true

FY

0001549631

0001549631

2023-01-01

2023-12-31

0001549631

2024-04-01

0001549631

2023-12-31

0001549631

2022-12-31

0001549631

us-gaap:NonrelatedPartyMember

2023-12-31

0001549631

us-gaap:NonrelatedPartyMember

2022-12-31

0001549631

us-gaap:RelatedPartyMember

2023-12-31

0001549631

us-gaap:RelatedPartyMember

2022-12-31

0001549631

QURT:QuartaRadIncMember

2023-01-01

2023-12-31

0001549631

QURT:QuartaRadIncMember

2022-01-01

2022-12-31

0001549631

QURT:SellavirIncMember

2023-01-01

2023-12-31

0001549631

QURT:SellavirIncMember

2022-01-01

2022-12-31

0001549631

2022-01-01

2022-12-31

0001549631

us-gaap:CommonStockMember

2021-12-31

0001549631

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001549631

us-gaap:RetainedEarningsMember

2021-12-31

0001549631

2021-12-31

0001549631

us-gaap:CommonStockMember

2022-12-31

0001549631

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001549631

us-gaap:RetainedEarningsMember

2022-12-31

0001549631

us-gaap:CommonStockMember

2022-01-01

2022-12-31

0001549631

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-12-31

0001549631

us-gaap:RetainedEarningsMember

2022-01-01

2022-12-31

0001549631

us-gaap:CommonStockMember

2023-01-01

2023-12-31

0001549631

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-12-31

0001549631

us-gaap:RetainedEarningsMember

2023-01-01

2023-12-31

0001549631

us-gaap:CommonStockMember

2023-12-31

0001549631

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001549631

us-gaap:RetainedEarningsMember

2023-12-31

0001549631

QURT:AmendedAndRestatedMember

srt:MaximumMember

2012-07-02

0001549631

QURT:AmendedAndRestatedMember

2012-07-02

0001549631

QURT:ThirdPartyMember

2023-12-31

0001549631

us-gaap:AccountsReceivableMember

us-gaap:CreditConcentrationRiskMember

QURT:TwoSellersMember

2023-01-01

2023-12-31

0001549631

us-gaap:AccountsReceivableMember

us-gaap:CreditConcentrationRiskMember

QURT:TwoSellersMember

2022-01-01

2022-12-31

0001549631

us-gaap:CostOfGoodsTotalMember

us-gaap:SupplierConcentrationRiskMember

QURT:ThirdPartyMember

2023-01-01

2023-12-31

0001549631

us-gaap:CostOfGoodsTotalMember

us-gaap:SupplierConcentrationRiskMember

QURT:TwoRelatedPartyVendorsMember

2022-01-01

2022-12-31

0001549631

QURT:SellavirIncMember

us-gaap:RelatedPartyMember

2022-01-01

2022-12-31

0001549631

QURT:SellavirIncMember

us-gaap:RelatedPartyMember

2022-12-31

0001549631

QURT:SellavirIncMember

us-gaap:RelatedPartyMember

2023-12-31

0001549631

us-gaap:FairValueInputsLevel1Member

2023-12-31

0001549631

us-gaap:FairValueInputsLevel2Member

2023-12-31

0001549631

us-gaap:FairValueInputsLevel3Member

2023-12-31

0001549631

us-gaap:FairValueInputsLevel1Member

2022-12-31

0001549631

us-gaap:FairValueInputsLevel2Member

2022-12-31

0001549631

us-gaap:FairValueInputsLevel3Member

2022-12-31

0001549631

QURT:SellavirMember

2023-03-31

0001549631

QURT:ThaiCorporationMember

2023-03-31

0001549631

QURT:ThaiCorporationMember

2023-03-01

2023-03-31

0001549631

QURT:ThaiCorporationMember

us-gaap:SubsequentEventMember

2024-01-31

2024-01-31

0001549631

QURT:SellavirMember

2023-12-31

0001549631

QURT:SellavirMember

2023-01-01

2023-12-31

0001549631

QURT:ThaiCorporationMember

2023-12-31

0001549631

QURT:ThaiCorporationMember

2023-05-31

0001549631

QURT:NotesReceivableOneMember

2023-12-31

0001549631

QURT:NotesReceivableTwoMember

2023-12-31

0001549631

QURT:StarSystemsCorporationMember

2023-01-01

2023-12-31

0001549631

QURT:StarSystemsCorporationMember

2022-01-01

2022-12-31

0001549631

QURT:QuartaRadLtdMember

2023-01-01

2023-12-31

0001549631

QURT:QuartaRadLtdMember

2022-01-01

2022-12-31

0001549631

QURT:RussianAffiliateMember

us-gaap:SoftwareDevelopmentMember

2017-07-31

0001549631

us-gaap:RelatedPartyMember

QURT:RussianAffliateMember

2023-12-31

0001549631

us-gaap:RelatedPartyMember

QURT:RussianAffliateMember

2022-12-31

0001549631

us-gaap:MajorityShareholderMember

srt:ChiefExecutiveOfficerMember

2023-01-01

2023-12-31

0001549631

us-gaap:MajorityShareholderMember

srt:ChiefExecutiveOfficerMember

2022-01-01

2022-12-31

0001549631

us-gaap:MajorityShareholderMember

srt:ChiefExecutiveOfficerMember

2023-12-31

0001549631

us-gaap:MajorityShareholderMember

srt:ChiefExecutiveOfficerMember

2022-12-31

0001549631

QURT:QuartaRadLtdMember

2023-01-01

2023-12-31

0001549631

QURT:SellavirIncMember

2023-01-01

2023-12-31

0001549631

QURT:QuartaRadLtdMember

2022-01-01

2022-12-31

0001549631

QURT:SellavirIncMember

2022-01-01

2022-12-31

0001549631

QURT:QuartaRadLtdMember

2023-12-31

0001549631

QURT:QuartaRadLtdMember

2022-12-31

0001549631

QURT:SellavirIncMember

2023-12-31

0001549631

QURT:SellavirIncMember

2022-12-31

0001549631

2019-12-31

0001549631

us-gaap:AccountsPayableAndAccruedLiabilitiesMember

2023-12-31

0001549631

us-gaap:AccountsPayableAndAccruedLiabilitiesMember

2022-12-31

0001549631

QURT:ThaiCorporationMember

us-gaap:SubsequentEventMember

srt:MinimumMember

2024-01-31

2024-01-31

0001549631

QURT:ThaiCorporationMember

us-gaap:SubsequentEventMember

srt:MaximumMember

2024-01-31

2024-01-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

QURT:Segment

QURT:Integer

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K/A

(Amendment No. 1)

☒

ANNUAL REPORT under SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the fiscal year ended: December 31, 2023

☐

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from ______ to ______

Commission

File No. 000-55964

Quarta-Rad,

Inc.

(Exact

Name of Registrant as Specified in its Charter)

| Delaware |

|

45-4232089 |

(State

or other Jurisdiction of

Incorporation

or Organization) |

|

(I.R.S.

Employer

Identification

No.) |

1201

N. Orange St., Suite 700, Wilmington, DE 19801

(Address

of principal executive offices) (Zip Code)

Registrant’s

telephone number, including area code: (732) 887-8511

| Common

Stock, $0.0001 par value per share |

|

None |

| (Title

of Each Class) |

|

(Name

of Each Exchange on Which Registered) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol |

|

Name

of Each Exchange on Which Registered |

| Common

Stock, par value $0.0001 per share |

|

QURT |

|

OTC

|

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes ☐ No☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject

to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data

File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding

12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐ [check

“yes” if statement is accurate.]

