false

0000063330

0000063330

2023-08-18

2023-08-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 18, 2023

MAUI LAND & PINEAPPLE COMPANY, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-06510

|

99-0107542

|

|

(State of Incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification Number)

|

|

200 Village Road, Lahaina, Maui, Hawaii 96761

(Address of principal executive offices) (Zip Code)

|

(808) 877-3351

(Registrant’s telephone number, including area code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.0001 par value

|

MLP

|

New York Stock Exchange

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On August 18, 2023, the Company issued a press release, which sets forth the results of its operations for the six months ended June 30, 2023. A copy of the press release is filed herewith as Exhibit 99.1 and incorporated herein by reference.

Such information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and is not incorporated by reference into any filing of the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

|

Exhibit

Number

|

Description

|

|

99.1

|

|

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

MAUI LAND & PINEAPPLE COMPANY, INC.

|

| |

|

|

|

Date: August 18, 2023

|

By:

|

/s/ WADE K. KODAMA

|

| |

|

Wade K. Kodama

|

| |

|

Chief Financial Officer

|

Exhibit 99.1

Maui Land & Pineapple Company Reports Second Quarter 2023 Results

Provides update about ongoing support for wildfire aid on Maui

KAPALUA, Hawai‘i, August 18, 2023 (BusinessWire) – Maui Land & Pineapple Company, Inc. (NYSE: MLP) today reported its second quarter financial results along with a company update after wildfire destruction to the Upcountry area and severe impacts to the nearby town of Lahaina, Maui. The report covers the second quarter and six months ended June 30, 2023.

“The destruction from wildfires on Maui is devastating. Our hearts go out to the families across the island who have lost loved ones, homes, history, and more. We are grateful that Maui Land & Pineapple Company team members and assets are safe. In this time of great need, we are focused on mobilizing in support of the relief efforts for our team, tenants, residents, partners, and community members.

Over the past four months, Maui Land and Pineapple Company, Inc. has advanced its transition from a focus on stabilization and reduction of liabilities, to a focus on the creation of value for our residents, visitors, and shareholders. With over 22,000 acres of land and over 260,000 square feet of commercial properties for lease, a key to this transition is that we establish a strong team of experts in land development, asset management, and community development. Our results of operations for the six months ended June 30, 2023 include one-time costs related to this important transition, and a strategic pause on land sales to ensure we put our portfolio of assets to their highest and best use. Our plan through the remainder of 2023 is to establish our team, improve the occupancy, utilization, and stabilized revenue of our commercial real estate portfolio, solidify a thoughtful land-use strategy in light of the needs on Maui, and begin to advance on this strategy.” – Race Randle, CEO of Maui Land & Pineapple Company.

Second Quarter 2023 Highlights

| |

●

|

Revenues - Excluding land sales, the total operating revenues increased by $117,000 for the six months ended June 30, 2023, compared to the six months ended June 30, 2022. Including land sales, for the six months ended June 30, 2023, the total operating revenues decreased by $11,464,000 to $4,770,000 compared to the same period last year as a direct result of two land sales closed in the prior year in the amount of $11,600,000.

|

| |

●

|

Costs and expenses – Operating costs and expenses totaled $7,484,000 for the six months ended June 30, 2023, an increase of $1,389,000 compared to the six month period ended June 30, 2022. $1,321,000 of the operating costs and expenses were related to one-time costs of the leadership transition due to $1,153,000 for severance, accelerated vesting of incentive stock for departing executives and related legal and consulting fees for document preparation, and $168,000 for onboarding costs of new executive team. These costs are not anticipated to recur in the upcoming quarters with the exception of the extended severance paid to the former CEO monthly until March 31, 2025. |

| |

●

|

Net loss – Net loss was $2,481,000, or $0.13 per common share, in the six months ended June 30, 2023, compared to net income of $ 9,907,000, or $0.51 per common share, in the six months of 2022, as a direct result of land sales of $11,600,000 at June 30, 2022, versus no land sales in the current year, and increased operating costs. |

| |

●

|

Adjusted EBITDA – For the six months ending June 30, 2023, after adjusting for non-cash expenses of $2,509,000, Adjusted EBITDA was $ 28,000.

|

| |

●

|

Cash and Liquid Investments Convertible to Cash (Non-GAAP) – Cash and liquid investments convertible to cash totaled $10,305,000 at June 30, 2023, a decrease of $1,187,000 compared to $11,492,000 at June 30, 2022. $591,000 of the decrease in cash is attributable to one-time expenses due to employment separations for the former CEO and Vice President and onboarding transition of the new CEO and Board Chairman realized in the three months ended June 30, 2023. |

In order to advance efforts with value creation from our land portfolio and commercial real estate, MLP made the following key leadership and service changes in the three months ended June 30, 2023:

| |

1.

