- Announced divestiture of two assets as we continue to pursue

strategic sales and debt refinancing to further improve the balance

sheet and support future growth

- Announced total YTD implied bookings of $810.5 million,

including $543.9 million of bookings, a 27% increase compared to

same period of 2023

- Excluding divestitures, announced implied backlog of $628.2

million, which includes $361.6 million of backlog, a 48% increase

compared to the same period of 2023

- Received final approval to proceed on a previously announced

$246 million natural gas conversion project in Indiana as of

November 2024

- Began ramp up to BrightLoop™ project in Massillon, Ohio

targeted to produce hydrogen and sequester CO2 by early

2026

Q3 2024 Continuing Operations Financial Highlights

- Significantly improved margin performance, which helped meet

adjusted EBITDA and net income expectations for the quarter when

adjusted for one-time items

- Revenue of $209.9 million, compared to revenue of $239.4

million, in the third quarter of 2023 which included revenues of

$34.2 million from a B&W Renewable Service A/S (BWRS)

asset

- Operating loss of $1.5 million, which includes a $5.8 million

non-cash impairment on the recent SPIG divestiture and a $4.9

million settlement to exit a long-term loss-generating maintenance

contract, compared to operating income of $5.5 million in the third

quarter of 2023

- Net loss of $11.1 million, including a $5.8 million non-cash

impairment on the recent SPIG divestiture and $4.9 million

settlement to exit a loss-generating maintenance contract that had

10 years remaining, compared to a net loss of $12.3 million in the

third quarter of 2023

- Loss per share of $0.16, compared to a loss per share of $0.18

in the third quarter of 2023

- Adjusted EBITDA of $22.3 million, compared to adjusted EBITDA

of $20.0 million in the third quarter of 2023. Adjusted EBITDA in

the third quarter of 2023 was $12.5 million excluding the BWRS

divestiture or an increase of 78%. Adjusted EBITDA excluding

BrightLoop™ and ClimateBright™ expenses was $23.3 million in the

third quarter of 2024

Babcock & Wilcox Enterprises, Inc. ("B&W" or the

"Company") (NYSE: BW) announced results for the third quarter of

2024.

Energy Demand

"We believe that we are in a unique position to leverage the

significant increase in base-load generation demand in North

America and around the world," said Kenneth Young, B&W Chairman

and Chief Executive Officer. "Consumer demand for energy – either

from the grid or behind the meter – along with increased energy

needs from utility and large industrial clients are providing even

greater opportunities for us to deliver our broad range of

technology and considerable expertise in the areas of fossil fuels,

natural gas, synthetic fuels and renewable energy to help meet that

demand. We believe the increasing need for power and electricity

fueled by demand from AI data centers, electric vehicles and

expanding economies will be key drivers for growth across our broad

range of technologies and we are seeing our utility and industrial

clients, including in the oil and gas sector, continuing to

increase capacity utilizing our core technologies while evaluating

further power generation augmentation through biomass, hydrogen and

natural gas. We expect these tail-winds to increase in the coming

years, as the amount of front-end engineering design (FEED)

opportunities have grown. Today we have 12 to 15 active FEED

studies that represent potential projects of over $1 billion in

revenues in our pipeline. We believe that these expected industry

tailwinds provide a strong foundation for B&W to grow in 2025

and beyond as we continue to drive for higher margins and improved

cash flows."

"Overall, we continue to see strong demand for our diverse

portfolio of technologies that help drive our increased backlog and

higher implied bookings of over $800 million. As further evidence

of the opportunities for growth, we are excited to announce that we

have now received full notice to proceed on the $246 million

natural gas conversion project in Indiana," Young added.

BrightLoop and ClimateBright

"Our investments across our ClimateBright suite of

decarbonization technologies to support the world’s energy

transition are progressing well and notably we continued to move

forward on our BrightLoop project in Massillon, Ohio, with a target

of producing hydrogen by early 2026," Young said. “We are working

on several carbon capture opportunities that utilize our

SolveBright post combustion CO2 capture technology and our

oxy-combustion technology that injects pure oxygen into the

combustion process to significantly reduce CO2 emissions. We

recently announced a FEED study in Sweden that utilizes our

post-combustion technology with an existing waste-to-energy

facility. In addition to our work in support of the BrightLoop

project in Massillon, Ohio, we also are further developing our

BrightLoop projects in West Virginia, Wyoming and Louisiana and are

engaging in FEED studies for BrightLoop with various customers in

Canada and around the world.”

