0000924396

false

0000924396

2023-08-01

2023-08-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 1, 2023

| OpenLocker

Holdings, Inc. |

| (Exact name of registrant as specified in its charter) |

| Delaware |

|

000-24520 |

|

04-3021770 |

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

| 625

N. Flagler Drive, Suite 600, West Palm Beach, FL |

|

33401 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (305) 351-9195

| N/A |

| (Former name or former address, if changed since last report.) |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| N/A |

|

N/A |

|

N/A |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01. Entry into a Material Definitive Agreement.

On

August 1, 2023, (the “Issue Date”) OpenLocker Holdings, Inc. (“OpenLocker”) entered into a Note

Purchase Agreement (each a “Note Purchase Agreement”) and a Promissory Note (each a “Note”) with

American Capital Ventures, Inc. (“American Capital”) and Leone Group LLC (“Leone Group”). Howard

Gostfrand (“Gostfrand”), the President of American Capital, is also the Chief Executive Officer, Principal Financial

Officer, and a Director of OpenLocker. Laura Anthony (“Anthony”), the Managing Member of Leone Group, is also the

President, Secretary and Chairperson of the Board of OpenLocker.

Each

of Leone Group and American Capital each loaned OpenLocker Forty Thousand Dollars ($40,000.00) (the “Principal Amount”)

pursuant to a Note Purchase Agreement and a Note. Each Note matures on the one-year anniversary of the Issue Date, at which time the

Principal Amount of each Note and simple interest at the rate of ten percent (10%) per annum shall be due and payable to each of American

Capital and Leone Group.

Each

Note Purchase Agreement and Promissory Note contain customary representations, warranties, and provisions of the parties thereto.

The

information set forth above is qualified in its entirety by reference to the actual terms of the form of Note Purchase Agreement and

the Note between OpenLocker and American Capital and Leone Group, respectively, copies of which are attached hereto as Exhibits 10.1

and 10.2, respectively, and incorporated herein by reference.

Item

9.01. Financial Statements and Exhibits

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

OPENLOCKER

HOLDINGS, INC. |

| |

(Registrant) |

| |

|

|

| Date:

August 4, 2023 |

|

/s/

Howard Gostfrand |

| |

Name: |

Howard

Gostfrand |

| |

Title: |

Chief

Executive Officer |

Exhibit

10.1

Note

Purchase Agreement

Dated

as of August [_______], 2023

Buyer: [________________]

This

Note Purchase Agreement (this “Agreement”) is entered into as of the date set forth above (the “Closing Date”),

by and among OpenLocker Holdings, Inc., a Delaware corporation (the “Company”) and the person or entity set forth above (“Buyer”).

The Company and the Buyer may be collectively referred to herein as the “Parties” and each individually as a “Party”.

WHEREAS,

the Company desires to issue and sell to the Buyer a promissory note of the Company on the terms set forth herein and the Buyer wishes

to purchase such promissory note on the terms and conditions provided for herein and the Parties desire to undertake the other actions

and enter into the other agreements as set forth herein;

NOW,

THEREFORE, in consideration of the mutual covenants and agreements hereinafter set forth and for other good and valuable consideration,

the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows:

Article

I. DEFINITIONS AND INTERPRETATION

Section

1.01 Definitions. In addition to the terms defined elsewhere in this Agreement, the following terms, as used herein, have the

following meanings:

| (a) | “Affiliate”

means, with respect to a specified Person, any other Person that directly or indirectly Controls,

is Controlled by or is under common Control with, the specified Person. |

| (b) | “Business

Day” means any day except Saturday, Sunday and any legal holiday or a day on which

banking institutions in Florida generally are authorized or required by Law or other governmental

actions to close. |

| (c) | “Control”

means (a) the possession, directly or indirectly, of the power to vote 10% or more of the

securities or other equity interests of a Person having ordinary voting power, (b) the possession,

directly or indirectly, of the power to direct or cause the direction of the management and

policies of a Person, by contractor otherwise, or (c) being a director, officer, executor,

trustee or fiduciary (or their equivalents) of a Person or a Person that controls such Person. |

| (d) | “Governmental

Entity” means any federal, state, municipal, local or foreign government and any court,

tribunal, arbitral body, administrative agency, department, subdivision, entity, commission

or other governmental, government appointed, quasi-governmental or regulatory authority,

reporting entity or agency, domestic, foreign or supranational. |

| (e) | “Law”

means any applicable foreign, federal, state or local law (including common law), statute,

treaty, rule, directive, regulation, ordinances and similar provisions having the force or

effect of law or an Order of any Governmental Entity. |

| (f) | “Liabilities”

means liabilities, obligations or responsibilities of any nature whatsoever, whether direct

or indirect, matured or un-matured, fixed or unfixed, known or unknown, asserted or unasserted,

choate or inchoate, liquidated or unliquidated, secured or unsecured, absolute, contingent

or otherwise, including any direct or indirect indebtedness, guaranty, endorsement, claim,

loss, damage, deficiency, cost or expense. |

| (g) | “Lien”

means, with respect to any property or asset, any lien, security interest, mortgage, pledge,

charge, claim, lease, agreement, right of first refusal, option, limitation on transfer or

use or assignment or licensing, restrictive easement, charge or any other restriction of

any kind, and any conditional sale or voting agreement or proxy, and including any restriction

on the ownership, use, voting, transfer, possession, receipt of income or other exercise

of any attributes of ownership, in respect of such property or asset, and any agreement to

give any of the foregoing. |

| (h) | “Losses”

means any losses, damages, deficiencies, Liabilities, assessments, fines, penalties, judgments,

actions, claims, costs, disbursements, fees, expenses or settlements of any kind or nature,

including legal, accounting and other professional fees and expenses. |

| (i) | “Order”

means any judgment, writ, decree, determination, award, compliance agreement, settlement

agreement, injunction, ruling, charge, judicial or administrative order, determination or

other restriction of any Governmental Entity or arbitrator. |

| (j) | “Person”

means a natural person, a corporation, a limited liability company, a partnership, an association,

a trust or any other entity or organization, including a government or political subdivision

or any agency or instrumentality thereof. |

| (k) | “Securities

Act” means the United States Securities Act of 1933, as amended, and the rules and

regulation promulgated thereunder. |

| (l) | “Transactions”

means the purchase and sale of the Note and the other transactions contemplated under the

