false

0000095029

0000095029

2024-08-01

2024-08-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

August

1, 2024

STURM, RUGER & COMPANY, INC.

(Exact Name of Registrant as Specified in its

Charter)

|

Delaware

(State or Other Jurisdiction of Incorporation) |

001-10435

(Commission File Number) |

06-0633559

(IRS Employer Identification Number) |

| One Lacey Place, Southport, Connecticut |

06890 |

| (Address of Principal Executive Offices) |

(Zip Code) |

(203) 259-7843

Registrant’s telephone number, including

area code

N/A

(Former name or former address, if changed

since last report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock |

RGR |

NYSE |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the

Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 | Regulation FD Disclosure |

On August 1, 2024, the Company hosted its post-earnings

release conference call and webcast to discuss our second quarter 2024 financial results. The transcript of the conference call and webcast

is included as Exhibit 99.1 to this Report on Form 8-K.

The information in this Report on Form 8-K (including

the exhibit) is furnished pursuant to Item 7.01 and shall not be deemed to be “filed” for the purpose of Section 18 of the

Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. This Report on Form 8-K will not

be deemed an admission as to the materiality of any information in the Report that is required to be disclosed solely by Regulation FD.

The text included with this Report on Form 8-K

and the replay of the conference call and webcast on August 1, 2024, is available on our website located at Ruger.com/corporate, although

we reserve the right to discontinue that availability at any time.

Certain statements contained in this Report on

Form 8-K (including the exhibit) may be deemed to be forward-looking statements under federal securities laws, and we intend that such

forward-looking statements be subject to the safe harbor created thereby. Such forward-looking statements include, but are not limited

to, statements regarding market demand, sales levels of firearms, anticipated castings sales and earnings, the need for external financing

for operations or capital expenditures, the results of pending litigation against the Company, the impact of future firearms control and

environmental legislation, and accounting estimates. Readers are cautioned not to place undue reliance on these forward-looking statements,

which speak only as of the date made. The Company undertakes no obligation to publish revised forward-looking statements to reflect events

or circumstances after the date such forward-looking statements are made or to reflect the occurrence of subsequent unanticipated events.

| Item 9.01 | Financial Statements and Exhibits |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| |

STURM, RUGER & COMPANY, INC. |

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

By: |

/S/ Thomas A. Dineen |

| |

|

Name: |

Thomas A. Dineen |

| |

|

Title: |

Principal Financial Officer, |

| |

|

|

Principal Accounting Officer, |

| |

|

|

Senior Vice President, Treasurer and |

| |

|

|

Chief Financial Officer |

Dated: August 2, 2024

| August 01, 2024 / 1:00PM UTC, Q2 2024 Sturm Ruger & Company Inc Earnings Call |

CORPORATE PARTICIPANTS

| • | Christopher Killoy Sturm Ruger & Company Inc - President,

Chief Executive Officer, Director |

| • | Patricia Shepard Sturm Ruger & Company Inc - Deputy General

Counsel |

| • | Thomas Dineen Sturm Ruger & Company Inc - Chief Financial

Officer, Senior Vice President, Treasurer |

CONFERENCE CALL PARTICIPANTS

| • | Mark Smith Lake Street - Analyst |

| • | Rommel Dionisio Aegis Capital - Analyst |

PRESENTATION

Operator

Good day and thank you for standing by. Welcome to the Sturm Ruger

Earnings Conference Call. (Operator Instructions) Please be advised that today's conference is being recorded. I would now like to hand

the conference over to your first speaker today, Chris Killoy, President and CEO. Please go ahead.

Christopher Killoy Sturm Ruger & Company Inc - President,

Chief Executive Officer, Director

Good morning, and welcome to the Sturm Ruger & Company second

quarter 2024 conference call. I'll ask Patricia Shepard, our Deputy General Counsel to read the caution on forward-looking statements.

Tom Dineen, our Chief Financial Officer, will then give an overview of the second quarter 2024 financial results. And then I will discuss

our operations and the market. After that, we'll get to your questions. Pat.

Patricia Shepard Sturm Ruger & Company Inc - Deputy

General Counsel

Thanks, Chris. I just want to remind everyone that statements

made in the course of this meeting that state the company's or management's intentions, hopes, beliefs, expectations or predictions of

the future are forward-looking statements. It is important to note that the company's actual results could differ materially from those

projected in such forward-looking statements. Additional information concerning factors that could cause actual results to differ materially

from those in the forward-looking statements, is contained from time to time in the company's SEC filings, including, but not limited

to the company's report on Form 10-K for the year ended December 31, 2023, and of course, on the Form 10-Q for the second quarter of 2024,

which we filed last night.

