McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) is

pleased to report on three outcomes of its large exploration

investment at the Stock Mine property, part of the Fox Complex, in

the prolific Timmins gold district of Northern Ontario, Canada:

One, a 31% year over year increase of gold

resources at Stock West and Stock Main (historical Stock Mine),

with

Two, confirmation of good grading structures

plunging to depth; and

Three, Stock East emerging

as a potential new near-term source of future revenue.

31% Resource Growth (Inferred +

Indicated) and the Importance of Structures at Stock West and

Main

Geological interpretations suggest that two

principal structures that plunge to depth, emanating from the

historical Stock Mine (see Fig. 1) control the

mineralization of Stock West and Stock Main. Resources identified

within these structures in 2023 account for most of the 31%

increase in the Stock West and Main resource (see

Table 2) when compared to year end 2022. The

infill drilling at Stock West completed in 2023 demonstrated an

increase in the widths of the mineralized zones with a slight

decrease in the overall grade. Drilling along the deeper part of

structures accounts for about half of the 31% increase in the

updated resource estimate and demonstrates the potential for these

structures to extend to depth and remain highly prospective for

additional exploration and resource growth.

Stock East Emerging

Drilling in late 2023 and continuing into 2024

was designed to assess Stock East’s potential to be a shallow

source of near-term revenue during the construction phase of the

access ramp at Stock West. Assay results from the infill drill

program successfully identified mineable widths and grades. In

addition, the block model updated in 2022 has been successful in

forecasting the projected grades and widths for the new drilling.

Stock East mineralization appears to be controlled by two plunge

directions, with one similar to that seen for the rest of Stock

structures (see Fig. 1 in upper right-hand corner

and Fig. 3)

An assay result from drillhole SEZ24-86 that

returned 121.5 grams per tonne

(g/t) gold (Au) over 0.4

meters (m), equivalent to

3.91 ounces per tonne (oz/t) Au

over 1.3 ft (see Fig. 2), is very

intriguing because of its high grade, proximity to surface and

position outside the main mineralized zone (lying approximately 75

m in the hanging wall to the main Stock East zone). Its orientation

suggests that earlier drilling may have missed other possible

high-grade occurrences. To date, all of the drilling at Stock East

has been in a mostly North to North-West orientation, therefore

this particular intercept may have been mostly missed. Additional

follow-up drilling is warranted to determine its true geometry.

Some of the key drill results from our recent

drilling programs are listed below; see Fig. 3:

Also shown in Fig. 3 are earlier assay values of

attractive grades and widths.

|

SEZ23-69:SEZ24-71:SEZ24-84:SEZ24-85:SEZ24-88: |

7.1 g/t Au over 4.8 m4.5

g/t Au over 7.7 m6.5 g/t

Au over 10.2 m3.5 g/t Au over

5.3 m4.5 g/t Au over 10.4

m |

0.23 oz/t Au over 15.8

ft0.14 oz/t Au over 25.3

ft0.21 oz/t Au over 33.5

ft0.11 oz/t Au over 17.4

ft0.14 oz/t Au over 34.1

ft |

|

|

|

|

The location of Stock East is strategic for

multiple reasons:

From a geological perspective: The Stock East

zone lies close to the splay point of the NE-SW trending Nighthawk

Lake fault and the E-W trending regional Destor-Porcupine fault

(see Fig. 2). Such splays are known in the

district to be good traps for gold mineralization. The host rocks

at Stock East are a combination of altered mafic & ultramafic

volcanics and quartz breccias.

From an operational perspective: It is located

only 700 meters East of our mill (see Fig. 1);

Stock East is a shallow deposit positioned just 400 meters

from the proposed ramp to Stock West, that could be quickly and

inexpensively accessed; and it could potentially provide early

revenue during the construction of the Stock West ramp.

The current drilling program aims to upgrade the

majority of the Inferred mineralization to the Indicated category

while also targeting higher grade (>10 GxM, grade x true width)

sections of the zone. We are also updating the resource for Stock

East to include these new intercepts, targeting completion by the

end of Q1 2024 (see Table 1).

Figure 1: Longitudinal section

looking North, extending from Stock West to Stock East and showing

the principal plunge directions which control most the

mineralization on the Stock property

Figure 2: Plan view of the mineralization seen

on the Stock property

Figure 3: Longitudinal section

looking North - Stock East Zone: 2023 & 2024 drill results

shown in yellow

Most of the assay results from Stock East shown

in Fig 3. represent true widths

of over 4 m with good grades, and there is sound geological

continuity between the drillholes. The outline of this zone is well

defined and geological interpretations indicate a dip of about 70

degrees to the SE. Stock East has a strike length of approximately

400 meters, it extends vertically from near surface to a depth

of at least 350 m and is open down-dip and to the East. The two

proposed conjugate structural plunge directions (see Fig.

