Cameco Corporation (“Cameco”) (NYSE: CCJ; TSX: CCO) and Brookfield

Renewable Partners (“Brookfield Renewable”) (NYSE: BEP, BEPC; TSX:

BEP.UN, BEPC), together with its institutional partners (“the

consortium”), are forming a strategic partnership to acquire

Westinghouse Electric Company (“Westinghouse”), one of the world’s

largest nuclear services businesses.

Brookfield Renewable, with its institutional partners, will own

a 51% interest in Westinghouse and Cameco will own 49%.

Bringing together Cameco’s expertise in the nuclear industry

with Brookfield Renewable’s expertise in clean energy positions

nuclear power at the heart of the energy transition and creates a

powerful platform for strategic growth across the nuclear

sector.

The total enterprise value for Westinghouse is $7.875 billion.

Westinghouse’s existing debt structure will remain in place,

leaving an estimated $4.5 billion equity cost to the consortium,

subject to closing adjustments. This equity cost will be shared

proportionately between Brookfield and its institutional partners

(approximately $2.3 billion) and Cameco (approximately $2.2

billion).

Brookfield Renewable is pursuing this opportunity through the

Brookfield Global Transition Fund I (“BGTF I”), which is the

largest fund in the world focused on the energy transition.

Brookfield Renewable, which has significant available liquidity,

expects to invest approximately $750 million to acquire an

approximate 17% interest in Westinghouse, which will be funded

through normal course funding initiatives, including asset level

upfinancings and asset recycling.

Cameco currently has available liquidity and committed financing

facilities for the purposes of supporting the transaction to

acquire a 49% share in Westinghouse. However, Cameco will be

pursuing a permanent financing mix of capital sources (cash, debt

and equity), designed to preserve the company’s balance sheet and

ratings strength while maintaining its liquidity, prior to

closing.

Brookfield Renewable is among the world’s largest investors in

clean energy and transition assets, with approximately 125,000 MW

of operating and development capacity worldwide.

Cameco is one of the largest global suppliers of uranium fuel

for nuclear energy, with extensive uranium mining and milling

operations, as well as refining and conversion facilities and CANDU

fuel fabrication for heavy water reactors.

Investment highlights

- An industry leader:

Westinghouse services about half the nuclear power generation

sector and is the original equipment manufacturer to more than half

the global nuclear reactor fleet. The company has industry-leading

intellectual property and a specialized workforce of roughly 9,000

employees capable of operating in highly regulated markets around

the world.

- Stable and reliable

revenues: Approximately 85% of Westinghouse’s revenue has

come from long-term contracted or highly recurring customer service

provision with a nearly 100% customer retention rate given its

comprehensive services offerings and position as an original

equipment manufacturer, providing stability in all macroeconomic

environments.

- Multiple avenues for

growth: With strong growth projected in the nuclear energy

market, Westinghouse is well positioned to increase business in its

core fuel and services segments, execute on the growing pipeline

for extending and uprating nuclear power plants, and service the

rising demand for new utility-scale and modular baseload nuclear

power generation.

- Compelling partnership

opportunity: Cameco and Brookfield Renewable are well

placed to build a global player in the clean-energy transition. The

acquisition is expected to align Cameco’s uranium production and

fuel services capabilities with Westinghouse’s downstream

capabilities to potentially offer utilities a highly competitive

nuclear fuel solution to deliver value for existing and new

customers. This could include offering customers more efficient

access to fuel supplies sourced in North America and Europe.

Mark Carney, Brookfield Vice Chair and Head of Transition

Investing, said:

“Every credible net-zero pathway relies on significant growth in

nuclear power. It is an essential, reliable zero-carbon technology

that directly displaces fossil fuels and supports the growth of

renewables by providing critical baseload to our grids. The

partnership of Brookfield and Cameco will help drive forward the

growth of nuclear power the world needs for its clean energy

transition.”

