Medusa Mining Limited (TSX:MLL)(ASX:MML)(LSE:MML)

Snapshot of Medusa:

-- Un-hedged, low cost, dividend paying OVERVIEW:

gold producer focused on organic

growth in the Philippines Co-O MINE PRODUCTION &

DEVELOPMENT

-- 5 years growth path to production - New Co-O plant with

of 400,000 ozs per year capacity for 200,000

ounces per year

-- Growth underpinned by strong (750,000 tonnes per year)

cashflow from Co-O Mine permitting in progress, design

(narrow vein underground) and supervising engineers

appointed

-- FY 2010/11: revised

target 102,000 ozs at cash - Quarterly production

costs circa US$190/oz of 25,114 ounces at

an average recovered grade of

-- FY 2011/12: target 120,000 11.58 g/t at cash cost of

to 130,000 ozs at cash US$191 per ounce

costs circa US$190/oz

- Saga Shaft: revised plan to

-- Current Mineral Resources Level 7 depth, accelerated

comprise development commenced,

shaft currently at 32 metres,

-- Co-O Mine: Indicated 603k temporary headframe erected

ozs at 13.2 g/t gold;

Inferred 898k ozs - New Level 1 adit advanced

at 9.6 g/t gold to 65 metres

-- Bananghilig: Inferred 650k Co-O MINE & REGIONAL DRILLING

ozs at 1.3 g/t gold

- Discovery of new wide high

-- Current Probable Reserves : Co-O Mine grade vein below Level 5

505k ozs @ 10.7 g/t gold

- Drilling is continuing with six

-- Co-O Mine Resources and Reserves surface and four underground

to be maintained at current levels rigs.

-- Conceptual exploration target size - Results include 2.00 metres at

(ii) of Co-O Mine of 3 to 7 219.70 g/t gold, 0.80

million ozs metres at 42.33 g/t

gold, 4.80 metres at

-- Excellent exploration upside: 13.84 g/t gold, 9.65

high grade vein and disseminated metres at 12.58 g/t gold

bulk gold targets, plus seven and 13.10 metres at 47.81

copper targets g/t gold

-- 820 km2 of tenements and exploration BANANGHILIG DEPOSIT

budget for FY 2010/11 of US$21M

- Resource validation drilling

Board of Directors: continuing with two rigs

and extensional drilling

Peter R. Jones (Non-executive Chairman) with four rigs

Geoffrey Davis (CEO)

Peter Hepburn-Brown (COO) - Regional mapping continuing

Roy Daniel (CFO)

Robert Weinberg (Non-executive Director) SAUGON PROJECT

Andrew Teo (Non-executive Director)

- Drilling with three rigs

continuing

Capital Structure:

TENEMENTS

Ordinary shares: 188,233,911

Unlisted options: 750,000 - Lingig & Tambis MPSAs 343,

344-2010-XIII resp. and

Listings: EPs 030 & 031-XIII

have been granted

ASX and LSE (Code: MML),TSX (Code: MLL)

Address and Contact Details: FINANCIALS & CORPORATE

PO Box 860 - Total cash and cash equivalent

Canning Bridge WA 6153 in gold on metal account

Telephone: +618 9367 0601 at end of quarter of

Facsimile: +618 9367 0602 approximately US$92.4 million

Email: admin@medusamining.com.au

Website: www.medusamining.com.au - An interim dividend of A$0.05

per share was paid to

shareholders on 23 March 2011

(ii) The potential target size and grade is conceptual in nature, and there

has been insufficient exploration to define a mineral resource, and it is

uncertain if further exploration will result in the target being defined as

a mineral resource. Refer to Stock Exchange announcement dated 18 January

2010.

PROJECT OVERVIEW

The locations of the Company's projects are shown on Figures 1 and 2.

To view "Figure 1. Location diagram showing the Company's tenement areas and

prominent East-West structures", please visit the following link:

http://media3.marketwire.com/docs/mll_fg1_427.jpg

To view "Figure 2. Regional tenement map showing mines and prospects", please

visit the following link:

http://media3.marketwire.com/docs/mll_fg2_427.jpg

Co-O MINE

Gold Production

The production statistics for the March 2011 quarter with comparatives for the

previous three quarters as well as the year-to-date production statistics are

summarised in Table I below.

