SCHEDULE 14A

INFORMATION REQUIRED IN A PROXY STATEMENT

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant [ X ]

Filed by a Party other than

the Registrant [ ]

Check the appropriate box:

[X] Preliminary Proxy Statement

[ ] Confidential, for

Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[ ]

Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ]

Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12

TRANSAKT LTD.

(Name of

Registrant as Specified in Its Charter)

Not Applicable

(Name of Person(s) Filing Proxy

Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[x] No fee required.

[ ] Fee computed on table below per Exchange Act Rules

14a-6(i)(4) and 0-11.

(1) Title of each class of securities to which transaction

applies: N/A

(2) Aggregate number of securities to which transaction

applies: N/A

(3) Per unit price or other underlying value of transaction

computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the

filing fee is calculated and state how it was determined): N/A

(4) Proposed maximum aggregate value of transaction: N/A

(5) Total fee paid: N/A

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee if offset as provided by

Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid: N/A

(2) Form, Schedule or Registration Statement No.: N/A

(3) Filing Party: N/A

(4) Date Filed: N/A

| TRANSAKT LTD. |

| Unit 8, 3/F., Wah Yiu Industrial Centre, 30-32 Au Pui

Wan Street, Fo Tan |

| N.T. Hong Kong |

| |

| |

| NOTICE OF ANNUAL AND SPECIAL MEETING OF

STOCKHOLDERS |

| TO BE HELD ON APRIL 1, 2016, at 10:00 AM (Pacific

Daylight Time) |

NOTICE IS HEREBY GIVEN that TransAKT Ltd., a Nevada

corporation, will hold an Annual and Special meeting of stockholders on Friday,

April 1, 2016, at 10:00 AM (CST/local time) at Conference room no.5, 6/F Taiwan

Railways Administration MOTC, No. 3 Beiping W Road, Zhongzheng District, Taipei

City, Taiwan (the “Meeting”). The Meeting is being held for the following

purposes:

| 1. |

to approve a reverse stock split of our issued and

outstanding shares on the basis of up to 20 old shares for 1 new share, to

be implemented at the discretion of the Board of Directors by April 1,

2017 (the “Reverse Stock Split”); no fractional shares will be

issued in connection with the Reverse Stock Split, in the case of a

fractional share, the fractional share will be rounded up; |

| |

|

| 2. |

to elect Ho Kang-Wing, He Jiaxian, He Jingtian, and Tam

Yuk-Ching as Directors to serve our company for the ensuing year and until

their successors are elected; |

| |

|

| 3. |

to ratify the appointment of AWC (CPA) Ltd. as our independent registered public accounting firm for the fiscal year ended December 31, 2015 and to allow Directors to set the remuneration; and |

| |

|

| 4. |

to transact such other business as may properly come

before the Meeting or any adjournment or postponement

thereof. |

Our board of directors recommends that you vote “for” each

of the nominees and vote “for” each proposal.

Our board has fixed the close of business on February 29, 2016

as the record date for determining the stockholders entitled to notice of, and

to vote at, the Meeting or any adjournment or postponement of the Meeting. At

the Meeting, each holder of record of shares of common stock, $0.001 par value

per share, will be entitled to one vote per share of common stock held on each

matter properly brought before the Meeting.

THE VOTE OF EACH STOCKHOLDER IS IMPORTANT. YOU CAN VOTE YOUR

SHARES BY ATTENDING THE MEETING OR BY COMPLETING AND RETURNING THE PROXY CARD

SENT TO YOU. PLEASE SUBMIT A PROXY AS SOON AS POSSIBLE SO THAT YOUR SHARES CAN

BE VOTED AT THE MEETING IN ACCORDANCE WITH YOUR INSTRUCTIONS. FOR SPECIFIC

INSTRUCTIONS ON VOTING, PLEASE REFER TO THE INSTRUCTIONS ON THE PROXY CARD OR

THE INFORMATION FORWARDED BY YOUR BROKER, BANK OR OTHER HOLDER OF RECORD. EVEN

IF YOU HAVE VOTED YOUR PROXY, YOU MAY STILL VOTE IN PERSON IF YOU ATTEND THE

MEETING. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A

BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE IN PERSON AT THE MEETING, YOU

MUST OBTAIN FROM SUCH BROKER, BANK OR OTHER NOMINEE, A PROXY ISSUED IN YOUR

NAME.

Dated: February 18, 2016.

By Order of the Board of Directors,

| /s/Ho Kang-Wing |

| Ho Kang-Wing President and Director |

| |

IMPORTANT: Please complete, date, sign and promptly

return the enclosed proxy card in the prepaid envelope (if mailing within the

United States) to ensure that your shares will be represented. If you attend the

meeting, you may choose to vote in person even if you have previously sent in

your proxy card.

| TRANSAKT LTD. |

| Unit 8, 3/F., Wah Yiu Industrial Centre, 30-32 Au Pui

Wan Street, Fo Tan |

| N.T. Hong Kong |

| |

| Proxy Statement for the Annual and Special Meeting of

Stockholders |

The enclosed proxy is solicited on behalf of our Board of

Directors (the “Board”) for use at the Annual and Special Meeting of

Stockholders (the “Meeting”) to be held on April 1, 2016 at 10:00 AM

(CST/local time) at Conference room no.5, 6/F Taiwan Railways Administration

MOTC, No. 3 Beiping W Road, Zhongzheng District, Taipei City, Taiwan., or at any

continuation, postponement or adjournment thereof, for the purposes discussed in

this proxy statement and in the accompanying Notice of Annual and Special

Meeting and any business properly brought before the Meeting. Proxies are

solicited to give all stockholders of record an opportunity to vote on matters

properly presented at the Meeting. We intend to mail this proxy statement and

accompanying proxy card on or about March 7, 2016 to all stockholders entitled

to vote at the Meeting who have not consented to electronic delivery of

materials. Stockholders entitled to vote at the Meeting who have consented to

electronic delivery will instead receive materials electronically.

Unless the context requires otherwise, references to “we”, “us”

“our” and “our company” refer to TransAKT Ltd.

What items will be voted at the meeting?

Our stockholders will vote:

| 1. |

the approval of a reverse stock split of our issued and

outstanding shares on the basis of up to 20 old shares for 1 new share, to

be implemented at the discretion of the Board of Directors by November 9,

2016 (the “Reverse Stock Split”); no fractional shares will be

issued in connection with the Reverse Stock Split, in the case of a

fractional share, the fractional share will be rounded up, and no current shareholder shall have less than one share, after effectiveness of the consolidation; |

| |

|

| 2. |

to elect Ho Kang-Wing, He Jiaxian, He Jingtian, and Tam

Yuk-Ching as Directors to serve our company for the ensuing year and until

their successors are elected; |

| |

|

| 3. |

to ratify the appointment of AWC(CPA) Ltd.as our independent registered public accounting firm for the fiscal year ended December 31, 2015, and to allow the Directors to set the remuneration; and

|

| |

|

| 4. |

to transact such other business as may properly come

before the Meeting or any adjournment of postponement

thereof. |

We urge you to carefully read and consider the information

contained in this proxy statement. We request that you cast your vote on each of

the proposals described in this proxy statement. You are invited to attend the

Meeting, but you do not need to attend the Meeting in person to vote your

shares. Even if you do not plan to attend the Meeting, please vote by proxy by

following instructions provided in the proxy card.

