the press release is attached hereto as Exhibit 99.1.

The information in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, is being furnished herewith and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Act”), or the Exchange Act, except as expressly set forth by specific reference in such filing.

Section 7 – Regulation FD

Item 7.01 Regulation FD Disclosure.

On October 29, 2024, the Company issued a press release announcing that it will report its third quarter 2024 consolidated financial results via a webcast and conference call on October 29, 2024 at 10:00 a.m. Eastern Time which can be accessed through the “Investors” section of the Company’s website, www.armstrongceilings.com. During this report, the Company will reference a slide presentation, a copy of which is attached hereto as Exhibit 99.2 and incorporated herein by reference.

The information in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.2, is being furnished herewith and shall not be deemed “filed” for the purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Act, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Section 9 – Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

ARMSTRONG WORLD INDUSTRIES, INC. |

|

|

By: |

|

/s/ Austin K. So |

|

|

Austin K. So |

|

|

Senior Vice President, General Counsel, Secretary and Chief Compliance Officer |

Date: October 29, 2024

Exhibit 99.1

Armstrong World Industries Reports

Third-Quarter 2024 Results

•Record setting quarterly net sales of $387 million, an increase of 11%

•Operating income increased 11% and diluted net earnings per share increased 12%

•Adjusted EBITDA up 11% and adjusted diluted net earnings per share up 13%

•Raising full-year 2024 guidance for adjusted EBITDA, adjusted diluted net earnings per share and adjusted free cash flow

(Comparisons above are versus the prior-year period unless otherwise stated)

LANCASTER, Pa., Oct. 29, 2024 -- Armstrong World Industries, Inc. (NYSE:AWI), a leader in the design, innovation and manufacture of ceiling and wall solutions in the Americas, today reported third-quarter 2024 financial results highlighted by robust sales and earnings growth.

“With another quarter of record setting sales and strong earnings growth, we continue to demonstrate our ability to deliver growth despite muted market conditions through operational execution and our investments in strategic acquisitions, innovation and digital initiatives,” said Vic Grizzle, President and CEO of Armstrong World Industries. “As market demand continues to stabilize, we are well positioned to deliver full year double-digit top and bottom-line growth with industry-leading margin performance through strong Mineral Fiber Average Unit Value improvement, market-driven innovation, operational excellence and Architectural Specialties growth.”

Third-Quarter Results

|

|

|

|

|

|

|

|

|

|

|

(Dollar amounts in millions except per-share data) |

|

For the Three Months Ended September 30, |

|

|

|

|

|

2024 |

|

|

2023 |

|

|

Change |

Net sales |

|

$ |

386.6 |

|

|

$ |

347.3 |

|

|

11.3% |

Operating income |

|

$ |

111.3 |

|

|

$ |

100.2 |

|

|

11.1% |

Operating income margin (Operating income as a % of net sales) |

|

|

28.8 |

% |

|

|

28.9 |

% |

|

(10)bps |

Net earnings |

|

$ |

76.9 |

|

|

$ |

69.5 |

|

|

10.6% |

Diluted net earnings per share |

|

$ |

1.75 |

|

|

$ |

1.56 |

|

|

12.2% |

|

|

|

|

|

|

|

|

|

Additional Non-GAAP* Measures |

|

|

|

|

|

|

|

|

Adjusted EBITDA |

|

$ |

139 |

|

|

$ |

125 |

|

|

11.2% |

Adjusted EBITDA margin (Adjusted EBITDA as a % of net sales) |

|

|

35.9 |

% |

|

|

36.0 |

% |

|

(10)bps |

Adjusted net earnings |

|

$ |

79 |

|

|

$ |

71 |

|

|

11.1% |

Adjusted diluted net earnings per share |

|

$ |

1.81 |

|

|

$ |

1.60 |

|

|

13.1% |

* The Company uses non-GAAP adjusted measures in managing the business and believes the adjustments provide meaningful comparisons of operating performance between periods and are useful alternative measures of performance. Reconciliations of the most comparable generally accepted accounting principles in the United States ("GAAP") measure are found in the tables at the end of this press release. Excluding per share data, non-GAAP figures are rounded to the nearest million and corresponding percentages are rounded to the nearest decimal.

Third-quarter 2024 consolidated net sales increased 11.3% from prior-year results, driven by higher volumes of $30 million and favorable Average Unit Value (dollars per unit sold, or "AUV") of $9 million. Architectural Specialties net sales increased $31 million and Mineral Fiber net sales increased $8 million. Architectural Specialties segment net sales improved primarily due to a $25 million increase from our April 2024 acquisition of 3form, LLC ("3form") and our

July 2023 acquisition of BOK Modern, LLC ("BOK"). The increase in Mineral Fiber net sales was primarily driven by favorable AUV.

Consolidated operating income increased 11.1% in the third quarter of 2024 primarily due to a $17 million margin benefit from higher sales volumes, a $6 million benefit from favorable AUV and a $2 million increase in Worthington Armstrong Joint Venture ("WAVE") equity earnings. These benefits were partially offset by a $13 million increase in selling, general and administrative (“SG&A”) expenses, primarily due to the impact of acquisitions, and to a lesser extent, an increase in Mineral Fiber SG&A expenses.

Third-Quarter Segment Results

Mineral Fiber

|

|

|

|

|

|

|

|

|

|

|

(Dollar amounts in millions) |

|

For the Three Months Ended September 30, |

|

|

|

|

|

2024 |

|

|

2023 |

|

|

Change |

Net sales |

|

$ |

258.0 |

|

|

$ |

249.7 |

|

|

3.3% |

Operating income |

|

$ |

93.0 |

|

|

$ |

85.5 |

|

|

8.8% |

Adjusted EBITDA* |

|

$ |

113 |

|

|

$ |

105 |

|

|

8.2% |

Operating income margin |

|

|

36.0 |

% |

|

|

34.2 |

% |

|

180bps |

Adjusted EBITDA margin* |

|

|

43.9 |

% |

|

|

41.9 |

% |

|

200bps |

Mineral Fiber net sales increased 3.3% in the third quarter of 2024 due to $10 million of favorable AUV, partially offset by $1 million of lower sales volumes. The improvement in AUV was driven by favorable like-for-like pricing.

Mineral Fiber operating income increased in the third quarter of 2024 primarily due to a $6 million benefit from favorable AUV, a $3 million decrease in manufacturing and input costs and a $2 million increase in WAVE equity earnings primarily driven by favorable AUV. These benefits were partially offset by a $3 million increase in SG&A expenses, primarily driven by higher incentive compensation.

Architectural Specialties

|

|

|

|

|

|

|

|

|

|

|

(Dollar amounts in millions) |

|

For the Three Months Ended September 30, |

|

|

|

|

|

2024 |

|

|

2023 |

|

|

Change |

Net sales |

|

$ |

128.6 |

|

|

$ |

97.6 |

|

|

31.8% |

Operating income |

|

$ |

19.2 |

|

|

$ |

15.5 |

|

|

23.9% |

Adjusted EBITDA* |

|

$ |

26 |

|

|

$ |

20 |

|

|

27.1% |

Operating income margin |

|

|

14.9 |

% |

|

|

15.9 |

% |

|

(100)bps |

Adjusted EBITDA margin* |

|

|

20.1 |

% |

|

|

20.8 |

% |

|

(70)bps |

Architectural Specialties net sales increased 31.8% in the third quarter of 2024 driven primarily by a $25 million increase due to the acquisitions of 3form and BOK, in addition to increased custom metal project net sales.

Architectural Specialties operating income increased in the third quarter of 2024 primarily due to an $18 million margin benefit from increased sales, driven primarily by the acquisitions of 3form and BOK, and partially due to improved custom project margins. This increase largely offset a $10 million increase in SG&A expenses and a $4 million increase in manufacturing costs, both of which were primarily due to the acquisitions of 3form and BOK.

Unallocated Corporate

Unallocated Corporate operating loss was $1 million in the third quarter of 2024 and 2023.

Cash Flow

Year-to-date cash flows from operating activities in 2024 increased $4 million in comparison to the prior-year period. The favorable change in operating cash flows was primarily driven by higher cash earnings partially offset by net unfavorable working capital impacts. Year-to-date cash flows from investing activities decreased $51 million versus the prior-year period primarily due to $94 million of cash paid for the acquisition of 3form, partially offset by proceeds received from sales of real estate.

Share Repurchase Program

During the third quarter of 2024, we repurchased 0.1 million shares of common stock for a total cost of $15 million, excluding the cost of commissions and taxes. As of September 30, 2024, there was $677 million remaining under our Board of Directors' current authorized share repurchase program**.

** In July 2016, our Board of Directors approved a share repurchase program authorizing us to repurchase up to $150 million of our outstanding common stock through July 2018 (the “Program”). Pursuant to additional authorizations and extensions of the Program approved by our Board of Directors, including $500 million authorized on July 18, 2023, we are authorized to purchase up to $1,700 million of our outstanding shares of common stock through December 2026. Since inception and through September 30, 2024, we have repurchased 14.5 million shares under the Program for a total cost of $1,023 million, excluding commissions and taxes.

Updating 2024 Outlook

“We delivered strong profitability in the third quarter, highlighted by forty-four percent Mineral Fiber and twenty percent Architectural Specialties adjusted EBITDA margins. With our strong third quarter results and an improved profitability outlook for the remainder of the year, we are increasing our full-year 2024 guidance for adjusted EBITDA and adjusted diluted net earnings per share, as well as modestly increasing guidance for adjusted free cash flow, while tightening the range on our full-year sales outlook,” said Chris Calzaretta, AWI Senior Vice President and CFO. “We remain focused on expanding adjusted EBITDA margin at the total company level and expect to deliver a fourth consecutive year of net sales and earnings growth in 2024. With a strong balance sheet and our demonstrated ability to generate cash, we expect to continue to execute our capital allocation strategy to drive shareholder value.”

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Year Ended December 31, 2024 |

(Dollar amounts in millions except per-share data) |

2023 Actual |

|

Current Guidance |

|

VPY Growth % |

Net sales |

$ |

1,295 |

|

$ |

1,420 |

|

to |

$ |

1,435 |

|

10% |

to |

11% |

Adjusted EBITDA* |

$ |

430 |

|

$ |

482 |

|

to |

$ |

490 |

|

12% |

to |

14% |

Adjusted diluted net earnings per share* |

$ |

5.32 |

|

$ |

6.15 |

|

to |

$ |

6.25 |

|

16% |

to |

17% |

Adjusted free cash flow* |

$ |

263 |

|

$ |

290 |

|

to |

$ |

300 |

|

10% |

to |

14% |

|

|

|

|

|

|

|

|

|

|

|

Earnings Webcast

Management will host a live webcast conference call at 10:00 a.m. ET today, to discuss third-quarter 2024 results. This event will be available on the Company's website. The call and accompanying slide presentation can be found on the investor relations section of the Company's website at www.armstrongworldindustries.com. The replay of this event will be available on the website for up to one year after the date of the call.

Uncertainties Affecting Forward-Looking Statements

Disclosures in this release contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including without limitation, those relating to future financial and operational results, market and broader economic conditions and guidance. Those statements provide our future expectations or forecasts and can be identified by our use of words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “outlook,” “target,” “predict,” “may,” “will,” “would,” “could,” “should,” “seek,” and other words or phrases of similar meaning in connection with any discussion of future operating or financial performance. This includes annual guidance. Forward-looking statements, by their nature, address matters that are uncertain and involve risks because they relate to events and depend on circumstances that may or may not occur in the future. As a result, our actual results may differ materially from our expected results and from those expressed in our forward-looking statements. A more detailed discussion of the risks and uncertainties that could cause our actual results to differ materially from those projected, anticipated or implied is included in the “Risk Factors” and “Management’s Discussion and Analysis” sections of our reports on Form 10-K and Form 10-Q filed with the U.S. Securities and Exchange Commission (“SEC”), including our quarterly report for the quarter ended September 30, 2024, that the Company expects to file today. Forward-looking statements speak only as of the date they are made. We undertake no obligation to update any forward-looking statements beyond what is required under applicable securities law.

About Armstrong and Additional Information

Armstrong World Industries, Inc. is a leader in the design, innovation and manufacture of innovative ceiling and wall solutions in the Americas. With $1.3 billion in revenue in 2023, AWI has approximately 3,500 employees and a manufacturing network of 19 facilities, plus seven facilities dedicated to its WAVE joint venture. For over 160 years, Armstrong has delivered products and services to our customers that can transform how people design, build and experience spaces with aesthetics, acoustics, wellbeing and sustainability in mind.