3, dashed lines) appear to be consistent with geological

interpretations for the mineralization seen at Stock East and to

provide excellent targeting vectors for future exploration and

resource growth.

Table 1: Highlights of recent

drill intercepts received for the Stock East zone

|

Hole ID |

From(m) |

To(m) |

Core Length (m) |

TrueWidth(m) |

Au (g/t) |

Au (g/t) x TW

(m) |

Core Length (ft) |

TrueWidth(ft) |

Au (oz/t) |

Au (oz/t) xTW

(ft) |

|

SEZ23-69 |

80.40 |

87.70 |

7.30 |

4.78 |

7.11 |

33.96 |

23.95 |

15.68 |

0.23 |

3.58 |

|

Including |

84.60 |

87.70 |

3.10 |

1.90 |

13.28 |

|

10.17 |

6.23 |

0.43 |

|

|

SEZ23-70 |

86.65 |

93.74 |

7.09 |

4.80 |

4.27 |

20.47 |

23.26 |

15.74 |

0.14 |

2.16 |

|

Including |

86.65 |

91.00 |

4.35 |

2.81 |

5.88 |

|

14.27 |

9.22 |

0.19 |

|

|

SEZ23-71 |

80.55 |

90.00 |

9.45 |

7.74 |

4.51 |

34.91 |

31.00 |

25.39 |

0.14 |

3.68 |

|

Including |

87.00 |

90.00 |

3.00 |

2.51 |

10.64 |

|

9.84 |

8.24 |

0.34 |

|

|

SEZ24-80A |

139.65 |

143.50 |

3.85 |

2.85 |

4.96 |

14.13 |

12.63 |

9.34 |

0.16 |

1.49 |

|

SEZ24-84 |

212.64 |

229.00 |

16.36 |

10.22 |

6.45 |

65.92 |

53.67 |

33.53 |

0.21 |

6.95 |

|

Including |

226.34 |

229.00 |

2.66 |

1.71 |

30.31 |

|

8.73 |

5.62 |

0.97 |

|

|

SEZ24-85 |

133.59 |

140.00 |

6.41 |

5.25 |

3.49 |

18.32 |

21.03 |

17.24 |

0.11 |

1.93 |

|

SEZ24-86 |

85.08 |

85.67 |

0.59 |

0.39 |

121.53 |

45.60 |

1.94 |

1.29 |

3.91 |

5.03 |

|

SEZ24-88 |

226.00 |

241.84 |

15.84 |

10.36 |

4.48 |

46.41 |

51.97 |

33.99 |

0.14 |

4.90 |

|

Including |

238.00 |

241.84 |

3.84 |

2.61 |

12.96 |

|

12.60 |

8.58 |

0.42 |

|

|

SEZ24-95 |

202.54 |

207.77 |

5.23 |

3.74 |

5.69 |

21.28 |

17.16 |

12.27 |

0.18 |

2.24 |

|

SEZ19-28* |

337.00 |

343.50 |

6.50 |

5.91 |

34.71 |

205.25 |

21.33 |

19.40 |

1.12 |

21.65 |

|

Including |

339.80 |

342.80 |

3.00 |

2.73 |

74.13 |

|

9.84 |

8.96 |

2.38 |

|

|

SEZ19-35* |

324.30 |

330.50 |

6.20 |

5.64 |

83.49 |

470.95 |

20.34 |

18.51 |

2.68 |

49.68 |

|

Including |

325.30 |

326.50 |

1.20 |

1.09 |

417.00 |

|

3.94 |

3.58 |

13.41 |

|

|

SEZ19-39* |

303.60 |

319.40 |

15.80 |

12.90 |

3.97 |

51.23 |

51.84 |

42.33 |

0.13 |

5.40 |

|

Including |

304.30 |

305.00 |

0.70 |

0.54 |

10.25 |

|

2.30 |

1.76 |

0.33 |

|

|

Including |

316.00 |

317.00 |

1.00 |

0.77 |

25.50 |

|

3.28 |

2.52 |

0.82 |

|

|

S18-02* |

230.40 |

241.00 |

10.60 |

9.40 |

4.49 |

42.21 |

34.78 |

30.84 |

0.14 |

4.45 |

|

Including |

233.40 |

234.00 |

0.60 |

0.53 |

15.90 |

|

1.97 |

1.74 |

0.51 |

|

|

S18-10* |

204.00 |

218.80 |

14.80 |

11.96 |

5.24 |

62.67 |

48.56 |

39.24 |

0.17 |

6.61 |

|

Including |

215.80 |

217.80 |

2.00 |

1.62 |

26.53 |

|

6.56 |

5.31 |

0.85 |

|

|

S18-47* |

335.70 |

348.00 |

12.30 |

9.69 |

5.76 |

55.81 |

40.35 |

31.79 |

0.19 |

5.89 |

|

Including |

344.45 |

347.10 |

2.65 |

2.09 |

25.16 |

|

8.69 |

6.86 |

0.81 |

|

|

Grades are presented uncapped; * - previously reported

intervals. |

Table 2: Comparison of the Stock

West and Main resource beginning with the 2022 PEA

|

|

Classification |

Quantity '000 t |

Change |

Gold Grade |

Change |

Contained Metal |

Change |

|

|

% |

g/t |

% |

'000 oz Au |

% |

|

2022 PEA |

Indicated |

1,171 |

|

3.83 |

|

144 |

|

|

Inferred |

1,049 |

|

3.30 |

|

111 |

|

|

Year-End 2022 |

Indicated |

1,280 |

+9% |

3.66 |

-4% |

151 |

+5% |

|

Inferred |

1,041 |

-1% |

3.20 |

-3% |

107 |

-4% |

|

Year-End 2023** |

Indicated |

1,938 |

+51% |

3.31 |

-10% |

206 |

+37% |

|

Inferred |

1,386 |

+33% |

2.96 |

-8% |

132 |

+23% |

** Mineral resources are not mineral reserves

and do not have demonstrated economic viability. All figures are