Who Can Vote

You are entitled to vote if you were a holder of record of

shares of our common stock, $0.001 par value per share (the “Common

Stock”) as of the close of business on February 29, 2016 (the “Record

Date”). Your shares can be voted at the Meeting only if you are present in

person or represented by a valid proxy.

Shares Outstanding and Quorum

Holders of record of Common Stock at the close of business on

the Record Date will be entitled to receive notice of and vote at the Meeting.

At the Meeting, each of the shares of Common Stock represented will be entitled

to one (1) vote on each matter properly brought before the Meeting. As of

February 18, 2016, there were 613,447,306 shares of Common

Stock issued and outstanding.

- 2 -

In order to carry on the business of the Meeting, we must have

a quorum. Under our bylaws, a quorum is a majority of issued and outstanding

entitled to vote, represented in person or by proxy.

Proxy Card and Revocation of Proxy

In voting, please specify your choices by marking the

appropriate spaces on the enclosed proxy card, signing and dating the proxy card

and returning it in the accompanying envelope. If no directions are given and

the signed proxy is returned, the proxy holders will vote the shares in favor of

Proposal 1, at their discretion, on any other matters that may properly come

before the Meeting. The Board knows of no other business that will be presented

for consideration at the Meeting. In addition, since no stockholder proposals or

nominations were received by us on a timely basis, no such matters may be

brought at the Meeting.

Any stockholder giving a proxy has the power to revoke the

proxy at any time before the proxy is voted. In addition to revocation in any

other manner permitted by law, a proxy may be revoked by an instrument in

writing executed by the stockholder or by his attorney authorized in writing,

or, if the stockholder is a corporation, under its corporate seal or by an

officer or attorney thereof duly authorized, and deposited at the offices of our

transfer agent, Transfer Online, Inc., 512 SE Salmon St., Portland, OR 97214

(Telephone: (503) 227-2950), at any time up to and including the last business

day preceding the day of the Meeting, or any adjournment thereof, or with the

chairman of the Meeting on the day of the Meeting. Attendance at the Meeting

will not in and of itself constitute revocation of a proxy.

Voting of Shares

Stockholders of record on February 29, 2016 record date are

entitled to one (1) vote for each share of Common Stock held on all matters to

be voted upon at the Meeting. You may vote in person or by completing and

mailing the enclosed proxy card. All shares entitled to vote and represented by

properly executed proxies received before the polls are closed at the Meeting,

and not revoked or superseded, will be voted at the Meeting in accordance with

the instructions indicated on those proxies.

ADVICE TO BENEFICIAL HOLDERS OF SHARES OF COMMON STOCK

THE INFORMATION SET FORTH IN THIS SECTION IS OF SIGNIFICANT

IMPORTANCE TO MANY STOCKHOLDERS OF OUR COMPANY, AS A SUBSTANTIAL NUMBER OF

STOCKHOLDERS DO NOT HOLD SHARES IN THEIR OWN NAME.

Stockholders who do not hold their shares in their own name

(referred to in this Proxy Statement as “beneficial stockholders”) should note

that only proxies deposited by stockholders whose names appear on the records of

our company as the registered holders of shares of common stock can be

recognized and acted upon at our annual and special meeting. If shares of common

stock are listed in an account statement provided to a stockholder by a broker,

then in almost all cases those shares of common stock will not be registered in

the stockholder’s name on the records of our company. Such shares of common

stock will more likely be registered under the names of the stockholder’s broker

or an agent of that broker. In the United States, the vast majority of such

shares are registered under the name of Cede & Co. as nominee for The

Depository Trust Company (which acts as depository for many U.S. brokerage firms

and custodian banks), and in Canada, under the name of CDS & Co. (the

registration name for The Canadian Depository for Securities Limited, which acts

as nominee and custodian for many Canadian brokerage firms). Beneficial

stockholders should ensure that instructions respecting the voting of their

shares of common stock are communicated to the appropriate person, as without

specific instructions, brokers/nominees are prohibited from voting shares for

their clients.

Applicable regulatory policy requires intermediaries/brokers to

seek voting instructions from beneficial stockholders in advance of

stockholders’ meetings, unless the beneficial stockholders have waived the right

to receive meeting materials. Every intermediary/broker has its own mailing

procedures and provides its own return instructions to clients, which should be carefully followed by beneficial

stockholders in order to ensure that their shares of common stock are voted at

our annual and special meeting. The Form of Proxy supplied to a beneficial

stockholder by its broker (or the agent of the broker) is similar to the Form of

Proxy provided to registered stockholders by our company. However, its purpose

is limited to instructing the registered stockholder (the broker or agent of the

broker) how to vote on behalf of the beneficial stockholder. The majority of

brokers now delegate responsibility for obtaining instructions from clients to

Broadridge Financial Solutions, Inc. (“Broadridge”) (formerly, ADP

Investor Communication Services in the United States and Independent Investor

Communications Company in Canada). Broadridge typically applies a special

sticker to proxy forms, mails those forms to the beneficial stockholders and the

beneficial stockholders return the proxy forms to Broadridge. Broadridge then

tabulates the results of all instructions received and provides appropriate

instructions respecting the voting of shares to be represented at our annual and

special meeting. A beneficial stockholder receiving a Broadridge proxy cannot

use that proxy to vote shares of common stock directly at our Annual and Special

Meeting - the proxy must be returned to Broadridge well in advance of our Annual

Meeting in order to have the shares of common stock voted.

- 3 -

Although a beneficial stockholder may not be recognized

directly at our Annual and Special Meeting for the purposes of voting shares of

common stock registered in the name of his broker (or agent of the broker), a

beneficial stockholder may attend at our Annual and Special Meeting as

proxyholder for the registered stockholder and vote the shares of common stock

in that capacity. Beneficial stockholders who wish to attend at our Annual and

Special Meeting and indirectly vote their shares of common stock as proxyholder

for the registered stockholder should enter their own names in the blank space

on the instrument of proxy provided to them and return the same to their broker

(or the broker’s agent) in accordance with the instructions provided by such

broker (or agent), well in advance of our annual and special meeting.

Alternatively, a beneficial stockholder may request in writing

that his or her broker send to the beneficial stockholder a legal proxy which

would enable the beneficial stockholder to attend at our Annual and Special

Meeting and vote his or her shares of common stock.

There are two kinds of beneficial owners – those who object to

their name being made known to the issuers of securities which they own (called

OBOs for Objecting Beneficial Owners) and those who do not object to the issuers

of the securities they own knowing who they are (called NOBOs for Non-Objecting

Beneficial Owners).

YOUR VOTE IS IMPORTANT.

Counting of Votes

All votes will be tabulated by the inspector of election

appointed for the Meeting, who will separately tabulate affirmative and negative

votes and abstentions. Shares represented by proxies that reflect abstentions as

to a particular proposal will be counted as present and entitled to vote for

purposes of determining a quorum. An abstention is counted as a vote against

that proposal. Shares represented by proxies that reflect a broker “non-vote”

will be counted as present and entitled to vote for purposes of determining a

quorum. A broker “non-vote” will be treated as not-voted for purposes of

determining approval of a proposal and will not be counted as “for” or “against”

that proposal. A broker “non-vote” occurs when a nominee holding shares for a

beneficial owner does not vote on a particular proposal because the nominee does

not have discretionary authority or does not have instructions from the

beneficial owner.

