UGE International Announces Upsized $6.1 Million Bought Deal Unit Offering

26 January 2021 - 4:07AM

UGE International Ltd. (“

UGE” or the

“

Company”) (TSXV:UGE), a leader in commercial and

community solar energy solutions, is pleased to announce that it

has entered into an amended letter of engagement with Eight

Capital, under which Eight Capital has now agreed to purchase, as

sole bookrunner and lead underwriter, together with a syndicate of

underwriters (together with Eight Capital, the

“

Underwriters”) 2,300,000 units of the Company

(the “

Unit”), on a “bought deal” private placement

basis, subject to all required regulatory approvals, at a price per

Unit of $2.65 (the “

Issue Price”) for gross

proceeds of $6,095,000 (the “

Offering”).

Each Unit shall consist of one common share of

the Company (a “Share”) and one-half of one common

share purchase warrant (each full warrant, a

“Warrant”). Each Warrant shall entitle the holder

thereof to acquire one Share at a price of $3.30 per Share for a

period of 24 months following the Closing Date. Following the one

year anniversary of the closing, at the option of the Company, the

Warrants may be subject to accelerated expiry in the event the

closing price of the Company’s common shares on the TSXV is $4.50

or greater for ten consecutive trading days.

The Company has agreed to grant the Underwriters

an over-allotment option to purchase up to an additional 15% of the

Shares at the Issue Price, exercisable in whole or in part, at any

time for a period of up to 48 hours prior to the closing of the

Offering. If this option is exercised in full, an additional

$914,250 will be raised pursuant to the Offering and the aggregate

proceeds of the Offering will be $7,009,250.

The Company intends to use the net proceeds of

the Offering for working capital and general corporate

purposes.

The closing date of the Offering is scheduled to

be on or about February 10, 2021 (the “Closing

Date”) and is subject to certain conditions including, but

not limited to, the receipt of all necessary approvals, including

the approval of the applicable securities regulatory

authorities.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy nor shall there be

any sale of the securities in any state in which such offer,

solicitation or sale would be unlawful. The securities being

offered have not been, nor will they be, registered under the

United States Securities Act of 1933, as amended, and may not be

offered or sold in the United States absent registration or an

applicable exemption from the registration requirements of the

United States Securities Act of 1933, as amended, and applicable

state securities laws.

On behalf of the Board of

Directors

“Nick Blitterswyk”

Nick Blitterswyk, Chief Executive Officer

About UGE

UGE delivers immediate savings to businesses

through the low cost of solar energy. We help commercial and

industrial clients become more competitive by providing low cost

distributed renewable energy solutions at no upfront cost and

maximum long-term benefit. With over 400MW of global experience, we

work daily to power a more sustainable world. Visit us at

www.ugei.com.

For more information, contact UGE at:+1 917 720

5685investors@ugei.com

Forward-Looking Statements

Certain information set forth in this news

release may contain forward-looking statements that involve

substantial known and unknown risks and uncertainties, certain of

which are beyond the control of the Company. Forward-looking

statements are frequently characterized by words such as "plan",

"continue", "expect", "project", "intend", "believe", "anticipate",

"estimate", "may", "will", "potential", "proposed" and other

similar words, or statements that certain events or conditions

"may" or "will" occur. These statements are only predictions.

Readers are cautioned that the assumptions used in the preparation

of such information, although considered reasonable at the time of

preparation, may prove to be imprecise and, as such, undue reliance

should not be placed on forward-looking statements. Forward looking

statements include, but are not limited to, the anticipated closing

of the Offering, the anticipated use of proceeds, and the receipt

of regulatory approvals, including the approval of the TSX Venture

Exchange. The Company assumes no obligation to update

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by applicable

law.

Neither the TSX Venture Exchange nor its

Market Regulator (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

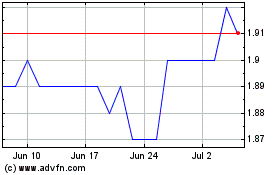

UGE (TSXV:UGE)

Historical Stock Chart

From Nov 2024 to Dec 2024

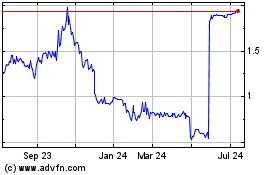

UGE (TSXV:UGE)

Historical Stock Chart

From Dec 2023 to Dec 2024