SANTA BARBARA, CA, April 10, 2012 /CNW/ - Underground Energy

Corporation ("Underground", "UGE" or the "Company") reports a

correction from source with respect to the news release of

Underground published at 7:00 am ET, on April 10, 2012. As a

result of a clerical error, the total light oil proved producing

reserves of Underground, on a gross basis, was incorrectly reported

in the first table appearing in the release as 3 Mbbls (3,000

barrels), which has been corrected to 39 Mbbls (39,000

barrels). The complete and corrected release follows, which

replaces the prior press release of Underground: Underground today

released information on its Chamberlin 4-2 well, the initial well

drilled by the Company at its recently acquired 7,750 acre

Chamberlin lease in the Zaca Field Extension Project ("Zaca") in

Santa Barbara County, California. The Company holds an 80% working

interest in the Chamberlin lease, which surrounds the existing Zaca

Field on three sides. The Company spudded the Chamberlin 4-2 well

on February 28, 2012 and the well reached a total depth of 6,679

feet on March 23, 2012. The Company is very encouraged by the

results from this well which encountered oil shows in a number of

sections and, in particular, penetrated more than 900 feet of

continuous, strong oil shows in a section of Monterey consistent

with the most productive sections at the existing Zaca field and

elsewhere in the Santa Maria Basin. The intervals in this

section of Monterey typically contain a high density of natural

fractures which is key to completing productive wells.

Initial results from the Chamberlin 4-2 well, including 32 feet of

oil bearing, highly fractured core that was recovered from the top

of this section of Monterey, indicate that this well encountered a

similar density of natural fractures. In addition, the 900 foot oil

column penetrated by the Chamberlin 4-2 well is in a new fault

block, the Chamberlin East Fault Block, not previously penetrated

by any wells at the existing Zaca field and it, therefore, has the

potential for virgin pressure and to yield production rates similar

to wells drilled early in the life of the existing field by Getty

Oil. The Company's recently acquired 2D swath seismic survey had

indicated the possible presence of the Chamberlin East Fault Block

and it became one of the key targets for the Chamberlin 4-2 well,

which has now confirmed the discovery of this new fault block. The

Chamberlin East Fault Block is 1,500 to 2,000 feet deeper than the

main productive fault block at the existing Zaca field, which is

only one-half mile west of the Chamberlin 4-2 well, and which has

produced more than 32 million barrels of oil from 61 wells to date.

The Company had designed the Chamberlin 4-2 well with the

expectation that it would produce from this shallower fault block,

however, the shallower fault block was not encountered during

drilling, at which point the Company elected to continue drilling

to test the new Chamberlin East Fault Block. Following the

discovery of the Chamberlin East Fault Block, the Chamberlin 4-2

well encountered mechanical issues and delays. These delays

lead to well bore instability and, as a result of the well not

being designed to produce from this deeper fault block, the Company

decided it was prudent to plug-back the well to the intermediate

casing and to drill a new well specifically designed to produce

from the Chamberlin East Fault Block. At a later date, the Company

intends to re-drill the Chamberlin 4-2 well from the intermediate

casing back towards the existing Zaca Field targeting the shallower

fault block. The plug-back work has been completed and the

Chamberlin 4-2 well is now suspended awaiting re-design and then

re-entry. The Company is now moving the rig to an adjacent surface

location and is about to commence drilling a "twin" well, the

Chamberlin 3-2, offsetting the Chamberlin 4-2 well by approximately

300 feet. This well will directly target the newly discovered

Chamberlin East Fault Block and information gained in drilling the

Chamberlin 4-2 well will be used in designing, drilling, completing

and ultimately producing the Chamberlin 3-2 well. The Company

expects the Chamberlin 3-2 well to be drilled, completed and

production tested by mid-May. As originally planned, once the

Chamberlin 3-2 well has been drilled, the Company plans to move the

rig to its other permitted drilling pad within the Zaca Eastern

Extension Project area and to drill up to three additional wells

from that site. "We are excited about the strong oil shows

encountered in the newly discovered Chamberlin East Fault Block,

which has the right rock properties and potential reservoir

pressure to be as prolific a producing block as the main fault

block at the existing Zaca Field," said Mike Kobler, President and

CEO of Underground Energy. "While geologic conditions meant that we

were not able to complete and produce the Chamberlin 4-2 well, we

are confident that the Chamberlin 3-2 well will confirm the initial

results from the 4-2 well and we believe that it will provide the

production results and validation required to proceed with a

multiple well development program." GLJ Reserves Evaluation as at

December 31, 2011 The Company today also announced the results of

the year-end reserve evaluation conducted by GLJ Petroleum

Consultants Ltd. ("GLJ") of Calgary, the Company's independent

reserve engineers. In a report dated April 9, 2012, GLJ

evaluated the Company's proved, probable, and possible reserves as

at December 31, 2011 in accordance with the Canadian standards and

requirements of National Instrument 51-101 - Standards of

Disclosure for Oil and Gas Activities, the results of which are

summarized below. Prospective and contingent resources on

each of the Company's prospects were not evaluated by GLJ, although

the Company intends to have such an evaluation completed in the

next two to three months. Gross(1) Net(2) Reserves Category Mbbl(3)

