0OIR Six-month Interim Report (Q2) 2023

24 August 2023 - 3:30PM

UK Regulatory

TIDMALK TIDMB

ALK delivers 11% revenue growth with operating profit up 120% in

Q2 (unaudited)

ALK's revenue grew by 11% in Q2 2023, driven by 17% growth in

tablet sales and double-digit growth in combined SCIT/SLIT-drops

sales. Operating profit (EBIT) increased by 120% in local

currencies on sales growth and gross margin improvements.

Q2 2023 financial highlights

Comparative figures for Q2 2022 are shown in brackets. Revenue

growth rates are stated in local currencies, unless otherwise

indicated

-- Revenue increased by 11% to DKK 1,135 million (1,045), equalling 12%

growth when disregarding the one-year mandatory rebate increase in

Germany. Currencies lowered reported growth by 2 percentage points.

-- Revenue increased by 64% in International markets, by 10% in North

America, and by 2% in Europe.

-- Tablet sales increased by 17% to DKK 547 million (480), with an increase

of 97% in International markets (mainly driven by product shipments to

Japan), and 20% in North America. As expected, growth in tablet sales in

Europe was flat.

-- Global SCIT and SLIT-drops sales increased by 13% to DKK 423 million

(380) driven by Europe and China, while sales of Other products and

services decreased by 8% to DKK 165 million (185) on declining Jext(R)

sales.

-- Q2 operating profit (EBIT) increased by 120% in local currencies, which

equates to 98% in reported currency, on sales growth and gross margin

improvements, which were partly offset by a minor increase in capacity

costs. EBIT was DKK 97 million (49) with an EBIT-margin of 9% (5),

resulting in a 14% (12) EBIT-margin for the first half year.

Financial performance for the first six months (H1) 2023

H1 H1 Growth Growth

In DKKm 2023 2022 (local currencies) (reported)

Revenue 2,369 2,200 9% 8%

------------ ----- ----- ------------------- -----------

EBIT 325 264 33% 23%

------------ ----- ----- ------------------- -----------

EBIT

margin - % 14% 12%

Progress on strategic priorities

-- Based on the strong results from the paediatric MT-12 Phase 3 trial, ALK

has started preparing a registration application for authorities in

Europe and North America to expand the indications for the house dust

mite (HDM) tablet to include children aged five to 11. The MT-12 trial

met its primary endpoint and all key secondary endpoints.

-- Top-line results from the TT-06 paediatric Phase 3 trial with the tree

tablet are still expected in Q4 2023.

-- First readouts from the Phase 1 trial of tablet treatment for peanut

allergy are still expected end-2023.

-- The regulatory review of the Biologics Licence Application for ALK's HDM

tablet in China is ongoing and is still expected to complete in 2024.

-- The government in Japan, one of the world's largest allergy immunotherapy

tablet markets, has launched a comprehensive action plan to further

combat respiratory allergy. ALK and its partner Torii are currently

assessing how to best support the government's plan.

2023 revenue outlook is narrowed; earnings outlook remains

unchanged

The full-year revenue outlook has been narrowed to mainly

reflect the year-to-date progress and intermittent supply shortages

affecting Jext(R) . The full-year earnings outlook is

unchanged:

-- Revenue is now expected to grow by 8-10% organically in local currencies

(previously: 7-11%), which is equivalent to 9-11% growth, disregarding

the one-year temporary mandatory rebate increase for prescription drugs

in Germany.

-- Tablets sales and SCIT/SLIT-drops sales are still expected to grow by

double digits respectively in the second half of the year. Full-year

tablet growth is still expected within the previously communicated range.

-- Earnings margin (EBIT margin) is still expected to increase from 10% in

2022 to 13-15% on sales growth, efficiencies, economies of scale and

lower R&D costs.

Hørsholm, 24 August 2023

ALK-Abelló A/S

For further information, contact:

Investor Relations: Per Plotnikof, tel. +45 4574 7527, mobile

+45 2261 2525

Media: Maiken Riise Andersen, tel. +45 5054 1434

Today, ALK is hosting a conference call for analysts and

investors at 1.30 p.m. (CEST) at which Management will review the

financial results and the outlook. The conference call will be

audio cast on

https://www.globenewswire.com/Tracker?data=FUA8aCQAnxRZTY8DyDJIqfU8LIc9Kir4IrLDjPKg0WzZbygp1k9jNgl2h2xJWF2Ta99YS-qa-MMSUUR1-MBieA==

https://ir.alk.net where the relevant presentation will be

available shortly before the call begins. Please call in before

1.25 p.m. (CEST). Danish participants should call in on tel. +45

7877 4197 and international participants should call in on tel. +44

0 808 101 1183 or +1 785 424 1102. Please use the Participant Pin

Code: 55214#

Attachment

-- FM_13_23UK_24082023

https://ml-eu.globenewswire.com/Resource/Download/a043ea0a-4e72-41db-8fc2-eab9e20c97b0

(END) Dow Jones Newswires

August 24, 2023 01:30 ET (05:30 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

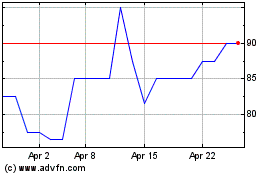

Alkemy Capital Investments (LSE:ALK)

Historical Stock Chart

From Apr 2024 to May 2024

Alkemy Capital Investments (LSE:ALK)

Historical Stock Chart

From May 2023 to May 2024