Table I. Gold production statistics

Qtr Qtr Qtr Qtr

ended ended ended ended YTD

31 Mar 31 Dec 30 Sep 30 Jun 31 Mar

Period Unit 11 10 10 10 11

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Tonnes mined (1) WMT 71,060 61,621 60,367 53,872 193,048

----------------------------------------------------------------------------

Ore milled DMT 71,747 66,038 52,463 60,611 190,248

----------------------------------------------------------------------------

Recovered grade gpt 11.58 13.09 15.77 13.65 13.26

----------------------------------------------------------------------------

Recovery % 94% 94% 94% 94% 94%

----------------------------------------------------------------------------

Gold produced (2) ozs 25,114 26,123 25,004 25,012 76,241

----------------------------------------------------------------------------

Cash costs (3) US$ $191 $185 $187 $182 $188

----------------------------------------------------------------------------

Gold sold ozs 25,911 23,224 25,659 24,858 74,794

----------------------------------------------------------------------------

Average gold price received US$ $1,401 $1,384 $1,208 $1,182 $1,329

----------------------------------------------------------------------------

Note:

(1) The moisture content in wet tonnes ranges between 6 to 7%

(2) Gold production is actual gold poured (and requires no further

processing) during the period and does not reflect changes in the

balance of gold in circuit. It includes any gold awaiting shipment

(3) Cash costs refers to the cost of gold mined (net of development costs),

produced but not necessarily sold and includes royalties and local

business taxes of US$52 per ounce for the current qtr (Dec 10 qtr:

US$51/oz, Sep 10 qtr: US$50/oz, Jun 2010 qtr: US$46/oz, YTD 2010/11:

US$51/oz)

Gold production for the quarter was marginally higher than budget at 25,114

ounces, at an average recovered grade of 11.58 g/t gold and cash costs of US$191

per ounce, inclusive of royalties and local business taxes of US$52 per ounce.

Medusa, an un-hedged gold producer, sold 25,911 ounces of gold at an average

price of US$1,401 per ounce during the quarter.

A breakdown of actual and forecasted production ounces and cost per ounce by

quarters for the last seven quarters and the remaining quarter of this fiscal

year is highlighted in Graph 1.

To view "Graph 1. Co-O quarterly production graph with unit costs (Actual-fiscal

year 2009/10, actual-Sep/Dec 2010 & Mar 2011 quarters and forecast-remainder

fiscal year 2010/11)", please visit the following link:

http://media3.marketwire.com/docs/mll_gr1_427.jpg

Operations

New Co-O Plant

In November 2010, the Board approved the construction of a new plant with

capacity to produce 200,000 ounces of gold per year based on processing up to

750,000 tonnes per year at the current reserve grade of the Co-O Mine.

Permitting is in progress with a timeline of late September 2011 for completion.

The Company has contracted Arccon (WA) Pty Ltd for the process engineering,

plant design and construction supervision.

The construction time for the new plant after the necessary regulatory approvals

are granted is estimated at approximately 21 months, and the full benefits of

the expansion are expected to be realised from mid calendar year 2013.

Mine Development

The Saga Shaft sinking has reached 32 metres and erection of a temporary

headframe has been completed. The shaft plan has been revised so that this shaft

will initially be sunk to Level 5 (200 metres below surface as originally

planned), and then extended to Level 7 (300 metres below surface). Completion to

Level 5 is estimated to be during the December 2011 quarter, subject to ground

conditions, and to Level 7 during the June quarter of 2012.

Plate 1 shows the collar area of the Saga Shaft and the temporary headframe.

Accelerated development was commenced during the quarter to ensure the

underground infrastructure and on-vein development will be in place as the shaft

reaches Level 5 then Level 7. This accelerated development, from approximately

500 metres per month to approximately 800 metres per month, is programmed to

continue for approximately the next 18 months and will increase the proportion

of development ore supplied to the mill.

Development on Level 6 is focussing mainly to the east from the Sabor Shaft.

The new Level 1 adit (Fig. 3) to access the Royal Veins and North Tinago Veins

has advanced 65 metres. At 80 metres the first cross-cut to the south to the

Saga Shaft will commence which will also cut some of the NT veins identified by

surface drilling. This adit will also be used as a drilling platform to

delineate parallel veins.

To view "Plate 1. Saga Shaft collar area and temporary headframe", please visit

the following link:

http://media3.marketwire.com/docs/mll_fg3_427.jpg

Mine Production

Production has continued uninterrupted at the mine. Surface stockpiles are

approximately 7,000 tonnes and underground broken ore is approximately 55,000

tonnes.

Mill Expansion

Installation of two new leach tanks will be completed late May and will increase

the leaching capacity to approximately 1,000 tonnes per day.

