THIS DOCUMENT IS NOT INTENDED FOR DISSEMINATION OR DISTRIBUTION IN THE UNITED

STATES.

Questor Technology Inc. ("Questor" or the "Company") (TSX VENTURE:QST) announced

today its financial and operating results for the three months ended March 31,

2011. The Company's unaudited condensed financial statements have been prepared

in accordance with International Financial Reporting Standards ("IFRS"),

including restatement of its prior year results for comparative purposes.

The Company reported a loss of $119,541 ($0.005 per basic share) for the three

months ended March 31, 2011 compared to a loss of $163,448 ($0.007 per basic

share) for the three months ended March 31, 2010. On a comparative basis, the

profit increase of $43,907 is primarily attributable to higher incinerator sales

and services revenues and lower net foreign exchange losses. Partially

offsetting these impacts is reduced incinerator rental revenue and combustion

services activity, a smaller income tax recovery and higher administration

expenses.

Financial Highlights Summary

(Stated in Canadian dollars except per share amounts)

Increase

For the three months ended March 31 2011 2010 (decrease)

----------------------------------------------------------------------------

Revenue(1) 899,980 489,629 410,351

Gross profit(2) 297,612 150,409 147,203

EBITDA(2) (100,476) (165,045) 64,569

Loss 119,541 163,448 (43,907)

Loss per share - Basic and diluted $ 0.005 $ 0.007 $ (0.002)

Cash used in operations before

movements in working capital(2) 44,565 91,479 (46,914)

Total assets 6,718,502 6,073,528 644,974

Non-current liabilities 100,655 55,072 45,583

(1) Includes loss on disposal of property and equipment and other revenue.

(2) Non-IFRS financial measure. Please see discussion in the Non-IFRS

Financial Measures section of this MD&A.

"Revenue increased by nearly 84 percent in first quarter 2011 compared to the

same period last year. The economic and environmental value created by Questor's

clean air technologies is evident in the successful start-up of a large

incinerator at a heavy oil in situ combustion development in Saskatchewan and

the upcoming commissioning of our incineration and waste heat water vaporization

equipment for a carbon emissions reduction and energy efficiency demonstration

project in Colorado. Both of these projects have led to additional opportunities

for Questor and discussions are underway with prospective customers for both

onshore and offshore applications in the Middle East, Mexico, China, Russia and

Europe. In recent weeks, we have deployed rental incinerator units to the United

States and European markets to provide a solution which addresses community

concerns associated with shale gas well testing activities," said Audrey

Mascarenhas, President and Chief Executive Officer. "Finally, in collaboration

with a major Canadian university and a leading Organic Rankine Cycle generator

manufacturer, we are advancing the development of our waste heat to power

technology and hope to have a demonstration site operational by the end of the

year."

"We are focused on the profitability and long-term growth of the Company. The

market's understanding of the economic benefits of clean combustion is evolving

and the awareness of Questor's incineration products and technologies is

building. We continue to position our core products and to develop new air

quality solutions to capitalize on the emerging market opportunities," concluded

Ms. Mascarenhas.

As previously announced, the Company was selected for Alberta Venture's 2011

Fast Growth 50 list, an annual ranking honoring fifty of the fastest growing

companies in Alberta. This is the third year in succession that Questor has been

selected. The May 2011 edition of Alberta Venture magazine featured the Company

and Audrey Mascarenhas in an article written by Steve Macleod entitled "Growing

Concern: Questor Technology Realized that Removing Waste Gas Doesn't Have to be

a Waste of Money".

On June 9, 2011, Ms. Mascarenhas presented at a paper entitled "Emission

Reduction: Effective, Efficient, Safe and Sustainable" at the 2011 North America

Gas and Oil Expo and Conference held in Calgary, Alberta, Canada. Ms.

Mascarenhas also spoke at the Regional Forum on Flaring Reduction and Gas

Utilization held June 17, 2011 in Baku, Azerbaijan, an event organized by the

World Bank led Global Gas Flaring Reduction (GGFR) partnership and SOCAR,

Azerbaijan's national oil company. Copies of these presentations are available

on the Company's website.

Questor's unaudited condensed financial statements and notes thereto and

management's discussion and analysis for the three months ended March 31, 2011

will be available shortly on the Company's website at www.questortech.com and

through SEDAR at www.sedar.com.

ABOUT QUESTOR TECHNOLOGY INC.