Transaction Documents. |

| (m) | “Transaction

Documents” means this Agreement, the Note and any other agreement, document, certificate

or writing delivered or to be delivered in connection with this Agreement and any other document

related to the Transactions related to the forgoing, including, without limitations, those

delivered at the Closing. |

Section

1.02 Interpretive Provisions. Unless the express context otherwise requires, the words “hereof,” “herein,”

and “hereunder” and words of similar import, when used in this Agreement, shall refer to this Agreement as a whole and not

to any particular provision of this Agreement; terms defined in the singular shall have a comparable meaning when used in the plural,

and vice versa; the terms “Dollars” and “$” mean United States Dollars, unless otherwise specified herein; references

herein to a specific Section, Subsection, Recital or Exhibit shall refer, respectively, to Sections, Subsections, Recitals or Exhibits

of this Agreement; wherever the word “include,” “includes,” or “including” is used in this Agreement,

it shall be deemed to be followed by the words “without limitation”; references herein to any gender shall include each other

gender; references herein to any Person shall include such Person’s heirs, executors, personal representatives, administrators,

successors and assigns; provided, however, that nothing contained in this Section 1.02 is intended to authorize any assignment or transfer

not otherwise permitted by this Agreement; references herein to a Person in a particular capacity or capacities shall exclude such Person

in any other capacity; references herein to any contract or agreement (including this Agreement) mean such contract or agreement as amended,

supplemented or modified from time to time in accordance with the terms thereof; with respect to the determination of any period of time,

the word “from” means “from and including” and the words “to” and “until” each means

“to but excluding”; references herein to any Law or any license mean such Law or license as amended, modified, codified,

reenacted, supplemented or superseded in whole or in part, and in effect from time to time; and references herein to any Law shall be

deemed also to refer to all rules and regulations promulgated thereunder.

Article

II. PURCHASE AND SALE

Section

2.01 Purchase and Sale. Subject to the terms and conditions of this Agreement, at the Closing (as defined below), the Company

shall issue and sell to Buyer a promissory note of the Company in the form as attached hereto as Exhibit A (the “Note”) in

the aggregate principal amount as set forth on the signature page attached hereto, for a purchase price equal to such aggregate principal

amount (the “Purchase Price”).

Section

2.02 Deliverables at Closing.

| (a) | At

the Closing, the Buyer shall: |

| (i) | Pay

the Purchase Price to the Company, pursuant to the wire transfer instructions as provided

by the Company to Buyer; and |

| (ii) | Deliver

to the Company a copy of the Note, duly executed by the Buyer. |

| (b) | At

the Closing, the Company shall deliver to the Buyer a copy of the Note, duly executed by

an authorized officer of the Company. |

Section

2.03 Closing. On the terms set forth herein, the closing of the Transactions (the “Closing”) shall take place on the

Closing Date by conference call and electronic communication (i.e., emails/pdf) and exchange of the executed Transaction Documents.

Article

III. REPRESENTATIONS AND WARRANTIES

OF THE COMPANY

The

Company represents and warrants to Buyer that the following representations and warranties contained in this Article III are true and

correct as of the Closing Date:

Section

3.01 Authorization of Transactions. The Company is a corporation duly authorized and in good standing in the State of Delaware

and has the requisite power and capacity to execute and deliver the Transaction Documents to which it is a party and to perform its obligations

hereunder and thereunder. The execution, delivery and performance by the Company of the applicable Transaction Documents and the consummation

of the Transactions have been duly and validly authorized by all requisite action on the part of the Company. The Transaction Documents

to which the Company is a party have been duly and validly executed and delivered by The Company. Each Transaction Document to which

the Company is a party constitutes the valid and legally binding obligation of the Company, enforceable against the Company in accordance

with its terms and conditions, except to the extent enforcement thereof may be limited by applicable bankruptcy, insolvency or other

Laws affecting the enforcement of creditors’ rights or by the principles governing the availability of equitable remedies.

Section

3.02 Governmental Approvals; Non-contravention.

| (a) | No

consent, Order, action or non-action of, or filing, notification, declaration or registration

with, any Governmental Entity or Person is necessary for the execution, delivery or performance

by the Company of this Agreement or any other Transaction Document to which the Company is

a party. |

| (b) | The

execution, delivery and performance by the Company of the Transaction Documents to which

the Company is a party, and the consummation by the Company of the Transactions, do not (i)

violate or conflict with any Law or Order to which the Company may be subject, (ii) constitute

a violation or breach of, be in conflict with, constitute or create (with or without due

notice or lapse of time or both) a default (or give rise to any right of termination, modification,

cancellation or acceleration) of any obligation under any contract to which the Company is

a party or to which the Company is subject or by which the Company’s properties, assets

or rights are bound or (iii) result in the creation or imposition of any Lien upon any of

the rights, properties or assets of the Company. |

Section

3.03 Brokers. The Company has not engaged, or caused to be incurred any Liability or obligation to, any investment banker, finder,

broker or sales agent or any other Person in connection with the origin, negotiation, execution, delivery or performance of the Transaction

Documents to which it is a party, or the Transactions.

