Halitron, Inc. (HAON) Merger to Generate $4 million in Sales

13 August 2018 - 8:47PM

InvestorsHub NewsWire

Halitron, Inc. (HAON)

Merger to Generate $4 million in Sales

Halitron is forecasting 4 million in annual sales

through its recently announced

merger

Miami,

FL--(InvestorsHub NewsWire – August 13, 2018) – EmergingGrowth.com,

a leading independent small cap media portal with an extensive

history of providing unparalleled content for the Emerging Growth

markets and companies, reports on Halitron, Inc. (OTC Pink:

HAON).

Halitron

(OTC Pink: HAON) just announced

the merger of two acquisition brands resulting in "Retailiom"

which, with the current customer contact list from both

acquired entities of 111,235, is anticipated to add $4 million

annually to Halitron’s already growing sales, which have been

coming in at almost $400,000.00 per quarter before this

merger.

At the end

of Q1 2018, Halitron’s portfolio company, Hopp Companies, Inc. had

already realized a $61,000 profit for that quarter

alone.

Retailiom alone, is expected to grow sales of

Halitron, by over 200% over the next calendar

year.

During

fiscal years 2016 and 2017 respectively, HAON acquired the assets

of a print-based point of purchase product businesses CinchSigns

and the Hop Companies, Inc. and has setup the infrastructure

in Newtown, Connecticut to merge the assets of the two acquisitions

into what is currently known as Retailiom.

HAON may not be at

these levels much longer.

See the Press Release and more on

Halitron, Inc. (OTC Pink: HAON) at EmergingGrowth.com

http://emerginggrowth.com/?s=haon

Retailiom’s

differentiating point in the market place is its ability to produce

custom orders within 24-to-48 hours on product lines that are not

readily available at competitors, like Staples, or

Uline. Whether it’s a custom size, shape, color, or marketing

message, Retailiom can meet the needs and timing of a critical

retail marketing campaign. Our products keep retail shelves

neat, clean, and well-organized saving retailers time and money

from a maintenance standpoint and increasing sales from a highly

visible product position perspective.

Staples was

purchased in September of 2017 for $6.9 billion.

Could

Halitron be next?

Halitron,

Inc. (OTC Pink: HAON) is expecting to

release its Q2 operating results before the market open on August

15

Halitron, Inc Beats $350,000 Forecast for the First

Quarter of 2018

- Sales were

$361,000 in Q1, 2018, a period in which management relocated

operations in New York to Connecticut facilities without a negative

impact to shipments.

- Direct Gross

Margins for the portfolio manufacturing company were 69.8% for the

quarter.

- A one-time charge

of $46,529 was incurred directly due to the successful relocation

of Hopp assets to a lower-cost Connecticut

facility.

- The combined cash

balance at the end of the quarter totaled

$61,280.

- Solid revenues,

consistent margins, as well as the exit of our New Hyde Park, New

York facility will reduce overhead costs and improve cash flows for

the remainder of the year.

Halitron

(OTC Pink: HAON) also recently

announced that its portfolio company, Hopp Companies, won a project

with a major national retailer with over 425 retail

stores.

Management

is forecasting that the new project, which has already begun to

ship, will have a projected positive impact on sales and gross

margins for the fiscal year 2018. The product is a new supply

product line for retail shelving that is internally

manufactured.

Due to the

competitive nature of the industry, Management has elected to keep

the account name and any product line descriptions confidential,

but can report that to most families, its new

retail account is a household

name.

Highlights from Halitron, Inc.'s (OTC Pink: HAON) previous Press

Release:

- No Reverse Split

Planned.As previously communicated July 11, 2017,

Management does not anticipate a reverse split of the stock to

achieve the increased share objective but rather is forecasting for

increased sales along with future accretive acquisitions whereby

the cash flow from operations can be utilized to buy the shares

back in the open market.

- Audit and Up

List to OTCQB. Halitron has re-engaged Freidman LLP

to complete the 2017 audit, which is one of the qualifying factors

to up list to the OTCQB exchange. Friedman was previously engaged

to provide audit work for the period ending September 30, 2016 and

will continue to finalize the project through September 30, 2017

over the coming months. Management will be adding another

accounting intern to help support the growing business as well as

focus on completing the audit for the period ending September 30,

2017.

- Share Buy

Back. Another requirement for the up list is a share

price of $0.01 or higher and the Company, as previously announced,

is currently engaged in a share buyback program to help support

increased share price. Management is forecasting increased

purchases quarter-over-quarter based on projected increasing cash

flows, as the New York facility is closed, and the Company reaps

the benefits of reduced overhead. Forecasted increasing sales from

the new product launch and cross-selling initiatives will also have

a positive impact on this project.