Asset Sales and Debt Refinancing

“During the quarter, we completed the sale of our SPIG/GMAB

business for net proceeds of $33.7 million, which improves our

balance sheet to support growth and aligns with our ongoing

strategy to sell certain non-strategic businesses. Combined, we

have raised over $116 million from divestiture of two assets in

2024. These sales reaffirm our objective to strengthen our balance

sheet,” Young continued. “We remain in dialogue related to the sale

of other non-strategic assets as previously discussed, as well as

potential refinancing options."

Increased Margin Performance

“Our third quarter results demonstrated significant margin

improvement, reflecting our strategic direction as evidenced by

strong year-over-year adjusted EBITDA and net income increases.

These results include two one-time items, a non-cash impairment on

the recent SPIG divestiture and a settlement on a maintenance

contract to avoid 10 years of potential significant future losses.

Excluding these two one-time charges, we met adjusted EBITDA and

net income expectations for the quarter. Looking ahead, we continue

to expect increasing operating momentum driven by our Thermal and

Environmental segments, as the fourth quarter is historically a

seasonally strong period for B&W’s businesses, with increased

services and project schedules from our customers," Young said.

“Our business as a whole prior to divestitures is on target to

achieve our stated goals in 2024. When adjusting the targets to

reflect the recent divestitures, our EBITDA target range is around

$91.0 million to $95.0 million, excluding BrightLoop and

ClimateBright expenses. Our global pipeline of over $9 billion in

identified project opportunities remains healthy across all

business segments, and we anticipate continued prospects for new

bookings and stronger financial performance throughout the fourth

quarter and heading into 2025.”

Q3 2024 Continuing Operations Financial Summary

Revenues in the third quarter of 2024 were $209.9 million versus

revenues of $239.4 million in the third quarter of 2023, which

includes $34.2 million in revenues from BWRS. Revenues in the third

quarter of 2024 increased by $4.6 million when compared to revenues

without BWRS in the third quarter of 2023. This increase was driven

primarily by growth in our domestic and European Environmental

business as well as Thermal segment benefits related to a large

natural gas project and increased volume in parts during the year.

Operating loss in the third quarter of 2024 was $1.5 million,

compared to operating income of $5.5 million in the third quarter

of 2023. The decrease is primarily attributable to the divestiture

of BWRS which resulted in a reduction of income from the previous

quarter of $7.4 million, as well as two one-time charges of a $5.8

million non-cash impairment related to the sale of SPIG and a $4.9

million settlement to exit a loss generating maintenance contract.

This completes our exit strategy from European O&M, which has

resulted in approximately $15.0 million in losses over the last

three years, and allows us to avoid 10 years of potentially

significant escalating losses. Loss in the third quarter of 2024

was $11.1 million, compared to a loss of $12.3 million in the third

quarter of 2023, for the same reasons noted with respect to

operating income above. Loss per common share in the third quarter

of 2024 was $0.16 compared to a loss per common share of $0.18 in

the third quarter of 2023. Adjusted EBITDA was $22.3 million, an

increase compared to $20.0 million in the third quarter of 2023,

which included $7.4 million of BWRS Adjusted EBITDA, primarily due

to the impact of SG&A reductions, product mix and project

margins. Implied bookings in the third quarter of 2024 were $142.0

million, compared to $197.9 million in the third quarter of 2023.

Ending implied backlog was $628.2 million, an increase of 22%

compared to implied backlog at the end of the third quarter of

2023. All amounts referred to in this release are on a continuing

operations basis, unless otherwise noted. Reconciliations of net

income, the most directly comparable GAAP measure, to Adjusted

EBITDA for the Company's segments, are provided in the exhibits to

this release.

Babcock & Wilcox Renewable segment revenues were

$38.2 million for the third quarter of 2024, a decrease compared to

$87.1 million in the third quarter of 2023. The decrease is

primarily due to the divestiture of BWRS, which accounted for $34.2

million of revenue in the third quarter of 2023. Adjusted EBITDA in

the third quarter of 2024 was $5.0 million, a decrease compared to

$10.1 million in the third quarter of 2023, which included $7.4

million from BWRS, partially offset by favorable project closeouts

in the current quarter. Bookings in Renewable parts and services

during the third quarter of 2024 exceeded bookings in the same

period in 2023, with total bookings increasing from $32.7 million

in 2023 to $40.8 million in 2024.

