Brown-Forman

Corporation (BF.B), one of the leading producers and

distributors of premium alcoholic beverages in the world, is

scheduled to report its fourth-quarter and fiscal 2012 financial

results before the opening bell on June 6, 2012.

The current Zacks Consensus

Estimate for the quarter is 76 cents per share. For the quarter

under review, revenue is expected to be $805 million, according to

the Zacks Consensus Estimate.

For fiscal 2012, the Zacks

Consensus Estimate stands at $3.59 per share while revenue is

expected to be $3,453 million.

Third-Quarter 2012 - A

Synopsis

Brown-Forman reported earnings of

93 cents per share for third-quarter 2012, missing the Zacks

Consensus Estimate of $1.00 and declined approximately 3.1% from

the year-ago earnings of 96 cents. Higher input and fuel costs

coupled with increased operating expenses affected the company’s

bottom line.

Brown-Forman's net sales remained

almost flat year over year at $959 million. As per the company, the

distributors piled up the inventories in anticipation of a price

rise during the second quarter, which was the main reason for flat

third-quarter sales.

Guidance for Fiscal

2012

In anticipation of a solid

improvement in consumer trends during the last quarter of fiscal

2012, Brown-Forman expects high-single digit growth in net sales

and operating income. However, it anticipates that the stronger

U.S. dollar value may have an adverse impact on its bottom line.

Accordingly, the company narrowed its earnings guidance range at

the time of third-quarter earnings release. Currently, Brown-Forman

expects fiscal 2012 earnings in the range of $3.50 to $3.65 per

share instead of $3.45 to $3.70.

Zacks

Consensus

The analysts following the stock

expect Brown-Forman to post fourth-quarter 2012 earnings of 76

cents a share, lower than 80 cents delivered in the prior-year

quarter. Currently, the Zacks Consensus Estimate ranges between 71

cents and 77 cents a share.

For fiscal 2012, the Zacks

Consensus Estimate stands at $3.59 per share, higher than the

year-ago fiscal earnings of $3.57. The current Zacks Consensus

Estimate ranges between $3.55 and $3.60 per share.

Agreement of

Estimate

For the fourth quarter of fiscal

2012, of the 7 analysts covering the stock, only 1 analyst revised

its estimates upward, while none have revised their estimates in

the downward direction, over the last 30 days. For full fiscal

2012, 1 analyst revised their estimate downward, while none revised

in the opposite direction, in the last 30 days.

In the last 7 days, no movement in

estimates has been noticed in either direction either for

fourth-quarter 2012 or fiscal 2012.

Magnitude of Estimate

Revisions

The magnitude of estimate revisions

for Brown-Forman depicts a neutral outlook for the upcoming fourth

quarter and fiscal 2012. Over the last 7 days, estimates for the

upcoming quarter and fiscal 2012 have remained unchanged at 76

cents and $3.59 per share, respectively.

However, in the last 30 days,

estimates for the upcoming fourth quarter moved up by a penny to 76

cents per share while they remain unchanged at $3.59 for fiscal

2012.

Surprise

History

With respect to earnings surprises,

Brown-Forman has missed as well as topped the Zacks Consensus

Estimate over the last four quarters in the range of negative 7% to

positive 25%. The average remained a positive 5.2%. This suggests

that Brown-Forman has surpassed the Zacks Consensus Estimate by an

average of 5.2% in the trailing four quarters.

Our

Recommendation

Brown-Forman is one of the leading

producers and distributors of premium alcoholic beverages in the

world. The company commands a strong portfolio of globally

recognized brands, such as Jack Daniel’s, Finlandia, Southern

Comfort and Canadian Mist. We believe this provides a competitive

edge to the company and bolsters its well-established position in

the market.

Moreover, we believe Brown-Forman’s

strategy of expanding Jack Daniel's market share in developed

markets, such as France and the U.S., and emerging markets

including Russia, Poland and Mexico, where the whiskey category is

in early stages of development will boost its top line.

However, apart from macroeconomic

headwinds, distilled spirits are subject to excise tax in various

countries. Rising fiscal pressure in the U.S., European and many

emerging markets may lead to increasing risk of a potential excise

tax on spirits by the governments of respective countries. The

effect of any excise tax increase in future may have an adverse

effect on Brown-Forman’s financial performance.

Above all, the company faces

intense competition from other well-established players in the

industry, including Beam Inc. (BEAM),

Constellation Brands Inc. (STZ) and Diageo

plc (DEO). Moreover, Brown-Forman also encounters

competition from local and regional players in the respective

countries. Consequently, this may dent the company’s future

operating performance.

Currently, Brown-Forman has a Zacks

#4 Rank, which implies a short-term Sell rating. However, we

maintain a long-term Neutral recommendation on the stock.

BEAM INC (BEAM): Free Stock Analysis Report

BROWN FORMAN B (BF.B): Free Stock Analysis Report

DIAGEO PLC-ADR (DEO): Free Stock Analysis Report

CONSTELLATN BRD (STZ): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

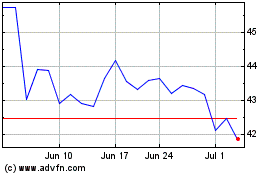

Brown Forman (NYSE:BF.B)

Historical Stock Chart

From Jun 2024 to Jul 2024

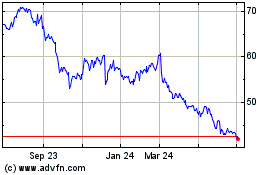

Brown Forman (NYSE:BF.B)

Historical Stock Chart

From Jul 2023 to Jul 2024