Copies of these documents may be obtained by contacting the company

or the SEC or on the company's website at ruger.com/corporate or the SEC website at sec.gov. We reference non-GAAP EBITDA. Please note

that the reconciliation of GAAP net income to non-GAAP EBITDA can be found in our Form 10-K for the year ended December 31, 2023, and

our Form 10-Q for the second quarter of 2024, both of which are also posted to our website.

Furthermore, the company disclaims all responsibility to update

forward-looking statements. Chris

2

| August 01, 2024 / 1:00PM UTC, Q2 2024 Sturm Ruger & Company Inc Earnings Call |

Christopher Killoy Sturm Ruger & Company Inc - President,

Chief Executive Officer, Director

Thank you, Pat.

Now, Tom, will discuss the company's second quarter 2024 results.

Thomas Dineen Sturm Ruger & Company Inc - Chief Financial

Officer, Senior Vice President, Treasurer

Thanks, Chris. For the second quarter of 2024, net sales were

$130.8 million and diluted earnings were $0.47 per share. For the corresponding period in 2023, net sales were $142.8 million and diluted

earnings were $0.91 per share. For the six months ended June 29, 2024, net sales were $267.6 million and diluted earnings were $0.87 per

share. For the corresponding period in 2023, net sales were $292.3 million and diluted earnings were $1.72 per share.

Our second quarter profitability improved from the first quarter

despite a reduction in sales as we increased production 18%, notwithstanding the reduction in headcount resulting from the reduction in

force we implemented at the end of the first quarter. At June 29, 2024 our cash and short-term investments totaled $106 million. Our short-term

investments are invested in the United States Treasury bills and in a money market fund that invests exclusively in the United States

Treasury instruments, which mature within one year.

At June 29, 2024, our current ratio was 4.8:1, and we had no debt.

Stockholders' equity was $322 million, which equates to a book value of $18.90 per share, of which $6.21 was cash and short-term investments.

In the first half of 2024, we generated $26.1 million of cash from operations. We reinvested $10.4 million of that back into the company

in the form of capital expenditures. We expect our 2024 capital expenditures will total approximately $20 million, related to some exciting

new product introductions, upgrades to our manufacturing equipment and improvements to our facilities.

In the first half of 2024, we returned $27.1 million to our shareholders

through the payment of $6.8 million of quarterly dividends and the repurchase of 478,000 shares of our common stock in the open market

at an average price of $42.41 per share for a total of $20.3 million. Since the end of the second quarter, we repurchased an additional

157,000 shares of our common stock at an average price of $41.27 per share for a total of $6.5 million. Thus far in 2024, we have returned

$26.7 million to our shareholders by repurchasing 634,000 shares, more than 3% of the shares outstanding as of the beginning of the year,

at an average price of $42.12 per share.

Our current cash balance remains above $100 million. Our Board

of Directors declared a $0.19 per share quarterly dividend for shareholders of record as of August 15, 2024, payable on August 30, 2024.

As a reminder, our quarterly dividend is approximately 40% of net income and therefore varies quarter to quarter. Our variable dividend

strategy, coupled with our strong debt-free balance sheet allows us to continually and consistently provide returns to our shareholders

without sacrificing our ability to capitalize on opportunities that emerge. That's the financial update for the second quarter. Chris?

Christopher Killoy Sturm Ruger & Company Inc - President,

Chief Executive Officer, Director

Thanks, Tom. We were pleased with the consistency of demand for

many of our products in the second quarter despite the declining consumer demand in the firearms market from last year. On the strength

of these products, many of which were introduced last year, the estimated sell-through of our products from our independent distributors

to retailers increased 1% in both the second quarter and the first half of 2024 compared to the prior year.

For the same period, NICS background checks, as adjusted by the

National Shooting Sports Foundation, decreased 8% and 6% respectively. Recently introduced products that drove distributor sell through

include the American Rifle Generation II family of rifles, the Marlin 1895 Dark Series lever-action rifles, Marlin 336 lever-action rifles

and the LC Carbine chambered in .45 Auto. Additionally, the 75th Anniversary Mark IV Target pistol, 75th Anniversary 10/22 rifles, the

75th Anniversary LCP MAX pistol and the Mini-14 rifle with side-folding stock also helped drive those sales.