Article

IV. REPRESENTATIONS AND WARRANTIES

OF BUYER

Buyer

represents and warrants to the Company that the following statements contained in this Article IV are true and correct as of the Closing

Date:

Section

4.01 Authorization of Transactions. The Buyer is a natural person or is an entity duly organized and in good standing under the

laws of the jurisdiction of organization and has the requisite power and capacity to execute and deliver the Transaction Documents to

which it is are a party and to perform its obligations hereunder and thereunder. The execution, delivery and performance by Buyer of

the applicable Transaction Documents and the consummation of the Transactions have been duly and validly authorized by all requisite

action on the part of Buyer. The Transaction Documents to which Buyer is a party have been duly and validly executed and delivered by

Buyer. Each Transaction Document to which Buyer is a party constitutes the valid and legally binding obligation of Buyer, enforceable

against Buyer in accordance with its terms and conditions, except to the extent enforcement thereof may be limited by applicable bankruptcy,

insolvency or other Laws affecting the enforcement of creditors’ rights or by the principles governing the availability of equitable

remedies.

Section

4.02 Governmental Approvals; Non-contravention.

| (a) | No

consent, Order, action or non-action of, or filing, notification, declaration or registration

with, any Governmental Entity is necessary for the execution, delivery or performance by

Buyer of this Agreement or any other Transaction Document to which Buyer is a party. |

| (b) | If

Buyer is an entity, the execution, delivery and performance by Buyer of the Transaction Documents

to which Buyer is a party, and the consummation by Buyer of the Transactions, do not violate

any Laws or Orders to which Buyer is subject or violate, breach or conflict with any provision

of Buyer’s organizational documents. |

Section

4.03 Investment Representations.

| (a) | Buyer

understands and agrees that the consummation of this Agreement including the delivery of

the Note as contemplated hereby constitute the offer and sale of securities under the Securities

Act and applicable state statutes and that the Note is being acquired for Buyer’s own

account and not with a present view towards the public sale or distribution thereof, except

pursuant to sales registered or exempted from registration under the Securities Act. |

| (b) | Buyer

is an “accredited investor” as that term is defined in Rule 501(a) of Regulation

D under the Securities Act (an “Accredited Investor”) or is a not a “US

Person” as defined in Regulation S under the Securities Act. |

| (c) | Buyer

understands that the Note is being offered and sold to Buyer in reliance upon specific exemptions

from the registration requirements of United States federal and state securities Laws and

that the Company is relying upon the truth and accuracy of, and Buyer’s compliance

with, the representations, warranties, agreements, acknowledgments and understandings of

Buyer set forth herein in order to determine the availability of such exemptions and the

eligibility of Buyer to acquire the Securities. |

| (d) | At

no time was Buyer presented with or solicited by any leaflet, newspaper or magazine article,

radio or television advertisement, or any other form of general advertising or solicited

or invited to attend a promotional meeting otherwise than in connection and concurrently

with such communicated offer. Buyer is not purchasing the Securities acquired by Buyer hereunder

as a result of any “general solicitation” or “general advertising,”

as such terms are defined in Regulation D under the Securities Act, which includes, but is

not limited to, any advertisement, article, notice or other communication regarding the Note

acquired by Buyer hereunder published in any newspaper, magazine or similar media or on the

internet or broadcast over television, radio or the internet or presented at any seminar

or any other general solicitation or general advertisement. |

| (e) | Buyer

is acquiring the Note for its own account as principal, not as a nominee or agent, for investment

purposes only, and not with a view to, or for, resale, distribution or fractionalization

thereof in whole or in part and no other person has a direct or indirect beneficial interest

in the Note. Further, Buyer does not have any contract, undertaking, agreement or arrangement

with any person to sell, transfer or grant participations to such person or to any third

person, with respect to the Note. |

| (f) | Buyer,

either alone or together with its representatives, has such knowledge, sophistication and

experience in business and financial matters so as to be capable of evaluating the merits

and risks of the prospective investment in the Note, and has so evaluated the merits and

risks of such investment. |

| (g) | Buyer

and Buyer’s advisors, if any, have been furnished with all materials relating to the

business, finances and operations of the Company and materials relating to the offer and

sale of the Note which have been requested by Buyer or Buyer’s advisors. Buyer and

Buyer’s advisors, if any, have been afforded the opportunity to ask questions of the

Company. Buyer understands that Buyer’s investment in the Note involves a significant

degree of risk. Buyer is not aware of any facts that may constitute a breach of any of the

Company’s representations and warranties made herein. |

| (h) | Buyer

understands that (i) the sale or re-sale of the Note has not been and is not being registered

under the Securities Act or any applicable state securities Laws, and the Note may not be

transferred unless (a) the Note is sold pursuant to an effective registration statement under

the Securities Act, (b) Buyer shall have delivered to the Company, at the cost of Buyer,

an opinion of counsel that shall be in form, substance and scope customary for opinions of

counsel in comparable transactions to the effect that the Note to be sold or transferred

may be sold or transferred pursuant to an exemption from such registration, which opinion

shall be accepted by the Company, (c) the Note is sold or transferred to an “affiliate”

(as defined in Rule 144 promulgated under the Securities Act (or a successor rule) (“Rule

144”)) of Buyer who agree to sell or otherwise transfer the Note only in accordance

with this Section 4.03(h) and who is an Accredited Investor, (d) the Note is sold pursuant

to Rule 144, or (e) the Note is sold pursuant to Regulation S under the Securities Act (or

a successor rule) (“Regulation S”), and Buyer shall have delivered to the Company,

at the cost of Buyer, an opinion of counsel that shall be in form, substance and scope customary

for opinions of counsel in corporate transactions, which opinion shall be accepted by the

Company; (ii) any sale of such Note made in reliance on Rule 144 may be made only in accordance

with the terms of said Rule and further, if said Rule is not applicable, any re-sale of such

Note under circumstances in which the seller (or the person through whom the sale is made)

may be deemed to be an underwriter (as that term is defined in the Securities Act) may require

compliance with some other exemption under the Securities Act or the rules and regulations

of the Securities and Exchange Commission thereunder; and (iii) neither the Company nor any

other person is under any obligation to register such Note under the Securities Act or any

state securities Laws or to comply with the terms and conditions of any exemption thereunder