|

Following a procurement process, MLP selected Colliers, a leading Global commercial real estate services company, as its property manager and leasing agent for its portfolio of land, retail, and industrial properties. “As we begin to implement our goal to intentionally utilize our assets on Maui, Colliers will help us strategically tenant our properties in order to improve operating performance while cultivating a sense of place to elevate the quality of life in our communities. Our goal, combined with their expertise in large-scale land leasing, will aid our effort to be stewards of the land and increase shareholder value, all while making a positive impact in Hawai‘i.” – Race Randle, CEO of Maui Land & Pineapple.

|

| |

2.

|

On August 1, 2023, Ashley Takitani Leahey began her tenure as MLP’s Vice President of Community Development. A fifth-generation Maui resident, Takitani Leahey will manage the Kapalua Resort, and Maui Gold brands, lead the resort amenities businesses, and oversee all external affairs functions including marketing, communications, community engagement, public affairs and investor relations. She brings over a decade of experience in managing communications, marketing, and community relations for leading Hawai‘i companies and nonprofit organizations. |

| |

3.

|

On August 7, 2023, Dean Frampton began his tenure as MLP’s Vice President of Land & Natural Resources. Born and raised on Maui, Frampton will lead the company’s efforts in responsible land stewardship to continue MLP’s legacy while executing the company’s fresh strategy. Frampton’s experience founding his own consulting firm, Dean K. Frampton LLC, combined with his time as a partner at F&W Land, has given him over three decades of experience in planning, permitting, infrastructure, and land-use matters. |

Non-GAAP Financial Measures

Certain non-GAAP financial measures are presented in this press release, including Adjusted EBITDA, to provide information that may assist investors in understanding the Company's financial results and assessing its prospects for future performance. We believe these non-GAAP financial measures are important indicators of our operating performance because they exclude items that are unrelated to, and may not be indicative of, our core operating results. These non-GAAP financial measures, as we calculate them, may not be comparable to similarly titled measures of other companies and may not be appropriate measures for comparing the performance of other companies relative to the Company. These non-GAAP financial results are not intended to represent and should not be considered to be more meaningful measures than, or alternatives to, measures of operating performance as determined in accordance with GAAP. To the extent we utilize such non-GAAP financial measures in the future, we expect to calculate them using a consistent method from period to period.

EBITDA is a non-GAAP financial measure defined as net income (loss) excluding interest, taxes, and depreciation and amortization. Adjusted EBITDA is further adjusted for non-cash stock-based compensation expense and pension and post-retirement expenses. Adjusted EBITDA is a key measure used by the Company to evaluate operating performance, generate future operating plans and make strategic decisions for the allocation of capital. The Company presents Adjusted EBITDA to provide information that may assist investors in understanding its financial results. However, Adjusted EBITDA is not intended to be a substitute for net income (loss). A reconciliation of Adjusted EBITDA to the most directly comparable GAAP financial measure is provided further below.

Additional Information

More information about Maui Land & Pineapple Company’s second quarter 2023 operating results is available in the Form 10-Q filed with the Securities and Exchange Commission and posted at mauiland.com/.

About Maui Land & Pineapple Company

Maui Land & Pineapple Company, Inc. (NYSE: MLP) develops, manages, and sells real estate on the island of Maui, where the company stewards 22,000 acres, including the world-renowned Kapalua Resort. Kapalua is home to the luxury hotels, The Ritz-Carlton Maui and Montage Kapalua Bay, residential communities, two championship golf courses, three pristine beaches, a network of walking and hiking trails, and the Pu‘u Kukui Watershed Preserve, one of the largest private nature preserves in Hawai‘i. Founded in 1909, Maui Land & Pineapple Company cultivated pineapple on Maui plantations for nearly a century and has been a source of economic opportunity for more than 114 years. Learn more about Maui Land & Pineapple Company’s commitment to supporting the Maui community, protecting the island’s natural resources, and perpetuating resilient and thriving communities at mauiland.com.

# # #

Contacts

|

Investors:

|

Wade Kodama | Chief Financial Officer | Maui Land & Pineapple Company

|

e: wkodama@kapalua.com

|

Media:

|

Ashley Takitani Leahey | Vice President | Maui Land & Pineapple Company

|

p: (808) 264-1676 e: ashley@mauiland.com

Dylan Beesley | Senior Vice President | Bennet Group Strategic Communications

p: (808) 285-7272 e: dylan@bennetgroup.com

MAUI LAND & PINEAPPLE COMPANY, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