Mbbl(3) Proved Proved Producing Light Oil 39 32 Heavy Oil - -

Proved Undeveloped Light Oil 47 38 Heavy Oil 480 376 Total Proved

Light Oil 86 69 Heavy Oil 480 376 Total Proved(1P) 566 445 Probable

Light Oil 179 144 Heavy Oil 1,300 1,017 Total Probable 1,479 1,161

Total Proved plus Probable (2P) 2,045 1,606 Possible(4) Light Oil

296 238 Heavy Oil 1,820 1,424 Total Possible 2,116 1,662 (3P) Light

Oil 561 451 Heavy Oil 3,600 2,817 Total Provedplus Probable

plusPossible(3P) 4,161 3,268 Notes: 1. "Gross" reserves means

Underground's working interest (operating and non-operating) share

before deduction of royalties and without including any royalty

interest of Underground. 2. "Net" reserves means Underground's

working interest (operating and non-operating) share after

deduction of royalty obligations, plus Underground's royalty

interest in reserves. 3. Totals for each category are reported on

an "oil equivalent" basis which represents total light oil and

heavy oil, in thousands of barrels of oil. 4. Possible reserves are

those additional reserves that are less certain to be recovered

than probable reserves. There is a 10% probability that the

quantities actually recovered will equal or exceed the sum of

proved plus probable plus possible reserves. The estimated pre-tax

value of the future net revenues associated with Underground's

reserves at various discount rates as at December 31, 2011 are set

forth as follows: Before Tax Net Present (thousands of US dollars)

ValueSummary Discount Rate Undiscounted 5% 10% 15% 20% Proved

Proved Producing 2,065 1,916 1,788 1,678 1,583 Proved Developed 0 0

0 0 0 Non-Producing Proved Undeveloped 23,652 12,268 7,219 4,535

2,910 Total Proved 25,717 14,183 9,007 6,214 4,493 Total Probable

75,963 46,258 31,658 23,265 17,903 Total Proved Plus Probable

101,680 60,441 40,665 29,479 22,395 Total Possible 114,836 64,201

40,938 28,290 20,591 Total Proved Plus Probable 216,516 124,642

81,603 57,769 42,986 Plus Possible Notes: 1. The estimated future

net revenues are stated before deducting future estimated site

restoration costs and are reduced for estimated future abandonment

costs and estimated capital for future development associated with

the reserves. 2. All future net revenue values calculated utilizing

GLJ January 1, 2012 oil price forecast for WTI delivered into

Cushing, OK corrected for oil gravity and local price

differentials. 3. It should not be assumed that the discounted

future net revenues estimated by GLJ represent the fair market

value of the reserves. 4. Possible reserves are those additional

reserves that are less certain to be recovered than probable

reserves. There is a 10% probability that the quantities actually

recovered will equal or exceed the sum of proved plus probable plus

possible reserves. "GLJ's estimates validate the purchase price of

our November 2011 asset acquisition and show the accretive nature

of that transaction. In addition, considering recent seismic

and drilling work, including the discovery of the East Chamberlin

Fault Block at Zaca, which all occurred subsequent to December 31,

2011, we believe these GLJ numbers provide a great reserve base

from which we will grow in the coming months," said Mike Kobler.