Babcock & Wilcox Environmental segment revenues were

$56.6 million in the third quarter of 2024, an increase of 22%

compared to $46.4 million in the third quarter of 2023.

Approximately $7.7 million of the increase is attributable to

growth in our domestic environmental and electrostatic precipitator

business and $1.0 million of the increase is due to growth in our

European environmental business. Adjusted EBITDA in the third

quarter of 2024 was $4.7 million, which is favorable to our

internal targets, compared to $5.0 million in the third quarter of

2023, which is primarily in line with the previous year.

Babcock & Wilcox Thermal segment revenues were $119.9

million in the third quarter of 2024, which is an increase of 12%

compared to $107.0 million in the third quarter of 2023. The

revenue increase is primarily the result of a large natural gas

project which accounted for $4.2 million and an increased volume of

parts which accounted for $4.8 million. Adjusted EBITDA in the

third quarter of 2024 was $18.4 million, an increase compared to

$11.3 million in the third quarter of 2023. The revenue drivers

above resulted in an increase in Adjusted EBITDA of $4.2 million

and favorable project margins in our construction business resulted

in an increase of $2.1 million.

Liquidity and Balance Sheet

At September 30, 2024, the Company had total debt of $475.4

million and a cash, cash equivalents and restricted cash balance of

$127.9 million.

Earnings Call Information

B&W plans to host a conference call and webcast on Tuesday,

November 12, 2024 at 5 p.m. ET to discuss the Company's third

quarter 2024 results. The listen-only audio of the conference call

will be broadcast live via the Internet on B&W’s Investor

Relations site. The dial-in number for participants in the U.S. is

(833) 470-1428; the dial-in number for participants in Canada is

(833) 950-0062; the dial-in number for participants in all other

locations is (929) 526-1599. The conference ID for all participants

is 883496. A replay of this conference call will remain accessible

in the investor relations section of the Company’s website for a

limited time.

Non-GAAP Financial Measures

The Company uses non-GAAP financial measures internally, also

referred to in this release as “adjusted” financial measures, to

evaluate its performance and in making financial and operational

decisions. When viewed in conjunction with GAAP results and the

accompanying reconciliation, the Company believes that its

presentation of these measures provides investors with greater

transparency and a greater understanding of factors affecting its

financial condition and results of operations than GAAP measures

alone. The presentation of non-GAAP financial measures should not

be considered in isolation or as a substitute for the Company’s

related financial results prepared in accordance with GAAP.

Adjusted EBITDA on a consolidated basis is a non-GAAP metric

defined as the sum of the Adjusted EBITDA for each of the segments,

further adjusted for corporate allocations and research and

development costs. At a segment level, the Adjusted EBITDA

presented is consistent with the way the Company's chief operating

decision maker reviews the results of operations and makes

strategic decisions about the business and is calculated as

earnings before interest expense, tax, depreciation and

amortization adjusted for items such as gains or losses arising

from the sale of non-income producing assets, net pension benefits,

restructuring costs, impairments, gains and losses on debt

extinguishment, costs related to financial consulting, research and

development costs and other costs that may not be directly

controllable by segment management and are not allocated to the

segment. The Company presents consolidated Adjusted EBITDA because

it believes it is useful to investors to help facilitate

comparisons of the ongoing, operating performance before corporate

overhead and other expenses not attributable to the operating

performance of the Company's revenue generating segments. In

addition, the Company presents the non-GAAP financial measure of

Adjusted EBITDA excluding BrightLoop and ClimateBright. Management

believes this measure is useful to investors because of the

increasing importance of BrightLoop and ClimateBright to the future

growth of the Company. Management uses Adjusted EBITDA excluding

BrightLoop and ClimateBright to assess the Company's performance

independent of these technologies.

This release presents Adjusted Operating Income, Adjusted EBITDA

without BWRS and Revenue without BWRS as additional non-GAAP

financial measures. Management believes these measures are useful

to investors to facilitate comparisons between years by excluding

the impact from business divestitures in the current year and their

related operating results from the prior year. Management uses

these measures to preview and evaluate performance of retained

businesses.

