0001501134FALSE00015011342023-12-132023-12-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 13, 2023

| | |

| Invitae Corporation |

| (Exact name of the registrant as specified in its charter) |

| | | | | | | | | | | | | | |

| Delaware | | 001-36847 | | 27-1701898 |

| (State or other jurisdiction of | | (Commission | | (I.R.S. employer |

| incorporation or organization) | | File Number) | | identification number) |

1400 16th Street, San Francisco, California 94103

(Address of principal executive offices, including zip code)

(415) 374-7782

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of exchange on which registered |

| Common Stock, $0.0001 par value per share | | NVTA | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.05 | Costs Associated with Exit or Disposal Activities. |

On December 13, 2023, Invitae Corporation (the “Company”) announced it has divested the assets of its Ciitizen patient-centric consumer health tech platform. The Company also announced plans to reduce its operating expenses through a workforce reduction and other cost saving initiatives, which include streamlining processes across its core platforms and optimizing its technology, professional services and other spending. The divestiture and the announced plans will decrease the Company's workforce by approximately 15%. In combination with the Ciitizen transaction, these initiatives are anticipated to result in one-time severance related payments of approximately $10 million. In addition, the Company expects to incur non-cash charges which it is currently not able to estimate. The Company will file an amendment to this Current Report on Form 8-K, as necessary, when such charges become estimable. The Company plans to recognize these charges in its financial statements for the quarters ending December 31, 2023 and March 31, 2024.On December 13, 2023, the Company issued a press release describing the Ciitizen divestiture and plans to reduce operating expenses (the “Press Release”). The full text of the Press Release is furnished as Exhibit 99.1 to this Current Report on Form 8-K. Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements relating to the Company’s strategic objectives and anticipated outcomes; the divestiture of and future partnership opportunities with Ciitizen; and operational streamlining, cost reduction initiatives and their projected impact on the Company’s financial and operational performance. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially and reported results should not be considered as an indication of future performance. These risks and uncertainties include, but are not limited to: the availability of and need for capital; the ability to service the Company’s debt obligations; the successful execution and anticipated benefits of the divestiture and cost reduction strategies; potential unforeseen costs or challenges associated with these strategies; the risk that the disruption resulting from these activities may harm the Company’s business, market share or its relationship with customers or potential customers; the impact of inflation and the current economic environment on the Company’s business; and the other risks set forth in the reports filed by the Company in its Quarterly Report on Form 10-Q for the quarter ended September 30, 2023. These forward-looking statements speak only as of the date hereof, and Invitae Corporation disclaims any obligation to update these forward-looking statements.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits | | | | | | | | |

| Exhibit No. | | Description |

| |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: December 14, 2023

| | | | | | | | |

| | |

| INVITAE CORPORATION |

| |

| By: | | /s/ Thomas R. Brida |

| Name: | | Thomas R. Brida |

| Title: | | General Counsel |

Invitae Divests Ciitizen Health Data Platform and Implements Further Cost Cuts

– Maintains Minority Equity Stake in Ciitizen –

– Anticipated Total Cash Savings of Approximately $90-100 Million on an Annualized Basis –

SAN FRANCISCO – Dec. 13, 2023 – Invitae (NYSE: NVTA), a leading medical genetics company, today announced strategic changes to streamline operations and reduce operating cash burn. The company has divested the assets of Ciitizen and announced strategic cost cuts, which will include a workforce reduction and other operating expense reductions.

Ciitizen Divestiture

Ciitizen is a patient-centric consumer health tech platform that helps patients collect, organize, store and share their medical records digitally. With the divestiture, the Ciitizen assets have been transferred to a new entity established by the leadership team of the Ciitizen business and funded by a group of venture capital investors. Invitae maintains a minority equity interest in this newly formed company. Invitae and the new company intend to collaborate on key initiatives as the Ciitizen platform expands globally.

Invitae continues to operate its core genetics data business, including sponsored testing programs, biopharma research services and rare disease discovery.

“We continue to believe that patient-consented data is growing in importance for improving patient care, and that this new company will be able to take the platform to the next level,” said Ken Knight, president and chief executive officer of Invitae.

“Ciitizen’s direct relationships with patients are at the heart of our platform, and Ciitizen has proven its benefits to patients living with rare diseases,” said Farid Vij, prior Ciitizen general manager at Invitae and chief executive officer of the new company. “We’re grateful for the incredible support from Invitae and our investors, and we are excited to continue to serve more patients and their families. We remain dedicated to working closely with the patient advocacy groups and industry partners in the rare disease community, and we look forward to exploring opportunities by partnering with Invitae.”

Strategic Operating Expense Reductions

Today, the company also implemented efforts to significantly reduce its operating expenses via a workforce reduction and other cost saving initiatives, which include streamlining processes across its core platforms and optimizing its technology, professional services and other spending.

In combination with the Ciitizen transaction, these initiatives are anticipated to result in annualized cash savings of approximately $90-100 million, excluding one-time severance related payments.

Knight continued, “The actions announced today will assist in streamlining our operations and reducing our cash burn. While these moves unfortunately involve a reduction in our workforce, we are committed to working closely with those impacted to ensure a smooth transition for them and for our customers and patients.”

About Invitae

Invitae (NYSE: NVTA) is a leading medical genetics company trusted by millions of patients and their providers to deliver timely genetic information using digital technology. We aim to provide accurate and actionable answers to strengthen medical decision-making for individuals and their families. Invitae's genetics experts apply a rigorous approach to data and research, serving as the foundation of their mission to bring comprehensive genetic information into mainstream medicine to improve healthcare for billions of people.

To learn more, visit invitae.com and follow for updates on Twitter, Instagram, Facebook and LinkedIn @Invitae.

Safe Harbor Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements relating to the company’s strategic objectives and anticipated outcomes; the divestiture of and future partnership opportunities with Ciitizen; and operational streamlining, cost reduction initiatives and their projected impact on the company’s financial and operational performance. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially and reported results should not be considered as an indication of future performance. These risks and uncertainties include, but are not limited to: the availability of and need for capital; the ability to service the company’s debt obligations; the successful execution and anticipated benefits of the divestiture and cost reduction strategies; potential unforeseen costs or challenges associated with these strategies; the risk that the disruption resulting from these activities may harm the company’s business, market share or its relationship with customers or potential customers; the impact of inflation and the current economic environment on the company’s business; and the other risks set forth in the reports filed by the company with the SEC, including its Quarterly Report on Form 10-Q for the quarter ended September 30, 2023. These forward-looking statements speak only as of the date hereof, and Invitae Corporation disclaims any obligation to update these forward-looking statements.

Invitae Contacts:

Investor Relations

Hoki Luk

ir@invitae.com

Public Relations

Amy Hadsock

pr@invitae.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

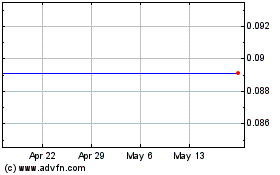

Invitae (NYSE:NVTA)

Historical Stock Chart

From Feb 2025 to Mar 2025

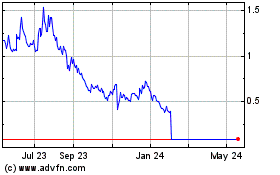

Invitae (NYSE:NVTA)

Historical Stock Chart

From Mar 2024 to Mar 2025