"Given recent and ongoing progress at Zaca, we plan to update our

third party reserve estimates and obtain a prospective resource

report by an independent reserve evaluator over the next two to

three months." About Underground Energy Corporation Underground

Energy is focused on identifying, acquiring rights to, exploring

for, developing and producing oil reserves from shale formations in

North America using the latest exploration and recovery techniques

and technologies. Underground focuses on identifying and acquiring

sizable land positions and prospects in historically prolific but

under-explored shale formations as well as in emerging shale plays

that, in both instances, hold large volumes of prospective

resources. Underground currently holds hydrocarbon rights on

approximately 69,291 net acres of highly prospective lands in

California and Nevada with an initial focus on the Monterey shale

in California. Underground is listed on the TSX Venture Exchange

under the ticker symbol "UGE". For more information on Underground,

including a copy of the Company's latest corporate presentation,

please visit www.ugenergy.com. Underground's regulatory filings are

available under the Company's profile at www.sedar.com. Cautionary

Statements Statements in this press release contain forward-looking

information and forward-looking statements within the meaning of

applicable securities laws (collectively, "forward-looking

information"). Forward-looking information is frequently

characterized by words such as "plan", "expect", "project",

"intend", "believe", "anticipate", "estimate" and other similar

words, or statements that certain events or conditions "may" or

"will" occur. In particular, forward-looking information in

this press release includes, without limitation, statements with

respect to: (i) the nature of the formation encountered by the

Chamberlin 4-2 well; (ii) the Company's plan to re-drill the

Chamberlin 4-2 well from the intermediate casing back towards the

existing Zaca Field targeting the shallower fault block; (iii) the

Company's plans and expectations for the Chamberlin 3-2 well; (iv)

the Company's drilling plans following the completion of the

Chamberlin 3-2 well; and (v) the Company's plans for updated

reserve and resource evaluations. Although we believe that the

expectations and assumptions reflected in the forward-looking

information are reasonable, there can be no assurance that such

expectations or assumptions will prove to be correct. In

particular, assumptions have been made that: (i) the formations

encountered by the Chamberlin 4-2 well will demonstrate

characteristics similar to formations encountered by other industry

participants that have drilled wells on the Zaca Field; (ii)

Underground will be able to obtain equipment, qualified staff and

regulatory approvals in a timely manner to carry out its planned

exploration and development activities; (iii) Underground will have

sufficient financial resources with which to conduct its planned

capital expenditures; and (iv) the current regulatory and tax

regime will remain substantially unchanged. Certain or all of the

forgoing assumptions may prove to be untrue. Forward-looking

information is based on the opinions and estimates of management at

the date the statements are made, and is subject to a variety of

risks and uncertainties and other factors (many of which are beyond

the control of Underground) that could cause actual events or

results to differ materially from those anticipated in the

forward-looking information. Some of the risks and other

factors could cause results to differ materially from those

expressed in the forward-looking information include, but are not

limited to: operational risks in exploration, development and

production; delays or changes in plans; competition for and/or

inability to retain drilling rigs and other services; competition

for, among other things, capital, acquisitions of reserves,

undeveloped lands, skilled personnel and supplies; risks associated

to the uncertainty of reserve and resource estimates; governmental

regulation of the oil and gas industry, including environmental

regulation; geological, technical, drilling and processing

problems and other difficulties in producing reserves; the

uncertainty of estimates and projections of production, costs and

expenses; unanticipated operating events or performance which can

reduce production or cause production to be shut in or delayed;

incorrect assessments of the value of acquisitions; the need to

obtain required approvals from regulatory authorities; stock market

volatility; volatility in market prices for oil and natural

gas; liabilities inherent in oil and natural gas operations; access

to capital; and other factors. Readers are cautioned that

this list of risk factors should not be construed as

exhaustive. The forward-looking information contained in this

news release is expressly qualified by this cautionary

statement. Underground does not undertake any obligation to

update or revise any forward-looking statements to conform such

information to actual results or to changes in our expectations

except as otherwise required by applicable securities

legislation. Readers are cautioned not to place undue

reliance on forward-looking information. Certain information

contained herein is considered "analogous information" as defined

National Instrument 51-101. Underground is unable to verify

whether such information has been prepared in accordance with NI

51-101 and the Canadian Oil and Gas Evaluation Handbook and

Underground is unable to confirm whether such estimates have been

prepared by a qualified reserves evaluator. The information on the

historic production of wells drilled by other industry participants

on the Zaca Field was obtained from California Division of Oil, Gas

and Geothermal Resources on August 24, 2011. The information has

been provided to demonstrate the potential for similar aggregate

production for certain wells to be drilled by Underground at the

Zaca Field. Neither the TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release. Underground Energy Corporation

CONTACT: Peter BallacheyChief Financial OfficerUnderground Energy

CorporationTel: 805-845-4700 x 17Simon ClarkeVice President,

Corporate DevelopmentUnderground Energy CorporationTel:

604-551-9665

Copyright

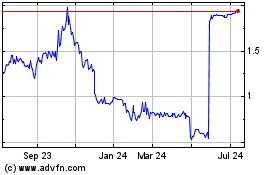

UGE (TSXV:UGE)

Historical Stock Chart

From Dec 2024 to Jan 2025

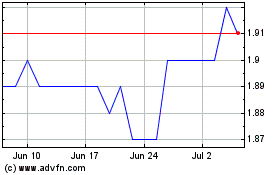

UGE (TSXV:UGE)

Historical Stock Chart

From Jan 2024 to Jan 2025