Strong pull through of demand kept inventories of Ruger products

in the distribution channel at healthy levels. And for our products in stronger demand, the sell-through outpaced production during the

first half of the year. Consequently, compared to this time last year, our finished goods inventory and the distributors' finished goods

inventories of Ruger products have decreased over 100,000 units, 13,000 units in our warehouses and 89,000 units at the distributors.

3

| August 01, 2024 / 1:00PM UTC, Q2 2024 Sturm Ruger & Company Inc Earnings Call |

As such, we plan on continuing to increase our production in the

second half of the year, to begin to replenish these inventories, especially for the new products just mentioned. Increased production

will help us leverage our fixed costs and favorably impact our margins. Designing, engineering and manufacturing innovative new products

remains our priority. New product sales totaled $80 million or 31% of firearm sales in the first half of 2024. New product sales include

only major new products that were introduced in the past two years. In addition, we add dozens of line extensions and distributor exclusive

firearms to our offerings every year. We look forward to launching another exciting new product and more product derivatives in the second

half of this year.

Earlier this year, we reorganized some aspects of our business

and implemented a reduction in force to achieve greater efficiency, productivity and flexibility throughout our organization. We are starting

to realize the benefits of these actions. Despite the reduction in head count, second quarter production increased 18% from the first

quarter. We expect further improvements from the initiatives we are currently pursuing, and we continue to look for additional opportunities

to reduce or eliminate inefficiencies in every part of our business. We remain focused on the long-term goal of creating shareholder value.

Our disciplined pricing and promotion strategy may not always

benefit current period sales and profitability, but instead ensure our long-term performance and promote consistency throughout the distribution

channel, allowing both independent distributors and retailers to confidently invest in our inventory is essential to Ruger's long-term

success and leadership in the volatile firearms market.

The industry has recognized many of our innovative products with

awards and accolades in 2024, including recently announced Industry Choice Awards for Lever Gun of the Year, the Marlin Dark Series Model

1895, Carbine of the Year, the LC Carbine in .45 Auto and High Overall Rifle of the Year, the Ruger American Rifle Gen II Ranch. Those

are the highlights of the second quarter of 2024.

Operator, can we have the first question?

QUESTIONS AND ANSWERS

Operator

(Operator Instructions)

Our first question comes from Mark Smith at Lake Street.

Mark Smith Lake Street - Analyst

Hey, good morning, guys. My question -- first question is really

around ASPs. As we look at kind of the difference between ASP's on units shipped versus those in the backlog, backlog ASPs at very high

levels, is this more so kind of Marlin lever action rifles that we're seeing in the backlog that maybe get built as we move closer in

the fall or anything, give us the -- kind of walk us through. You can see the difference between those two numbers?

Christopher Killoy Sturm Ruger & Company Inc - President,

Chief Executive Officer, Director

Yes, good question, Mark. What that typically is right now is

heavy backlog on Marlin. We also have quite a few Ruger American Generation II Rifles that are in there at a slightly higher price point

than the Gen Is. So that makes up the -- I'll say the difference between what's on the backlog number versus what incoming orders may

reflect, which include a lot of the 75th anniversary values.

Mark Smith Lake Street - Analyst

Okay.

And as we think about units that were shipped, are we still continuing

to see, you know, strong demand or maybe some lower priced items or ones that you're shipping out in over this last quarter, maybe the

Super Wrangler Security 380, is that something or do you feel pretty good about the mix of items that were produced and shipped during

the quarter?

4

| August 01, 2024 / 1:00PM UTC, Q2 2024 Sturm Ruger & Company Inc Earnings Call |

Christopher Killoy Sturm Ruger & Company Inc - President,

Chief Executive Officer, Director

The mix is very strong. However, it is biased to some of those

lower price points with those 75th anniversary guns. One of the things we talked about was that we didn't engage in a lot of discounting

for promotional activity to negatively impact gross margins. However, those 75th Anniversary models, the 10/22, LCP MAX, the Mark IV 75th

commemorative, of all of those we're priced to sell. They were priced pretty sharply to make sure going into this market with the 75th

anniversary model, you're going to build things that will go stale at some point. So you want to make sure you can move those. And as

part of our strategy, and that's a little bit of why those were at a lower price, to make sure that the velocity we wanted with both our

wholesalers, retailers and the end users.