Expansion and upgrading of the gold room will be completed in late April.

Mine Resource Drilling

Surface drilling with two rigs has continued at the Co-O Mine mainly at the

eastern end of the deposit focusing on infill drilling east of the Agsao River

(Figure 3 and Table II). Underground drilling with four rigs (Figure 4 and Table

III) is on-going for resource delineation and pre-development drilling. The

announcement of 5 April 2011 contains additional detailed results for the MD

series of holes and the underground drill holes with intersections down to 0.20

metres width which are summarised at greater than or equal to 0.5 metre down

hole widths in Tables II and III.

The underground drilling has located a new exceptionally wide high grade vein

section east of the Oriental Fault and below Level 5 as shown by the

intersections in holes L5-039 and L5-041.

Table II. Surface drill hole results greater than or equal to 3 g/t gold and

greater than or equal to 0.5 metres downhole for new holes MD 300 to MD 305

and complete assays for a previously partly reported hole designated(ii)

----------------------------------------------------------------------------

Grade

Hole Dip Azimuth From Width (uncut)

number East North (degrees) (degrees) (metres) (metres) (g/t gold)

----------------------------------------------------------------------------

MD291

(ii) 614223 913120 -55 192 334.10 1.20 4.13

--------------------------

378.40 0.55 11.92

--------------------------

452.60 1.40 5.69

----------------------------------------------------------------------------

MD295

(ii) 614223 913120 -65 193 400.45 5.65 6.05

--------------------------

462.00 0.60 6.16

(i)

--------------------------

612.90 0.50 3.41

(i)

----------------------------------------------------------------------------

MD297

(ii) 614018 913157 -64 205 97.40 1.00 3.17

(i)

--------------------------

179.50 2.45 3.39

(i)

--------------------------

296.65 1.00 3.03

(i)

----------------------------------------------------------------------------

MD298

(ii) 614160 913111 -50 193 265.45 0.65 12.87

(i)

--------------------------

425.40 2.00 219.17

(i)

--------------------------

443.10 1.10 14.07

(i)

--------------------------

489.20 1.60 7.89

(i)

----------------------------------------------------------------------------

MD300 614160 913113 -60 196 0.00 4.00 5.89

(i)

--------------------------

342.50 0.60 5.07

(i)

----------------------------------------------------------------------------

MD301 614020 913156 -55 188 143.65 0.55 15.13

(i)

--------------------------

549.75 0.55 4.57

(i)

----------------------------------------------------------------------------

MD302 614021 913156 -52 174 143.10 2.70 6.24

(i)

--------------------------

176.15 2.15 14.33

(i)

--------------------------

216.90 1.80 5.56

(i)

--------------------------

295.70 0.80 42.33

(i)

----------------------------------------------------------------------------

MD303 614114 913101 -57 206 55.00 2.50 7.76

(i)

--------------------------

205.80 0.85 54.70

(i)

--------------------------

315.35 1.00 4.05

(i)

--------------------------

366.35 1.00 31.45

(i)

--------------------------

400.60 0.80 3.70

(i)

--------------------------

429.50 0.60 6.30

(i)

--------------------------

610.00 0.80 5.81

(i)

----------------------------------------------------------------------------

Notes:

(1) Intersection widths are downhole drill widths not true widths;

(2) Assays denoted by (i) are by Philsaga Mining Corporation's laboratory,

all other assays are by McPhar Geoservices Inc. in Manila;

(3) Grid co-ordinates based on the Philippine Reference System 92.

Table III. Underground drill hole results greater than or equal to 3 g/t

gold and greater than or equal to 0.5 metres downhole.

----------------------------------------------------------------------------

Grade

Hole Dip Azimuth From Width (uncut)

number East North (degrees) (degrees) (metres) (metres) (g/t gold)

----------------------------------------------------------------------------

LEVEL 2

L2-041 613313 912873 3 193 60.80 0.55 5.63

(i)

----------------------------------------------------------------------------

LEVEL 3

L3-014 613965 913136 3 36 61.40 0.60 24.47 (i)

----------------------------------------------------------------------------

L3-016 613730 912861 3 225 69.60 3.30 5.06 (i)

------------------------------

75.60 0.80 4.67 (i)

----------------------------------------------------------------------------

L3-017 613728 912863 3 231 102.10 0.60 17.58 (i)

----------------------------------------------------------------------------

LEVEL 4

L4-010 613563 912804 3 359 43.05 3.05 5.32 (i)

----------------------------------------------------------------------------

L4-011 613561 912804 3 322 95.75 1.40 3.59 (i)

