Maersk Lifts Guidance, Will Cut 2,000 Jobs in Restructuring -- Update

13 October 2020 - 11:39PM

Dow Jones News

By Costas Paris and Dominic Chopping

A.P. Moeller-Maersk AS lifted its full-year guidance Tuesday

after noting a faster-than-expected rebound in shipping volumes and

freight rates, but cautioned that it will take a $100 million

restructuring charge in the third quarter to cover the costs of

cutting 2,000 jobs.

Maersk said full-year earnings before interest, tax,

depreciation and amortization is now expected to be between $7.5

billion and $8 billion before restructuring and integration costs,

from previous guidance of $6 billion to $7 billion.

The Danish shipping company prereleased third-quarter revenue of

$9.9 billion and Ebitda before restructuring and integration costs

of $2.4 billion. Analysts polled by FactSet had expected revenue of

$9.87 billion.

Volumes in the company's main ocean unit declined by around 3%

in the third quarter compared with the previous year, which is

slightly better than the mid-single-digit contraction seen by the

company.

"Volumes have rebounded faster than expected, our cost have

remained well under control, freight rates have increased due to

strong demand and we are growing earnings rapidly in Logistics

& Services," said Chief Executive Soren Skou.

"The outlook for [the fourth quarter] is solid for the same

reasons, and we are therefore able to upgrade our expectations for

the full year."

The company said shipping volumes fell 3% in the third quarter,

less than the "mid single-digit contraction" it had earlier

forecast. Maersk said it expects third-quarter revenue of $9.9

billion in line with analyst expectations of $9.87 billion.

Maersk's shares jumped on the news, trading up 1.8% at 10,865

Danish kroner on the Copenhagen Stock Exchange.

The company is the world's biggest ocean container line, with

about 17% of the world's capacity, according to maritime research

group Alphaliner. The company has been under pressure from

shareholders to complete a reorganization that began in 2016, when

it split its shipping and logistics operations from its energy

business.

Maersk didn't give details about the job cuts Tuesday. It said

last month that up to 27,000 staff, nearly a third of its global

workforce of 80,000, could be affected by the restructuring. The

Wall Street Journal reported, citing people familiar with the

matter, that the job reductions could involve employees at Damco

and Safmarine, operating units the company said last month would be

integrated into the wider group.

Damco, which specializes in freight forwarding and logistics,

employs around 2,000 people and Safmarine, a container operator

that mostly serves Africa, employs about 1,000. The Journal

reported that there may also be redundancies at Hamburg Süd, the

German container line that Maersk bought in 2017 for $4 billion and

that employs 4,500 people.

Maersk Line and other container ship operators sharply curtailed

capacity at the onset of the coronavirus pandemic as widespread

lockdowns aimed at slowing the spread of the virus weighed on

trade.

Volumes began recovering in late May as lockdowns in many

countries began easing and freight rates started surging as

shipping demand began to outpace capacity. London-based Drewry

Shipping Consultants Ltd. said its index of world-wide container

freight rates for the week ending Oct. 8 was double the level of a

year ago, and spot-market prices from Shanghai to Los Angeles had

more than tripled from the same period last year.

Maersk said in August it tripled its second-quarter net profit

to $427 million from $141 million a year earlier, strongly

exceeding expectations.

Mr. Skou warned that prospects for next year are uncertain

because of a potential resurgence in Covid-19 cases during the

winter.

"The positive impact from stimulus packages may be less strong

in 2021, potential new lockdowns will impact demand and the timing

and the effectiveness of a potential vaccine will impact 2021," he

said.

Norway-based Fearnley Securities said in a report that Maersk's

outlook is favorable over the next two years, with current freight

rates almost double what they were a year ago.

Maersk's full third quarter results will be published Nov.

18.

Write to Costas Paris at costas.paris@wsj.com and Dominic

Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

October 13, 2020 08:24 ET (12:24 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

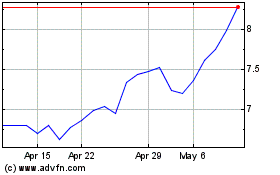

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From Nov 2024 to Dec 2024

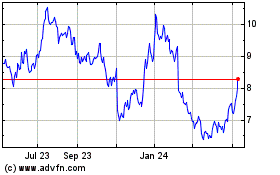

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From Dec 2023 to Dec 2024