Tim Gitzel, President and CEO of Cameco, said:

“We’re witnessing some of the best market fundamentals we’ve

ever seen in the nuclear energy sector. As one of the few forms of

electricity generation capable of safely, reliably and affordably

producing emissions-free, baseload power, nuclear energy is

becoming increasingly important in a world that prioritizes

electrification, decarbonization and energy security. The

opportunity to partner with Brookfield Renewable, a leader in the

clean-energy space, to acquire Westinghouse is expected to create a

platform for growth across the nuclear value chain. Coupled with

our more than 30-year proven track record of providing secure and

reliable fuel supplies to a global customer base, this transaction

fits perfectly within Cameco’s strategy and is expected to increase

our ability to meet the growing needs of existing and new customers

at a time when origin and security of supply is of significant

concern. At the same time, we expect the recurring demand for

Westinghouse’s operating plant services and nuclear fuel will

generate a strong revenue stream and add stable cash flow to

complement Cameco’s existing uranium and fuel services

business.”

Connor Teskey, CEO of Brookfield Renewable, said:

“Westinghouse has successfully refocused on providing core

services to the nuclear industry and is ready for the next phase of

growth. The business aligns well with our existing portfolio,

delivering highly contracted and dependable revenue by serving

customers who operate critical clean energy assets. Partnering with

Cameco brings deep nuclear sector expertise, alongside our

knowledge of energy markets and global customer base, to form a

formidable champion for nuclear power. We see significant potential

to grow the business and deliver on broader growth in the nuclear

power sector through our strategic partnership with Cameco.”

Market trends

The consortium partners see several major external trends that

are expected to benefit the acquisition of Westinghouse,

including:

- Critical transition

technology: Nuclear power is the one of the only

zero-emission, baseload sources of electricity currently available

at scale. Driven by electrification, decarbonization and energy

security benefits, an estimated 400 GW of additional nuclear

capacity will be needed by 2050.

- Accelerating growth

plans: Nuclear power is experiencing a resurgence around

the world with more than 20 countries across the Americas, Europe,

the Middle East and Asia pursuing new projects or plant extensions.

More than 50 GW of plant extensions have been announced to date and

more than 60 GW of new-build reactors are expected between 2020 and

2040.

- Energy security:

Energy supply chains are coming under stress as a result of

geopolitical uncertainty. In the short-term, the transaction

provides the opportunity to win new business supporting dozens of

nuclear facilities across Eastern European countries traditionally

served by Russia. In the medium term, demand for stable supply of

nuclear fuel and technology is expected to grow substantially,

commensurate with the growth in nuclear power generation as

countries look to increase energy security.

- Technology

advancements: There are multi-decade growth opportunities

in the rollout of next-generation advanced nuclear technology and

long-term nuclear energy storage solutions. Modular baseload

generation, such as Westinghouse’s eVinci micro-reactor technology,

can play a growing role in an increasingly decentralized and

decarbonized energy system.

Business summary

Westinghouse’s history in the energy industry stretches back

over a century, during which time the company became a pioneer in

nuclear energy. Today Westinghouse is an industry leader providing

mission-critical and specialized technologies, products and

services across most phases of the nuclear power sector.

Westinghouse has four key business lines:

- Operating Plant

Services: Recurring service provider for outages and

maintenance, engineering solutions, and replacement components and

parts.

- Nuclear Fuel:

Long-term contracting for the manufacturing and installation of

fuel assemblies and other ancillary equipment across multiple light

water reactor technologies, including as the original equipment

manufacturer for approximately half the nuclear plants

worldwide.

- Energy Systems:

Designing, engineering and supporting the development of new

nuclear reactors.

- Environmental

Services: Services to government and commercial customers

that support nuclear sustainability, environmental stewardship and

remediation.

Background to the transaction

The transaction follows the turnaround of Westinghouse by

Brookfield Business Partners (“BBU”) – the industrials and services

business of Brookfield Asset Management – which acquired the

business in 2018. Under BBU’s ownership Westinghouse has refocused

on core nuclear services, reduced its operating cost base and

pursued several complementary M&A transactions to strengthen

its in-house expertise.