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S−K (§229.405 of this chapter) is not

contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10−K or any amendment to this Form 10−K. ☒

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large

accelerated filer ☐ |

Accelerated

filer ☐ |

| |

Non-accelerated

filer ☐ |

Smaller

reporting company ☒ |

| |

|

Emerging

Growth Company ☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation

received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The

aggregate market value of the voting stock held by non-affiliates of the registrant as of April 1,2024, based upon the last sale price

of the common stock of such date: $3,958,717.

The

number of shares of the registrant’s common stock issued and outstanding as of April 1, 2024, was 15,659,483.

table

of contents

EXPLANATORY NOTE

Quarta-Rad,

Inc. (the “Company”) is filing this Amendment No. 1 on Form 10-K/A for the year ended December

31, 2023, to amend the Annual Report on Form 10-K that was originally filed on April 1, 2024 (the

“Original 10-K”) to include Item 1C. Cybersecurity. No other changes have been made to the Original Report, and this amended

Annual Report is presented as of the filing date of the Original Report and does not reflect events occurring after that date or modify

or update disclosures in any way other than as described herein.

CAUTIONARY

NOTE ABOUT FORWARD-LOOKING STATEMENTS

The

information contained in this Report includes some statements that are not purely historical and that are “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”), and as such, may involve risks and uncertainties. These

forward-looking statements relate to, among other things, expectations of the business environment in which we operate, perceived opportunities

in the market and statements regarding our mission and vision. In addition, any statements that refer to projections, forecasts or other

characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. You can generally

identify forward-looking statements as statements containing the words “anticipates,” “believes,” “continue,”

“could,” “estimates,” “expects,” “intends,” “may,” “might,” “plans,”

“possible,” “potential,” “predicts,” “projects,” “seeks,” “should,”

“will,” “would” and similar expressions, or the negatives of such terms, but the absence of these words does

not mean that a statement is not forward-looking.

Forward-looking

statements involve risks and uncertainties that could cause actual results or outcomes to differ materially from those expressed in the

forward-looking statements. The forward-looking statements contained herein are based on various assumptions, many of which are based,

in turn, upon further assumptions. Our expectations, beliefs and forward-looking statements are expressed in good faith on the basis

of management’s views and assumptions as of the time the statements are made, but there can be no assurance that management’s

expectations, beliefs or projections will result or be achieved or accomplished.

In

addition to other factors and matters discussed elsewhere herein, the following are important factors that, in our view, could cause

actual results to differ materially from those discussed in the forward-looking statements: technological advances, impact of competition,

dependence on key personnel and the need to attract new management, effectiveness of cost and marketing efforts, acceptances of products,

ability to expand markets and the availability of capital or other funding on terms satisfactory to us. We disclaim any obligation to

update forward-looking statements to reflect events or circumstances after the date hereof.

For

a discussion of the risks, uncertainties, and assumptions that could affect our future events, developments or results, you should carefully

review the “Risk Factors” set forth under “Item 1. Description of Business” below. Considering these risks, uncertainties

and assumptions, the future events, developments or results described by our forward-looking statements herein could turn to be materially

different from those we discuss or imply.

PART

I

Item

1. Description of Business.

Organization

We

were incorporated in the State of Delaware as a for-profit company on November 29, 2011, under the name Quatra-Rad, Inc. and our incorporator

adopted our bylaws and appointed our two directors. On February 29, 2012, we amended our Certificate of Incorporation to change our name

to Quarta-Rad, Inc. On July 16, 2012, we amended and restated its Certificate of Incorporation to increase its authorized shares of common

stock to 50,000,000, $0.0001 par value from 1,500, no par value and effected a 10,000 to 1 forward split. On February 4, 2015, we filed

a Certificate of Correction to our Certificate of Amendment to Certificate of Incorporation to correct it for inadvertently excluding

the 10,000 to 1 forward stock split, which our shareholders and directors approved on June 29, 2012. From November 29, 2011 (inception)

through May 2012, we had limited operations. Commencing in May 2012, we began sales and implemented our business plan to distribute detection

devices, including but not limited to Geiger counters, to homeowners and interested customers in North America by selling them on consignment

on behalf of a related party owned by our majority shareholder and which are purchased from a company owned by our minority shareholder.

We also purchase the products directly from the company owned by our minority shareholder and sell them to independent third party resellers.

A Geiger counter is an instrument used for measuring ionizing radiation. It detects radiation such as Beta particles, Gamma rays and

X-rays using the ionization produced in a Geiger–Müller tube, which gives its name to the instrument. We do not currently

manufacture any of the products that we sell. We intend to continue to target homebuilders and home renovation contractors for the sale

of products and resellers that market to these customers. Our business activities are now focused on expanding our Internet sales. We

have established a fiscal year end of December 31. Initially we sold the products on consignment on behalf of Star Systems Corporation,

a Japanese company owned by Victor Shvetsky, our majority shareholder, and purchase products from Quarta-Rad, Ltd., a Russian company

owned by Alexey Golovanov, our minority shareholder, which we sell to independent third party resellers. Commencing in 2013, we began

selling the products directly to third parties through Internet sales.

On

November 29, 2011, we issued 1,500 pre-split shares of our no par value common stock, valued at $1 per share, to our 2 founders, which

includes 1,200 pre-split common shares to our chief executive officer, Victor Shvetsky and 300 pre-split common shares to our president,

Alexey Golovanov in exchange for organizational services incurred in our formation valued at $1,200 and $300, respectively. We believe

that our present capital is sufficient to cover our monthly burn rate for the next 12 months. However, we believe that we will require

between $70,000 to $400,000 in cash in to accomplish the goals set out in our plan of operation (See Item 7). To the extent we are unable

to accomplish our goals with the proceeds from the issuance of our common stock, then we intend to use our existing cash or raise additional

capital from investors through the sale of our common stock or from loans or advances from our majority shareholder. Our majority shareholder

has orally agreed to advance us the funds without interest and has agreed to defer repayment until we are able to repay him. In the fourth

quarter of 2016, we raised $65,230 from 34 investors through the issuance of our common stock pursuant to our registration statement.

No additional funds were raised in 2022 or 2023.

During

April 2020, we acquired Quarta-Rad USA, Inc., a Delaware corporation, as a wholly owned subsidiary. There was no consideration paid for

the shares. The purpose of the acquisition is to separate the sales of certain products in separate entities. There was no activity,

assets or liabilities in the subsidiary through December 31, 2023.

During

December 2020, we acquired Sellavir, Inc, a Delaware corporation, under common control, as a wholly owned subsidiary We acquired the

company in exchange for 333,333 shares on common stock. The value of the stock on the date of issue was approximately $170,000. Sellavir

is a video analytics company whose platform empowers organizations to decode videos to develop creative marketing strategies and analysis

through advanced and proprietary technologies.

Our

principal business, executive and registered statutory office is located at 1201 N. Orange St., Suite 700, Wilmington, DE 19801-1186

and our telephone number is (302) 887-9916 and email contact is info@quartarad.com. Our URL address is www.quartarad.com.