Mark Smith Lake Street - Analyst

Okay. And margins kind of my next question. As we think about

the backlog and maybe you're building and shipping some of these Marlin and other centerfire rifle as we work through the next couple

of quarters. I know you guys don't give guidance around margin, but how do you feel about you know the impact of maybe mix shift on margin

in the second half? And also, you know, maybe seeing more benefit from some of the cuts and work that you guys did earlier this year on

cutting costs?

Christopher Killoy Sturm Ruger & Company Inc - President,

Chief Executive Officer, Director

Yes, I think there may be some of that mix shift. I think more

likely margin improvements will be driven by our performance improvement in terms of some of the cost reductions and initiatives we've

undertaken as well as deleveraging some of the fixed costs as we take up production numbers. As Tom noted, we're up, I think production

was up 18% in Q2, and we expect it to be up again in the back half of the year.

Mark Smith Lake Street - Analyst

Okay. And I think the last question for me, just curious, Chris,

if you can give kind of your outlook into demand or primarily as we think about July, we haven't seen the NICS numbers come out yet, but

we saw kind of a jump of mid month around news and events in firearm demand. Curious if you know, any thoughts that you can give us around

July demand for firearms and what you kind of heard and saw from distributors and retailers.

Christopher Killoy Sturm Ruger & Company Inc - President,

Chief Executive Officer, Director

And by and large, a jump that we saw related to items in the news

cycle was pretty short and pretty minor, to be perfectly honest. I don't think that drove much in July. July continued a pretty slow period.

When you look at the overall demand at the retail level. I was just down at a one of our major retailers in Alabama for their promotion

this past weekend. And while we did well, what was moving was the lower priced items. Lower priced items, hard to get items, and our core

customer is still hurting. So I think when the matter when it comes into the gun store and if the credit cards maxed out, there's only

so much they can put on that card and so much they can buy. And I think that's partially driving it. And again, July is a tough month

historically. We're back to that cyclical nature and seasonal nature of our business. And July is typically one of the toughest months

for the firearms industry.

Mark Smith Lake Street - Analyst

Okay. And maybe I'll squeeze in one more. Just as you're out there

in the industry and talking to people, is it safe to assume that you guys are not expecting a historical big ramp as we get closer into

a presidential election this year?

Christopher Killoy Sturm Ruger & Company Inc - President,

Chief Executive Officer, Director

Good question. I don't know what to expect. I mean, we're ready

either way. I mean, our production is going to be moving forward based on the on what we have for new products in the pipeline. So we're

going to be increasing our production regardless. And if there is an unexpected spike in demand, we've got inventory, distributors have

inventory is lower than it was last year at this time, which is a healthy thing, but there's still inventory to support that. So again,

we're not banking on it or planning on it, but we'll be ready for it if it comes.

5

| August 01, 2024 / 1:00PM UTC, Q2 2024 Sturm Ruger & Company Inc Earnings Call |

Mark Smith Lake Street - Analyst

Excellent.

Thank you, guys.

Operator

Thank you. Our next question comes from Rommel Dionisio at Aegis

Capital.

Rommel Dionisio Aegis Capital - Analyst

Good morning and thank you. Chris, you alluded to some new product

launches in the back half of the year, certainly looking forward to that. But as you think about the timing and the cadence of new product

launches: difficult, challenging industry environment overall right now, doesn't this cause you to kind of -- it may be had this set for

a while. But as we enter as you think about 2025, do you think about slowing that down and waiting for kind of an industry bounce back?

Or how do you kind of think about the cadence of new product introductions here over the next few quarters?

Christopher Killoy Sturm Ruger & Company Inc - President,

Chief Executive Officer, Director

Thanks, Rommel. Typically we don't let that drive our new product

thinking. We know we've got to have a steady stream of new products coming. Some of them are products that take several years to work

through, get it, get it into market. Others can be pretty short and quick hits. But the the actual time to time it is always difficult.

And candidly, almost any new product initiatives, it always takes longer than you'd like. So it's kind of fraught with peril if you're

trying to time it too closely. So we're gonna go as fast as we can with the new products. We've got a couple of cool things coming in

the fall that we're excited about. And again, we're certainly not going to hold off on anything, waiting for either a shift in the market

raising else when it's ready and we've got inventory, we're going to get it out there. I think most people know now that Ruger, unlike

some folks when we announce products, we'd like to have it available either right at distributors or even ideally at retailers before

the customer hears about it. So that's going to be our plan as we go forward.