----------------------------------------------------------------------------

LEVEL 5

L5-027 613942 912887 -19 203 71.80 1.20 4.93 (i)

----------------------------------------------------------------------------

L5-028 614136 912893 -19 190 25.30 0.50 3.63 (i)

(ii) ------------------------------

69.70 0.60 10.41 (i)

------------------------------

162.40 4.80 13.84 (i)

------------------------------

208.20 0.80 49.93 (i)

----------------------------------------------------------------------------

L5-031 613945 912887 0 140 120.05 1.50 6.38 (i)

------------------------------

143.80 3.70 7.31 (i)

------------------------------

223.40 0.60 3.65 (i)

----------------------------------------------------------------------------

L5-033 613943 912887 0 162 55.10 0.60 13.47 (i)

----------------------------------------------------------------------------

L5-034 613942 912887 0 183 110.40 0.55 27.96 (i)

----------------------------------------------------------------------------

L5-035 613942 912887 0 200 117.10 0.80 7.93 (i)

----------------------------------------------------------------------------

L5-039 613943 912887 -53 187 180.95 9.65 12.58 (i)

----------------------------------------------------------------------------

L5-041 613943 912887 -53 183 162.80 13.10 47.81 (i)

----------------------------------------------------------------------------

Notes:

(1) Intersection widths are downhole drill widths not true widths;

(2) Assays denoted by (i) are by Philsaga Mining Corporation's

laboratory, all other assays are by McPhar Geoservices Inc. in Manila;

(3) Grid co-ordinates based on the Philippine Reference System 92.

To view "Figure 3. Map of the Co-O Mine showing the locations of drill holes

MD300 to MD305 and EXP54 to EXP65", please visit the following link:

http://media3.marketwire.com/docs/mll_fg4m_427.jpg

To view "Figure 4. Map of the Co-O Mine showing the location of the underground

drill holes", please visit the following link:

http://media3.marketwire.com/docs/mll_fg3m_427.jpg

Regional Drilling

Mapping, trenching and surface drilling around the Co-O Mine with four rigs is

continuing (Fig. 3). The announcement of 5 April 2011 contains additional

detailed results down to 0.2 metre widths which are summarised at greater than

or equal to 0.5 metre downhole widths in Table IV.

Some holes have returned multiple intersections increasing the potential of the

North Tinago vein set.

It should be emphasised that, as new vein systems are drilled, drill

intersections in veins rarely provide ore-grade intersections in every hole. As

the data base grows, and the characteristics of each vein become clearer,

statistical assessment of the percentage of oregrade drill hole intersections

required, maybe as low as 40% of holes with ore grade intersections, will

increasingly provide the levels of certainty for turning exploration drill

results into ore that can be developed with confidence.

Table IV. Regional drill hole EXP 054-065 results greater than or equal to

3 g/t gold and greater than or equal to 0.5 metres downhole

----------------------------------------------------------------------------

Grade

Hole Dip Azimuth From Width (uncut)

number East North (degrees) (degrees) (metres) (metres) (g/t gold)

----------------------------------------------------------------------------

EXP054 614102 913410 -50 160 710.60 1.15 12.49 (i)

---------------------------

782.25 0.55 8.29 (i)

----------------------------------------------------------------------------

EXP055 613438 913741 -50 180 586.55 0.70 5.10 (i)

----------------------------------------------------------------------------

EXP062 614354 913289 -50 160 482.20 0.70 30.43 (i)

----------------------------------------------------------------------------

594.15 1.00 8.87 (i)

---------------------------

736.10 1.00 3.74 (i)

----------------------------------------------------------------------------

EXP064 613972 913316 -50 160 348.50 1.00 3.42 (i)

----------------------------------------------------------------------------

Notes:

(1) Intersection widths are downhole drill widths not true widths;

(2) Assays denoted by (i) are by Philsaga Mining Corporation's

laboratory, all other assays are by McPhar Geoservices Inc. in Manila;

(3) Grid coordinates based on the Philippine Reference System 92.

Co-O Drill Hole Sampling and Assaying Procedures

Samples are taken from mainly HQ sized (hole outside diameter 96 mm, hole inside

diameter 63.5 mm) and some NQ sized (hole outside diameter 75.8 mm, hole inside

diameter 47.6 mm) drill core. The selected sample intervals are halved by

diamond saw and half the core was bagged, numbered and sent to the Company

laboratory. In a small number of cases to confirm the geological logging, the

selected interval was re-split and 1/4 core re-submitted for assay.

