Donovan S. Royal, ~4.6% Shareholder of LL

Flooring, Independently Voices Strong Concerns Regarding LL

Flooring’s Leadership and Supports the Election of F9’s Three

Highly Qualified Director Nominees

F9 Urges Shareholders Vote the GOLD Proxy Card “FOR” F9’s Director

Nominees – Tom Sullivan, Jason Delves, and Jill Witter – Who Are

the Right Individuals to Restore Value to LL Flooring

F9 Investments, LLC (“F9”), which together with its affiliates

collectively owns approximately 8.85% of LL Flooring Holdings, Inc.

(“LL Flooring” or the “Company”) (NYSE: LL) common stock and is the

Company’s largest shareholder, today noted that another significant

Company shareholder, Donovan S. Royal, has independently voiced

strong concerns regarding LL Flooring’s current strategy and

leadership and has reiterated support for the election of F9’s

three highly qualified nominees to the Company’s Board of Directors

(the “Board”) at its 2024 Annual Meeting to be held on July 10,

2024. Mr. Royal is not affiliated with F9 Investments.

Donovan S. Royal, a longtime flooring industry executive who

holds approximately 4.6% of LL Flooring’s outstanding common stock

as of the Company’s 2024 record date, yesterday issued a statement

addressing certain mischaracterizations in LL Flooring’s most

recent proxy materials regarding F9’s nominees and called out the

Board for its failure to take accountability for the Company’s

abysmal performance which has left LL Flooring at risk of going out

of business.

The full text of Mr. Royal’s filing can be accessed directly

here and at www.SEC.gov.

With regard to the Company’s filed statements regarding the

fitness of F9’s nominees to serve on the Board and Mr. Sullivan’s

track record of value creation, Mr. Royal noted:

Those filings dated June 17, 20241 and

substantially parroted on June 18, 20242 contain questionable

statements about the experience and qualifications of the Company’s

nominees and incorrectly assert, “Mr. Sullivan and his other two

nominees... offer no incremental value to your Board.” The

Company’s own actions undermine this claim, as LL had previously

offered a board seat to one of Mr. Sullivan’s nominees, John Jason

Delves, who evidently possesses the requisite experience (as do Mr.

Sullivan’s other nominees) to repair the damage done by the current

Board and management.

The Company claims, “if these (Mr.

Sullivan’s) nominees were elected, they would remove superior

talent, critical skills and... risk derailing the progress being

made in executing on the Company’s set of five strategic

priorities...” To which progress is the Company referring? Is it

the collapse in sales from roughly $1.1 billion in 2019 to the

abysmal trailing twelve month revenue haul of ~$850 million, a

colossal drop in revenue of ~22% in four years?

… In the Company’s filing on June 18, 2024,

the Board asserts that Mr. Sullivan was responsible for significant

shareholder losses, but omits the value Mr. Sullivan added,

starting in 1994 in the back of his pick-up truck, until his exit

from the Company. From the date of the IPO on November 9, 2007,

until December 30, 2016, the last day Mr. Sullivan worked at the

Company, LL investors earned a 61% return on their investment.3

Regarding the Board’s failure to take accountability for the

disastrous results of its so-called strategic initiatives, and the

danger to shareholders that re-empaneling the current Board would

pose, Mr. Royal wrote:

Comparing the catastrophic decline in

business over the last four years to another period of turmoil at

the Company from 2013 to 2017,4 would take into account the events

the Board describes in multiple pages of its filing in an attempt

to discredit Mr. Sullivan, cherry picking facts, ignoring its own

complicity (Douglas T. Moore and Nancy M. Taylor have been Board

members since 2006 and 2014, respectively), and avoiding the

fundamental question of how did this negative publicity actually

impact the business. That answer is: not as much as the current

Board’s failed strategy.

… the statements by the Company that Mr.

