Xanadu Mines Ltd (

ASX:XAM, TSX:XAM)

(

Xanadu,

XAM or

the

Company) is pleased to provide the Pre-Feasibility Study

(PFS) for its flagship Kharmagtai Copper-Gold Project (Kharmagtai

or the Project), located in an established mining jurisdiction in

the South Gobi region of Mongolia.

This Study confirms the potential of Kharmagtai

as a globally significant, long life, low cost, low risk future

copper-gold mine. It is based on conventional open pit mining and

sulphide flotation, with low environmental, social and governance

(ESG) risk, and supported by nearby rail, road and

power links providing the potential for rapid development.

Kharmagtai is well positioned to help fill the looming copper

global supply gap driven by growing demand for an increasingly

electrified economy.

HighlightsPresented in

100% Terms (Xanadu holds 50% control and 38.25% economic

share)

-

Confirms Kharmagtai as a potential world class, low cost, long life

mine. Estimated Results:

-

21% IRR (range 14-25%, and 31% at spot commodity

prices)

-

US$930 million NPV @ 8% (range US$ 450-1,220 million, and

US$1,880 million at spot commodity prices)

-

4-year payback (range 4-5 years, and 3 years at spot

commodity prices)

-

29-year mine life

-

Projected production ranges from 60-80ktpa copper and 165-170kozpa

gold production across the first and second stages of

expansion.

-

First quartile all-in sustaining (C1) costs of US$0.70/lb Cu for

first eight years, net of by-product credits

-

Conventional, low technical complexity open pit and process plant

with low 0.6:1 strip ratio for first eight years

-

Located in sparsely populated, flat terrain, with nearby

established rail, power and water links

-

Bankable Feasibility Study expected to commence in Q1 CY2025 and

complete in Q2 of CY2026

-

Robust study outcomes, led by high quality advisory team

Xanadu’s Executive Chairman and Managing

Director, Mr Colin Moorhead, said “This Pre-Feasibility

Study is the result of 18 months of hard work led by Spencer Cole,

working closely with our JV partners at Zijin Mining Group Co Ltd.

This confirms to an international PFS standard that Kharmagtai as a

world class copper asset, located in a region of the South Gobi

which hosts several significant deposits, including those at Rio

Tinto’s Oyu Tolgoi mine. The future development of Kharmagtai into

a long life, low cost, mine will provide significant value to our

shareholders and multi-generation employment and economic

opportunity for our stakeholders in Mongolia. It remains true today

that as the global economy decarbonises, the supply of copper

cannot meet forecast demand. Development of large scale porphyry

copper deposits is becoming more urgent, and with a competitive

time to production and relatively low ESG risk, Kharmagtai is well

positioned to move forward quickly. We are excited to demonstrate

such a strong Project at Kharmagtai and to move forward with its

final pre-construction stage of development.”

Pre-Feasibility StudyThe

Pre-Feasibility Study is attached to this Announcement.

Cautionary StatementThe

Pre-Feasibility Study (PFS) has been undertaken to

assess the viability of developing the Kharmagtai Copper-Gold

Project by constructing a large-scale open cut mine and processing

facility to produce a saleable gold-rich copper concentrate for

export and gold doré for sale to the Bank of Mongolia. It is a

technical and economic study assessing the potential viability of

the Kharmagtai Project. It is based on technical and economic

assessments that are sufficient to support the estimation of ore

reserves. The PFS is based on the material assumptions in this

document. These include assumptions about the availability of

funding. While Xanadu Mines Ltd (Xanadu) considers

all the material assumptions to be based on reasonable grounds,

there is no certainty that they will prove to be correct or that

the range of outcomes indicated by the PFS will be achieved.

The PFS is based on the October 2024 Mineral Resource Estimate,

Probable Ore Reserves, and a PFS standard level of technical and

economic assessments, which do not provide assurance of economic

development or certainty that the PFS outcomes will be realised.

The PFS has been completed to a level of accuracy of +/-25% in line

with industry standard accuracy for this stage of development.

The Company has reasonable grounds for disclosing a Production

Target, whereby the first eight years of production is

predominantly scheduled from the Indicated Resource category which

exceeds the economic payback period for the project by 4 years. As

a result, the project economics are not dependent upon Inferred

Resource to justify investment.

Approximately 73% of the 29-year Life of Mine Production Target

and 88% of the first 8 years of mining is delineated from the

Indicated Mineral Resource category. There is a lower level of

geological confidence associated with Inferred Mineral Resource,

and while the company recognises the mine inventory contains a

significant amount of Inferred Resource in the later years of the

mine life, due to the nature of the orebody, it considers the

estimates to be accurate and to have a high probability of

conversion from Inferred to Indicated Resource category through

further drilling, with a low probability of material downgrade. The

nature of Kharmagtai mineralisation is bulk tonnage, lower grade

and disseminated in nature, which results in predictable variations

in grade over larger drill spacing than for other types of

mineralisation.

The Company considers all the material assumptions in this PFS

to be based on reasonable grounds, there is no certainty that they

will prove to be correct or that the range of outcomes indicated

will be achieved. Given the uncertainties involved, investors

should not make any investment decisions based solely on the

results of the PFS.

During the completion of the PFS, evaluation of an Ore Reserve

Estimate was completed including only Probable tonnes. To support

the Ore Reserve evaluation within the PFS, a separate Whittle 4X

open pit optimization evaluation was completed by Mining Plus with

no value given to the Inferred Mineral Resource within all

deposits. Using this model a PFS level mine design, mine

scheduling, mining costing and overall project economic model

evaluation was completed solely based on Indicated Resource to

confirm positive economic outcomes for the Ore Reserve. For full

details of the estimated Ore Reserve, please refer to Xanadu

ASX/TSX Announcement dated 14 October 2024.