Business

We

commenced operations in May 2012, by selling products on consignment from a company owned by our majority shareholder. In 2012, we purchased

products from a company owned by our minority shareholder and sold them to a company owned by our majority shareholder and to third party

resellers. We believe the terms of those sales were arms-length. In 2012, we began use of the Internet as well as the services of an

independent sales representative to market the products to homeowners and interested customers in North America and the majority of our

sales were from unrelated third parties. We market the products to homebuilders and home renovation contractors. We have had limited

operations and have limited financial resources. In 2011, our operations were devoted primarily to start-up, development and operational

activities as well as related party and third party sales, which included:

| |

1. |

Formation

of the Company; |

| |

2. |

Development

of our business plan; |

| |

3. |

Evaluating

various detection devices; |

| |

4. |

Research

on marketing channels/strategies for our detection devices and the industry; |

| |

5. |

Secured

our website domain www.quartarad.com and beginning the development of our initial online website; and |

| |

6. |

Research

on future products to distribute. |

| |

7. |

Consignment

sales on behalf of a related party. |

| |

8. |

Sales

to third party resellers. |

In

May 2012, we commenced our business operations by selling products on consignment from a related party company and developing our distribution

network. In June 2012, we began to utilize our website to market the products we sell on consignment to our potential customers. We also

began implementing our business plan by promoting these products for sale on various websites. We also engaged independent, third party

distributors to sell the products. In 2013, increased our Internet presence and increased our sales whereby the majority of our sales

were from unrelated third parties. From 2014 to the present, we have continued to sell the products through the Internet to unrelated

third parties. In October 2018, our United Kingdom retail platform was suspended due to certain UK restrictions. We are in the process

of becoming compliant in order to lift these restrictions and exploring and testing new partners for EU distribution. We have reserved

$100,000 on our balance sheet as accrued expenses in connection with this matter.

The

Company paid $41,822 during 2020, $35,680 during 2021, and $3,783 during 2022 towards the estimated liability, During April 2023 a final

payment was made of $3,783 and the remaining $18,715 reserve reversed in 2023. There was $ZERO and $22,498 due on December 31, 2023 and

2022 respectively.

We

believe that our principal source of revenue will continue through Sellavir as Quarta-Rad wind down the Internet Sales and sales to resellers

for the following products;

Radiation

Detection Equipment

RADEX

RD1503 – basic model of a hand-held radiation detector for the consumer market.

RADEX

RD1706 – enhanced model of a hand-held radiation detector; additional radiation counter provides for a more accurate results (confirmed

by JQA – Japan Quality Assurance organization), vibration alarm and several additional functions improve on the RD1503 design specifications.

RADEX

RD1008 – high-end radiation detection device that provides readings for Gamma- and Beta- radiation values separately. Equivalent

devices from other manufacturers cost 5-10 times more.

RADEX

RD1212 – new model of hand-held radiation detector for the consumer market. It includes all the functionality of RD1503 model as

well as ability to store measured values in memory for later transfer to PC. This device comes with newly developed software, RadexRead,

developed by Quarta-Rad Inc to further enhances the RADEX family of Geiger counters by combining the power of PC and Internet, allowing

the user to visualize and share their measurements with other RADEX consumers.

RADEX

RD1212-BT – upgraded version of RD1212 with Bluetooth, now capable of linking to smartphones or tablets to transfer data in real

time. Also measures atmospheric pressure and air temperature. Special Android/iOS application for smartphones can be used alongside with

this product.

RADEX

RD ONE – compact personal radiation detector, smaller and less expensive than any of the other models. Besides the size, the device

has additional features such as: counts accumulative dose, can display measurements in CPMs and links via USB cord to PC for data transfer

and analysis. Other standard features include audio/vibration alarm and adjustable alarm thresholds like on all other models. New analytical

software was created to chart and analyze received data.

Radon

Detection Equipment

RADEX

M107 – simple Radon gas detector that provides visual/audio alarm when a certain (or legal) threshold is reached.

EMI

Detection Equipment

RADEX

EMI50 – hand-held device that provides real-time measuring of Electric Field Strength (in kiloVolt/meter) and Electro Magnetic

Field (in microTesla).

Light

and brightness Detection Equipment

RADEX

Lupin – Light Meter, Pulse meter and Lucimeter. A hand-held device that measures illumination, brightness and flicker ratio of

LED screens, any type of light bulbs or monitors at work or at home. RadexLight Software allows PC connection and data transfer. Spectral

sensitivity is identical to a human eye, which separates this model from the competition.

Although

we have commenced our marketing sales campaign with our own resources and are selling products through online retailers and through resellers,

we believe that we need additional capital to increase our sales and expand our marketing program. Our ability to achieve and maintain

profitability and positive cash flow is dependent upon our ability to cost effectively purchase and sell the products and market them

through the Internet and through distributors. We intend to rely on our Chairman and President’s relationships in the industry

to supply us with products and introduce us to resellers. We also intend to market our website to the home renovation industry to solicit

orders for the sale of products. There can be no guarantee or assurance that our Chairman or President and/or our website will enable

us to purchase products on attractive terms that will allow us to resale them to independent third party distributors.

No

assurance can be given that the products we purchase will be sold to resellers and, if sold to them, will return an investment or make

a profit. To achieve the goal of purchasing products on favorable terms, we plan to be selective in our choice of suppliers and work

with our shareholders’ companies as well as other cost-effective suppliers.

Major

advantages that can be capitalized on immediately are:

| |

● |

existing

brand recognition of RADEX name; |

| |

● |

existing

product line up that can be sold now; |

| |

● |

access

to device library that are in the prototyping stage for a quicker push into production and sales phases; |

| |

● |

access

to Quarta-Rad, Ltd. engineers and its proprietary tech library that would allow for quick prototyping and manufacture of devices

based on reports from the field sales-force; and |

| |

● |

Exclusive

distribution rights for the RADEX brand in the United States, Canada and the European Union |

Quarta-Rad,

Ltd.’s proprietary tech library is combination of source code, database, firmware and hardware used for measuring and displaying

radiation measurements. The source code is for the: (i) RD1212 web program; (ii) RD1212 BT application for Android and iPhone; (iii)

Web RadexRead; and (iv) database of radiation measurements

At

the end of 2023, we discontinued the RADEX series, thereby eliminating our reliance on Quarta-Rad Ltd, the Russian producer, including

any dependency on their firmware. We maintain ownership of the RadexRead component’s source code and are investigating the potential

for its compatibility with the SMADEV series. Victor Shvetsky remains responsible for the ongoing maintenance of this product’s

source code.

Sellavir

Consulting:

We

expanded our operations through the acquisition of Sellavir Inc in December 2020. Sellavir is an AI company that leverages its knowledge

in neural networks to provide customized AI and development services to our clients. Our initial services were focused on offering customized

solutions for image processing.. Quarta-Rad had initially acquired the company to:

-

leverage Sellavir capabilities to combine it with its Radex series to offer AI-enhanced radiation detection capabilities

-

expand its scope outside the radiation measurement

Beginning

in 2024, Sellavir will strategically focus on harnessing its advanced AI capabilities and extensive experience to innovate within the

call center industry. The industry’s evolving landscape, particularly the shift from traditional on-premise solutions to cloud-hosted

platforms, presents a unique opportunity for Sellavir to introduce a suite of AI-driven products. These products are designed to process

live video, audio, as well as meta-data related to the call and agent performance, thereby significantly enhancing the operational efficiency

of call centers.