Questor is an international environmental oilfield service company founded in

late 1994 and headquartered in Calgary, Alberta, Canada with a field office

located in Grande Prairie, Alberta, Canada. The Company is focused on clean air

technologies with activities in Canada, the United States, Europe and Asia.

Questor designs and manufactures high efficiency waste gas incinerators for sale

or for use on a rental basis and also provides combustion-related oilfield

services. The Company's proprietary incinerator technology destroys noxious or

toxic hydrocarbon gases which ensures regulatory compliance, environmental

protection, public confidence and reduced operating costs for customers. Questor

is recognized for its particular expertise in the combustion of sour gas (H2S).

While the Company's current customer base is primarily in the oil and gas

industry, this technology is applicable to other industries such as landfills,

water and sewage treatment, tire recycling and agriculture.

Questor trades on the TSX Venture Exchange under the symbol "QST".

Certain information in this news release constitutes forward-looking statements.

When used in this news release, the words "may", "would", "could", "will",

"intend", "plan", "anticipate", "believe", "seek", "propose", "estimate",

"expect", and similar expressions, as they relate to the Company, are intended

to identify forward-looking statements. In particular, this news release

contains forward-looking statements with respect to, among other things,

business objectives, expected growth, results of operations, performance,

business projects and opportunities and financial results. These statements

involve known and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those anticipated in such

forward-looking statements. Such statements reflect the Company's current views

with respect to future events based on certain material factors and assumptions

and are subject to certain risks and uncertainties, including without

limitation, changes in market, competition, governmental or regulatory

developments, general economic conditions and other factors set out in the

Company's public disclosure documents. Many factors could cause the Company's

actual results, performance or achievements to vary from those described in this

news release, including without limitation those listed above. These factors

should not be construed as exhaustive. Should one or more of these risks or

uncertainties materialize, or should assumptions underlying forward-looking

statements prove incorrect, actual results may vary materially from those

described in this news release and such forward-looking statements included in,

or incorporated by reference in this news release, should not be unduly relied

upon. Such statements speak only as of the date of this news release. The

Company does not intend, and does not assume any obligation, to update these

forward-looking statements. The forward-looking statements contained in this

news release are expressly qualified by this cautionary statement.

QUESTOR TECHNOLOGY INC.

CONDENSED STATEMENT OF COMPREHENSIVE LOSS

Stated in Canadian dollars

(unaudited)

For the three months ended March 31 2011 2010

----------------------------------------------------------------------------

Revenue $ 897,876 $ 488,117

Cost of sales (600,264) (337,708)

----------------------------------------------------------------------------

Gross profit 297,612 150,409

Administration expenses (384,269) (297,324)

Net foreign exchange losses (38,287) (47,295)

Research and development costs (20,968) (16,698)

Depreciation of property and equipment (2,888) (2,921)

Amortization of intangible assets (305) (4,010)

Loss on disposal of property and equipment (1,613) -

Finance costs - (504)

Other revenue 3,717 1,512

----------------------------------------------------------------------------

Loss before tax (147,001) (216,831)

Income tax income 27,460 53,383

----------------------------------------------------------------------------

Loss and comprehensive loss $ (119,541) $ (163,448)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Loss per share - Basic and diluted $ (0.005) $ (0.007)

----------------------------------------------------------------------------

QUESTOR TECHNOLOGY INC.

CONDENSED STATEMENT OF FINANCIAL POSITION

Stated in Canadian dollars

(unaudited)

