EMCOR Group, Inc. Completes Acquisition of Miller Electric Company

04 February 2025 - 12:30AM

Business Wire

EMCOR Group, Inc. (the “Company”) (NYSE: EME) today announced

that it has completed its previously announced acquisition of

Miller Electric Company (“Miller Electric”), a leading electrical

contractor serving high growth areas across the Southeastern U.S.,

for $865 million in cash, subject to customary adjustments.

The acquisition of Miller Electric increases EMCOR’s presence in

high growth sectors and expands the Company’s electrical

capabilities through a suite of complementary and comprehensive

mission-critical services. EMCOR expects Miller Electric to

generate approximately $805 million in revenue and approximately

$80 million in Adjusted EBITDA in calendar year 2024. The

transaction is expected to be modestly accretive to EMCOR’s

earnings per share in 2025, with further accretion in future

years.

Tony Guzzi, Chairman, President and Chief Executive Officer of

EMCOR, said, “We are thrilled to officially welcome Henry and the

Miller Electric team to EMCOR. The addition of Miller Electric

marks a meaningful milestone for our company as we advance our goal

to broaden our overall construction services platform and offer

clients an even wider range of solutions to meet their needs. As

one team, we will build upon our Mission First, People Always

culture and shared legacies of delivering innovative, high-quality

solutions to drive long-term value for our shareholders, employees

and clients alike.”

Henry Brown, Chief Executive Officer of Miller Electric, said,

“We could not be more pleased to have found such a strong cultural

and strategic fit in EMCOR. This acquisition will provide Miller

Electric with meaningful resources to accelerate our momentum as we

continue to lead the way in serving our clients. I look forward to

seeing all we accomplish together in the coming years.”

Miller Electric will operate within EMCOR’s Electrical

Construction Services segment under Dan Fitzgibbons, President and

CEO of EMCOR Electrical Construction Services. The Miller Electric

leadership team will remain in place and Miller Electric will

continue to be headquartered in Jacksonville, Florida.

EMCOR funded the transaction through cash on hand and will

discuss the acquisition when it releases its fourth quarter and

full year 2024 earnings results on February 26, 2025.

Advisors

Evercore is serving as financial advisor to EMCOR, and Ropes

& Gray LLP is serving as its legal advisor.

About EMCOR

EMCOR Group, Inc. is a Fortune 500 leader in mechanical and

electrical construction services, industrial and energy

infrastructure and building services. This press release and other

press releases may be viewed at the Company’s website at

www.emcorgroup.com. EMCOR routinely posts information that may be

important to investors in the “Investor Relations” section of our

website at www.emcorgroup.com. Investors and potential investors

are encouraged to consult the EMCOR website regularly for important

information about EMCOR.

Forward Looking Statements

This press release contains forward-looking statements. Such

statements speak only as of this press release, and EMCOR assumes

no obligation to update any such forward-looking statements, unless

required by law. These forward-looking statements include

statements regarding the anticipated financial impact of the

acquisition of Miller Electric. These forward-looking statements

involve risks and uncertainties that could cause actual results to

differ materially from those anticipated (whether expressly or

implied) by the forward-looking statements. Accordingly, these

statements do not guarantee future performance or events.

Applicable risks and uncertainties include, but are not limited to,

inability to achieve expected results in revenue and Adjusted

EBITDA; inability to realize the benefits of the acquisition to

EMCOR’s business; adverse business conditions; the continued

strength or weakness of business sectors from which we generate

revenue; labor market tightness and/or disruption; productivity

challenges; the impact of claims and litigation; the nature and

extent of supply chain disruptions impacting availability and

pricing of materials; global conflicts; and inflationary trends

more generally, including fluctuations in energy costs. Certain of

the risk factors associated with EMCOR’s business are also

discussed in Part I, Item 1A “Risk Factors,” of the Company’s 2023

Form 10-K, and in other reports filed from time to time with the

Securities and Exchange Commission and available at www.sec.gov and

www.emcorgroup.com. Such risk factors should be taken into account

in evaluating our business, including any forward-looking

statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250203899318/en/

EMCOR

Investors

Andrew G. Backman Vice President Investor Relations (203)

849-7938

FTI Consulting, Inc. Investors: Blake Mueller (718) 578-3706

Media

Joele Frank, Wilkinson Brimmer Katcher Andi Rose / Viveca Tress

(212) 355-4449

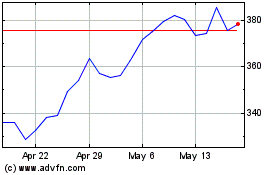

EMCOR (NYSE:EME)

Historical Stock Chart

From Jan 2025 to Feb 2025

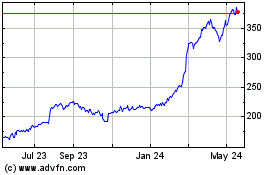

EMCOR (NYSE:EME)

Historical Stock Chart

From Feb 2024 to Feb 2025