Conroy Gold & Natural Resources Plc Issue of Convertible Loan Note to raise EUR250,000

15 July 2019 - 4:59PM

UK Regulatory

TIDMCGNR

15 July 2019

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES OF THE MARKET

ABUSE REGULATION (596/2014/EU) ("MAR").

Conroy Gold and Natural Resources plc

("Conroy Gold" or "the Company")

Issue of Convertible Loan Note to raise EUR250,000

Conroy Gold and Natural Resources plc (AIM: CGNR), the gold exploration and

development Company focused on Ireland and Finland, is pleased to announce that

it has raised EUR250,000 through the issue of an unsecured convertible loan note

("Convertible Loan Note") to Hard Metal Machine Tools Limited (the "Lender").

The Lender is a company 99% owned by Mr Philip Hannigan, an existing

shareholder of the Company with a beneficial interest in 1,961,577 ordinary

shares of EUR0.001 representing 8.28 per cent. of the current issued share

capital of the Company.

The net proceeds of the Convertible Loan Note will be used for general working

capital purposes and exploration programme costs.

Terms of the Convertible Loan Note

The Company has entered into an unsecured convertible loan note agreement for a

total amount of EUR250,000 with the Lender which have been created pursuant to a

loan note instrument. The Convertible Loan Note has a term of three years and

attracts interest at a rate of 5% per annum which is payable on the redemption

or conversion of the Convertible Loan Note. The Convertible Loan Note is

unsecured.

The Convertible Loan Note, including the total amount of accrued but unpaid

interest, is convertible at the conversion price of GBP0.07. The Lender has the

right to seek conversion at any time during the term of the Convertible Loan

Note.

Unless the Lender has given prior notice to convert, the Convertible Loan Note

will be repaid immediately prior to the completion of an offer or agreement

pursuant to which any person or those acting in concert acquires over 50% of

the issued share capital of Conroy.

The Lender shall be entitled, on serving written notice on the Company, to

require the Company to redeem all or any part of the Convertible Loan Note at

par on or after the three-year term of the Convertible Loan Note.

A total of EUR 250,000 has been immediately drawn down by the Company under the

Convertible Loan Note facility.

The Lender's conversion rights are limited to the extent that the Company has

adequate shareholder authority to convert.

No application has been or will be made to any stock exchange for the listing

of, or for permission to deal in, all or any of the Convertible Loan Note.

For further information please contact:

Conroy Gold and Natural Resources plc Tel: +353-1-479-6180

Professor Richard Conroy, Chairman

Allenby Capital Limited (Nomad) Tel: +44-20-3328-5656

Nick Athanas/Nick Harriss

Brandon Hill Capital Limited (Broker) Tel: +44-20-3463-5000

Jonathan Evans

Lothbury Financial Services Tel: +44-20-3290-0707

Michael Padley

Hall Communications Tel: +353-1-660-9377

Don Hall

Visit the website at: www.conroygold.com

END

(END) Dow Jones Newswires

July 15, 2019 02:59 ET (06:59 GMT)

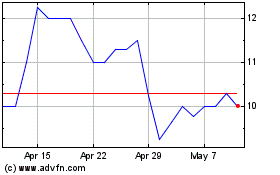

Conroy Gold & Natural Re... (LSE:CGNR)

Historical Stock Chart

From Apr 2024 to May 2024

Conroy Gold & Natural Re... (LSE:CGNR)

Historical Stock Chart

From May 2023 to May 2024