Cameco and Brookfield Renewable will bring a compelling

combination of strategic and operational expertise to Westinghouse,

a business which represents a strong fit with the mandate of the

Brookfield Global Transition Fund. With Brookfield Renewable and

its institutional partners taking a 51% shareholding in the

consortium, Westinghouse’s current debt facilities will remain in

place.

This transaction was unanimously approved by the independent

directors of Brookfield Renewable based, in part, on the

recommendation of a committee of independent directors who assessed

the fairness of the transaction from a financial perspective. The

independent committee received an opinion as to the financial

fairness of the consideration from Greenhill & Co. Canada,

Ltd., as independent financial advisor, as well as advice from

independent legal counsel. Goldman Sachs & Co. LLP and CIBC

Capital Markets are acting as financial advisors to Cameco on the

transaction.

The transaction is also subject to the required approval of BBU

unitholders that are not affiliated with Brookfield Asset

Management, as well as customary closing conditions and regulatory

approvals. The consortium and BBU have entered into support

agreements with BBU unitholders who collectively own approximately

37% of the votes eligible to be cast, to vote in favor of the

transaction at the approval meeting. Closing is anticipated in the

second half of 2023.

For further information regarding Westinghouse Electric Company

and its downstream capabilities in the nuclear energy sector,

please visit its website at www.westinghousenuclear.com.

Cameco will be holding a conference call for investors and media

today, October 11, at 5:00 p.m. Eastern. There will not be a

participant question session as part of the call. To join, please

dial 1-800-319-4610 (Canada and US toll-free) or 604-638-5340. The

presentation slides and a live webcast of the conference call will

also be accessible from a link on the home page of Cameco’s

website, www.cameco.com.

A recorded version of the proceedings will be posted on the

Cameco website shortly after the call concludes. It can also be

accessed by phone until midnight Eastern on October 11 by calling

1-800-319-6413 (Canada and US toll-free) or 604-638-9010 (passcode

9527).

Contact information

|

Brookfield Renewable |

|

|

Media: |

Investors: |

|

Simon Maine |

Cara Silverman |

|

+44 7398 909 278 |

+1 416-649-8196 |

|

simon.maine@brookfield.com |

cara.silverman@brookfield.com |

|

|

|

|

Cameco |

|

|

Media: |

Investors: |

|

Veronica Baker |

Rachelle Girard |

|

306-385-5541 |

306-956-6403 |

|

veronica_baker@cameco.com |

rachelle_girard@cameco.com |

About Brookfield

Brookfield Renewable operates one of the world’s largest

publicly traded, pure-play renewable power platforms. Its portfolio

consists of hydroelectric, wind, solar and storage facilities in

North America, South America, Europe and Asia, and totals

approximately 24,000 MW of installed capacity and an approximately

100,000 MW development pipeline. Investors can access its portfolio

either through Brookfield Renewable Partners L.P. (NYSE: BEP; TSX:

BEP.UN), a Bermuda-based limited partnership, or Brookfield

Renewable Corporation (NYSE, TSX: BEPC), a Canadian corporation.

Further information is available at www.bep.brookfield.com and

https://bep.brookfield.com/bepc. Important information may be

disseminated exclusively via the website; investors should consult

the site to access this information.

Brookfield Renewable is the flagship listed renewable power

company of Brookfield Asset Management, a leading global

alternative asset manager with approximately $750 billion of assets

under management.

The Brookfield Global Transition Fund, co-led by Mark Carney,

Brookfield Vice Chair and Head of Transition Investing, and Connor

Teskey, CEO of Brookfield Renewable, is Brookfield’s inaugural

impact fund focusing on investments that accelerate the global

transition to a net-zero carbon economy, while delivering strong

risk-adjusted returns to investors. The Fund targets investment

opportunities relating to reducing greenhouse gas emissions and

energy consumption, as well as increasing low-carbon energy

capacity and supporting sustainable solutions. Consistent with its

dual objectives of earning strong risk-adjusted returns and

generating a measurable positive environmental change, the Fund

will report to investors on both its financial and environmental

impact performance.