rounded to reflect the relative accuracy of the estimates. For this

update, an additional 272 drillholes (100,834 m) were added to the

database since the last resource update in December 2022.

Composites were capped where appropriate. Mineral resources are

reported at a cut-off grade of 1.95 g/t gold, demonstrate

Reasonable Prospects of Eventual Economic Extraction assuming an

underground extraction scenario, being constrained by MSO stope

shapes, a gold price of US $1,725 per ounce, and a metallurgical

recovery of 94 percent.

This resource statement does not include the

Stock East deposit, which had its own mineral resource estimation

updated in March 2022; there is a separate Mineral Resource

Statement for Stock East.

Technical information

Technical information pertaining to the Fox

Complex exploration contained in this news release has been

prepared under the supervision of Sean Farrell, P.Geo., Chief

Exploration Geologist, who is a Qualified Person as defined by

Canadian Securities Administrators National Instrument 43-101

"Standards of Disclosure for Mineral Projects."

The technical information related to resource

and reserve estimates in this news release has been reviewed and

approved by Luke Willis, P.Geo., McEwen Mining’s Director of

Resource Modelling and Qualified Person as defined by SEC S-K 1300

and Canadian Securities Administrators National Instrument 43-101

"Standards of Disclosure for Mineral Projects."

Exploration drill core samples at the Stock

Complex were typically submitted as 1/2 core. Analyses reported

herein were either performed by the fire assay method at the

accredited laboratory Pangea Laboratorio in Sinaloa, Mexico, owned

and operated by an indirect subsidiary of the Company

(NMX-EC-17025-IMNC-2018, ISO /IEC 17025:2017), or by the photon

assay method at the accredited laboratory MSA Labs in Timmins,

Ontario, Canada (ISO 9001 & ISO 10725).

For a list of drilling results at Stock since June 2,

2023, including hole location and alignment, click

here:https://www.mcewenmining.com/files/doc_news/archive/2024/2024_02_StockDrillResults.xlsx

CAUTION CONCERNING FORWARD-LOOKING

STATEMENTSThis news release contains certain

forward-looking statements and information, including

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. The forward-looking

statements and information expressed, as at the date of this news

release, McEwen Mining Inc.’s (the "Company") estimates, forecasts,

projections, expectations or beliefs as to future events and

results. Forward-looking statements and information are necessarily

based upon a number of estimates and assumptions that, while

considered reasonable by management, are inherently subject to

significant business, economic and competitive uncertainties, risks

and contingencies, and there can be no assurance that such

statements and information will prove to be accurate. Therefore,

actual results and future events could differ materially from those

anticipated in such statements and information. Risks and

uncertainties that could cause results or future events to differ

materially from current expectations expressed or implied by the

forward-looking statements and information include, but are not

limited to, effects of the COVID-19 pandemic, fluctuations in the

market price of precious metals, mining industry risks, political,

economic, social and security risks associated with foreign

operations, the ability of the corporation to receive or receive in

a timely manner permits or other approvals required in connection

with operations, risks associated with the construction of mining

operations and commencement of production and the projected costs

thereof, risks related to litigation, the state of the capital

markets, environmental risks and hazards, uncertainty as to

calculation of mineral resources and reserves, and other risks.