This release also presents certain targets for the Company's

Adjusted EBITDA in the future; these targets are not intended as

guidance regarding how the Company believes the business will

perform. The Company is unable to reconcile these targets to their

GAAP counterparts without unreasonable effort and expense. Prior

period results have been revised to conform with the revised

definition and present separate reconciling items in our

reconciliation, including business transition costs.

Bookings and Backlog

Bookings and backlog are our measure of remaining performance

obligations under our sales contracts. It is possible that our

methodology for determining bookings and backlog may not be

comparable to methods used by other companies. Implied backlog and

implied bookings include projects awarded or under contract but not

fully released for performance.

We generally include expected revenue from contracts in our

backlog when we receive written confirmation from our customers

authorizing the performance of work and committing the customers to

payment for work performed. Backlog may not be indicative of future

operating results, and contracts in our backlog may be canceled,

modified or otherwise altered by customers. Backlog can vary

significantly from period to period, particularly when large new

build projects or operations and maintenance contracts are booked

because they may be fulfilled over multiple years. Because we

operate globally, our backlog is also affected by changes in

foreign currencies each period. We do not include orders of our

unconsolidated joint ventures in backlog.

Bookings represent changes to the backlog. Bookings include

additions from booking new business, subtractions from customer

cancellations or modifications, changes in estimates of liquidated

damages that affect selling price and revaluation of backlog

denominated in foreign currency. We believe comparing bookings on a

quarterly basis or for periods less than one year is less

meaningful than for longer periods, and that shorter-term changes

in bookings may not necessarily indicate a material trend.

Impacts of Market Conditions

Management continues to adapt to macroeconomic conditions,

including the impacts from inflation, changing interest rates and

foreign exchange rate volatility, geopolitical conflicts (including

the ongoing conflicts in Ukraine and the Middle East) and global

shipping and supply chain disruptions that continued to have an

impact during the first nine months of 2024. In certain instances,

these situations have resulted in cost increases and delays or

disruptions that have had, and could continue to have, an adverse

impact on our ability to meet customers’ demands. We continue to

actively monitor the impact of these market conditions on current

and future periods and actively manage costs and our liquidity

position to provide additional flexibility while still supporting

our customers and their specific needs. The duration and scope of

these conditions cannot be predicted, and therefore, any

anticipated negative financial impact on our operating results

cannot be reasonably estimated.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. All statements other than statements of historical or current

fact included in this release are forward-looking statements. You

should not place undue reliance on these statements.

Forward-looking statements include words such as “expect,”

“intend,” “plan,” “likely,” “seek,” “believe,” “project,”

“forecast,” “target,” “goal,” “potential,” “estimate,” “may,”

“might,” “will,” “would,” “should,” “could,” “can,” “have,” “due,”

“anticipate,” “assume,” “contemplate,” “continue” and other words

and terms of similar meaning in connection with any discussion of

the timing or nature of future operational performance or other

events.

These forward-looking statements are based on management’s

current expectations and involve a number of risks and

uncertainties, including, among other things: our financial

condition and ability to continue as a going concern; the impact of

global macroeconomic conditions, including inflation and volatility

in the capital markets; risks associated with contractual pricing

in our industry; our relationships with customers, subcontractors

and other third parties; our ability to comply with our contractual

obligations; disruptions at our or manufacturing facilities or a

third-party manufacturing facility that we have engaged; the

actions or failures of our co-venturers; our ability to implement

our growth strategy, including through strategic acquisitions,

which we may not successfully consummate or integrate; our

evaluation of strategic alternatives for certain businesses and

non-strategic assets, which may not result in a successful

transaction; the risks of unexpected adjustments and cancellations

in our backlog; professional liability, product liability, warranty

and other claims; our ability to compete successfully against

current and future competitors; our ability to develop and

successfully market new products; the impacts of industry

conditions and public health crises; the cyclical nature of the

industries in which we operate; changes in the legislative and

regulatory environment in which we operate; supply chain issues,

including shortages of adequate components; failure to properly

estimate customer demand; our ability to comply with the covenants

in our debt agreements; our ability to refinance our 8.125% Notes

due 2026 and 6.50% Notes due 2026 prior to their maturity; our

ability to maintain adequate bonding and letter of credit capacity;

impairment of goodwill or other indefinite-lived intangible assets;