About Cameco

Cameco is one of the largest global providers of the uranium

fuel needed to energize a clean-air world. Our competitive position

is based on our controlling ownership of the world’s largest

high-grade reserves and low-cost operations. Utilities around the

world rely on our nuclear fuel products to generate safe, reliable,

carbon-free nuclear power. Our shares trade on the Toronto and New

York stock exchanges. Our head office is in Saskatoon,

Saskatchewan.

About Westinghouse

Westinghouse Electric Company is shaping the future of

carbon-free energy by providing safe, innovative nuclear

technologies to utilities globally. Westinghouse supplied the

world’s first commercial pressurized water reactor in 1957 and the

company’s technology is the basis for nearly one-half of the

world’s operating nuclear plants. Over 135 years of innovation

makes Westinghouse the preferred partner for advanced technologies

covering the complete nuclear energy life cycle. For more

information, visit www.westinghousenuclear.com and follow us

on Facebook, LinkedIn and Twitter.

Cautionary Statement Regarding Forward-looking

Statements

Certain information in this press release, including statements

regarding the percentages of the acquisition of Westinghouse;

sources and uses of proposed financing scenarios; timeline of the

acquisition of Westinghouse, including the anticipated closing

thereof; expected investment of Cameco, Brookfield Renewable, and

BGTF I; growth of the nuclear energy market; increase in business

in Westinghouse’s core fuel and services segments; alignment of

Cameco’s uranium production and fuel services capabilities with

Westinghouse’s downstream capabilities; and market trends,

including critical transition technology, accelerating growth

plans; energy security and technology advancements, constitutes

forward-looking information within the meaning of applicable

securities laws in Canada and the United States, including the

United States Private Securities Litigation Reform Act of 1995. In

some cases, but not necessarily in all cases, forward-looking

information can be identified by the use of forward-looking

terminology such as “plans”, “targets”, “expects” or “does not

expect”, “is expected”, “should”, “an opportunity exists”, “is

positioned”, “estimates”, “intends”, “assumes”, “anticipates” or

“does not anticipate” or “believes”, or variations of such words

and phrases or state that certain actions, events or results “may”,

“could”, “would”, “might”, “will” or “will be taken”, “occur” or

“be achieved”. In addition, any statements that refer to

expectations, projections or other characterizations of future

events or circumstances contain forward-looking information.

Statements containing forward-looking information are not

historical facts but instead represent management’s expectations,

estimates and projections regarding future events.

Forward-looking information is necessarily based on a number of

opinions, assumptions and estimates that, while considered

reasonable by us as of the date of this press release, are subject

to known and unknown risks, uncertainties, assumptions and other

factors that may cause the actual results, level of activity,

performance or achievements to be materially different from those

expressed or implied by such forward-looking information, including

but not limited to the factors described in greater detail in (i)

the “[Risk Factors]” section of Brookfield’s current annual report

on Form 20-F and in Brookfield’s other materials filed with the SEC

and the Canadian securities regulatory authorities from time to

time, available at www.sec.gov and www.sedar.com, respectively and

(ii) the “Risk Factors” section of the Cameco’s current annual

information form and in Cameco’s other materials filed with the

Canadian securities regulatory authorities and the SEC from time to

time, available at www.sedar.com and www.sec.gov, respectively.

These factors are not intended to represent a complete list of the

factors that could affect Brookfield and Cameco; however, these

factors should be considered carefully. There can be no assurance

that such estimates and assumptions will prove to be correct. The

forward-looking statements contained in this press release are made

as of the date of this press release, and Brookfield and Cameco

expressly disclaims any obligation to update or alter statements

containing any forward-looking information, or the factors or

assumptions underlying them, whether as a result of new

information, future events or otherwise, except as required by

law.

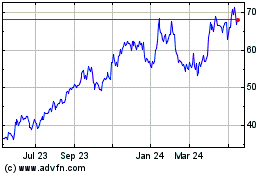

Cameco (TSX:CCO)

Historical Stock Chart

From Feb 2025 to Mar 2025

Cameco (TSX:CCO)

Historical Stock Chart

From Mar 2024 to Mar 2025