Our

target market includes users of prominent platforms such as Genesys and Nice. By developing sophisticated tools that integrate seamlessly

with these platforms, we aim to simplify the complex tasks faced by call center operators. Our solutions will not only expedite problem

resolution for callers but also refine the overall user experience. By proactively detecting potential issues and either automatically

resolving them or equipping agents with the necessary information for resolution, Sellavir intends to revolutionize the call center industry’s

approach to customer service and support. This strategic direction underscores our commitment to innovation and excellence in the realm

of AI technology, setting a new standard for operational efficiency and customer satisfaction in call centers.

Financing

Strategy

Our

ability to increase our inventory will depend on additional outside financing, advances from our majority shareholder and reinvesting

our profits. Primary responsibility for the overall inventory planning and management will rest with our management. For each detection

device product, we plan to purchase, management will need to assess the market and our financing needs to acquire product at cost-effective

prices. All decisions will be subject to budgetary restrictions and our business control. We cannot provide any guarantee that we will

be able to ever purchase product on cost-effect terms or employ independent distributors to effectively sell the products.

Once

we determine our inventory needs, there are various methods of obtaining the funds needed to complete the purchase of the detection devices.

Examples of financing alternatives include the assignment of our rights to purchase order financing. Alternatively, we may form a limited

liability company or partnership where we will be the managing member or the general partner and raise funds to finance inventory. We

may also obtain favorable pre-sales commitments from various customers such as home restoration contractors, distributors and developers.

These various techniques, which are commonly used in the industry, can be combined to finance our inventory without a major bank financing.

Distribution

Arrangements

Effective

distribution is critical to the economic success of the detection devices, particularly when made by a small company without sufficient

marketing resources. We have negotiated a few independent distribution agreements.

We

intend to continue to distribute the products in the United States through existing independent distributors and the Internet. Our primary

emphasis will be on marketing to homebuilders, home renovation contractors and general contractors. In addition, we intend to also target

direct consumers via the Internet through online retailers and through national and regional retailers.

To

the extent that we may engage in distribution of the products in foreign markets, we will be subject to all of the additional risks of

doing business abroad including, but not limited to, government censorship, currency fluctuations, exchange controls, greater risk of

“piracy” copying, and licensing or qualification fees.

It

is not possible to predict, with certainty, the nature of the distribution arrangements, if any, that we may secure for the detection

devices we sell.

We

believe that the catastrophic events such as the March 11, 2011 nuclear accident in Japan will drive consumers and the market to radiation

detection devices and other detection devices will either be in demand from the construction community and will be cost effective for

the consumer and the industry professional.

We

believe that effective Internet advertising along with participation in trade shows is the quickest and most cost effective method to

let consumers know about the products. Additionally, large resellers and distributors will require promotional packages that we will

need to develop and produce.

Competition

The

detection device industry is highly competitive. We compete with a variety of companies, many of which have greater financial and other

resources than us, or are subsidiaries or divisions of larger organizations. In particular, the industry is characterized by a small

number of large, dominant organizations that perform this service, such as United Technologies Corporation, Radiation Alert, Osun Technologies,

Lutron, General Tools, Mazur Instruments, First Alert, Inc./BRK Brands, Inc., which is wholly owned by Sunbeam Corporation, as well as

many companies that have greater financial and other resources than us.

The

major competitive factors in our business are the timeliness and quality of customer service, the quality of finished products and price.

Our ability to compete effectively in providing customer service and quality finished products depends primarily on our manufacturers’

standards and the level of training of our future staff, the utilization of computer software and equipment and the ability to deliver

the Products we sell. We believe we will compete effectively in all of these areas.

Many

of our competitors have substantially greater financial, technical, managerial, marketing and other resources than we do and they may

compete more effectively than we can. If our competitors offer detection devices at lower prices than we do, we may have to lower the

prices we charge, which will adversely affect our results of operations. Furthermore, many of our competitors are able to obtain more

experienced employees than we can.

Intellectual

Property Rights

We

do not currently have any intellectual property rights. In the summer of 2013, Victor Shvetsky, our majority shareholder and director

developed a software program called RadexRead, which Quarta-Rad, Ltd is using in the manufacture of its RD1212 products that we purchase

as party of our inventory. We are not incurring any additional costs or benefits from Mr. Shvetsky’ s ownership of this software

and, there are no current plans for Mr. Shvetsky to sell the software to the Company or contribute it for additional shares of our common

stock.

Through

Sellavir, we are in the process of obtaining patents.

Status

Of Any Publicity Announced New Products and Services

In

late 2013, we began distributing a new product named RD1212, which we believe has a sleek new design. It has the ability to store measurements

in internal memory and transfer this data to a personal computer (“PC”). The RadexRead software utilized in this device allows

users to view values retrieved from the Geiger counter, map them on Google Maps, and share their data with other Radex users.

We

estimate that the cost for us to purchase software from an independent party that performs the same functions as RadexRead would be approximately

$30,000. This software allows us to retrieve data from the RD1212 device to a Windows PC, analyze it, and geo-tag the values and place

them on Google Map. The software offers an interactive view of the world map with readings other Radex RD1212 users can, at their option,

submit.

We

believe RadexRead brings numerous advantages to us over our competition, specifically:

| |

● |

RadexRead

distinguishes the products we sell from other Geiger counters in its price range by providing free visualization software; |

| |

● |

RadexRead,

to the best of our knowledge, is the only software for Geiger counters in the RD1212 price range that allows users to mark radiation

values collected by Geiger counters and place them on a map; |

| |

● |

RadexRead

is the only software in this Geiger counter class that allows users to share their data with each other over the Internet; |

| |

● |

RadexRead

is designed for use by users with little or no scientific background, making it simple and fun to collect, visualize and share radiation

measurements with the community; and |

| |

● |

RadexRead

allows us to further increase its visibility through collaboration with Safecast, a worldwide volunteer organization that collects

radiation data. RadexRead gives user an option of saving data online and submit its radiation and geographical data shared with other

users to Safecast monitoring network. |

We

believe RadexRead has increased RADEX’s appeal over our competition and helped RD1212 become one of our top selling Geiger counters,

despite the product’s manufacturer’s suggested retail price being almost forty percent higher than the previous top-selling

device, the low-cost RD1503.

At

the end of 2023, we discontinued the RADEX series, thereby eliminating our reliance on Quarta-Rad Ltd, the Russian producer, including

any dependency on their firmware. We maintain ownership of the RadexRead component’s source code and are investigating the potential

for its compatibility with the SMADEV series. Victor Shvetsky remains responsible for the ongoing maintenance of this product’s

source code.

Our

Website

Our

website is located at www.quartarad.com and provides a description of our company, the products we sell and our contact information

including our address, telephone number and e-mail address.

Trademarks

And Patents

We

do not have any registered trademarks or patents.

Need

for any Government Approval of Principal Products or Services

We

are also subject to federal, state and local laws and regulations generally applied to businesses, such as payroll taxes on the state

and federal levels. Sales of the products we sell on consignment or sell to independent, third party distributors and services we may

provide internationally are subject to U.S. and local government regulations and procurement policies and practices including regulations

relating to import-export control. Violations of export control rules could result in suspension of our ability to export items from

one or more businesses or the entire corporation. Depending on the scope of the suspension, this could have a material effect on our

ability to perform certain international contracts. We believe that we are in conformity with all applicable laws in the states we conduct

business and the United States.