- Sales have

increased to approximately $407K in Q4, 2017,

which represents 150% over approximately $163K for Q3 3017. There

were no sales for 2016 to compare, as the strategic acquisition is

now the foundation for the team to build on.

According

to OTC Markets, the current market cap of Halitron, Inc. (OTC

Pink: HAON) is approximately $2.1 million and as such, its

shares can have a dramatic upside.

HAON may not be at

these levels much longer.

See the Press Release and more on

Halitron, Inc. (OTC Pink: HAON) at EmergingGrowth.com

http://emerginggrowth.com/?s=haon

Other Companies in the news

and featured on EmergingGrowth.com

Life Clips,

Inc.

After what seems like countless months of

low to mediocre trading, OTC stop sign company Life Clips, Inc.

(OTC: LCLP) gained a bit of

life. The company traded over $1 million in dollar volume

over the past two sessions. The only new information in the

market that we have seen is a request to withdraw a registration

statement on form S-1. Candlesticks are indicating a down

turn so that could be the end of the run.

Have a look at Halitron, Inc.’s (OTC Pink: HAON) who just

announced that it expects $4 million in sales from its recent

merger.

RushNet,

Inc.

RushNet, Inc. (OTC

Pink: RSHN) began its 500% run on July 13th, a week

prior to any news announcements. Since July 20th,

we’ve seen about 5 press releases discussing trademarks. Its’

recent Q for period ending June 30, 2018, show zero sales, and 18

billion fully diluted shares outstanding. With a $44 million

market cap, I’m afraid that this run could do an about face any day

now.

Andiamo

Corp.

Back in January, EmergingGrowth.com

released the story “Andiamo (OTC Pink: ANDI) and the $100

million Pipe Dream”. https://emerginggrowth.com/andiamo-otc-pink-andi-100-million-pipe-dream/

The stock since has decreased 95% since the release of the

article. I’m willing to bet that, the little green candle

stick from Friday represents a dead cat bounce.

Have a look at Halitron, Inc.

(OTC

Pink: HAON). Sales are increasing quarterly, and a recent

merger is expected to add about $4 million in additional revenue

over the next 12 months.

About EmergingGrowth.com

EmergingGrowth.com is a leading independent small cap

media portal with an extensive history of providing unparalleled

content for the Emerging Growth markets and companies.

Through its evolution, EmergingGrowth.com found a niche in

identifying companies that can be overlooked by the markets due to,

among other reasons, trading price or market capitalization.

We look for strong management, innovation, strategy, execution, and

the overall potential for long- term growth. Aside from being

a trusted resource for the Emerging Growth info-seekers, we are

well known for discovering undervalued companies and bringing them

to the attention of the investment community. Through our

parent Company, we also have the ability to facilitate road shows

to present your products and services to the most influential

investment banks in the space.

All

information contained herein as well as on the EmergingGrowth.com

website is obtained from sources believed to be reliable but not

guaranteed to be accurate or all-inclusive. All material is for

informational purposes only, is only the opinion of

EmergingGrowth.com and should not be construed as an offer or

solicitation to buy or sell securities. The information may include

certain forward-looking statements, which may be affected by

unforeseen circumstances and / or certain risks. This report

is not without bias. EmergingGrowth.com has motivation by means of

either self-marketing or EmergingGrowth.com has been compensated by

or for a company or companies discussed in this article. Full

details about which can be found in our full disclosure, which

can be found here, http://www.emerginggrowth.com/disclosure-4266/.

Please consult an investment professional before investing in

anything viewed within. When EmergingGrowth.com is long shares it

will sell those shares. In addition, please make sure you read and

understand the Terms of Use, Privacy Policy and the Disclosure

posted on the EmergingGrowth.com website.

CONTACT:

Company: EmergingGrowth.com - http://www.EmergingGrowth.com

Contact

Email: info@EmergingGrowth.com

SOURCE: EmergingGrowth.com

Andiamo (CE) (USOTC:ANDI)

Historical Stock Chart

From Dec 2024 to Jan 2025

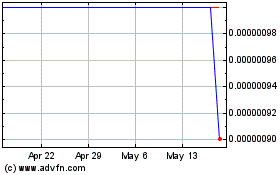

Andiamo (CE) (USOTC:ANDI)

Historical Stock Chart

From Jan 2024 to Jan 2025