More details on the Company’s performance can be found in its report on Form 10-Q for the quarter ended September 30, 2024, that the Company expects to file with the SEC today.

Contact

Investors & Media: Theresa Womble, tlwomble@armstrongceilings.com or (717) 396-6354

Reported Financial Results

(Amounts in millions, except per share data)

SELECTED FINANCIAL RESULTS

Armstrong World Industries, Inc. and Subsidiaries

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net sales |

|

$ |

386.6 |

|

|

$ |

347.3 |

|

|

$ |

1,078.0 |

|

|

$ |

982.9 |

|

Cost of goods sold |

|

|

222.5 |

|

|

|

205.9 |

|

|

|

640.3 |

|

|

|

605.4 |

|

Gross profit |

|

|

164.1 |

|

|

|

141.4 |

|

|

|

437.7 |

|

|

|

377.5 |

|

Selling, general and administrative expenses |

|

|

77.6 |

|

|

|

64.6 |

|

|

|

223.1 |

|

|

|

189.2 |

|

Loss related to change in fair value of contingent consideration |

|

|

0.2 |

|

|

|

- |

|

|

|

0.6 |

|

|

|

- |

|

Impairment and gain on sales of fixed assets, net |

|

|

0.2 |

|

|

|

- |

|

|

|

0.3 |

|

|

|

- |

|

Equity (earnings) from unconsolidated affiliates, net |

|

|

(25.2 |

) |

|

|

(23.4 |

) |

|

|

(78.7 |

) |

|

|

(69.1 |

) |

Operating income |

|

|

111.3 |

|

|

|

100.2 |

|

|

|

292.4 |

|

|

|

257.4 |

|

Interest expense |

|

|

10.5 |

|

|

|

8.8 |

|

|

|

30.6 |

|

|

|

26.7 |

|

Other non-operating (income), net |

|

|

(3.0 |

) |

|

|

(2.3 |

) |

|

|

(9.3 |

) |

|

|

(6.9 |

) |

Earnings before income taxes |

|

|

103.8 |

|

|

|

93.7 |

|

|

|

271.1 |

|

|

|

237.6 |

|

Income tax expense |

|

|

26.9 |

|

|

|

24.2 |

|

|

|

68.4 |

|

|

|

60.6 |

|

Net earnings |

|

$ |

76.9 |

|

|

$ |

69.5 |

|

|

$ |

202.7 |

|

|

$ |

177.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted net earnings per share of common stock |

|

$ |

1.75 |

|

|

$ |

1.56 |

|

|

$ |

4.61 |

|

|

$ |

3.93 |

|

Average number of diluted common shares outstanding |

|

|

43.9 |

|

|

|

44.6 |

|

|

|

44.0 |

|

|

|

45.0 |

|

SEGMENT RESULTS

Armstrong World Industries, Inc. and Subsidiaries

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net Sales |

|

|

|

|

|

|

|

|

|

|

|

|

Mineral Fiber |

|

$ |

258.0 |

|

|

$ |

249.7 |

|

|

$ |

747.8 |

|

|

$ |

712.1 |

|

Architectural Specialties |

|

|

128.6 |

|

|

|

97.6 |

|

|

|

330.2 |

|

|

|

270.8 |

|

Total net sales |

|

$ |

386.6 |

|

|

$ |

347.3 |

|

|

$ |

1,078.0 |

|

|

$ |

982.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Segment operating income (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

Mineral Fiber |

|

$ |

93.0 |

|

|

$ |

85.5 |

|

|

$ |

253.9 |

|

|

$ |

224.8 |

|

Architectural Specialties |

|

|

19.2 |

|

|

|

15.5 |

|

|

|

41.1 |

|

|

|

34.9 |

|

Unallocated Corporate |

|

|

(0.9 |

) |

|

|

(0.8 |

) |

|

|

(2.6 |

) |

|

|

(2.3 |

) |

Total consolidated operating income |

|

$ |

111.3 |

|

|

$ |

100.2 |

|

|

$ |

292.4 |

|

|

$ |

257.4 |

|

SELECTED BALANCE SHEET INFORMATION

Armstrong World Industries, Inc. and Subsidiaries

|

|

|

|

|

|

|

|

|

|

|

Unaudited |

|

|

|

|

|

|

September 30, 2024 |

|

|

December 31, 2023 |

|

Assets |

|

|

|

|

|

|

Current assets |

|

$ |

357.7 |

|

|

$ |

313.0 |

|

Property, plant and equipment, net |

|

|

577.4 |

|

|

|

566.4 |

|

Other non-current assets |

|

|

868.9 |

|

|

|

793.0 |

|

Total assets |

|

$ |

1,804.0 |

|

|

$ |

1,672.4 |

|

Liabilities and shareholders’ equity |

|

|

|

|

|

|

Current liabilities |

|

$ |

218.4 |

|

|

$ |

194.5 |

|

Non-current liabilities |

|

|

868.6 |

|

|

|

886.1 |

|

Shareholders' equity |

|

|

717.0 |

|

|

|

591.8 |

|

Total liabilities and shareholders’ equity |

|

$ |

1,804.0 |

|

|

$ |

1,672.4 |

|

SELECTED CASH FLOW INFORMATION

Armstrong World Industries, Inc. and Subsidiaries

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

For the Nine Months Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

Net earnings |

|

$ |

202.7 |

|

|

$ |

177.0 |

|

Other adjustments to reconcile net earnings to net cash provided by operating activities |

|

|

12.8 |

|

|

|

5.4 |

|

Changes in operating assets and liabilities, net |

|

|

(35.3 |

) |

|

|

(6.0 |

) |

Net cash provided by operating activities |

|

|

180.2 |

|

|

|

176.4 |

|

Net cash (used for) investing activities |

|

|

(61.2 |

) |

|

|

(10.6 |

) |

Net cash (used for) financing activities |

|

|

(115.7 |

) |

|

|

(175.1 |

) |

Effect of exchange rate changes on cash and cash equivalents |

|

|

(0.4 |

) |

|

|

(0.1 |

) |

Net increase (decrease) in cash and cash equivalents |

|

|

2.9 |

|

|

|

(9.4 |

) |

Cash and cash equivalents at beginning of year |

|

|

70.8 |

|

|

|

106.0 |

|

Cash and cash equivalents at end of period |

|

$ |

73.7 |

|

|

$ |

96.6 |

|

Supplemental Reconciliations of GAAP to non-GAAP Results (unaudited)

(Amounts in millions, except per share data)

To supplement its consolidated financial statements presented in accordance with accounting principles generally accepted in the United States (“GAAP”), the Company provides additional measures of performance adjusted to exclude the impact of certain discrete expenses and income including adjusted Earnings Before Interest, Taxes, Depreciation and Amortization ("EBITDA"), adjusted diluted earnings per share ("EPS") and adjusted free cash flow. Investors should not consider non-GAAP measures as a substitute for GAAP measures. The Company excludes certain acquisition related expenses (i.e. – impact of adjustments related to the fair value of inventory, contingent third-party professional fees, changes in the fair value of contingent consideration and deferred compensation accruals for acquisitions). Acquisition related deferred compensation accruals excluded from adjusted EBITDA represented cash and stock awards that were recorded over each award's respective vesting period, as such payments were subject to the sellers’ and employees’ continued employment with the Company. The Company also excludes all acquisition-related intangible amortization from adjusted net earnings and in calculations of adjusted diluted EPS. Examples of other excluded items have included plant closures, restructuring charges and related costs, impairments, separation costs and other cost reduction initiatives, environmental site expenses and environmental insurance recoveries, endowment level charitable contributions, the impact of defined benefit plan settlements, gains and losses on sales or impairment of fixed assets, and certain other gains and losses. The Company also excludes income/expense from its U.S. Retirement Income Plan (“RIP”) in the non-GAAP results as it represents the actuarial net periodic benefit credit/cost recorded. For all periods presented, the Company was not required and did not make cash contributions to the RIP based on guidelines established by the Pension Benefit Guaranty Corporation, nor does the Company expect to make cash contributions to the plan in 2024. Adjusted free cash flow is defined as cash from operating and investing activities, adjusted to remove the impact of cash used or proceeds received for acquisitions and divestitures, environmental site expenses and environmental insurance recoveries. Management's adjusted free cash flow measure includes returns of investment from WAVE and cash proceeds received from the settlement of company-owned life insurance policies, which are presented within investing activities on our condensed consolidated statement of cash flows. The Company uses these adjusted performance measures in managing the business, including communications with its Board of Directors and employees, and believes that they provide users of this financial information with meaningful comparisons of operating performance between current results and results in prior periods. The Company believes that these non-GAAP financial measures are appropriate to enhance understanding of its past performance, as well as prospects for its future performance. The Company also uses adjusted EBITDA and adjusted free cash flow (with further adjustments, when necessary) as factors in determining at-risk compensation for senior management. These non-GAAP measures may not be defined and calculated the same as similar measures used by other companies. Non-GAAP financial measures utilized by the Company may not be comparable to non-GAAP financial measures used by other companies. A reconciliation of these adjustments to the most directly comparable GAAP measures is included in this release and on the Company’s website. These non-GAAP measures should not be considered in isolation or as a substitute for the most comparable GAAP measures.

In the following charts, numbers may not sum due to rounding. Excluding adjusted diluted EPS, non-GAAP figures are rounded to the nearest million and corresponding percentages are rounded to the nearest percent based on unrounded figures.

Consolidated Results – Adjusted EBITDA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net sales |

|

$ |

387 |

|

|

$ |

347 |

|

|

$ |

1,078 |

|

|

$ |

983 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings |

|

$ |

77 |

|

|

$ |

70 |

|

|

$ |

203 |

|

|

$ |

177 |

|

Add: Income tax expense |

|

|

27 |

|

|

|

24 |

|

|

|

68 |

|

|

|

61 |

|

Earnings before income taxes |

|

$ |

104 |

|

|

$ |

94 |

|

|

$ |

271 |

|

|

$ |

238 |

|

Add: Interest/other income and expense, net |

|

|

8 |

|

|

|

7 |

|

|

|

21 |

|

|

|

20 |

|

Operating income |

|

$ |

111 |

|

|

$ |

100 |

|

|

$ |

292 |

|

|

$ |

257 |

|

Add: RIP expense (1) |

|

|

1 |

|

|

|

1 |

|

|

|

2 |

|

|

|

2 |

|

Add: Acquisition-related impacts (2) |

|

|

- |

|

|

|

1 |

|

|

|

2 |

|

|

|

4 |

|

Add: Cost reduction initiatives |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

3 |

|

Add: WAVE pension settlement (3) |

|

|

- |

|

|

|

- |

|

|

|

1 |

|

|

|

- |

|

(Less): Gain on sales of fixed assets, net (4) |

|

|

(5 |

) |

|

|

- |

|

|

|

(5 |

) |

|

|

- |

|

Add: Impairment of fixed asset (5) |

|

|

5 |

|

|

|

- |

|

|

|

5 |

|

|

|

- |

|

Add: Environmental expense |

|

|

- |

|

|

|

- |

|

|

|

2 |

|

|

|

- |

|

Adjusted operating income |

|

$ |

113 |

|

|

$ |

102 |

|

|

$ |

299 |

|

|

$ |

266 |

|

Add: Depreciation and amortization |

|

|

26 |

|

|

|

23 |

|

|

|

76 |

|

|

|

66 |

|

Adjusted EBITDA |

|

$ |

139 |

|

|

$ |

125 |

|

|

$ |

375 |

|

|

$ |

332 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income margin |

|

|

28.8 |

% |

|

|

28.9 |

% |

|

|

27.1 |

% |

|

|

26.2 |

% |

Adjusted EBITDA margin |

|

|

35.9 |

% |

|

|

36.0 |

% |

|

|

34.8 |

% |

|

|

33.8 |

% |

1.RIP expense represents only the plan service cost that is recorded within Operating income. For all periods presented, we were not required to and did not make cash contributions to our RIP.

2.Represents the impact of acquisition-related adjustments for the fair value of inventory, contingent third-party professional fees, changes in fair value of contingent consideration, deferred compensation and restricted stock expenses.

3.Represents the Company's 50% share of WAVE's loss upon settlement of their defined benefit pension plan.

4.During the third quarter of 2024 we sold our idled Mineral Fiber plant in St. Helens, Oregon.

5.During the third quarter of 2024 we recorded an impairment charge for an undeveloped parcel of land upon reclassification to assets held for sale.