Research

and Development

From

our inception through September 30, 2014, we have not spent any money on research and development activities. In the fourth quarter of

2014, we began spending money on research and development for a new software program that we may license to others and $155,000 to our

related party supplier for the development of a new product for us to sell. In 2022 and 2023, we spent $-0- and -0-, respectively, on

research and development with our related party. We have paid an independent contractor to improve and upgrade our website and Victor

Shvetsky, our majority shareholder and director, has developed, at no cost to us, a software program called RadexRead, which was used

in the manufacture of our RD1212 products.In 2018, we also entered into an agreement with our related party developer for $180,000 to

develop software for the device RADEX AQ.

Employees

Presently,

we do not have any employees other than our officers and directors who devote their time as needed to our business and expect to devote

10 hours per week.

Item

1A. Risk Factors

Not

required to disclose since we are a “smaller reporting” company.

Item

1B. Unresolved Staff Comments

None.

Item

1C. Cybersecurity

Our board of directors and senior management recognize

the critical importance of maintaining the trust and confidence of our clients, business partners and employees. Our management, led by

our Chief Executive Officer, is actively involved in oversight of our risk management efforts, and cybersecurity represents an important

component of the Company’s overall approach to enterprise risk management (“ERM”). Our cybersecurity processes and practices

are fully integrated into the Company’s ERM efforts. In general, we seek to address cybersecurity risks through a cross-functional

approach that is focused on preserving the confidentiality, security and availability of the information that we collect and store by

identifying, preventing and mitigating cybersecurity threats and effectively responding to cybersecurity incidents when they occur.

Risk Management and Strategy

As one of the critical elements of our overall ERM

approach, our cybersecurity efforts are focused on the following key areas:

| |

● |

Governance: Management oversees cybersecurity risk mitigation and reports to the board of directors any cybersecurity incidents. |

| |

● |

Collaborative Approach: We have implemented a cross-functional approach to identifying, preventing and mitigating cybersecurity threats and incidents, while also implementing controls and procedures that provide for the prompt escalation of certain cybersecurity incidents so that decisions regarding the public disclosure and reporting of such incidents can be made by management in a timely manner. |

| |

● |

Technical Safeguards: We deploy technical safeguards that are designed to protect our information systems from cybersecurity threats, including firewalls, intrusion prevention and detection systems, anti-virus and anti-malware functionality and access controls, which are evaluated and improved through vulnerability assessments and cybersecurity threat intelligence . |

We have not engaged third-party service providers

to conduct evaluations of our security controls, independent audits or consulting on best practices to address new challenges.

While we have not experienced any cybersecurity threats

in the past in the normal course of business, in the future, we may not be successful in preventing or mitigating a cybersecurity incident

that could have a material adverse effect on us.

Item

2. Properties

We

hold no real property. We do not presently own any interests in real estate. Our executive, administrative and operating offices are

located at 1201 N. Orange St., Suite 700, Wilmington, DE 19801. We do not have a written lease with the landlord and rent space on a

month-to-month basis at the rate of $30 per month.

Item

3. Legal Proceedings

We

are not involved in any legal proceedings nor are we aware of any pending or threatened litigation against us. None of our officers or

director is a party to any legal proceeding or litigation. None of our officers or director has been convicted of a felony or misdemeanor

relating to securities or performance in corporate office.

Item

4. Mine Safety Disclosures

Not

applicable.

PART

II

Item

5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

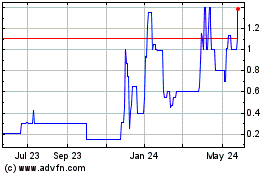

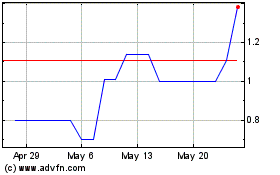

Beginning

in February 2018, our common stock is traded on the OTC Bulletin Board under the symbol “QURT.” The following table sets

forth the high and low bid information of our common stock on the OTC Bulletin Board for each quarter during the last two fiscal years,

as reported by the OTC Bulletin Board. This information reflects inter-dealer prices, without retail mark-up, mark-down or commission

and may not represent actual transactions.

| Year | |

Period | |

High Bid | | |

Low Bid | |

| 2023 | |

First Quarter | |

| 0.45 | | |

| 0.21 | |

| | |

Second Quarter | |

| 0.31 | | |

| 0.30 | |

| | |

Third Quarter | |

| 0.42 | | |

| 0.30 | |

| | |

Fourth Quarter | |

| 1.00 | | |

| 0.15 | |

| Year | |

Period | |

High Bid | | |

Low Bid | |

| 2022 | |

February and March | |

| 0.50 | | |

| 0.18 | |

| | |

Second Quarter | |

| 0.45 | | |

| 0.18 | |

| | |

Third Quarter | |

| 0.45 | | |

| 0.10 | |

| | |

Fourth Quarter | |

| 0.35 | | |

| 0.23 | |

Common

Stock Currently Outstanding

As

of April 1, 2024, we have 15,659,483 shares of our common stock outstanding.

Holders

As

of the date of this Report, we had 39 stockholders of record of our common stock.

Dividends

We

have not declared any cash dividends on our common stock since our Date of Incorporation and do not anticipate paying any dividends in

the foreseeable future. We plan to retain future earnings, if any, for use in our business. Any decisions as to future payments of dividends

will depend on our earnings and financial position and such other facts, as our Director deems relevant.

Transfer

Agent

Globex

Stock Transfer, LLC, is our independent stock transfer agent.

Recent

Sales of Unregistered Securities

None.

Additional

Information

Copies

of our annual reports on Form 10−K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports,

are available free of charge on the Internet at www.sec.gov. All statements made in any of our filings, including all forward-looking

statements, are made as of the date of the document, in which the statement is included, and we do not assume or undertake any obligation

to update any of those statements or documents unless we are required to do so by law.

Item

6. Selected Financial Data

Not

required under Regulation S-K for “smaller reporting companies.”

Item

7. Management’s Discussion and Analysis of Financial Conditions and Results of Operations

This

Annual Report on Form 10−K contains forward-looking statements. Our actual results could differ materially from those set forth

because of general economic conditions and changes in the assumptions used in making such forward-looking statements. The following discussion

and analysis of our financial condition and results of operations should be read together with the audited consolidated financial statements

and accompanying notes and the other financial information appearing elsewhere in this Report. The analysis set forth below is provided

pursuant to applicable Securities and Exchange Commission regulations and is not intended to serve as a basis for projections of future

events. Refer also to “Risk Factors” and “Cautionary Note Regarding Forward Looking Statements” in Item 1 above.

The

following is management’s discussion and analysis of financial condition and results of operations and is provided as a supplement

to the accompanying financial statements and notes to help provide an understanding of our financial condition, results of operations

and cash flows during the periods included in the accompanying financial statements.

In

this Annual Report on Form 10-K, “Company,” “the Company,” “us,” and “our” refer to Quarta-Rad,

Inc., a Delaware corporation, unless the context requires otherwise.