(in each case). |

| (i) | Buyer

understands that until such time as the Note has been registered under the Securities Act

or may be sold pursuant to any applicable exemption without any restriction, the Note may

bear a restrictive legend in substantially the following form (and a stop-transfer order

may be placed against transfer of the certificates for the Note): |

“THE

ISSUANCE AND SALE OF THIS NOTE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR APPLICABLE STATE SECURITIES

LAWS. THIS NOTE MAY NOT BE OFFERED FOR SALE, SOLD, TRANSFERRED OR ASSIGNED (I) IN THE ABSENCE OF (A) AN EFFECTIVE REGISTRATION STATEMENT

FOR THIS NOTE UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR (B) AN OPINION OF COUNSEL (WHICH COUNSEL SHALL BE SELECTED BY THE HOLDER),

IN A GENERALLY ACCEPTABLE FORM, THAT REGISTRATION IS NOT REQUIRED UNDER SAID ACT OR (II) UNLESS SOLD PURSUANT TO AN APPLICABLE EXEMPTION

UNDER SAID ACT.”

| (j) | Buyer

understands that no United States federal or state agency or any other governmental or state

agency has passed on or made recommendations or endorsement of the Note or the suitability

of the investment in the Note nor have such authorities passed upon or endorsed the merits

of the transactions set forth herein. |

Section

4.04 Brokers. Buyer has not engaged any investment banker, finder, broker or sales agent or any other Person in connection with

the origin, negotiation, execution, delivery or performance of any Transaction Document to which it is a party, or the Transactions.

Article

V. MISCELLANEOUS

Section

5.01 Indemnification. Each Party (the “Indemnifying Party”) agrees to indemnify, defend and hold harmless the other

Party and such other Party’s Affiliates and each of their respective directors, officers, managers, partners, employees, agents,

equity holders, successors and assigns (each, an “Indemnified Party”), from and against any and all Losses incurred or suffered

by any Indemnified Party arising out of, based upon or resulting from any breach of any representation or warranty of the Indemnifying

Party herein or breach by the Indemnifying Party of, or any failure the Indemnifying Party to perform, any of the covenants, agreements

or obligations contained in or made pursuant to this Agreement or the Transaction Documents by the Indemnifying Party.

Section

5.02 Notices.

| (a) | Any

notice or other communications required or permitted hereunder shall be in writing and shall

be sufficiently given if personally delivered to it or sent by email, overnight courier or

registered mail or certified mail, postage prepaid, addressed as follows: |

if

to the Company, to:

OpenLocker

Holdings, Inc.

Attn:

Howard Gostfrand

625

N. Flagler Drive, Suite 600

West

Palm Beach, FL 33401

E-mail:

hg@amcapventures.com

If

to the Buyer, to the address for the Buyer as set forth on the signature page hereof.

| (b) | Any

Party may change its address for notices hereunder upon notice to each other Party in the

manner for giving notices hereunder. |

| (c) | Any

notice hereunder shall be deemed to have been given (i) upon receipt, if personally delivered,

(ii) on the day after dispatch, if sent by overnight courier, (iii) upon dispatch, if transmitted

by email with return receipt requested and received and (iv) three (3) days after mailing,

if sent by registered or certified mail. |

Section

5.03 Attorneys’ Fees. In the event that any Party institutes any action or suit to enforce this Agreement or to secure relief

from any default hereunder or breach hereof, the prevailing Party shall be reimbursed by the losing Party for all costs, including reasonable

attorney’s fees, incurred in connection therewith and in enforcing or collecting any judgment rendered therein.

Section

5.04 Amendments; No Waivers; No Consequential Damages.

| (a) | This

Agreement may be amended, modified, superseded, terminated or cancelled, and any of the terms,

covenants, representations, warranties or conditions hereof may be waived, only by a written

instrument executed by both of the Parties. |

| (b) | Every

right and remedy provided herein shall be cumulative with every other right and remedy, whether

conferred herein, at law, or in equity, and may be enforced concurrently herewith, and no

waiver by any Party of the performance of any obligation by another Party shall be construed

as a waiver of the same or any other default then, theretofore, or thereafter occurring or

existing. |

| (c) | Neither

any failure or delay in exercising any right or remedy hereunder or in requiring satisfaction

of any condition herein nor any course of dealing shall constitute a waiver of or prevent

any Party from enforcing any right or remedy or from requiring satisfaction of any condition.

No notice to or demand on a Party waives or otherwise affects any obligation of that Party

or impairs any right of the Party giving such notice or making such demand, including any

right to take any action without notice or demand not otherwise required by this Agreement.

No exercise of any right or remedy with respect to a breach of this Agreement shall preclude

exercise of any other right or remedy, as appropriate to make the aggrieved Party whole with

respect to such breach, or subsequent exercise of any right or remedy with respect to any

other breach. |

| (d) | Notwithstanding

anything else contained herein, no Party shall seek, nor shall any Party be liable for, consequential,

punitive or exemplary damages, under any tort, contract, equity, or other legal theory, with

respect to any breach (or alleged breach) of this Agreement or any provision hereof or any

matter otherwise relating hereto or arising in connection herewith. |

Section

5.05 Expenses. Unless otherwise contemplated or stipulated by a Transaction Document, all costs and expenses incurred in connection

with this Agreement shall be paid by the Party incurring such cost or expense.

Section

5.06 Further Assurances. At and following the Closing, each Party shall execute and deliver such documents and other papers and

take such further action as may be reasonably required to carry out the provisions of the Transaction Documents.