Solicitation of Proxies

We will bear the entire cost of solicitation of proxies,

including preparation, assembly and mailing of this proxy statement, the proxy

and any additional information furnished to stockholders. Copies of solicitation

materials will be furnished to banks, brokerage houses, depositories,

fiduciaries and custodians holding shares of Common Stock in their names that

are beneficially owned by others to forward to these beneficial owners. We may

reimburse persons representing beneficial owners for their costs of forwarding

the solicitation material to the beneficial owners of the Common Stock. Original

solicitation of proxies by mail may be supplemented by telephone, facsimile,

electronic mail or personal solicitation by our directors, officers or other

regular employees. No additional compensation will be paid to directors,

officers or other regular employees for such services. To date, we have not incurred costs in connection with the solicitation of proxies

from our stockholders, however, our estimate for total costs is $8,000.

- 4 -

INTEREST OF CERTAIN PERSONS IN OR OPPOSITION TO MATTERS TO

BE ACTED UPON

Except as disclosed elsewhere in this Proxy Statement, as of February 18, 2016, none of the following persons has any substantial interest, direct or indirect, by security holdings or otherwise in any matter to be acted upon:

| |

1. |

any director or officer of our corporation; |

| |

|

|

| |

2. |

any proposed nominee for election as a director of our

corporation; and |

| |

|

|

| |

3. |

any associate or affiliate of any of the foregoing

persons. |

The shareholdings of our directors and officers are listed below in the section entitled “Principal Stockholders and Security Ownership of Management”. To our knowledge, no director has advised that he or she intends to oppose any proposal described herein.

PRINCIPAL STOCKHOLDERS AND SECURITY OWNERSHIP OF

MANAGEMENT

As of February 18, 2016, we had a total of 613,447,306 shares

of common stock ($0.001 par value per share) issued and outstanding.

The following table sets forth, as of February 18, 2016,

certain information with respect to the beneficial ownership of our common and

preferred stock by each stockholder known by us to be the beneficial owner of

more than 5% of our common and preferred stock and by each of our current

directors and executive officers. Each person has sole voting and investment

power with respect to the shares of common stock and preferred stock, except as

otherwise indicated. Beneficial ownership consists of a direct interest in the

shares of common and preferred stock, except as otherwise indicated.

Name and Address of Beneficial Owner

|

Amount and Nature of

Beneficial Ownership |

Percentage

of

Class(1) |

James Wu

Former President, Chief Executive

Officer,

and Director (3)

2 FL NO 28 Lane

231 Fu-Hsin N Rd

Taipei, Taiwan |

17,485,862

|

2.85%

|

Cheng Chun-Chih

Former Director

(Chairman of Taiwan Halee

International Co. Ltd.)

(4)

NO 3 Lane 141 Sec 3 Pei-Shen Rd

Shen-Ken

Hsiaung

Taipei Hsieng, Taiwan |

5,000,000

|

(2)

|

Ho Kang-Wing

President, Chief Executive Officer,

and

Director

503 5F Silvercord Tower 2,

30 Canton

Rd

Tsimshatsui Kowloon, HKG |

25,000,000

|

4.08%

|

- 5 -

Dr. Shiau Tzong-Huei

Former Director (Chief

Technical Officer of

Taiwan

Halee and Chairman of

TransAKT Taiwan

Corp.) (5)

NO 3 Lane 141 Sec 3

Pei-Shen Rd

Shen-Ken Hsiaung

Taipei Hsieng, Taiwan" |

1,000,000

|

(2)

|

Taifen Day

Former Chief Financial Officer

(6)

420 12 Ave N.W.

Calgary, Alberta T2M 0C9

Canada |

Nil

|

(2)

|

Yam Chi-Wah

Chief Financial Officer

Flat E

7/F Block 21 Laguna City

Kwun Tong, Kowloon, Hong Kong |

2,500,000

|

(2)

|

He Jingtian

Director

11 Jinghong Road Hujing

Garden

Daliang Shunde

528300 Foshan Gd

China |

28,000,000

|

4.564%

|

He Jiaxian

Director

11 Jinghong Road Hujing

Garden

Daliang Shunde

528300 Foshan Gd

China |

15,000,000

|

2.45%

|

Tam Yuk-Ching

Director

23 Sam Mun Tsai Road,

The Beverly Hills

Boulevard Du Lac, House 212, Tai Po, Nt

Hong

Kong |

28,000,000

|

4.564%

|

| Directors

and Executive Officers as a Group |

121,985,862 Common Shares |

19.89% |

Liu Ju-Wen

2nd Floor-2 No 8 Lane 80 San-Min Rd

Song-San District

Taipei City, Taiwan |

39,119,400

|

6.38%

|

| Other Shareholders |

39,119,400 Common Shares |

6.38% |

| |

(1) |

Based on 613,447,306 shares of common stock issued and

outstanding as of February 18, 2016. Beneficial ownership is determined in

accordance with the rules of the SEC and generally includes voting and

investment power with respect to securities. Except as otherwise

indicated, we believe that the beneficial owners of the common stock

listed above, based on information furnished by such owners, have sole

investment and voting power with respect to such shares, subject to

community property laws where applicable. |

| |

(2) |

Less than 1%. |

| |

(3) |

James Wu served as our President, Chief Executive

Officer, and Director from October 25, 2004 until March 12,

2015. |

| |

(4) |

Dr. Shiau Tzong-Huei served as our Director from December

14, 2006 until March 12, 2015. |

| |

(5) |

Cheng Chun-Chih served as our Director from December 14,

2006 until March 12, 2015. |

| |

(6) |

Taifen Day served as our Chief Financial Officer from

July 27, 2006 until March 12, 2015. |

- 6 -

PROPOSAL NO. 1 - REVERSE STOCK SPLIT

General

Our board of directors has approved, and recommended that our

stockholders approve, a proposal to permit our board of directors, in their sole

discretion, to effect a reverse stock split of our issued and outstanding shares

of common stock on a basis of up to twenty (20) old for one (1) new share.

If our stockholders approve the Reverse Stock Split, and our

board of directors decides to implement it, the Reverse Stock Split will become

effective upon approval of The Financial Industry Regulatory Authority

(“FINRA”).

Even if the stockholders approve the Reverse Stock Split, we

may abandon or postpone the proposal if our board of directors determines that

it is no longer in the best interests of our company and our stockholders. If

the Reverse Stock Split is not implemented by our board of directors within 12

months of the annual and special meeting, the proposal will be deemed abandoned,

without further effect. In that case, our board of directors may again seek

stockholder approval at a future date if it deems a reverse stock split to be

advisable at that time.

Action and Effect

On November 9, 2015, our Board of Directors approved, subject

to receiving the approval of a majority of the shareholders of our common stock,

a consolidation of our current issued and outstanding common shares on the basis

of 1 new common share for 20 old common shares. There will be no change to the

authorized shares of our common stock as a result of any reverse stock split and

any fractional shares will be rounded down.

We will obtain a new CUSIP number for the common stock at the

time of the Reverse Stock Split. We must provide FINRA at least ten (10)

calendar days advance notice of the effective date of a reverse stock split in

compliance with Rule 10b-17 under the Securities Exchange Act of 1934.