Sullivan’s ideas are “outdated and fail to recognize the current

industry landscape” are in the opinion of the filer, an expert in

the industry, simply ludicrous. It is time for change in the board

room and C Suite. If Ms. Taylor and Mr. Tyson had not wasted

millions on the failed re-brand, and had that Board hired the right

executive talent with the appropriate skill set to navigate the

current environment, the Company would not be in the precarious

position it finds itself today, with a measly $41 million market

capitalization, about $400 million LESS than when Mr. Sullivan left

the Company.

… make no mistake, if the three current

Board members up for election at this year’s annual meeting are

successful in retaining their seats and are allowed to continue

pursuing the disastrous five strategic priorities, this Company

will not survive.

Time is short. All LL Flooring shareholders

must protect the value of their investment.

VOTE ON THE GOLD PROXY CARD TODAY “FOR” F9’S NOMINEES TOM

SULLIVAN, JASON DELVES, AND JILL WITTER AND “WITHHOLD” ON ALL LL

FLOORING NOMINEES AND JERALD HAMMANN

Shareholders must act decisively to safeguard their investment.

YOUR VOTE MATTERS, NO MATTER HOW MANY SHARES YOU OWN. We

urge all shareholders to protect the value of their investment by

voting for F9’s nominees today using the GOLD proxy card.

You can cast your vote online at www.ProxyVote.com or by

completing, signing and dating the GOLD proxy card or GOLD voting

instruction form and mailing it in the postage paid envelope

provided.

If you have not received the GOLD proxy card from F9 and have

only received a WHITE proxy card sent to you by the Company, you

can still support F9’s nominees using the WHITE proxy card. You can

do so by checking the “WITHHOLD” boxes on all of the Company

nominees and Jerald Hammann and checking the “FOR” boxes for all F9

nominees – Tom Sullivan, Jason Delves, and Jill Witter.

If you have any questions about how to vote your shares, please

contact our proxy solicitor, Campaign Management, by telephone

1-(855) 264-1527 (shareholders) or (212) 632-8422 (banks &

brokerages) or by email at info@campaign-mgmt.com.

For more information about F9 and detailed voting instructions,

visit our website at www.LLGroove.com.

Solomon Partners Securities, LLC is serving as F9’s financial

advisor and Dentons US LLP is serving as its legal advisor.

DISCLAIMER

Except as otherwise set forth in this press release, the views

expressed in this press release reflect the opinions of F9

Investments, LLC and its affiliates (“F9”) and are based on

publicly available information with respect to LL Flooring

Holdings, Inc. (“LL” or the “Company”). F9 recognizes that there

may be confidential information in the possession of the Company

that could lead it or others to disagree with F9’s conclusions. F9

reserves the right to change any of its opinions expressed herein

at any time as it deems appropriate and disclaims any obligation to

notify the market or any other party of any such change, except as

required by law. F9 disclaims any obligation to update the

information or opinions contained in this press release, except as

required by law. For the avoidance of doubt, this press release is

not affiliated with or endorsed by LL.

This press release is provided merely as information and is not

intended to be, nor should it be construed as, an offer to sell or

a solicitation of an offer to buy any security nor as a

recommendation to purchase or sell any security. Certain of the

Participants (as defined below) currently beneficially own shares

of the Company. The Participants and their affiliates may from time

to time sell all or a portion of their holdings of the Company in

open market transactions or otherwise, buy additional shares (in

open market or privately negotiated transactions or otherwise), or

trade in options, puts, calls, swaps or other derivative

instruments relating to such shares.

Some of the materials in this press release contain

forward-looking statements. All statements contained herein that

are not clearly historical in nature or that necessarily depend on

future events are forward-looking, and the words “anticipate,”

“believe,” “expect,” “potential,” “could,” “opportunity,”

“estimate,” “plan,” “once again,” “achieve,” and similar

expressions are generally intended to identify forward-looking

statements. The projected results and statements contained herein

that are not historical facts are based on current expectations,

speak only as of the date of these materials and involve risks,

uncertainties and other factors that may cause actual results,

performances or achievements to be materially different from any

future results, performances or achievements expressed or implied

by such projected results and statements. Assumptions relating to

the foregoing involve judgments with respect to, among other

things, future economic competitive and market conditions and

future business decisions, all of which are difficult or impossible

to predict accurately and many of which are beyond the control of

F9.