Section

5.07 Successors and Assigns; Benefit. This Agreement shall be binding upon and shall inure to the benefit of the Parties and their

respective successors and permitted assigns. No Party shall have any power or any right to assign or transfer, in whole or in part, this

Agreement, or any of its rights or any of its obligations hereunder, including, without limitation, any right to pursue any claim for

damages pursuant to this Agreement or the transactions contemplated herein, or to pursue any claim for any breach or default of this

Agreement, or any right arising from the purported assignor’s due performance of its obligations hereunder, including by merger,

consolidation, operation of law, or otherwise, without the prior written consent of the other Party and any such purported assignment

in contravention of the provisions herein shall be null and void and of no force or effect. Other than as specifically set forth herein,

including in Section 5.01, nothing in this Agreement shall confer on any Person other than the Parties, and their respective successors

and assigns, any rights, remedies, obligations, or Liabilities under or by reason of this Agreement.

Section

5.08 Governing Law; Etc.

| (a) | This

Agreement, and all matters based upon, arising out of or relating in any way to the Transactions

or the Transaction Documents, including, without limitation, tort claims, statutory claims

and contract claims, shall be interpreted, construed, governed and enforced under and in

accordance with the substantive and procedural Laws of the State of Florida in each case

as in effect from time to time and as the same may be amended from time to time, and as applied

to agreements performed wholly within the State of Florida. |

| (b) | ANY

LEGAL SUIT, ACTION OR PROCEEDING ARISING OUT OF OR BASED UPON THIS AGREEMENT OR THE TRANSACTIONS

CONTEMPLATED HEREIN SHALL BE INSTITUTED SOLELY IN THE FEDERAL COURTS OF THE UNITED STATES

OF AMERICA OR THE COURTS OF THE STATE OF FLORIDA, IN EACH CASE LOCATED IN PALM BEACH COUNTY,

FLORIDA, AND EACH PARTY IRREVOCABLY SUBMITS TO THE EXCLUSIVE JURISDICTION OF SUCH COURTS

IN ANY SUCH SUIT, ACTION OR PROCEEDING. SERVICE OF PROCESS, SUMMONS, NOTICE OR OTHER DOCUMENT

BY MAIL TO SUCH PARTY’S ADDRESS SET FORTH HEREIN SHALL BE EFFECTIVE SERVICE OF PROCESS

FOR ANY SUIT, ACTION OR OTHER PROCEEDING BROUGHT IN ANY SUCH COURT. THE PARTIES IRREVOCABLY

AND UNCONDITIONALLY WAIVE ANY OBJECTION TO THE LAYING OF VENUE OF ANY SUIT, ACTION OR ANY

PROCEEDING IN SUCH COURTS AND IRREVOCABLY WAIVE AND AGREE NOT TO PLEAD OR CLAIM IN ANY SUCH

COURT THAT ANY SUCH SUIT, ACTION OR PROCEEDING BROUGHT IN ANY SUCH COURT HAS BEEN BROUGHT

IN AN INCONVENIENT FORUM. |

| |

(C) |

EACH PARTY HERETO HEREBY

WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY IN ANY LEGAL PROCEEDING DIRECTLY

OR INDIRECTLY ARISING OUT OF OR RELATING TO THIS AGREEMENT OR THE TRANSACTIONS, THE PERFORMANCE THEREOF OR THE FINANCINGS CONTEMPLATED

THEREBY (WHETHER BASED ON CONTRACT, TORT OR ANY OTHER THEORY). EACH PARTY HERETO (A) CERTIFIES THAT NO REPRESENTATIVE, AGENT OR ATTORNEY

OF ANY OTHER PARTY HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT SUCH OTHER PARTY WOULD NOT, IN THE EVENT OF LITIGATION, SEEK TO ENFORCE

THE FOREGOING WAIVER AND (B) ACKNOWLEDGES THAT IT AND THE OTHER PARTIES HERETO HAVE BEEN INDUCED TO ENTER INTO THIS AGREEMENT BY, AMONG

OTHER THINGS, THE MUTUAL WAIVERS AND CERTIFICATIONS IN THIS SECTION 5.08(C). EACH OF THE PARTIES ACKNOWLEDGE THAT EACH HAS BEEN REPRESENTED

IN CONNECTION WITH THE SIGNING OF THE WAIVER ABOVE BY INDEPENDENT LEGAL COUNSEL SELECTED BY THE RESPECTIVE PARTY AND THAT SUCH PARTY

HAS DISCUSSED THE LEGAL CONSEQUENCES AND IMPORT OF THIS WAIVER WITH LEGAL COUNSEL. EACH OF THE PARTIES FURTHER ACKNOWLEDGE THAT EACH

HAS READ AND UNDERSTANDS THE MEANING OF SUCH WAIVER AND GRANTS THIS WAIVER KNOWINGLY, VOLUNTARILY, WITHOUT DURESS AND ONLY AFTER CONSIDERATION

OF THE CONSEQUENCES OF THIS WAIVER WITH LEGAL COUNSEL. |

Section

5.09 Survival. The representations and warranties in this Agreement shall survive the Closing for a period of the later of (i)

12 months from the Closing Date and (ii) the full payment of all amounts pursuant to the Note, and no claim for indemnification may be

made after such time. All covenants and agreements in this Agreement, and such provisions herein as required to give effect to the same,

will survive until fully performed; provided, however, that, nothing herein shall prevent a Party from making any claim hereunder, or

relieve any other Party from any liability hereunder, after such time for any breach thereof.

Section

5.10 Severability. If any provision of this Agreement is invalid, illegal or incapable of being enforced by any rule of law, or

public policy, all other conditions and provisions of this Agreement shall nevertheless remain in full force and effect so long as the

economic or legal substance of the Transactions is not affected in any manner adverse to any Party. Upon such determination that any

provision is invalid, illegal or incapable of being enforced, the Parties shall negotiate in good faith to modify this Agreement so as

to effect the original intent of the Parties as closely as possible in an acceptable manner to the end that the Transactions are fulfilled

to the extent possible.