The purpose of the reverse stock split is to attempt to

increase the per share trading value of our common stock and have fewer shares

issued and outstanding to make us more attractive as a business combination

target. However, in many cases, the market price of a company’s shares declines

after a reverse stock split.

Effect on Shareholders

After the effective day of the proposed Reverse Stock Split,

each stockholder will own a reduced number of shares of Common Stock. As of the

Record Date, 613,447,306 shares of common stock were issued and outstanding.

Without taking into account the issuance of any common stock to allow for

fractional shares, based on the number of shares issued and outstanding and, for

illustrative purposes only, we would have approximately 30,672,366 shares

outstanding immediately following the completion of the Reverse Stock Split.

Further, any outstanding options, warrants and rights as of the effective date

that are subject to adjustment will be adjusted accordingly. These adjustments

may include adjustments to the number of shares of common stock that may be

obtained upon exercise or conversion of the securities, the applicable exercise

or purchase price as well as other adjustments.

The proposed Reverse Stock Split will affect all common

stockholders uniformly and will not affect any shareholders’ percentage interest

our common stock compared to other shareholders (except for shareholders gaining

one whole share for a fractional share interest).

- 7 -

Further, an effect of the existence of authorized but un-issued

capital stock may be to enable our Board of Directors to render more difficult

or to discourage an attempt to obtain control of the company by means of a

merger, tender offer, proxy contest, or otherwise, and thereby to protect the

continuity of our company’s management. If, in the due exercise of its fiduciary

obligations, for example, the Board of Directors were to determine that a

takeover proposal was not in our company’s best interest, such shares could be

issued by the Board of Directors without stockholder approval in one or more

private placements or other transactions that might prevent, or render more

difficult or costly, completion of the takeover transaction by diluting the

voting or other rights of the proposed acquiror or insurgent stockholder or

stockholder group, by creating a substantial voting block in institutional or

other hands that might undertake to support the position of the incumbent board

of directors, by effecting an acquisition that might complicate or preclude the

takeover, or otherwise. We do not have any current plans, proposals, or

arrangements to propose any amendments to the Articles of Incorporation or

bylaws that would have a material anti-takeover effect.

We cannot predict the effect of any Reverse Stock Split upon

the market price over an extended period and, in many cases the market value of

a company’s common stock following a reverse split declines. We cannot assure

you that the trading price of our common stock after the Reverse Stock Split

will rise in inverse proportion to the reduction in the number of shares of our

common stock outstanding as a result of the reverse stock split. Also, we cannot

assure you that the Reverse Stock Split would lead to a sustained increase in

the trading price of our common stock. The trading price of the common stock may

change due to a variety of other factors, including our operating results and

other factors related to our business and general market conditions.

Further, as a result of any consolidation, some stockholders

may own less than 100 shares of the common stock. A purchase or sale of less

than 100 shares, known as an “odd lot” transaction, may result in incrementally

higher trading costs through certain brokers, particularly “full service”

brokers. Therefore, those stockholders who own less than 100 shares following

the reverse split may be required to pay higher transaction costs if they sell

their shares of common stock.

No fractional shares of post-reverse common stock will be

issued to any shareholder. In lieu of any such fractional share interest, each

holder of pre-reverse common stock who would otherwise be entitled to receive a

fractional share of post-reverse common stock will in lieu thereof receive one

full share upon surrender of certificates formerly representing pre-reverse

common stock held by such holder.

We are not attempting to go “private” by the action of Reverse

Stock Split. The actual number of shareholders shall remain the same, with no

current shareholder having less than one share, after the effectiveness of a

consolidation.

After giving effect to this proposal, our capital structure

will be as follows:

Shares Authorized

(if proposal #1 is approved)

|

200,000,000 |

| Issued and Outstanding |

30,672,366 |

| Authorized and Reserved for Issuance |

0 |

| Authorized and Unreserved for Issuance |

169,327,634 |

Tax Effect

The following discussion is a summary of the U.S. federal

income tax consequences to a stockholder who exchanges shares pursuant to the

reverse stock split. This discussion is for general information only and is not

intended to be a complete description of all potential tax consequences to a

particular stockholder. Nor does it describe state, local or foreign tax

consequences. Any written tax advice contained herein was not written or

intended to be used (and cannot be used) by any taxpayer for the purpose of

avoiding penalties that may be imposed under the U.S. Internal Revenue Code of

1986, as amended (the “Code”).

- 8 -

This discussion is based on current provisions of the Code,

Treasury regulations promulgated under the Code, Internal Revenue Service

(“IRS”) rulings and pronouncements, and judicial decisions now in effect,

all of which are subject to change at any time by legislative, judicial or

administrative action. Any such changes may be applied retroactively. We have

not sought nor will we seek any rulings from the IRS with respect to the U.S.

federal income tax consequences discussed below. The discussion below is not in

any way binding on the IRS or the courts or in any way constitutes an assurance

that the U.S. federal income tax consequences discussed herein will be accepted

by the IRS or the courts.

We will not recognize any gain or loss for tax purposes as a

result of the reverse stock split. Furthermore, the reverse stock split will not

result in the recognition of gain or loss to our common stockholders. The

holding period for the shares of common stock each stockholder receives will

include the holding period of the shares exchanged in the reverse stock split.

The aggregate adjusted basis of the new shares of common stock will be equal to

the aggregate adjusted basis of the old shares exchanged in the reverse stock

split.

Stockholders should consult their own tax advisors to know

their individual federal, state, local and foreign tax consequences.

PROPOSAL NO. 2 - ELECTION OF DIRECTORS

Our Board of Directors has nominated the persons named below as

candidates for Directors at the Meeting. These nominees are all of our current

Directors. Unless otherwise directed, the proxy holders will vote the proxies

received by them for the five nominees named below.

Each Director who is elected will hold office until the next

Meeting of Stockholders and until his or her successor is elected and qualified.

Any Director may resign his or her office at any time and may be removed at any

time by the majority of vote of the stockholders given at a special meeting of

our stockholders called for that purpose.

Our company’s management proposes to nominate the persons named

in the table below for election by the stockholders as Directors of the company.

Information concerning such persons, as furnished by the individual nominees, is

as follows:

Our Board of Directors recommends that you vote FOR the

nominees.

Nominees

As at the Record Date, our Directors and executive officers,

their age, positions held, and duration of term, are as follows:

Name |

Position Held with our Company |

Age |

Date First Elected

Or

Appointed |

| Ho Kang-Wing |

Chairman, Chief Executive Officer, President

and Director |

53 |

March 12, 2015 |

| He Jiaxian |

Director |

61 |

March 12, 2015 |

| He Jingtian |

Director |

29 |

March 12, 2015 |

| Tam Yuk-Ching |

Director |

49 |

March 12, 2015 |

- 9 -

Business Experience

The following is a brief account of the education and business

experience of the nominees during at least the past five years, indicating their

principal occupation during the period, and the name and principal business of

the organization by which they were employed.

Ho Kang-Wing – Chairman, Chief Executive Officer, President

and Director

Since 1993 Ho Kang Wing has served and the managing director of

Guangdong Dongrong Metal Products Co., Ltd., Foshan, Guangdong, China based

company specializing in the design and production of metal and wood products.