(UNAUDITED)

| |

|

Six Months Ended

June 30,

|

|

| |

|

2023

|

|

|

2022

|

|

| |

|

(in thousands except

|

|

| |

|

per share amounts)

|

|

|

OPERATING REVENUES

|

|

|

|

|

|

|

|

|

|

Real estate

|

|

$ |

19 |

|

|

$ |

11,600 |

|

|

Leasing

|

|

|

4,318 |

|

|

|

4,228 |

|

|

Resort amenities and other

|

|

|

433 |

|

|

|

406 |

|

|

Total operating revenues

|

|

|

4,770 |

|

|

|

16,234 |

|

| |

|

|

|

|

|

|

|

|

|

OPERATING COSTS AND EXPENSES

|

|

|

|

|

|

|

|

|

|

Real estate

|

|

|

418 |

|

|

|

796 |

|

|

Leasing

|

|

|

1,833 |

|

|

|

1,739 |

|

|

Resort amenities and other

|

|

|

911 |

|

|

|

840 |

|

|

General and administrative

|

|

|

2,059 |

|

|

|

1,516 |

|

|

Share-based compensation

|

|

|

1,772 |

|

|

|

654 |

|

|

Depreciation

|

|

|

491 |

|

|

|

550 |

|

|

Total operating costs and expenses

|

|

|

7,484 |

|

|

|

6,095 |

|

| |

|

|

|

|

|

|

|

|

|

OPERATING INCOME (LOSS)

|

|

|

(2,714 |

) |

|

|

10,139 |

|

| |

|

|

|

|

|

|

|

|

|

Other income

|

|

|

479 |

|

|

|

- |

|

|

Pension and other post-retirement expenses

|

|

|

(243 |

) |

|

|

(229 |

) |

|

Interest expense

|

|

|

(3 |

) |

|

|

(3 |

) |

|

NET INCOME (LOSS)

|

|

$ |

(2,481 |

) |

|

$ |

9,907 |

|

|

Other comprehensive income - pension, net

|

|

|

164 |

|

|

|

312 |

|

|

TOTAL COMPREHENSIVE INCOME (LOSS)

|

|

$ |

(2,317 |

) |

|

$ |

10,219 |

|

| |

|

|

|

|

|

|

|

|

|

NET INCOME (LOSS) PER COMMON SHARE-BASIC AND DILUTED

|

|

$ |

(0.13 |

) |

|

$ |

0.51 |

|

MAUI LAND & PINEAPPLE COMPANY, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

| |

|

June 30, 2023

|

|

|

December 31, 2022

|

|

| |

|

(unaudited)

|

|

|

(audited)

|

|

| |

|

(in thousands except share data)

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

CURRENT ASSETS

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

7,246 |

|

|

$ |

8,499 |

|

|

Restricted cash

|

|

|

- |

|

|

|

10 |

|

|

Accounts receivable, net

|

|

|

1,248 |

|

|

|

892 |

|

|

Investments, current portion

|

|

|

2,785 |

|

|

|

2,432 |

|

|

Prepaid expenses and other assets

|

|

|

497 |

|

|

|

368 |

|

|

Assets held for sale

|

|

|

3,056 |

|

|

|

3,019 |

|

|

Total current assets

|

|

|

14,832 |

|

|

|

15,220 |

|

| |

|

|

|

|

|

|

|

|

|

PROPERTY & EQUIPMENT, NET

|

|

|

15,566 |

|

|

|

15,878 |

|

| |

|

|

|

|

|

|

|

|

|

OTHER ASSETS

|

|

|

|

|

|

|

|

|

|

Investments, net of current portion

|

|

|

274 |

|

|

|

551 |

|

|

Deferred development costs

|

|

|

9,585 |

|

|

|

9,566 |

|

|

Other noncurrent assets

|

|

|

1,198 |

|

|

|

1,191 |

|

|

Total other assets

|

|

|

11,057 |

|

|

|

11,308 |

|

|

TOTAL ASSETS

|

|

$ |

41,455 |

|

|

$ |

42,406 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES & STOCKHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

LIABILITIES

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

459 |

|

|

$ |

589 |

|

|

Payroll and employee benefits

|

|

|

736 |

|

|

|

869 |

|

|

Accrued retirement benefits, current portion

|

|

|

142 |

|

|

|

142 |

|

|

Deferred revenue, current portion

|

|

|

447 |

|

|

|

227 |

|

|

Other current liabilities

|

|

|

488 |

|

|

|

480 |

|

|

Total current liabilities

|

|

|

2,272 |

|

|

|

2,307 |

|

| |

|

|

|

|

|

|

|

|

|

LONG-TERM LIABILITIES

|

|

|

|

|

|

|

|

|

|

Accrued retirement benefits, net of current portion

|

|

|

2,626 |

|

|

|

2,612 |

|

|

Deferred revenue, net of current portion

|

|

|

1,433 |

|

|

|

1,500 |

|

|

Deposits

|

|

|

2,148 |

|

|

|

2,185 |

|

|

Other noncurrent liabilities

|

|

|

19 |

|

|

|

30 |

|

|

Total long-term liabilities

|

|

|

6,226 |

|

|

|

6,327 |

|

|

TOTAL LIABILITIES

|

|

|

8,498 |

|

|

|

8,634 |

|

| |

|

|

|

|

|

|

|

|

|

COMMITMENTS AND CONTINGENCIES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