We

intend the following discussion to assist in the understanding of our financial position as of December 31, 2023 and 2022 and our results

of operations for the year ended December 31, 2023 and December 31, 2022. You should refer to the Financial Statements and related Notes

in conjunction with this discussion.

Results

of Operations

General

We

were incorporated under the laws of the State of Delaware on November 29, 2011 with fiscal year end in December 31. We were formed to

distribute and sell detection devices to homeowners and interested consumers in North America. Initially, our business plan was to sell

products on consignment from Star Systems Japan, a corporation owned by our majority shareholder. We purchased these products from Quarta-Rad,

Ltd., a company owned by our minority shareholder. We also targeted direct-to-consumer sales since we believe we can distribute these

products through the Internet. We have never been party to any bankruptcy, receivership or similar proceeding, nor have we undergone

any material reclassification, merger, consolidation, purchase or sale of a significant amount of assets not in the ordinary course of

business.

As

of the date of this Form 10-K, we continue to expand our operations and expect to increase our revenues with additional working capital

by increasing our advertising and marketing. Our chief executive officer and director, Victor Shvetsky, and our director and president,

Alexey Golovanov, are our only employees. Mr. Shvetsky and Mr. Golovanov will devote at least ten hours per week to us but may increase

the number of hours as necessary. In 2012, Messrs. Shvetsky and Golovanov’s companies have been the source of commissionable consignment

sales and we did not carry any inventory. In 2013, we discontinued selling the products on consignment from our majority shareholder’s

company for a commission or consignment fee and began purchasing inventory directly from Quarta-Rad, Ltd (Russia) (“QRR”)

to sell on the Internet to direct consumers and to third party resellers. In 2012, when a reseller placed an order from us we purchased

the product from our related party supplier and have it ship the product directly to the reseller. Beginning in 2013, we began purchasing

the products from Quarta-Rad, Ltd., our related party supplier and it shipped the products to us. We then shipped the products to a third

party online retailer, to hold for Internet sales and sales to our third party resellers.

We

expanded our operations through the acquisition of Sellavir Inc in December 2020. Sellavir is an AI company that leverages its knowledge

in neural networks to provide customized AI and development services to our clients. Our services are focused on offering customized

solutions for image processing. Our current business model relies on identifying the specific customer needs and developing a software

solution to address them. We currently do not have any clients in the US, and our sole revenue stream is from our Japanese reseller.

We will focus on the expansion of this line of business.

Our

administrative office is located at 1201 N. Orange St., Suite 700, Wilmington, DE 19801, which is a virtual office.

In

2022, we generated $1,100,431 in sales, and incurred a net profit of $14,578 In 2023, we generated $508,316 in sales, and incurred a

net profit of $44,492. We anticipate that we will be able to increase our revenues. We believe that we have sufficient working capital

to continue our operations for the next 12 months; however, we believe that we need to seek additional financing to expand our sales.

As of December 31, 2023, we had $72,625 in cash on hand in our corporate bank account and liabilities of $289,721, which consisted of

$184,477 in related party payables, and $105,244 in accounts payable and accrued expenses We currently have two officers and directors.

These individuals allocate time and personal resources to us on a part-time basis and devote approximately 10 hours per week to us. Our

sales are to independent, third parties. Since May 2012, we have utilized the services of an independent contractor to assist us in selling

the products. He is paid on a commission only basis.

In

2018, we continued to focus our business operations on the development of our distribution agreements and reseller network as well as

continue to advertise on the Internet. We plan to continue to utilize our website to promote the products to home renovation contractors

and other purchasers of detection devices. We are promoting the detection products by advertising our website and marketing to independent

distributors and others interested in detection devices. We purchase the products from QRR, which is owned by our minority shareholder

and is the original manufacturer for RADEX product line. Under an oral agreement with QRR, we have the exclusive distribution rights

for sale of QRR products in Europe, the US, and Asia (excluding China) for a period of 10 years which expires in 2027. We sell the products

we purchase from QRR directly to third party buyers and to resellers. The purchase terms require us to prepay for the products we purchase

at a price that is set forth in each purchase order. The product pricing has been discounted pursuant to a discount agreement. We have

extended this agreement thru 2027. During 2019, our ability to sell through our distributor in the UK was suspended due to an ongoing

UK VAT examination, we are currently testing new partners for EU distribution and have resumed UK sales.

We

have secured another factory in Kazakhstan to supply inventory. A test batch of inventory was purchased in December 2023.

During

December 2011, Quarta-Rad we acquired Sellavir, Inc, a Delaware corporation, under common control, as a wholly owned subsidiary We acquired

the company in exchange for 333,333 shares on common stock. The value of the stock on the date of issue was approximately $170,000. Sellavir

is a video analytics company whose platform empowers organizations to decode videos to develop creative marketing strategies and analysis

through advanced and proprietary technologies. Quarta-Rad had acquired the company to leverage Sellavir capabilities to combine it with

its Radex series to offer AI-enhanced radiation detection capabilities and expand its scope outside the radiation measurement. Beginning

in 2024, Sellavir will strategically focus on harnessing its advanced AI capabilities and extensive experience to innovate within the

call center industry.

The

Company has two operating segments through the operations of Quarta-Rad and Sellavir. Net income for the year ended December 31, 2023

is comprised of:

| | |

Quarta Rad | | |

Sellavir | | |

Total | |

| Sales | |

$ | 321,316 | | |

$ | 187,000 | | |

$ | 508,316 | |

| Cost of Good Sold | |

| 233,944 | | |

| 91,009 | | |

| 324,953 | |

| Gross Profit | |

| 87,372 | | |

| 95,991 | | |

| 183,363 | |

| | |

| | | |

| | | |

| | |

| Expenses: | |

| | | |

| | | |

| | |

| General & administrative | |

| 28,356 | | |

| 3,162 | | |

| 31,518 | |

| Advertising | |

| 49,940 | | |

| - | | |

| 49,940 | |

| Professional and consulting fees | |

| 110,671 | | |

| 4,000 | | |

| 114,671 | |

| Operating expenses | |

| 188,967 | | |

| 7,162 | | |

| 196,129 | |

| | |

| | | |

| | | |

| | |

| Net income (loss) from operations | |

| (101,595 | ) | |

| 88,829 | | |

| (12,766 | ) |

| | |

| | | |

| | | |

| | |

| Interest and dividends | |

| - | | |

| 303 | | |

| 303 | |

| Other expense - foreign currency translation loss | |

| - | | |

| (36 | ) | |

| (36 | ) |

| Other income - interest - related party | |

| - | | |

| 46,578 | | |

| 46,578 | |

| Unrealized gain on investments | |

| - | | |

| 25,769 | | |

| 25,769 | |

| Realized loss on investments | |

| - | | |

| (3,529 | ) | |

| (3,529 | ) |

| Interest expense | |

| - | | |

| - | | |

| - | |

| Income tax benefit/(expense) | |

| 21,335 | | |

| (33,162 | ) | |

| (11,827 | ) |

| | |

| | | |

| | | |

| | |

| Net income/(loss) | |

$ | (80,260 | ) | |

$ | 124,752 | | |

$ | 44,492 | |

Revenues

for the year ended December 31, 2023 were $508,316 comprised of $321,316 from Quarta-Rad and $187,000 from Sellavir.

Operating

expenses for the year ended December 31, 2023 were $196,129 comprised of $188,967 from Quarta-Rad and $7,162 from Sellavir.