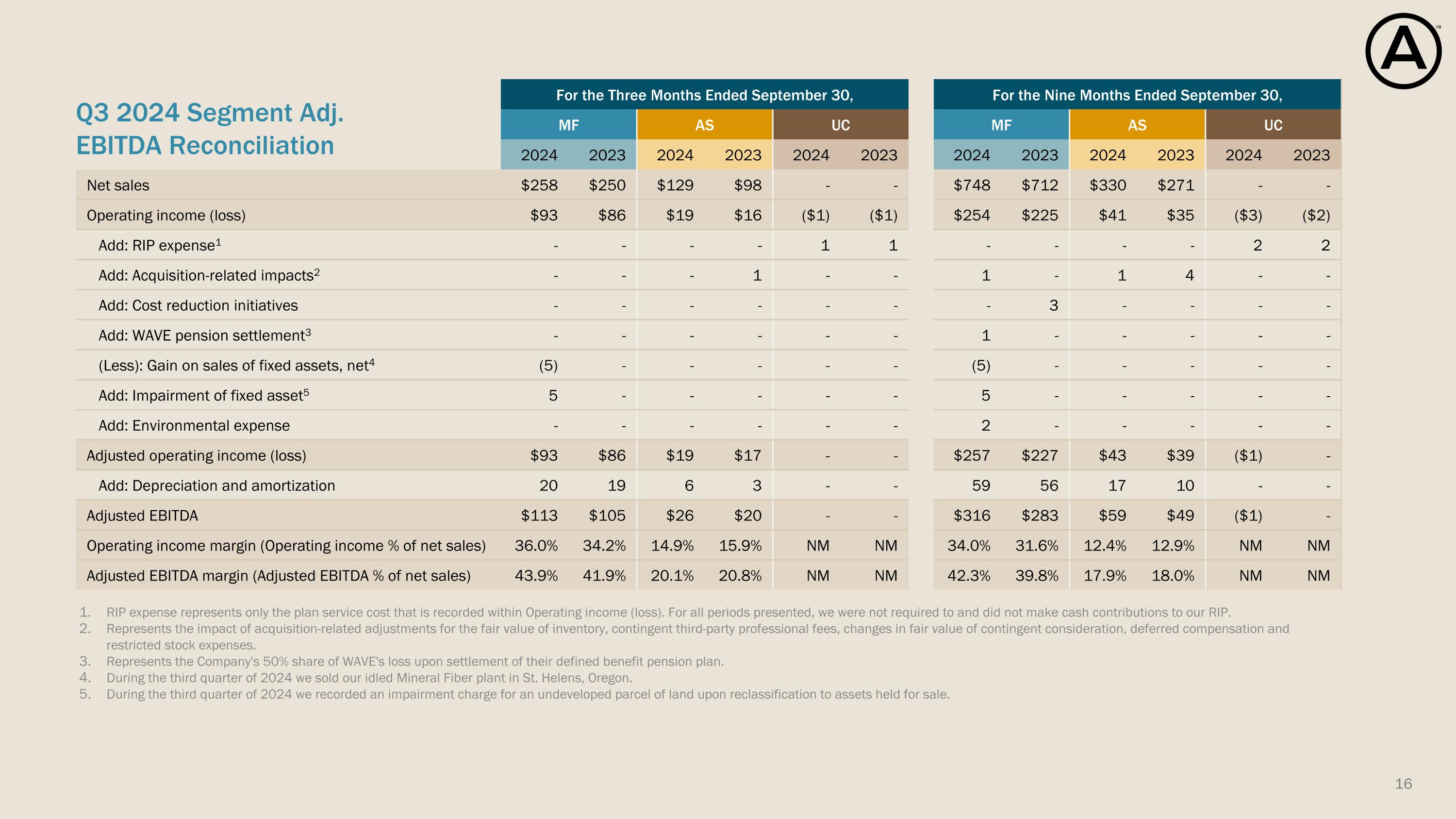

Mineral Fiber

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net sales |

|

$ |

258 |

|

|

$ |

250 |

|

|

$ |

748 |

|

|

$ |

712 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income |

|

$ |

93 |

|

|

$ |

86 |

|

|

$ |

254 |

|

|

$ |

225 |

|

Add: Acquisition-related impacts (1) |

|

|

- |

|

|

|

- |

|

|

|

1 |

|

|

|

- |

|

Add: Cost reduction initiatives |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

3 |

|

Add: WAVE pension settlement (2) |

|

|

- |

|

|

|

- |

|

|

|

1 |

|

|

|

- |

|

(Less): Gain on sales of fixed assets, net (3) |

|

|

(5 |

) |

|

|

- |

|

|

|

(5 |

) |

|

|

- |

|

Add: Impairment of fixed asset (4) |

|

|

5 |

|

|

|

- |

|

|

|

5 |

|

|

|

- |

|

Add: Environmental expense |

|

|

- |

|

|

|

- |

|

|

|

2 |

|

|

|

- |

|

Adjusted operating income |

|

$ |

93 |

|

|

$ |

86 |

|

|

$ |

257 |

|

|

$ |

227 |

|

Add: Depreciation and amortization |

|

|

20 |

|

|

|

19 |

|

|

|

59 |

|

|

|

56 |

|

Adjusted EBITDA |

|

$ |

113 |

|

|

$ |

105 |

|

|

$ |

316 |

|

|

$ |

283 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income margin |

|

|

36.0 |

% |

|

|

34.2 |

% |

|

|

34.0 |

% |

|

|

31.6 |

% |

Adjusted EBITDA margin |

|

|

43.9 |

% |

|

|

41.9 |

% |

|

|

42.3 |

% |

|

|

39.8 |

% |

1.Represents the impact of acquisition-related adjustments for changes in fair value of contingent consideration.

2.Represents the Company's 50% share of WAVE's loss upon settlement of their defined benefit pension plan.

3.During the third quarter of 2024 we sold our idled Mineral Fiber plant in St. Helens, Oregon.

4.During the third quarter of 2024 we recorded an impairment charge for an undeveloped parcel of land upon reclassification to assets held for sale.

Architectural Specialties

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net sales |

|

$ |

129 |

|

|

$ |

98 |

|

|

$ |

330 |

|

|

$ |

271 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income |

|

$ |

19 |

|

|

$ |

16 |

|

|

$ |

41 |

|

|

$ |

35 |

|

Add: Acquisition-related impacts (1) |

|

|

- |

|

|

|

1 |

|

|

|

1 |

|

|

|

4 |

|

Adjusted operating income |

|

$ |

19 |

|

|

$ |

17 |

|

|

$ |

43 |

|

|

$ |

39 |

|

Add: Depreciation and amortization |

|

|

6 |

|

|

|

3 |

|

|

|

17 |

|

|

|

10 |

|

Adjusted EBITDA |

|

$ |

26 |

|

|

$ |

20 |

|

|

$ |

59 |

|

|

$ |

49 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income margin |

|

|

14.9 |

% |

|

|

15.9 |

% |

|

|

12.4 |

% |

|

|

12.9 |

% |

Adjusted EBITDA margin |

|

|

20.1 |

% |

|

|

20.8 |

% |

|

|

17.9 |

% |

|

|

18.0 |

% |

1.Represents the impact of acquisition-related adjustments for the fair value of inventory, contingent third-party professional fees, changes in fair value of contingent consideration, deferred compensation and restricted stock expenses.

Unallocated Corporate

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Operating (loss) |

|

$ |

(1 |

) |

|

$ |

(1 |

) |

|

$ |

(3 |

) |

|

$ |

(2 |

) |

Add: RIP expense (1) |

|

|

1 |

|

|

|

1 |

|

|

|

2 |

|

|

|

2 |

|

Adjusted operating (loss) |

|

$ |

- |

|

|

$ |

- |

|

|

$ |

(1 |

) |

|

$ |

- |

|

Add: Depreciation and amortization |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

Adjusted EBITDA |

|

$ |

- |

|

|

$ |

- |

|

|

$ |

(1 |

) |

|

$ |

- |

|

1.RIP expense represents only the plan service cost that is recorded within Operating loss. For all periods presented, we were not required to and did not make cash contributions to our RIP.

Consolidated Results – Adjusted Free Cash Flow

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net cash provided by operating activities |

|

$ |

97 |

|

|

$ |

83 |

|

|

$ |

180 |

|

|

$ |

176 |

|

Net cash provided by (used for) investing activities |

|

|

20 |

|

|

|

(5 |

) |

|

|

(61 |

) |

|

|

(11 |

) |

Net cash provided by operating and investing activities |

|

$ |

117 |

|

|

$ |

78 |

|

|

$ |

119 |

|

|

$ |

166 |

|

Add: Cash paid for acquisitions, net of cash acquired and investment in unconsolidated affiliate |

|

|

- |

|

|

|

14 |

|

|

|

99 |

|

|

|

24 |

|

Add: Arktura deferred compensation (1) |

|

|

- |

|

|

|

- |

|

|

|

6 |

|

|

|

- |

|

Add: Contingent consideration in excess of acquisition-date fair value (1) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

5 |

|

(Less): Proceeds from sales of facilities (2) |

|

|

(9 |

) |

|

|

- |

|

|

|

(12 |

) |

|

|

- |

|

Adjusted Free Cash Flow |

|

$ |

107 |

|

|

$ |

92 |

|

|

$ |

212 |

|

|

$ |

195 |

|

1.Deferred compensation and contingent consideration payments related to 2020 acquisitions were recorded as components of net cash provided by operating activities.

2.Proceeds related to the sale of Architectural Specialties design center and the sale of our idled Mineral Fiber plant in St. Helens, Oregon.

Consolidated Results – Adjusted Diluted Earnings Per Share (EPS)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

|

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

|

Total |

|

Per Diluted

Share |

|

Total |

|

Per Diluted

Share |

|

|

Total |

|

Per Diluted

Share |

|

Total |

|

Per Diluted

Share |

|

Net earnings |

$ |

77 |

|

$ |

1.75 |

|

$ |

70 |

|

$ |

1.56 |

|

|

$ |

203 |

|

$ |

4.61 |

|

$ |

177 |

|

$ |

3.93 |

|

Add: Income tax expense |

|

27 |

|

|

|

|

24 |

|

|

|

|

|

68 |

|

|

|

|

61 |

|

|

|

Earnings before income taxes |

$ |

104 |

|

|

|

$ |

94 |

|

|

|

|

$ |

271 |

|

|

|

$ |

238 |

|

|

|

(Less): RIP (credit) (1) |

|

- |

|

|

|

|

- |

|

|

|

|

|

(1 |

) |

|

|

|

(1 |

) |

|

|

Add: Acquisition-related impacts (2) |

|

- |

|

|

|

|

1 |

|

|

|

|

|

2 |

|

|

|

|

4 |

|

|

|

Add: Acquisition-related amortization (3) |

|

3 |

|

|

|

|

2 |

|

|

|

|

|

8 |

|

|

|

|

4 |

|

|

|

Add: Cost reduction initiatives |

|

- |

|

|

|

|

- |

|

|

|

|

|

- |

|

|

|

|

3 |

|

|

|

Add: WAVE pension settlement (4) |

|

- |

|

|

|

|

- |

|

|

|

|

|

1 |

|

|

|

|

- |

|

|

|

(Less): Gain on sales of fixed assets, net (5) |

|

(5 |

) |

|

|

|

- |

|

|

|

|

|

(5 |

) |

|

|

|

- |

|

|

|

Add: Impairment of fixed asset (6) |

|

5 |

|

|

|

|

- |

|

|

|

|

|

5 |

|

|

|

|

- |

|

|

|

Add: Environmental expense |

|

- |

|

|

|

|

- |

|

|

|

|

|

2 |

|

|

|

|

- |

|

|

|

Adjusted net earnings before income taxes |

$ |

107 |

|

|

|

$ |

96 |

|

|

|

|

$ |

283 |

|

|

|

$ |

248 |

|

|

|

(Less): Adjusted income tax expense (7) |

|

(28 |

) |

|

|

|

(25 |

) |

|

|

|

|

(71 |

) |

|

|

|

(63 |

) |

|

|

Adjusted net earnings |

$ |

79 |

|

$ |

1.81 |

|

$ |

71 |

|

$ |

1.60 |

|

|

$ |

211 |

|

$ |

4.81 |

|

$ |

184 |

|

$ |

4.10 |

|

Adjusted diluted EPS change versus prior year |

|

|

13.1% |

|

|

|

|

|

|

|

|

17.3% |

|

|

|

|

|

Diluted shares outstanding |

|

|

|

43.9 |

|

|

|

|

44.6 |

|

|

|

|

|

44.0 |

|

|

|

|

45.0 |

|

Effective tax rate |

|

|

26% |

|

|

|

26% |

|

|

|

|

25% |

|

|

|

26% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.RIP (credit) represents the entire actuarial net periodic pension (credit) recorded as a component of net earnings. For all periods presented, we were not required to and did not make cash contributions to our RIP.