credit risk; disruptions in, or failures of, our information

systems; our ability to comply with privacy and information

security laws; our ability to protect our intellectual property and

use the intellectual property that we license from third parties;

risks related to our international operations, including

fluctuations in the value of foreign currencies, global tariffs,

sanctions and export controls; could harm our profitability;

volatility in the price of our common stock; B. Riley’s significant

influence over us; changes in tax rates or tax law; our ability to

use net operating loss and certain tax credits; our ability to

maintain effective internal control over financial reporting; our

ability to attract and retain skilled personnel and senior

management; labor problems, including negotiations with labor

unions and possible work stoppages; risks associated with our

retirement benefit plans; natural disasters or other events beyond

our control, such as war, armed conflicts or terrorist attacks; and

the other factors specified and set forth under "Risk Factors" in

the Company’s periodic reports filed with the Securities and

Exchange Commission, including our most recent annual report on

Form 10-K.

These forward-looking statements are made based upon detailed

assumptions and reflect management’s current expectations and

beliefs. While we believe that these assumptions underlying the

forward-looking statements are reasonable, we caution that it is

very difficult to predict the impact of known factors, and it is

impossible for us to anticipate all factors that could affect

actual results. The forward-looking statements included herein are

made only as of the date hereof. We undertake no obligation to

publicly update or revise any forward-looking statement as a result

of new information, future events, or otherwise, except as required

by law.

About B&W Enterprises, Inc.

Headquartered in Akron, Ohio, Babcock & Wilcox Enterprises,

Inc. is a leader in energy and environmental products and services

for power and industrial markets worldwide. Follow us on LinkedIn

and learn more at babcock.com.

Exhibit 1

Babcock & Wilcox Enterprises,

Inc.

Condensed Consolidated Statements of

Operations(1)

(In millions, except per share

amounts)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Revenues

$

209.9

$

239.4

$

651.1

$

772.2

Costs and expenses:

Cost of operations

160.0

186.0

498.3

603.7

Selling, general and administrative

expenses

43.1

45.7

135.1

143.4

Restructuring activities

0.5

1.3

2.8

2.7

Research and development costs

1.4

0.9

3.7

3.1

Gain on sale of business

0.1

—

(40.1

)

—

Impairment on long-lived assets

5.8

—

5.8

—

Loss (gain) on asset disposals, net

0.4

—

0.4

—

Total costs and expenses

211.3

233.9

606.0

753.0

Operating (loss) income

(1.5

)

5.5

45.1

19.2

Other income (expense):

Interest expense

(10.6

)

(13.4

)

(36.0

)

(37.2

)

Interest income

0.3

0.3

0.9

0.9

Loss on debt extinguishment

(0.7

)

—

(6.8

)

—

Benefit plans, net

0.1

(0.1

)

0.3

(0.3

)

Foreign exchange

2.3

(4.9

)

1.4

(4.2

)

Other expense, net

(0.8

)

—

(0.4

)

(0.7

)

Total other expense, net

(9.4

)

(18.1

)

(40.6

)

(41.6

)

(Loss) income before income tax

expense

(10.9

)

(12.6

)

4.5

(22.3

)

Income tax expense (benefit)

0.2

(0.3

)

6.1

2.0

Loss from continuing operations

(11.1

)

(12.3

)

(1.6

)

(24.4

)

Income (loss) from discontinued

operations, net of tax

5.7

(104.5

)

4.9

(109.9

)

Net (loss) income

(5.3

)

(116.8

)

3.2

(134.2

)

Net income attributable to non-controlling

interest

—

(0.1

)

—

(0.1

)

(0.2

)

Net (loss) income attributable to

stockholders

(5.3

)

(116.9

)

3.2

(134.5

)

Less: Dividend on Series A preferred

stock

3.7

3.7

11.1

11.1

Net loss attributable to stockholders

of common stock

$

(9.0

)

$

(120.6

)

$

(8.0

)

$

(145.6

)

Basic and diluted loss per share:

Continuing operations

$

(0.16

)

$

(0.18

)

$

(0.14

)

$

(0.40

)

Discontinued operations

0.06

(1.17

)

0.05

(1.24

)

Basic and diluted loss per share

$

(0.10

)

$

(1.35

)

$

(0.09

)

$

(1.64

)

Shares used in the computation of earnings

(loss) per share:

Basic and diluted

92.3

89.1

90.9

88.9

(1) Figures may not be clerically accurate

due to rounding

Exhibit 2

Babcock & Wilcox Enterprises,

Inc.

Condensed Consolidated Balance

Sheets(1)

(In millions, except per share amount)

September 30, 2024

December 31, 2023

Cash and cash equivalents

$

30.6

$

65.3

Current restricted cash

63.4

5.7

Accounts receivable – trade, net

143.0

144.0

Accounts receivable – other

26.7

36.2

Contracts in progress

101.3

90.1

Inventories, net

116.6

113.9

Other current assets

21.8

23.9

Current assets held for sale

26.9

18.5

Total current assets

530.2

497.6

Net property, plant and equipment, and

finance leases

73.6

78.4

Goodwill

84.6

102.0

Intangible assets, net

23.9

45.6

Right-of-use assets

29.7

28.2

Long-term restricted cash

33.9

0.3

Deferred tax assets

6.3

2.1

Other assets

22.4

21.6

Total assets

$

804.6

$

775.7

Accounts payable

$

122.4

$

127.5

Accrued employee benefits

11.6

10.8

Advance billings on contracts

58.8

81.1

Accrued warranty expense

6.8

7.6

Financing lease liabilities

1.5

1.4

Operating lease liabilities

3.8

3.9

Other accrued liabilities

53.1

68.1

Loans payable

3.0

6.2

Current liabilities held for sale

36.9

43.6

Total current liabilities

297.9

350.2

Senior notes

339.7

337.9

Loans payable, net of current portion

132.8

35.4

Pension and other postretirement benefit

liabilities

163.8

172.9

Finance lease liabilities, net of current

portion

25.8

26.2

Operating lease liabilities, net of

current portion

27.1

25.4

Deferred tax liability

10.7

13.0

Other noncurrent liabilities

10.0

15.1

Total liabilities

1,007.8

976.0

Commitments and contingencies

Stockholders' deficit:

Preferred stock, par value $0.01 per

share, authorized shares of 20,000; issued and outstanding shares

7,669 at September 30, 2024 and December 31, 2023

0.1

0.1

Common stock, par value $0.01 per share,

authorized shares of 500,000; outstanding shares of 92,382 and

89,449 at September 30, 2024 and December 31, 2023,

respectively

5.2

5.1

Capital in excess of par value

1,552.0

1,546.3

Treasury stock at cost, 2,339 and 2,139

shares at September 30, 2024 and December 31, 2023,

respectively

(115.4

)

(115.2

)

Accumulated deficit

(1,578.9

)

(1,570.9

)

Accumulated other comprehensive loss

(66.6

)

(66.4

)

Stockholders' deficit attributable to

shareholders

(203.7

)

(201.0

)

Non-controlling interest

0.6

0.6

Total stockholders' deficit

(203.1

)

(200.4

)

Total liabilities and stockholders'

deficit

$

804.6

$

775.7

(1) Figures may not be clerically accurate

due to rounding.

Exhibit 3

Babcock & Wilcox Enterprises,

Inc.

Condensed Consolidated Statements of

Cash Flows(1)

(In millions)

Nine Months Ended September

30,

2024

2023

Cash flows from operating activities:

Net loss from continuing operations

$

(1.6

)

$

(24.4

)

Net income (loss) from discontinued

operations

4.9

(109.9

)

Net income (loss)

3.2

(134.2

)

Adjustments to reconcile net income (loss)

to net cash used in operating activities:

Depreciation and amortization of

long-lived assets

13.7

16.5

Goodwill impairment

—

56.6

Amortization of deferred financing costs

and debt discount

3.7

3.7

Amortization of guaranty fee

2.1

0.5

Non-cash operating lease expense

5.2

4.4

Loss on debt extinguishment

6.8

—

Gain on sale of business

(40.1

)

—

Impairment on long-lived assets

5.8

—

Loss on asset disposals

0.4

0.2

Benefit from deferred income taxes

(6.5

)

(5.6

)

Prior service cost amortization for

pension and postretirement plans

0.7

0.7

Stock-based compensation

3.8

7.2

Foreign exchange

(1.4

)

4.2

Changes in operating assets and

liabilities:

Accounts receivable - trade, net and

other

(17.7

)