Rommel Dionisio Aegis Capital - Analyst

Okay, great.

Thanks very much, Chris.

Christopher Killoy Sturm Ruger & Company Inc - President,

Chief Executive Officer, Director

Thanks, Rommel.

Operator

Thank you. I'm showing no further questions at this time. I would

now like to turn it back over to Chris for closing remarks.

6

| August 01, 2024 / 1:00PM UTC, Q2 2024 Sturm Ruger & Company Inc Earnings Call |

Christopher Killoy Sturm Ruger & Company Inc - President,

Chief Executive Officer, Director

In closing, I'd like to thank all of you for attending our call

this morning, and thank our shareholders for the continued investment in our company. And most importantly, I'd like to thank our loyal

customers and our 1800 hard-working members of the Ruger team who design, build and sell rugged reliable firearms throughout the year.

Thank you.

Operator

Thank you for your participation in today's conference. This does

conclude the program. You may now disconnect.

7

| August 01, 2024 / 1:00PM UTC, Q2 2024 Sturm Ruger & Company Inc Earnings Call |

DISCLAIMER

The London Stock Exchange Group and its affiliates (collectively,

"LSEG") reserves the right to make changes to documents, content, or other information on this web site without obligation to

notify any person of such changes. No content may be modified, reverse engineered, reproduced or distributed in any form by any means,

or stored in a database or retrieval system, without the prior written permission of LSEG. The content shall not be used for any unlawful

or unauthorized purposes. LSEG does not guarantee the accuracy, completeness, timeliness or availability of the content. LSEG is not responsible

for any errors or omissions, regardless of the cause, for the results obtained from the use of the content. In no event shall LSEG be

liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs,

expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by

negligence) in connection with any use of the content even if advised of the possibility of such damages.

In the conference calls upon which Summaries are based, companies

may make projections or other forward-looking statements regarding a variety of items. Such forward-looking statements are based upon

current expectations and involve risks and uncertainties. Actual results may differ materially from those stated in any forward-looking

statement based on a number of important factors and risks, which are more specifically identified in the companies’ most recent

SEC filings. Although the companies may indicate and believe that the assumptions underlying the forward-looking statements are reasonable,

any of the assumptions could prove inaccurate or incorrect and, therefore, there can be no assurance that the results contemplated in

the forward-looking statements will be realized.

LSEG assumes no obligation to update the content following publication

in any form or format. The content should not be relied on and is not a substitute for the skill, judgment and experience of the user,

its management, employees, advisors and/or clients when making investment and other business decisions. LSEG does not act as a fiduciary

or an investment advisor except where registered as such.

THE INFORMATION CONTAINED IN TRANSCRIPT SUMMARIES REFLECTS LSEG'S

SUBJECTIVE CONDENSED PARAPHRASE OF THE APPLICABLE COMPANY'S CONFERENCE CALL AND THERE MAY BE MATERIAL ERRORS, OMISSIONS, OR INACCURACIES

IN THE REPORTING OF THE SUBSTANCE OF THE CONFERENCE CALLS. IN NO WAY DOES LSEG OR THE APPLICABLE COMPANY ASSUME ANY RESPONSIBILITY FOR

ANY INVESTMENT OR OTHER DECISIONS MADE BASED UPON THE INFORMATION PROVIDED ON THIS WEB SITE OR IN ANY SUMMARY. USERS ARE ADVISED TO REVIEW

THE APPLICABLE COMPANY'S CONFERENCE CALL ITSELF AND THE APPLICABLE COMPANY'S SEC FILINGS BEFORE MAKING ANY INVESTMENT OR OTHER DECISIONS.

Copyright ©2024 LSEG. All Rights Reserved.

8

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

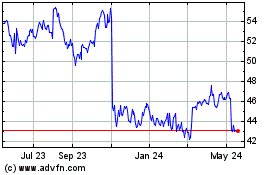

Sturm Ruger (NYSE:RGR)

Historical Stock Chart

From Dec 2024 to Jan 2025

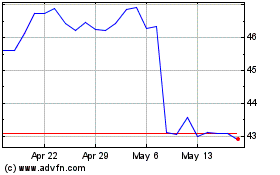

Sturm Ruger (NYSE:RGR)

Historical Stock Chart

From Jan 2024 to Jan 2025