2.Represents the impact of acquisition-related adjustments for the fair value of inventory, contingent third-party professional fees, changes in fair value of contingent consideration, deferred compensation and restricted stock expenses.

3.Represents acquisition-related intangible amortization, including customer relationships, developed technology, software, trademarks and brand names, non-compete agreements and other intangibles.

4.Represents the Company's 50% share of WAVE's loss upon settlement of their defined benefit pension plan.

5.During the third quarter of 2024 we sold our idled Mineral Fiber plant in St. Helens, Oregon.

6.During the third quarter of 2024 we recorded an impairment charge for an undeveloped parcel of land upon reclassification to assets held for sale.

7.Adjusted income tax expense is calculated using the effective tax rate multiplied by the adjusted net earnings before income taxes.

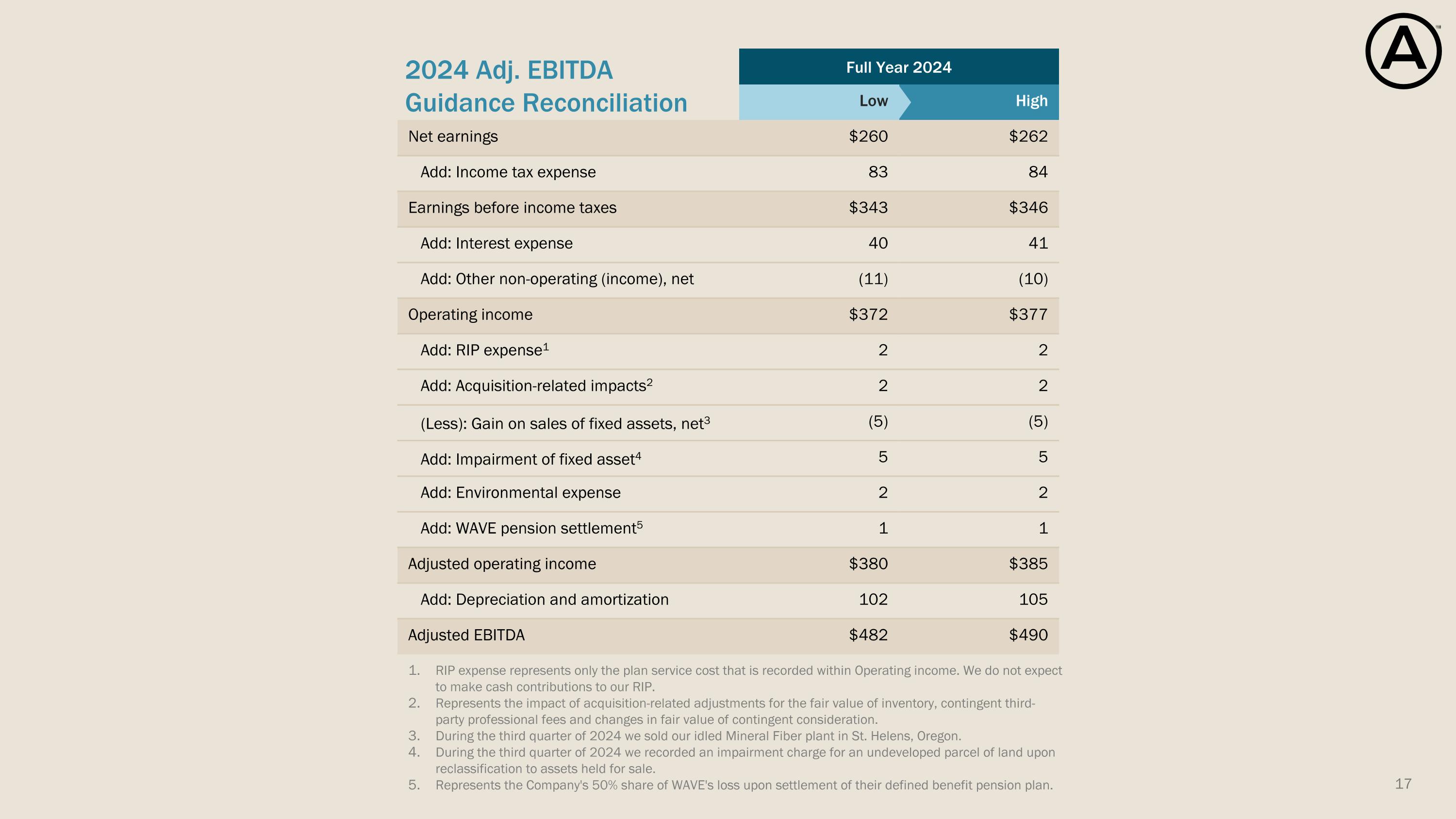

Adjusted EBITDA Guidance

|

|

|

|

|

|

|

|

|

|

|

For the Year Ending December 31, 2024 |

|

|

|

Low |

|

|

High |

|

Net earnings |

|

$ |

260 |

|

to |

$ |

262 |

|

Add: Income tax expense |

|

|

83 |

|

|

|

84 |

|

Earnings before income taxes |

|

$ |

343 |

|

to |

$ |

346 |

|

Add: Interest expense |

|

|

40 |

|

|

|

41 |

|

Add: Other non-operating (income), net |

|

|

(11 |

) |

|

|

(10 |

) |

Operating income |

|

$ |

372 |

|

to |

$ |

377 |

|

Add: RIP expense (1) |

|

|

2 |

|

|

|

2 |

|

Add: Acquisition-related impacts (2) |

|

|

2 |

|

|

|

2 |

|

(Less): Gain on sales of fixed assets, net (3) |

|

|

(5 |

) |

|

|

(5 |

) |

Add: Impairment of fixed asset (4) |

|

|

5 |

|

|

|

5 |

|

Add: Environmental expense |

|

|

2 |

|

|

|

2 |

|

Add: WAVE pension settlement (5) |

|

|

1 |

|

|

|

1 |

|

Adjusted operating income |

|

$ |

380 |

|

to |

$ |

385 |

|

Add: Depreciation and amortization |

|

|

102 |

|

|

|

105 |

|

Adjusted EBITDA |

|

$ |

482 |

|

to |

$ |

490 |

|

1.RIP expense represents only the plan service cost that is recorded within Operating income. We do not expect to make cash contributions to our RIP.

2.Represents the impact of acquisition-related adjustments for the fair value of inventory, contingent third-party professional fees and changes in fair value of contingent consideration.

3.During the third quarter of 2024 we sold our idled Mineral Fiber plant in St. Helens, Oregon.

4.During the third quarter of 2024 we recorded an impairment charge for an undeveloped parcel of land upon reclassification to assets held for sale.

5.Represents the Company's 50% share of WAVE's loss upon settlement of their defined benefit pension plan.

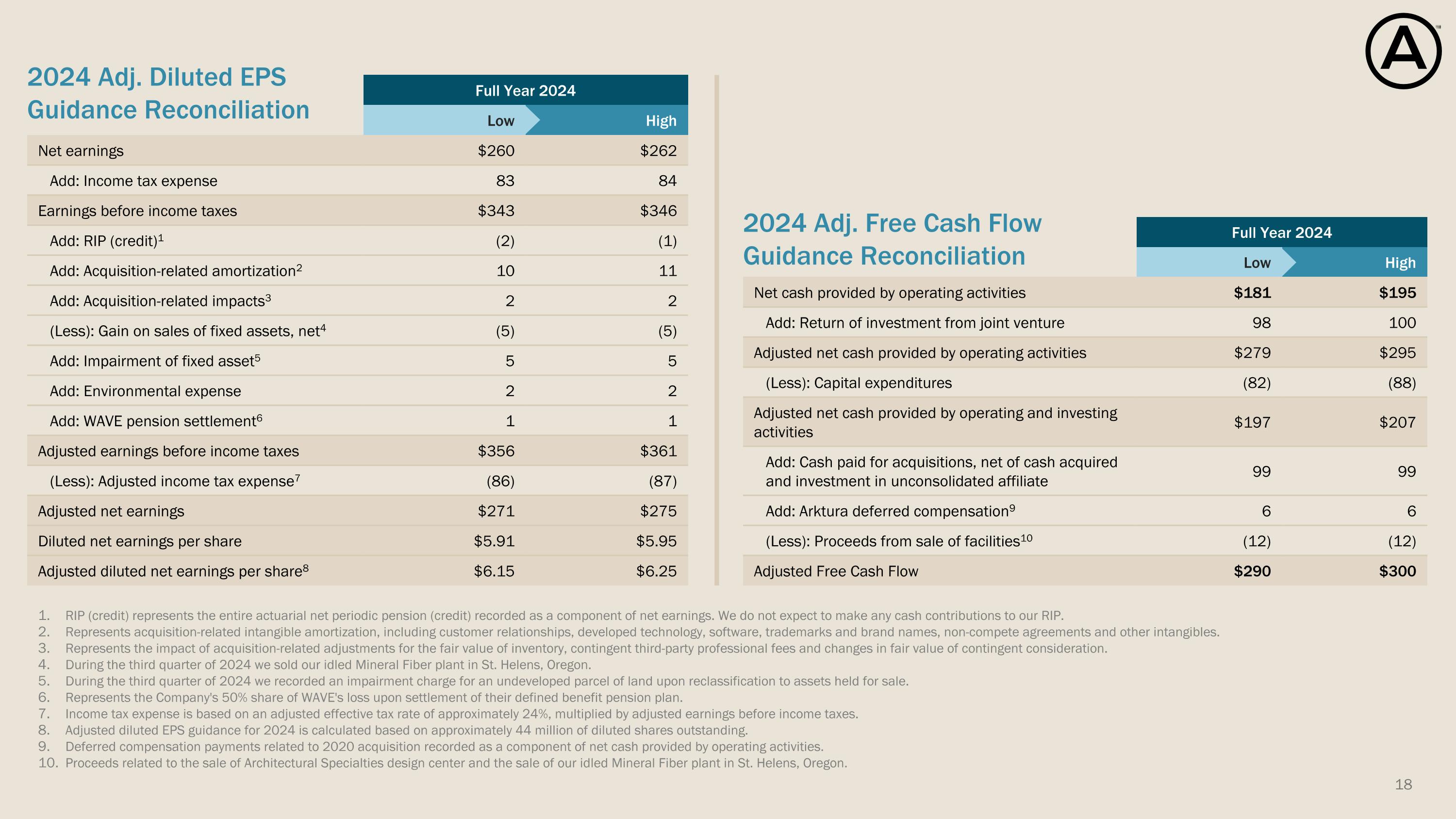

Adjusted Diluted Net Earnings Per Share Guidance

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Year Ending December 31, 2024 |

|

|

|

Low |

|

|

Per Diluted

Share(1) |

|

|

High |

|

|

Per Diluted

Share(1) |

|

Net earnings |

|

$ |

260 |

|

|

$ |

5.91 |

|

to |

$ |

262 |

|

|

$ |

5.95 |

|

Add: Income tax expense |

|

|

83 |

|

|

|

|

|

|

84 |

|

|

|

|

Earnings before income taxes |

|

$ |

343 |

|

|

|

|

to |

$ |

346 |

|

|

|

|

Add: RIP (credit) (2) |

|

|

(2 |

) |

|

|

|

|

|

(1 |

) |

|

|

|

Add: Acquisition-related amortization (3) |

|

|

10 |

|

|

|

|

|

|

11 |

|

|

|

|

Add: Acquisition-related impacts (4) |

|

|

2 |

|

|

|

|

|

|

2 |

|

|

|

|

(Less): Gain on sales of fixed assets, net (5) |

|

|

(5 |

) |

|

|

|

|

|

(5 |

) |

|

|

|

Add: Impairment of fixed asset (6) |

|

|

5 |

|

|

|

|

|

|

5 |

|

|

|

|

Add: Environmental expense |

|

|

2 |

|

|

|

|

|

|

2 |

|

|

|

|

Add: WAVE pension settlement (7) |

|

|

1 |

|

|

|

|

|

|

1 |

|

|

|

|

Adjusted earnings before income taxes |

|

$ |

356 |

|

|

|

|

to |

$ |

361 |

|

|

|

|

(Less): Adjusted income tax expense (8) |

|

|

(86 |

) |

|

|

|

|

|

(87 |

) |

|

|

|

Adjusted net earnings |

|

$ |

271 |

|

|

$ |

6.15 |

|

to |

$ |

275 |

|

|

$ |

6.25 |

|

1.Adjusted diluted EPS guidance for 2024 is calculated based on approximately 44 million of diluted shares outstanding.

2.RIP (credit) represents the entire actuarial net periodic pension (credit) recorded as a component of net earnings. We do not expect to make any cash contributions to our RIP.

3.Represents acquisition-related intangible amortization, including customer relationships, developed technology, software, trademarks and brand names, non-compete agreements and other intangibles.

4.Represents the impact of acquisition-related adjustments for the fair value of inventory, contingent third party professional fees and changes in fair value of contingent consideration.

5.During the third quarter of 2024 we sold our idled Mineral Fiber plant in St. Helens, Oregon.

6.During the third quarter of 2024 we recorded an impairment charge for an undeveloped parcel of land upon reclassification to assets held for sale.

7.Represents the Company's 50% share of WAVE's loss upon settlement of their defined benefit pension plan.

8.Income tax expense is based on an adjusted effective tax rate of approximately 24%, multiplied by adjusted earnings before income taxes.

Adjusted Free Cash Flow Guidance

|

|

|

|

|

|

|

|

|

|

|

For the Year Ending December 31, 2024 |

|

|

|

Low |

|

|

High |

|

Net cash provided by operating activities |

|

$ |

181 |

|

to |

$ |

195 |

|

Add: Return of investment from joint venture |

|

|

98 |

|

|

|

100 |

|

Adjusted net cash provided by operating activities |

|

$ |

279 |

|

to |

$ |

295 |

|

Less: Capital expenditures |

|

|

(82 |

) |

|

|

(88 |

) |

Net cash provided by operating and investing activities |

|

$ |

197 |

|

to |

$ |

207 |

|

Add: Cash paid for acquisitions, net of cash acquired and investment in unconsolidated affiliate |

|

|

99 |

|

|

|

99 |

|

Add: Arktura deferred compensation (1) |

|

|

6 |

|

|

|

6 |

|

(Less): Proceeds from sales of facilities (2) |

|

|

(12 |

) |

|

|

(12 |

) |

Adjusted Free Cash Flow |

|

$ |

290 |

|

to |

$ |

300 |

|

1.Deferred compensation payments related to 2020 acquisition recorded as a component of net cash provided by operating activities.

2.Proceeds related to the sale of Architectural Specialties design center and the sale of our idled Mineral Fiber plant in St. Helens, Oregon.

3rd Quarter 2024 �Earnings Presentation October 29, 2024 Exhibit 99.2

Safe Harbor Statement Disclosures in this presentation contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including without limitation, those relating to future financial and operational results, market and broader economic conditions and guidance. Those statements provide our future expectations or forecasts and can be identified by our use of words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “outlook,” “target,” “predict,” “may,” “will,” “would,” “could,” “should,” “seek,” and other words or phrases of similar meaning in connection with any discussion of future operating or financial performance. This includes annual guidance. Forward-looking statements, by their nature, address matters that are uncertain and involve risks because they relate to events and depend on circumstances that may or may not occur in the future. As a result, our actual results may differ materially from our expected results and from those expressed in our forward-looking statements. A more detailed discussion of the risks and uncertainties that could cause our actual results to differ materially from those projected, anticipated or implied is included in the “Risk Factors” and “Management’s Discussion and Analysis” sections of our reports on Form 10-K and Form 10-Q filed with the U.S. Securities and Exchange Commission (“SEC”), including our report for the quarterly period ended September 30, 2024, that the Company expects to file today. Forward-looking statements speak only as of the date they are made. We undertake no obligation to update any forward-looking statements beyond what is required under applicable securities law. In addition, we will be referring to non-Generally Accepted Accounting Principles (“GAAP”) financial measures within the meaning �of SEC Regulation G. A reconciliation of the differences between these measures with the most directly comparable financial measures calculated in accordance �with GAAP are included within this presentation and available on the Investor Relations page of our website at www.armstrongceilings.com. The guidance in this presentation is only effective as of the date given, October 29, 2024, and will not be updated or affirmed unless �and until we publicly announce updated or affirmed guidance.

Basis of Presentation Explanation Results throughout this presentation are presented on a normalized basis. We remove the impact of certain discrete expenses and income in certain measures including adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”), adjusted diluted earnings per share (“EPS”) and adjusted free cash flow. The Company excludes certain acquisition related expenses (i.e. – impact of adjustments related to the fair value of inventory, contingent third-party professional fees, changes in the fair value of contingent consideration and deferred compensation accruals for acquisitions). Acquisition related deferred compensation accruals excluded from adjusted EBITDA represented cash and stock awards that were recorded over each award’s respective vesting period, as such payments were subject to the sellers’ and employees’ continued employment with the Company. The Company also excludes all acquisition-related intangible amortization from adjusted net earnings and in calculations of adjusted diluted EPS. Examples of other excluded items have included plant closures, restructuring charges and related costs, impairments, separation costs and other cost reduction initiatives, environmental site expenses and environmental insurance recoveries, endowment level charitable contributions, the impact of defined benefit plan settlements, gains and losses on sales or impairment of fixed assets, and certain other gains and losses. The Company also excludes income/expense from its U.S. Retirement Income Plan (“RIP”) in the non-GAAP results as it represents the actuarial net periodic benefit credit/cost recorded. For all periods presented, the Company was not required to and did not make cash contributions to the RIP based on guidelines established by the Pension Benefit Guaranty Corporation, nor does the Company expect to make cash contributions to the plan in 2024. Our tax rate may be adjusted for certain discrete items which are identified in the footnotes. Adjusted free cash flow is defined as cash from operating and investing activities, adjusted to remove the impact of cash used or proceeds received for acquisitions and divestitures, environmental site expenses and environmental insurance recoveries. Management's adjusted free cash flow measure includes returns of investment from WAVE and cash proceeds received from the settlement of company-owned life insurance policies, which are presented within investing activities on our condensed consolidated statement of cash flows. Investors should not consider non-GAAP measures as a substitute for GAAP measures. Excluding adjusted diluted EPS, non-GAAP figures are rounded to the nearest million and corresponding percentages are based on unrounded figures. Operating Segments: “MF”: Mineral Fiber, “AS”: Architectural Specialties, “UC”: Unallocated Corporate All dollar figures throughout the presentation are in $ millions, expect per share data, and all comparisons are versus prior year unless otherwise noted. Figures may not sum due to rounding.

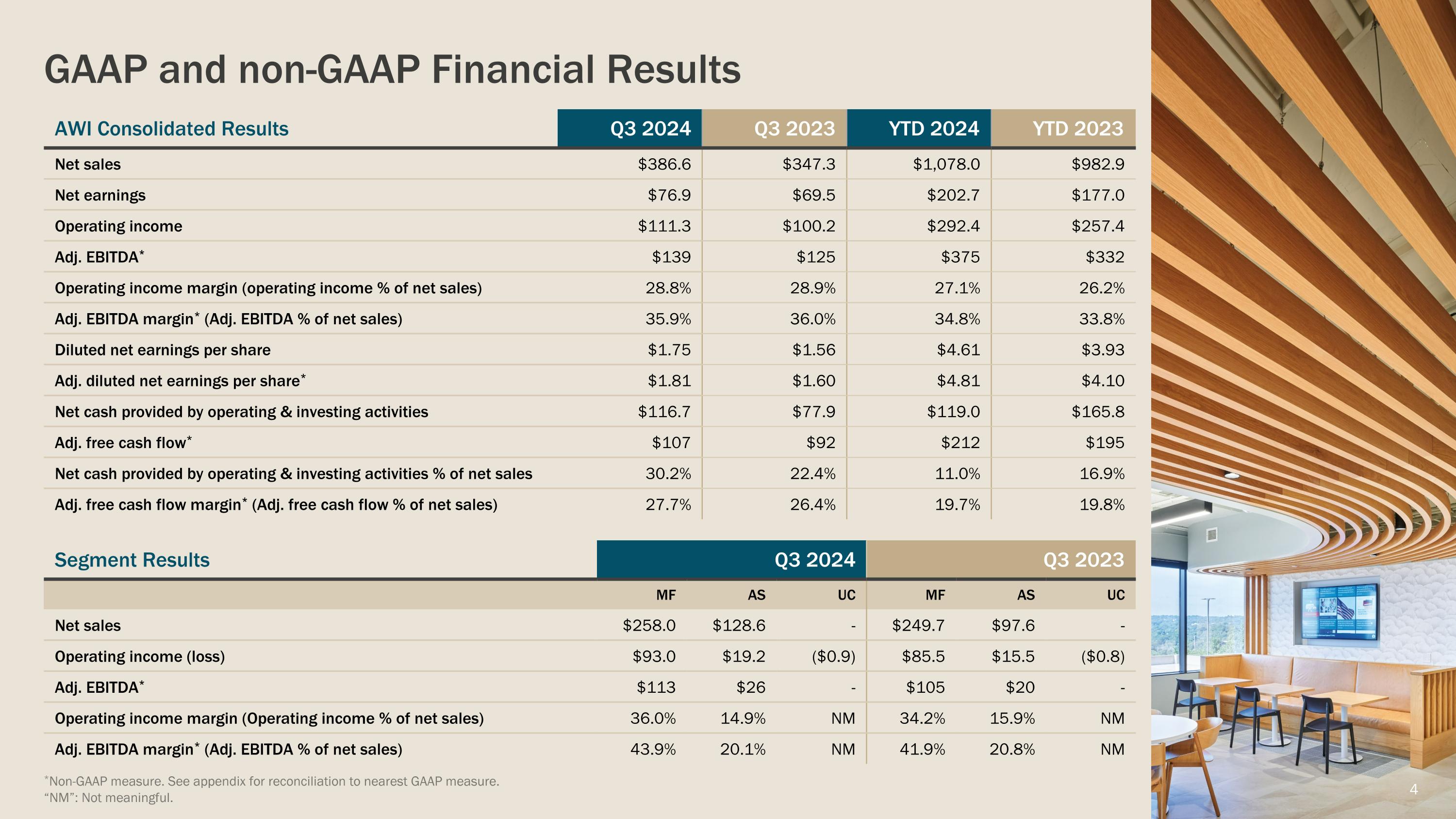

GAAP and non-GAAP Financial Results AWI Consolidated Results Q3 2024 Q3 2023 YTD 2024 YTD 2023 Net sales $386.6 $347.3 $1,078.0 $982.9 Net earnings $76.9 $69.5 $202.7 $177.0 Operating income $111.3 $100.2 $292.4 $257.4 Adj. EBITDA* $139 $125 $375 $332 Operating income margin (operating income % of net sales) 28.8% 28.9% 27.1% 26.2% Adj. EBITDA margin* (Adj. EBITDA % of net sales) 35.9% 36.0% 34.8% 33.8% Diluted net earnings per share $1.75 $1.56 $4.61 $3.93 Adj. diluted net earnings per share* $1.81 $1.60 $4.81 $4.10 Net cash provided by operating & investing activities $116.7 $77.9 $119.0 $165.8 Adj. free cash flow* $107 $92 $212 $195 Net cash provided by operating & investing activities % of net sales 30.2% 22.4% 11.0% 16.9% Adj. free cash flow margin* (Adj. free cash flow % of net sales) 27.7% 26.4% 19.7% 19.8% Segment Results Q3 2024 Q3 2023 MF AS UC MF AS UC Net sales $258.0 $128.6 - $249.7 $97.6 - Operating income (loss) $93.0 $19.2 ($0.9) $85.5 $15.5 ($0.8) Adj. EBITDA* $113 $26 - $105 $20 - Operating income margin (Operating income % of net sales) 36.0% 14.9% NM 34.2% 15.9% NM Adj. EBITDA margin* (Adj. EBITDA % of net sales) 43.9% 20.1% NM 41.9% 20.8% NM *Non-GAAP measure. See appendix for reconciliation to nearest GAAP measure. “NM”: Not meaningful.

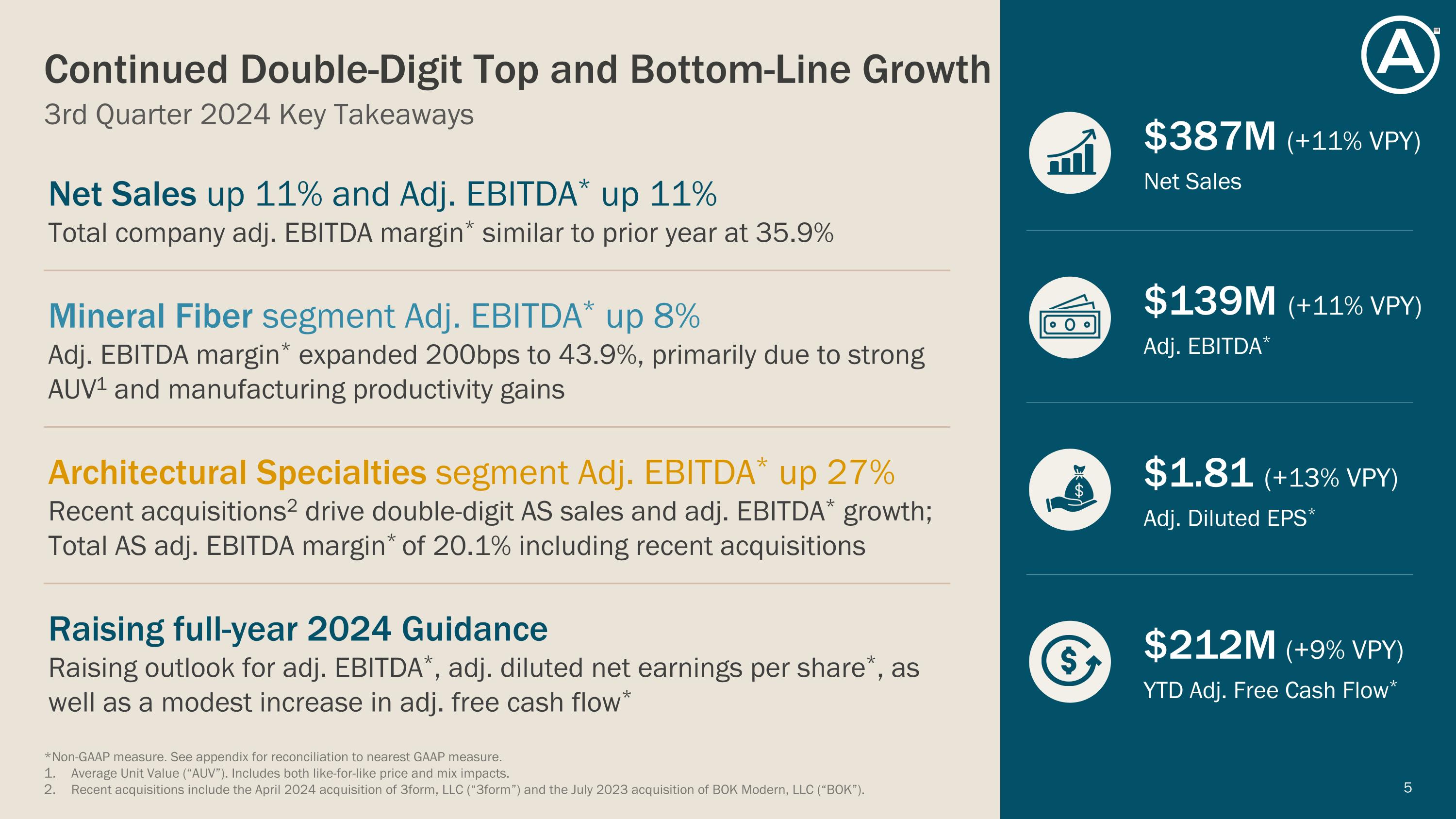

$387M (+11% VPY) Net Sales $139M (+11% VPY) Adj. EBITDA* $1.81 (+13% VPY) Adj. Diluted EPS* $212M (+9% VPY) YTD Adj. Free Cash Flow* 3rd Quarter 2024 Key Takeaways Continued Double-Digit Top and Bottom-Line Growth *Non-GAAP measure. See appendix for reconciliation to nearest GAAP measure. Average Unit Value (“AUV”). Includes both like-for-like price and mix impacts. Recent acquisitions include the April 2024 acquisition of 3form, LLC (“3form”) and the July 2023 acquisition of BOK Modern, LLC (“BOK”). Net Sales up 11% and Adj. EBITDA* up 11%�Total company adj. EBITDA margin* similar to prior year at 35.9% Mineral Fiber segment Adj. EBITDA* up 8%�Adj. EBITDA margin* expanded 200bps to 43.9%, primarily due to strong AUV1 and manufacturing productivity gains Architectural Specialties segment Adj. EBITDA* up 27%�Recent acquisitions2 drive double-digit AS sales and adj. EBITDA* growth; Total AS adj. EBITDA margin* of 20.1% including recent acquisitions Raising full-year 2024 Guidance Raising outlook for adj. EBITDA*, adj. diluted net earnings per share*, as well as a modest increase in adj. free cash flow*

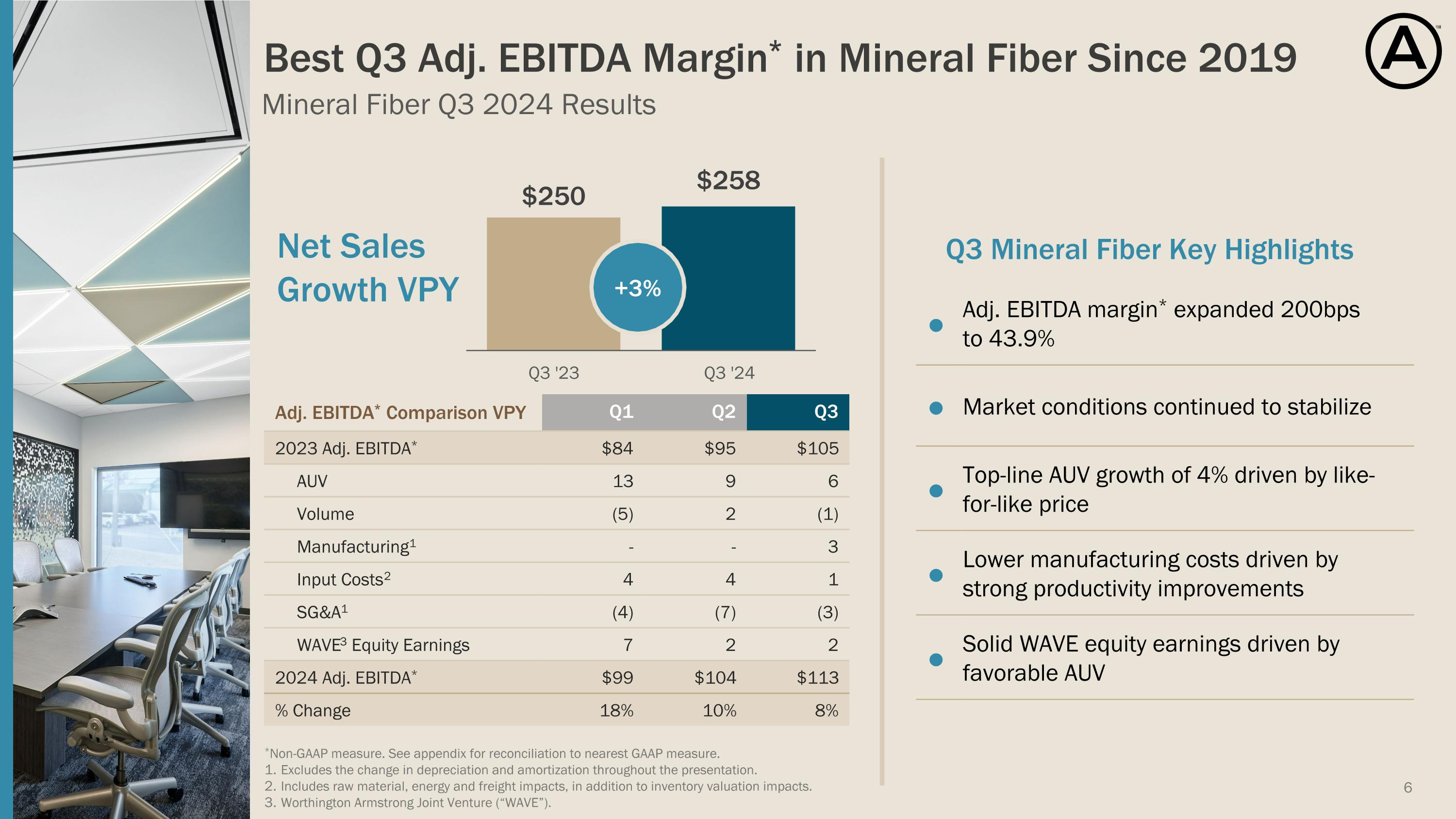

Mineral Fiber Q3 2024 Results Best Q3 Adj. EBITDA Margin* in Mineral Fiber Since 2019 Net Sales Growth VPY Q3 Mineral Fiber Key Highlights ● Adj. EBITDA margin* expanded 200bps to 43.9% ● Market conditions continued to stabilize ● Top-line AUV growth of 4% driven by like-for-like price ● Lower manufacturing costs driven by strong productivity improvements ● Solid WAVE equity earnings driven by favorable AUV Adj. EBITDA* Comparison VPY Q1 Q2 Q3 2023 Adj. EBITDA* $84 $95 $105 AUV 13 9 6 Volume (5) 2 (1) Manufacturing1 - - 3 Input Costs2 4 4 1 SG&A1 (4) (7) (3) WAVE3 Equity Earnings 7 2 2 2024 Adj. EBITDA* $99 $104 $113 % Change 18% 10% 8% +3% *Non-GAAP measure. See appendix for reconciliation to nearest GAAP measure. Excludes the change in depreciation and amortization throughout the presentation. Includes raw material, energy and freight impacts, in addition to inventory valuation impacts. Worthington Armstrong Joint Venture (“WAVE”).