Income

tax expense/benefit for the year ended December 31, 2023 was $11,827 net expense, comprised of $21,335 income tax benefit from Quarta-Rad

and $33,162 income tax expense from Sellavir.

Net

Income for the year ended December 31, 2023 was $44,492, comprised of $80,260 net loss from Quarta-Rad and a $124,752 net income from

Sellavir.

FOR

YEAR ENDED DECEMBER 31, 2022:

| | |

Quarta Rad | | |

Sellavir | | |

Total | |

| Sales | |

$ | 973,431 | | |

$ | 127,000 | | |

$ | 1,100,431 | |

| Cost of Good Sold | |

| 622,123 | | |

| 81,658 | | |

| 703,781 | |

| Gross Profit | |

| 351,308 | | |

| 45,342 | | |

| 396,650 | |

| | |

| | | |

| | | |

| | |

| Expenses: | |

| | | |

| | | |

| | |

| General & administrative | |

| 44,201 | | |

| 3,504 | | |

| 47,705 | |

| Advertising | |

| 43,735 | | |

| - | | |

| 43,735 | |

| Professional and consulting fees | |

| 157,766 | | |

| 10,000 | | |

| 167,766 | |

| Operating expenses | |

| 245,702 | | |

| 13,504 | | |

| 259,206 | |

| | |

| | | |

| | | |

| | |

| Net income (loss) from operations | |

| 105,606 | | |

| 31,838 | | |

| 137,444 | |

| | |

| | | |

| | | |

| | |

| Interest and dividends | |

| - | | |

| 285 | | |

| 285 | |

| Unrealized loss on investments | |

| - | | |

| (78,158 | ) | |

| (78,158 | ) |

| Realized loss on investments | |

| - | | |

| (41,118 | ) | |

| (41,118 | ) |

| Income tax (expense)/benefit | |

| (22,177 | ) | |

| 18,302 | | |

| (3,875 | ) |

| | |

| | | |

| | | |

| | |

| Net income/(loss) | |

$ | 83,429 | | |

$ | (68,851 | ) | |

$ | 14,578 | |

Revenues

for the year ended December 31, 2022 were $1,100,431 comprised of $973,431 from Quarta-Rad and $127,000 from Sellavir.

Operating

expenses for the year ended December 31, 2022 were $259,206 comprised of $245,702 from Quarta-Rad and $13,504 from Sellavir.

Income

tax expense/benefit for the year ended December 31, 2022 was $3,875 net benefit, comprised of $22,177 income tax expense from Quarta-Rad

and $18,302 income tax benefit from Sellavir.

Net

Income for the year ended December 31, 2022 was $14,578, comprised of $83,429 net income from Quarta-Rad and a $68,851 net loss from

Sellavir.

Critical

Accounting Policy and Estimates. Our Management’s Discussion and Analysis of Financial Condition and Results of Operations

section discusses our financial statements, which have been prepared in accordance with accounting principles generally accepted in the

United States of America. The preparation of these financial statements requires management to make estimates and assumptions that affect

the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses

during the reporting period. On an on-going basis, management evaluates its estimates and judgments, including those related to revenue

recognition, accrued expenses, financing operations, foreign investments and contingencies. Management bases its estimates and judgments

on historical experience and on various other factors that are believed to be reasonable under the circumstances, the results of which

form the basis for making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources.

Actual results may differ from these estimates under different assumptions or conditions. The most significant accounting estimates inherent

in the preparation of our financial statements include estimates as to the appropriate carrying value of certain assets and liabilities

which are not readily apparent from other sources. In addition, these accounting policies are described at relevant sections in this

discussion and analysis and in the notes to the financial statements included in this Annual Report on Form 10-K.

Accounts Receivable

Accounts Receivable and related party notes receivable

amounts from sales to various suppliers and online platforms and loans. Accounts receivable are stated at the amount management expects

to collect from outstanding balances. Management provides for probable uncollectable amounts through a charge to bad debt expense and

a credit to a valuation allowance based on its assessment of the current status of individual accounts. Balances that are still outstanding

after management has used reasonable collection efforts are written off through a charge to the valuation allowance and a credit to accounts

receivable. A reserve for sales returns and allowances is considered immaterial and, as a result, there was no reserve for sales returns

and allowances, at December 31, 2023 and 2022, respectively.

The

following discussion of our financial condition and results of operations should be read in conjunction with our audited financial statements

for the year ended December 31, 2023 and 2022, respectively, together with notes thereto, which are included in this Annual Report on

Form 10-K.

For

the Year Ended December 31, 2023 compared to the Year Ended December 31, 2022

Revenues.

Our net revenues decreased $592,115, or 53.81%, to $508,316 for the year ended December 31, 2023, compared with $1,100,431 for comparable

period in 2022. The decrease was primarily due to a decrease in revenue recognized through Quarta-Rad due to temporary distribution restrictions.

Cost

of Goods Sold. Our Cost of Goods Sold decreased $378,828, or 53.83% to $324,953 for the year ended December 31, 2023, compared to

$703,781 for the comparable period in 2022. The decrease is due to the decrease in sales.

Operating

Expenses. For the year ended December 31, 2023, our total operating expenses decreased $63,077 or 24.33%, to $196,129 compared to

$259,206 for the comparable period in 2022. Operating expenses were comprised of general and administrative expenses, professional and

consulting fees advertising costs. The components of operating expenses are discussed below.

| |

● |

General

and administrative expenses, including advertising, decreased $9,982 or 10.92%, to $81,458 for the year ended December 31, 2023 from

$91,440 for the comparable period in 2022. The decrease is primarily attributable to a full year of Sellavir expenses. |

| |

|

|

| |

● |

Professional

and consulting fees decreased $53,095 or 31.65% for the year ended December 31, 2023, to $114,671 from $167,766 for the comparable

period in 2022. The decrease primarily due to reduced professional fees through Quarta-Rad. |

Net

Income. Our net income increased by $29,914 to $44,492 or 205.20% for the year ended December 31, 2023, compared to $14,578 for the

year ended December 31, 2022. The increase is primarily attributable to a reduction of expenses in 2023 and an increase in investment

income through Sellavir.

QUARTA-RAD

For

the Year Ended December 31, 2023 compared to the Year Ended December 31, 2022

Revenues

Our net revenues decreased $652,115, or 66.99%, to $321,316 for the year ended December 31, 2023 compared with $973,431 or comparable

period in 2022. The decrease was primarily due to temporary distribution restrictions.

Cost

of Goods Sold. Our Cost of Goods Sold decreased $388,179 or 62.40% to $233,944 for the year ended December 31, 2023, compared to

$622,123 for the comparable period in 2022. The decrease is primarily due to the decrease in sales.

Operating

Expenses. For the year ended December 31, 2023, our total operating expenses decreased $56,735 or 23.09%, to $188,967 compared to

$245,704 for the comparable period in 2022. The decrease was attributable to a decrease in professional fees.

Net

Loss. Our net loss increased by $163,689 to a net loss of <$80,260> for the year ended December 31, 2023 compared to net income

of $83,429 for the year ended December 31, 2022. The increase is primarily attributable to a reduction of sales in 2023.