Under his direction Guangdong Dongrong has achieved annual revenues in excess of

USD$100,000,000. Mr. Ho has served on TransAKT’s board of directors since July

2013.Mr. Ho has committed to help TransAKT to develop a market for Vegfab in

China and other Asian countries. He is 53 years of age and resides in Kowloon

City, Hong Kong..

He Jingtian – Director

In 1993 Mr. He Jingtian founded Guangdong Dongrong Metal

Products Co., Ltd. He has served as general manager of Guangdong Dongrong since

its inception. He is 61 years of age and resides in Shunde City, Guangdong,

China.

He Jiaxian – Director

Mr. He Jiaxian obtained a Bachelors of Arts degree in

International Economics and Trade from South China University of Technology in

2010, and a Masters of Science in Management from Loughborough University (UK)

in 2012. In 2013 he joined Guangdong Dongrong Metal Products Co., Ltd. as a

project manager. He is also the founder and director of Guangdong Chuansuo

Agricultural Science and Technology Co. Ltd. Mr. He is 29 years of age and

resides in Shunde City, Guangdong, China.

Tam Yuk-Ching – Director

Since 2004 Ms. Tam Yuk Ching has served as the managing

director of Legend Hardware Ltd., a Hong Kong based manufacturer of furniture

hardware which employs over 2,500 workers at its 100,000 square foot factory in

Foshan, China. Ms. Tam brings more than 20 years of experience in corporate

finance and will assist the Company in all financing and capital raising

activities in the future. She is 49 years of age and resides in Hong Kong.

EXECUTIVE OFFICERS

Our executive officers are appointed by our Board of Directors

and serve at the pleasure of our Board of Directors.

The names of our executive officers, their ages, positions

held, and durations of are as follows:

Name |

Position Held with our Company |

Age |

Date First Elected

Or

Appointed |

| Ho Kang-Wing |

Chairman, Chief Executive Officer, President and Director |

53 |

March 12, 2015 |

| Yam Chi-Wah |

Chief Financial Officer |

52 |

March 12, 2015 |

Yam Chi-Wah –Chief Financial Officer

Mr. Yam holds a BA (Honors) of Business Finance from Napier

University of Edinburgh, and brings more than 20 years of industry experience in

the accounting field. Prior to joining TransAKT, Mr. Yam Served as financial

controller of Legend Hardware Ltd. from 2006 to 2015, a company specializing in

the manufacture, processing, and distribution of office & home furnishings. He has also

served as a finance manager for Neolink Technology Ltd., a listed company in

Hong Kong.

- 10 -

For information regarding Mr. Kang-Wing and Bhullar, see

“Nominees” beginning on page 8.

Family Relationships

There are no family relationships between any director or

executive officer.

Involvement in Certain Legal Proceedings

We know of no material proceedings in which any of our

Directors, officers, affiliates or any stockholder of more than 5% of any class

of our voting securities, or any associate thereof is a party adverse to our

company.

To the best of our knowledge, none of our directors or

executive officers has, during the past ten years:

| |

1. |

been convicted in a criminal proceeding or been subject

to a pending criminal proceeding (excluding traffic violations and other

minor offences); |

| |

|

|

| |

2. |

had any bankruptcy petition filed by or against the

business or property of the person, or of any partnership, corporation or

business association of which he was a general partner or executive

officer, either at the time of the bankruptcy filing or within two years

prior to that time; |

| |

|

|

| |

3. |

been subject to any order, judgment, or decree, not

subsequently reversed, suspended or vacated, of any court of competent

jurisdiction or federal or state authority, permanently or temporarily

enjoining, barring, suspending or otherwise limiting, his involvement in

any type of business, securities, futures, commodities, investment,

banking, savings and loan, or insurance activities, or to be associated

with persons engaged in any such activity; |

| |

|

|

| |

4. |

been found by a court of competent jurisdiction in a

civil action or by the SEC or the Commodity Futures Trading Commission to

have violated a federal or state securities or commodities law, and the

judgment has not been reversed, suspended, or vacated; |

| |

|

|

| |

5. |

been the subject of, or a party to, any federal or state

judicial or administrative order, judgment, decree, or finding, not

subsequently reversed, suspended or vacated (not including any settlement

of a civil proceeding among private litigants), relating to an alleged

violation of any federal or state securities or commodities law or

regulation, any law or regulation respecting financial institutions or

insurance companies including, but not limited to, a temporary or

permanent injunction, order of disgorgement or restitution, civil money

penalty or temporary or permanent cease-and-desist order, or removal or

prohibition order, or any law or regulation prohibiting mail or wire fraud

or fraud in connection with any business entity; or |

| |

|

|

| |

6. |

been the subject of, or a party to, any sanction or

order, not subsequently reversed, suspended or vacated, of any

self-regulatory organization (as defined in Section 3(a)(26) of the

Exchange Act (15 U.S.C. 78c(a)(26))), any registered entity (as defined in

Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29))), or

any equivalent exchange, association, entity or organization that has

disciplinary authority over its members or persons associated with a

member. |

Corporate Governance

Public Availability of Corporate Governance Documents

Our key corporate governance document

is our Code of Ethics which is:

- 11 -

-

available in print to any stockholder who requests it from our President;

and

-

filed on EDGAR as an exhibit to our Annual and Transition Report on Form

20-F/A filed on January 21, 2011.CODE OF ETHICS

We adopted a Code of Ethics applicable to our senior financial

officers and certain other finance executives, which is a "code of ethics" as

defined by applicable rules of the SEC. Our Code of Ethics is attached as an

exhibit to our Annual Report on Form 10-KSB filed on January 29, 2008. If we

make any amendments to our Code of Ethics other than technical, administrative,

or other non-substantive amendments, or grant any waivers, including implicit

waivers, from a provision of our Code of Ethics to our Chief Executive Officer,

chief financial officer, or certain other finance executives, we will disclose

the nature of the amendment or waiver, its effective date and to whom it applies

in a Current Report on Form 8-K filed with the SEC.

Meetings

Our Board of Directors held no formal meetings during the year

ended December 31, 2015. All proceedings of the Board of Directors were

conducted by resolutions consented to in writing by all the Directors and filed

with the minutes of the proceedings of the Directors. Such resolutions consented

to in writing by the Directors entitled to vote on that resolution at a meeting

of the Directors are, according to the Nevada Revised Statutes and our Bylaws,

as valid and effective as if they had been passed at a meeting of the Directors

duly called and held.

It is our policy to invite Directors to attend the Meeting of

stockholders. Two Directors are expected to attend the Meeting.

Committees of the Board of Directors

We currently do not have a nominating or compensation committee

or committees performing similar functions. There has not been any defined

policy or procedure requirements for stockholders to submit recommendations or

nomination for Directors.

Audit Committee and Audit Committee Financial Expert

Currently our audit committee consists of our entire Board of

Directors.

Our audit committee operates pursuant to a written charter

adopted by our Board of Directors, a copy of which is attached as Schedule A to

this Proxy Statement.