Initial sample preparation and assaying is undertaken at the Company's on-site

laboratory. Samples are dried at 105 degrees C for 6 to 8 hours, crushed to less

than 1.25 cm by jaw crusher, re-crushed to less than 3 mm using a secondary

crusher followed by ring grinding of 700 to 800 grams of sample to nominal

particle size of less than 200 mesh. Barren rock wash is used between samples in

the preparation equipment. The samples are assayed by fire assay with Atomic

Absorption Spectrometer (AAS) finish on a 30 gram sample. All assays over 5 g/t

gold are re-assayed using gravimetric fire assay techniques on a 30 gram sample.

Check assaying of the majority of samples used in the yearly resource estimates

is undertaken by McPhar Geoservices Phils Inc ("McPhar"), a NATA and ISO

9001/2000 accredited laboratory in Manila. The pulps are airfreighted to McPhar

who fire assay 30 grams of samples using AAS finish and a selected number of

samples are checked using gravimetric fire assay techniques. Duplicate samples

and standards are included in each batch of check samples.

When reporting results, where available, the assays of McPhar as an independent

laboratory have been given priority over the Company laboratory's results.

TENEMENTS

Figure 5 shows the locations of the Company's granted tenements. During the

quarter the Tambis tenement containing the Bananghilig Deposit was granted as

Mineral Production Sharing Agreement ("MPSA") 344-2010-XIII, the Das-Agan

tenement containing the Lingig copper prospect as MPSA 343-2010-XIII and

Exploration Permits ("EP") numbers 030 and 031-2010-XIII.

TAMBIS-BAROBO REGION

The Tambis project, currently comprising the Bananghilig Gold Deposit and the

Kamarangan copper-molybdenum porphyry prospect (Figure 2), is operated under a

Mining Agreement with Philex Gold Philippines Inc. over application

APSA-000022-XIII which covers 6,262 hectares.

Processing of the application is well advanced.

Bananghilig Gold Project

Validation drilling of the resource based on historical drilling has commenced

with two man-portable rigs. Four other rigs are continuing with extensional and

scout drilling.

The aim is to increase the resources to a level which could provide a 5 year

minimum mining life at a production rate of approximately 200,000 ounces per

year.

Regional mapping has been continuing around the deposit and an update on this

will be provided in May.

Usa Porphyry Copper-Gold Prospect

The Usa prospect is located within Mineral Production Sharing Agreement

application XIII-00077 and the Company has a Memorandum of Agreement with

Corplex Resources Inc.

A programme of soil sampling over the favourable geology is planned.

LINGIG

Mineral Production Sharing Agreement 343-2010-XIII with an area of 3,824

hectares was granted.

ANOLING

The Mines Operating Agreement with Alcorn Gold Resources Inc. covers MPSA

application 039-XIII situated approximately 8 kilometres north from the millsite

as shown on Figure 2.

Processing of the MPSA is progressing.

Mapping and sampling is continuing. Drilling may recommence prior to the

granting of the MPSA.

SAUGON PROJECT

First Hit Vein

Background

Figure 2 shows the Saugon Project located approximately 28 kilometres by road

from the Co-O Mill. Work in 2004 involved drilling at the First Hit Vein (holes

SDDH1 to SDDH35) in conjunction with underground development via a 30 metre deep

inclined winze down the vein-breccia to assist in understanding the

mineralisation.

Further details are contained in the announcements dated 20 April 2010 and 1

December 2010.

Drilling

Drilling is continuing with three drill rigs. Regional mapping and prospect

trenching are also in progress.

To view "Figure 5. Map showing granted tenements", please visit the following link:

http://media3.marketwire.com/docs/mll_fg5_427.jpg

FINANCIALS (unaudited)

As at 31 December 2010, the Company which is debt free, had total cash and cash

equivalent in gold on metal account of approximately US$92.4 million (31 Dec

2010: US$87.2 million).

During the quarter,

-- the Company sold 25,911 ounces of gold at an average price of US$1,401

per ounce (Dec 2010 qtr: sold 23,224 ounces of gold at an average price

of US$1,384 per ounce);

-- incurred exploration expenditure of US$7.1million (Dec 2010 qtr: US$7.1

million);

-- expended US$2.4 million on capital works associated sustaining capital

at the mine and mill and also with the construction and furnishing of

the Group's new office premises in the Philippines (Dec 2010 qtr: US$2.2

million); and

-- spent US$4.6 million on general and accelerated mine development,

inclusive of shaft sinking costs (Dec 2010 qtr: US$2.1 million).