Readers should not place undue reliance on forward-looking

statements or information included herein, which speak only as of

the date hereof. The Company undertakes no obligation to reissue or

update forward-looking statements or information as a result of new

information or events after the date hereof except as may be

required by law. See McEwen Mining’s Annual Report on Form 10-K for

the fiscal year ended December 31, 2022, and other filings with the

Securities and Exchange Commission, under the caption "Risk

Factors", for additional information on risks, uncertainties and

other factors relating to the forward-looking statements and

information regarding the Company. All forward-looking statements

and information made in this news release are qualified by this

cautionary statement.

The NYSE and TSX have not reviewed and do not

accept responsibility for the adequacy or accuracy of the contents

of this news release, which has been prepared by management of

McEwen Mining Inc.

ABOUT MCEWEN MINING

McEwen Mining is a gold and silver producer with

operations in Nevada, Canada, Mexico and Argentina. In addition, it

owns approximately 47.7% of McEwen Copper which owns the large,

advanced-stage Los Azules copper project in Argentina.

Rob McEwen, Chairman and Chief Owner, has a personal

investment in the company of US$220 million. His annual salary is

US$1.

Want News Fast?Subscribe to our

email list by clicking

here:https://www.mcewenmining.com/contact-us/#section=followUs and

receive news as it happens!

|

|

|

|

|

|

|

|

|

|

WEB SITE |

|

SOCIAL

MEDIA |

|

|

|

|

|

www.mcewenmining.com |

|

McEwen Mining |

Facebook: |

facebook.com/mcewenmining |

|

|

|

|

|

LinkedIn: |

linkedin.com/company/mcewen-mining-inc- |

|

|

|

CONTACT

INFORMATION |

|

Twitter: |

twitter.com/mcewenmining |

|

|

|

150 King Street West |

|

Instagram: |

instagram.com/mcewenmining |

|

|

|

Suite 2800, PO Box 24 |

|

|

|

|

|

|

|

Toronto, ON, Canada |

|

McEwen Copper |

Facebook: |

facebook.com/

mcewencopper |

|

|

|

M5H 1J9 |

|

LinkedIn: |

linkedin.com/company/mcewencopper |

|

|

|

|

|

Twitter: |

twitter.com/mcewencopper |

|

|

|

Relationship with

Investors: |

|

Instagram: |

instagram.com/mcewencopper |

|

|

|

(866)-441-0690 - Toll free line |

|

|

|

|

|

|

|

(647)-258-0395 |

|

Rob

McEwen |

Facebook: |

facebook.com/mcewenrob |

|

|

|

Mihaela Iancu ext. 320 |

|

LinkedIn: |

linkedin.com/in/robert-mcewen-646ab24 |

|

|

|

info@mcewenmining.com |

|

Twitter: |

twitter.com/robmcewenmux |

|

|

|

|

|

|

|

|

|

A photo accompanying this announcement is available

at:https://www.globenewswire.com/NewsRoom/AttachmentNg/5a77353f-7e14-4df0-8b0b-69000806b355https://www.globenewswire.com/NewsRoom/AttachmentNg/e3a4ebe6-3bd8-4b0b-a8dd-a15b91218334https://www.globenewswire.com/NewsRoom/AttachmentNg/df3902f4-4e4d-4c33-b5b3-3c69a1f7ca16

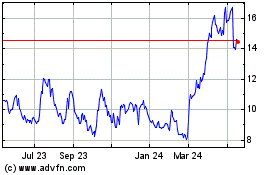

McEwen Mining (TSX:MUX)

Historical Stock Chart

From Nov 2024 to Dec 2024

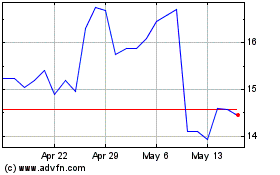

McEwen Mining (TSX:MUX)

Historical Stock Chart

From Dec 2023 to Dec 2024