Preferred stock--$0.0001 par value; 5,000,000 shares authorized; no shares issued and outstanding

|

|

|

- |

|

|

|

- |

|

|

Common stock--$0.0001 par value; 43,000,000 shares authorized; 19,589,504 and 19,476,671 shares issued and outstanding at June 30, 2023 and December 31, 2022, respectively

|

|

|

84,421 |

|

|

|

83,392 |

|

|

Additional paid-in-capital

|

|

|

9,657 |

|

|

|

9,184 |

|

|

Accumulated deficit

|

|

|

(53,018 |

) |

|

|

(50,537 |

) |

|

Accumulated other comprehensive loss

|

|

|

(8,103 |

) |

|

|

(8,267 |

) |

|

Total stockholders' equity

|

|

|

32,957 |

|

|

|

33,772 |

|

|

TOTAL LIABILITIES & STOCKHOLDERS' EQUITY

|

|

$ |

41,455 |

|

|

$ |

42,406 |

|

Maui Land & Pineapple Company Inc. and Subsidiaries

Supplemental Financial Information

(Non-GAAP) Unaudited

| |

|

Six Months Ended

June 30,

|

|

| |

|

2023

|

|

|

2022

|

|

| |

|

(in thousands except per share data)

|

|

| |

|

|

|

|

NET INCOME (LOSS)

|

|

$ |

(2,481 |

) |

|

$ |

9,907 |

|

| |

|

|

|

|

|

|

|

|

|

Add: Non-cash expenses

|

|

|

|

|

|

|

|

|

|

Interest

|

|

|

3 |

|

|

|

3 |

|

|

Depreciation

|

|

|

491 |

|

|

|

550 |

|

|

Share-based compensation

|

|

|

|

|

|

|

|

|

|

Vesting of Incentive Stock for former CEO and Vice President upon separation

|

|

|

730 |

|

|

|

- |

|

|

Vesting of Stock Options granted to Board Chair and Directors

|

|

|

473 |

|

|

|

- |

|

|

Vesting of employee Incentive Stock

|

|

|

569 |

|

|

|

654 |

|

|

Pension and post-retirement expenses

|

|

|

243 |

|

|

|

229 |

|

| |

|

|

|

|

|

|

|

|

|

ADJUSTED EBITDA

|

|

$ |

28 |

|

|

$ |

11,343 |

|

| |

|

|

|

|

|

|

|

|

|

ADJUSTED EBITDA PER COMMON SHARE-BASIC AND DILUTED

|

|

$ |

0.00 |

|

|

$ |

0.58 |

|

| |

|

June 30, 2023

|

|

|

December 31, 2022

|

|

| |

|

(unaudited)

|

|

|

(unaudited)

|

|

| |

|

(in thousands)

|

|

|

CASH AND LIQUID INVESTMENTS CONVERTIBLE TO CASH

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

7,246 |

|

|

$ |

8,499 |

|

|

Restricted cash

|

|

|

- |

|

|

|

10 |

|

|

Investments, current portion

|

|

|

2,785 |

|

|

|

2,432 |

|

|

Investments, net of current portion

|

|

|

274 |

|

|

|

551 |

|

| |

|

|

|

|

|

|

|

|

|

TOTAL CASH AND LIQUID INVESTMENTS COVERTIBLE TO CASH

|

|

$ |

10,305 |

|

|

$ |

11,492 |

|

# #

v3.23.2

Document And Entity Information

|

Aug. 18, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

MAUI LAND & PINEAPPLE COMPANY, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Aug. 18, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-06510

|

| Entity, Tax Identification Number |

99-0107542

|

| Entity, Address, Address Line One |

200 Village Road, Lahaina

|

| Entity, Address, City or Town |

Maui

|

| Entity, Address, State or Province |

HI

|

| Entity, Address, Postal Zip Code |

96761

|

| City Area Code |

808

|

| Local Phone Number |

877-3351

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

MLP

|

| Security Exchange Name |

NYSE

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000063330

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

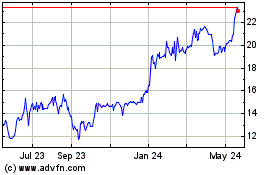

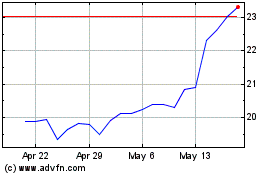

Maui Land and Pineapple (NYSE:MLP)

Historical Stock Chart

From Apr 2024 to May 2024

Maui Land and Pineapple (NYSE:MLP)

Historical Stock Chart

From May 2023 to May 2024