SELLAVIR

For

the Year Ended December 31, 2023 compared to the Year Ended December 31, 2022

Revenues

Our net revenues increased $60,000 or 47.24% to $187,000 for the year ended December 31, 2023 compared with $127,000 for comparable

period in 2022. The increase was due to research and development of current technology.

Cost

of Goods Sold. Our Cost of Goods Sold increased $9,351 or 11.45% to $91,009 for the year ended December 31, 2023, compared to $81,658

for the comparable period in 2022. The increase is due to direct project costs.

Operating

Expenses. For the year ended December 31, 2023, our total operating expenses decreased $6,342 or 46.96%, to $7,162 compared to $13,504

for the comparable period in 2022. The decrease was attributable to a decrease in professional fees and general and administrative expenses.

Net

Income. Our net income increased $193,603 to net income of $124,752 for the year ended December 31, 2023 compared to a net loss of

<$68,851> for the year ended December 31, 2022. The increase is primarily attributable an increase in sales and investment income.

Liquidity

and Capital Resources. During the year ended December 31, 2023, we used cash for operating expenses from cash on hand and the sale

of products on the Internet and from independent third-party resellers.

Our

total assets were $683,314 and $753,752 as of December 31, 2023 and December 31, 2022, respectively, consisting of $72,625 and $293,878,

respectively, in cash. Our working capital was a deficit of $46,448 of as December 31, 2023 and our working capital surplus was $310,835

as of December 31, 2022.

Our

total liabilities were $289,721 and $404,651 as of December 31, 2023 and December 31, 2022, respectively.

Our

stockholders’ equity was $393,593 and $349,101 as of December 31, 2023 and 2022, respectively. Our retained earnings were $45,299

and $807 as of December 31, 2023 and December 31, 2022, respectively.

We

had $49,773 and $200,206 in cash provided by operating activities for the year ended December 31, 2023 and 2022, respectively.

We

had $271,026 and $166,348 in cash used by investing activities for year ended December 31, 2023 and 2022, respectively.

We

had no cash provided by financing activities for the year ended December 31, 2023 and 2022, respectively.

We

do not have sufficient funds for pursuing our plan of operation, but we are in the process of trying to procure funds sufficient to fund

our operations until we are able to finance our operations through cash flow. There can be no assurance that we will be able to procure

funds sufficient for such purpose. If operating difficulties or other factors (many of which are beyond our control) delay our realization

of revenues or cash flows from operations, we may be limited in our ability to pursue our business plan. Moreover, if our resources from

obtaining additional capital or cash flows from operations, once we commence them, do not satisfy our operational needs or if unexpected

expenses arise due to unanticipated pressures or if we decide to expand our business plan beyond its currently anticipated level or otherwise,

we will require additional financing to fund our operations, in addition to anticipated cash generated from our operations. Additional

financing might not be available on terms favorable to us, or at all. If adequate funds were not available or were not available on acceptable

terms, our ability to fund our operations, take advantage of unanticipated opportunities, develop or enhance our business or otherwise

respond to competitive pressures would be significantly limited. In a worst-case scenario, we might not be able to fund our operations

or to remain in business, which could result in a total loss of our stockholders’ investment. If we raise additional funds through

the issuance of equity or convertible debt securities, the percentage ownership of our stockholders would be reduced, and these newly

issued securities might have rights, preferences or privileges senior to those of existing stockholders.

The

Company had no formal long-term lines of credit or other bank financing arrangements as of April 1, 2024.

The

Company has no current plans for the purchase or sale of any plant or equipment.

The

Company has no current plans to make any changes in the number of employees.

Management

intends to focus on raising funds going forward. The Company cannot provide any assurance or guarantee that it will be able to raise

funds. Potential investors must be aware if it is unable to raise funds through the sale of its common stock and generate sufficient

revenues, any investment made into the Company would be lost in its entirety.

The

ability of the Company to continue as a going concern is dependent upon its ability to successfully accomplish the plans described in

the preceding paragraph and eventually secure other sources of financing and attain profitable operations. The accompanying financial

statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern.

Income

Tax Expense (Benefit)

The

Company has a prospective income tax benefit resulting from a net operating loss carry forward and startup costs that may offset any

future operating profit. The Company has deferred tax assets of $24,069.

Impact

of Inflation

The

Company believes that inflation has had a negligible effect on operations over the past year.

Capital

Expenditures

The

Company expended no amounts on capital expenditures for the years ended December 31, 2023 and 2022, respectively.

Plan

of Operation

Our

business strategy is to continue to market our website (www.quartarad.com). We have used our website to market products for sale

to consumers as well to third party distributors. We will continue to strengthen our presence on e-commerce sites. We are also focusing

on expanding our reseller network by targeting large consumer retail chains.

The

number of detection devices, which we will be able to sell will depend upon the success of our marketing efforts through our website

and the distributors that we will enter into agreement with to sell the products.

We

intend to implement the following tasks within the next twelve months:

Inventory:

We intend to purchase inventory to increase our sales. We believe that these funds will be initially sufficient for us to increase our

inventory from Quarta-Rad, Ltd. The amount needed for inventory purchases is directly related to the demand for sales of our product.

Marketing:

(Estimated cost $25,000-$100,000). In addition to the website development costs, we intend to increase our marketing efforts on the Internet

to generate leads and sales. We will also utilize funds to develop marketing brochures and materials to market the products to industry

professionals such as home renovation contractors. We intend to market our services through Sellavir to obtain new clients and opportunities.

Secure

Distribution Agreements: (Estimated cost $10,000). We plan to seek and secure distribution agreements for the sale of our detection

devices.

Our

management does not anticipate the need to hire additional full or part- time employees over the next six (6) months, as the services

provided by our officers and directors and our independent contractor appear sufficient at this time. We believe that our operations

are currently on a small scale that is manageable by these two individuals as well as our independent contractor. Our management’s

responsibilities are mainly administrative at this early stage. While we believe that the addition of employees is not required over

the next six (6) months, the professionals we plan to utilize will be considered independent contractors. We do not intend to enter into

any employment agreements with any of these professionals. Thus, these persons are not intended to be employees of our company.

We

currently do not own any plants or equipment that we would seek to sell in the near future; we do not have any off-balance sheet arrangements;

and we have not paid for expenses on behalf of our directors.

Off-Balance

Sheet Arrangements

None.

Recent

Accounting Pronouncements

We

have adopted all recently issued accounting pronouncements. The adoption of the new accounting pronouncements is not anticipated to have

a material effect on our operations.

Item

7A. Quantitative and Qualitative Disclosures about Market Risk

As

a “smaller reporting company” as defined by Item 10 of Regulation S-K, we are not required to provide information

required by this item.

Item

8. Financial Statements and Supplementary Data

Our

audited financial statements are set forth in this Annual Report beginning on page F-1.

REPORT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To

the Board of Directors and

Stockholders of Quarta-Rad, Inc.

Opinion

on the Financial Statements

We

have audited the accompanying consolidated balance sheets of Quarta-Rad, Inc. (the “Company”) as of December 31, 2023 and

2022, the related consolidated statements of operations, stockholders’ equity (deficit), and cash flows for the years then ended,

and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements

present fairly, in all material respects, the financial position of the Company as of December 31, 2022 and 2022, and the results of

their operations and their cash flows for the years then ended, in conformity with accounting principles generally accepted in the United

States of America.

Basis

for Opinion

These

financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s

financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board

(United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal

securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We

conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain