Azimut Signs Option Agreement for its Pilipas Property James Bay Region, Quebec

11 December 2023 - 10:30PM

Azimut Exploration Inc. (“Azimut” or the

“Company”) (

TSXV: AZM) (

OTCQX:

AZMTF) is pleased to announce the signing of an Option to

Joint Venture Agreement (the “Agreement”) with

Ophir Gold Corp. (“Ophir”)

(

TSXV:OPHR, OTCQB:OPHRF) for its wholly-owned

Pilipas Property (the “Property”), located in

Eeyou Istchee James Bay region of Quebec (Figure 1).

Under the Agreement, Ophir can earn up to a 70%

interest in the Property from Azimut over three (3) years by

funding $4 million in exploration expenditures, and by making

payments totalling 6 million in shares of Ophir and $100,000 in

cash.

The Pilipas Property (135

claims, 70.7 km2) is located along the Billy-Diamond Highway and

adjacent to the Munischiwan project (Azimut – SOQUEM JV) and Elmer

East project (Quebec Precious Metal Corporation). Pilipas is

underlain by the Lower Eastmain greenstone belt, part of the La

Grande Sub-province of the Archean Superior Province. The

geoscientific database covering the project notably comprise a soil

geochemical survey and a magnetic-electromagnetic survey.

Pilipas displays significant exploration

potential for lithium-cesium-tantalum (LCT) pegmatites as well as

for intrusion-related and volcanogenic massive sulphides

gold-copper systems.

The Property is in close proximity to the recent

Ninaaskumuwin spodumene outcrop discovery made by Quebec Precious

Metals on their Elmer East project. Pilipas hosts several

identified outcropping pegmatites that have not been sampled for

lithium, constituting quality exploration targets.

The Property is also geologically situated along

strike with the InSight Prospect on the Munischiwan property, which

returned up to 100.5 g/t Au, 435.0 g/t Ag, 156.0 g/t Te and 1.67%

Cu (from grab samples) (see press release of December 5, 2018). An

IP survey completed in 2019 on Munischiwan suggests that this

prospective trend may extend north onto Pilipas (see press release

of April 30, 2019).

Key terms of the Agreement

Under the Agreement, Ophir can acquire up to a

70% interest in the Property by fulfiling over three (3) years (the

“Option Phase”), the following payments and exploration

expenditures:

|

Year |

Cash Payment |

Share Payment |

Minimum Exploration Expenditures |

Interest Earned |

|

Closing |

$20,000 |

2,000,000 |

- |

- |

|

1st Anniversary |

$25,000 |

1,000,000 |

$400,000 |

- |

|

2nd Anniversary |

$25,000 |

1,000,000 |

$1,600,000 |

50% |

|

3rd Anniversary |

$30,000 |

2,000,000 |

$2,000,000 |

70% |

|

Total |

$100,000 |

6,000,000 |

$4,000,000 |

|

Ophir will act as the operator during the Option

Phase with the first-year minimum expenditure representing a firm

exploration commitment.

Following the formation of a participating joint

venture, if a party’s interest is diluted below 10%, it will

convert to a 2% net smelter return royalty (NSR).

The parties are dealing at arm’s length. The

Agreement remains subject to regulatory approvals by the TSX

Venture Exchange.

Azimut’s management cautions that results or

discoveries on surrounding properties are not necessarily

indicative of mineralization hosted on the Company’s properties.

Grab samples are selective by nature and unlikely to represent

average grades.

This press release was prepared by Dr. Jean-Marc

Lulin, P.Geo., acting as Azimut’s qualified person within the

meaning of National Instrument 43-101.

About Ophir

Ophir is a diversified mineral exploration

company currently focused on the exploration and development of the

Radis lithium property in the James Bay region, and the

past-producing Breccia gold property located in Idaho.

About Azimut

Azimut is a leading mineral exploration company

with a solid reputation for target generation and partnership

development. The Company holds the largest mineral exploration

portfolio in Quebec (Canada). Its wholly owned flagship project,

the Elmer Gold Project, has advanced to the

resource stage with a strong exploration upside. The Company also

controls a strategic land position for copper-gold, nickel and

lithium (see the document: Azimut in Numbers).

The Company uses a pioneering approach to big

data analytics (the proprietary AZtechMine™ expert

system) enhanced by extensive exploration know-how. Azimut’s

competitive edge is based on systematic regional-scale data

analysis and concurrently active projects. The Company maintains

rigorous financial discipline and a strong balance sheet, with 85.2

million shares issued and outstanding.

Contact and Information

Jean-Marc Lulin, President and

CEOTel.: (450) 646-3015

Jonathan Rosset, Vice President Corporate

DevelopmentTel: (604)

202-7531info@azimut-exploration.com www.azimut-exploration.com

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

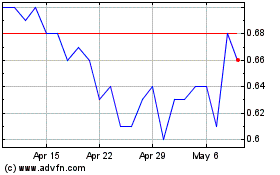

Azimut Exploration (TSXV:AZM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Azimut Exploration (TSXV:AZM)

Historical Stock Chart

From Apr 2023 to Apr 2024