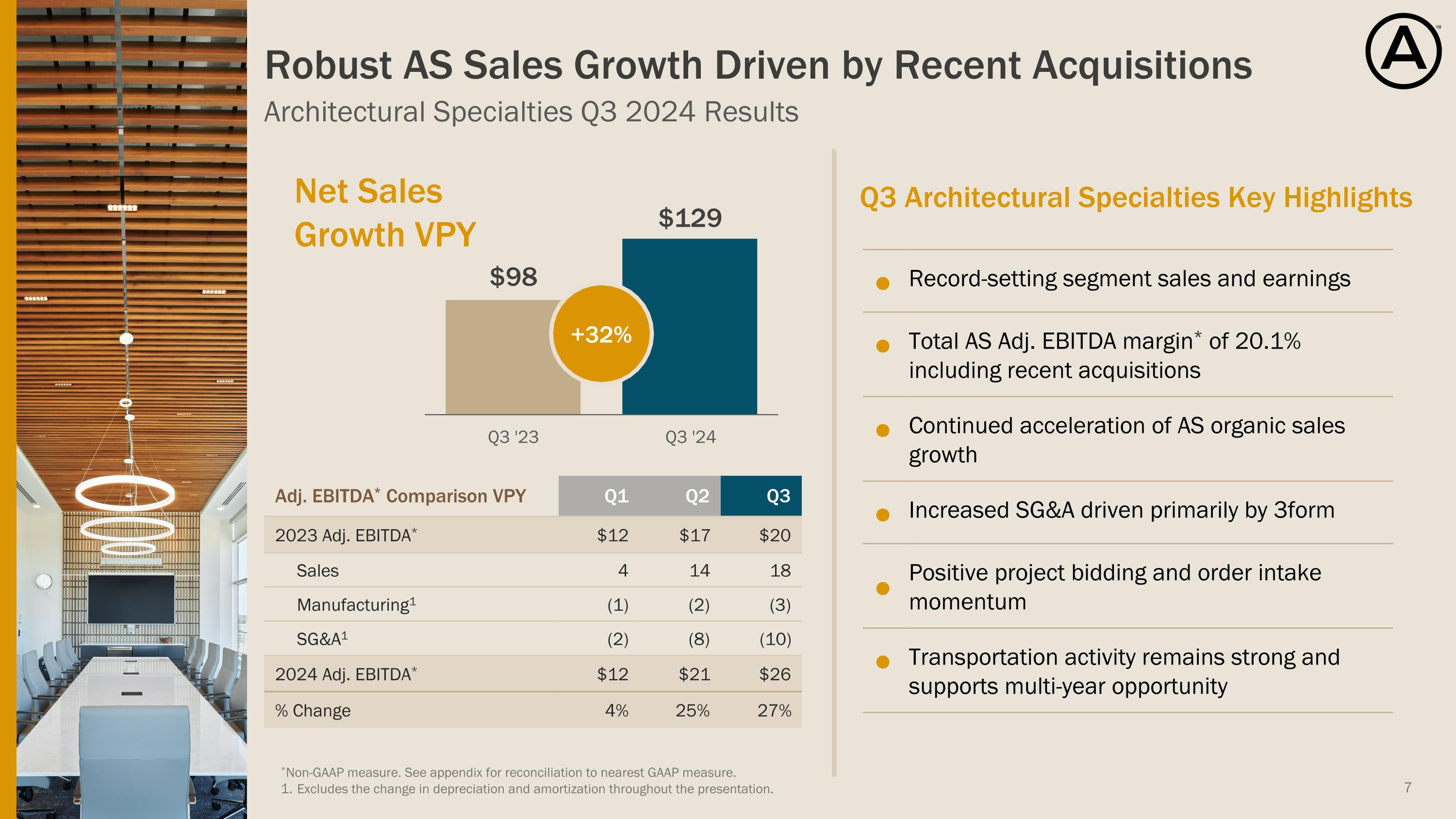

Architectural Specialties Q3 2024 Results Robust AS Sales Growth Driven by Recent Acquisitions Adj. EBITDA* Comparison VPY Q1 Q2 Q3 2023 Adj. EBITDA* $12 $17 $20 Sales 4 14 18 Manufacturing1 (1) (2) (3) SG&A1 (2) (8) (10) 2024 Adj. EBITDA* $12 $21 $26 % Change 4% 25% 27% Q3 Architectural Specialties Key Highlights ● Record-setting segment sales and earnings ● Total AS Adj. EBITDA margin* of 20.1% including recent acquisitions ● Continued acceleration of AS organic sales growth ● Increased SG&A driven primarily by 3form ● Positive project bidding and order intake momentum ● Transportation activity remains strong and supports multi-year opportunity Net Sales Growth VPY +32% *Non-GAAP measure. See appendix for reconciliation to nearest GAAP measure. Excludes the change in depreciation and amortization throughout the presentation.

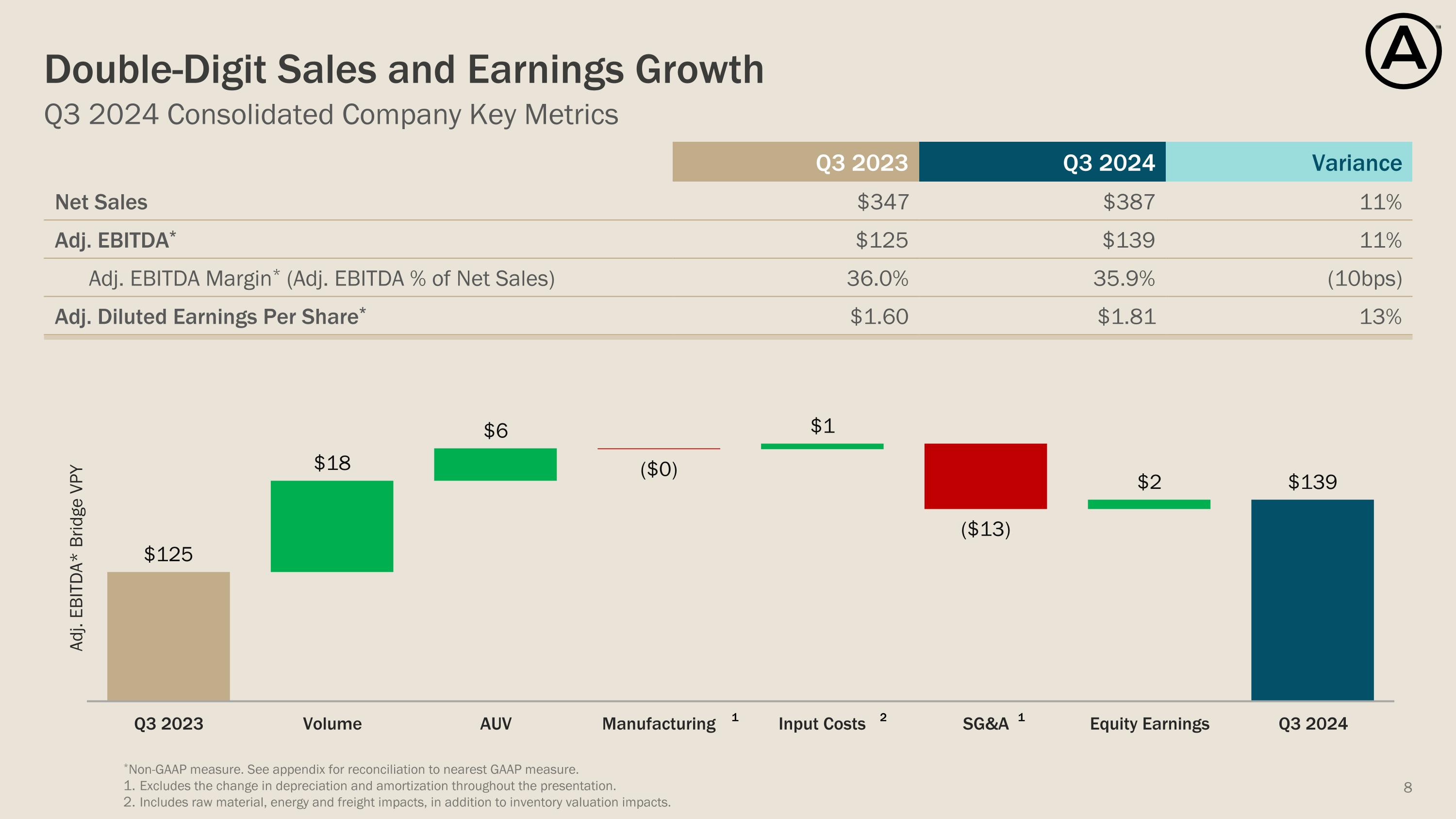

Q3 2024 Consolidated Company Key Metrics Double-Digit Sales and Earnings Growth Q3 2023 Q3 2024 Variance Net Sales $347 $387 11% Adj. EBITDA* $125 $139 11% Adj. EBITDA Margin* (Adj. EBITDA % of Net Sales) 36.0% 35.9% (10bps) Adj. Diluted Earnings Per Share* $1.60 $1.81 13% 1 2 1 *Non-GAAP measure. See appendix for reconciliation to nearest GAAP measure. Excludes the change in depreciation and amortization throughout the presentation. Includes raw material, energy and freight impacts, in addition to inventory valuation impacts.

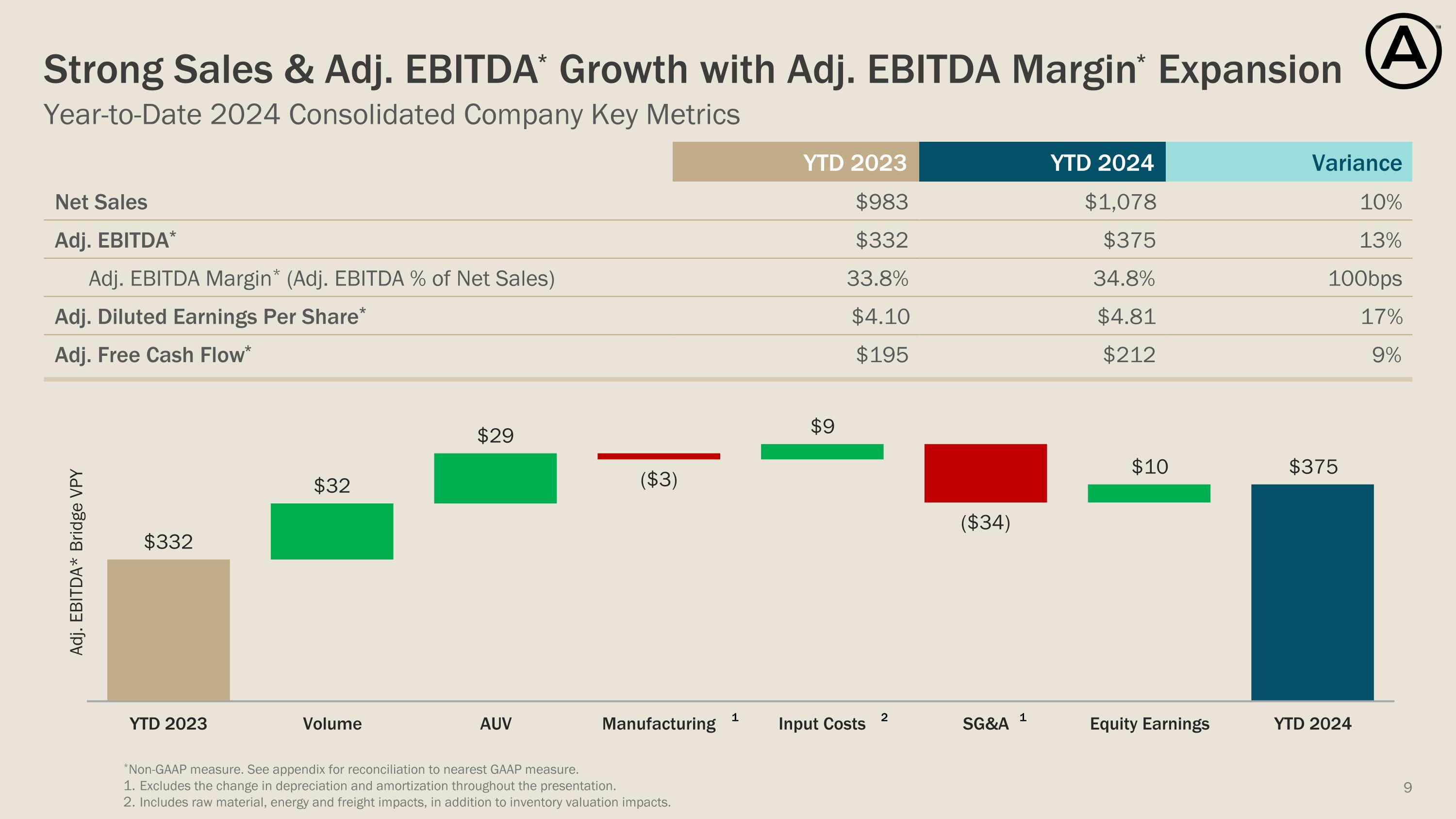

Year-to-Date 2024 Consolidated Company Key Metrics Strong Sales & Adj. EBITDA* Growth with Adj. EBITDA Margin* Expansion YTD 2023 YTD 2024 Variance Net Sales $983 $1,078 10% Adj. EBITDA* $332 $375 13% Adj. EBITDA Margin* (Adj. EBITDA % of Net Sales) 33.8% 34.8% 100bps Adj. Diluted Earnings Per Share* $4.10 $4.81 17% Adj. Free Cash Flow* $195 $212 9% 1 2 1 *Non-GAAP measure. See appendix for reconciliation to nearest GAAP measure. Excludes the change in depreciation and amortization throughout the presentation. Includes raw material, energy and freight impacts, in addition to inventory valuation impacts.