4.3

Contracts in progress

(30.4

)

2.5

Advance billings on contracts

(20.7

)

(29.7

)

Inventories, net

(3.4

)

(10.5

)

Income taxes

2.7

(0.2

)

Accounts payable

5.1

28.1

Accrued and other current liabilities

(5.8

)

(4.6

)

Accrued contract loss

(6.0

)

13.3

Pension liabilities, accrued

postretirement benefits and employee benefits

(7.6

)

(2.1

)

Other, net

(9.9

)

(5.6

)

Net cash used in operating

activities

(96.3

)

(50.5

)

Cash flows from investing

activities:

Purchase of property, plant and

equipment

(10.1

)

(10.5

)

Proceeds from sale of business and assets,

net

87.6

—

Purchases of available-for-sale

securities

(4.5

)

(5.3

)

Sales and maturities of available-for-sale

securities

5.0

7.4

Other, net

—

(0.1

)

Net cash provided by (used in)

investing activities

78.0

(8.6

)

Cash flows from financing

activities:

Borrowings on loan payable

184.8

97.1

Repayments on loan payable

(91.1

)

(72.5

)

Finance lease payments

(1.0

)

—

Payment of holdback funds from

acquisition

(3.0

)

(2.8

)

Payment of preferred stock dividends

(14.9

)

(7.4

)

Shares of common stock returned to

treasury stock

(0.3

)

(1.4

)

Issuance of common stock, net

2.0

—

Debt issuance costs

(5.6

)

(0.2

)

Other, net

(0.2

)

(0.9

)

Net cash provided by financing

activities

70.8

11.9

Effects of exchange rate changes on

cash

4.0

(0.7

)

Net increase (decrease) in cash, cash

equivalents and restricted cash

56.6

(47.9

)

Cash, cash equivalents and restricted cash

at beginning of period

71.4

113.0

Cash, cash equivalents and restricted cash

at end of period

$

127.9

$

65.1

(1) Figures may not be clerically accurate

due to rounding.

Exhibit 4

Babcock & Wilcox Enterprises,

Inc.

Segment Information(1)

(In millions)

SEGMENT RESULTS

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

REVENUES:

Babcock & Wilcox Renewable

$

38.2

$

87.1

$

151.4

$

256.4

Babcock & Wilcox Environmental

56.6

46.4

161.2

134.6

Babcock & Wilcox Thermal

119.9

107.0

350.3

384.2

Eliminations

(4.8

)

(1.1

)

(11.8

)

(3.0

)

$

209.9

$

239.4

$

651.1

$

772.2

ADJUSTED EBITDA:

Babcock & Wilcox Renewable

$

5.0

$

10.1

$

14.3

$

19.2

Babcock & Wilcox Environmental

4.7

5.0

14.8

10.3

Babcock & Wilcox Thermal

18.4

11.3

45.1

49.4

Corporate

(5.7

)

(5.6

)

(15.6

)

(16.2

)

Research and development costs

(0.2

)

(0.9

)

(0.5

)

(3.1

)

$

22.3

$

20.0

$

58.1

$

59.6

AMORTIZATION EXPENSE:

Babcock & Wilcox Renewable

$

0.1

$

0.5

$

1.0

$

1.6

Babcock & Wilcox Environmental

0.8

0.8

2.4

2.3

Babcock & Wilcox Thermal

1.1

1.1

3.2

3.3

$

2.0

$

2.4

$

6.7

$

7.2

DEPRECIATION EXPENSE:

Babcock & Wilcox Renewable

$

0.3

$

0.6

$

1.2

$

2.1

Babcock & Wilcox Environmental

0.6

0.2

1.4

0.6

Babcock & Wilcox Thermal

1.4

1.4

3.9

5.0

$

2.2

$

2.2

$

6.5

$

7.8

BOOKINGS AND BACKLOG

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

BOOKINGS:

Babcock & Wilcox Renewable

$

41

$

33

$

108

$

180

Babcock & Wilcox Environmental

17

54

118

154

Babcock & Wilcox Thermal

103

105

321

299

Other/Eliminations

0

6

(3

)

(5

)

$

161

$

198

$

544

$

628

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

IMPLIED BOOKINGS(2):

Babcock & Wilcox Renewable

$

41

$

33

$

108

$

180

Babcock & Wilcox Environmental

33

54

154

162

Babcock & Wilcox Thermal

68

105

552

299

Other/Eliminations

—

6

(3

)

(5

)

$

142

$

198

$

811

$

636

BACKLOG

IMPLIED BACKLOG(3)

As of September 30,

As of September 30,

2024

2023

2024

2023

Babcock & Wilcox Renewable

$

96

$

133

$

96

$

133

Babcock & Wilcox Environmental

66

173

101

181

Babcock & Wilcox Thermal

185

196

416

196

Other/Eliminations

15

5

15

5

$

362

$

507

$

628

$

515

(1) Figures may not be clerically accurate

due to rounding.

