Form 8-K - Current report

27 December 2023 - 12:20AM

Edgar (US Regulatory)

0001732409false00017324092023-12-262023-12-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): December 26, 2023 |

Grayscale Bitcoin Cash Trust (BCH)

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

000-56308 |

82-6867376 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

c/o Grayscale Investments, LLC 290 Harbor Drive, 4th Floor |

|

Stamford, Connecticut |

|

06902 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 212 668-1427 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(g) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Grayscale Bitcoin Cash Trust (BCH) Shares |

|

BCHG |

|

N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

On December 26, 2023, Grayscale Investments, LLC, the sponsor (the “Sponsor”) of Grayscale Bitcoin Cash Trust (BCH), announced that Barry E. Silbert and Mark Murphy notified the sole member of Sponsor (the “Sole Member”) of their resignation from the board of directors of the Sponsor (the “Board”) effective January 1, 2024, and that the Sole Member appointed Mark Shifke, Matthew Kummell and Edward McGee to the Board effective January 1, 2024. Mr. Shifke succeeds Mr. Silbert as Chairman of the Board. Effective January 1, 2024, the Board consists of Mr. Shifke, Mr. Kummell, Michael Sonnenshein, and Mr. McGee, who also retain the authority granted to them as officers under the limited liability company agreement of the Sponsor.

Mark Shifke, Chairman of the Board

Mark Shifke, 64, is the Chief Financial Officer of Digital Currency Group, Inc. (“DCG”). Since March 2021, Mr. Shifke has served on the board of directors of Dock Ltd., a full-stack payments and digital banking platform. Since September 2023, Mr. Shifke has served on the board of directors of Luno, a cryptocurrency platform. Mr. Shifke has nearly four decades of financial and fintech experience, and more than eight years of CFO experience leading two publicly-traded companies. Prior to joining DCG, Mr. Shifke served as CFO of Billtrust, a company focused on providing AR and cloud-based solutions around payments, and as CFO of Green Dot (NYSE: GDOT), a mobile banking company and payments platform. Previously, Mr. Shifke led teams at JPMorgan Chase and Goldman Sachs, specializing in M&A Structuring and Advisory, as well as Tax Asset Investments. Mr. Shifke also served as the Head of International Structured Finance Group at KPMG. Mr. Shifke began his career at Davis Polk, where he was a partner. He is a graduate of Tulane University (B.A./J.D.) and the New York University School of Law (LL.M. in Taxation).

Matthew Kummell, Board Member

Matt Kummell, 47, is Senior Vice President of Operations at DCG. In this role, Mr. Kummell leads the business’s post-investment efforts, including investment operations and value creation with regard to DCG’s portfolio companies. Since December 2023, Mr. Kummell has served as a member of the board of directors of Foundry, a digital asset mining and staking company. Until November 2023, Mr. Kummell served on the board of directors of CoinDesk, Inc., a digital media, events and information services company for the crypto asset and blockchain technology community. Until January 2012, Mr. Kummell served on the board of directors of Derivix Corporation, a financial services software company. Prior to joining DCG, Mr. Kummell was the Head of North America for Citi’s Business Advisory Services team, a strategic consulting practice focused on institutional investor clients in Citi’s Markets division. Mr. Kummell has also held strategic and front-office leadership roles at Citadel, Balyasny Asset Management, and S.A.C. Capital Advisors, the predecessor to Point 72 Asset Management. Previously, Mr. Kummell served as a case team leader at Bain & Company in its Boston headquarters. Mr. Kummell is an Adjunct Professor at the Tuck School of Business at Dartmouth College. He is a graduate of the University of California, Los Angeles (B.A.) and the Tuck School of Business at Dartmouth College (MBA).

Edward McGee, Board Member and Chief Financial Officer

Edward McGee, 40, serves on the Audit Committee of the Sponsor, and has been the Chief Financial Officer of the Sponsor since January 2022. Before serving in such role, Mr. McGee was Vice President, Finance and Controller of the Sponsor since June 2019. Prior to taking on his role at the Sponsor, Mr. McGee served as a Vice President, Accounting Policy at Goldman, Sachs & Co. providing coverage to their SEC Financial Reporting team facilitating the preparation and review of their financial statements and provided U.S. GAAP interpretation, application and policy development while servicing their Special Situations Group, Merchant Banking Division and Urban Investments Group from 2014 to 2019. From 2011 to 2014, Mr. McGee was an auditor at Ernst & Young providing assurance services to publicly listed companies. Mr. McGee earned his Bachelor of Science degree in accounting from the John H. Sykes College of Business at the University of Tampa and graduated with honors while earning his Master of Accountancy in Financial Accounting from the Rutgers Business School at the State University of New Jersey. Mr. McGee is a Certified Public Accountant licensed in the state of New York.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

Grayscale Investments, LLC as Sponsor of Grayscale

Bitcoin Cash Trust (BCH) |

|

|

|

|

Date: |

December 26, 2023 |

By: |

/s/ Michael Sonnenshein |

|

|

|

Michael Sonnenshein

Chief Executive Officer |

v3.23.4

Document And Entity Information

|

Dec. 26, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 26, 2023

|

| Entity Registrant Name |

Grayscale Bitcoin Cash Trust (BCH)

|

| Entity Central Index Key |

0001732409

|

| Entity Emerging Growth Company |

true

|

| Securities Act File Number |

000-56308

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

82-6867376

|

| Entity Address, Address Line One |

c/o Grayscale Investments, LLC

|

| Entity Address, Address Line Two |

290 Harbor Drive, 4th Floor

|

| Entity Address, City or Town |

Stamford

|

| Entity Address, State or Province |

CT

|

| Entity Address, Postal Zip Code |

06902

|

| City Area Code |

212

|

| Local Phone Number |

668-1427

|

| Entity Information, Former Legal or Registered Name |

N/A

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

false

|

| Title of 12(g) Security |

Grayscale Bitcoin Cash Trust (BCH) Shares

|

| Trading Symbol |

BCHG

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(g) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection g

| Name: |

dei_Security12gTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

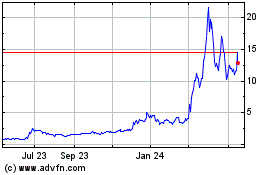

Grayscale Bitcoin Cash T... (QX) (USOTC:BCHG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Grayscale Bitcoin Cash T... (QX) (USOTC:BCHG)

Historical Stock Chart

From Dec 2023 to Dec 2024