We believe that the members of our Board of Directors are

collectively capable of analyzing and evaluating our financial statements and

understanding internal controls and procedures for financial reporting. We

believe that retaining an independent Director who would qualify as an “audit

committee financial expert” would be overly costly and burdensome and is not

warranted in our circumstances given the early stages of our development and the

fact that we have not generated any material revenues to date. In addition, we

currently do not have nominating, compensation or audit committees or committees

performing similar functions nor do we have a written nominating, compensation

or audit committee charter. Our Board of Directors does not believe that it is

necessary to have such committees because it believes the functions of such

committees can be adequately performed by our Board of Directors.

Director Independence

We currently act with four Directors, consisting of Ho

Kang-Wing, He Jiaxian, He Jingtian, and Tam Yuk-Ching.

We have determined that He Jiaxian, He Jingtian, and Tam

Yuk-Ching are each an “independent director” as defined in Rule 5605(a) of the

Nasdaq Listing Rules.

- 12 -

Stockholder Communications with Our Board of Directors

Because of our company’s small size, we do not have a formal

procedure for stockholder communication with our Board of Directors. In general,

members of our Board of Directors and executive officers are accessible by

telephone or mail. Any matter intended for our Board of Directors, or for any

individual member or members of our Board of Directors, should be directed to

our President with a request to forward the communication to the intended

recipient.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires

our executive officers and Directors, and persons who own more than 10% of our

common stock, to file reports regarding ownership of, and transactions in, our

securities with the Securities and Exchange Commission and to provide us with

copies of those filings. Based solely on our review of the copies of such forms

received by us, or written representations from certain reporting persons, we

believe that during fiscal year ended December 31, 2014, all filing requirements

applicable to our executive officers, Directors and persons who own more than

10% of our common stock were complied with.

Executive Compensation

The following table sets forth all compensation received during

the year ended December 31, 2014 and December 31, 2013 by our Chief Executive

Officer, Chief Financial Officer and each of the other most highly compensated

executive officers whose total compensation exceeded $100,000 in such fiscal

year. These officers are referred to as the “named executive officers” in this

proxy statement.

Summary Compensation

The particulars of compensation paid to the following persons:

| |

(a) |

our principal executive officer; |

| |

(b) |

each of our two most highly compensated executive

officers who were serving as executive officers at the end of the year

ended December 31, 2014 and December 31, 2013; and |

| |

(c) |

up to two additional individuals for whom disclosure

would have been provided under (b) but for the fact that the individual

was not serving as our executive officer at the end of the most recently

completed financial year, |

who we will collectively refer to as the named executive

officers, for our fiscal year ended Aug December 31, 2014 and December 31, 2013,

are set out in the following summary compensation table:

| SUMMARY COMPENSATION TABLE

|

Name

and

Principal

Position |

Year |

Salary

($) |

Bonus

($) |

Stock

Awards

($) |

Option

Awards

($) |

Non-Equity

Incentive

Plan

Compensa-

tion

($) |

Change in

Pension

Value and

Nonqualified

Deferred

Compensation

Earnings

($) |

All

Other

Compensa-

tion

($) |

Total

($) |

James Wu(1)

Chairman,

Chief

Executive

Officer,

President

and

Director |

2014

2013

|

90,000

90,000

|

Nil

Nil

|

Nil

Nil

|

Nil

Nil

|

Nil

Nil

|

Nil

Nil

|

Nil

Nil

|

90,000

90,000

|

Taifen Day(2)

Chief

Financial

Officer |

2014

2013

|

Nil

Nil

|

Nil

Nil

|

Nil

Nil

|

Nil

Nil

|

Nil

Nil

|

Nil

Nil

|

Nil

Nil

|

Nil

Nil

|

| J.T. Wang(3) |

2014 |

N/A |

N/A |

N/A |

N/A |

N/A |

N/A |

N/A |

N/A

|

- 13 -

Vice

President of

Asia

Operations |

2013

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Michael Lin –

Chairman of

Vegfab

Agricultural

Technology

Co. Ltd. |

2014

2013

|

N/A

Nil

|

N/A

Nil

|

N/A

Nil

|

N/A

Nil

|

N/A

Nil

|

N/A

Nil

|

N/A

Nil

|

N/A

Nil

|

Tsai Wen

Chin –

President of

Vegfab

Agricultural

Technology

Co.

Ltd. |

2014

2013

|

N/A

Nil

|

N/A

Nil

|

N/A

Nil

|

N/A

Nil

|

N/A

Nil

|

N/A

Nil

|

N/A

Nil

|

N/A

Nil

|

| |

(1) |

Mr. Ho Kang-Wing was appointed as chairman, chief

executive officer, president and a director of our company on March 12,

2015. |

| |

|

|

| |

(2) |

Mr. Yam Chi-Wah was appointed as chief financial officer

of our company on March 12, 2015. |

| |

|

|

| |

(3) |

Mr. Wu was appointed as chairman, chief executive

officer, president and a director of our company on October 25, 2004. Mr.

Wu resigned as chairman, chief executive officer, president and a director

of our company on March 12, 2015. |

| |

|

|

| |

(4) |

Taifen Day was appointed as chief financial officer of

our company on July 27, 2006. Taifen Day resigned as chief financial

officer of our company on March 12, 2015. |

| |

|

|

| |

(5) |

Mr. Wang was appointed as Vice President of Asia

Operations on April 1, 2007. Mr. Wang resigned on January 15,

2013. |

| |

|

|

| |

(6) |

Michael Lin resigned as Chairman of Vegfab Agriculture

Technology Company Ltd. on September 30, 2013. |

| |

|

|

| |

(7) |

Tsai Wen-Chin resigned as President of Vegfab

Agricultural Technology Co. Ltd. effective on December 31,

2013. |

There are no arrangements or plans in which we provide pension,

retirement or similar benefits for directors or executive officers. Our

directors and executive officers may receive share options at the discretion of

our board of directors in the future. We do not have any material bonus or

profit sharing plans pursuant to which cash or non-cash compensation is or may

be paid to our directors or executive officers, except that share options may be

granted at the discretion of our board of directors.

2014 Grants of Plan-Based Awards

There were no grants of plan based awards during the year ended

December 31, 2014.

Outstanding Equity Awards at Fiscal Year End

There were no outstanding equity awards at the year ended

December 31, 2014.

Option Exercises and Stock Vested

During our fiscal year ended December 31, 2014 there were no

options exercised by our named officers.

- 14 -

Compensation of Directors

We do not have any agreements for compensating our directors

for their services in their capacity as directors, although such directors are

expected in the future to receive stock options to purchase shares of our common

stock as awarded by our board of directors.

Pension, Retirement or Similar Benefit Plans

There are no arrangements or plans in which we provide pension,

retirement or similar benefits for directors or executive officers. We have no

material bonus or profit sharing plans pursuant to which cash or non-cash

compensation is or may be paid to our directors or executive officers, except

that stock options may be granted at the discretion of the board of directors or

a committee thereof.

Compensation of Directors

We do not have any agreements for compensating our directors

for their services in their capacity as directors, although such directors are

expected in the future to receive stock options to purchase shares of our common

stock as awarded by our board of directors.

Securities Authorized for Issuance under Equity Compensation

Plans

There are no arrangements or plans in which we provide pension,

retirement or similar benefits for directors or executive officers. We have no

material bonus or profit sharing plans pursuant to which cash or non-cash

compensation is or may be paid to our directors or executive officers, except

that stock options may be granted at the discretion of the board of directors or

a committee thereof.