Section

5.11 Entire Agreement. The Transaction Documents constitute the entire agreement between the Parties with respect to the subject

matter hereof and thereof and supersede all prior agreements and understandings, both oral and written, between the Parties with respect

to the subject matter hereof and thereof.

Section

5.12 Specific Performance. Each Party agrees that irreparable damage would occur if any provision of this Agreement were not performed

in accordance with the terms hereof and that each Party shall be entitled to seek specific performance of the terms hereof in addition

to any other remedy at law or in equity.

Section

5.13 Construction. The table of contents and headings contained in this Agreement are for reference purposes only and will not

affect in any way the meaning or interpretation of this Agreement. In the event of a conflict between language or amounts contained in

the body of this Agreement and language or amounts contained in the Exhibits attached hereto, the language or amounts in the body of

the Agreement shall control. References to Articles or Sections shall refer to those portions of this Agreement. The use of the terms

“hereunder,” “hereof,” “hereto” and words of similar import shall refer to this Agreement as a whole

and not to any particular Article, Section or clause of or Exhibit to this Agreement.

Section

5.14 Counterparts. This Agreement may be executed in multiple counterparts, each of which shall be deemed an original and all

of which taken together shall be but a single instrument. Counterparts may be delivered via facsimile, electronic mail (including pdf

or any electronic signature complying with the U.S. federal ESIGN Act of 2000, e.g., www.docusign.com) or other transmission method and

any counterpart so delivered shall be deemed to have been duly and validly delivered and be valid and effective for all purposes.

[Signature

page follows]

IN

WITNESS WHEREOF, the Parties have caused this Agreement to be duly executed as of the Closing Date.

| |

OpenLocker

Holdings, Inc. |

| |

|

|

| |

By: |

|

| |

|

|

| |

Name: |

|

| |

Title: |

|

| |

|

|

| |

Buyer |

| |

|

| |

Name:

|

|

| |

|

|

| |

By: |

|

| |

|

|

| |

Name:

|

|

| |

|

|

| |

Title: |

|

| |

|

(if

applicable) |

| |

Aggregate

Principal Amount/Purchase Price: |

| |

|

| |

$_________________________________________ |

| |

|

| |

Address

for notices: |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| Email: |

|

EXHIBIT

10.2

THE

ISSUANCE AND SALE OF THE SECURITIES REPRESENTED BY THIS NOTE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR

APPLICABLE STATE SECURITIES LAWS. THE SECURITIES MAY NOT BE OFFERED FOR SALE, SOLD, TRANSFERRED OR ASSIGNED (I) IN THE ABSENCE OF (A)

AN EFFECTIVE REGISTRATION STATEMENT FOR THE SECURITIES UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR (B) AN OPINION OF COUNSEL (WHICH

COUNSEL SHALL BE SELECTED BY THE HOLDER), IN A GENERALLY ACCEPTABLE FORM, THAT REGISTRATION IS NOT REQUIRED UNDER SAID ACT OR (II) UNLESS

SOLD PURSUANT TO RULE 144 OR RULE 144A UNDER SAID ACT.

| Principal

Amount: $[____________] |

Issue

Date: August [__________], 2023 |

OPENLOCKER

HOLDINGS, INC.

PROMISSORY

NOTE

Holder:

__________________

FOR

VALUE RECEIVED, pursuant to the terms and conditions of this Promissory Note (this “Note”), OpenLocker Holdings, Inc., a

Delaware corporation (the “Company”), hereby promises to pay to the order of the holder named above, or registered assigns

(the “Holder”), on the one year anniversary of the Issue Date as set forth above (the “Maturity Date”), or such

earlier date as may be required hereunder, the principal amount as set forth above (the “Principal Amount”), and to pay interest

on the outstanding Principal Amount at the rate of ten percent (10%) per annum, simple interest, to be paid at the same time as the Principal

Amount, in each case to the extent that this Note and the Principal Amount and any accrued interest hereunder (the “Indebtedness”)

has not been earlier repaid or due to be repaid as set forth herein, and subject to the other terms, conditions and limitations herein.

Interest shall commence accruing on the date hereof (the “Issue Date”), computed on the basis of a 365-day year and the actual

number of days elapsed, and shall be payable as set forth herein. The Holder and the Company may be referred to herein individually as

a “Party” and collectively as the “Parties”.

This

Note is entered into pursuant to a Note Purchase Agreement by and between the Company and the Holder dated as of the Issue Date (the

“Agreement”) and is subject to the terms and conditions thereof. This Note is one of a series of promissory notes being issued

by the Company on or about the Issue Date, all being of like tenor, terms and conditions, pursuant to an offering of such promissory

notes by the Company (the “Offering”), with all of such promissory notes issued in the Offering being referred to as the

“Offering Notes”.

This

Note will rank senior in right of payment to the Company’s capital stock. This Note is not a certificate of deposit or similar

obligation of, and is not guaranteed or insured by, any depository institution, the Federal Deposit Insurance Corporation, the Securities

Investor Protection Corporation or any other governmental or private fund or entity.

The

following terms shall apply to this Note:

Section

1. Definitions. Defined terms used herein without definition have the meanings given them in the Agreement.

Section

2. Interest; Payments and Prepayment.

(a) Interest

on this Note shall accrue on a simple interest, non-compounded basis, and shall be added to the outstanding Principal Amount on the Maturity

Date or such earlier date as the Indebtedness may be payable or paid hereunder or may be due hereunder pursuant to the terms herein.

(b) The

Holder, at any time and in Holder’s sole discretion, may demand that the then- unrepaid Indebtedness be repaid in full at such

time. Upon any such demand, the Company shall repay the unrepaid Indebtedness in full within one Business Day of such Demand.

