EUROPE MARKETS: European Stocks Dip Ahead Of Potential Trade Tension At G-20 Gathering

17 March 2017 - 9:37PM

Dow Jones News

By Carla Mozee, MarketWatch

Stoxx 600 on track for weekly rise

European stocks moved slightly lower Friday, but hovered around

their highest levels in more than a year, with investors turning

attention to the meeting of Group of 20 finance officials in

Germany.

The Stoxx Europe 600 index was off 0.1% at 377.36, with only the

financial, oil and gas and consumer services sectors showing gains.

The benchmark on Thursday ended 0.7% higher

(http://www.marketwatch.com/story/european-stocks-rally-after-dutch-election-surge-for-miners-2017-03-16)

and marked its best finish since December 2015, according to

FactSet data.

The pan-European benchmark is set to end the week higher by

1.1%, a second weekly rise in three weeks. Part of that push came

Thursday after Dutch voters rebuffed Geert Wilders's far-right

party in a general election.

G-20 gathering: Investors will watch for developments beginning

Friday from the G-20 meeting of finance ministers and central

bankers from the world's largest economies in Baden-Baden.

"The big overhang here is [U.S. President] Donald Trump's

intentions over global trade. There has been no shortage of talk

about border taxes and even the threat in isolation has been

sufficient to repatriate some jobs to the US, but the detail is

still unknown and this has the potential to create a tense

atmosphere," said Tony Cross, market analyst at TopTradr, in a

note.

"It is perhaps the clues this meeting may hold over future US

trade deals that will provide the most meaningful direction," he

said.

Trump and German Chancellor Angela Merkel may discuss trade

matters when they meet for the first time at the White House in

Washington on Friday.

Read:Opinion: Worlds will collide when the cautious Merkel meets

the impetuous Trump

(http://www.marketwatch.com/story/worlds-will-collide-when-the-cautious-merkel-meets-the-impetuous-trump-2017-03-13)

The euro on Friday was buying $1.0774, up from $1.0768 late

Thursday in New York. The euro advanced after Ewald Nowotny,

governor of the Austrian National Bank, told Handelsblatt newspaper

that the European Central Bank could raise its deposit rate

(https://global.handelsblatt.com/finance/austrian-ecb-council-member-rate-increase-could-be-on-the-way-728696)

before the prime rate. The deposit rate currently stands at

negative 0.4%.

Movers: Tullow Oil PLC (TLW.LN) shares sank 15% as the oil and

gas exploration company proposed a rights issue to raise $750

million

(http://www.marketwatch.com/story/tullow-oil-proposes-750-million-rights-issue-2017-03-17).

Airbus Group SE shares (AIR.FR) fell 1.2% after France's

financial-crimes investigator started a preliminary investigation

(http://www.marketwatch.com/story/france-opens-probe-into-possible-airbus-corruption-2017-03-17)

into alleged wrongdoing at the European plane maker over potential

corruption.

Berkeley Group Holdings PLC shares (BKG.LN) rose 5.4%, topping

the Stoxx 600 after the home-builder said its pretax profit for

fiscal 2017 will be at the top end of analysts' expectations

(http://www.marketwatch.com/story/berkeley-new-home-starts-fall-30-in-london-2017-03-17).

The company also said it's started to build fewer homes in London,

citing Brexit uncertainty as reason for a fall in reservations.

Barclays PLC (BCS) (BCS) picked up 1.2% after Morgan Stanley

raised its ratings on the lender to overweight from

equal-weight.

Indexes: Germany's DAX 30 index declined 0.1% to 12,069.72, and

France's CAC 40 added 0.2% at 5,027.346.

The FTSE 100 was fractionally lower at 7,413.48 after Thursday's

record-high close.

See: May doesn't back second Scottish independence vote

(http://www.marketwatch.com/story/uk-prime-minister-doesnt-back-second-scottish-independence-vote-2017-03-16)

(END) Dow Jones Newswires

March 17, 2017 06:22 ET (10:22 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

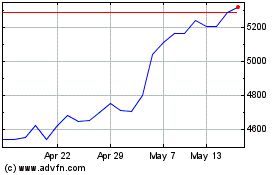

Berkeley (LSE:BKG)

Historical Stock Chart

From Apr 2024 to May 2024

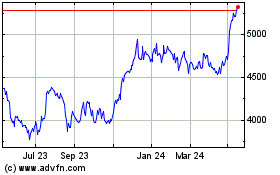

Berkeley (LSE:BKG)

Historical Stock Chart

From May 2023 to May 2024