Transactions with Related Persons

Our officers and shareholders have advanced funds to us for

working capital purposes. Our company has not entered into any agreement on the

repayment terms for these advances. As of December 31, 2014, there was $2,912

advances outstanding.

In 2013, we advanced funds bearing interest rate of 8% per

annum from a shareholder in an aggregate amount of NTD 28,780,933, or equivalent

to $969,630. We repaid both principal and interest during the same year. The

interest expense of $60,765 was recorded under other expense from continuing

operations before income taxes.

As of December 31, 2014 and 2013, $285,365 and $312,671 was due

from a former officer and shareholder, respectively. The amounts were repaid in

full in the first quarter of 2014 and 2015, respectively.

In July, 2012, our company issued 18,333,333 shares of common

stock to our President, Mr. James Wu, in relation to our acquisition of Vegfab

Agricultural Technology Co., Ltd. We agreed to pay Mr. Wu share compensation of

10% of the value of the acquisition that he secured for our Company. The

aggregate value of the issuance was $550,000, being 10% of the $5,500,000

purchase price paid for the acquisition of Vegfab.

Except as disclosed herein, no director, executive officer,

shareholder holding at least 5% of shares of our common stock, or any family

member thereof, had any material interest, direct or indirect, in any

transaction, or proposed transaction since the year ended December 31, 2014, in

which the amount involved in the transaction exceeded or exceeds the lesser of

$120,000 or one percent of the average of our total assets at the year-end for

the last three completed fiscal years.

- 15 -

PROPOSAL 3 - RATIFICATION OF THE CONTINUED APPOINTMENT OF THE

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

On April 20, 2015, we formally informed KCCW Accountancy Corp. of their dismissal as the Company’s independent registered public accounting firm. On April 28, 2015, we engaged AWC(CPA) Ltd. as our new independent registered public accounting firm.

Our Board of Directors is asking our stockholders to ratify the continued appointment of AWC(CPA) LTD., as our independent registered public accounting firm for the fiscal year ended December 31, 2015 at a remuneration to be fixed by the Board.

Stockholder ratification of the continued appointment of AWC(CPA) Ltd. is not required under the Nevada corporate law, our bylaws or otherwise. However, our Board of Directors is submitting the continued appointment of AWC(CPA) Ltd. as our independent registered public accounting firm to our stockholders for ratification as a matter of corporate practice. If our stockholders fail to ratify the continued appointment, our Board of Directors will reconsider whether or not to retain the firm. Even if the appointment is ratified, our Board of Directors in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if our Board of Directors determines that such a change would be in the best interest of our company and our stockholders.

Representatives of AWC(CPA) Ltd. are not expected to be present at the Meeting. However, we will provide contact information for AWC(CPA) LTD to any stockholders who would like to contact the firm with questions.

Unless otherwise directed, the proxy holders will vote the proxies received by them for the ratification of the continued appointment of AWC(CPA) Ltd. as our independent registered public accounting firm for the fiscal year ended December 31, 2015.

At the Meeting the stockholders will be asked to approve the

following resolution:

RESOLVED THAT the continued appointment of AWC(CPA) Ltd. as our independent registered public accounting firm is ratified, approved and confirmed and that the remuneration be fixed by the Board.

Our Board of Directors recommends that you vote FOR the ratification of the continued appointment of AWC(CPA) Ltd. as our independent registered public accounting firm as our auditors for the fiscal year ended December 31, 2015 at a remuneration to be fixed by the Board.

Fees Paid to Our (Former) Independent Registered Public Accounting

Firm

Audit fees

The aggregate fees billed for the most recently completed

fiscal year ended December 31, 2014 and 2013 for professional services rendered

by the principal accountant for the audit of our annual financial statements and

review of the financial statements included in our quarterly reports on Form

10-Q and services that are normally provided by the accountant in connection

with statutory and regulatory filings or engagements for these fiscal periods

were as follows:

|

Year Ended

|

| December 31, 2014 |

December 31, 2013 |

| Audit Fees |

$83,000 |

$84,500 |

| Audit Related Fees |

$Nil |

$Nil |

| Tax Fees |

$Nil |

$Nil |

| All Other Fees |

$Nil |

$Nil |

| Total |

$83,000 |

$84,500

|

Audit Fees

Audit fees consist of fees billed for professional services

rendered for the audits of our financial statements, reviews of our interim

financial statements included in quarterly reports, services performed in

connection with filings with the Securities and Exchange Commission and related

comfort letters and other services that are normally provided by KCCW Accountancy Corp. for the fiscal years ended December

31, 2014 and 2013 in connection with statutory and regulatory filings or

engagements.

- 16 -

Audit related Fees

There were $83,000 audit related fees paid to KCCW Accountancy

Corp. for the fiscal year ended December 31, 2014 and $84,500 for the fiscal

year ended December 31, 2013.

Tax Fees

Tax fees consist of fees billed for professional services for

tax compliance, tax advice and tax planning. These services include assistance

regarding federal, state and local tax compliance and consultation in connection

with various transactions and acquisitions. For the fiscal year ended December

31, 2014 and 2013, we did not use KCCW Accountancy Corp. for non-audit

professional services or preparation of corporate tax returns. We did not use

KCCW Accountancy Corp. for financial information system design and

implementation. These services, which include designing or implementing a system

that aggregates source data underlying the financial statements or generates

information that is significant to our financial statements, are provided

internally or by other service providers. We did not engage KCCW Accountancy

Corp. to provide compliance outsourcing services.

Effective May 6, 2003, the Securities and Exchange Commission

adopted rules that require that before our independent auditors are engaged by

us to render any auditing or permitted non-audit related service, the engagement

be:

- approved by our audit committee (which consists of our entire Board of

Directors); or

- entered into pursuant to pre-approval policies and procedures established

by the Board of Directors, provided the policies and procedures are detailed

as to the particular service, the Board of Directors is informed of each

service, and such policies and procedures do not include delegation of the

Board of Directors’ responsibilities to management.

Our Board of Directors (audit committee) pre-approves all

services provided by our independent auditors. All of the above services and

fees were reviewed and approved by the Board of Directors either before or after

the respective services were rendered.

Our Board of Directors has considered the nature and amount of

fees billed by our independent auditors and believes that the provision of

services for activities unrelated to the audit is compatible with maintaining

our independent auditors’ independence.

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED

UPON

Except as set out below, no Director, executive officer, or

nominee for election as a Director of our company and no associate of any of the

foregoing persons has any substantial interest, direct or indirect, by security

holding or otherwise, in any matter to be acted upon at the Meeting, other than

elections to office:

“HOUSEHOLDING” OF PROXY MATERIAL

The Securities and Exchange Commission permits companies and

intermediaries (e.g. brokers) to satisfy the delivery requirements for proxy

statements with respect to two or more stockholders sharing the same address by

delivering a single proxy statement addressed to those stockholders. This

process, commonly referred to as “householding”, potentially means extra

conveniences for stockholders and cost savings for companies.

A number of brokers with accountholders who are stockholders of

our company will be “householding” our proxy materials. As indicated in the

notice previously provided by these brokers to stockholders, a single proxy

statement will be delivered to multiple stockholders sharing an address unless

contrary instructions have been received from an affected stockholder. Once you

have received notice from your broker that they will be “householding” communications to your address, “householding” will continue

until you are notified otherwise or until you revoke your consent. If at any

time, you no longer wish to participate in “householding” and would prefer to

receive a separate proxy statement, please notify your broker.

