Dunedin Enterprise Inv Trust PLC 1st Quarter Results (5869N)

10 May 2018 - 4:01PM

UK Regulatory

TIDMDNE

RNS Number : 5869N

Dunedin Enterprise Inv Trust PLC

10 May 2018

Quarterly Update Report

Dunedin Enterprise Investment Trust PLC (Company No SC52844) -

Quarterly Update

1. Unaudited net asset value per share

The unaudited net asset value per share at 31 March 2018 was

451.9p. This represents a total return per share of 2.6% during the

quarter when compared to the net asset value per share of 489.2p as

at 31 December 2017 and taking account of the 50p per ordinary

share returned to shareholders in February 2018. The net asset

value per share of 451.9p is stated before the final dividend of

5.5p per share which is payable on 17 May 2018 following the

AGM.

2. Share price

The share price has decreased by from 396.5p to 370p in the

quarter to 31 March 2018. The share price total return for the

quarter to 31 March 2018 was 5.9%. This compares to a decrease in

the FTSE Small Cap Index of

6.5% over the same period. The discount to net asset value at 31 March 2018 was 18.1%.

3. Balance Sheet

The unaudited balance sheet as at 31 March 2018 is noted below:

-

GBP'm

Investments:-

Dunedin managed 59.2

Third party managed 9.8

69.0

Cash and near cash 22.8

Other assets and liabilities 1.5

------

Total net assets 93.3

======

Net asset value per share (p) 451.9p

======

4. Net asset value movements

The portfolio of investments has been re-valued at 31 March

2018. The increase in net asset value in the quarter can be

attributed to:-

-- Within the Dunedin managed portfolio there were valuation

increases at Red (GBP1.2m), Realza (GBP0.9m), Pyroguard (GBP0.8m),

Steeper (GBP0.7m), FRA (GBP0.5m) and Hawksford (GBP0.4m). The

valuations of Red, Pyroguard and FRA have benefitted from an

increase in maintainable earnings. The valuation uplift in Steeper

represents deferred proceeds received in February and April.

Hawksford has benefitted from a reduction in net debt.

-- These valuation increases have been offset by a reduction in

the valuation of CitySprint (GBP0.9m). CitySprint continues to

experience margin pressure in a competitive market.

5. Cash and Commitments

Dunedin Enterprise had cash and near cash balances of GBP22.8m

at 31 March 2018.

Dunedin Enterprise has outstanding capital commitments to

limited partnership funds following the recent realisations from

Dunedin Buyout Fund III LP which are GBP43.2m. It is expected that

GBP22m of the total outstanding commitments will ultimately be

drawn over the remaining life of the funds.

6. Dividend

If approved by shareholders at the Annual General Meeting on 10

May 2018 a final dividend of 5.5p per share will be paid to

shareholders on 17 May 2018.

7. Outlook

The Board remains committed to the aim of maximising shareholder

value through the orderly wind-down process. This will be achieved

either by the judicious and timely sales of fund interests on the

secondary market or by continuing to hold these interests if this

is likely to provide a better return to shareholders.

The Board remains encouraged by the pricing of realisations

achieved during 2017 and the trading performance of the

portfolio.

For further information on Dunedin Enterprise please go to

www.dunedinenterprise.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

QRFKMGGKGLKGRZZ

(END) Dow Jones Newswires

May 10, 2018 02:01 ET (06:01 GMT)

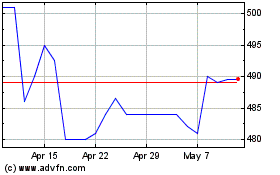

Dunedin Enterprise Inves... (LSE:DNE)

Historical Stock Chart

From Apr 2024 to May 2024

Dunedin Enterprise Inves... (LSE:DNE)

Historical Stock Chart

From May 2023 to May 2024