GoldQuest Reports Positive Preliminary Economic Assessment for the

Romero Gold-Copper Project, Dominican Republic

90,000 Ounces of Gold per Year for an All-In Sustaining Cost of

$353/Ounce

VANCOUVER, BC--(Marketwired

- May 27, 2014) - GoldQuest Mining Corp. (TSX-VENTURE: GQC)(FRANKFURT: M1W)(BERLIN:

M1W) ("GoldQuest" or the "Company") is pleased to report

positive results from the un-optimized Preliminary Economic

Assessment ("PEA") for a proposed underground mine at its 100%

owned Romero and Romero South Gold-Copper Deposits in the Dominican

Republic. The PEA study was led by Micon International Limited

("Micon"). All costs are in US dollars.

PEA Highlights:

- A 15 year underground mine producing an average of 90,000

ounces of payable gold and 15.6 million lbs. of payable copper for

each year of full production in two concentrates from 3,800 tonnes

per day (129,000 ounces of gold equivalent ("AuEq"))

- All-in sustaining costs ("AISC"), net of copper and minor

silver by-products, of $353/oz for 90,000 ounces of gold per year

consisting of on-site operating cash costs (net of by-product

credits of $557/oz) of $153, concentrate transportation and

Treatment Charges /Refining Charges ("TC/RCs") costs of $147/oz,

royalties of $21/oz and sustaining capital of $32/oz

- Metal recoveries are estimated to be 83% for gold and 91% for

copper resulting, after allowing for transportation and TC/RCs, in

net payable gold of 79.2% and net payable copper of 86.5%

- Total Life of Mine ("LOM") revenue of $2.35 billion, an

undiscounted pre-tax cash flow of $0.86 billion ($0.60 billion post

tax), producing 1.26 million ounces of payable gold (1.81 million

payable ounces of AuEq.) from processing 18.5 million tonnes

grading 2.69 g/t and 0.61% copper with a Net Smelter Return of $117

per tonne and cash operating costs of $58.69 per tonne

- Total LOM capital cost of $374 million, which includes an

initial capital cost of $333.5 million and a sustaining capital

cost of $40.4 million

- Pre-tax Internal Rate of Return ("IRR") of 19.7% (15.1% after

tax)

- Pre-tax Net Present Value ("NPV") of $318 million based on an

8% discount rate ($176 million after tax)

- Pre-tax NPV of $471 million based on a 5% discount rate ($274

million after tax)

- PEA completed only 2 years after discovery

- Of the mineral resources used in the PEA mine plan, 80% are

from the indicated category

- The PEA contemplates an environmentally sensitive approach,

including a small surface footprint and no use of cyanide on site,

seeking to minimize the impact on the environment and the local

communities

"We are proud to deliver a positive PEA for the Romero Project,

our cornerstone asset in the Dominican Republic," commented Chief

Executive Officer, Julio Espaillat. "Building on our low net All-In

Sustaining Costs, we are actively addressing the capital intensity

issues of the Romero project through ongoing optimization studies.

We also hope to add value through discovery of new resources, which

is the focus of our 10,000 metre 2014 exploration drilling

program."

The PEA is preliminary in nature, 20% of the mine plan consists

of inferred mineral resources that are considered too speculative

geologically to have the economic considerations applied to them

that would enable them to be categorized as mineral reserves, and

there is no certainty that the results of the PEA will be

realized. Mineral resources that are not mineral reserves do

not have demonstrated economic viability.

PEA Parameters and Inputs:

The following table is a summary of the PEA parameters or

inputs:

| |

|

|

|

|

| PEA Parameters |

|

Measure Criteria |

|

Input |

| Metal Grades |

|

Unit |

|

Average Grade |

|

|

Gold |

|

g/t |

|

2.69 |

| |

Copper |

|

% |

|

0.61 |

| Metal Prices |

|

|

|

|

|

|

Gold |

|

US$/oz. |

|

$1300 |

|

|

Copper |

|

US$/lb. |

|

$3.25 |

| |

Silver |

|

US$/oz |

|

$22 |

| Exchange Rates |

|

|

|

|

| |

CAD/USD |

|

Today's rate |

|

0.90 |

| Taxation |

|

Taxable Income |

|

Income Tax Rates |

|

|

Dominican Republic |

|

Federal |

|

25% |

| |

|

Environmental |

|

5% |

| Third Party Royalties |

|

Net Smelter Royalty |

|

1.25% |

| |

|

|

|

|

The following table is a summary of the PEA results:

| |

|

|

|

| Life of Mine Average |

US$ millions LOM |

US$/t milled |

US$/oz. gold |

| Gross Revenue |

|

|

|

| Gold |

|

|

1,300 |

| Copper |

|

|

549 |

| Silver |

|

|

8 |

| TOTAL |

2,348 |

127 |

1,857 |

| Operating Costs |

|

|

|

|

|

Mining Costs |

584 |

31.61 |

462 |

|

|

Processing Costs |

281 |

15.24 |

223 |

|

|

General & Administrative Costs |

33 |

1.76 |

26 |

|

|

On Site Costs sub-total |

|

|

|

|

|

LESS By-Product Credits |

|

|

710 |

|

|

Total |

|

|

-557 |

|

|

|

897 |

48.62 |

153 |

|

|

Add: |

|

|

|

| |

Smelting and Refining Charges |

186 |

10.07 |

147 |

| Cash Operating Costs |

1,083 |

58.69 |

301 |

| Net Operating Margin |

1,264 |

68.50 |

1,558 |

| |

|

|

|

| Royalties |

27 |

1.46 |

21 |

| Sustaining Capital |

40 |

2.19 |

32 |

| All in Sustaining Cost |

1,151 |

62.34 |

353 |

| Capital Expenditure (initial) |

333 |

18.07 |

264 |

| Pre-tax Cash Flow |

864 |

46.78 |

683 |

| Taxation |

269 |

14.55 |

212 |

| Net Cash Flow After Tax |

595 |

32.23 |

471 |

| |

|

|

|

The following figure presents the PEA sensitivities, showing

leverage to metals prices being the most important variable:

Link to figure:

http://www.goldquestcorp.com/images/press_release/GQC_PEA-sensitivitiesgraph.png

Mineral Resources:

The basis for the PEA is the mineral resource estimate prepared

by Micon as set out in the Company's National Instrument 43-101

("NI 43-101") report dated December 13, 2013 and effective October

29, 2013 entitled "A Mineral Resource Estimate for the Romero

Project, Tireo Property, Province of San Juan, Dominican Republic",

which was filed on SEDAR on December 13, 2013. Please refer to

the technical report for further information regarding the mineral

resource estimate. For the purposes of reporting the mineral

resources, Micon selected a net smelter returns ("NSR") cut-off of

US$60 (operating cost/commodity price weighted recovery) as an

estimate of what might be a reasonable marginal cost of extraction

at Romero and US$50 as the marginal cost of extraction at Romero

South. Metal prices used were Au = US$1,400/oz., Ag =

US$22.50/oz., Cu = US$3.18/lb. and Zn = US$0.95/lb.

A summary of this resource is:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Category |

|

Zone |

|

Tonnes |

|

Au (g/t) |

|

Cu (%) |

|

Zn (%) |

|

Ag (g/t) |

|

AuEq (g/t) |

|

Au Ounces |

|

AuEq Ounces |

|

Indicated |

|

Romero |

|

17,310,000 |

|

2.55 |

|

0.68 |

|

0.30 |

|

4.0 |

|

3.81 |

|

1,419,000 |

|

2,123,000 |

|

|

|

RomeroSouth |

|

2,110,000 |

|

3.33 |

|

0.23 |

|

0.17 |

|

1.5 |

|

3.80 |

|

226,000 |

|

258,000 |

| Total IndicatedMineral Resources |

|

19,420,000 |

|

2.63 |

|

0.63 |

|

0.29 |

|

3.7 |

|

3.81 |

|

1,645,000 |

|

2,381,000 |

| |

|

Inferred |

|

Romero |

|

8,520,000 |

|

1.59 |

|

0.39 |

|

0.46 |

|

4.0 |

|

2.47 |

|

437,000 |

|

678,000 |

|

|

|

RomeroSouth |

|

1,500,000 |

|

1.92 |

|

0.19 |

|

0.18 |

|

2.3 |

|

2.33 |

|

92,000 |

|

112,000 |

| Total InferredMineral Resources |

|

10,020,000 |

|

1.64 |

|

0.36 |

|

0.42 |

|

3.8 |

|

2.45 |

|

529,000 |

|

790,000 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: Mineral resources that are not mineral reserves do not

have demonstrated economic viability.

