China Global Media, Inc. Reported a Net Income of $7.8 Million and an Earnings Per Share of $0.20 for Fiscal Year 2011

03 April 2012 - 10:17PM

Marketwired

On March 30, 2012, China Global Media, Inc. (OTCBB: CGLO)

("Company") filed its Form 10-K annual report for the fiscal year

ended December 31, 2011 with SEC. The consolidated audited

financial statements contained in the Form 10-K show that the

Company has achieved significant growth in 2011 compared to 2010.

Here are some highlights:

Our sales for the year ended December 31, 2011 were $35,930,827,

which grew by 99% from our sales of $18,052,818 for the year ended

December 31, 2010.

Our net income for the year ended December 31, 2011 was

$7,843,628, which grew by 66% from our net income of $4,721,436 for

the year ended December 31, 2010.

Our comprehensive income, which adds the currency adjustment to

net income, was $8,223,375 for the year ended December 31, 2011,

which grew by 68% from our comprehensive income of $4,883,377 for

the year ended December 31, 2010.

Our Earnings Per Share for the year ended December 31, 2011 was

$ 0.20, which grew by 54% from the Earnings Per Share of $ 0.13 for

the year ended December 31, 2010.

"We are proud of the growth we have achieved in 2011 and we

believe this trend of growth will continue in 2012," commented Mr.

Jun Liang, our Chief Financial Officer, "We are making continuing

sales and marketing efforts to locate and develop new

customers."

A complete Form 10-K Annual Report for the year ended December

31, 2011 can be found on SEC's website: www.sec.gov.

About China Global Media, Inc. China Global Media, Inc. (OTCBB:

CGLO) mainly engages in the business of advertisement and brand

name development in China, especially in Hunan Province and other

southern Chinese provinces. It carries out business operations

through its Hong Kong subsidiary Phoenix International (China)

Limited, its Chinese subsidiary Hunan Beiwei International Media

Consulting Co., Ltd, and, by contractual arrangement, its three

affiliated operating entities including Changsha North Latitude 30

Cultural Communications Co., Ltd., Changsha Beichen Cultural

Communications Co., Ltd. and Changsha Zhongte Trade Advertising

Co., Ltd. Additional information about China Global Media, Inc. can

be found on the web at www.cnbwi.net.

Safe Harbor Statement Certain of the statements made in this

press release constitute forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933 and Section

27E of the Securities Act of 1934. Such forward-looking statements

involve known and unknown risks, uncertainties and other unknown

factors that could cause China Global Media, Inc.'s actual results

to be materially different from the historical results or from any

future results expressed or implied by such forward-looking

statements. Statements contained in this release that are not

historical facts may be deemed to be forward-looking statements. In

addition to statements that explicitly describe such risks and

uncertainties, readers are urged to consider statements labeled

with the terms "believes," "belief," "intends," "anticipates" or

"plans" to be uncertain and forward-looking. Additional risks that

could affect our future operating results are more fully described

in our United States Securities and Exchange Commission filings

including our 8-K dated July 22, 2011, and other recent filings.

These filings are available at www.sec.gov. The Company does not

intend to update any of the forward-looking statements after the

date of this release to conform these statements to actual results

or to changes in its expectations, except as may be required by

law.

Investor Relations Contact: Jun Liang Chief Financial Officer,

Chief Strategic Officer 25-26F Wanxiang Enterprise Building No.70

Station North Road Changsha, Hunan Province China, Postal Code:

410001 Phone: +86-731-89970899 Email: Email Contact

www.cnbwi.net

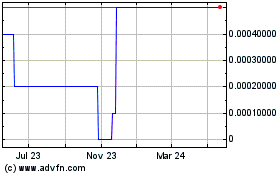

Coro Global (CE) (USOTC:CGLO)

Historical Stock Chart

From Jan 2025 to Feb 2025

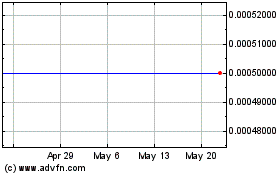

Coro Global (CE) (USOTC:CGLO)

Historical Stock Chart

From Feb 2024 to Feb 2025