March 31 December 31

As at 2011 2010

----------------------------------------------------------------------------

ASSETS

Current assets

Cash $ 3,950,136 $ 3,995,669

Trade and other receivables 1,020,352 1,873,636

Current tax assets 110,444 362

Inventories 398,698 313,567

Prepaid expenses and deposits 60,861 107,467

----------------------------------------------------------------------------

Total current assets 5,540,491 6,290,701

----------------------------------------------------------------------------

Non-current assets

Property and equipment 1,098,034 1,037,565

Intangible assets 10,454 10,759

Deferred tax assets 69,523 49,695

----------------------------------------------------------------------------

Total non-current assets 1,178,011 1,098,019

----------------------------------------------------------------------------

Total assets $ 6,718,502 $ 7,388,720

----------------------------------------------------------------------------

----------------------------------------------------------------------------

LIABILITIES AND EQUITY

Current liabilities

Trade payables, accrued liabilities and

provisions $ 625,381 $ 852,821

Current tax liabilities 13,408 230,746

Deferred revenue and deposits 31,944 146,485

----------------------------------------------------------------------------

Total current liabilities 670,733 1,230,052

----------------------------------------------------------------------------

Non-current liabilities

Deferred tax liabilities 100,655 108,287

----------------------------------------------------------------------------

Total liabilities 771,388 1,338,339

----------------------------------------------------------------------------

Capital and reserves

Issued capital 5,404,966 5,404,966

Reserves 610,218 593,944

(Deficit) retained earnings (68,070) 51,471

----------------------------------------------------------------------------

Total equity 5,947,114 6,050,381

----------------------------------------------------------------------------

Total liabilities and equity $ 6,718,502 $ 7,388,720

----------------------------------------------------------------------------

----------------------------------------------------------------------------

QUESTOR TECHNOLOGY INC.

CONDENSED STATEMENT OF CHANGES IN EQUITY

Stated in Canadian dollars

(unaudited)

(Deficit)

Issued retained Total

capital Reserves earnings equity

----------------------------------------------------------------------------

Balance at January 1,

2010 $ 5,265,736 $ 573,349 $ (393,589) $ 5,445,496

Loss - - (163,448) (163,448)

Recognition of share-

based payments - 26,308 - 26,308

Issue of ordinary shares

under employee share

option plan - - - -

----------------------------------------------------------------------------

Balance at March 31, 2010 5,265,736 599,657 (557,037) 5,308,356

----------------------------------------------------------------------------

Profit - - 608,508 608,508

Recognition of share-

based payments - 63,517 - 63,517

Issue of ordinary shares

under employee share

option plan 139,230 (69,230) - 70,000

----------------------------------------------------------------------------

Balance at December 31,

2010 5,404,966 593,944 51,471 6,050,381

----------------------------------------------------------------------------

Loss - (119,541) (119,541)

Recognition of share-

based payments - 16,274 - 16,274

Issue of ordinary shares

under employee share

option plan - - - -

----------------------------------------------------------------------------

Balance at March 31, 2011 $ 5,404,966 $ 610,218 $ (68,070) $ 5,947,114

----------------------------------------------------------------------------

----------------------------------------------------------------------------

QUESTOR TECHNOLOGY INC.

CONDENSED STATEMENT OF CASH FLOWS

Stated in Canadian dollars

(unaudited)

For the three months ended March 31 2011 2010

------------------------------------------------------------------------

Cash flows from operating activities

Loss $ (119,541) $ (163,448)

Adjustments for:

Income tax income recognized in loss (27,460) (53,383)

Finance costs recognized in loss - 504

Loss on disposal of property and

equipment 1,613 -

Depreciation of property and equipment 46,220 47,272

Amortization of intangible assets 305 4,010

Net foreign exchange loss 38,024 47,258

Expense recognized in respect of equity-

settled share-based payments 16,274 26,308

------------------------------------------------------------------------

(44,565) (91,479)

Movements in working capital 350,983 293,135

------------------------------------------------------------------------

Cash generated from operations 306,418 201,656

Income taxes paid (215,000) -

------------------------------------------------------------------------

Net cash generated by operating activities 91,418 201,656

------------------------------------------------------------------------

Cash flows from investing activities

Movements in working capital (28,984) (275)

Payments for property and equipment (82,518) (3,439)

Proceeds from disposal of property and

equipment 3,200 -

------------------------------------------------------------------------

Net cash used in investing activities (108,302) (3,714)

------------------------------------------------------------------------

Cash flows from financing activities

Repayment of borrowings - (5,077)

Interest paid - (504)

------------------------------------------------------------------------

Net cash used in financing activities - (5,581)

------------------------------------------------------------------------

Net increase (decrease) in cash (16,884) 192,361

Cash at beginning of period 3,995,669 3,080,997

Effects of exchange rate changes on the

balance of cash held in foreign currencies (28,649) (44,935)

------------------------------------------------------------------------

Cash at end of period $ 3,950,136 $ 3,228,423

------------------------------------------------------------------------

------------------------------------------------------------------------

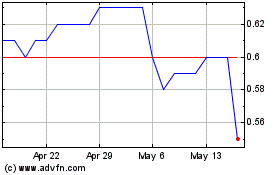

Questor Technology (TSXV:QST)

Historical Stock Chart

From Apr 2024 to May 2024

Questor Technology (TSXV:QST)

Historical Stock Chart

From May 2023 to May 2024