The Mineral Resource underpinning the production target in the

PFS has been prepared by a Competent Person in accordance with the

requirements of Australasian Code for Reporting of Exploration

Results, Mineral Resources and Ore Reserves (JORC Code 2012). The

Competent Person’s Statement is found at the end of this PFS. For

full details of the Mineral Resource Estimate, please refer to

Xanadu ASX/TSX Announcement dated 14 October 2024.

To achieve the range of outcomes indicated in the PFS, funding

in the order of $890 million will likely be required from owners of

the project. Investors should note that there is no certainty that

Xanadu will be able to source its share of the required funding

when needed. It is also possible that such funding may only be

available on terms that may be dilutive to or otherwise affect the

value of Xanadu’s existing shares. It is also possible that Xanadu

could pursue other ‘value realisation’ strategies such as a sale,

partial sale or further joint venture of the project. If it does,

this could materially reduce Xanadu proportionate ownership of the

project.

Xanadu confirms that it is not aware of any new information or

data that materially affects the information included in that

release. All material assumptions and technical parameters

underpinning the estimates in that Announcement continue to apply

and have not materially changed.

Unless otherwise stated, all currency stated in this PFS

is in US dollars.

Forward Looking

StatementsCertain statements contained in this PFS,

including information as to the future financial or operating

performance of Xanadu and its projects may also include statements

which are ‘forward-looking statements’ that may include, amongst

other things, statements regarding targets, estimates and

assumptions in respect of mineral reserves and mineral resources

and anticipated grades and recovery rates, production and prices,

recovery costs and results, capital expenditures and are or may be

based on assumptions and estimates related to future technical,

economic, market, political, social and other conditions. These

‘forward looking statements’ are necessarily based upon a number of

estimates and assumptions that, while considered reasonable by

Xanadu, are inherently subject to significant technical, business,

economic, competitive, political and social uncertainties and

contingencies and involve known and unknown risks and uncertainties

that could cause actual events or results to differ materially from

estimated or anticipated events or results reflected in such

forward-looking statements.

Xanadu disclaims any intent or obligation to update publicly or

release any revisions to any forward-looking statements, whether as

a result of new information, future events, circumstances or

results or otherwise after the date of this PFS or to reflect the

occurrence of unanticipated events, other than as required by the

Corporations Act 2001 (Cth) and the Listing Rules of the Australian

Securities Exchange (ASX) and Toronto Stock Exchange (TSX). The

words ‘believe’, ‘expect’, ‘anticipate’, ‘indicate’, ‘contemplate’,

‘target’, ‘plan’, ‘intends’, ‘continue’, ‘budget’, ‘estimate’,

‘may’, ‘will’, ‘schedule’ and similar expressions identify

forward-looking statements.

All ‘forward-looking statements’ made in this PFS are qualified

by the foregoing cautionary statements. Investors are cautioned

that ‘forward-looking statements’ are not a guarantee of future

performance and accordingly investors are cautioned not to put

undue reliance on ‘forward-looking statements’ due to the inherent

uncertainty therein.

Xanadu has concluded that it has a reasonable basis for

providing these forward-looking statements and the forecast

financial information included in this PFS.

To achieve the range of Kharmagtai Copper-Gold Project outcomes

indicated in this PFS, funding in the order of approximately $890

million will likely be required by the owners of the project. As a

result of minority ownership and carry agreements, Xanadu and Zijin

are jointly accountable for 90.4% of this total based.

Based on current market conditions and the results of studies

undertaken, there are reasonable grounds to believe Xanadu’s share

of the Project can be financed via a combination of equity and

debt, as has been done for numerous comparable projects in Mongolia

and other jurisdictions in Asia in recent years. Debt may be

secured from several sources including Australian banks,

international banks, the high yield bond market, resource credit

funds, and in conjunction with product sales of offtake agreements.

It is also possible the Company may pursue alternative funding

options, including undertaking a corporate transaction, seeking a

joint venture partner or partial asset sale. There is, however, no

certainty that Xanadu will be able to source funding as and when

required. Whilst no formal funding discussions have concluded, the

Company has engaged with several potential financiers of the

Kharmagtai Copper-Gold Project and these financial institutions and

corporations have expressed an interest in being involved in

funding of the Project.

This ASX PFS has been prepared in compliance with the current

JORC Code (2012) and the ASX Listing Rules. All material

assumptions, including sufficient progression of all JORC modifying

factors, on which the production target and forecast financial

information are based have been included in this ASX PFS.

About Xanadu MinesXanadu is an

ASX and TSX listed Exploration company operating in Mongolia. We

give investors exposure to globally significant, large-scale

copper-gold discoveries and low-cost inventory growth. Xanadu

maintains a portfolio of exploration projects and remains one of

the few junior explorers on the ASX or TSX who jointly control a

globally significant copper-gold deposit in our flagship Kharmagtai

project. Xanadu holds 50-50 JV share with Zijin Mining Group in

Khuiten Metals Pte Ltd, which controls 76.5% of the Kharmagtai

project.

For further information, please

contact:

|

Colin MoorheadManaging DirectorE: colin.moorhead@xanadumines.comT:

+61 2 8280 7497 |

Spencer ColeChief Development Officer & CFOE:

spencer.cole@xanadumines.com |

| |

|

This Announcement was authorised for release by

Xanadu’s Board of Directors.

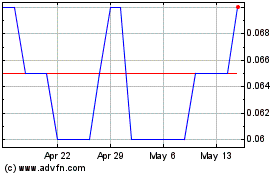

Xanadu Mines (TSX:XAM)

Historical Stock Chart

From Jan 2025 to Feb 2025

Xanadu Mines (TSX:XAM)

Historical Stock Chart

From Feb 2024 to Feb 2025