(c) In

the event that, at any time after the Issue Date, the Company receives or raises any capital through the sale or issuance of any Equity

Securities (as defined below) or debt securities of the Company, then the Company shall utilize all of such capital raised (the “Proceeds”),

to repay the then-unrepaid Indebtedness pursuant to this Note and all amounts then due and payable pursuant to the other Offering Notes

at such time (collectively, the “Offering Indebtedness”), with such Proceeds being apportioned pro rata to the repayment

of this Note and the other Offering Notes based on the respective portion of the Offering Indebtedness then due and payable with respect

to this Note and the other Offering Notes, in each case without any further action or demand of either of the Parties, with such repayment

to be made on the first Business Day following the receipt by the Company of the Proceeds. By way of example and not limitation, in the

event that the Proceeds are $20,000, the Indebtedness hereunder is $2,000, and the amounts owed under the other Offering Notes total

$8,000, then $4,000 of the Proceeds shall be used to repay the Indebtedness hereunder and $16,000 of the Proceeds shall be used to repay

the amounts owed pursuant to the other Offering Notes. For purposes herein, “Equity Security” means (i) any capital stock

or similar security of the Company, (ii) any security of the Company convertible into or exchangeable for any security described in clause

(i), (iii) any option, warrant, or other right issued by the Company to purchase or otherwise acquire any security described in clauses

(i) or (ii), and (iv) any “equity security” within the meaning of the Securities Exchange Act of 1934, as amended.

(d) The

Company may, at its sole option, elect to prepay all or any part of the Indebtedness at any time, without penalty.

(e) To

the extent not earlier paid, all Indebtedness shall be due and payable on the Maturity Date.

(f) In

the event that any amount due hereunder is not paid as and when due, such amounts shall accrue interest at the rate of 20% per year,

simple interest, non-compounding, until paid.

Section

3. Events of Default.

(a) The

Holder may elect to declare an “Event of Default” if any of the following conditions or events shall occur and be continuing:

| (i) | the

Company fails to pay the then-outstanding Indebtedness on any date any such amounts become

due and payable, and any such failure is not cured within three Business Days of written

notice thereof by Holder; |

| (ii) | the

Company shall (i) apply for or consent to the appointment of, or the taking of possession

by, a receiver, custodian, trustee or liquidator; (ii) make a general assignment for the

benefit of the Company’s creditors; or (iii) commence a voluntary case under the U.S.

Bankruptcy Code as now and hereafter in effect, or any successor statute; |

| (iii) | a

proceeding or case shall be commenced, without the application or consent of the Company,

in any court of competent jurisdiction, seeking (1) liquidation, reorganization or other

relief with respect to it or its assets or the composition or readjustment of its debts,

or (2) the appointment of a trustee, receiver, custodian, liquidator or the like of any substantial

part of its assets, and, in each case, such proceedings or case shall continue undismissed,

or an order, judgment or decree approving or ordering any of the foregoing shall be entered

and continue unstayed and in effect, for a period of 60 days, if in the United States, or

90 days, if outside of the United States; or an order for relief against the Company shall

be entered in an involuntary case under any bankruptcy, insolvency, composition, readjustment

of debt, liquidation of assets or similar Law of any jurisdiction; or |

| (iv) | a

breach of or default by the Company of any of the terms and provisions of this Note which

has not been cured within 5 days of written notice therefore from the Holder to the Company. |

(b) Consequences

of Events of Default. If an Event of Default has occurred and is continuing (i) the Holder may, by notice to the Company, declare

all or any portion of the then outstanding Indebtedness due and payable, and the Note shall thereupon become, immediately due and payable

in full and in cash; (ii) the Holder shall have the right to pursue any other remedies that the Holder may have under applicable law

and/or in equity; (iii) the Holder shall have the right to pursue any other remedies that the Holder may have in or under the Buyer’s

Security Interest (such term is used herein as it is defined in the Agreement) if applicable; (iv) the entire unpaid and outstanding

Principal Amount together with accrued interest thereon, shall bear interest at an interest rate equal to twenty percent (20%) per annum,

compounded annually; and/or (v) in the event that the Holder incurs expenses in the enforcement of its rights hereunder, including but

not limited to attorneys’ fees, then the Company shall immediately reimburse the Holder the reasonable costs thereof.

Section

4. Miscellaneous.

(a) Notices.

Any notice or other communications required or permitted hereunder shall be in writing and shall be given in accordance with the terms

of the Agreement.

(b) Absolute

Obligation. Except as expressly provided herein, no provision of this Note shall alter or impair the obligation of the Company, which

is absolute and unconditional, to pay principal and damages, as applicable, on this Note at the time, place, and rate, and in the coin

or currency, herein prescribed.

(c) Lost

or Mutilated Note. If this Note shall be mutilated, lost, stolen or destroyed, the Company shall execute and deliver, in exchange

and substitution for and upon cancellation of a mutilated Note, or in lieu of or in substitution for a lost, stolen or destroyed Note,

a new Note so mutilated, lost, stolen or destroyed, but only upon receipt of evidence of such loss, theft or destruction of this Note,

and of the ownership hereof reasonably satisfactory to the Company.

(d) Governing

Law. All questions concerning the construction, validity, enforcement and interpretation of this Note, including, without limitation,

tort claims, statutory claims and contract claims, shall be interpreted, construed, governed and enforced under and in accordance with

the substantive and procedural Laws of the State of Florida in each case as in effect from time to time and as the same may be amended

from time to time, and as applied to agreements performed wholly within the State of Florida. Each Party agrees that all legal proceedings

concerning the interpretation, enforcement and defense of the transactions contemplated by this Note (whether brought against a Party

or its respective Affiliates, directors, officers, shareholders, employees or agents) shall be commenced in the state and federal courts

sitting in Palm Beach County, Florida (the “Selected Courts”). Each Party hereby irrevocably submits to the exclusive jurisdiction

of the Selected Courts for the adjudication of any dispute hereunder or in connection herewith or with any transaction contemplated hereby

or discussed herein (including with respect to the enforcement of any of this Note), and hereby irrevocably waives, and agrees not to

assert in any suit, action or proceeding, any claim that it is not personally subject to the jurisdiction of such Selected Courts, or

such Selected Courts are improper or inconvenient venue for such proceeding. Each Party hereby irrevocably waives personal service of

process and consents to process being served in any such suit, action or proceeding by mailing a copy thereof via registered or certified

mail or overnight delivery (with evidence of delivery) to such Party at the address in effect for notices to it under this Note and agrees

that such service shall constitute good and sufficient service of process and notice thereof. Nothing contained herein shall be deemed

to limit in any way any right to serve process in any other manner permitted by applicable law. If any Party shall commence an action

or proceeding to enforce any provisions of this Note, then the prevailing Party in such action or proceeding shall be reimbursed by the

other Party for its attorneys’ fees and other costs and expenses incurred in the investigation, preparation and prosecution of

such action or proceeding.

