TORONTO, ONTARIO / ACCESSWIRE / March 27, 2014 /

Noble Mineral Exploration Inc. (the

"Company", "Noble" or

"NOB") (TSX-V:NOB, FRANKFURT:NB7, OTC.PK:NLPXF)

today provided an update regarding recent developments. At its

annual and special meeting of shareholders on March 26, 2014 (the

"Meeting"), J. Birks Bovaird, Yvan Champagne,

Gordon McKinnon, Paul Millar, Michael Newbury, and H. Vance White

were re-elected to the Company's Board of Directors (the

"Board"). Edward Godin, who did not stand for

re-election this year, will remain a consultant to the Company.

At the Meeting, the Company's shareholders also:

1. Re-appointed McCarney Greenwood LLP as the Company's auditor

for the 2014-15 financial year and authorized the Board to fix the

remuneration of the auditor;

2. Re-approved the Company's Amended and Restated Stock Option

Plan;

3. Approved a shares for debt settlement in respect of fees for

services rendered to the Company by its President, Chief Financial

Officer and Vice President of Exploration and Project Development

for the period from September 1, 2013 to January 31, 2014, a

transaction in respect of which the Company must apply for and

obtain approval of the TSX Venture Exchange prior to completion;

and

4. Approved a shares for debt settlement in respect of fees for

services rendered to the Company by its President, Chief Financial

Officer and Vice President of Exploration and Project Development

for the period from February 1, 2014 to August 31, 2014, a

transaction in respect of which the Company must apply for after

August 31, 2014 and then obtain approval of the TSX Venture

Exchange prior to completion.

With respect to the proposal by Noble to sell the surface rights

of Block A of Project 81 and certain related assets, a proposed

transaction that is described in the management information

circular prepared and mailed by the Company to its shareholders for

the Meeting, the Meeting was adjourned prior to a shareholder vote

being taken.

Regarding this proposed sale of the surface rights of Block A of

Project 81, a number of issues must be resolved in order for the

Company to complete the transaction. From Noble's perspective, the

most significant issue to be resolved arises from the fact that the

proceeds of the proposed sale are not sufficient for Noble to pay

off all of the debt that is in part secured by mortgages registered

over Block A of Project 81. The proceeds of the sale of the surface

of Block A of Project 81 are sufficient to pay off the principal

and interest owing to the holders of the first and second ranking

debt, namely Franco-Nevada Corporation and Bridging Credit Fund LP.

However, those proceeds are not sufficient to pay off the debt owed

to a third ranking group of secured creditors. Certain of those

secured creditors, namely those creditors who are or are affiliates

of management of the Company, have agreed that the mortgages

secured in their favour of the surface rights of Block A of Project

81 can be discharged without any payment being made towards their

loans. Management and the Board of Directors of Noble continue to

negotiate with the other third ranking creditors regarding the

terms under which those creditors would agree that the mortgages

registered in their favour over the surface rights of Block A of

Project 81 would be discharged so as to permit the Company to

conclude its proposed sale of those rights.

The Meeting was therefore adjourned to provide Noble sufficient

time to conclude its negotiations with those third ranking secured

creditors who have not yet agreed to a discharge, and then ensure

that all material information regarding the conditions for such

discharge, as they relate to the proposed sale of the surface

rights of Block A of Project 81, are disclosed to shareholders in a

timely and appropriate fashion before the shareholder vote is

closed.

At the shareholders Meeting, the Company's shareholders

therefore approved the adjournment of the Meeting to April 4, 2014,

(the "Adjourned Meeting"). The Adjourned Meeting

will then be reconvened at 10:00 a.m. on April 4, 2014 at Suite

720, 40 University Ave, Toronto, Ontario. Accordingly, the deadline

for shareholders to vote on the proposed sale of the surface rights

of Block A of Project 81 has been extended to 10:00 a.m. on

Wednesday, April 2, 2014. Voting conditions remain those described

in the management information circular dated February 24, 2014 for

the Meeting (which has been mailed to shareholders and posted at

www.sedar.com).

