Ebiquity PLC Pre-close trading statement (1425V)

26 January 2017 - 6:00PM

UK Regulatory

TIDMEBQ

RNS Number : 1425V

Ebiquity PLC

26 January 2017

Ebiquity Plc

("the Company")

Pre-close trading statement

Ebiquity plc, the leading independent marketing analytics

specialists, today announces its pre-close trading statement for

the year ended 31 December 2016 ("the year").

Ebiquity has continued to grow revenue with an increase in total

unaudited revenues of 9%. Group margins are broadly in line with

those achieved in 2015, with anticipated mid-single digit growth in

operating profit and earnings. Ebiquity continued to benefit from

the weakness of sterling, particularly in the second half of the

year, with two-thirds of revenue denominated in non-sterling

currency. FX revenue gains across the year amounted to GBP4.5m.

The Company remains on track with the milestones outlined in our

Growth Acceleration Plan, including the roll out of our

effectiveness services to Asia Pacific and the continued

development of our digital products and services.

The Marketing Performance Optimization ("MPO") practice

continues to be a rapidly growing part of our business and

performed in line with management expectations. We outlined in our

growth acceleration plan our intention to expand our Marketing

Effectiveness offering to Asia Pacific, and we were pleased to see

that in the second half of the year we commenced our first contract

in Australia.

The Media Value Measurement ("MVM") practice, outside of our

contract compliance business, has grown strongly across all regions

in line with management expectations. However, in our contract

compliance business (which represents a minority of MVM revenues)

we have experienced a slow-down in revenue due to clients taking

more time to act on the findings of the US Association of National

Advertisers' ("ANA") Media Transparency reports. We continue to

view the ANA Report and its findings as a long term growth driver

for the MVM practice.

Within the Market Intelligence ("MI") practice revenues from our

platform business (Portfolio), which accounts for over 90% of MI

revenue, stabilised year on year outside the US where revenue

reflected pressure on client budgets. Our new Ebiquity Portfolio

platform was launched in September and has now been successfully

rolled out to most clients globally. Additionally, we launched our

market leading Portfolio Digital service in Asia Pacific which will

roll out across Europe and North America in the coming weeks.

Portfolio Digital distinguishes between direct and programmatically

bought adverts on desktop and mobile, captures HTML5, rich media,

embedded video, and tracks behaviourally targeted adverts.

The start to 2017 has seen a noticeable pick up in new business

activity and consequently the Company has better revenue visibility

as compared with the prior year. This provides management with

early confidence in achieving its operational and financial

objectives for 2017.

In light of the continuing revenue growth, cash generation and

the visibility into 2017, the Board anticipates the continuation of

our progressive dividend policy.

The Company will release its preliminary results for the year

ended 31 December 2016 on 28 March 2017.

26 January 2017

Enquiries:

Ebiquity plc

Michael Karg (CEO)

Andrew Noble (CFO) 020 7650 9600

Instinctif Partners

Matthew Smallwood

Guy Scarborough 020 7457 2020

Numis Securities Limited

Nick Westlake (NOMAD)

Toby Adcock (Corporate

Broker) 020 7260 1000

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTEAXFSASKXEFF

(END) Dow Jones Newswires

January 26, 2017 02:00 ET (07:00 GMT)

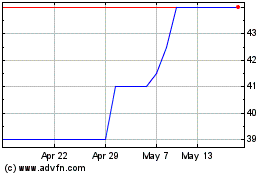

Ebiquity (LSE:EBQ)

Historical Stock Chart

From Apr 2024 to May 2024

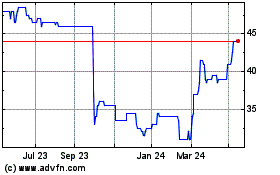

Ebiquity (LSE:EBQ)

Historical Stock Chart

From May 2023 to May 2024