TIDMDPA

RNS Number : 5620N

DP Aircraft I Limited

18 May 2015

18 May 2015

DP AIRCRAFT I LIMITED (the "Company")

QUARTERLY UPDATE

The Company is issuing this report for the period from 1 January

2015 to the date of publication as an investor update. It should

not be relied on by Shareholders, or any other party, as the basis

for an investment in the Company or for any other purpose.

Overview

DP Aircraft I Limited, a Guernsey based company, was launched in

October 2013. Its US$ 113 million placing was oversubscribed. The

Company has acquired two Boeing 787-8 aircraft, leased to Norwegian

Air Shuttle ASA, with the two aircraft delivered in June 2013 and

August 2013 respectively. DP Aircraft I Limited took over title to

the aircraft, EI-LNA and EI-LNB, on 9 October 2013. Since that date

all lease obligations have been met in full by Norwegian and no

incidents of note concerning operations of the aircraft have

occurred.

Inclusive of the May 2015 dividend, the Company has so far paid

out as scheduled six dividends of 2.25 cents each. The Company pays

out dividends on a quarterly basis and targets a yearly

distribution of 9 per cent on the initial placing price of US$

1.00. The next interim dividend payment is due on 18 May 2015. The

quarterly distributions are targeted for February, May, August and

November in each year.

Company Information

Ticker DPA

------------------------------------- ----------------------------------

Company Number 56941

------------------------------------- ----------------------------------

ISIN Number GG00BBP6HP33

------------------------------------- ----------------------------------

SEDOL Number BBP6HP3

------------------------------------- ----------------------------------

Traded Specialist Fund Market

------------------------------------- ----------------------------------

SFM Admission Date 4 October 2013

------------------------------------- ----------------------------------

Share Price USD1.0525 as at 12 May 2015

------------------------------------- ----------------------------------

Country of Incorporation Guernsey

------------------------------------- ----------------------------------

Current Shares in Issue 113,000,000 Ordinary Shares

------------------------------------- ----------------------------------

Administrator and Company Secretary Dexion Capital (Guernsey) Limited

------------------------------------- ----------------------------------

Asset Manager DS Aviation GmbH & Co. KG

------------------------------------- ----------------------------------

Auditor and Reporting Accountant KPMG

------------------------------------- ----------------------------------

Corporate Broker Canaccord Genuity Limited

------------------------------------- ----------------------------------

Aircraft Registration (Date of EI-LNA (28 June 2013)

Delivery) EI-LNB (23 August 2013)

------------------------------------- ----------------------------------

Manufacturer Serial Number MSN 35304

MSN 35305

------------------------------------- ----------------------------------

Aircraft Type and Model 787-8

------------------------------------- ----------------------------------

Lessee Norwegian Air Shuttle ASA

------------------------------------- ----------------------------------

Website http://www.dpaircraft.com

------------------------------------- ----------------------------------

The Company's investment objective is to obtain income returns

and a capital return for its Shareholders by acquiring, leasing and

then, when the Board considers it is appropriate, selling the

aircraft.

Aviation Market

In 2015, the International Air Transport Association (IATA)

expects global profits to further increase in all regions to a

total of USD 25.0 billion, with air travel growing by 7 per cent.,

after 2014 already proved to be one of the most profitable years

for airlines globally. The results of IATA's air passenger market

analysis in February confirm that global passenger growth remains

robust. Available Seat Kilometres (ASKs) of European carriers

increased by 2.8 per cent., while Revenue Passenger Kilometres

(RPKs) grew by 4.4 per cent. compared to the same period last year.

The strongest growth was seen in the Asia/Pacific region with a 9.1

per cent. increase in RPKs. Global passenger traffic in the first

quarter of 2015 looks to be up some 5-6 per cent. on the same

quarter in 2014. Moreover, IATA expects over USD 820 billion to be

spent on air transport in 2015.

Although oil prices are sharply down on a year ago, having

reached a six year low in January, there was a partial rebound in

prices in February and some stabilizing in March. Nonetheless,

uncertainty remains regarding the future direction of oil prices,

and therefore aircraft such as the Dreamliner Boeing B787, which

benefits from the latest technology providing low operating and

maintenance costs, will continue to stay in strong demand.

The long-term outlook remains positive for both the aviation

market and the levels of demand for new aircraft. Boeing (Current

Market Outlook 2014-2033) and Airbus (Global Market Forecast

2014-2033) remain of the opinion that passenger fleets will double

by 2033. In February 2015, a total of 128 new aircraft were

delivered. Additionally, according to Boeing, 53 per cent. of

aircraft deliveries over the next twenty years will be within the

200-300 seat category. On top of that, Airbus estimates annual

growth rates of airline traffic (RPK) at 4.7 per cent on average

over the next 20 years, while Boeing believes RPKs will increase by

5.0 per cent per annum. Both manufacturers have made their

forecasts based upon the assumption of an average annual increase

of 3.2 per cent in global GDP over the same period.