Mine Plan:

The mine plan for the Romero deposit uses mechanized longhole

stoping with both ramp and shaft access. At full production,

crushed ore is hoisted to the surface at an average rate of 3,800

tpd. The mining method requires sinking and equipping the shaft,

installing the primary crusher station at the bottom of the mine

and making provision for backfill from bottom up during the

pre-production development period, which generally increases

up-front capital (lowering IRR) but results in lower sustaining

capital and lower operating costs per tonne, compared to other

operations. The mine plan includes provisions for mining losses and

dilution. Some further drilling is recommended to upgrade inferred

resources to the higher measured and indicated categories, as well

as geotechnical and metallurgical drilling as part of any

pre-feasibility study.

It is proposed that the Romero South deposit would go into

production in year 14. The mine plan takes advantage of the

deposit outcrop and requires very little waste

development. Modified room and pillar mining with backfill is

the proposed mining method. The planned production rate is

2,700 tpd and the mining is expected to continue through the third

quarter of year 15.

Processing and Metallurgy:

The processing flow sheet selected for the PEA consists of

crushing, grinding and flotation to produce two concentrates; a

copper/gold sulphide concentrate and a gold oxide concentrate,

neither of which contains any significant deleterious elements. 92%

of the total copper and 51% of the total gold reports to the copper

concentrate and 32% of the total gold reports to the gold

concentrate. Bio-oxidation will be used for the gold

concentrate only and dry stacking will be used for tailings

disposal. This flow sheet is based on extensive metallurgical

testing carried out by ALS laboratories in Kamloops BC and Perth

Australia under the supervision of Micon. Total recoveries into the

final concentrates, based on existing metallurgical test work, are

expected to be approximately 83% for gold and 91% for copper

resulting in net payable gold of 79.2% and net payable copper of

86.5%. Both concentrates will be trucked from the mine site for

further processing.

Operating Costs: The operating costs used in the PEA were

estimated from first principles using local unit rates for labour,

consumables and power where possible, and Micon's estimates for the

off site costs. The Life of Mine All-In Sustaining Costs (AISC) are

estimated to be $353/oz of Au per year, for 90,000 ounce of Au per

year, consisting of on-site operating cash costs of $153/oz, net of

copper and minor silver by-products, concentrate transportation and

TC/RC costs of $147/oz, royalties of $21/oz and sustaining capital

of $32/oz.

Capital Costs:

The pre-production capital cost is estimated to be $333.5

million, plus $40.4 million for LOM sustaining capital, for a total

estimated LOM capital cost of $374 million, for a pre-production

capital intensity of $18.07 per LOM tonne processed. Initial

capital expenditures are based on 3,800 tonnes per day (1,380,000

tonnes per year) throughput. The up-front capital costs include the

underground mine, processing facilities, infrastructure and

hydro-electric installations prior to production and include

contingencies of $52.4 million, EPCM costs of $19.8 million and

$55.4 million for infrastructure costs including the hydro-electric

installations. Project electrical requirements are estimated

at 14MW.

Sustaining capital consists of capitalized waste development

after the initial production start-up, major equipment replacement

and tailings expansions. Mining development costs during production

are included in the mining operating costs.

The estimated preproduction capital costs are summarized in the

table below.

|

|

|

|

|

|

|

|

|

|

|

Capital Costs |

|

Start Up |

|

Start Up |

|

Start Up |

|

Start Up |

|

US$ Thousand |

|

Minus 2 |

|

Minus 1 |

|

Year 1 |

|

Total |

|

Preproduction |

|

$ |

97 |

|

$ |

9,469 |

|

|

- |

|

$ |

9,566 |

|

Mining Capital |

|

$ |

29,892 |

|

$ |

9,316 |

|

$ |

9,078 |

|

$ |

48,286 |

|

Processing Capital |

|

|

- |

|

$ |

73,723 |

|

$ |

36,311 |

|

$ |

110,034 |

|

Infrastructure Capital* |

|

|

- |

|

$ |

48,888 |

|

$ |

6,540 |

|

$ |

55,428 |

|

Indirect Capital |

|

|

- |

|

$ |

44,474 |

|

$ |

7,386 |

|

$ |

51,860 |

|

Owner's Costs |

|

|

|

|

$ |

3,958 |

|

$ |

1,558 |

|

$ |

5,516 |

|

Closure Bonding |

|

|

|

|

$ |

200 |

|

$ |

200 |

|

$ |

400 |

|

Contingency |

|

$ |

5,978 |

|

$ |

36,072 |

|

$ |

10,359 |

|

$ |

52,409 |

|

Total |

|

$ |

35,967 |

|

$ |

226,099 |

|

$ |

71,433 |

|

$ |

333,499 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*Includes access road, dry stack tailings storage facility, grid

power connection and hydro-electric installations.

A technical report supporting the PEA will be filed on SEDAR

within 45 days.

