Current Report Filing (8-k)

11 November 2022 - 1:56AM

Edgar (US Regulatory)

0001586495

false

0001586495

2022-11-04

2022-11-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 4, 2022

LEET

TECHNOLOGY INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

000-55053 |

|

46-3590850 |

|

(State or other

jurisdiction of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

805,

8th Floor, Menara Mutiara Majestic,

Jalan Othman, Petaling Jaya 46000,

Selangor, Malaysia

(Address of principal executive offices) (zip code)

+603 7783 1636

(Registrant’s telephone number, including

area code)

_______________________________________

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| None |

|

None |

|

None |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

Item 1.01 Entry into a Material Definitive

Agreement.

On November 4, 2022 (the

“Issue Date”), Leet Technology Inc. (the “Company”) entered into a Securities Purchase Agreement dated as of November

4, 2022 (the “SPA”), by and between the Company and 1800 Diagonal Lending LLC, a Virginia limited liability company (the “Investor”).

Pursuant to the SPA, among other things, the Company agreed to issue to the Investor a convertible note in the principal amount of $113,300.00

(the “Note” and together with the SPA, the “Agreements”). The Note contains an original issue discount amount

of $10,300.00, legal fees payable to Investor’s legal counsel of $2,000.00 and to Investor a due diligence fee of $1,000.00.

The Note accrues interest

at an annual interest rate of 8% and a default rate of 22%, and matures on November 4, 2024 (the “Maturity Date”). The Investor

may convert the Note into shares of the Company’s common stock, par value $0.0001 per share (the “Common Stock”), 180

days after the Issue Date until the later of (i) Maturity Date and (ii) the date the Company pays any amounts owed in connection with

an event of default. The per share conversion price into which the Note is convertible into shares of Common Stock (the “Conversion

Price”) is 75% multiplied by the average of the lowest three closing bid prices for the Common Stock during the ten trading days

ending on the last trading day prior to the conversion date.

The Company has the right

to prepay the outstanding principal amount of the Note, plus any accrued interest on the outstanding principal (including any default

interest) at a rate of (x) 110% during the period ending 60 days after the Issue Date, (y) 115% during the period between 61 days and

180 days after the Issue Date and (z) 120% during the period between 180 days and 730 days after the Issue Date.

The foregoing description

of the Securities Purchase Agreement, the Note and the transactions contemplated thereby does not purport to be complete and is subject

to, and qualified in its entirety by reference to, the full text of the Securities Purchase Agreement and the Note which are included

in this Current Report as Exhibits 10.1 and 10.2, respectively, and are incorporated herein by reference.

Item 2.03 Creation of a Direct Financial

Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

Please see the disclosures under Item 1.01 above.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

LEET TECHNOLOGY INC. |

|

| |

|

|

|

| |

|

|

|

| Date: November 10,

2022 |

By: |

/s/

Ding Jung, LONG |

|

| |

|

Chief Executive Officer |

|

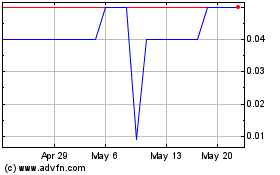

Leet Technology (PK) (USOTC:LTES)

Historical Stock Chart

From Jun 2024 to Jul 2024

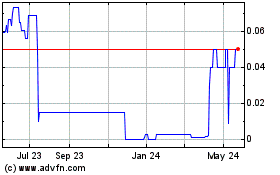

Leet Technology (PK) (USOTC:LTES)

Historical Stock Chart

From Jul 2023 to Jul 2024