- 17 -

Stockholders who currently receive multiple copies of the proxy

statement at their address and would like to request “householding” of their

communications should contact their broker.

OTHER BUSINESS

The Board knows of no other business that will be presented for

consideration at the Meeting. If other matters are properly brought before the

Meeting; however, it is the intention of the persons named in the accompanying

proxy to vote the shares represented thereby on such matters in accordance with

their best judgment.

If there are insufficient votes to approve any of the proposals

contained herein, the Board may adjourn the Meeting to a later date and solicit

additional proxies. If a vote is required to approve such adjournment, the

proxies will be voted in favor of such adjournment.

By Order of the Board of Directors,

/s/ Ho Kang-Wing

Ho Kang-Wing Director

PROXY CARD

ANNUAL AND SPECIAL MEETING OF STOCKHOLDERS OF

TRANSAKT

LTD.

(the “Company”)

TO BE HELD AT CONFERENCE ROOM NO.5, 6/F TAIWAN RAILWAYS

ADMINISTRATION MOTC, NO. 3 BEIPING W ROAD, ZHONGZHENG

DISTRICT, TAIPEI CITY,

TAIWAN.

ON FRIDAY, APRIL 1, 2016 at 10:00 AM (CST/local time)

(the

“Meeting”)

The undersigned stockholder (“Registered Stockholder”)

of the Company hereby appoints, Ho Kang-Wing, an officer of the Company, or

failing this person, Yam Chi-Wah, an officer of the Company, as proxyholder for

and on behalf of the Registered Stockholder with the power of substitution to

attend, act and vote for and on behalf of the Registered Stockholder in respect

of all matters that may properly come before the Meeting and at every

adjournment thereof, to the same extent and with the same powers as if the

undersigned Registered Stockholder were present at the said Meeting, or any

adjournment thereof.

The Registered Stockholder hereby directs the proxyholder to

vote the securities of the Company registered in the name of the Registered

Stockholder as specified herein.

[ ] Please check this box only if you intend to attend and vote

at the Meeting

To assist the Company in tabulating the votes submitted by

proxy prior to the Meeting, we request that you mark, sign, date and return this

Proxy by 2:00 p.m., March 18, 2016 using the enclosed envelope.

THIS PROXY IS SOLICITED ON BEHALF MANAGEMENT OF THE COMPANY.

PLEASE MARK YOUR VOTE IN THE BOX.

| |

PROPOSAL 1: |

Approval of 20 Old for 1 New Reverse Stock

Split |

FOR |

[ ] |

AGAINST |

[ ] |

| |

|

|

|

|

|

|

| |

PROPOSAL 2:

|

Election of Ho Kang-Wing, He Jiaxian, He

Jingtian,

and Tam Yuk-Ching as Directors |

FOR

|

[ ]

|

AGAINST

|

[ ]

|

| |

|

|

|

|

|

|

| |

PROPOSAL 3 :

|

Ratify the appointment of AWC (CPA) Ltd. as

independent registered public accounting firm for

fiscal 2015 and to allow Directors to set the

remuneration |

FOR

|

[ ]

|

AGAINST

|

[ ]

|

In their discretion, the Proxies are authorized to vote upon

such other business as may properly come before the Meeting. This Proxy, when

properly executed, will be voted in the manner directed by the Registered

Stockholder. If no direction is made, this Proxy will be voted “FOR” each of the

nominated directors and “FOR” the remaining Proposal.

Please sign exactly as name appears below. When shares are held

jointly, both Registered Stockholders should sign. When signing as attorney,

executor, administrator, trustee or guardian, please indicate full title as

such. If a corporation, please indicate full corporate name; and if signed by

the president or another authorized officer, please specify the officer’s

capacity. If a partnership, please sign in partnership name by authorized

person.

| SIGN HERE: |

|

| |

|

| |

|

| Please Print Name: |

|

| |

|

| |

|

| Date: |

|

| |

|

| |

|

| Number of Shares Represented by Proxy

|

|

THIS PROXY FORM IS NOT VALID

UNLESS IT IS SIGNED AND

DATED.

SEE IMPORTANT INFORMATION AND INSTRUCTIONS ON

REVERSE.

INSTRUCTIONS FOR COMPLETION OF PROXY

1. This form of proxy (“Instrument of Proxy”) must

be signed by you, the Registered Stockholder, or by your attorney

duly authorized by you in writing, or, in the case of a corporation, by a duly

authorized officer or representative of the corporation; and if executed by

an attorney, officer, or other duly appointed representative, the original

or a notarial copy of the instrument so empowering such person, or such other

documentation in support as shall be acceptable to the Chairman of the Meeting,

must accompany the Instrument of Proxy.

2. If this Instrument of Proxy is not

dated in the space provided, authority is hereby given by you,

the Registered Stockholder, for the proxyholder to date this proxy seven (7)

calendar days after the date on which it was mailed to you, the Registered

Stockholder.

3. A Registered Stockholder who wishes to

attend the Meeting and vote on the resolutions in

person, may simply register with the Scrutineer before the Meeting

begins.

4. A Registered Stockholder who is not able to

attend the Meeting in person but wishes to vote on the

resolutions, may do the following:

(a) appoint one of the management

proxyholders named on the Instrument of Proxy, by leaving the wording

appointing a nominee as is; OR

(b) appoint another

proxyholder.

5. The securities represented by this Instrument of Proxy will

be voted or withheld from voting in accordance with the instructions of the

Registered Stockholder on any poll of a resolution that may be called for and,

if the Registered Stockholder specifies a choice with respect to any matter to

be acted upon, the securities will be voted accordingly. Further, the securities

will be voted by the appointed proxyholder with respect to any amendments or

variations of any of the resolutions set out on the Instrument of Proxy or

matters which may properly come before the Meeting as the proxyholder in its

sole discretion sees fit.

INSTRUCTIONS AND OPTIONS FOR VOTING:

To be represented at the Meeting, this Instrument of Proxy

must be DEPOSITED at the office of Transfer Online Inc., by mail in the enclosed

business reply envelope, at any time up to and including 10:00 a.m. (Pacific

time) on March 29, 2016, or at least 72 hours (excluding Saturdays, Sundays and

holidays) before the time that the Meeting is to be reconvened after any

adjournment of the Meeting.

If there you have any questions please don’t hesitate to

contact TransAKT Ltd. at 852-52389111 (Hong Kong) or Transfer Online at

503.227.2950 (State of Oregon).

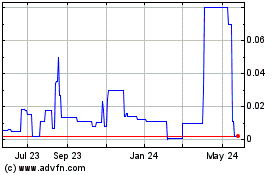

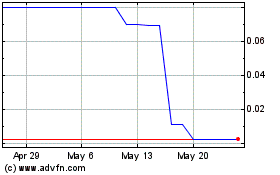

TransAKT (PK) (USOTC:TAKD)

Historical Stock Chart

From Oct 2024 to Nov 2024

TransAKT (PK) (USOTC:TAKD)

Historical Stock Chart

From Nov 2023 to Nov 2024