Sibanye-Stillwater To Benefit From Higher Commodity Prices After Anglo American Platinum Closes Plant -- Update

07 March 2020 - 4:44AM

Dow Jones News

--Anglo American Platinum cut its full-year guidance after an

explosion forced a plant closure

--The company slashed its full-year platinum guidance by about

20%

--Sibanye-Stillwater believes short-term commodity price

increases will benefit the company

By Alexandra Wexler and Adriano Marchese

JOHANNESBURG--Sibanye-Stillwater Ltd. said Friday that it will

benefit from a short-term commodity price increase caused by a

supply disruption in Anglo American Platinum Ltd.'s operation

following the closure of one of its processing plants in South

Africa.

Earlier in the day, Anglo Platinum, the world's biggest refiner

of platinum group of metals, declared force majeure and slashed its

full-year guidance by about 20% after closing the South Africa

plant, sending platinum futures higher and potentially pushing the

global market into a deficit this year.

The miner, a subsidiary of Anglo American PLC, said it has shut

down its Anglo Converter Plant at its Waterval smelter in the

platinum-mining town of Rustenburg after an explosion on Feb. 10 in

the phase A section of the plant caused damage. Water detected in

the furnace of the processing plant's alternate phase B section

posed the risk of another explosion and forced the closure of the

entire facility, the company said Friday.

South African mining company Sibanye-Stillwater has a toll

agreement with Anglo Platinum and its Rustenburg operation as well

as a purchase-of-concentrate agreement through its Kroondal and

Platinum Mile operations. Sibanye-Stillwater said it had received

written notification of the force majeure from Anglo American

Platinum.

It said that its own Marikana and U.S. PGM operations are not

affected and instead should benefit from the increased short-term

price increase due to the disruption.

Anglo Platinum slashed its 2020 guidance for refined platinum

production to 1.5 million-1.7 million ounces from a previous

estimate of 2 million-2.2 million ounces. Platinum group metals had

been seen as a bright spot for Anglo in recent months, allowing it

to outperform rivals. Guidance for palladium in 2020 was also cut

to 1.1 million-1.2 million ounces, down from 1.4 million-1.5

million ounces. Overall platinum group of metals production--which

includes platinum, palladium, rhodium and others--was cut to

between 3.3 million and 3.8 million ounces from 4.2 million-4.7

million ounces.

The changes in supply could push the market into a deficit this

year, according to the latest figures from the World Platinum

Investment Council, an industry group that recently revised its

estimated surplus for 2020 downward to just 119,000 ounces. Anglo

Platinum says the shutdown will delay approximately 900,000 ounces

of production from hitting the market.

Platinum was recently trading 4.2% higher at $901.80 a troy

ounce on the New York Mercantile Exchange. Palladium was 1.9%

higher at $2,515.80 a troy ounce on Friday morning in New York.

Meanwhile, shares of Anglo American tumbled 8% to 16.94 pounds

($22.04) a share on the London Stock Exchange and Anglo Platinum

shares on the Johannesburg Stock Exchange tumbled 14% to 956 South

African rand ($60.67).

Anglo Platinum said repairs to phase B of its processing plant

are expected to take around 80 days, while phase A repairs are

expected to be completed around the second quarter of 2021. No one

was injured in the explosion, but the closures have forced the

company to declare force majeure to clients, since production from

its own mines and third party material cannot be refined.

Sibanye-Stillwater said it has "significant spare PGM processing

capacity" at the Marikana operations and at the precious metal

refinery in Brakpan and that it will be assessing how best to use

this capacity.

Anglo Platinum Chief Executive Chris Griffith said on a call

with media that the plant is "an integral part of our processing

chain," and that it will take about two years to catch up on

processing the material that will be continue to be mined during

the shutdown.

--Joe Hoppe contributed to this article.

Write to Alexandra Wexler at alexandra.wexler@wsj.com, and

Adriano Marchese at adriano.marchese@wsj.com

(END) Dow Jones Newswires

March 06, 2020 12:29 ET (17:29 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

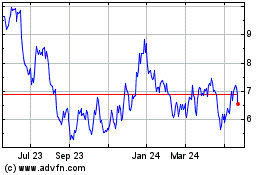

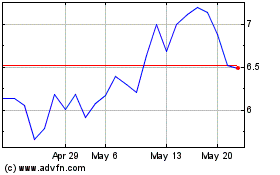

Anglo American Platinum (PK) (USOTC:ANGPY)

Historical Stock Chart

From Jan 2025 to Feb 2025

Anglo American Platinum (PK) (USOTC:ANGPY)

Historical Stock Chart

From Feb 2024 to Feb 2025