Qualified Person:

The technical information contained in this news release is

based upon information prepared by Messrs. Hennessey, Jacobs,

Gowans and Ms Dreesbach of Micon International Ltd., who are each a

Qualified Person and independent of GoldQuest as defined by NI

43-101.

Jeremy K. Niemi, P.Geo., VP Exploration, GoldQuest Mining Inc.,

is the Qualified Person who supervised the preparation of the

technical data in this news release.

About GoldQuest Mining Corp.

GoldQuest is a Canadian based mineral exploration company with

projects in the Dominican Republic traded on the TSX-V under the

symbol GQC.V and in Frankfurt/Berlin with symbol M1W, with

145,755,044 shares outstanding as at May 14, 2014 (160,096,563 on a

fully diluted basis, as at May 14, 2014). is actively exploring the

Tireo Project, a 50 kilometre long land package which encompasses

the Romero and Romero South deposits. The company seeks to grow

mineral resources through an aggressive exploration campaign.

Forward-looking statements:

Statements contained in this news release that are not

historical facts are forward-looking information that involves

known and unknown risks and uncertainties. Forward-looking

statements in this news release include, but are not limited to,

statements with respect to the PEA results, the proposed

underground mine, the discovery of new mineral resources, mineral

resource estimates, the merits of the Company's mineral properties,

future studies, and the Company's plans and exploration programs

for its mineral properties, including the timing of such plans and

programs. In certain cases, forward-looking statements can be

identified by the use of words such as "plans", "has proven",

"expects" or "does not expect", "is expected", "potential", "goal",

"proposed", "appears", "budget", "scheduled", "estimates",

"forecasts", "at least", "intends", "hope", "anticipates" or "does

not anticipate", or "believes", or variations of such words and

phrases or state that certain actions, events or results "may",

"could", "would", "should", "might" or "will be taken", "occur" or

"be achieved".

Forward-looking statements involve known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of the Company to be materially

different from any future results, performance or achievements

expressed or implied by the forward-looking statements. Such risks

and other factors include, among others, risks related to

uncertainties inherent in the preparation of the PEA and in the

estimation of mineral resources; commodity prices; changes in

general economic conditions; market sentiment; currency exchange

rates; the Company's ability to continue as a going concern; the

Company's ability to raise funds through equity financings; risks

inherent in mineral exploration; risks related to operations in

foreign countries; future prices of metals; failure of equipment or

processes to operate as anticipated; accidents, labor disputes and

other risks of the mining industry; delays in obtaining

governmental approvals; government regulation of mining operations;

environmental risks; title disputes or claims; limitations on

insurance coverage and the timing and possible outcome of

litigation. Although the Company has attempted to identify

important factors that could affect the Company and may cause

actual actions, events or results to differ materially from those

described in forward-looking statements, there may be other factors

that cause actions, events or results not to be as anticipated,

estimated or intended. There can be no assurance that

forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Accordingly, do not place undue

reliance on forward-looking statements. All statements are made as

of the date of this news release and the Company is under no

obligation to update or alter any forward-looking statements except

as required under applicable securities laws.

Forward-looking statements are based on assumptions that the

Company believes to be reasonable, including expectations regarding

the PEA parameters and inputs, mineral exploration and development

costs; expected trends in mineral prices and currency exchange

rates; the accuracy of the Company's current mineral resource

estimates; that the Company's activities will be in accordance with

the Company's public statements and stated goals; that there will

be no material adverse change affecting the Company or its

properties; that all required approvals will be obtained and that

there will be no significant disruptions affecting the Company or

its properties.

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this news release.

Image Available:

http://www.marketwire.com/library/MwGo/2014/5/26/11G016183/Images/GQC_PEA-sensitivitiesgraph-990828143577.jpg

GoldQuest Mining Corp. Julio Espaillat President & Chief

Executive Officer +1-829-919-8701

jespaillat@goldquestcorp.comGoldQuest Mining Corp. Bill Fisher

Executive Chairman Office of the Chairman - Toronto +1-416-583-5606

wfisher@goldquestcorp.com www.goldquestcorp.com

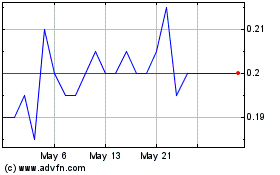

GoldQuest Mining (TSXV:GQC)

Historical Stock Chart

From Nov 2024 to Dec 2024

GoldQuest Mining (TSXV:GQC)

Historical Stock Chart

From Dec 2023 to Dec 2024