Prior to the adjournment of the Meeting, shareholders and others

present asked a number of questions of management relating to the

Company's efforts regarding the sale of the surface rights of Block

A of Project 81, the progress of that sale, Noble's efforts to

reduce operating and general and administrative expenses and its

plans for the exploration of the mineral rights in Project 81 going

forward. In order to ensure that all shareholders of the Company

are provided the same information as those who were at the Meeting,

management of the Company advises shareholders that:

- The issues that remain to be resolved by Noble for it to

conclude the sale of the surface rights of Block A of Project 81

relate to unresolved negotiations with certain secured

creditors;

- In addition to having to resolve business issues with those

secured creditors and in order to complete the sale of the surface

rights of Block A of Project 81, Noble and the purchaser are

working to resolve procedural issues relating to the transfer of

title to the property, as a result of which the transaction cannot

close on March 31, 2014, as originally hoped, and will have to

close at a later date;

- To date, no other offer has been presented to the Company for

the purchase of the surface rights of Block A of Project 81;

- In order to conclude the proposed sale of the surface rights

of Block A of Project 81, the Company will have to pay $1,000,000

to the party holding a right of first refusal over timber harvested

from both Blocks A and B of Project 81 in order to have that right

of first refusal terminate;

- A 5% finder's fee is payable in cash to IBK Capital Corp. in

connection with the proposed sale of the surface rights of Block A

of Project 81;

- The total principal amount of secured debt owing by Noble is

approximately $7,000,453;

- Should the proposed sale of the surface rights of Block A of

Project 81 not proceed, the Company's bridge loan from Bridging

Credit Fund LP would be repayable within 30-60 days;

- Currently, the total value of the Company's cash, marketable

securities, and receivables for timber harvested from its property

is approximately $389,000 not including any potential tax

receivables currently being incurred;

- Recognizing that it is currently difficult for mineral

exploration companies to raise financing for their exploration or

operational expenses, Noble is implementing significant

cost-cutting measures that should reduce its cash expenses for

salaries, office rent, and general and administrative matters by

approximately 50-60%;

- The Company has begun contacting other companies and parties

who, it is hoped, might be interested in entering into joint

venture or option agreements to advance the exploration of the

minerals at Block A of Project 81; and

- In order to improve the likelihood that other parties will be

interested in joint venture or option arrangements that will

advance the exploration of Block A of Project 81, Noble may have to

conduct additional mineral exploration and analysis of that

property.

Following the adjournment, the Company has contacted the

proposed purchaser for the surface rights of Block A of Project 81

requesting an extension of the closing date for that transaction.

An extension is anticipated but has not yet been agreed to, and

Noble will advise shareholders of any new information in that

regard as soon as it is available.

At a Board meeting held after the Meeting, the Board re-elected

the following as the officers of the Company: H. Vance White

(President & CEO), Gaetan Chabot (Chief Financial Officer),

Randy Singh (Vice President of Exploration and Project

Development), and Denis Frawley (Secretary). The Board also

appointed J. Birks Bovaird, Gord McKinnon and Michael Newbury as

the Company's Audit Committee, and J. Birks Bovaird, and Michael

Newbury as the Company's Nominating, Compensation and Governance

Committee.

Subsequent to the Board meeting Mr. Paul Millar submitted his

resignation as a director. The Company wishes Mr. Millar all the

best in his future endeavours and thanks him for his input to the

Company.

About Noble Mineral Exploration Inc.:

Noble Mineral Exploration Inc. is a Canadian based junior

exploration company holding in excess of 72,000 hectares of

property in the Timmins, Iroquois Falls and Smooth Rock Falls areas

of Northern Ontario. The Company also holds a portfolio of

diversified exploration projects at various stages of exploration

Gold in the Wawa area of Northern Ontario, and Uranium in Northern

Saskatchewan.

More detailed information is available on the website at

www.noblemineralexploration.com

Cautionary Statement:

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release. No stock exchange, securities

commission or other regulatory authority has approved or

disapproved the information contained herein.

The foregoing information may contain forward-looking statements

relating to the future performance of Noble Mineral Exploration

Inc. Forward-looking statements, specifically those concerning

future performance, are subject to certain risks and uncertainties,

and actual results may differ materially from the Company's plans

and expectations. These plans, expectations, risks and

uncertainties are detailed herein and from time to time in the

filings made by the Company with the TSX Venture Exchange and

securities regulators. Noble Mineral Exploration Inc. does not

assume any obligation to update or revise its forward-looking

statements, whether as a result of new information, future events

or otherwise.

Contacts:

H. Vance White, President

Phone: 416-214-2250

Fax: 416-367-1954

Email: info@noblemineralexploration.com

Investor Relations

Phone: 416-214-2250

Email: ir@noblemineralexploration.com

SOURCE: Noble Mineral Exploration Inc.

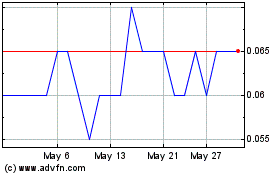

Noble Mineral Exploration (TSXV:NOB)

Historical Stock Chart

From Oct 2024 to Nov 2024

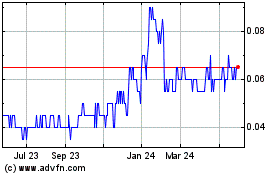

Noble Mineral Exploration (TSXV:NOB)

Historical Stock Chart

From Nov 2023 to Nov 2024