Furthermore, according to the latest Airline Business Confidence

Index published in April 2015, two thirds of all participating

airline CFOs and heads of cargo expect profitability to increase

over the next 12 months. Furthermore 79.3 per cent. of participants

assume that passenger traffic volumes will also increase over the

next 12 months.

The Assets: Boeing B787s

The Boeing B787 Dreamliner still ranks alongside the Airbus A350

(which entered into commercial service on 15th January 2015) as the

latest technological, mid-size wide-body aircraft available in the

market. As of April 2015, 261 Boeing B787s have been delivered to

26 different airlines. In the first quarter of 2015, an additional

35 Dreamliners have been ordered by three different customers. With

a backlog of over 840 aircraft orders in March 2015, and production

fully sold out until 2019, it is clear that the aircraft remains in

high demand.

Since DP Aircraft I Limited took title of both LNA and LNB in

2013, Norwegian has met all of its lease obligations in full. The

carrier operates the aircraft in a two-class configuration seating

32 premium economy plus 259 economy passengers.

The chart below gives a short overview of the utilisation of the

airframe and engines of each of the aircraft. LNA's engine, Engine

Serial Number (ESN) 10119, is expected to be back from shop

mid-May. The upgrade, which extends the maintenance intervals for

the engines, of both LNA's and LNB's engines will then be completed

at Rolls Royce's Derby facilities.

AIRFRAME STATUS EI-LNA EI-LNB

(31 March 2015)

--------------------------- -------------------------- --------------------------

TOTAL March 2015 TOTAL March 2015

--------------------------- ------------ ------------ ------------ ------------

Flight hours 6,669:46 497:15 8,030:38 406:04

--------------------------- ------------ ------------ ------------ ------------

Cycles 841 57 1,009 45

--------------------------- ------------ ------------ ------------ ------------

Block hours (average) 10:95 16:04 13:91 13:10

--------------------------- ------------ ------------ ------------ ------------

Flight hours/Cycles

Ratio 7.93 : 1 8.72 : 1 7.96 : 1 9.02 : 1

--------------------------- ------------ ------------ ------------ ------------

ENGINE DATA

(31 March 2015)

--------------------------- -------------------------- --------------------------

Engine Serial Number 10118 10119 10130 10135

--------------------------- ------------ ------------ ------------ ------------

Engine Manufacturer Rolls-Royce Rolls-Royce Rolls-Royce Rolls-Royce

--------------------------- ------------ ------------ ------------ ------------

Engine Type and Trent 1000 Trent 1000 Trent 1000 Trent 1000

Model

--------------------------- ------------ ------------ ------------ ------------

Total Time [flight

hours] 5,561:55 4,127:10 3,650:35 3,503:32

--------------------------- ------------ ------------ ------------ ------------

Total Cycles 735 594 353 423

--------------------------- ------------ ------------ ------------ ------------

LLP Various HPT Various HPT Various HPT Various HPT

Components Components Components Components

--------------------------- ------------ ------------ ------------ ------------

Cycles to LLP Replacement 2,765 2,906 3,147 3,007

--------------------------- ------------ ------------ ------------ ------------

Location LNA In Shop LNA Serviceable

Spare

--------------------------- ------------ ------------ ------------ ------------

As announced in the previous Shareholder Report, DS Skytech, the

joint-venture company between DS Aviation and Skytech-AIC, took

over the technical asset management of both of the Company's

aircraft on 1 May 2015.

Norwegian Air Shuttle ASA

Norwegian Air Shuttle transported nearly 24 million passengers

in 2014. As at 31 March 2015, the carrier operated 425 scheduled

routes to 130 destinations in 39 countries. This includes 17

non-stop long-haul routes between Europe and the U.S., as well as

Thailand. In autumn 2015, Norwegian will add three new long-haul

destinations from the UK and Scandinavia, operating flights to

Puerto Rico, St. Croix (in the US Virgin Islands) and Las

Vegas.

In the financial year 2014, operating revenue increased to NOK

19,540 million (USD 2,635 million), while EBIT and net profit

dropped to NOK -1,411 million (USD -187 million) and NOK -1,070

million (USD -142 million) respectively. Ancillary revenues, which

are a crucial source of income under Norwegian's business model,

increased by 34 per cent. per passenger. In the same period ASK

increased by 35.4 per cent. and RPKs by 39.9 per cent. The load

factor therefore increased by 2.6 percentage points to 80.9 per

cent. Unit costs including fuel remained stable, while unit costs

excluding fuel decreased by 1 per cent. Cash and cash equivalents

at 31 December 2014 amounted to NOK 2,011 million (USD 267

million).