(2) Implied bookings are bookings plus

projects that are awarded but not contracted or are under contract

but not fully released for performance.

(3) Implied backlog is backlog plus

projects that are awarded or under contract but not fully released

for performance.

Exhibit 5

Babcock & Wilcox Enterprises,

Inc.

Reconciliation of Adjusted

EBITDA(3)

(In millions)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Income (loss) from continuing

operations

$

(11.1

)

$

(12.3

)

$

(1.6

)

$

(24.4

)

Interest expense

10.3

13.4

35.1

37.1

Income tax expense

0.2

(0.3

)

6.1

2.0

Depreciation & amortization

4.2

4.6

13.2

15.0

EBITDA

3.6

5.4

52.8

29.7

Gain on sale of business

—

—

(40.2

)

—

Benefit plans, net

(0.1

)

0.1

(0.3

)

0.3

Gain on asset sales, net

0.4

—

0.4

—

Impairment on long-lived assets

5.8

—

5.8

—

Stock compensation

0.9

0.4

3.6

5.9

Restructuring activities and business

services transition costs

0.5

1.3

2.8

3.3

Settlement and related legal costs

(0.1

)

—

3.2

(2.5

)

Loss on debt extinguishment

0.7

—

6.8

—

Acquisition pursuit and related costs

0.2

0.3

0.3

0.6

Product development (1)

2.1

0.9

5.1

3.3

Foreign exchange

(2.3

)

4.9

(1.4

)

4.2

Financial advisory services

1.1

—

1.3

—

Contract disposal (2)

6.1

4.3

10.1

8.4

Letter of credit fees

1.3

2.0

5.9

5.6

Other - net

2.2

0.4

1.7

0.8

Adjusted EBITDA

$

22.3

$

20.0

$

58.1

$

59.6

Product development (1)

(1.7

)

(0.5

)

(3.9

)

(2.6

)

BrightLoopTM and ClimateBrightTM

expenses

2.7

1.7

6.9

5.9

Adjusted EBITDA excluding BrightLoopTM and

ClimateBrightTM expenses

$

23.3

$

21.2

$

61.1

$

62.9

(1) Costs associated with development of

commercially viable products that are ready to go to market.

(2) Impacts of the disposal of our O&M

contracts has been adjusted in the prior period to ensure uniform

presentation with the current period.

(3) Figures may not be clerically accurate

due to rounding.

Exhibit 6 Babcock & Wilcox Enterprises, Inc.

Other Non-GAAP Reconciliations(1)

(in millions)

Three months ended September

30, 2023

Revenue

$

239.4

Less:

BWRS Revenue

34.2

Revenue, less BWRS

$

205.2

(in millions)

Three months ended September

30, 2023

Adjusted EBITDA

$

20.0

Less:

BWRS Adjusted EBITDA

7.4

Adjusted EBITDA, less BWRS

$

12.6

(1) Figures may not be clerically accurate

due to rounding.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241112543518/en/

Investor Contact: Lou Salamone, CFO Babcock & Wilcox

Enterprises, Inc. 704.625.4944 | investors@babcock.com

Media Contact: Ryan Cornell Public Relations Babcock

& Wilcox Enterprises, Inc. 330.860.1345 |

rscornell@babcock.com

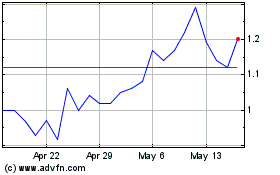

Babcock and Wilcox Enter... (NYSE:BW)

Historical Stock Chart

From Oct 2024 to Nov 2024

Babcock and Wilcox Enter... (NYSE:BW)

Historical Stock Chart

From Nov 2023 to Nov 2024