(e) Waiver

of Jury Trial. EACH OF THE COMPANY AND THE HOLDER HEREBY IRREVOCABLY WAIVES ANY AND ALL RIGHT TO TRIAL BY JURY IN ANY LEGAL PROCEEDING

ARISING OUT OF OR RELATING TO THIS NOTE. EACH OF THE COMPANY AND THE HOLDER CERTIFIES AND ACKNOWLEDGES THAT (A) NO REPRESENTATIVE, AGENT

OR ATTORNEY OF THE HOLDER HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT THE HOLDER WOULD NOT, IN THE EVENT OF LITIGATION, ABIDE BY THE

FOREGOING WAIVER, (B) EACH OF THE COMPANY AND THE HOLDER UNDERSTANDS AND HAS CONSIDERED THE IMPLICATIONS OF THIS WAIVER, (C) EACH OF

THE COMPANY AND THE HOLDER MAKES THIS WAIVER VOLUNTARILY, AND (D) EACH OF THE COMPANY AND THE HOLDER HAS ENTERED INTO THIS NOTE FREELY

AND FULLY UNDERSTANDS THE WAIVER IN THIS Section 4(e).

(f) Waiver.

Any waiver by the Company or Holder of a breach of any provision of this Note shall not operate as or be construed to be a waiver of

any other breach of such provision or of any breach of any other provision of this Note or a waiver by any other Holders. The failure

of the Company or Holder to insist upon strict adherence to any term of this Note on one or more occasions shall not be considered a

waiver or deprive that Party (or any other Holder) of the right thereafter to insist upon strict adherence to that term or any other

term of this Note on any other occasion. Any waiver by the Company or Holder must be in writing.

(g) Severability.

If any provision of this Note is invalid, illegal or unenforceable, the balance of this Note shall remain in effect, and if any provision

is inapplicable to any Person or circumstance, it shall nevertheless remain applicable to all other Persons and circumstances. If it

shall be found that any amount deemed interest due hereunder violates the applicable law governing usury, the applicable rate of interest

due hereunder shall automatically be lowered to equal the maximum rate of interest permitted under applicable law.

(h) Next

Business Day. Whenever any payment or other obligation hereunder shall be due on a day other than a Business Day, such payment shall

be made on the next succeeding Business Day.

(i) Entire

Agreement. This Note (including any recitals hereto) and the Agreement set forth the entire understanding of the Parties with respect

to the subject matter hereof, and shall not be modified or affected by any offer, proposal, statement or representation, oral or written,

made by or for any party in connection with the negotiation of the terms hereof, and may be modified only by instruments signed by both

Parties.

(j) Assignment.

No Party shall have any power or any right to assign or transfer, in whole or in part, this Note, or any of its rights or any of its

obligations hereunder, including, without limitation, any right to pursue any claim for damages pursuant to this Note or the transactions

contemplated herein, or to pursue any claim for any breach or default of this Note, or any right arising from the purported assignor’s

due performance of its obligations hereunder, including by merger, consolidation, operation of law, or otherwise, without the prior written

consent of the other Party and any such purported assignment in contravention of the provisions herein shall be null and void and of

no force or effect. This Note shall be binding upon and shall inure to the benefit of the Parties and their respective successors and

permitted assigns.

(k) Headings.

The headings contained herein are for convenience only, do not constitute a part of this Note and shall not be deemed to limit or affect

any of the provisions hereof.

(l) Currency. All dollar amounts are in U.S. dollars.

(m) Counterparts.

This Note may be executed in multiple counterparts, each of which shall be deemed an original and all of which taken together shall be

but a single instrument. Counterparts may be delivered via facsimile, electronic mail (including pdf or any electronic signature complying

with the U.S. federal ESIGN Act of 2000, e.g., www.docusign.com) or other transmission method and any counterpart so delivered shall

be deemed to have been duly and validly delivered and be valid and effective for all purposes.

[SIGNATURE

PAGE FOLLOWS]

IN

WITNESS WHEREOF, the undersigned have executed this Note as of the Issue Date.

| |

OpenLocker

Holdings, Inc. |

| |

|

|

| |

By: |

|

| |

Name: |

|

| |

Title: |

|

| Agreed and accepted: |

|

| |

|

|

| Holder:

|

|

|

| |

|

|

| By: |

|

|

| |

|

|

| Name:

|

|

|

| |

|

|

| Title: |

|

|

|

(if

applicable) |

|

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

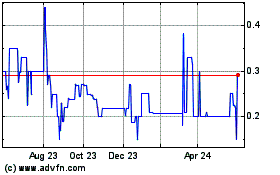

OpenLocker (PK) (USOTC:OLKR)

Historical Stock Chart

From Jan 2025 to Feb 2025

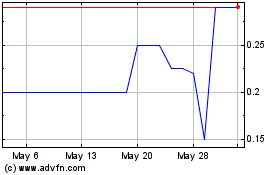

OpenLocker (PK) (USOTC:OLKR)

Historical Stock Chart

From Feb 2024 to Feb 2025