The first quarter results for 2015 show that Norwegian's

operating revenues increased by 14 per cent. and EBITDAR improved

by NOK 283.6 million (USD 35.4 million) to NOK 68.4 million (USD

8.5 million) compared to the same quarter of the previous year. The

carrier showed an operating loss of NOK 722 million (USD 90

million), which is a reduction of NOK 54.4 million (USD 6.8

million); and net loss was reduced by NOK 56.4 million (USD 7.0

million) compared to the first quarter of the previous year. ASKs

grew by 7 per cent., and RPKs increased by 15 per cent and

therefore the load factor improved by 6 percentage points to 83 per

cent. The number of transported passengers went up by 2 per cent.

and ancillary revenues per passenger increased by 25 per cent,

mainly due to ancillary revenues from long-haul operations.

Nevertheless, Norwegian's results are challenged by the weak

Norwegian currency and the Q1 2015 results have also been affected

by the 11-day pilot strike in Scandinavia in March. Norwegian

estimates the total costs of the strike, including lost revenues,

to be NOK 350 million (USD 43 million). Nevertheless, according to

Norwegian's CEO Bjørn Kjos, passenger growth on the carrier's

long-haul routes outside Scandinavia is strong and there is a

positive outlook on future booking figures.

Norwegian is still hampered by the delayed US approval process

for a foreign air carrier permit. The airline's application is

supported by the European Commission, which is seeking to

accelerate matters. In any event, although the permit would

facilitate transatlantic operations, Norwegian's current flight

schedule will not be constrained by this approval procedure, and

the carrier continues to expand its long-haul network as previously

mentioned. However, due to administrative reasons and existing

Norwegian civil aviation regulations, the carrier plans to transfer

several B787s from Irish to Norwegian registration to be in the

position to maintain the present smooth running of long-haul

services and to continue with its prospective network extension as

scheduled.

In April 2015, Norwegian took delivery of its eighth B787-8. The

carrier will receive another four Dreamliners in 2016, three in

2017 and a further two B787s in 2018 so that it will operate a

fleet of 17 Boeing Dreamliner 787s by the end of 2018. Last but not

least, Norwegian is targeting growth of 5 per cent. in ASKs by

year's end, and the carrier reports that bookings for the current

year are ahead of last year. Norwegian is expecting further good

progress in its long-haul operations this year, and is on track to

achieve its cost level goal for 2015.

Material Events since 31 December 2014

January 2015

Result of AGM (2 January 2015)

The Board of the Company was pleased to announce that all of the

resolutions put to shareholders at the AGM held on 2 January 2015

were passed.

Interim Dividend (20 January 2015)

The Company declared an interim dividend, in respect of the

quarter ended 31 December 2014, of 2.25 cents per Share, to holders

of Shares on the register at 30 January 2015. The ex-dividend date

was 29 January 2015, and payment was made on 13 February 2015.

March 2015

Annual Financial Report (23 March 2015)

The Company issued its Annual Financial Report for the period

from 5 July 2013 to 31 December 2014.

April 2015

Interim Dividend (20 April 2015)

The Company declared an interim dividend, in respect of the

quarter ended 31 March 2015, of 2.25 cents per Share, to holders of

Shares on the register at 1 May 2015. The ex-dividend date was 30

April 2015, and payment is due today,18 May 2015.

Proposed Placing and publication of Circular (30 April 2015)

The Board of the Company was pleased to announce that the

Company had published a shareholder circular setting out the key

terms of a proposed US$106.8m placing of Ordinary Shares to finance

the acquisition of additional aircraft and convening an

extraordinary general meeting at which approval was sought from

Shareholders for, inter alia, that acquisition.

May 2015

Results of AGM (12 May 2015)

The Board of the Company announced that all of the resolutions

put to shareholders at the AGM held on 12 May 2015 were passed.

Results of EGM (18 May 2015)

The Board of the Company was pleased to announce that all of the

resolutions put to shareholders at the EGM held on 18 May 2015 were

passed.

Accordingly, the Company has the requisite shareholder authority

to proceed to purchase two further Boeing 787-8 aircraft which are

currently leased to Thai Airways. A Prospectus relating to the

proposed equity issue necessary to part finance the acquisition

will be published shortly.

Investor Information

The latest available portfolio information can be accessed by

eligible Shareholders via www.dpaircraft.com

Enquiries:

Kellie Blondel / Carol Kilby

Dexion Capital (Guernsey) Limited

As Company Secretary to DP Aircraft I Limited

Tel: + 44 (0) 1481 743940

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCSFMFMAFISESI

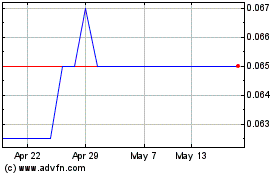

Dp Aircraft I (LSE:DPA)

Historical Stock Chart

From Jun 2024 to Jul 2024

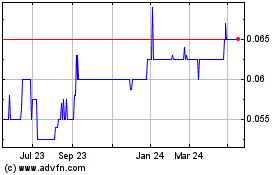

Dp Aircraft I (LSE:DPA)

Historical Stock Chart

From Jul 2023 to Jul 2024