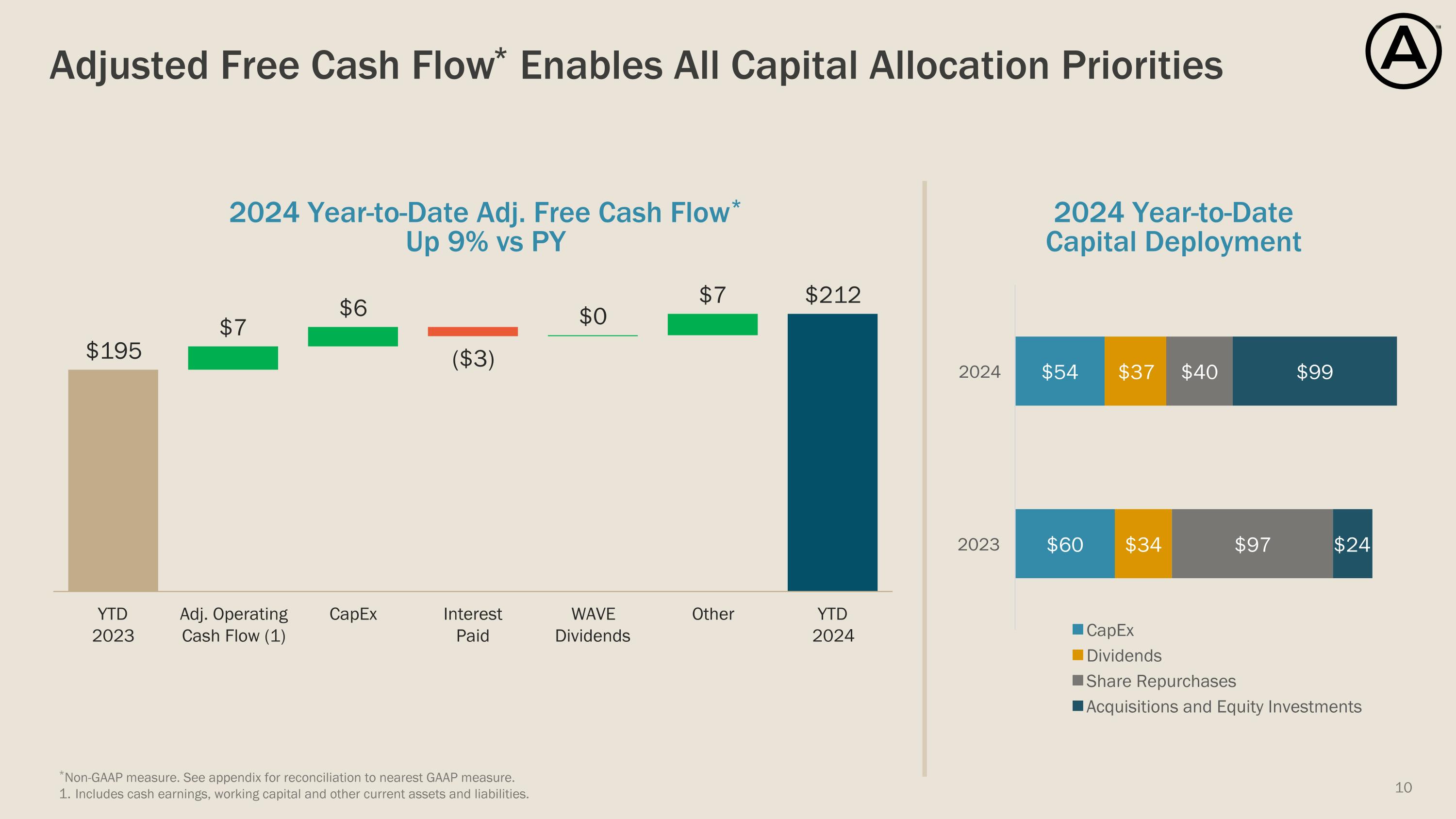

Adjusted Free Cash Flow* Enables All Capital Allocation Priorities 2024 Year-to-Date Capital Deployment 2024 Year-to-Date Adj. Free Cash Flow* �Up 9% vs PY *Non-GAAP measure. See appendix for reconciliation to nearest GAAP measure. Includes cash earnings, working capital and other current assets and liabilities.

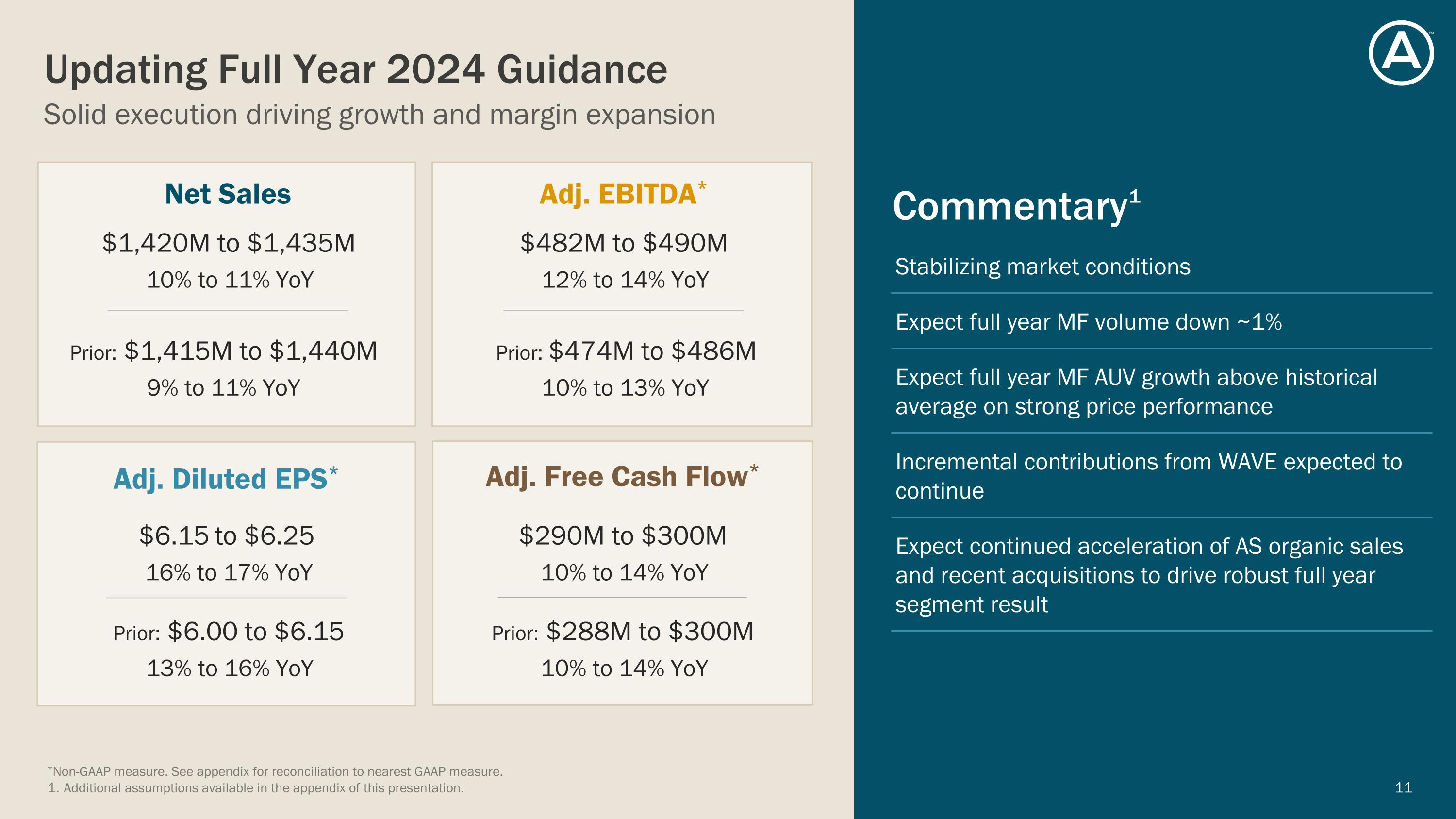

Solid execution driving growth and margin expansion Updating Full Year 2024 Guidance Commentary1 Prior: $1,415M to $1,440M 9% to 11% YoY Net Sales Prior: $6.00 to $6.15 13% to 16% YoY Adj. Diluted EPS* Prior: $474M to $486M 10% to 13% YoY Adj. EBITDA* Prior: $288M to $300M 10% to 14% YoY Adj. Free Cash Flow* $1,420M to $1,435M 10% to 11% YoY Stabilizing market conditions Expect full year MF volume down ~1% Expect full year MF AUV growth above historical average on strong price performance Incremental contributions from WAVE expected to continue Expect continued acceleration of AS organic sales and recent acquisitions to drive robust full year segment result $290M to $300M 10% to 14% YoY $482M to $490M 12% to 14% YoY $6.15 to $6.25 16% to 17% YoY *Non-GAAP measure. See appendix for reconciliation to nearest GAAP measure. Additional assumptions available in the appendix of this presentation.

Appendix

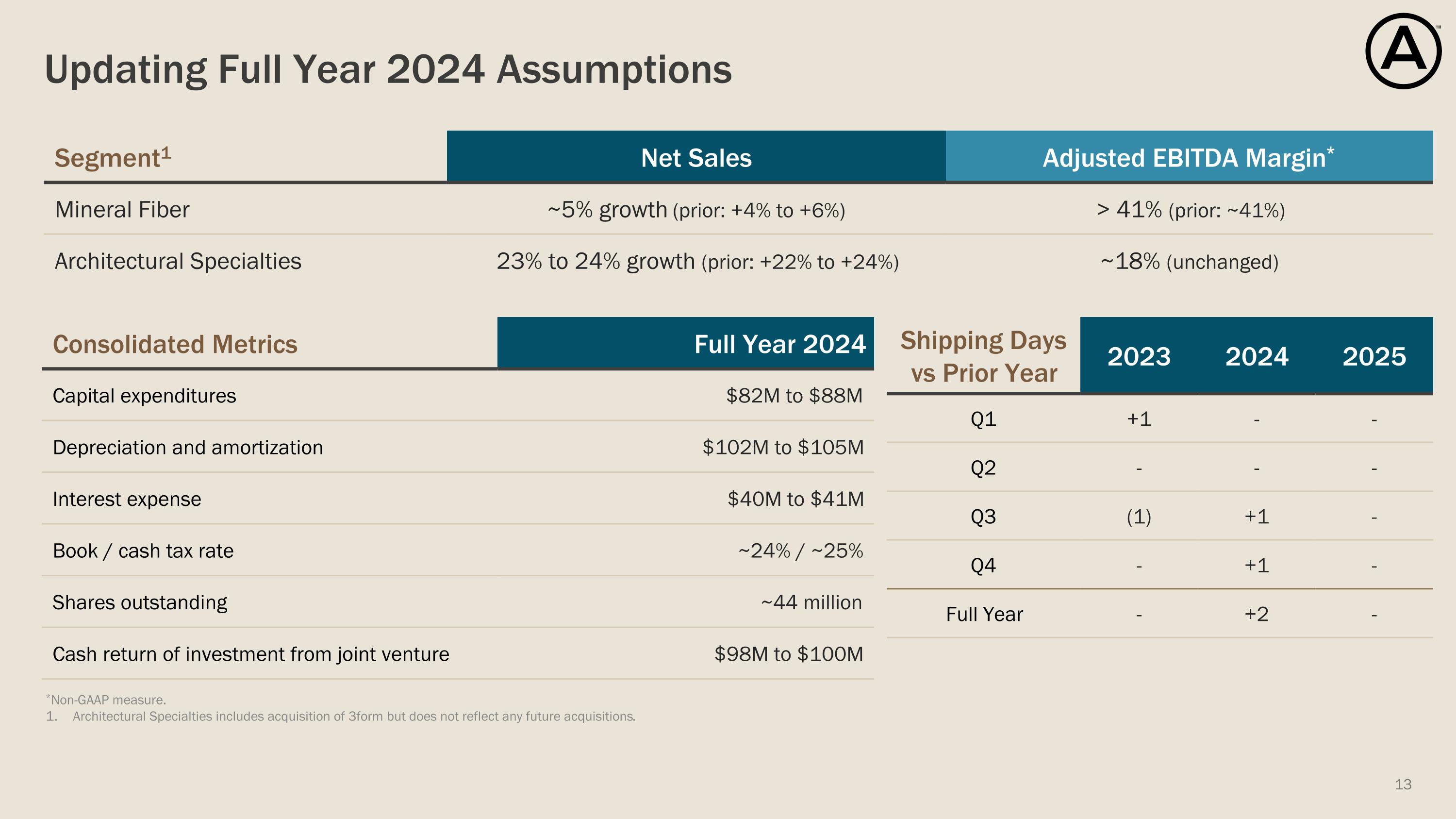

Updating Full Year 2024 Assumptions Segment1 Net Sales Adjusted EBITDA Margin* Mineral Fiber ~5% growth (prior: +4% to +6%) > 41% (prior: ~41%) Architectural Specialties 23% to 24% growth (prior: +22% to +24%) ~18% (unchanged) Consolidated Metrics Full Year 2024 Capital expenditures $82M to $88M Depreciation and amortization $102M to $105M Interest expense $40M to $41M Book / cash tax rate ~24% / ~25% Shares outstanding ~44 million Cash return of investment from joint venture $98M to $100M Shipping Days vs Prior Year 2023 2024 2025 Q1 +1 - - Q2 - - - Q3 (1) +1 - Q4 - +1 - Full Year - +2 - 13 *Non-GAAP measure. Architectural Specialties includes acquisition of 3form but does not reflect any future acquisitions.