CORPORATE

Dividend

An interim unfranked dividend of A$0.05 per share was paid to shareholders on 23

March 2011.

Managing Director, Geoff Davis commented:

"The Company has attained its forecast gold production for the quarter and is on

track to meet its annual forecast production.

At the Co-O Mine, the Saga Shaft is progressing and the Level 1 adit to access

the Royal and NT veins is well underway. The accelerated development programme

will continue to open up new levels and new veins.

Drilling at the Co-O Mine continues to deliver some outstanding results, and

potential resource additions in the area of the Royal and North Tinago veins are

taking shape.

The permitting process for the new Co-O Mill is progressing and currently on

track to be completed by the end of September 2011.

At the Bananghilig prospect drilling with six rigs is continuing. Initial

findings of an extensive regional mapping programme over the Tambis region will

be reported shortly."

Information in this report relating to Exploration Results has been reviewed and

is based on information compiled by Mr Geoff Davis, who is a member of The

Australian Institute of Geoscientists. Mr Davis is the Managing Director of

Medusa Mining Limited and has sufficient experience which is relevant to the

style of mineralisation and type of deposits under consideration and to the

activity which he is undertaking to qualify as a "Competent Person" as defined

in the 2004 Edition of the "Australasian Code for Reporting of Exploration

Results, Mineral Resources and Ore Reserves" and is a "Qualified Person" as

defined in "National Instrument 43-101" of the Canadian Securities

Administrators. Mr Davis consents to the inclusion in the report of the matters

based on his information in the form and context in which it appears.

Information in this report relating to Mineral Resources has been estimated and

compiled by Mark Zammit of Cube Consulting Pty Ltd of Perth, Western Australia.

Mr Zammit is a member of The Australasian Institute of Mining & Metallurgy and

has sufficient experience that is relevant to the style of mineralisation and

type of deposit under consideration and to the activity which he is undertaking

to qualify as a Competent Person as defined in the 2004 Edition of the

"Australasian Code for Reporting of Exploration Results, Mineral Resources and

Ore Reserves" and is a "Qualified Person" as defined in "National Instrument

43-101" of the Canadian Securities Administrators. Mr Zammit consents to the

inclusion in the report of the matters based on his information in the form and

context in which it appears.

Information in this report relating to Ore Reserves is based on information

compiled by Declan Franzmann, B Eng (Mining), MAusIMM. Mr Franzmann is a

full-time employee of Crosscut Consulting. Mr Franzman has sufficient experience

which is relevant to the style of mineralisation and type of deposit under

consideration and to the activity which they are undertaking to qualify as

Competent Persons as defined in the 2004 Edition of the "Australasian Code for

Reporting of Exploration Results, Mineral Resources and Ore Reserves" and is a

"Qualified Person" as defined in "National Instrument 43-101" of the Canadian

Securities Administrators. Mr Franzmann consents to the inclusion in the report

of the matters based on his information in the form and context in which it

appears.

Refer to the revised Technical Report which was filed on Sedar in August 2010

for further discussion of the Co-O Deposit's geology, structural controls,

drilling, sampling and assaying information, and any known material

environmental, permitting, legal, title, taxation, socio-political, marketing or

other relevant issue.

DISCLAIMER

This announcement may contain certain forward-looking statements. The words

'anticipate', 'believe', 'expect', 'project', 'forecast', 'estimate', 'likely',

'intend', 'should', 'could', 'may', 'target', 'plan' and other similar

expressions are intended to identify forward-looking statements. Indications of,

and guidance on, future earnings and financial position and performance are also

forward-looking statements.

Such forward-looking statements are not guarantees of future performance and

involve known and unknown risks, uncertainties and other factors, many of which

are beyond the control of Medusa, and its officers, employees, agents and

associates, that may cause actual results to differ materially from those

expressed or implied in such statements.

Actual results, performance or outcomes may differ materially from any

projections and forward-looking statements and the assumptions on which those

assumptions are based.

You should not place undue reliance on forward-looking statements and neither

Medusa nor any of its directors, employees, servants or agents assume any

obligation to update such information.

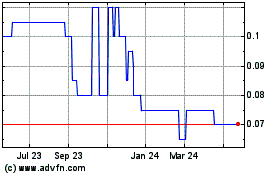

Empire Metals (TSXV:EP)

Historical Stock Chart

From Dec 2024 to Jan 2025

Empire Metals (TSXV:EP)

Historical Stock Chart

From Jan 2024 to Jan 2025