Li-FT Closes $12.4 Million Public Offering

18 November 2023 - 1:21AM

Li-FT Power Ltd. (“

LIFT” or the

“

Company”) (

TSXV: LIFT)

(

OTCQX: LIFFF)

(

Frankfurt: WS0) is pleased

to announce it has closed the previously announced overnight

marketed public offering (the “Offering”) of 1,437,500 common

shares of the Company issued on a “flow-through" basis (each a

“Flow-Through Share”) at a price of $8.65 per Flow-Through Share.

The Offering generated aggregate gross proceeds of $12,434,375,

which included the full exercise of the option granted to the

agents to sell up to an additional 187,500 Flow-Through Shares. The

Flow-Through Shares will qualify as “flow-through shares” (within

the meaning of subsection 66(15) of the Income Tax Act (Canada)).

The Offering was led by Canaccord Genuity Corp.

on behalf of a syndicate of agents, including SCP Resource Finance

LP, Scotia Capital Inc. and Beacon Securities Limited

(collectively, the “Agents”).

The gross proceeds of the Offering will be used

by the Company to incur eligible “Canadian exploration expenses”

that will qualify as “flow-through critical mineral mining

expenditures” as such terms are defined in the Income Tax Act

(Canada) (the “Qualifying Expenditures”) related to the Company’s

Yellowknife Lithium Project located in the Northwest Territories,

Canada on or before December 31, 2024. All Qualifying Expenditures

will be renounced in favour of the subscribers effective December

31, 2023.

The Offering was completed pursuant to a

prospectus supplement dated November 13, 2023 (the “Prospectus

Supplement”) to the Company’s Canadian base shelf prospectus dated

September 21, 2023 (the “Base Shelf Prospectus”). The Base Shelf

Prospectus and the Prospectus Supplement are available under the

Company’s profile on SEDAR+ at www.sedarplus.ca.

In connection with the Offering, the Company

paid to the Agents a cash commission of 5.0% of the gross proceeds

from the Offering.

This press release does not constitute an offer

to sell or a solicitation of an offer to buy nor shall there be any

sale of any of the securities in any jurisdiction in which such

offer, solicitation or sale would be unlawful, including any of the

securities in the United States of America. The securities have not

been and will not be registered under the United States Securities

Act of 1933, as amended (the “1933 Act”) or any state securities

laws and may not be offered or sold within the United States or to,

or for account or benefit of, U.S. Persons (as defined in

Regulation S under the 1933 Act) unless registered under the 1933

Act and applicable state securities laws, or an exemption from such

registration requirements is available.

About LIFT

LIFT is a mineral exploration company engaged in

the acquisition, exploration, and development of lithium pegmatite

projects located in Canada. The Company’s flagship project is the

Yellowknife Lithium Project located in Northwest Territories,

Canada. LIFT also holds three early-stage exploration properties in

Quebec, Canada with excellent potential for the discovery of buried

lithium pegmatites, as well as the Cali Project in Northwest

Territories within the Little Nahanni Pegmatite Group.

For further information, please

contact:

|

Francis MacDonaldChief Executive OfficerTel: +

1.604.609.6185Email: info@li-ft.comWebsite: www.li-ft.com |

|

Daniel GordonInvestor RelationsTel: +1.604.609.6185Email:

daniel@li-ft.com |

|

|

|

|

Cautionary Statement Regarding Forward-Looking

Information

Certain statements included in this press

release constitute forward-looking information or statements

(collectively, “forward-looking statements”), including those

identified by the expressions “anticipate”, “believe”, “plan”,

“estimate”, “expect”, “intend”, “may”, “should” and similar

expressions to the extent they relate to the Company or its

management. The forward-looking statements are not historical facts

but reflect current expectations regarding future results or

events. This press release contains forward looking statements

relating to the use of proceeds of the Offering and the timing of

incurring the Qualifying Expenditures and the renunciation of the

Qualifying Expenditures. These forward-looking statements and

information reflect management's current beliefs and are based on

assumptions made by and information currently available to the

Company with respect to the matters described in this press

release.

Forward-looking statements involve risks and

uncertainties, which are based on current expectations as of the

date of this press release and subject to known and unknown risks

and uncertainties that could cause actual results to differ

materially from those expressed or implied by such statements.

Additional information about these assumptions and risks and

uncertainties is contained under "Risk Factors" in the Company's

annual information form filed on March 30, 2023, which is available

under the Company's SEDAR+ profile at www.sedarplus.ca, and in

other filings that the Company has made and may make with

applicable securities authorities in the future. Forward-looking

statements contained herein are made only as to the date of this

press release and we undertake no obligation to update or revise

any forward-looking statements whether as a result of new

information, future events or otherwise, except as required by law.

We caution investors not to place considerable reliance on the

forward-looking statements contained in this press release.

Neither the TSX Venture Exchange (the “TSXV”)

nor its Regulation Services Provider (as that term is defined in

the policies of the TSXV) accepts responsibility for the adequacy

or accuracy of this release.

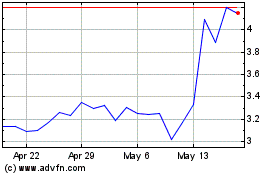

Li FT Power (TSXV:LIFT)

Historical Stock Chart

From Dec 2024 to Jan 2025

Li FT Power (TSXV:LIFT)

Historical Stock Chart

From Jan 2024 to Jan 2025