The estimates, projections and potential impact of the

opportunities identified by F9 herein are based on assumptions that

F9 believes to be reasonable as of the date of this press release,

but there can be no assurance or guarantee (i) that any of the

proposed actions set forth in this press release will be completed,

(ii) that the actual results or performance of the Company will not

differ, and such differences may be material, or (iii) that any of

the assumptions provided in this press release are accurate.

F9 has neither sought nor obtained the consent from any third

party to use any statements or information contained herein that

have been obtained or derived from statements made or published by

such third parties, nor has it paid for any such statements. Any

such statements or information should not be viewed as indicating

the support of such third parties for the views expressed herein.

F9 does not endorse third-party estimates or research which are

used herein solely for illustrative purposes.

Important Information

F9 Investments, LLC, Thomas D. Sullivan, John Jason Delves and

Jill Witter (collectively, the “Participants”) filed a definitive

proxy statement and accompanying form of gold proxy card (as

supplemented and amended, the “Definitive Proxy Statement”) with

the Securities and Exchange Commission (the "SEC”) on May 31, 2024

to be used in connection with the 2024 annual meeting of

stockholders of the Company.

THE PARTICIPANTS STRONGLY ADVISE ALL STOCKHOLDERS OF THE COMPANY

TO READ THE DEFINITIVE PROXY STATEMENT AND OTHER PROXY MATERIALS

BECAUSE THEY CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS

ARE AVAILABLE AT NO CHARGE ON THE SEC’S WEBSITE AT WWW.SEC.GOV AND

F9’S WEBSITE AT WWW.LLGROOVE.COM. THE DEFINITIVE PROXY STATEMENT

AND ACCOMPANYING PROXY CARD WILL BE FURNISHED TO SOME OR ALL OF THE

COMPANY’S STOCKHOLDERS. STOCKHOLDERS MAY ALSO DIRECT A REQUEST TO

F9’S PROXY SOLICITOR, CAMPAIGN MANAGEMENT, 15 WEST 38TH STREET,

SUITE #747, NEW YORK, NY 10018 (STOCKHOLDERS CAN E-MAIL

INFO@CAMPAIGNMANAGEMENT.COM OR CALL TOLL-FREE: (855) 264-1527.

Information about the Participants and a description of their

direct or indirect interests by security holdings or otherwise can

be found in the Definitive Proxy Statement.

___________________________ 1 LL Flooring, “DEFA14A Proxy

Material,” June 17, 2024, pp. 4, 28, available at:

https://www.sec.gov/Archives/edgar/data/1396033/000119312524162674/d851150ddefa14a.htm

2 LL Flooring, “DEFA14A Proxy Material,” June 18, 2024, available

at:

https://www.sec.gov/Archives/edgar/data/1396033/000119312524163066/d856039ddefa14a.htm

3 Values based on LL closing prices of $9.76 and $15.74 as of

11/9/2007 and 12/30/2016, respectively. 4 See Lumber Liquidators

SEC Filings from 2013-2016

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240625586100/en/

Investors: Michael Fein Campaign Management (212) 632-8422

michael.fein@campaign-mgmt.com

Media: Jonathan Gasthalter/Nathaniel Garnick Gasthalter &

Co. (212) 257-4170 F9Investments@gasthalter.com

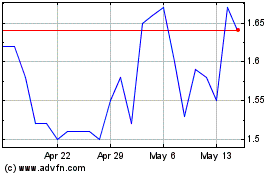

LL Flooring (NYSE:LL)

Historical Stock Chart

From Nov 2024 to Dec 2024

LL Flooring (NYSE:LL)

Historical Stock Chart

From Dec 2023 to Dec 2024